In the evolving energy landscape, Centrus Energy Corp. (LEU) and NuScale Power Corporation (SMR) stand out as key players driving nuclear innovation. Centrus specializes in uranium supply and technical solutions, while NuScale pioneers modular nuclear reactors for diverse energy needs. Both companies share a focus on nuclear power but target different market segments and technologies. This article will help you decide which company presents the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between Centrus Energy Corp. and NuScale Power Corporation by providing an overview of these two companies and their main differences.

Centrus Energy Corp. Overview

Centrus Energy Corp. supplies nuclear fuel and related services primarily in the United States, Japan, Belgium, and other international markets. The company operates through two segments: Low-Enriched Uranium (LEU), which sells components critical for nuclear power plants, and Technical Solutions, offering engineering and operational services. Centrus, incorporated in 1998 and headquartered in Bethesda, Maryland, positions itself as a key supplier in the uranium industry.

NuScale Power Corporation Overview

NuScale Power Corporation develops and markets modular light water nuclear reactors designed for electricity generation and other industrial uses such as district heating and desalination. Founded in 2007 and based in Portland, Oregon, NuScale offers scalable power plants, including the NuScale Power Module and VOYGR series, to meet diverse customer energy needs. The company operates under the utilities sector and is a subsidiary of Fluor Enterprises, Inc.

Key similarities and differences

Both companies focus on the nuclear energy sector but serve distinct parts of the value chain. Centrus Energy concentrates on supplying nuclear fuel and technical services, whereas NuScale Power specializes in reactor design and modular nuclear power plant development. Centrus is more established with a longer market presence since 1998, while NuScale, founded in 2007, emphasizes innovative reactor technology and modular solutions for energy production.

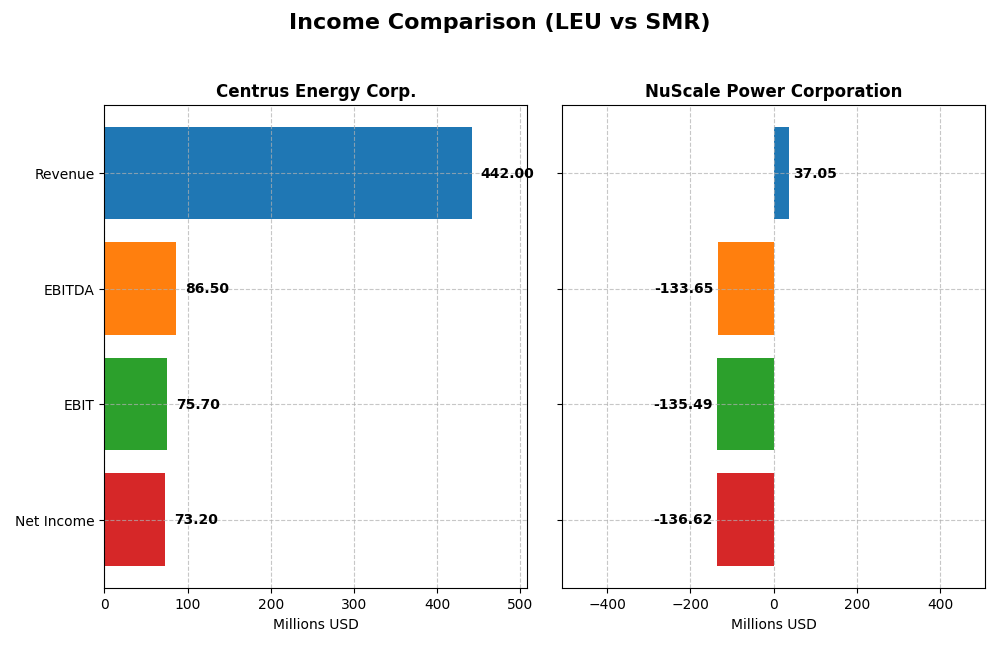

Income Statement Comparison

Below is a side-by-side comparison of the latest available income statement metrics for Centrus Energy Corp. and NuScale Power Corporation, reflecting their fiscal year 2024 performance.

| Metric | Centrus Energy Corp. (LEU) | NuScale Power Corporation (SMR) |

|---|---|---|

| Market Cap | 4.8B | 4.9B |

| Revenue | 442M | 37M |

| EBITDA | 87M | -134M |

| EBIT | 76M | -135M |

| Net Income | 73M | -137M |

| EPS | 4.49 | -1.47 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Centrus Energy Corp.

Centrus Energy Corp. showed a solid upward trend in revenue from 2020 to 2024, reaching $442M in 2024, up 38% from 2023. Net income grew overall but declined in 2024 to $73.2M. Margins remain favorable, with gross margin at 25.23% and net margin at 16.56%. However, net margin and EPS both contracted in the most recent year, signaling some margin pressure despite revenue growth.

NuScale Power Corporation

NuScale Power’s revenue increased strongly over the five-year period, surging to $37M in 2024, a 62% rise from 2023. Gross margin is very high at 86.67%, but EBIT and net margins remain deeply negative at -365.74% and -368.8%, respectively. Although EBIT improved by 51% in 2024, net loss widened, and EPS declined sharply, underscoring ongoing profitability challenges.

Which one has the stronger fundamentals?

Both companies present mixed fundamentals with roughly 64% favorable income statement metrics. Centrus Energy maintains positive profitability and stable margins despite recent margin declines, while NuScale Power delivers exceptional revenue and gross margin growth but continues to incur significant net losses and negative EBIT margins. The stronger fundamentals hinge on balancing growth with sustainable profitability.

Financial Ratios Comparison

This table presents the latest available financial ratios for Centrus Energy Corp. (LEU) and NuScale Power Corporation (SMR), offering a side-by-side view of key performance and financial health metrics for 2024.

| Ratios | Centrus Energy Corp. (LEU) | NuScale Power Corporation (SMR) |

|---|---|---|

| ROE | 45.4% | -22.1% |

| ROIC | 4.02% | -30.7% |

| P/E | 14.8 | -12.2 |

| P/B | 6.73 | 2.70 |

| Current Ratio | 2.93 | 5.25 |

| Quick Ratio | 2.46 | 5.25 |

| D/E (Debt-to-Equity) | 0.97 | 0.00 |

| Debt-to-Assets | 14.4% | 0.0% |

| Interest Coverage | 17.8 | 0 |

| Asset Turnover | 0.40 | 0.07 |

| Fixed Asset Turnover | 47.0 | 15.3 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Centrus Energy Corp.

Centrus Energy displays mostly favorable financial ratios with a strong net margin of 16.56% and an impressive ROE of 45.35%, indicating efficient profitability and shareholder value creation. However, concerns arise from a weak ROIC of 4.02% and a high PB ratio of 6.73. The company does not pay dividends, consistent with a possible reinvestment or growth strategy.

NuScale Power Corporation

NuScale Power’s ratios reveal significant weaknesses, including a deeply negative net margin (-368.8%) and ROE (-22.08%), signaling operational and profitability challenges. The company shows some strengths in debt management with zero debt-to-assets and a favorable quick ratio. It does not pay dividends, likely reflecting ongoing investment in R&D and development activities.

Which one has the best ratios?

Comparing both, Centrus Energy has a more favorable overall ratio profile, with stronger profitability and liquidity metrics, despite some concerns on capital efficiency. NuScale Power’s ratios are largely unfavorable, dominated by losses and weak returns, reflecting its developmental stage and financial stress. Centrus Energy’s ratios suggest comparatively better financial health.

Strategic Positioning

This section compares the strategic positioning of Centrus Energy Corp. and NuScale Power Corporation, including Market position, Key segments, and disruption:

Centrus Energy Corp.

- Established uranium supplier with 4.77B market cap, facing moderate competitive pressure.

- Focuses on Low-Enriched Uranium sales and technical services, driven by separative work units and uranium product sales.

- Exposure tied to nuclear fuel supply chain, with no explicit mention of technological disruption risks.

NuScale Power Corporation

- Renewable utilities player with 4.87B market cap, higher beta implies greater volatility.

- Develops modular nuclear reactors for power, heating, and industrial applications, with limited current revenue.

- Engages in innovative modular reactor tech, potentially facing disruption from evolving energy technologies.

Centrus Energy Corp. vs NuScale Power Corporation Positioning

Centrus has a concentrated focus on nuclear fuel supply with significant revenue from established segments, while NuScale pursues diversified modular nuclear solutions but currently generates minimal revenue, reflecting differing maturity and business models.

Which has the best competitive advantage?

Both companies show value destruction with ROIC below WACC. Centrus has declining profitability, while NuScale shows improving ROIC trends, indicating slightly less unfavorable competitive advantage despite current losses.

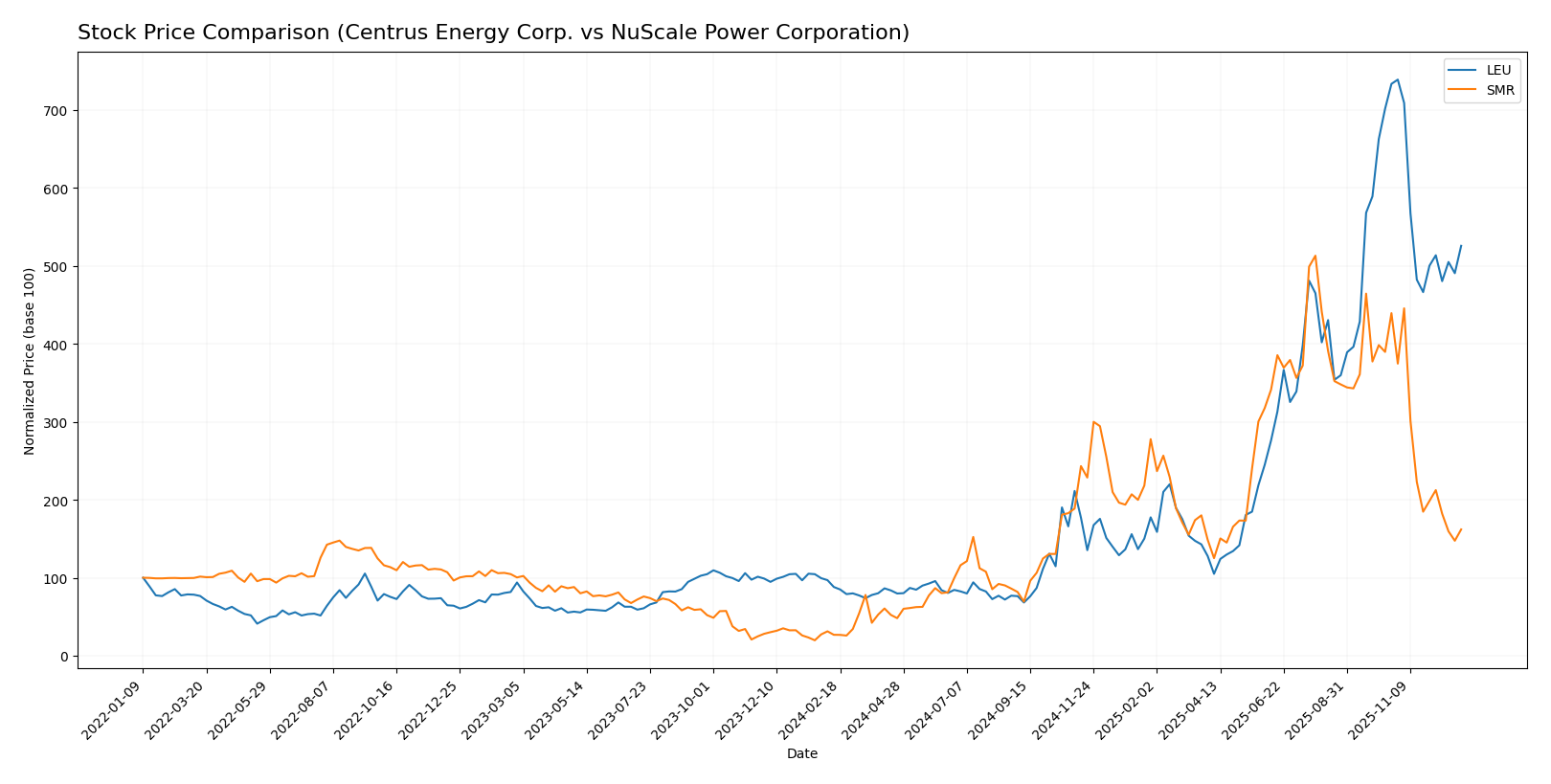

Stock Comparison

The stock prices of Centrus Energy Corp. (LEU) and NuScale Power Corporation (SMR) have shown significant gains over the past 12 months, with both experiencing a strong bullish trend but recent declines indicating short-term weakness.

Trend Analysis

Centrus Energy Corp. (LEU) posted a 496.41% price increase over the past year, confirming a bullish trend with deceleration in momentum. The stock reached a high of 383.0 and a low of 35.36, showing high volatility with a 95.68 standard deviation.

NuScale Power Corporation (SMR) exhibited a 504.07% price rise over the same period, also bullish but with decelerating momentum. Its price ranged between 2.6 and 51.67, with lower volatility reflected by a 12.51 standard deviation.

Comparing both, SMR slightly outperformed LEU in yearly gains. However, LEU’s higher volatility contrasts with SMR’s steadier price movement, reflecting different risk profiles.

Target Prices

Here is the consensus target price overview for Centrus Energy Corp. and NuScale Power Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Centrus Energy Corp. | 357 | 245 | 282.25 |

| NuScale Power Corporation | 55 | 20 | 33.83 |

Analysts expect Centrus Energy’s price to trade moderately above its current 272.5 USD level, reflecting confidence in its nuclear fuel market. NuScale Power’s consensus target of 33.83 USD suggests significant upside from its current 16.32 USD price, indicating growth potential in modular nuclear power.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Centrus Energy Corp. and NuScale Power Corporation:

Rating Comparison

LEU Rating

- Rating: B, considered Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation profile.

- ROE Score: 5, a Very Favorable measure of profitability from shareholders’ equity.

- ROA Score: 4, Favorable efficiency in using assets to generate earnings.

- Debt To Equity Score: 1, Very Unfavorable, signaling higher financial risk.

- Overall Score: 3, Moderate overall financial standing.

SMR Rating

- Rating: D+, also considered Very Favorable.

- Discounted Cash Flow Score: 1, indicating a Very Unfavorable valuation profile.

- ROE Score: 1, a Very Unfavorable indicator of profitability.

- ROA Score: 1, Very Unfavorable asset utilization.

- Debt To Equity Score: 1, Very Unfavorable financial leverage.

- Overall Score: 1, Very Unfavorable overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Centrus Energy Corp. (LEU) is better rated overall, with higher scores in discounted cash flow, ROE, ROA, and a more moderate overall score compared to NuScale Power Corporation (SMR), which has uniformly low scores.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score for Centrus Energy Corp. and NuScale Power Corporation:

LEU Scores

- Altman Z-Score of 2.7 places LEU in the grey zone, indicating moderate bankruptcy risk.

- Piotroski Score of 5 indicates LEU has average financial strength as an investment.

SMR Scores

- Altman Z-Score of 7.9 places SMR in the safe zone, indicating low bankruptcy risk.

- Piotroski Score of 2 indicates SMR has very weak financial strength as an investment.

Which company has the best scores?

SMR shows a much stronger Altman Z-Score, signaling lower bankruptcy risk, but a much weaker Piotroski Score, indicating poor financial strength. LEU’s scores are moderate for both metrics. Thus, the companies lead in different financial aspects.

Grades Comparison

Here is a detailed comparison of the most recent and reliable grades assigned to each company:

Centrus Energy Corp. Grades

The following table presents recent grades assigned by reputable grading companies for Centrus Energy Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Buy | 2025-12-22 |

| Needham | Maintain | Buy | 2025-12-22 |

| UBS | Maintain | Neutral | 2025-11-25 |

| JP Morgan | Maintain | Neutral | 2025-11-07 |

| JP Morgan | Maintain | Neutral | 2025-10-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-26 |

| Evercore ISI Group | Maintain | Outperform | 2025-08-08 |

| B of A Securities | Downgrade | Neutral | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-08-07 |

| B. Riley Securities | Maintain | Buy | 2025-06-23 |

Overall, Centrus Energy Corp. exhibits a consistent trend of Buy and Neutral ratings, with a notable Outperform grade maintained by Evercore ISI Group.

NuScale Power Corporation Grades

Below are recent grades from recognized grading firms for NuScale Power Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Buy | 2025-12-22 |

| Goldman Sachs | Maintain | Neutral | 2025-12-12 |

| UBS | Maintain | Neutral | 2025-11-25 |

| RBC Capital | Maintain | Sector Perform | 2025-11-10 |

| Citigroup | Downgrade | Sell | 2025-10-21 |

| B of A Securities | Downgrade | Underperform | 2025-09-30 |

| Canaccord Genuity | Maintain | Buy | 2025-09-03 |

| UBS | Maintain | Neutral | 2025-08-11 |

| Canaccord Genuity | Maintain | Buy | 2025-08-11 |

| BTIG | Downgrade | Neutral | 2025-06-25 |

NuScale Power Corporation shows a more mixed pattern with Buy and Neutral ratings, but also several downgrades to Sell and Underperform from major firms.

Which company has the best grades?

Centrus Energy Corp. has generally received more favorable and stable grades, including multiple Buy and an Outperform rating, while NuScale Power Corporation faces several downgrades and Sell/Underperform ratings. This contrast suggests differing investor sentiment and risk profiles for each company.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Centrus Energy Corp. (LEU) and NuScale Power Corporation (SMR) based on the latest available data.

| Criterion | Centrus Energy Corp. (LEU) | NuScale Power Corporation (SMR) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from separative work units and uranium products, some service income | Very limited: Revenue mostly from minor “Other” category, indicating nascent commercial activity |

| Profitability | Favorable net margin (16.56%) and ROE (45.35%), but ROIC below WACC, shedding economic value | Unfavorable profitability metrics with negative margins and returns; ROIC well below WACC but improving |

| Innovation | Established nuclear fuel supply with some technological assets | Strong growth in ROIC suggests improving innovation, but currently unprofitable and early-stage |

| Global presence | Moderate: Serves global nuclear fuel markets via specialized uranium products | Limited: Small revenue base with focus on emerging SMR technology, likely regional or pilot scale |

| Market Share | Significant in nuclear fuel supply chain segment | Minimal market share as commercial deployment of SMRs is still developing |

Key takeaways: Centrus Energy exhibits solid profitability and established market presence but faces value destruction reflected in ROIC below cost of capital. NuScale Power is in a growth phase with improving profitability trends, yet remains unprofitable with limited diversification. Investors should weigh Centrus’s stability against NuScale’s growth potential and higher risk profile.

Risk Analysis

Below is a comparative table presenting key risk metrics for Centrus Energy Corp. (LEU) and NuScale Power Corporation (SMR) based on the most recent 2024 data.

| Metric | Centrus Energy Corp. (LEU) | NuScale Power Corporation (SMR) |

|---|---|---|

| Market Risk | Beta 1.34 (moderate volatility) | Beta 2.10 (high volatility) |

| Debt Level | Debt to Equity 0.97 (neutral) | Debt to Equity 0 (favorable) |

| Regulatory Risk | Moderate, nuclear fuel sector compliance | High, nuclear reactor development heavily regulated |

| Operational Risk | Moderate, technical services and enrichment | High, early-stage modular reactor commercialization |

| Environmental Risk | Moderate, uranium supply chain impacts | Moderate to high, nuclear technology environmental scrutiny |

| Geopolitical Risk | Moderate, international uranium markets exposure | Moderate, US-centric but influenced by energy policy shifts |

Centrus Energy’s most impactful risks lie in regulatory compliance and moderate market volatility, but it has a stable debt profile and solid operational performance. NuScale Power faces higher market and operational risks due to its developmental stage and regulatory environment, despite a clean balance sheet. Investors should weigh NuScale’s growth potential against its financial and operational challenges.

Which Stock to Choose?

Centrus Energy Corp. (LEU) shows favorable income growth with a 78.8% revenue increase over five years and a solid net margin of 16.56%. Its financial ratios reveal strong profitability with a 45.35% ROE, reasonable debt levels, and a very favorable rating of B. However, the company’s MOAT is rated very unfavorable due to declining ROIC below WACC.

NuScale Power Corporation (SMR) displays impressive revenue growth of 6074% over five years but suffers from negative net margins and returns, with a 22.08% ROE loss and unfavorable financial ratios overall. SMR’s rating is D+ with very unfavorable scores, and its MOAT is slightly unfavorable despite improving ROIC trends.

Investors seeking growth potential might find SMR’s significant revenue expansion appealing, although its profitability and financial stability remain weak. Conversely, those prioritizing profitability and a stronger rating could view LEU’s consistent income and favorable ratios more cautiously, given its negative MOAT trend.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Centrus Energy Corp. and NuScale Power Corporation to enhance your investment decisions: