Nuclear energy remains a critical pillar of the global energy transition, making uranium companies like Centrus Energy Corp. (LEU) and enCore Energy Corp. (EU) key players to watch. Both operate in the uranium sector but differ in scale, focus, and innovation strategies—Centrus with its advanced nuclear fuel services, and enCore emphasizing uranium exploration and development. In this article, I will analyze their strengths and risks to help you decide which stock deserves a place in your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Centrus Energy Corp. and enCore Energy Corp. by providing an overview of these two companies and their main differences.

Centrus Energy Corp. Overview

Centrus Energy Corp. supplies nuclear fuel and services for the nuclear power industry across the US, Japan, Belgium, and internationally. It operates two segments: Low-Enriched Uranium (LEU), selling separative work units and natural uranium, and Technical Solutions, offering engineering and manufacturing services. Headquartered in Bethesda, Maryland, Centrus is positioned as a key player in uranium fuel supply and technical support.

enCore Energy Corp. Overview

enCore Energy Corp. focuses on the acquisition, exploration, and development of uranium resource properties within the United States. Its portfolio includes multiple uranium projects across New Mexico, Utah, South Dakota, and Wyoming. Based in Corpus Christi, Texas, enCore is primarily a uranium exploration and development company with extensive land holdings in key uranium districts.

Key similarities and differences

Both Centrus and enCore operate in the uranium sector within the US energy industry, but their business models differ significantly. Centrus emphasizes nuclear fuel supply and technical services with an international reach, while enCore concentrates on domestic uranium exploration and development. Centrus has a larger market cap of 5.4B USD versus enCore’s 519M USD, reflecting their differing scales and operational focuses.

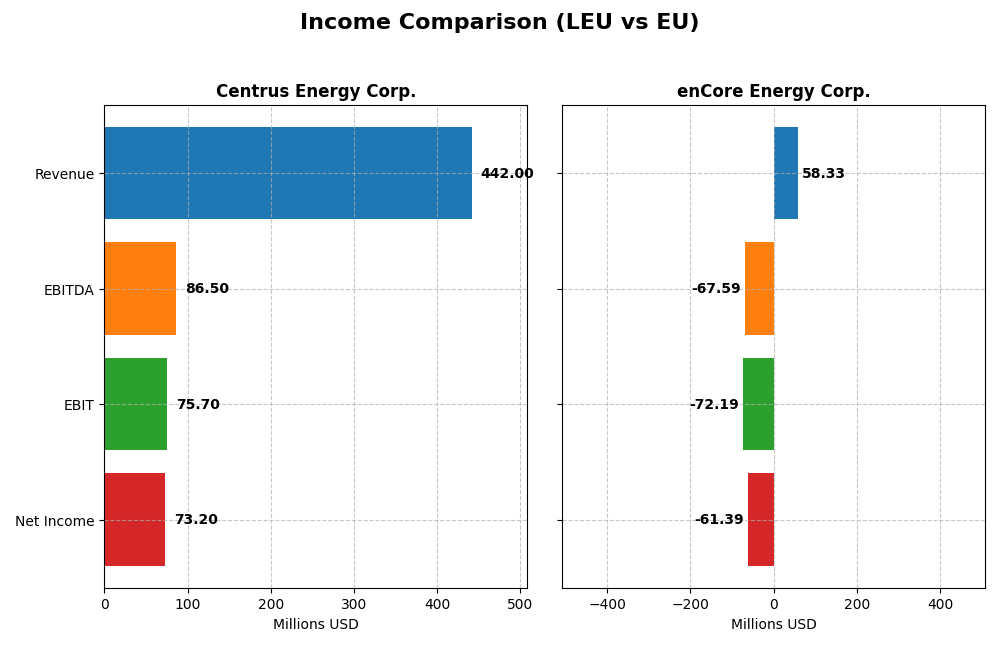

Income Statement Comparison

The table below compares key income statement metrics for Centrus Energy Corp. and enCore Energy Corp. for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | Centrus Energy Corp. (LEU) | enCore Energy Corp. (EU) |

|---|---|---|

| Market Cap | 5.36B | 519M |

| Revenue | 442M | 58.3M |

| EBITDA | 86.5M | -67.6M |

| EBIT | 75.7M | -72.2M |

| Net Income | 73.2M | -61.4M |

| EPS | 4.49 | -0.34 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Centrus Energy Corp.

Centrus Energy Corp. experienced overall revenue growth of 78.8% from 2020 to 2024, with net income increasing by 34.56%. Margins remain generally favorable, with a gross margin of 25.23% and net margin of 16.56% in 2024. Despite a 38.04% revenue rise in 2024, net income and EBIT margins declined, reflecting some margin pressure last year.

enCore Energy Corp.

EnCore Energy Corp. reported fluctuating revenues, with a significant 163.38% increase in 2024 compared to 2023 but no overall growth since 2020. The company posted negative gross and EBIT margins in 2024, at -12.35% and -123.75%, respectively, indicating persistent losses. Net income remained negative, though net margin growth showed slight improvement recently.

Which one has the stronger fundamentals?

Centrus Energy Corp. demonstrates stronger fundamentals, with consistent revenue and net income growth and positive margins over the period. In contrast, enCore Energy Corp. shows unfavorable income statements overall, with persistent losses and negative margins despite recent revenue growth. The evaluations favor Centrus for stability and profitability.

Financial Ratios Comparison

The table below compares the most recent key financial ratios for Centrus Energy Corp. (LEU) and enCore Energy Corp. (EU) based on their 2024 fiscal year data.

| Ratios | Centrus Energy Corp. (LEU) | enCore Energy Corp. (EU) |

|---|---|---|

| ROE | 45.4% | -21.5% |

| ROIC | 4.0% | -17.3% |

| P/E | 14.8 | -10.1 |

| P/B | 6.73 | 2.17 |

| Current Ratio | 2.93 | 2.91 |

| Quick Ratio | 2.46 | 2.21 |

| D/E (Debt-to-Equity) | 0.97 | 0.07 |

| Debt-to-Assets | 14.4% | 5.2% |

| Interest Coverage | 17.8 | -41.6 |

| Asset Turnover | 0.40 | 0.15 |

| Fixed Asset Turnover | 47.0 | 0.20 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Centrus Energy Corp.

Centrus Energy shows mostly favorable financial ratios with a strong net margin of 16.56% and an impressive return on equity at 45.35%, though its return on invested capital is weak at 4.02%. Liquidity is robust, with a current ratio near 2.93 and solid interest coverage. The company does not pay dividends, likely reflecting a reinvestment or growth strategy given its zero dividend yield.

enCore Energy Corp.

enCore Energy’s ratios are largely unfavorable, with a deeply negative net margin of -105.24% and negative returns on equity and invested capital, indicating operational challenges. Liquidity ratios are healthy, but interest coverage is deeply negative at -41.61. The company does not pay dividends, possibly due to ongoing losses and focus on exploration or development activities.

Which one has the best ratios?

Centrus Energy presents a more favorable ratio profile overall, with stronger profitability, liquidity, and coverage metrics compared to enCore Energy. While Centrus shows some weaknesses like a low return on invested capital, enCore’s negative profitability and coverage ratios point to significant financial stress, making Centrus the company with superior financial ratios in this comparison.

Strategic Positioning

This section compares the strategic positioning of Centrus Energy Corp. and enCore Energy Corp., including Market position, Key segments, and exposure to technological disruption:

Centrus Energy Corp.

- Leading uranium supplier with significant market cap of 5.36B, facing competitive pressure in uranium sector.

- Operates through two segments: Low-Enriched Uranium sales and Technical Solutions services driving revenue.

- Exposure involves nuclear fuel technology and engineering services, but no explicit mention of disruption.

enCore Energy Corp.

- Smaller uranium exploration and development company with market cap of 519M, operating in US uranium belt.

- Focused on uranium resource acquisition, exploration, and development with multiple project interests.

- Primarily a resource developer with no stated technological disruption exposure in uranium mining.

Centrus Energy Corp. vs enCore Energy Corp. Positioning

Centrus has a diversified approach combining uranium product sales and technical services, providing multiple revenue streams. enCore is concentrated on uranium resource development with extensive land holdings but limited business segment diversity based on the data.

Which has the best competitive advantage?

Both companies show very unfavorable MOAT evaluations with declining ROIC below WACC, indicating value destruction and weak competitive advantages in the uranium sector over 2020-2024.

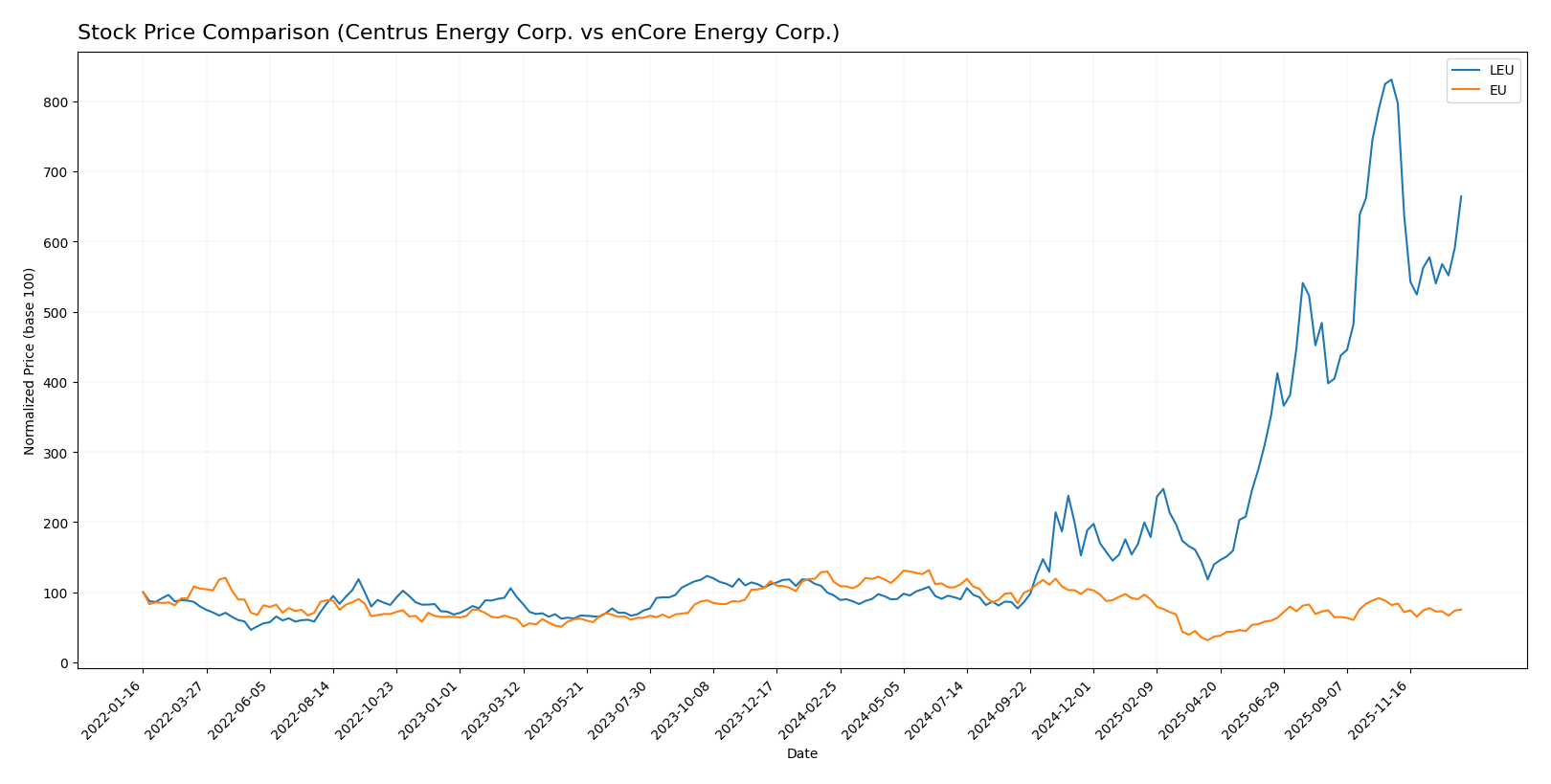

Stock Comparison

The stock price movements over the past 12 months reveal contrasting dynamics, with Centrus Energy Corp. exhibiting a strong bullish trend despite recent deceleration, while enCore Energy Corp. has faced a sustained bearish trajectory.

Trend Analysis

Centrus Energy Corp. (LEU) showed a robust bullish trend over the past year with a 595.57% price increase, though the trend is decelerating and recently declined by 20.05% from October 2025 to January 2026.

enCore Energy Corp. (EU) displayed a bearish trend over the same period with a -34.52% price change and decelerating losses, including a recent -7.97% drop with minimal volatility.

Comparing both stocks, Centrus Energy Corp. delivered the highest market performance over the past year, significantly outperforming enCore Energy Corp. despite recent short-term weakness.

Target Prices

The current analyst consensus for target prices reflects a cautious but optimistic outlook for these uranium sector companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Centrus Energy Corp. | 390 | 125 | 288.4 |

| enCore Energy Corp. | 3.5 | 3.5 | 3.5 |

For Centrus Energy Corp., the consensus target price of 288.4 USD is slightly below its current price of 306.19 USD, suggesting potential modest downside or consolidation. In contrast, enCore Energy’s consensus target matches its current price of 2.77 USD, indicating a stable valuation outlook from analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Centrus Energy Corp. (LEU) and enCore Energy Corp. (EU):

Rating Comparison

LEU Rating

- Rating: B, classified as Very Favorable.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation.

- ROE Score: 5, rated Very Favorable for profit generation efficiency.

- ROA Score: 4, Favorable for asset utilization effectiveness.

- Debt To Equity Score: 1, Very Unfavorable signaling higher financial risk.

- Overall Score: 3, Moderate overall financial standing.

EU Rating

- Rating: C-, classified as Very Unfavorable.

- Discounted Cash Flow Score: 1, indicating a Very Unfavorable valuation.

- ROE Score: 1, rated Very Unfavorable for profit generation efficiency.

- ROA Score: 1, Very Unfavorable for asset utilization effectiveness.

- Debt To Equity Score: 2, Moderate financial risk level.

- Overall Score: 1, Very Unfavorable overall financial standing.

Which one is the best rated?

Based on the provided data, Centrus Energy Corp. (LEU) holds stronger ratings and scores across all key financial metrics compared to enCore Energy Corp. (EU), which shows generally very unfavorable scores and a lower overall rating.

Scores Comparison

Here is a comparison of the financial scores for Centrus Energy Corp. and enCore Energy Corp.:

LEU Scores

- Altman Z-Score: 2.70, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 5, rated as average financial strength.

EU Scores

- Altman Z-Score: 1.17, in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 4, rated as average financial strength.

Which company has the best scores?

Based strictly on the provided data, Centrus Energy (LEU) has a higher Altman Z-Score in the grey zone, indicating better bankruptcy safety than enCore Energy (EU), which is in the distress zone. Both have similar average Piotroski Scores, with LEU slightly higher.

Grades Comparison

The following presents a comparison of reliable grade data for Centrus Energy Corp. and enCore Energy Corp.:

Centrus Energy Corp. Grades

This table summarizes recent grades issued by major financial institutions for Centrus Energy Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth Capital | Maintain | Neutral | 2026-01-08 |

| B. Riley Securities | Maintain | Buy | 2025-12-22 |

| Needham | Maintain | Buy | 2025-12-22 |

| UBS | Maintain | Neutral | 2025-11-25 |

| JP Morgan | Maintain | Neutral | 2025-11-07 |

| JP Morgan | Maintain | Neutral | 2025-10-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-26 |

| Evercore ISI Group | Maintain | Outperform | 2025-08-08 |

| B of A Securities | Downgrade | Neutral | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-08-07 |

Overall, Centrus Energy Corp. shows a mixed but generally cautious grade pattern, with a consensus rating of “Hold” supported by five Buy and six Hold recommendations.

enCore Energy Corp. Grades

This table summarizes recent grades issued by major financial institutions for enCore Energy Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-08-12 |

| HC Wainwright & Co. | Maintain | Buy | 2025-05-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-19 |

| HC Wainwright & Co. | Maintain | Buy | 2024-10-07 |

| HC Wainwright & Co. | Maintain | Buy | 2024-08-15 |

| HC Wainwright & Co. | Maintain | Buy | 2024-06-14 |

| B. Riley Securities | Maintain | Buy | 2024-05-15 |

enCore Energy Corp. consistently receives Buy ratings from its grading companies, reflected in a consensus rating of “Buy” with no Hold or Sell recommendations.

Which company has the best grades?

enCore Energy Corp. has received consistently better grades, with all recent ratings at Buy level, signaling stronger analyst confidence. Centrus Energy Corp. shows a more cautious stance with a Hold consensus, which might imply moderate investor risk tolerance. This contrast could affect portfolio positioning depending on risk preferences.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of Centrus Energy Corp. (LEU) and enCore Energy Corp. (EU) based on their recent financial and operational data.

| Criterion | Centrus Energy Corp. (LEU) | enCore Energy Corp. (EU) |

|---|---|---|

| Diversification | Moderate product mix: Separative Work Units, Uranium, Services | Limited diversification; primarily uranium focused |

| Profitability | Favorable net margin (16.56%) and ROE (45.35%), but ROIC below WACC (4.02% vs. 9.06%) | Unfavorable profitability with negative net margin (-105.24%) and ROE (-21.49%) |

| Innovation | Strong fixed asset turnover (47.02) indicating efficient asset use | Low asset turnover (0.15) and fixed asset turnover (0.2), suggesting inefficiencies |

| Global presence | Established with growing revenues in separative work units and uranium product | Smaller scale with no detailed revenue segmentation reported |

| Market Share | Solid market position in uranium enrichment and supply | Smaller player with less market penetration and unfavorable financial metrics |

Key takeaways: Centrus Energy shows stronger operational efficiency and profitability despite some concerns on capital returns. enCore Energy struggles with profitability and asset utilization, indicating higher investment risk. Caution is advised when considering enCore Energy for your portfolio.

Risk Analysis

Below is a comparative table summarizing key risk factors for Centrus Energy Corp. (LEU) and enCore Energy Corp. (EU) as of 2024:

| Metric | Centrus Energy Corp. (LEU) | enCore Energy Corp. (EU) |

|---|---|---|

| Market Risk | Beta 1.25 – moderate volatility | Beta 1.44 – higher volatility |

| Debt level | Debt-to-Equity ~0.97 – moderate | Debt-to-Equity ~0.07 – low |

| Regulatory Risk | High – nuclear fuel industry, subject to strict regulations | High – uranium exploration and development, regulatory sensitive |

| Operational Risk | Moderate – technical services and uranium supply chain complexity | High – exploration stage, dependent on successful resource development |

| Environmental Risk | Moderate – uranium handling and nuclear fuel cycle impact | High – mining and exploration impact on land and ecosystems |

| Geopolitical Risk | Moderate – US and international nuclear policies | Moderate – US domestic uranium market and regulatory environment |

Centrus Energy faces notable regulatory and operational risks tied to the nuclear fuel market but maintains moderate debt and solid financial stability. enCore Energy, in contrast, carries higher operational and environmental risks due to its exploration focus and weaker financial health, including distress-level bankruptcy risk indicated by its Altman Z-Score. Investors should weigh Centrus’s stable cash flows against enCore’s higher volatility and developmental uncertainties.

Which Stock to Choose?

Centrus Energy Corp. (LEU) shows a favorable income evolution with 38% revenue growth in one year and a 34.56% net income increase over five years. Its financial ratios are mostly positive, including a 45.35% ROE and a strong current ratio of 2.93. Despite a favorable rating of B, the company faces some challenges such as an unfavorable ROIC and a very unfavorable MOAT status indicating value destruction.

EnCore Energy Corp. (EU) displays an unfavorable income profile with negative net margins and declining profitability despite a strong one-year revenue growth of 163%. Its financial ratios are largely unfavorable, with negative returns and a distress zone Altman Z-score. The company holds a C- rating but suffers from a very unfavorable MOAT, indicating persistent value loss.

From an investor’s perspective, Centrus Energy Corp. might appear more favorable due to its stronger income statement and overall financial ratios, despite its value destruction signal. Conversely, EnCore Energy Corp. may be considered riskier with weaker financial health. Risk-tolerant investors focused on potential turnaround opportunities could interpret EnCore’s profile differently than risk-averse investors prioritizing stability might view Centrus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Centrus Energy Corp. and enCore Energy Corp. to enhance your investment decisions: