In the fast-evolving semiconductor industry, SkyWater Technology, Inc. (SKYT) and CEVA, Inc. (CEVA) stand out with distinct yet overlapping innovation strategies. SkyWater focuses on semiconductor manufacturing and engineering services, while CEVA specializes in licensing advanced wireless and AI processing technologies. This comparison explores their market approaches and growth potential, helping you identify which company aligns best with your investment goals in 2026.

Table of contents

Companies Overview

I will begin the comparison between SkyWater Technology, Inc. and CEVA, Inc. by providing an overview of these two companies and their main differences.

SkyWater Technology, Inc. Overview

SkyWater Technology, Inc. specializes in semiconductor development and manufacturing services. The company co-creates technologies with customers and provides manufacturing for silicon-based analog and mixed-signal, power discrete, microelectromechanical systems, and rad-hard integrated circuits. It serves diverse industries including aerospace, automotive, bio-health, consumer, and industrial IoT. Founded in 2017, SkyWater is headquartered in Bloomington, Minnesota, with a market cap of approximately 1.58B USD.

CEVA, Inc. Overview

CEVA, Inc. operates as a licensor of wireless connectivity and smart sensing technologies worldwide. It designs and licenses digital signal processors, AI processors, wireless platforms, and software solutions for applications such as 5G, imaging, computer vision, and IoT. Incorporated in 1999 and based in Rockville, Maryland, CEVA supports OEMs and semiconductor companies in various sectors including mobile, automotive, robotics, and aerospace. It has a market capitalization near 542M USD.

Key similarities and differences

Both companies operate within the semiconductor industry, focusing on technology innovation and serving diverse global markets. SkyWater emphasizes semiconductor manufacturing and co-development services, while CEVA concentrates on licensing intellectual property and software platforms. SkyWater’s business model involves direct manufacturing services, contrasting with CEVA’s licensing approach, which provides DSP cores and AI processors to chip and device makers.

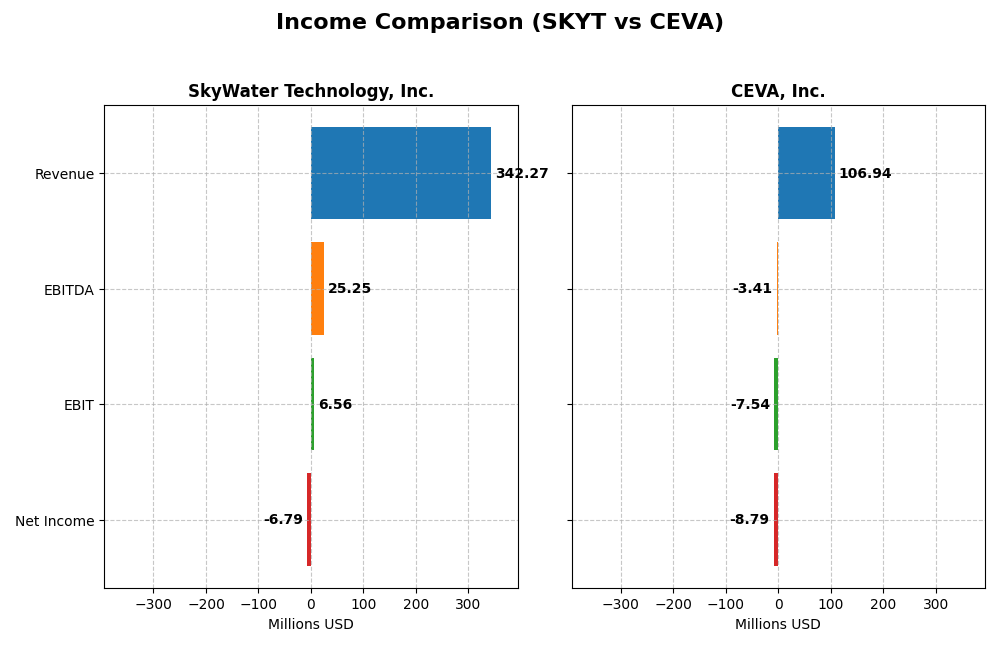

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for SkyWater Technology, Inc. and CEVA, Inc. for the fiscal year 2024, offering a snapshot of their financial performance.

| Metric | SkyWater Technology, Inc. (SKYT) | CEVA, Inc. (CEVA) |

|---|---|---|

| Market Cap | 1.58B USD | 542M USD |

| Revenue | 342M USD | 107M USD |

| EBITDA | 25.3M USD | -3.41M USD |

| EBIT | 6.56M USD | -7.55M USD |

| Net Income | -6.79M USD | -8.79M USD |

| EPS | -0.14 USD | -0.37 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

SkyWater Technology, Inc.

SkyWater Technology has demonstrated strong revenue growth of 144% from 2020 to 2024, with a 19% increase in revenue from 2023 to 2024. Gross margin improved to 20.34%, while net income remains negative but shows an 81.5% improvement in net margin over the last year. The 2024 fiscal year saw a notable turnaround in EBIT, increasing 144%, signaling operational progress despite a small net loss.

CEVA, Inc.

CEVA’s revenue increased modestly by 6.6% over the 2020-2024 period and 9.8% in the last year. The company maintains a high gross margin of 88%, but EBIT margin remains negative at -7.06%, reflecting operational challenges. Although net income improved by 33% in 2024, it still shows a significant overall decline over five years, with net margins and EPS trending negatively.

Which one has the stronger fundamentals?

SkyWater Technology’s fundamentals benefit from robust revenue and profitability growth, improving margins, and positive EBIT trajectory despite ongoing net losses. CEVA boasts a superior gross margin but suffers from sustained negative EBIT and net margin results, with long-term declines in net income and EPS. SkyWater’s more consistent margin improvements and growth metrics suggest comparatively stronger income statement fundamentals.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for SkyWater Technology, Inc. (SKYT) and CEVA, Inc. (CEVA) based on the most recent fiscal year data available (2024).

| Ratios | SkyWater Technology, Inc. (SKYT) | CEVA, Inc. (CEVA) |

|---|---|---|

| ROE | -11.79% | -3.30% |

| ROIC | 3.40% | -2.68% |

| P/E | -100.3 | -84.8 |

| P/B | 11.82 | 2.79 |

| Current Ratio | 0.86 | 7.09 |

| Quick Ratio | 0.76 | 7.09 |

| D/E (Debt-to-Equity) | 1.33 | 0.021 |

| Debt-to-Assets | 24.5% | 1.80% |

| Interest Coverage | 0.74 | 0 |

| Asset Turnover | 1.09 | 0.35 |

| Fixed Asset Turnover | 2.07 | 8.43 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

SkyWater Technology, Inc.

SkyWater Technology exhibits mostly unfavorable ratios, including negative net margin (-1.98%) and return on equity (-11.79%), alongside a low current ratio (0.86) indicating liquidity concerns. Despite a favorable price-to-earnings ratio, high debt-to-equity (1.33) and poor interest coverage (0.74) raise caution. The company does not pay dividends, likely reflecting ongoing reinvestment and a challenging profitability profile.

CEVA, Inc.

CEVA’s ratios reveal a mixed picture with unfavorable net margin (-8.22%) and negative returns on equity (-3.3%) and invested capital (-2.68%). The company has a strong quick ratio (7.09) and low debt-to-equity (0.02), but zero interest coverage signals financial stress. CEVA also pays no dividends, suggesting a focus on R&D and growth initiatives rather than shareholder payouts.

Which one has the best ratios?

Both companies face unfavorable overall ratio evaluations, but CEVA shows a higher proportion of favorable ratios (35.71% vs. 21.43%) and stronger liquidity as indicated by its quick ratio. SkyWater struggles more with leverage and profitability metrics. Neither company currently distributes dividends, reflecting their financial and strategic priorities.

Strategic Positioning

This section compares the strategic positioning of SkyWater Technology, Inc. and CEVA, Inc., focusing on Market position, Key segments, and Exposure to technological disruption:

SkyWater Technology, Inc.

- Mid-cap semiconductor manufacturer facing high beta and competitive pressure in semiconductor services.

- Key segments include advanced technology services and wafer services, serving aerospace, automotive, bio-health, and industrial IoT sectors.

- Exposure through semiconductor manufacturing but no explicit mention of disruptive technology challenges.

CEVA, Inc.

- Smaller market cap with moderate beta, competing as a licensor in wireless and smart sensing technologies.

- Focused on licensing connectivity and smart sensing IP for mobile, IoT, automotive, and industrial markets.

- Exposure to disruption through continuous innovation in wireless platforms and AI processors licensing.

SkyWater Technology, Inc. vs CEVA, Inc. Positioning

SkyWater shows a diversified manufacturing and service model addressing multiple industries, while CEVA concentrates on licensing advanced wireless and sensing IP. SkyWater’s breadth offers varied revenue drivers; CEVA’s niche focus depends heavily on licensing success and technology adoption.

Which has the best competitive advantage?

Both companies are shedding value with ROIC below WACC. SkyWater shows improving profitability trends, while CEVA faces declining returns, suggesting SkyWater holds a relatively stronger, though still slightly unfavorable, competitive advantage.

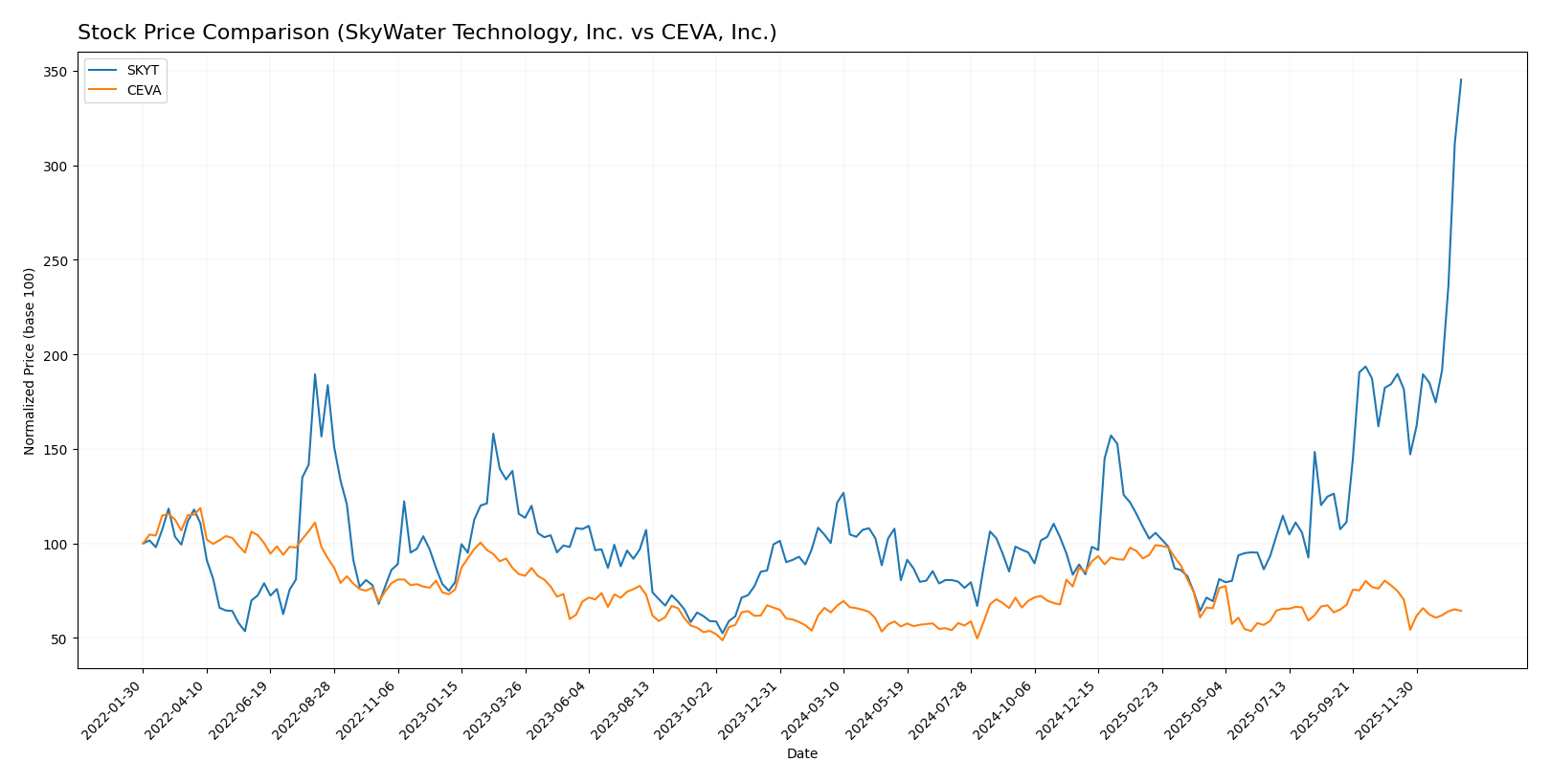

Stock Comparison

The stock price dynamics over the past year reveal significant divergence between SkyWater Technology, Inc. (SKYT) and CEVA, Inc. (CEVA), with SKYT showing a strong upward momentum while CEVA’s price remained largely flat with recent weakness.

Trend Analysis

SkyWater Technology, Inc. (SKYT) exhibited a pronounced bullish trend over the past 12 months, with a 244.62% price increase and accelerating momentum, reaching a high of 32.77 and a low of 6.1. Recent months show continued strength with an 87.39% gain.

CEVA, Inc. (CEVA) displayed a marginal overall price increase of 1.35% over the year, indicating a neutral trend with deceleration. The stock recently declined by 17.31%, reflecting seller dominance and a downward slope in the short term.

Comparing both, SKYT delivered the highest market performance by a wide margin, driven by a strong and accelerating bullish trend, whereas CEVA’s price change remained nearly flat with recent weakening.

Target Prices

The consensus target prices from verified analysts suggest clear valuation expectations for these semiconductor companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| SkyWater Technology, Inc. | 25 | 25 | 25 |

| CEVA, Inc. | 28 | 28 | 28 |

Analysts expect SkyWater Technology’s stock to correct down to $25 from the current $33, indicating potential downside risk. CEVA’s target at $28 suggests upside from its current $22.58 price, showing more growth potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for SkyWater Technology, Inc. (SKYT) and CEVA, Inc. (CEVA):

Rating Comparison

SKYT Rating

- Rating: B+, rated Very Favorable overall

- Discounted Cash Flow Score: 1, indicating Very Unfavorable

- ROE Score: 5, indicating Very Favorable

- ROA Score: 5, indicating Very Favorable

- Debt To Equity Score: 1, indicating Very Unfavorable

- Overall Score: 3, indicating Moderate

CEVA Rating

- Rating: C+, rated Very Favorable overall

- Discounted Cash Flow Score: 3, indicating Moderate

- ROE Score: 1, indicating Very Unfavorable

- ROA Score: 1, indicating Very Unfavorable

- Debt To Equity Score: 4, indicating Favorable

- Overall Score: 2, indicating Moderate

Which one is the best rated?

Based strictly on the provided data, SKYT holds a higher rating (B+) and superior scores in ROE and ROA, whereas CEVA has a lower overall rating (C+) but a more favorable debt-to-equity score. Overall, SKYT is better rated in key profitability metrics.

Scores Comparison

The comparison of financial scores for SkyWater Technology, Inc. and CEVA, Inc. is as follows:

SKYT Scores

- Altman Z-Score: 2.20, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 5, classified as average financial strength.

CEVA Scores

- Altman Z-Score: 9.99, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 4, classified as average financial strength.

Which company has the best scores?

CEVA has a significantly higher Altman Z-Score, placing it in the safe zone, while SKYT remains in the grey zone. Both companies have average Piotroski Scores, with SKYT slightly higher.

Grades Comparison

The following section presents a comparison of recent grades given to SkyWater Technology, Inc. and CEVA, Inc. by established grading companies:

SkyWater Technology, Inc. Grades

This table summarizes recent grades assigned to SkyWater Technology, Inc. by reputable grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology, Inc. has consistently received Buy or Overweight ratings, showing stability and confidence from analysts.

CEVA, Inc. Grades

Below is a summary of recent grades given to CEVA, Inc. by recognized grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-12 |

| Rosenblatt | Maintain | Buy | 2025-11-11 |

| Rosenblatt | Maintain | Buy | 2025-08-14 |

| Oppenheimer | Maintain | Outperform | 2025-05-09 |

| Rosenblatt | Maintain | Buy | 2025-05-08 |

| Barclays | Maintain | Overweight | 2025-05-08 |

| Rosenblatt | Maintain | Buy | 2025-04-23 |

| Barclays | Maintain | Overweight | 2025-02-14 |

| Rosenblatt | Maintain | Buy | 2025-02-14 |

| Rosenblatt | Maintain | Buy | 2025-02-11 |

CEVA, Inc. shows a strong and consistent Buy or Overweight consensus, with an Outperform rating from Oppenheimer during 2025, reflecting positive analyst sentiment.

Which company has the best grades?

Both SkyWater Technology, Inc. and CEVA, Inc. have predominantly Buy or Overweight ratings from credible firms. CEVA, Inc. has a slightly broader consensus with more Buy ratings and an Outperform rating, potentially indicating stronger market confidence; investors may interpret this as a marginally more favorable outlook for CEVA.

Strengths and Weaknesses

Below is a comparative overview of the key strengths and weaknesses of SkyWater Technology, Inc. (SKYT) and CEVA, Inc. based on recent financial and operational data.

| Criterion | SkyWater Technology, Inc. (SKYT) | CEVA, Inc. |

|---|---|---|

| Diversification | Moderate: Primarily advanced technology and wafer services with steady revenue segments. | Moderate: Focused on licensing and royalty revenues, with a narrower product range. |

| Profitability | Unfavorable: Negative net margin (-1.98%) and ROIC (3.4%) below WACC (19.81%). | Unfavorable: Negative net margin (-8.22%), negative ROIC (-2.68%) and declining profitability. |

| Innovation | Growing ROIC trend indicates improving operational efficiency and potential innovation gains. | Declining ROIC trend reflects challenges in sustaining innovation and profitability. |

| Global presence | Established in advanced technology services, but limited global footprint data. | Strong global licensing model but limited asset base impacts scale. |

| Market Share | Increasing revenue in advanced technology services, suggesting stable market presence. | Reliant on licensing and royalties, market share may be vulnerable to competition and tech shifts. |

Key takeaways: SkyWater shows improving profitability trends despite current value destruction, supported by diversified service offerings. CEVA faces significant profitability challenges with declining returns, relying heavily on licensing revenue, which may limit growth and competitive resilience. Both require cautious evaluation with risk management in mind.

Risk Analysis

Below is a comparative table of key risks for SkyWater Technology, Inc. (SKYT) and CEVA, Inc. based on the most recent 2024 data.

| Metric | SkyWater Technology, Inc. (SKYT) | CEVA, Inc. |

|---|---|---|

| Market Risk | High beta at 3.49 indicates high volatility | Moderate beta at 1.44 suggests moderate volatility |

| Debt level | Debt-to-equity ratio 1.33 (unfavorable), interest coverage low at 0.74 | Very low debt-to-equity ratio 0.02 (favorable), but zero interest coverage |

| Regulatory Risk | Moderate, operates in semiconductors and defense sectors | Moderate, licensing tech in wireless and AI sectors |

| Operational Risk | Negative net margin (-1.98%), low liquidity ratios (current ratio 0.86) | Negative net margin (-8.22%), but strong liquidity (current ratio 7.09) |

| Environmental Risk | Moderate, semiconductor manufacturing impacts | Lower, primarily IP licensing with limited manufacturing |

| Geopolitical Risk | Exposure to aerospace and defense markets | Exposure to global semiconductor markets, sensitive to trade policies |

The most impactful risks are SkyWater’s high market volatility and financial leverage combined with low liquidity, increasing financial distress risk. CEVA, while financially more stable with low debt and strong liquidity, faces operational challenges from consistent losses and limited interest coverage. Both companies operate in sectors sensitive to regulatory and geopolitical shifts, but SkyWater’s manufacturing exposure adds complexity.

Which Stock to Choose?

SkyWater Technology, Inc. (SKYT) shows favorable income growth with a 19.39% revenue increase in 2024 and an overall positive income statement evaluation. However, its financial ratios are mostly unfavorable, including a low current ratio of 0.86 and high debt-to-equity. The company is shedding value with a slightly unfavorable moat and holds a very favorable B+ rating.

CEVA, Inc. (CEVA) reports a smaller 9.77% revenue growth in 2024 and a mixed income statement evaluation with some unfavorable net margin metrics. Its financial ratios are moderately better, featuring a strong quick ratio and low debt-to-equity, though overall ratios remain unfavorable. CEVA has a very unfavorable moat due to declining profitability and a moderate C+ rating.

Investors seeking growth might find SkyWater’s improving income and bullish price trend appealing despite financial weaknesses, while those prioritizing financial stability may view CEVA’s stronger liquidity and lower leverage as positive, though its profitability declines warrant caution. The choice could depend on the investor’s tolerance for risk and preference for growth versus stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of SkyWater Technology, Inc. and CEVA, Inc. to enhance your investment decisions: