In the fast-evolving semiconductor industry, IPG Photonics Corporation and CEVA, Inc. stand out as innovative players with distinct yet overlapping market focuses. IPG specializes in high-performance fiber lasers primarily for materials processing, while CEVA leads in licensing advanced wireless connectivity and AI processor technologies. This comparison highlights their strategic approaches and growth potential, guiding investors to identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between IPG Photonics Corporation and CEVA, Inc. by providing an overview of these two companies and their main differences.

IPG Photonics Corporation Overview

IPG Photonics Corporation specializes in developing, manufacturing, and selling high-performance fiber lasers, fiber amplifiers, and diode lasers primarily used in materials processing worldwide. The company also offers integrated laser systems and optical components for telecommunications and advanced applications. Founded in 1990 and headquartered in Marlborough, Massachusetts, IPG operates within the semiconductor industry with a market cap of approximately 3.38B USD.

CEVA, Inc. Overview

CEVA, Inc. is a licensor of wireless connectivity and smart sensing technologies, designing and licensing digital signal processors, AI processors, and wireless platforms for semiconductor and OEM companies worldwide. Its technologies support applications in mobile, IoT, automotive, robotics, and aerospace markets. Founded in 1999, CEVA is based in Rockville, Maryland, with a market cap near 547M USD and focuses on intellectual property licensing within the semiconductor sector.

Key similarities and differences

Both companies operate in the semiconductor industry but differ in their core business models. IPG Photonics manufactures and sells physical laser products and systems, while CEVA primarily licenses digital signal processing and wireless technology IP to chipmakers and OEMs. IPG has a larger market capitalization and workforce, focusing on hardware solutions, whereas CEVA emphasizes software and IP licensing for connectivity and sensing technologies.

Income Statement Comparison

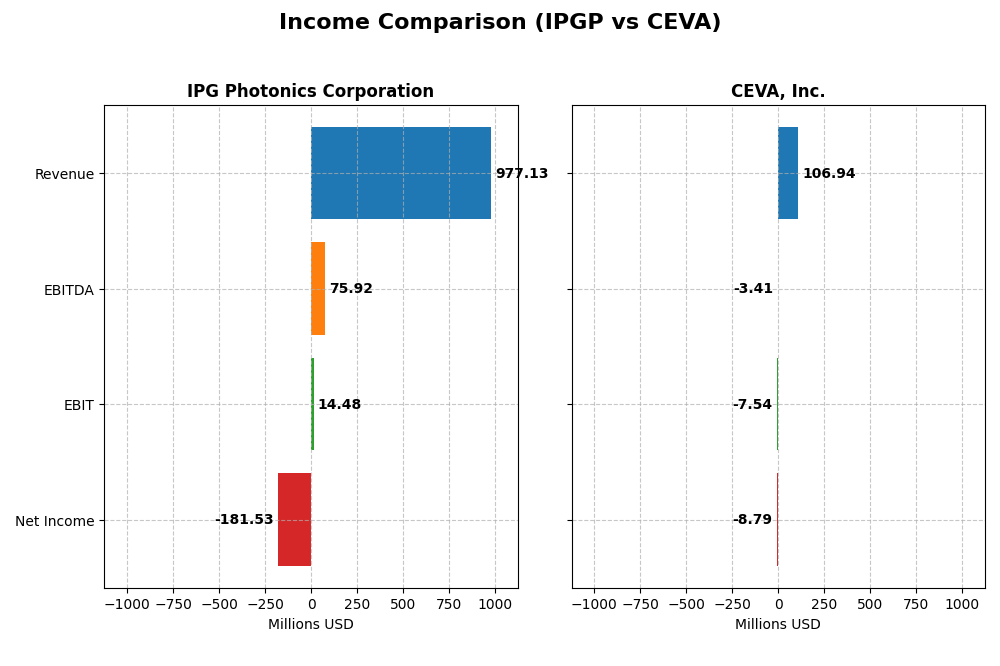

The table below compares the key income statement metrics for IPG Photonics Corporation and CEVA, Inc. for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | IPG Photonics Corporation | CEVA, Inc. |

|---|---|---|

| Market Cap | 3.38B | 547M |

| Revenue | 977M | 107M |

| EBITDA | 76M | -3.4M |

| EBIT | 14.5M | -7.5M |

| Net Income | -182M | -8.8M |

| EPS | -4.09 | -0.37 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

IPG Photonics Corporation

From 2020 to 2024, IPG Photonics saw declining revenue and net income, with revenue decreasing about 18.6% overall and net income falling dramatically by over 213%. Gross margins remained favorable near 34.6%, but net margins turned negative to -18.6% in 2024. The most recent year showed a sharp revenue drop of 24.1% and a net loss of $181.5M, indicating significant margin pressures and declining profitability.

CEVA, Inc.

CEVA experienced modest revenue growth of 6.6% from 2020 to 2024, with positive 9.8% growth in the latest year. However, net income declined overall by 269%, reflecting sustained losses despite improving margins. Gross margin was very strong at 88%, but EBIT and net margins remained negative at -7.1% and -8.2% respectively in 2024. Recent results showed improved net margin growth of 32.6%, signaling some operational progress despite losses.

Which one has the stronger fundamentals?

CEVA demonstrates more favorable income statement fundamentals with strong gross margins and recent growth in revenue, EBIT, and net margin, despite ongoing net losses. Conversely, IPG Photonics faces unfavorable declines across revenue, net income, and margins, culminating in a steep net loss in 2024. Overall, CEVA’s income statement metrics suggest stronger operational trends relative to IPG Photonics.

Financial Ratios Comparison

The table below presents key financial ratios for IPG Photonics Corporation and CEVA, Inc. for the most recent fiscal year 2024, facilitating a straightforward comparison of their financial performance and stability.

| Ratios | IPG Photonics Corporation | CEVA, Inc. |

|---|---|---|

| ROE | -8.97% | -3.30% |

| ROIC | -9.97% | -2.68% |

| P/E | -17.76 | -84.79 |

| P/B | 1.59 | 2.79 |

| Current Ratio | 6.98 | 7.09 |

| Quick Ratio | 5.59 | 7.09 |

| D/E (Debt-to-Equity) | 0.009 | 0.021 |

| Debt-to-Assets | 0.008 | 0.018 |

| Interest Coverage | 0 | 0 |

| Asset Turnover | 0.43 | 0.35 |

| Fixed Asset Turnover | 1.66 | 8.43 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

IPG Photonics Corporation

IPG Photonics shows mixed financial health with several unfavorable ratios such as negative net margin (-18.58%) and return on equity (-8.97%), indicating profitability and efficiency challenges. Its current ratio is high at 6.98 but considered unfavorable, possibly signaling inefficient asset use. The company does not pay dividends, likely due to negative net income and a focus on reinvestment or growth.

CEVA, Inc.

CEVA’s ratios reveal significant weaknesses, including negative net margin (-8.22%) and return on equity (-3.3%), with an unfavorable weighted average cost of capital (10.46%). The interest coverage ratio is zero, raising concerns about debt servicing. CEVA also does not pay dividends, reflecting ongoing losses or reinvestment in R&D, consistent with its high research and development expense ratio.

Which one has the best ratios?

Both companies face profitability challenges with negative margins and returns, but IPG Photonics presents a slightly better overall profile with fewer unfavorable ratios and a favorable interest coverage ratio. CEVA shows a higher proportion of unfavorable metrics, particularly in debt servicing and cost of capital, resulting in a less favorable ratios evaluation.

Strategic Positioning

This section compares the strategic positioning of IPG Photonics Corporation and CEVA, Inc., focusing on Market position, Key segments, and Exposure to technological disruption:

IPG Photonics Corporation

- Leading in fiber laser manufacturing with global materials processing focus; faces semiconductor industry competition.

- Diversified product lines including high-power lasers, amplifiers, and integrated systems driving materials processing and communications revenue.

- Exposure to evolving laser technologies and integration challenges but limited direct disruption from wireless IP trends.

CEVA, Inc.

- Licensor of wireless connectivity and smart sensing IP, targeting semiconductor and OEM companies worldwide.

- Concentrated on licensing digital signal processors and AI tech for mobile, IoT, automotive, and industrial markets.

- Faces disruption risk from rapid wireless standards evolution and AI processor innovation in a competitive licensing market.

IPG Photonics Corporation vs CEVA, Inc. Positioning

IPG shows a diversified approach centered on fiber laser products for materials processing and communications, while CEVA focuses on licensing advanced wireless and AI processor IP. IPG’s broader product scope offers multiple revenue streams; CEVA’s concentrated licensing model depends heavily on semiconductor partners.

Which has the best competitive advantage?

Both companies exhibit very unfavorable MOAT evaluations with declining ROIC below WACC, indicating value destruction. Neither currently demonstrates a sustainable competitive advantage based on capital efficiency trends from 2020 to 2024.

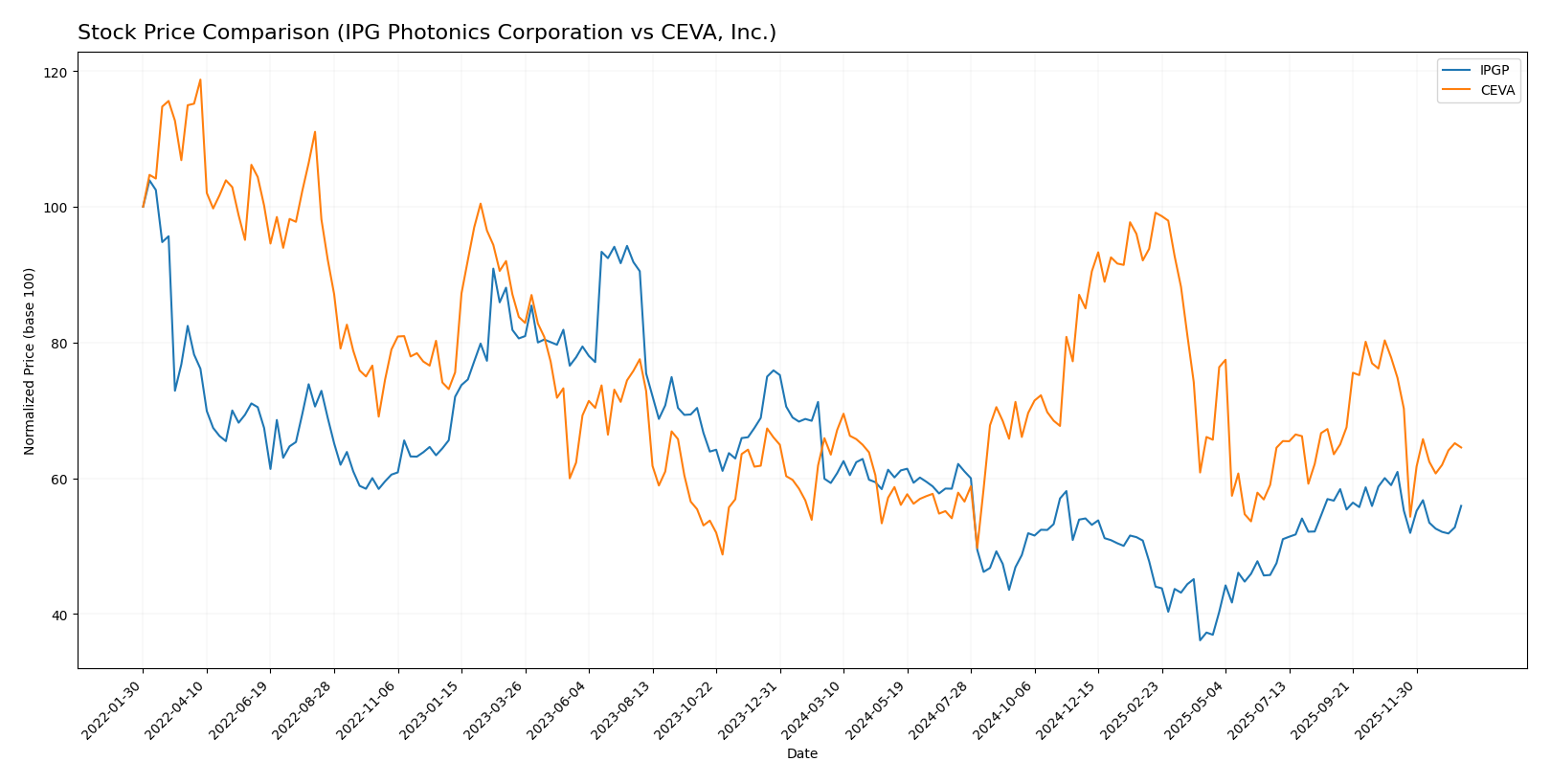

Stock Comparison

The stock price movements of IPG Photonics Corporation and CEVA, Inc. over the past 12 months reveal contrasting trends, with IPGP showing a sustained bearish trajectory and CEVA exhibiting a mild bullish trend despite recent declines.

Trend Analysis

IPG Photonics Corporation’s stock experienced a -5.69% price change over the past year, indicating a bearish trend with deceleration. The price ranged from a low of 52.12 to a high of 90.69, showing high volatility (9.28 std deviation).

CEVA, Inc.’s stock saw a 1.67% price increase over 12 months, classifying as a bullish trend with deceleration. The price fluctuated between 17.39 and 34.67, with moderate volatility (4.4 std deviation).

Comparing both, IPGP showed the more significant negative performance, while CEVA delivered the highest market performance with a modest overall price increase.

Target Prices

Here is the current target price consensus from verified analysts for the selected semiconductor companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| IPG Photonics Corporation | 96 | 92 | 94 |

| CEVA, Inc. | 28 | 28 | 28 |

Analysts expect IPG Photonics to trade significantly above its current price of 80.35 USD, indicating potential upside. CEVA’s consensus target of 28 USD also suggests a strong positive outlook compared to its current price of 22.76 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for IPG Photonics Corporation and CEVA, Inc.:

Rating Comparison

IPGP Rating

- Rated B+ with a very favorable status, reflecting a strong overall financial standing.

- Discounted Cash Flow Score of 4, favorable for assessing potential undervaluation.

- Return on Equity Score of 2, moderate efficiency in generating profit from equity.

- Return on Assets Score of 3, moderate effectiveness in utilizing assets.

- Debt To Equity Score of 4, favorable with low financial risk from debt levels.

- Overall Score of 3, moderate overall financial strength.

CEVA Rating

- Rated C+ with a very favorable status, indicating a solid but lower standing.

- Discounted Cash Flow Score of 3, moderate indication of valuation concerns.

- Return on Equity Score of 1, very unfavorable, indicating low profit efficiency.

- Return on Assets Score of 1, very unfavorable, showing weak asset utilization.

- Debt To Equity Score of 4, favorable, similarly low financial risk.

- Overall Score of 2, moderate but below IPGP’s overall financial strength.

Which one is the best rated?

Based on the provided data, IPGP holds a higher rating (B+) compared to CEVA’s C+. IPGP also scores better on discounted cash flow, ROE, ROA, and overall financial strength, while both share a favorable debt-to-equity score.

Scores Comparison

Here is a comparison of the financial scores for IPGP and CEVA:

IPGP Scores

- Altman Z-Score: 9.65, placing it in the safe zone.

- Piotroski Score: 7, indicating strong financial health.

CEVA Scores

- Altman Z-Score: 9.99, placing it in the safe zone.

- Piotroski Score: 4, indicating average financial health.

Which company has the best scores?

Both IPGP and CEVA have Altman Z-Scores well within the safe zone, signaling low bankruptcy risk. However, IPGP has a higher Piotroski Score (7 vs. 4), suggesting stronger overall financial health based on profitability and efficiency criteria.

Grades Comparison

The grades issued by reputable financial institutions for IPG Photonics Corporation and CEVA, Inc. are as follows:

IPG Photonics Corporation Grades

This table shows recent grades and changes from leading grading companies for IPGP:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Stifel | Maintain | Buy | 2025-02-12 |

| Needham | Maintain | Hold | 2025-02-12 |

| Seaport Global | Downgrade | Neutral | 2024-08-01 |

| Stifel | Maintain | Buy | 2024-07-31 |

| Raymond James | Maintain | Strong Buy | 2024-07-31 |

Overall, IPGP’s ratings reflect a generally positive trend with several upgrades to Buy and Strong Buy, though some mixed opinions persist.

CEVA, Inc. Grades

This table presents the current grades and stability of CEVA’s ratings from respected firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-12 |

| Rosenblatt | Maintain | Buy | 2025-11-11 |

| Rosenblatt | Maintain | Buy | 2025-08-14 |

| Oppenheimer | Maintain | Outperform | 2025-05-09 |

| Rosenblatt | Maintain | Buy | 2025-05-08 |

| Barclays | Maintain | Overweight | 2025-05-08 |

| Rosenblatt | Maintain | Buy | 2025-04-23 |

| Barclays | Maintain | Overweight | 2025-02-14 |

| Rosenblatt | Maintain | Buy | 2025-02-14 |

| Rosenblatt | Maintain | Buy | 2025-02-11 |

The grades for CEVA show consistent Buy and Overweight ratings with no recent changes, indicating stable analyst confidence.

Which company has the best grades?

Both IPG Photonics and CEVA hold a consensus “Buy” rating, but CEVA’s grades are more consistently positive with multiple Buy and Overweight ratings maintained steadily. IPGP shows a mix of upgrades and some Sell or Neutral opinions, suggesting more varied analyst perspectives. This consistency may influence investor sentiment and perceived risk differently between the two.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for IPG Photonics Corporation (IPGP) and CEVA, Inc. based on the most recent financial and operational data.

| Criterion | IPG Photonics Corporation (IPGP) | CEVA, Inc. |

|---|---|---|

| Diversification | Moderate product diversification across laser types and services; strong focus on materials processing | Narrower product range focused on licensing and royalties; evolving towards smart sensing and connectivity |

| Profitability | Negative net margin (-18.58%) and ROIC (-9.97%); company is shedding value | Negative net margin (-8.22%) and ROIC (-2.68%); also shedding value but less severely |

| Innovation | Strong presence in laser technology with diverse laser products | Focused on semiconductor IP with growing smart sensing and connectivity solutions |

| Global presence | Established global footprint in laser systems | Growing international presence via licensing agreements |

| Market Share | Leading in high-power laser markets with steady revenues | Smaller market share focused on niche semiconductor IP markets |

Key takeaways: Both companies currently face profitability challenges, reflected in negative margins and ROIC well below WACC. IPG Photonics shows more product diversification and a stronger global presence, but is experiencing sharper declines in value creation. CEVA has a narrower focus but is working on innovation in semiconductor IP. Caution is advised given their unfavorable financial trends.

Risk Analysis

Below is a comparative table of key risks for IPG Photonics Corporation (IPGP) and CEVA, Inc. based on the most recent 2024 data.

| Metric | IPG Photonics Corporation (IPGP) | CEVA, Inc. |

|---|---|---|

| Market Risk | Moderate beta 1.02; technology sector volatility | Higher beta 1.44; more volatile market exposure |

| Debt level | Very low debt-to-equity 0.01; strong interest coverage | Low debt-to-equity 0.02; zero interest coverage, riskier |

| Regulatory Risk | Moderate; operates globally with tech regulations | Moderate; licensing and IP exposure to regulatory changes |

| Operational Risk | Moderate; complex manufacturing and supply chains | Moderate; reliance on licensing and technology development |

| Environmental Risk | Low; limited direct manufacturing impact | Low; primarily IP licensing, minimal environmental footprint |

| Geopolitical Risk | Moderate; global sales but US-based | Moderate; global client base and technology export controls |

IPGP’s most significant risks include operational complexity and moderate market volatility, but its very low debt and strong interest coverage reduce financial risk. CEVA faces higher market volatility and operational risks from reliance on IP licensing, with zero interest coverage signaling financial strain. Both companies operate in technology sectors where regulatory and geopolitical risks remain relevant.

Which Stock to Choose?

IPG Photonics Corporation (IPGP) shows a declining income trend with a 24.1% revenue drop in 2024 and unfavorable profitability ratios, including a -18.58% net margin and negative returns on equity and invested capital. Its low debt and strong liquidity contrast with a slightly unfavorable global ratio evaluation, while its rating is very favorable (B+).

CEVA, Inc. (CEVA) presents a modest revenue growth of 9.77% in 2024 and a favorable gross margin of 88.06%, but profitability remains negative with an -8.22% net margin and weak returns on equity and invested capital. The company holds low debt, a strong quick ratio, yet its overall ratios and rating are unfavorable to moderate (C+).

For investors prioritizing growth and positive income trends, CEVA’s improving revenue and favorable gross margin might appear more attractive despite its profitability challenges. Conversely, those focused on financial stability and creditworthiness could find IPGP’s stronger rating and low debt profile more reassuring, though its declining income and profitability could signal caution.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of IPG Photonics Corporation and CEVA, Inc. to enhance your investment decisions: