Investing in the healthcare sector demands careful analysis, especially when choosing between industry leaders like IQVIA Holdings Inc. (IQV) and Charles River Laboratories International, Inc. (CRL). Both companies operate in the medical diagnostics and research space, yet they differentiate through unique innovation strategies and service offerings. This comparison will help investors identify which company presents a more compelling opportunity for their portfolio in 2026. Let’s explore their strengths and potential together.

Table of contents

Companies Overview

I will begin the comparison between IQVIA Holdings Inc. and Charles River Laboratories International, Inc. by providing an overview of these two companies and their main differences.

IQV Overview

IQVIA Holdings Inc. operates in the healthcare sector, providing advanced analytics, technology solutions, and clinical research services to the life sciences industry worldwide. The company serves pharmaceutical, biotechnology, device, and consumer health firms through segments like Technology & Analytics Solutions, Research & Development Solutions, and Contract Sales & Medical Solutions. Founded in 1982 and headquartered in Durham, NC, IQVIA employs approximately 89,000 people.

CRL Overview

Charles River Laboratories International, Inc. is a non-clinical contract research organization focused on drug discovery, non-clinical development, and safety testing services globally. It operates through three segments: Research Models and Services, Discovery and Safety Assessment, and Manufacturing Solutions. Established in 1947 and based in Wilmington, MA, Charles River employs about 18,700 staff and supports pharmaceutical and biotechnology clients internationally.

Key similarities and differences

Both IQVIA and Charles River operate in the healthcare diagnostics and research industry, serving pharmaceutical and biotech sectors. While IQVIA emphasizes technology-driven analytics and clinical research services, Charles River focuses more on non-clinical research models, safety assessments, and manufacturing solutions. IQVIA is significantly larger with a broader global footprint and workforce, whereas Charles River specializes in early-stage drug discovery and non-clinical testing.

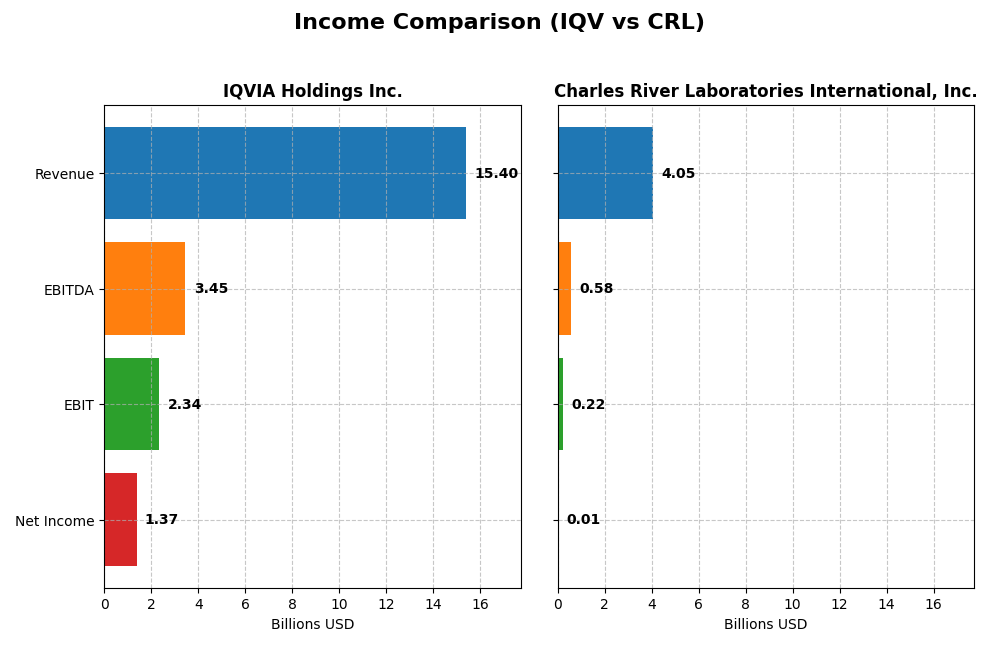

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for IQVIA Holdings Inc. and Charles River Laboratories International, Inc. for the fiscal year 2024.

| Metric | IQVIA Holdings Inc. | Charles River Laboratories International, Inc. |

|---|---|---|

| Market Cap | 41.3B | 10.9B |

| Revenue | 15.4B | 4.05B |

| EBITDA | 3.45B | 581M |

| EBIT | 2.34B | 219M |

| Net Income | 1.37B | 10.3M |

| EPS | 7.57 | 0.20 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

IQVIA Holdings Inc.

IQVIA shows a strong upward trend in revenue from $11.4B in 2020 to $15.4B in 2024, with net income rising from $279M to $1.37B. Margins have generally improved, highlighted by a favorable gross margin of 34.9% and an EBIT margin of 15.2% in 2024. However, revenue growth slowed to 2.8% in the latest year, despite a 9.8% EBIT increase.

Charles River Laboratories International, Inc.

Charles River’s revenue increased from $2.92B in 2020 to $4.05B in 2024, but net income has sharply declined from $364M to just $10M. Margins deteriorated, with a neutral net margin of 0.25% and declining EBIT margin at 5.4%. The most recent year showed a 1.9% revenue decline and a significant 69.4% drop in EBIT, reflecting operational challenges.

Which one has the stronger fundamentals?

IQVIA demonstrates stronger fundamentals, with consistent revenue and net income growth, favorable margins, and a positive overall income statement evaluation. Conversely, Charles River faces declining profitability and unfavorable margin trends despite revenue growth over the period. IQVIA’s financial stability and improving profitability suggest a more robust income statement profile.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for IQVIA Holdings Inc. and Charles River Laboratories International, Inc. from their most recent fiscal year, 2024.

| Ratios | IQVIA Holdings Inc. | Charles River Laboratories International, Inc. |

|---|---|---|

| ROE | 22.63% | 0.30% |

| ROIC | 8.59% | 0.95% |

| P/E | 25.95 | 921.12 |

| P/B | 5.87 | 2.74 |

| Current Ratio | 0.84 | 1.41 |

| Quick Ratio | 0.84 | 1.13 |

| D/E (Debt-to-Equity) | 2.33 | 0.79 |

| Debt-to-Assets | 52.63% | 36.18% |

| Interest Coverage | 3.29 | 1.80 |

| Asset Turnover | 0.57 | 0.54 |

| Fixed Asset Turnover | 19.93 | 2.01 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

IQVIA Holdings Inc.

IQVIA presents a mixed ratio profile with a strong return on equity at 22.63%, but unfavorable valuation metrics such as a high PE of 25.95 and PB of 5.87. Liquidity is weak, reflected by a current ratio of 0.84, while leverage is elevated with a debt-to-equity ratio of 2.33. The company does not pay dividends, likely prioritizing reinvestment and growth over shareholder payouts.

Charles River Laboratories International, Inc.

Charles River shows generally weak profitability ratios with net margin and ROE close to zero and a very high PE of 921.12, signaling valuation concerns. Liquidity is healthier than IQVIA’s, boasting a current ratio of 1.41 and a favorable quick ratio of 1.13. Like IQVIA, Charles River does not pay dividends, possibly focusing on internal investments and development.

Which one has the best ratios?

Both IQVIA and Charles River have slightly unfavorable global ratio assessments. IQVIA’s stronger profitability contrasts with its weaker liquidity and higher leverage, while Charles River’s liquidity is better but profitability and valuation metrics are poorer. Neither company pays dividends, aligning with growth or reinvestment strategies. Overall, neither stands out clearly as having superior ratios.

Strategic Positioning

This section compares the strategic positioning of IQV and CRL, focusing on market position, key segments, and exposure to technological disruption:

IQV

- Leading global player in life sciences with high market cap and moderate competitive pressure.

- Diversified segments: Technology & Analytics, R&D, and Contract Sales driving growth and innovation.

- Strong integration of advanced analytics and cloud-based solutions indicating moderate technological disruption risk.

CRL

- Smaller market cap focused on non-clinical contract research with higher competitive intensity.

- Concentrated on Research Models, Safety Assessment, and Manufacturing, emphasizing early-stage services.

- Focus on early discovery, safety testing, and manufacturing with limited exposure to disruptive tech trends.

IQV vs CRL Positioning

IQV pursues a diversified strategy across technology, analytics, and clinical services, offering scale and innovation benefits. CRL’s concentrated focus on non-clinical research and manufacturing provides specialization but limits broader market exposure. Each approach presents distinct operational scopes and risk profiles.

Which has the best competitive advantage?

Based on MOAT evaluation, IQV shows slightly unfavorable value creation but improving profitability, while CRL has very unfavorable value creation with declining profitability. IQV thus currently maintains a comparatively stronger competitive advantage.

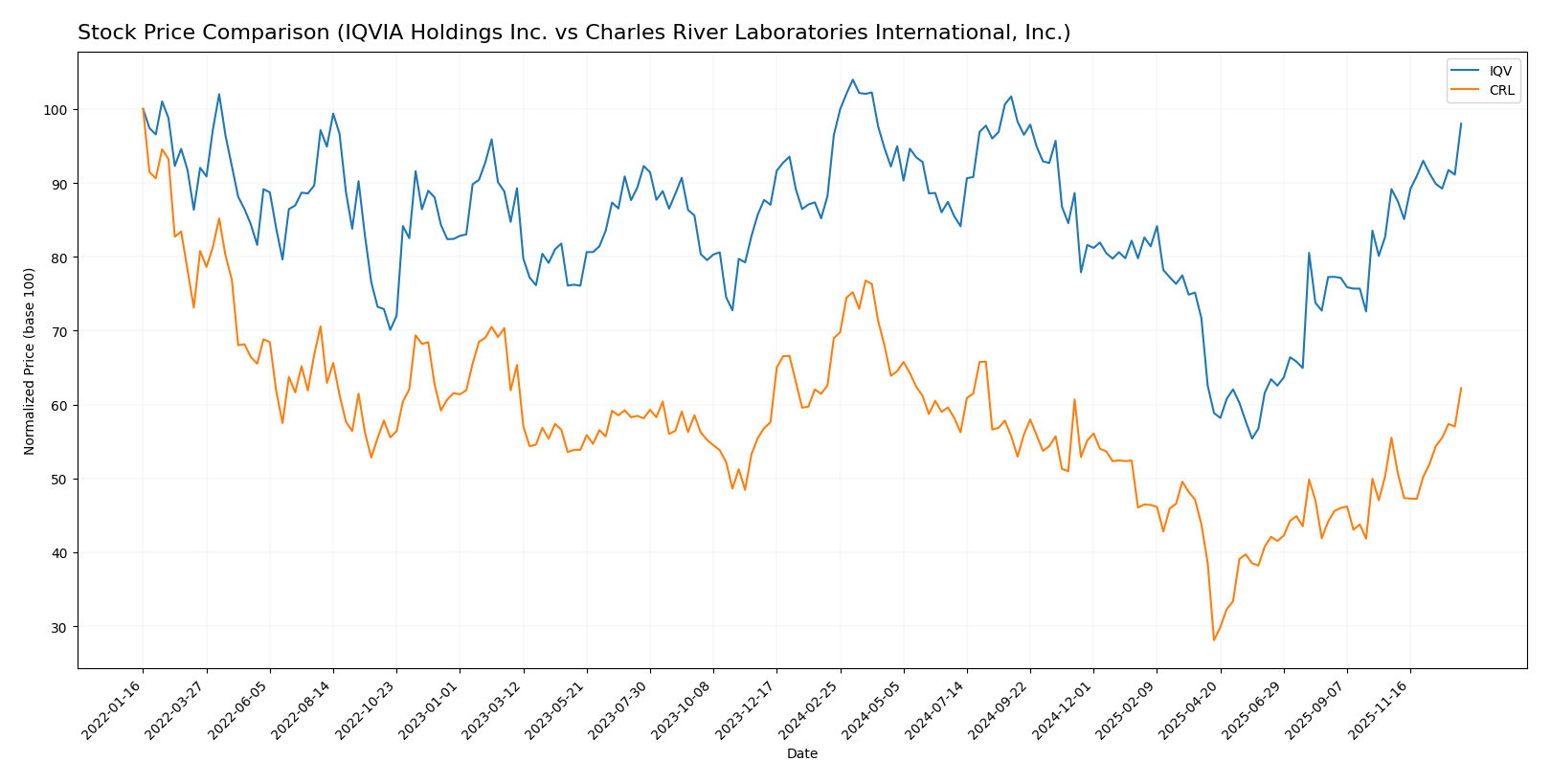

Stock Comparison

The stock price movements of IQVIA Holdings Inc. and Charles River Laboratories International, Inc. over the past year reveal distinct trading dynamics, with IQV showing a mild overall gain and CRL experiencing a notable decline, both displaying acceleration in trend direction.

Trend Analysis

IQVIA Holdings Inc. exhibited a 1.6% price increase over the past year, indicating a neutral to mild bullish trend with accelerating momentum and a substantial price range between 137.0 and 257.18. Charles River Laboratories experienced a -9.82% price decline over the same period, marking a clear bearish trend with acceleration and a wider price range from 99.75 to 272.57. Comparing the two, IQVIA delivered the highest market performance with a positive price change, whereas Charles River trended downward despite recent short-term gains.

Target Prices

The current analyst consensus suggests moderately optimistic price targets for both IQVIA Holdings Inc. and Charles River Laboratories International, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| IQVIA Holdings Inc. | 290 | 214 | 253.2 |

| Charles River Laboratories International, Inc. | 224 | 185 | 204.86 |

Analysts expect IQVIA’s price to rise above its current 242.41 USD, with consensus 253.2 USD indicating potential upside. Charles River’s consensus target of 204.86 USD is slightly below its current 220.91 USD price, pointing to limited near-term upside or consolidation.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for IQVIA Holdings Inc. and Charles River Laboratories International, Inc.:

Rating Comparison

IQV Rating

- Rating: B+ indicating a very favorable overall assessment.

- Discounted Cash Flow Score: 4, reflecting a favorable valuation based on future cash flows.

- ROE Score: 5, very favorable showing strong profit generation from equity.

- ROA Score: 4, favorable indicating effective asset utilization.

- Debt To Equity Score: 1, very unfavorable suggesting high financial risk.

- Overall Score: 3, moderate overall financial standing.

CRL Rating

- Rating: C with a very favorable status despite a lower letter grade.

- Discounted Cash Flow Score: 4, also favorable for valuation.

- ROE Score: 1, very unfavorable indicating weak efficiency in generating profit from equity.

- ROA Score: 1, very unfavorable showing poor asset utilization.

- Debt To Equity Score: 1, very unfavorable indicating similar financial risk concerns.

- Overall Score: 2, moderate but lower than IQV.

Which one is the best rated?

Based strictly on the provided data, IQVIA Holdings Inc. is better rated overall with a higher letter rating (B+) and stronger scores in ROE and ROA, despite both companies sharing a very unfavorable debt-to-equity score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

IQV Scores

- Altman Z-Score: 2.15, indicating moderate bankruptcy risk in grey zone.

- Piotroski Score: 5, reflecting average financial strength.

CRL Scores

- Altman Z-Score: 2.27, indicating moderate bankruptcy risk in grey zone.

- Piotroski Score: 6, reflecting average financial strength.

Which company has the best scores?

Both IQV and CRL are in the grey zone for Altman Z-Score, indicating moderate bankruptcy risk. CRL’s slightly higher Piotroski Score of 6 versus IQV’s 5 suggests marginally stronger financial health, based solely on these scores.

Grades Comparison

Here is the comparison of grades assigned to IQVIA Holdings Inc. and Charles River Laboratories International, Inc.:

IQVIA Holdings Inc. Grades

The latest grades from reputable firms for IQVIA Holdings Inc. are shown in the table below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-01-08 |

| UBS | Maintain | Buy | 2026-01-08 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

| TD Cowen | Downgrade | Hold | 2025-11-03 |

| Baird | Upgrade | Outperform | 2025-10-29 |

| Truist Securities | Maintain | Buy | 2025-10-29 |

| JP Morgan | Maintain | Overweight | 2025-10-29 |

| Stifel | Maintain | Buy | 2025-10-29 |

| Citigroup | Maintain | Neutral | 2025-10-29 |

| UBS | Maintain | Buy | 2025-10-29 |

The overall trend for IQVIA shows mostly buy and overweight ratings with a few recent upgrades and one minor downgrade, indicating generally positive sentiment.

Charles River Laboratories International, Inc. Grades

The latest grades from reputable firms for Charles River Laboratories International, Inc. are summarized here:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Neutral | 2025-12-18 |

| JP Morgan | Maintain | Neutral | 2025-12-15 |

| Barclays | Maintain | Overweight | 2025-12-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-11 |

| TD Cowen | Maintain | Buy | 2025-11-10 |

| Baird | Upgrade | Outperform | 2025-11-06 |

| Barclays | Maintain | Overweight | 2025-11-06 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Mizuho | Maintain | Neutral | 2025-10-17 |

| William Blair | Upgrade | Outperform | 2025-10-06 |

Charles River Laboratories’ grades mostly range from neutral to overweight with several upgrades to outperform, reflecting a cautiously optimistic outlook.

Which company has the best grades?

Both IQVIA Holdings Inc. and Charles River Laboratories have a consensus “Buy” rating; however, IQVIA holds a higher proportion of “Buy” and “Overweight” grades, whereas Charles River leans more toward neutral and equal weight ratings with fewer buy signals. This implies IQVIA may be perceived as having stronger growth or stability potential by analysts, which can influence investor confidence and portfolio weighting decisions.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for IQVIA Holdings Inc. (IQV) and Charles River Laboratories International, Inc. (CRL), based on their recent financial and operational data.

| Criterion | IQVIA Holdings Inc. (IQV) | Charles River Laboratories (CRL) |

|---|---|---|

| Diversification | Highly diversified with strong segments in Research & Development Solutions (8.53B), Technology & Analytics (6.16B), and Contract Sales (718M) | Moderately diversified, mainly in Discovery & Safety Assessment (2.45B), Manufacturing Support (769M), and Research Models (829M) |

| Profitability | Neutral net margin (8.91%), favorable ROE (22.63%), but value destruction indicated by ROIC below WACC (-0.1%) | Low profitability with very low net margin (0.25%), ROE (0.3%), and ROIC (0.95%), plus significant value destruction and declining ROIC |

| Innovation | Strong focus on technology and analytics solutions supporting innovation | Less emphasis on innovation, more traditional lab and manufacturing services |

| Global presence | Extensive global footprint with advanced analytics and clinical services | Global presence focused on preclinical and discovery labs, smaller scale compared to IQV |

| Market Share | Leading market position in clinical research services with multiple revenue streams | Smaller market presence with niche focus on safety assessment and research models |

Key takeaways: IQVIA demonstrates strong diversification and innovation capabilities with improving profitability trends, despite currently shedding value. Charles River shows weaker profitability, declining returns, and a narrower service focus, indicating higher investment risk.

Risk Analysis

Below is a comparative overview of the key risks for IQVIA Holdings Inc. (IQV) and Charles River Laboratories International, Inc. (CRL) based on the most recent data from 2024:

| Metric | IQVIA Holdings Inc. (IQV) | Charles River Laboratories (CRL) |

|---|---|---|

| Market Risk | Beta 1.37, moderate market volatility sensitivity | Beta 1.62, higher market sensitivity |

| Debt level | High debt-to-equity 2.33, unfavorable leverage risks | Moderate debt-to-equity 0.79, manageable leverage |

| Regulatory Risk | High, due to healthcare and pharma industry compliance | High, strict regulations in drug development and testing |

| Operational Risk | Moderate, complex global operations with 89K employees | Moderate, fewer employees (18.7K) but specialized services |

| Environmental Risk | Moderate, healthcare sector impact and sustainability focus | Moderate, lab operations with environmental controls required |

| Geopolitical Risk | Moderate, global presence with exposure to international markets | Moderate, international operations but less diversified |

IQV faces significant leverage risk with a debt-to-equity ratio above 2, increasing financial vulnerability. CRL has better debt management but suffers from very low profitability metrics and interest coverage concerns. Market volatility impacts CRL more due to its higher beta. Both companies face substantial regulatory risks inherent to their industries.

Which Stock to Choose?

IQVIA Holdings Inc. shows a favorable income statement with strong profitability metrics and a growing ROIC trend, despite a slightly unfavorable overall financial ratio profile and a moderate debt burden. Its rating is very favorable with a B+ grade.

Charles River Laboratories International, Inc. displays an unfavorable income statement marked by declining profitability and a deteriorating ROIC trend. Financial ratios are slightly unfavorable with moderate debt levels, and it holds a very favorable rating with a C grade.

Investors focused on growth and improving profitability might find IQVIA’s profile more supportive, while those with tolerance for volatility and seeking potential turnaround opportunities could see Charles River as a different prospect given its recent trend acceleration. Overall, IQVIA’s financial stability and income strength appear more robust.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of IQVIA Holdings Inc. and Charles River Laboratories International, Inc. to enhance your investment decisions: