Investors seeking exposure to the uranium sector often consider both operational and royalty companies, each offering distinct risk and reward profiles. Centrus Energy Corp. (LEU) is a leading supplier of nuclear fuel and technical services, while Uranium Royalty Corp. (UROY) focuses on accumulating diversified uranium royalties. This comparison explores their market positions, innovation strategies, and growth potential to help you identify which company aligns best with your investment goals. Let’s uncover which opportunity stands out for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Centrus Energy Corp. and Uranium Royalty Corp. by providing an overview of these two companies and their main differences.

Centrus Energy Corp. Overview

Centrus Energy Corp. supplies nuclear fuel and services to the nuclear power industry in the US, Japan, Belgium, and internationally. It operates through two segments: Low-Enriched Uranium (LEU), selling components for nuclear utilities, and Technical Solutions, offering engineering and manufacturing services. Founded in 1998 and headquartered in Bethesda, Maryland, Centrus holds a strong position in uranium enrichment and nuclear fuel supply.

Uranium Royalty Corp. Overview

Uranium Royalty Corp. is a pure-play uranium royalty company that acquires and manages a diverse portfolio of uranium interests across North America and Namibia. Established in 2017 and based in Vancouver, Canada, it holds royalty stakes in multiple uranium projects in Canada and the US. The company focuses on generating revenue through royalties rather than direct production or enrichment activities.

Key similarities and differences

Both companies operate in the uranium sector within the energy industry, but their business models differ significantly. Centrus Energy is involved in uranium enrichment and technical services, providing physical products and support to nuclear utilities. Uranium Royalty Corp., in contrast, focuses solely on royalty interests, generating income from a diversified portfolio of uranium projects without direct operational involvement. Their geographic footprints also vary, with Centrus having a more international presence and Uranium Royalty emphasizing North American assets.

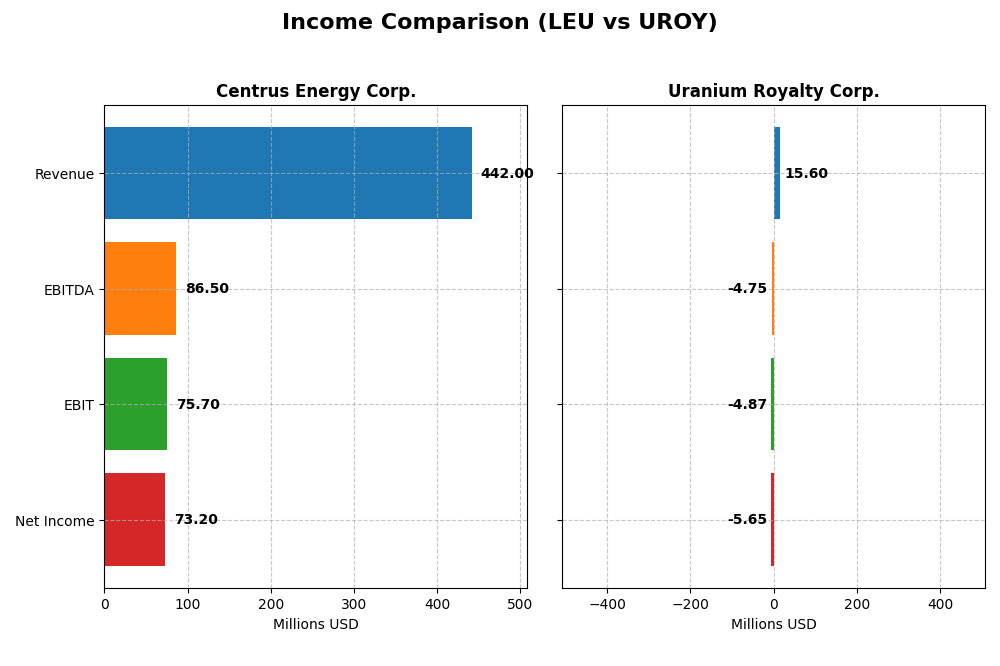

Income Statement Comparison

The table below compares key income statement metrics for Centrus Energy Corp. and Uranium Royalty Corp. based on their most recent fiscal year data.

| Metric | Centrus Energy Corp. (LEU) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Market Cap | 5.36B USD | 535M CAD |

| Revenue | 442M USD | 15.6M CAD |

| EBITDA | 86.5M USD | -4.75M CAD |

| EBIT | 75.7M USD | -4.87M CAD |

| Net Income | 73.2M USD | -5.65M CAD |

| EPS | 4.49 USD | -0.045 CAD |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Centrus Energy Corp.

Centrus Energy Corp. exhibited strong revenue growth of 78.8% over 2020-2024, with net income increasing 34.56%. Despite a 2024 slowdown where gross profit and EBIT declined slightly, revenue grew 38.04%, reflecting robust top-line momentum. Margins remain favorable overall, though net margin contracted by 24.74%, signaling margin pressures in the latest year.

Uranium Royalty Corp.

Uranium Royalty Corp. faced significant challenges, with revenue dropping 63.48% in the last year and no overall revenue growth since 2021. The company reported persistent net losses, with a net margin of -36.26% and EBIT margin at -31.24%. The 2025 fiscal year showed deteriorating profitability and considerable margin weakness, underscoring ongoing operational difficulties.

Which one has the stronger fundamentals?

Centrus Energy Corp. demonstrates stronger fundamentals supported by consistent revenue and net income growth and favorable margin trends over the period. In contrast, Uranium Royalty Corp.’s financials reveal sustained losses, declining revenues, and unfavorable margins. The overall income statement evaluation favors Centrus Energy for resilience and profitability.

Financial Ratios Comparison

This table presents the most recent key financial ratios for Centrus Energy Corp. (LEU) and Uranium Royalty Corp. (UROY), reflecting data as of fiscal year-end 2024 for LEU and April 2025 for UROY.

| Ratios | Centrus Energy Corp. (LEU) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| ROE | 45.4% | -1.9% |

| ROIC | 4.0% | -1.6% |

| P/E | 14.8 | -56.0 |

| P/B | 6.73 | 1.07 |

| Current Ratio | 2.93 | 233.49 |

| Quick Ratio | 2.46 | 233.49 |

| D/E | 0.97 | 0.0007 |

| Debt-to-Assets | 14.4% | 0.07% |

| Interest Coverage | 17.8 | -11.0 |

| Asset Turnover | 0.40 | 0.05 |

| Fixed Asset Turnover | 47.0 | 82.5 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Centrus Energy Corp.

Centrus Energy Corp. shows a mostly favorable ratio profile with strong net margin of 16.56% and an impressive return on equity at 45.35%. However, return on invested capital at 4.02% and asset turnover are less favorable, indicating some efficiency concerns. The company maintains solid liquidity with a current ratio of 2.93. It does not pay dividends, likely focusing on reinvestment or growth strategies.

Uranium Royalty Corp.

Uranium Royalty Corp. presents a challenging ratio set, with unfavorable net margin of -36.26% and negative returns on equity and invested capital, signaling profitability issues. While price-to-book at 1.07 and zero debt-to-equity ratio are positive, the extremely high current ratio of 233.49 is unusual. This company also does not pay dividends, probably due to ongoing investment or development phase.

Which one has the best ratios?

Centrus Energy Corp. demonstrates a more favorable overall ratio profile, with a higher proportion of positive profitability and liquidity metrics. Uranium Royalty Corp.’s ratios reveal greater financial stress and operational inefficiencies, reflected in its negative margins and returns. Thus, Centrus Energy Corp. holds the stronger financial ratios based on available data.

Strategic Positioning

This section compares the strategic positioning of Centrus Energy Corp. and Uranium Royalty Corp., including market position, key segments, and exposure to technological disruption:

Centrus Energy Corp.

- Large market cap of 5.36B; operates in multiple countries with moderate competitive pressure.

- Operates two segments: Low-Enriched Uranium sales and Technical Solutions services.

- Limited explicit data on exposure; operates in nuclear fuel supply and technical services.

Uranium Royalty Corp.

- Smaller market cap of 535M; focuses on geographically diversified uranium royalties.

- Pure-play uranium royalty company managing multiple royalty interests in uranium projects.

- No explicit disclosure on technological disruption exposure in provided data.

Centrus Energy Corp. vs Uranium Royalty Corp. Positioning

Centrus Energy presents a diversified approach with product sales and technical services across several countries, while Uranium Royalty concentrates on royalty interests across uranium projects. Centrus has broader operational scope; Uranium Royalty offers geographic diversification in royalties.

Which has the best competitive advantage?

Both companies show very unfavorable MOAT evaluations with declining ROIC and value destruction. Neither currently demonstrates a sustainable competitive advantage based on the provided MOAT data.

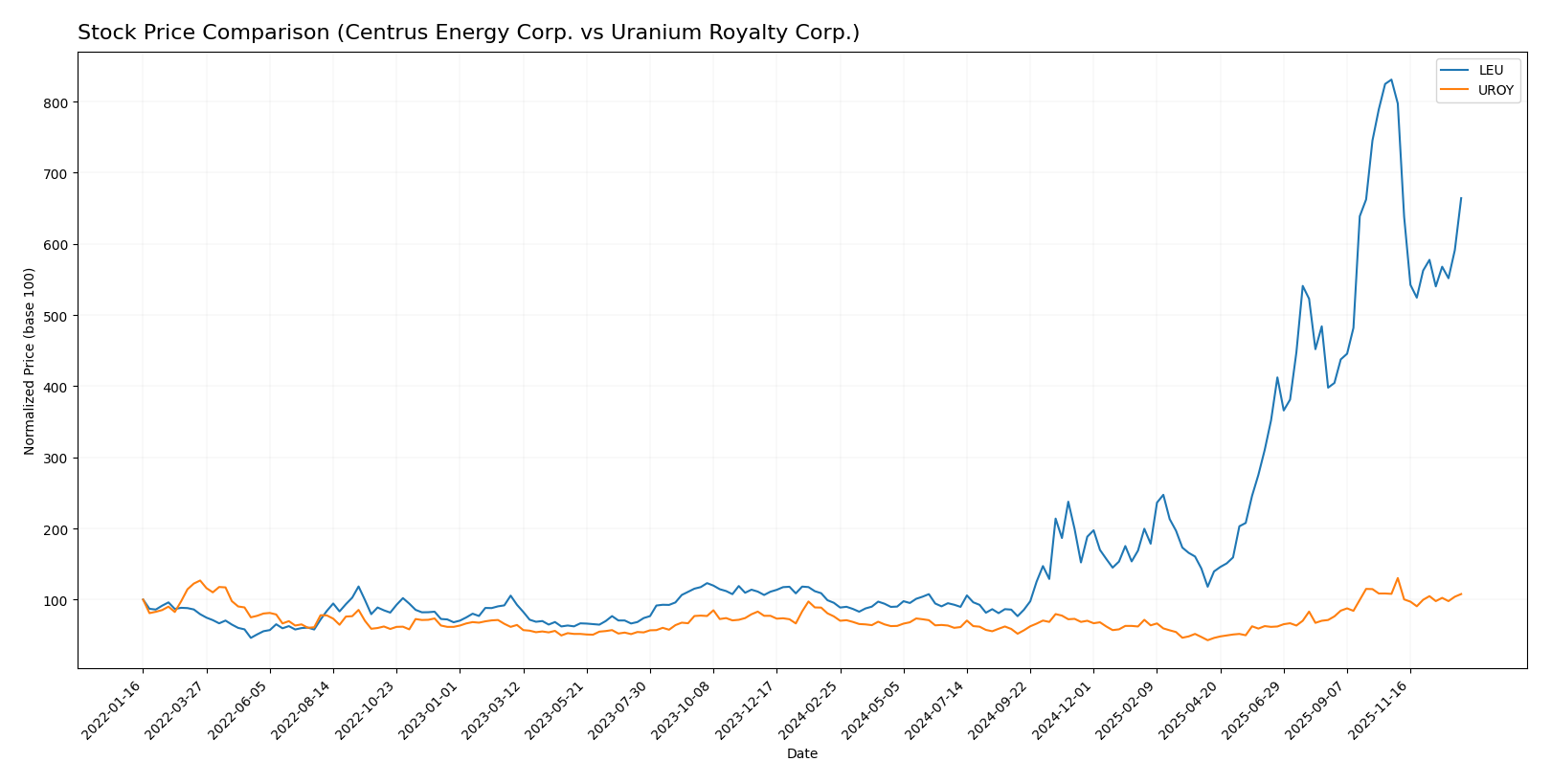

Stock Comparison

The stock price dynamics over the past 12 months reveal significant divergence, with Centrus Energy Corp. (LEU) exhibiting strong gains followed by recent retracement, while Uranium Royalty Corp. (UROY) shows moderate appreciation with near stability in the last quarter.

Trend Analysis

Centrus Energy Corp. (LEU) experienced a robust bullish trend over the past year with a 595.57% price increase, though recent months indicate a 20.05% decline reflecting a deceleration phase. Uranium Royalty Corp. (UROY) showed a bullish trend as well, with a 41.05% gain over the year and a virtually neutral recent trend with a slight 0.25% decrease. Comparing both, LEU delivered substantially higher market performance despite its recent pullback, while UROY maintained steadier but more modest growth.

Target Prices

The consensus target price data for Centrus Energy Corp. shows a moderate upside potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Centrus Energy Corp. | 390 | 125 | 288.4 |

Analysts expect Centrus Energy Corp. shares to trade around 288.4, which is slightly below the current price of 306.19, suggesting a cautious outlook. No verified target price data is available for Uranium Royalty Corp., leaving its market sentiment less defined.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Centrus Energy Corp. and Uranium Royalty Corp.:

Rating Comparison

Centrus Energy Corp. Rating

- Rating: B, classified as Very Favorable

- Discounted Cash Flow Score: 4, Favorable

- ROE Score: 5, Very Favorable

- ROA Score: 4, Favorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 3, Moderate

Uranium Royalty Corp. Rating

- Rating: C-, classified as Very Favorable

- Discounted Cash Flow Score: 1, Very Unfavorable

- ROE Score: 1, Very Unfavorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 4, Favorable

- Overall Score: 1, Very Unfavorable

Which one is the best rated?

Based strictly on the provided data, Centrus Energy Corp. holds higher scores in Discounted Cash Flow, ROE, ROA, and Overall Score, whereas Uranium Royalty Corp. only scores better on Debt To Equity. Overall, Centrus Energy Corp. is better rated.

Scores Comparison

Here is the comparison of the Altman Z-Score and Piotroski Score for Centrus Energy Corp. and Uranium Royalty Corp.:

Centrus Energy Corp. Scores

- Altman Z-Score: 2.70, classified in the grey zone.

- Piotroski Score: 5, indicating average financial health.

Uranium Royalty Corp. Scores

- Altman Z-Score: 388.37, classified in the safe zone.

- Piotroski Score: 3, indicating very weak financial health.

Which company has the best scores?

Uranium Royalty Corp. has a significantly higher Altman Z-Score in the safe zone, while Centrus Energy shows an average Piotroski Score better than Uranium Royalty’s very weak score. The companies excel differently in these scores.

Grades Comparison

Here is a comparison of the recent grades assigned by reputable grading companies for the two companies:

Centrus Energy Corp. Grades

The following table shows the latest grades from well-known grading firms for Centrus Energy Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth Capital | Maintain | Neutral | 2026-01-08 |

| B. Riley Securities | Maintain | Buy | 2025-12-22 |

| Needham | Maintain | Buy | 2025-12-22 |

| UBS | Maintain | Neutral | 2025-11-25 |

| JP Morgan | Maintain | Neutral | 2025-11-07 |

| JP Morgan | Maintain | Neutral | 2025-10-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-26 |

| Evercore ISI Group | Maintain | Outperform | 2025-08-08 |

| B of A Securities | Downgrade | Neutral | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-08-07 |

Overall, the grades for Centrus Energy Corp. show a balanced mix of Buy and Neutral ratings, with no recent upgrades or downgrades beyond a single downgrade to Neutral.

Uranium Royalty Corp. Grades

The following table presents recent grades from a recognized grading firm for Uranium Royalty Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-04-22 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-19 |

| HC Wainwright & Co. | Maintain | Buy | 2024-09-17 |

| HC Wainwright & Co. | Maintain | Buy | 2024-06-17 |

| HC Wainwright & Co. | Maintain | Buy | 2024-03-11 |

| HC Wainwright & Co. | Maintain | Buy | 2022-01-03 |

| HC Wainwright & Co. | Maintain | Buy | 2021-09-29 |

| HC Wainwright & Co. | Maintain | Buy | 2021-09-28 |

| HC Wainwright & Co. | Maintain | Buy | 2021-07-02 |

| HC Wainwright & Co. | Maintain | Buy | 2021-07-01 |

Uranium Royalty Corp. has consistently maintained a Buy rating from HC Wainwright & Co. over several years, indicating stable positive sentiment.

Which company has the best grades?

Uranium Royalty Corp. holds a more consistently positive grading record with an unbroken series of Buy ratings from a single reputable grading company, while Centrus Energy Corp. presents a mixed consensus with a broader range of Neutral and Buy ratings. This difference may influence investor perception of relative confidence and risk between the two companies.

Strengths and Weaknesses

Below is a comparative overview of Centrus Energy Corp. (LEU) and Uranium Royalty Corp. (UROY) based on diversification, profitability, innovation, global presence, and market share using the most recent data available.

| Criterion | Centrus Energy Corp. (LEU) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Diversification | Moderate: Revenue split among product, separative work units, uranium | Limited: Primarily focused on uranium royalties |

| Profitability | Moderate profitability: Net margin 16.56%, ROE 45.35%, but ROIC below WACC | Negative profitability: Net margin -36.26%, negative ROE and ROIC |

| Innovation | Strong in separative work units technology with growing product revenue | Limited innovation focus, royalty model limits direct R&D engagement |

| Global presence | Established global operations with diverse contract services | Smaller global footprint, focused on royalty assets |

| Market Share | Significant in uranium enrichment and related services | Niche player in uranium royalty market |

Key takeaways: Centrus Energy shows strength in profitability metrics and innovation in enrichment services but faces challenges with ROIC efficiency. Uranium Royalty struggles with profitability and operational scale but benefits from low debt and a focused royalty business model. Both companies have value destruction risks, demanding cautious investment consideration.

Risk Analysis

Below is a comparative risk table for Centrus Energy Corp. (LEU) and Uranium Royalty Corp. (UROY) based on the most recent data from 2024-2025.

| Metric | Centrus Energy Corp. (LEU) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Market Risk | Beta 1.25, moderate volatility | Beta 2.03, high volatility |

| Debt level | Debt-to-assets 14.36%, moderate | Nearly no debt, very low financial risk |

| Regulatory Risk | Exposure to US and international nuclear regulations | Exposure mainly in Canada and US, regulatory complexity in multiple jurisdictions |

| Operational Risk | Medium, with technical and manufacturing services | Low operational risk, royalty-based business model |

| Environmental Risk | Moderate, nuclear fuel supply involves strict environmental oversight | Low environmental impact, as royalties do not involve direct operations |

| Geopolitical Risk | US-centric with some international exposure | Diversified geographically across North America and Namibia |

The most impactful risks are market volatility for UROY due to its high beta and operational complexity for LEU given its manufacturing segment. Regulatory risks remain significant for both, given the nuclear industry’s strict oversight and geopolitical factors affecting uranium supply. Investors should consider these alongside each company’s financial stability and growth prospects.

Which Stock to Choose?

Centrus Energy Corp. (LEU) shows a favorable income evolution with a 78.8% revenue growth over 2020-2024 and a solid net margin of 16.56%. Its financial ratios are mostly favorable, including a strong ROE of 45.35%, though ROIC is slightly unfavorable. The company carries moderate debt and holds a very favorable overall rating of B.

Uranium Royalty Corp. (UROY) exhibits an unfavorable income trend marked by a 310.75% net income decline and a negative net margin of -36.26%. Its financial ratios are largely unfavorable, with negative ROE and ROIC, despite low debt levels. The company’s rating is very favorable at C-, reflecting mixed signals amid financial challenges.

Investors seeking growth and profitability might find Centrus Energy’s strong income and favorable financial profile more appealing, while those with tolerance for risk and interest in undervalued assets could interpret Uranium Royalty’s low debt and rating as potential, despite unfavorable income statements and ratios. Both companies show declining profitability, suggesting caution.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Centrus Energy Corp. and Uranium Royalty Corp. to enhance your investment decisions: