Home > Comparison > Healthcare > IDXX vs CRL

The strategic rivalry between IDEXX Laboratories, Inc. and Charles River Laboratories International, Inc. shapes the future of the healthcare diagnostics and research sector. IDEXX operates as a product-focused leader in veterinary and environmental diagnostics, while Charles River excels as a service-driven contract research organization. This head-to-head contrasts a specialized equipment manufacturer against a comprehensive drug discovery service provider. This analysis will identify which business model delivers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

IDEXX Laboratories and Charles River Laboratories stand as pivotal players in medical diagnostics and research sectors. Their innovations shape healthcare and pharmaceutical development worldwide.

IDEXX Laboratories, Inc.: Veterinary & Water Diagnostics Leader

IDEXX dominates the companion animal diagnostics market, generating revenue from point-of-care veterinary instruments and rapid assay test kits. It expands through veterinary reference labs and health monitoring for livestock and water quality. In 2026, its strategic focus remains on advancing diagnostic imaging and integrating practice management software to enhance veterinary care efficiency.

Charles River Laboratories International, Inc.: Contract Research Powerhouse

Charles River stands out in non-clinical contract research, earning primarily from drug discovery services and research model sales. Its segments include research models, safety assessment, and manufacturing solutions for pharmaceuticals. The 2026 strategy centers on expanding early-stage drug discovery and safety testing, addressing growing biopharma demand for outsourced preclinical services.

Strategic Collision: Similarities & Divergences

Both companies excel in medical research support but differ in scope: IDEXX targets veterinary diagnostics with a product-service hybrid, while Charles River emphasizes contract research with a service-driven model. Their primary battleground lies in biomedical innovation and pharmaceutical development support. Investors face distinct profiles—IDEXX offers diagnostic product resilience, Charles River rides biotech outsourcing growth.

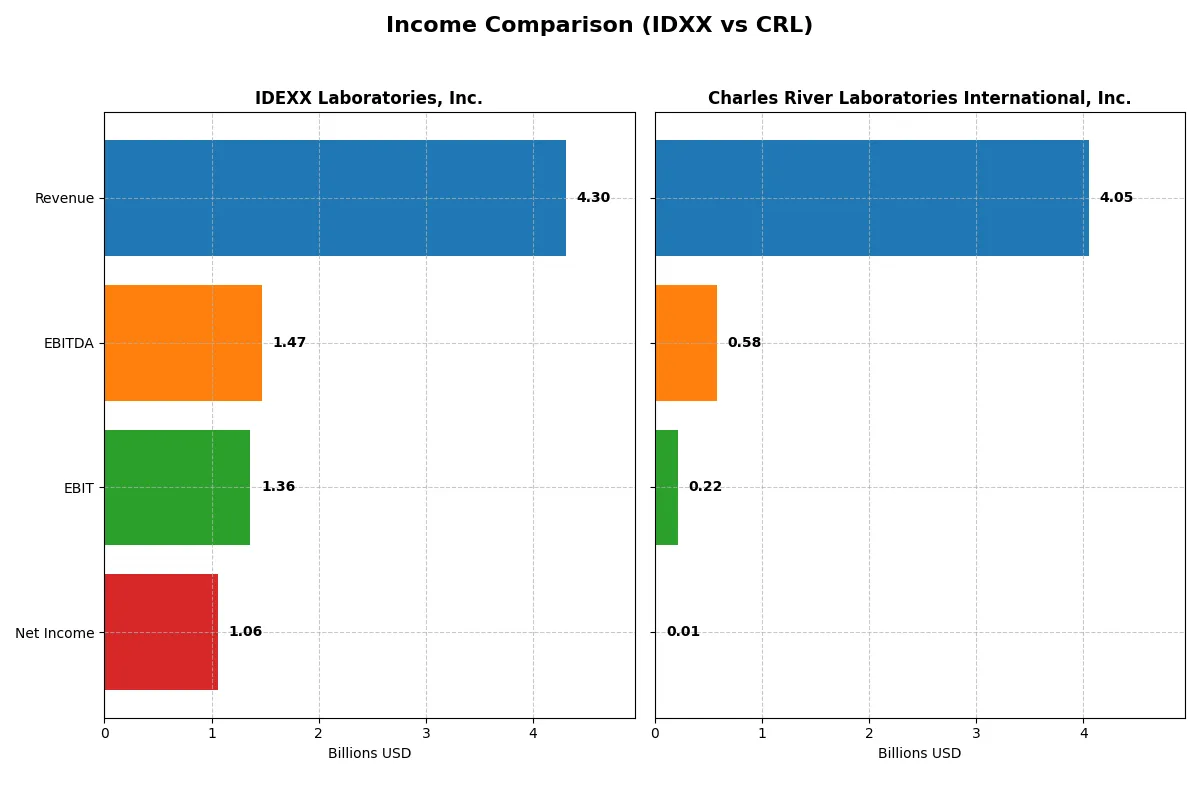

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | IDEXX Laboratories, Inc. (IDXX) | Charles River Laboratories International, Inc. (CRL) |

|---|---|---|

| Revenue | 4.30B | 4.05B |

| Cost of Revenue | 1.64B | 2.72B |

| Operating Expenses | 1.30B | 1.10B |

| Gross Profit | 2.66B | 1.33B |

| EBITDA | 1.47B | 581M |

| EBIT | 1.36B | 219M |

| Interest Expense | 38M | 126M |

| Net Income | 1.06B | 10M |

| EPS | 13.17 | 0.20 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company demonstrates superior operational efficiency and sustainable profitability.

IDEXX Laboratories, Inc. Analysis

IDEXX’s revenue rose steadily from 3.2B in 2021 to 4.3B in 2025, with net income surging from 745M to 1.06B. The company maintains strong gross margins around 62%, and net margins near 25%, reflecting robust cost control and pricing power. In 2025, IDEXX accelerated EBIT growth by 19%, signaling improving operational momentum and capital allocation discipline.

Charles River Laboratories International, Inc. Analysis

Charles River posted mixed results, with revenue growing from 2.9B in 2020 to 4.1B in 2023 but dipping slightly to 4.0B in 2024. Net income plunged dramatically from 475M in 2023 to just 10M in 2024, crushing net margins to 0.25%. Gross margin halved to 33%, and EBIT tumbled 69% last year, reflecting operational challenges and deteriorating profitability.

Margin Power vs. Revenue Scale

IDEXX clearly outperforms Charles River in margin quality and bottom-line growth. IDEXX’s consistent margin expansion and profit growth highlight superior efficiency and business resilience. Meanwhile, Charles River’s sharp net income collapse makes its revenue scale less attractive. For investors, IDEXX’s profile offers a more compelling combination of growth and profitability.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | IDEXX Laboratories, Inc. (IDXX) | Charles River Laboratories International, Inc. (CRL) |

|---|---|---|

| ROE | 66.0% | 0.3% |

| ROIC | 40.7% | 0.9% |

| P/E | 51.1 | 928.9 |

| P/B | 33.8 | 2.8 |

| Current Ratio | 1.23 | 1.41 |

| Quick Ratio | 0.90 | 1.13 |

| D/E (Debt-to-Equity) | 0.05 | 0.79 |

| Debt-to-Assets | 2.2% | 36.2% |

| Interest Coverage | 35.5 | 1.8 |

| Asset Turnover | 1.28 | 0.54 |

| Fixed Asset Turnover | 5.76 | 2.01 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and operational strengths that shape investor confidence and valuation.

IDEXX Laboratories, Inc.

IDEXX demonstrates robust profitability with a 66% ROE and a strong 24.6% net margin, signaling operational excellence. However, its valuation appears stretched, with a P/E of 51.15 and a P/B at 33.75. The company retains earnings for growth, as it pays no dividend, reflecting a clear reinvestment strategy in R&D and innovation.

Charles River Laboratories International, Inc.

Charles River struggles with profitability, showing a 0.3% ROE and a near break-even margin at 0.25%. Its valuation is extremely high, with a P/E at 929, indicating significant investor expectations despite weak returns. The firm offers no dividends, likely reinvesting to stabilize growth, but its financial health and cash flow coverage raise caution.

Premium Valuation vs. Operational Safety

IDEXX balances impressive returns with a high but justifiable premium, while Charles River faces valuation stress amid poor profitability. IDEXX suits investors prioritizing operational strength and growth, whereas Charles River fits those willing to accept elevated risk for potential turnaround gains.

Which one offers the Superior Shareholder Reward?

IDEXX Laboratories (IDXX) and Charles River Laboratories (CRL) both forgo dividends, prioritizing reinvestment and buybacks. IDXX delivers superior free cash flow per share (~$13.2B in 2025) with a zero payout ratio, fueling a robust buyback program. CRL, with lower margins and free cash flow (~$9.8B in 2024), also repurchases shares but at a more constrained pace. IDXX’s higher operating margins (~31.7% vs. CRL’s 5.6%) and stronger cash flow coverage indicate a more sustainable distribution model. I conclude IDXX offers a more attractive total return profile for 2026 investors due to disciplined capital allocation and superior cash generation.

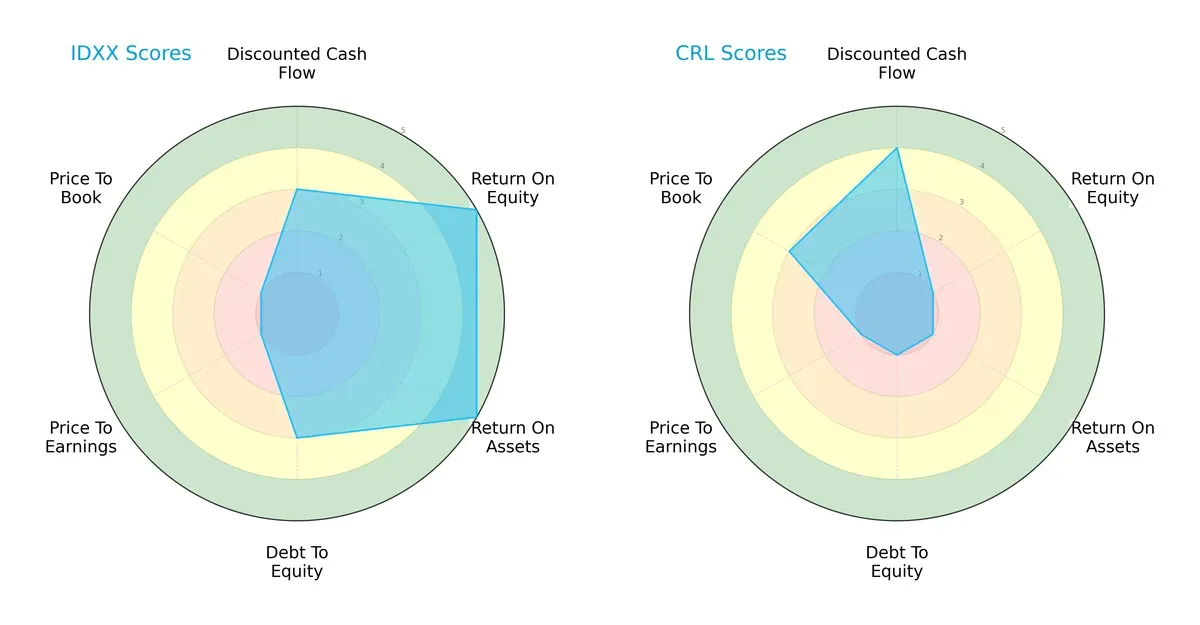

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of IDEXX Laboratories, Inc. and Charles River Laboratories International, Inc.:

IDXX demonstrates strength in profitability with top ROE and ROA scores of 5, signaling efficient asset use and shareholder returns. CRL excels in discounted cash flow with a score of 4, indicating better future cash flow projections. However, CRL’s financial stability appears weaker, reflected by low debt-to-equity (1) and profitability scores (ROE and ROA at 1). IDXX maintains a more balanced profile with moderate leverage and cash flow scores, despite unfavorable valuation metrics (P/E and P/B at 1). CRL relies heavily on its DCF advantage but shows vulnerabilities in operational efficiency and leverage.

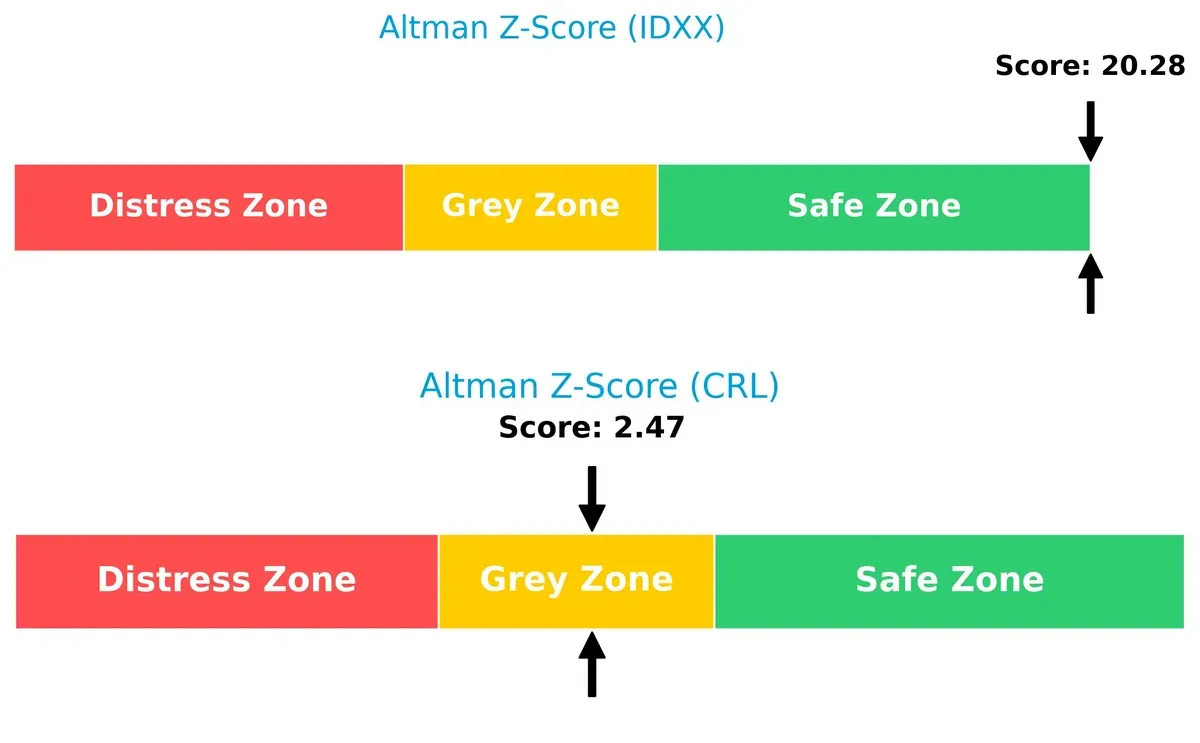

Bankruptcy Risk: Solvency Showdown

IDXX’s Altman Z-Score stands at 20.3, placing it well into the safe zone, while CRL’s score of 2.5 situates it in the grey zone:

This large delta highlights IDXX’s robust long-term solvency, minimizing bankruptcy risk even under economic stress. CRL’s grey zone score warns of moderate financial distress risk, requiring cautious monitoring through volatile cycles.

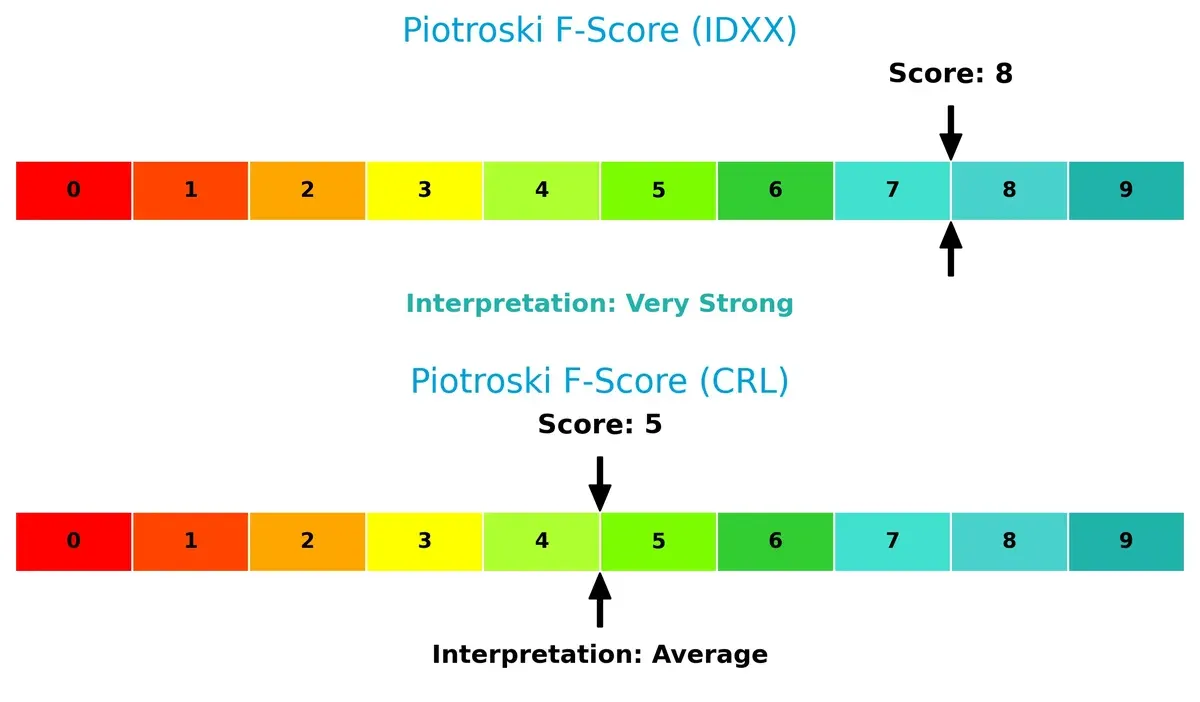

Financial Health: Quality of Operations

IDXX scores an 8 on the Piotroski F-Score, indicating very strong financial health. CRL’s 5 marks average performance:

IDXX’s superior score reflects strong profitability, liquidity, and operational efficiency. CRL’s middling score flags potential red flags in internal metrics, undermining confidence in its financial quality relative to its peer.

How are the two companies positioned?

This section dissects the operational DNA of IDXX and CRL by comparing their revenue distribution and internal dynamics—strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

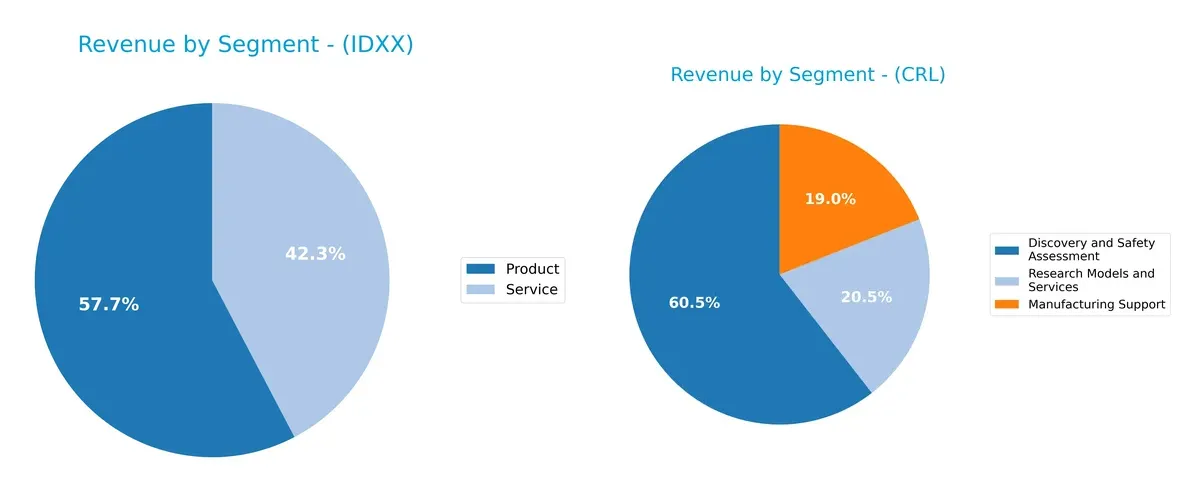

This visual comparison dissects how IDEXX Laboratories and Charles River Laboratories diversify their income streams and reveals where each company places its primary sector bets:

IDEXX anchors its 2024 revenue in two segments: Products at $2.25B and Services at $1.65B, showing moderate diversification. Charles River leans on a more balanced mix, with Discovery and Safety Assessment dominating at $2.45B but supported by Manufacturing Support ($770M) and Research Models and Services ($830M). IDEXX’s concentration in products and services hints at ecosystem lock-in, while Charles River’s spread reduces concentration risk and taps varied research infrastructure.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of IDXX and CRL based on key financial and strategic factors:

IDXX Strengths

- High profitability with net margin 24.62%

- Strong ROE 65.99% and ROIC 40.68%

- Low debt levels with debt-to-assets 2.24%

- Favorable fixed asset turnover 5.76

- Diversified revenue streams in products and services

- Significant US and EMEA market presence

CRL Strengths

- Diversified revenue across discovery, manufacturing, and research services

- Favorable quick ratio 1.13 indicates liquidity strength

- Balanced geographic revenue with strong US and Europe presence

- Moderate debt-to-assets 36.18% is manageable

- Presence in multiple growth regions including Asia and Canada

IDXX Weaknesses

- High valuation multiples with PE 51.15 and PB 33.75

- No dividend yield

- WACC 11.47% above ROIC could indicate capital cost concerns

- Neutral current and quick ratios may limit liquidity flexibility

CRL Weaknesses

- Very low profitability with net margin 0.25% and ROE 0.3%

- High PE 928.9 reflects market skepticism or volatility

- Interest coverage 1.74 signals risk in servicing debt

- Neutral to unfavorable asset turnover ratios

- No dividend yield

Overall, IDXX exhibits strong profitability and efficient capital use but faces valuation and capital cost challenges. CRL shows diversified operations and liquidity but struggles with profitability and debt servicing capacity. These contrasts shape each company’s strategic focus on growth versus financial stability.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only defense protecting long-term profits from relentless competitive erosion. Let’s examine how these two firms guard their turf:

IDEXX Laboratories, Inc.: Intangible Assets and Switching Costs

IDEXX leverages proprietary diagnostic technology and strong customer relationships, reflected in a 29% ROIC above WACC and stable 31.7% EBIT margins. Its expanding product portfolio deepens this moat despite a slight ROIC decline in 2025.

Charles River Laboratories International, Inc.: Scale and Service Integration

Charles River’s moat hinges on its comprehensive contract research services network, contrasting IDEXX’s tech focus. However, its negative ROIC versus WACC and steep margin erosion reveal a weakening competitive edge, though expansion in biologics testing offers future upside.

Moat Strength Showdown: Intangible Assets vs. Service Scale

IDEXX holds the deeper moat, with sustained value creation and margin resilience. Charles River’s shrinking ROIC signals vulnerability. IDEXX is better positioned to defend and grow market share in 2026.

Which stock offers better returns?

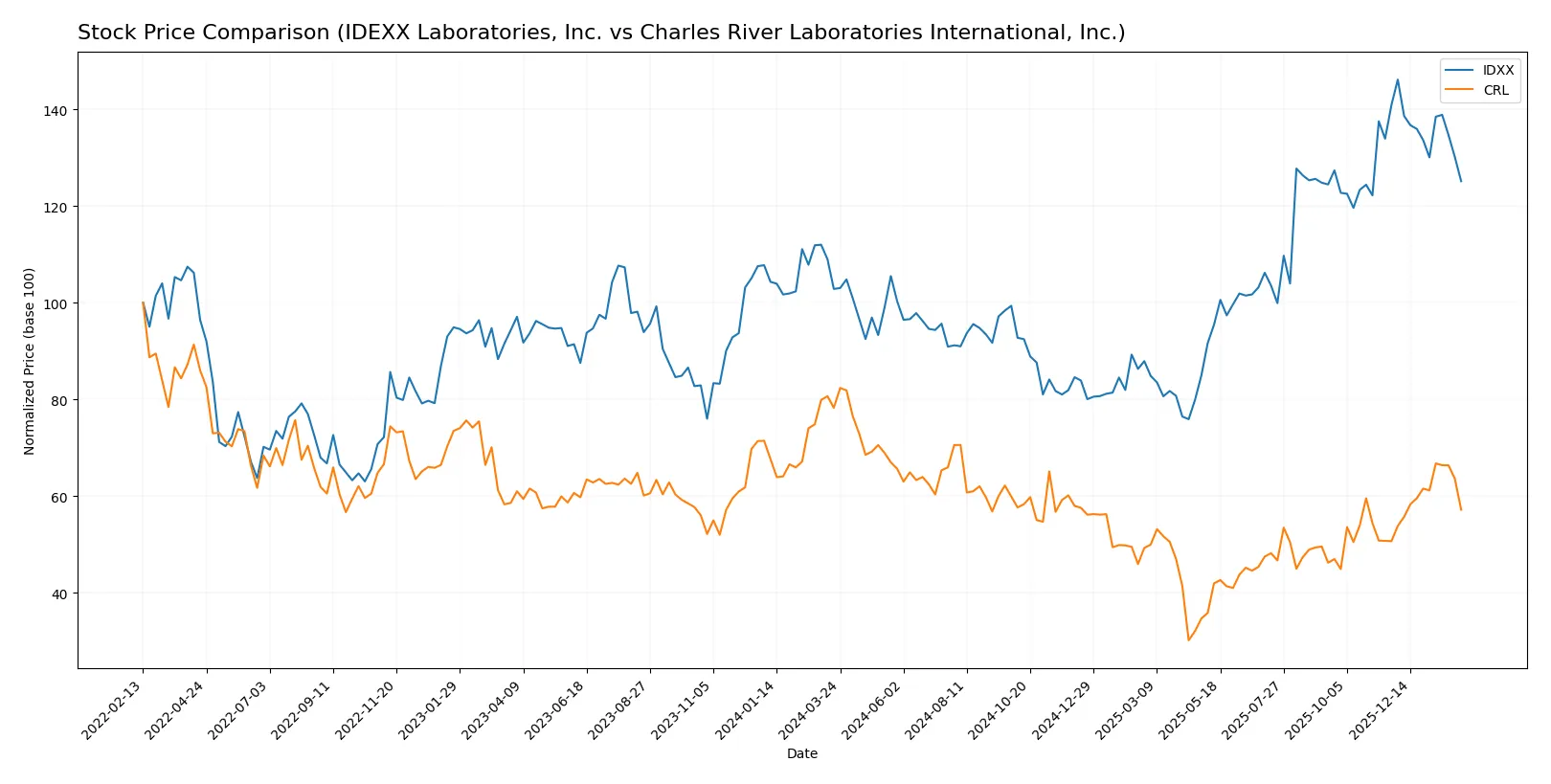

The past year shows contrasting dynamics: IDEXX Laboratories posts a 21.7% gain with decelerating momentum, while Charles River Laboratories falls 27% but accelerates its recent recovery trend.

Trend Comparison

IDEXX Laboratories exhibits a bullish trend over 12 months with a 21.7% price increase and high volatility (96.7 std deviation). The trend decelerates, peaking at $753, bottoming near $391.

Charles River Laboratories shows a bearish 27% decline over the year, with accelerating downside momentum. Its price fluctuated between $100 and $273, displaying lower volatility (33.7 std deviation).

Comparing both, IDEXX delivers the highest market performance despite recent downward pressure, while Charles River’s trend remains negative but shows early signs of recovery.

Target Prices

Analysts project a bullish outlook for both IDEXX Laboratories and Charles River Laboratories based on current consensus targets.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| IDEXX Laboratories, Inc. | 730 | 830 | 789.29 |

| Charles River Laboratories International, Inc. | 185 | 260 | 214.43 |

IDEXX’s target consensus suggests a 22.5% upside from its $645 price, signaling strong growth expectations. Charles River’s consensus target implies a 13.3% potential rise from $189, reflecting moderate optimism among analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for IDEXX Laboratories, Inc. and Charles River Laboratories International, Inc.:

IDEXX Laboratories, Inc. Grades

This table presents recent grade updates from leading financial institutions for IDEXX Laboratories, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-02-05 |

| BTIG | Maintain | Buy | 2026-02-03 |

| UBS | Maintain | Neutral | 2026-02-03 |

| UBS | Maintain | Neutral | 2025-11-04 |

| JP Morgan | Maintain | Overweight | 2025-11-04 |

| BTIG | Maintain | Buy | 2025-11-04 |

| Morgan Stanley | Maintain | Overweight | 2025-11-04 |

| Stifel | Upgrade | Buy | 2025-10-31 |

| Morgan Stanley | Maintain | Overweight | 2025-08-15 |

| Piper Sandler | Maintain | Neutral | 2025-08-11 |

Charles River Laboratories International, Inc. Grades

This table displays recent institutional grade changes for Charles River Laboratories International, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-13 |

| Mizuho | Maintain | Neutral | 2025-12-18 |

| JP Morgan | Maintain | Neutral | 2025-12-15 |

| Barclays | Maintain | Overweight | 2025-12-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-11 |

| TD Cowen | Maintain | Buy | 2025-11-10 |

| Baird | Upgrade | Outperform | 2025-11-06 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Barclays | Maintain | Overweight | 2025-11-06 |

Which company has the best grades?

IDEXX Laboratories holds a consistent pattern of “Buy” and “Overweight” ratings, indicating steady institutional confidence. Charles River Laboratories features a mix of “Buy,” “Outperform,” and “Neutral” grades, with some upgrades, suggesting cautious optimism. Investors may interpret IDEXX’s grades as more uniformly positive, while Charles River’s diverse ratings reflect varying analyst views.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

IDEXX Laboratories, Inc. (IDXX)

- Strong diagnostics niche with high ROIC but faces premium valuation pressures.

Charles River Laboratories International, Inc. (CRL)

- Diverse CRO services but low profitability and high P/E reflect competitive and margin challenges.

2. Capital Structure & Debt

IDEXX Laboratories, Inc. (IDXX)

- Very low leverage with strong interest coverage supports financial resilience.

Charles River Laboratories International, Inc. (CRL)

- Higher debt levels and weak interest coverage increase refinancing and solvency risks.

3. Stock Volatility

IDEXX Laboratories, Inc. (IDXX)

- Beta at 1.66 indicates above-average volatility relative to S&P 500.

Charles River Laboratories International, Inc. (CRL)

- Beta at 1.62 also signals elevated volatility in a cyclical sector.

4. Regulatory & Legal

IDEXX Laboratories, Inc. (IDXX)

- Exposure to animal health and human diagnostics regulations demands ongoing compliance.

Charles River Laboratories International, Inc. (CRL)

- CRO regulatory environment complex and evolving, especially in global safety testing standards.

5. Supply Chain & Operations

IDEXX Laboratories, Inc. (IDXX)

- Reliance on specialized diagnostic consumables could be vulnerable to raw material disruptions.

Charles River Laboratories International, Inc. (CRL)

- Broad global operations increase supply chain complexity and geopolitical risk exposure.

6. ESG & Climate Transition

IDEXX Laboratories, Inc. (IDXX)

- Growing demand for sustainable animal health products creates both opportunity and compliance costs.

Charles River Laboratories International, Inc. (CRL)

- ESG pressures on animal testing practices could intensify regulatory scrutiny and reputational risk.

7. Geopolitical Exposure

IDEXX Laboratories, Inc. (IDXX)

- Primarily US-based with moderate international sales; less geopolitical risk.

Charles River Laboratories International, Inc. (CRL)

- More global footprint exposes CRL to trade tensions and regulatory divergence.

Which company shows a better risk-adjusted profile?

IDEXX Laboratories faces valuation and market volatility risks but benefits from a fortress-like balance sheet and strong profitability. Charles River Laboratories struggles with weaker profitability, higher leverage, and operational complexity that elevate its systemic risks. IDXX’s Altman Z-Score of 20.3 confirms financial robustness, while CRL’s 2.47 warns of moderate distress risk. The single most impactful risk for IDXX is its stretched valuation multiples that may limit downside protection. For CRL, its high debt and thin margins pose a critical threat to stability. IDXX clearly offers a superior risk-adjusted profile in 2026, backed by strong capital allocation and operational efficiency.

Final Verdict: Which stock to choose?

IDEXX Laboratories wields unmatched efficiency in capital allocation, consistently creating value well above its cost of capital. Its ability to generate high returns on equity and invested capital underpins its durable competitive edge. However, investors should watch its premium valuation and slightly declining profitability as points of vigilance. It suits portfolios targeting Aggressive Growth with a tolerance for elevated multiples.

Charles River Laboratories’ strategic moat lies in its niche recurring revenue streams and steady operational cash flow. Though it lacks the robust profitability of IDEXX, it offers a safety profile with stronger liquidity ratios and a less stretched balance sheet. This positions CRL as more fitting for GARP investors who prioritize stability and reasonable valuation over rapid expansion.

If you prioritize superior capital efficiency and growth momentum, IDEXX outshines with its proven value creation and strong profitability metrics. However, if you seek better stability and a more conservative risk profile, Charles River offers a more tempered investment case despite its current operational challenges. Both present distinct analytical scenarios tailored to different investor appetites.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of IDEXX Laboratories, Inc. and Charles River Laboratories International, Inc. to enhance your investment decisions: