In the evolving energy landscape, Centrus Energy Corp. (LEU) and Oklo Inc. (OKLO) stand out as pioneers in nuclear-related technologies. While Centrus focuses on supplying nuclear fuel and technical solutions globally, Oklo innovates with advanced fission power plants and fuel recycling in the U.S. Both companies intersect in nuclear energy but approach it from complementary angles. This analysis will help you decide which company holds greater investment potential in 2026.

Table of contents

Companies Overview

I will begin the comparison between Centrus Energy Corp. and Oklo Inc. by providing an overview of these two companies and their main differences.

Centrus Energy Corp. Overview

Centrus Energy Corp. supplies nuclear fuel and services to the nuclear power industry in the US, Japan, Belgium, and internationally. Operating through Low-Enriched Uranium (LEU) and Technical Solutions segments, the company offers separative work units, uranium components, and engineering services. Founded in 1998 and headquartered in Bethesda, Maryland, Centrus positions itself as a key player in uranium supply and nuclear technology.

Oklo Inc. Overview

Oklo Inc. designs and develops fission power plants to deliver reliable, commercial-scale energy primarily in the US. It also provides used nuclear fuel recycling services. Founded in 2013 and based in Santa Clara, California, Oklo operates in the regulated electric sector with a focus on innovative nuclear energy solutions and sustainability.

Key similarities and differences

Both Centrus and Oklo operate in the nuclear energy sector, focusing on fuel and power solutions. Centrus emphasizes uranium supply and technical services for nuclear plants internationally, while Oklo concentrates on designing fission plants and recycling used fuel domestically. Centrus is larger in market cap and employee count, whereas Oklo has a lower beta, indicating potentially lower stock volatility.

Income Statement Comparison

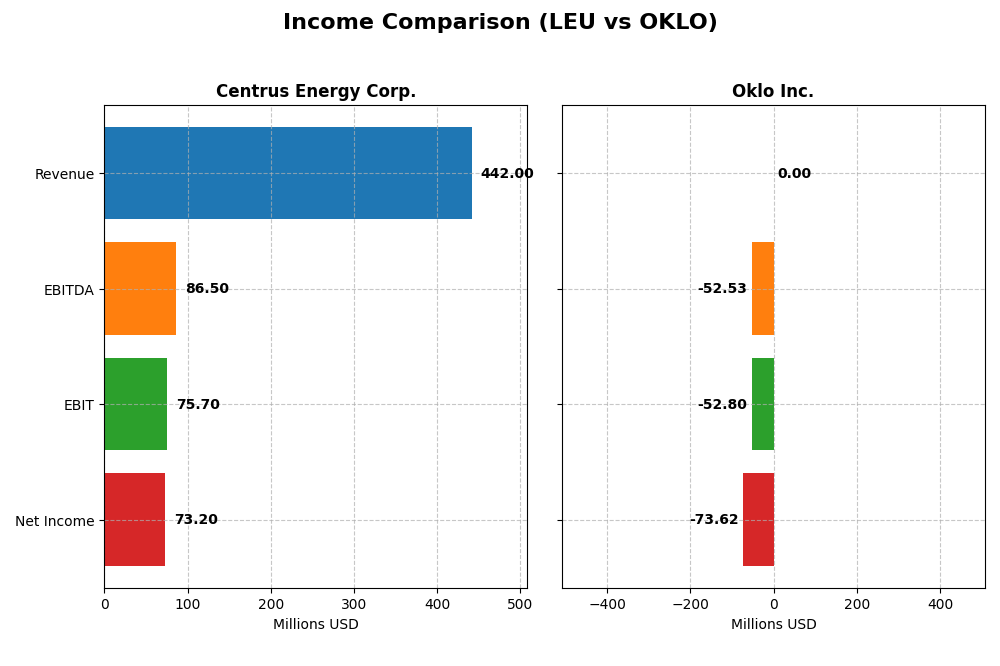

The table below compares key income statement metrics for Centrus Energy Corp. and Oklo Inc. based on their most recent fiscal year results for 2024.

| Metric | Centrus Energy Corp. (LEU) | Oklo Inc. (OKLO) |

|---|---|---|

| Market Cap | 4.77B | 12.16B |

| Revenue | 442M | 0 |

| EBITDA | 86.5M | -52.5M |

| EBIT | 75.7M | -52.8M |

| Net Income | 73.2M | -73.6M |

| EPS | 4.49 | -0.74 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Centrus Energy Corp.

Centrus Energy Corp. showed strong revenue growth over 2020-2024, rising by 78.8% to $442M in 2024. Net income also increased by 34.6% over the period, reaching $73.2M in 2024, although net margin declined by 24.7%. The latest year saw a 38% revenue jump but a slight dip in gross profit and net income margins, signaling margin pressure despite top-line gains.

Oklo Inc.

Oklo Inc. reported no revenue from 2021 to 2024, maintaining a zero gross margin and negative net income, which worsened to -$73.6M in 2024. Operating and net margins remained unfavorable throughout, with a significant drop in earnings per share by 59.4% in the most recent year. The company continues to incur heavy R&D and operating expenses without generating sales.

Which one has the stronger fundamentals?

Centrus Energy Corp. demonstrates stronger fundamentals, supported by favorable earnings growth, positive margins, and substantial revenue gains. In contrast, Oklo Inc. shows persistent losses, no revenue, and negative margins, reflecting ongoing development costs without operational profitability. The financial trends position Centrus as the more stable entity in income statement performance.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Centrus Energy Corp. (LEU) and Oklo Inc. (OKLO) based on their most recent fiscal year data from 2024.

| Ratios | Centrus Energy Corp. (LEU) | Oklo Inc. (OKLO) |

|---|---|---|

| ROE | 45.35% | -29.35% |

| ROIC | 4.02% | -19.23% |

| P/E | 14.84 | -28.52 |

| P/B | 6.73 | 8.37 |

| Current Ratio | 2.93 | 43.47 |

| Quick Ratio | 2.46 | 43.47 |

| D/E | 0.97 | 0.01 |

| Debt-to-Assets | 14.36% | 0.46% |

| Interest Coverage | 17.78 | 0 |

| Asset Turnover | 0.40 | 0 |

| Fixed Asset Turnover | 47.02 | 0 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Centrus Energy Corp.

Centrus Energy exhibits a majority of favorable ratios, including a strong net margin of 16.56% and an impressive return on equity of 45.35%. However, the return on invested capital at 4.02% and a high price-to-book ratio of 6.73 are less encouraging. The company does not pay dividends, focusing instead on operational efficiency and maintaining a solid liquidity position with a current ratio of 2.93.

Oklo Inc.

Oklo faces predominantly unfavorable ratios, such as a negative return on equity of -29.35% and a zero net margin, indicating operational challenges. Its extremely high current ratio of 43.47 is marked unfavorable, possibly signaling inefficient asset use. Oklo also does not pay dividends, likely due to its ongoing growth phase and reinvestment strategy, prioritizing development over shareholder returns.

Which one has the best ratios?

Centrus Energy Corp. presents a more favorable overall financial profile with a balance of profitability, liquidity, and moderate leverage, despite some concerns like a high price-to-book ratio. In contrast, Oklo Inc.’s ratios indicate operational struggles and negative returns, reflecting its early-stage growth and reinvestment focus, resulting in a less favorable ratio assessment.

Strategic Positioning

This section compares the strategic positioning of Centrus Energy Corp. and Oklo Inc., including Market position, Key segments, and exposure to disruption:

Centrus Energy Corp.

- Operates in uranium market with moderate competitive pressure; NYSE-listed with 4.8B market cap.

- Focuses on Low-Enriched Uranium and Technical Solutions segments driving revenue.

- Exposure to nuclear fuel technology; no explicit mention of disruption risk or innovation.

Oklo Inc.

- Engaged in regulated electric sector; NYSE-listed with 12.2B market cap.

- Develops fission power plants and used nuclear fuel recycling services.

- Focused on advanced fission technology and recycling, sensitive to technological changes.

Centrus Energy Corp. vs Oklo Inc. Positioning

Centrus has a more diversified business model with uranium and technical services, while Oklo concentrates on innovative fission power and recycling. Centrus’s segments provide varied revenue streams; Oklo’s focus is narrower but technology-driven, implying different risk exposures.

Which has the best competitive advantage?

Both companies show declining ROIC below WACC, indicating value destruction and weak competitive moats. Neither currently demonstrates a sustainable competitive advantage based on MOAT evaluation.

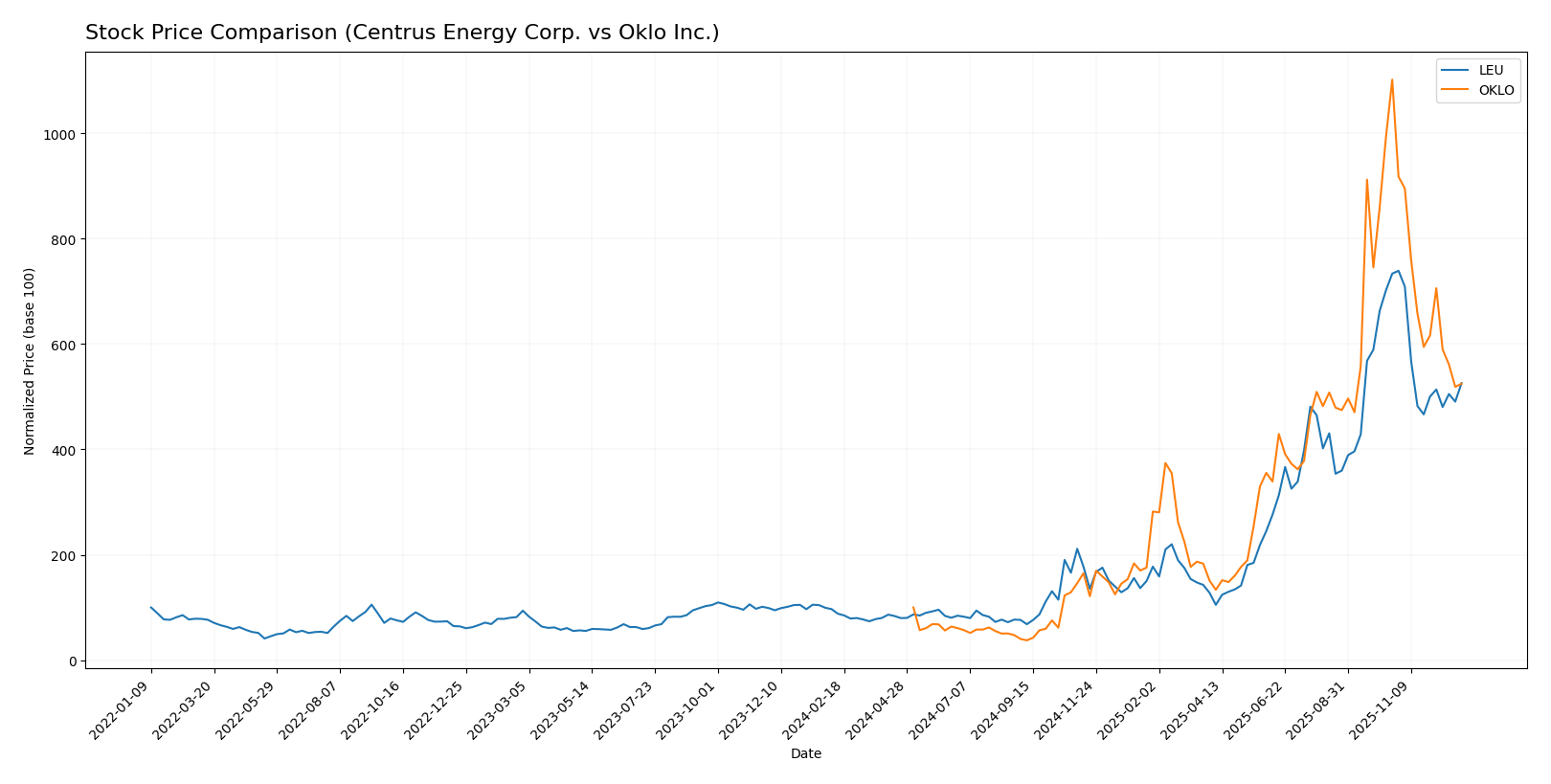

Stock Comparison

The stock prices of Centrus Energy Corp. (LEU) and Oklo Inc. (OKLO) have exhibited substantial growth over the past year, followed by recent downward adjustments reflecting varied trading dynamics.

Trend Analysis

Centrus Energy Corp. (LEU) shows a bullish trend over the past 12 months with a 496.41% price increase and decelerating momentum. Recent weeks reveal a 28.32% decline, indicating a short-term bearish shift.

Oklo Inc. (OKLO) experienced a bullish trend with a 424.61% gain over the year, also decelerating. However, its recent performance dropped 52.38%, showing stronger short-term bearish pressure than LEU.

Comparing both, LEU delivered the highest market performance over the year, despite recent declines, outperforming OKLO by approximately 72 percentage points.

Target Prices

The target price consensus for Centrus Energy Corp. and Oklo Inc. reflects moderately optimistic analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Centrus Energy Corp. | 357 | 245 | 282.25 |

| Oklo Inc. | 150 | 95 | 129.6 |

Analysts expect Centrus Energy’s price to rise slightly above the current 272.5 USD, while Oklo’s consensus target of 129.6 USD suggests significant upside from its current 77.8 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Centrus Energy Corp. and Oklo Inc.:

Rating Comparison

Centrus Energy Corp. Rating

- Rating: B, classified as Very Favorable

- Discounted Cash Flow Score: 4, indicating a Favorable value

- ROE Score: 5, Very Favorable, showing strong profit efficiency

- ROA Score: 4, Favorable, effective asset utilization

- Debt To Equity Score: 1, Very Unfavorable, indicating higher financial risk

- Overall Score: 3, Moderate

Oklo Inc. Rating

- Rating: C+, classified as Very Favorable

- Discounted Cash Flow Score: 3, indicating Moderate

- ROE Score: 1, Very Unfavorable, indicating weak profit generation

- ROA Score: 1, Very Unfavorable, weak asset utilization

- Debt To Equity Score: 5, Very Favorable, indicating low financial risk

- Overall Score: 2, Moderate

Which one is the best rated?

Based strictly on the data, Centrus Energy Corp. holds a better overall rating (B vs. C+) and stronger scores in discounted cash flow, ROE, and ROA. Oklo Inc. only surpasses in debt-to-equity score, showing lower financial risk.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Centrus Energy Corp. and Oklo Inc.:

Centrus Energy Corp. Scores

- Altman Z-Score: 2.70, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 5, indicating average financial strength.

Oklo Inc. Scores

- Altman Z-Score: 339.43, in the safe zone indicating very low bankruptcy risk.

- Piotroski Score: 2, indicating very weak financial strength.

Which company has the best scores?

Oklo Inc. shows a much higher Altman Z-Score, placing it firmly in the safe zone, while Centrus Energy is in the grey zone. Conversely, Centrus Energy has a stronger Piotroski Score compared to Oklo’s very weak rating.

Grades Comparison

Here is the recent grades comparison for Centrus Energy Corp. and Oklo Inc.:

Centrus Energy Corp. Grades

The table below shows recent grades from major financial institutions for Centrus Energy Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Buy | 2025-12-22 |

| Needham | Maintain | Buy | 2025-12-22 |

| UBS | Maintain | Neutral | 2025-11-25 |

| JP Morgan | Maintain | Neutral | 2025-11-07 |

| JP Morgan | Maintain | Neutral | 2025-10-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-26 |

| Evercore ISI Group | Maintain | Outperform | 2025-08-08 |

| B of A Securities | Downgrade | Neutral | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-08-07 |

| B. Riley Securities | Maintain | Buy | 2025-06-23 |

Grades for Centrus Energy Corp. mostly remain stable with a mix of Buy and Neutral ratings, including a recent downgrade to Neutral by B of A Securities.

Oklo Inc. Grades

The table below presents recent grades from reputable firms for Oklo Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Seaport Global | Upgrade | Buy | 2025-12-08 |

| UBS | Maintain | Neutral | 2025-12-03 |

| B of A Securities | Maintain | Neutral | 2025-11-12 |

| B. Riley Securities | Maintain | Buy | 2025-11-12 |

| Wedbush | Maintain | Outperform | 2025-11-12 |

| B of A Securities | Downgrade | Neutral | 2025-09-30 |

| Seaport Global | Downgrade | Neutral | 2025-09-23 |

| Wedbush | Maintain | Outperform | 2025-09-22 |

| Wedbush | Maintain | Outperform | 2025-08-14 |

| Wedbush | Maintain | Outperform | 2025-08-12 |

Oklo Inc. shows a mix of Neutral and Outperform ratings, with a recent upgrade to Buy by Seaport Global and some downgrades to Neutral earlier.

Which company has the best grades?

Centrus Energy Corp. generally maintains consistent Buy and Neutral ratings, whereas Oklo Inc. has several Outperform ratings and a recent upgrade to Buy. Investors may note that Oklo’s higher-grade trend could imply stronger analyst confidence.

Strengths and Weaknesses

Below is a comparison table of key strengths and weaknesses for Centrus Energy Corp. (LEU) and Oklo Inc. (OKLO) based on the latest financial and operational data.

| Criterion | Centrus Energy Corp. (LEU) | Oklo Inc. (OKLO) |

|---|---|---|

| Diversification | Moderate: Revenue from Uranium, Separative Work Units, and Services; steady growth in product segments | Limited: Focused primarily on innovative nuclear technologies; less revenue diversification |

| Profitability | Favorable net margin (16.56%) and ROE (45.35%), though ROIC is slightly unfavorable (4.02% below WACC) | Unfavorable profitability with negative net margin and ROIC; company is shedding value |

| Innovation | Moderate: Traditional nuclear fuel services with stable asset turnover | High potential: Advanced nuclear tech but currently no revenue and negative profitability |

| Global presence | Established with global uranium and enrichment markets | Emerging company with limited footprint and scale |

| Market Share | Stable market share in uranium enrichment and fuel supply | Nascent market presence with future growth potential |

Key takeaway: Centrus Energy shows solid profitability and a diversified revenue base, although its efficiency in capital use needs improvement. Oklo is an innovative but high-risk player, currently unprofitable with limited diversification and market presence. Investors should weigh stability versus growth potential carefully.

Risk Analysis

Below is a comparative risk assessment for Centrus Energy Corp. (LEU) and Oklo Inc. (OKLO) based on the most recent 2024 data.

| Metric | Centrus Energy Corp. (LEU) | Oklo Inc. (OKLO) |

|---|---|---|

| Market Risk | Moderate, beta 1.34 indicates higher volatility | Lower, beta 0.75 suggests less volatility |

| Debt level | Moderate debt/equity ratio 0.97, manageable | Very low debt/equity ratio 0.01, minimal leverage |

| Regulatory Risk | High, due to nuclear fuel industry regulations in US and abroad | High, nuclear technology and recycling subject to stringent regulations |

| Operational Risk | Moderate, technical and manufacturing services may face operational complexities | High, early-stage technology with operational uncertainties |

| Environmental Risk | Elevated, nuclear fuel supply entails environmental and safety concerns | Elevated, nuclear waste recycling and fission plant operations are environmentally sensitive |

| Geopolitical Risk | Considerable, international uranium markets and geopolitical tensions affect supply | Moderate, mainly US-focused but sensitive to national energy policies |

The most likely and impactful risks for both companies stem from regulatory and environmental factors due to the nuclear sector’s strict oversight and potential safety issues. Centrus’s moderate debt and higher market volatility present additional financial risks, while Oklo faces operational risks linked to its innovative but nascent technology platform.

Which Stock to Choose?

Centrus Energy Corp. (LEU) shows favorable income evolution with 64% positive income statement indicators despite some margin declines. Its financial ratios are mostly favorable, particularly net margin (16.56%) and ROE (45.35%), with moderate debt and a very favorable rating of B. However, its MOAT evaluation signals value destruction due to declining ROIC below WACC.

Oklo Inc. (OKLO) presents an unfavorable income profile with over 90% negative income statement metrics and negative profitability ratios, including a -29.35% ROE. Despite low debt and a very favorable overall rating of C+, its MOAT evaluation also indicates value destruction with declining ROIC and unfavorable financial ratios.

From a financial health perspective, LEU’s favorable ratings and income growth might appeal to investors prioritizing growth and profitability, whereas OKLO’s low debt and high liquidity could be seen as potential for risk-tolerant investors focused on turnaround opportunities. Both companies have value-destroying moats, suggesting caution depending on one’s risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Centrus Energy Corp. and Oklo Inc. to enhance your investment decisions: