In the dynamic uranium industry, Centrus Energy Corp. (LEU) and Denison Mines Corp. (DNN) stand out as key players with distinct strategies and market footprints. Centrus focuses on nuclear fuel supply and technical solutions across multiple countries, while Denison specializes in uranium exploration and development in Canada’s Athabasca Basin. This comparison explores which company offers the most compelling opportunity for investors seeking exposure to the evolving energy sector. Let’s uncover which stock deserves a place in your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Centrus Energy Corp. and Denison Mines Corp. by providing an overview of these two companies and their main differences.

Centrus Energy Corp. Overview

Centrus Energy Corp. supplies nuclear fuel and services primarily for the nuclear power industry in the US, Japan, Belgium, and internationally. The company operates two segments: Low-Enriched Uranium (LEU), which sells components for nuclear fuel, and Technical Solutions, providing engineering and manufacturing services. Founded in 1998 and headquartered in Bethesda, Maryland, Centrus plays a key role in nuclear energy supply.

Denison Mines Corp. Overview

Denison Mines Corp. focuses on uranium acquisition, exploration, development, and processing in Canada. Its major asset is the Wheeler River uranium project in Saskatchewan’s Athabasca Basin. Founded in 1997 and based in Toronto, Denison is engaged primarily in Canadian uranium properties, reflecting a strong regional focus in the nuclear energy sector.

Key similarities and differences

Both Centrus and Denison operate in the uranium industry within the energy sector, yet Centrus has a broader international presence and diversified business segments including technical services. Denison concentrates on Canadian uranium mining and development projects. Centrus has a larger workforce with 322 employees versus Denison’s 65, and a substantially higher market capitalization, reflecting differences in scale and market positioning.

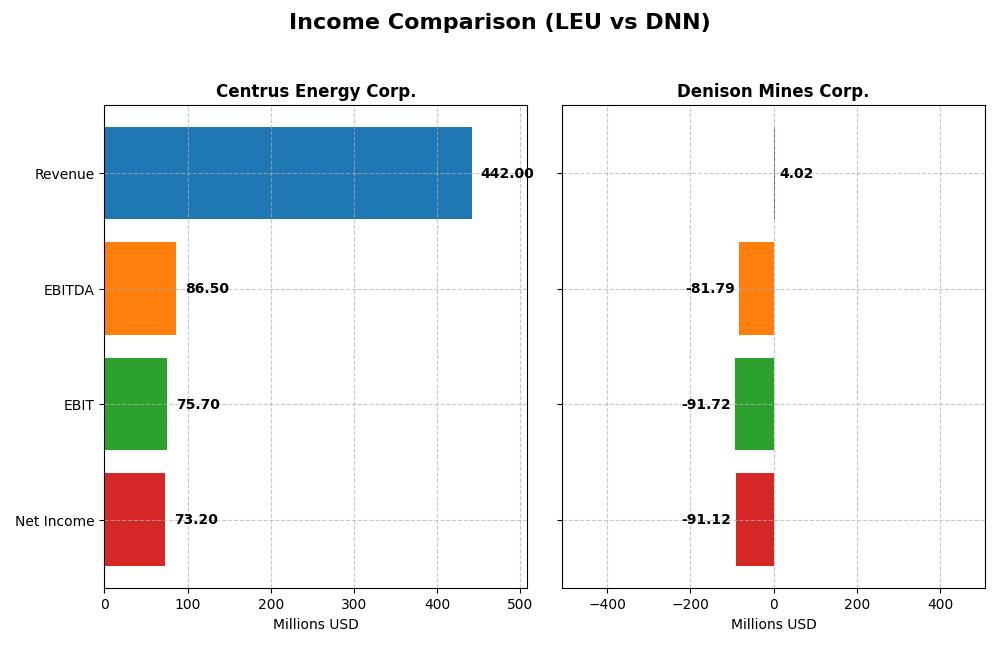

Income Statement Comparison

Below is a comparison of key income statement metrics for Centrus Energy Corp. and Denison Mines Corp. for the fiscal year 2024, expressed in their respective reported currencies.

| Metric | Centrus Energy Corp. (LEU) | Denison Mines Corp. (DNN) |

|---|---|---|

| Market Cap | 5.4B USD | 3B CAD |

| Revenue | 442M USD | 4.0M CAD |

| EBITDA | 86.5M USD | -81.8M CAD |

| EBIT | 75.7M USD | -91.7M CAD |

| Net Income | 73.2M USD | -91.1M CAD |

| EPS | 4.49 USD | -0.10 CAD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Centrus Energy Corp.

Centrus Energy Corp. showed a strong revenue growth of 38% in 2024, continuing an overall increase of nearly 79% since 2020. Despite this, gross profit slightly declined and EBIT fell by 12% last year, which contributed to a 37% decrease in net margin. The company maintains favorable gross and EBIT margins above 17%, with a net margin of 16.56%, reflecting solid profitability despite margin pressure.

Denison Mines Corp.

Denison Mines Corp. experienced significant revenue growth of 117% in 2024, following a period of overall decline since 2020. However, the company posted negative gross and EBIT margins, indicating operational challenges. Net margin remained deeply negative, and net income declined sharply with a 200% drop in EPS last year. Interest expense remains low at 2.68% of revenue, but overall profitability metrics are unfavorable.

Which one has the stronger fundamentals?

Centrus Energy Corp.’s income statement presents stronger fundamentals with favorable margins, positive net income growth, and a solid revenue increase over the period. In contrast, Denison Mines Corp. faces persistent losses, negative margins, and unfavorable income growth metrics, despite recent revenue improvement. The financials suggest Centrus Energy is better positioned operationally and profitably.

Financial Ratios Comparison

The table below compares key financial ratios for Centrus Energy Corp. (LEU) and Denison Mines Corp. (DNN) based on their most recent fiscal year data (2024), providing a snapshot of profitability, liquidity, leverage, and valuation metrics.

| Ratios | Centrus Energy Corp. (LEU) | Denison Mines Corp. (DNN) |

|---|---|---|

| ROE | 45.4% | -16.1% |

| ROIC | 4.0% | -10.0% |

| P/E | 14.8 | -25.3 |

| P/B | 6.73 | 4.09 |

| Current Ratio | 2.93 | 3.65 |

| Quick Ratio | 2.46 | 3.54 |

| D/E (Debt-to-Equity) | 0.97 | 0 |

| Debt-to-Assets | 14.4% | 0 |

| Interest Coverage | 17.8 | -586.3 |

| Asset Turnover | 0.40 | 0.0061 |

| Fixed Asset Turnover | 47.0 | 0.0155 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Centrus Energy Corp.

Centrus Energy displays mostly favorable ratios, including a strong net margin of 16.56% and an impressive return on equity of 45.35%, indicating efficient profitability. However, its return on invested capital at 4.02% and asset turnover ratios are less favorable, suggesting some operational inefficiency. The company currently does not pay dividends, likely prioritizing reinvestment or growth over shareholder payouts.

Denison Mines Corp.

Denison Mines shows predominantly unfavorable ratios, with a deeply negative net margin (-2264.95%) and negative returns on equity and invested capital, reflecting operational and profitability challenges. Despite a solid quick ratio and zero debt, the company offers no dividends, likely due to ongoing losses or a focus on exploration and development activities rather than immediate returns.

Which one has the best ratios?

Centrus Energy holds a more favorable ratio profile overall, with majority positive indicators in profitability and financial health. Conversely, Denison Mines struggles with significant negative margins and returns, making its ratio profile less attractive. The contrast highlights Centrus Energy’s stronger financial position relative to Denison Mines as of 2024.

Strategic Positioning

This section compares the strategic positioning of Centrus Energy Corp. and Denison Mines Corp. based on market position, key segments, and exposure to technological disruption:

Centrus Energy Corp.

- Mid-sized uranium supplier with moderate competitive pressure, US and international markets

- Diversified revenue from Low-Enriched Uranium and technical services for nuclear industry

- Exposure through nuclear fuel technology and centrifuge engineering; potential technical innovation

Denison Mines Corp.

- Smaller uranium company focused on Canadian uranium properties, facing high competitive pressure

- Concentrated on uranium acquisition, exploration, and development in Athabasca Basin, Canada

- Limited information on technological disruption; primarily focused on resource development

Centrus Energy Corp. vs Denison Mines Corp. Positioning

Centrus pursues a diversified strategy combining uranium supply and technical services across multiple countries, providing broader business drivers. Denison concentrates on uranium exploration and development in Canada, focusing on a flagship project, resulting in a more concentrated approach with potentially higher project risk.

Which has the best competitive advantage?

Both companies are shedding value with ROIC below WACC. Centrus shows a declining ROIC trend (very unfavorable moat), while Denison has stable but unfavorable profitability, indicating neither currently holds a strong competitive advantage.

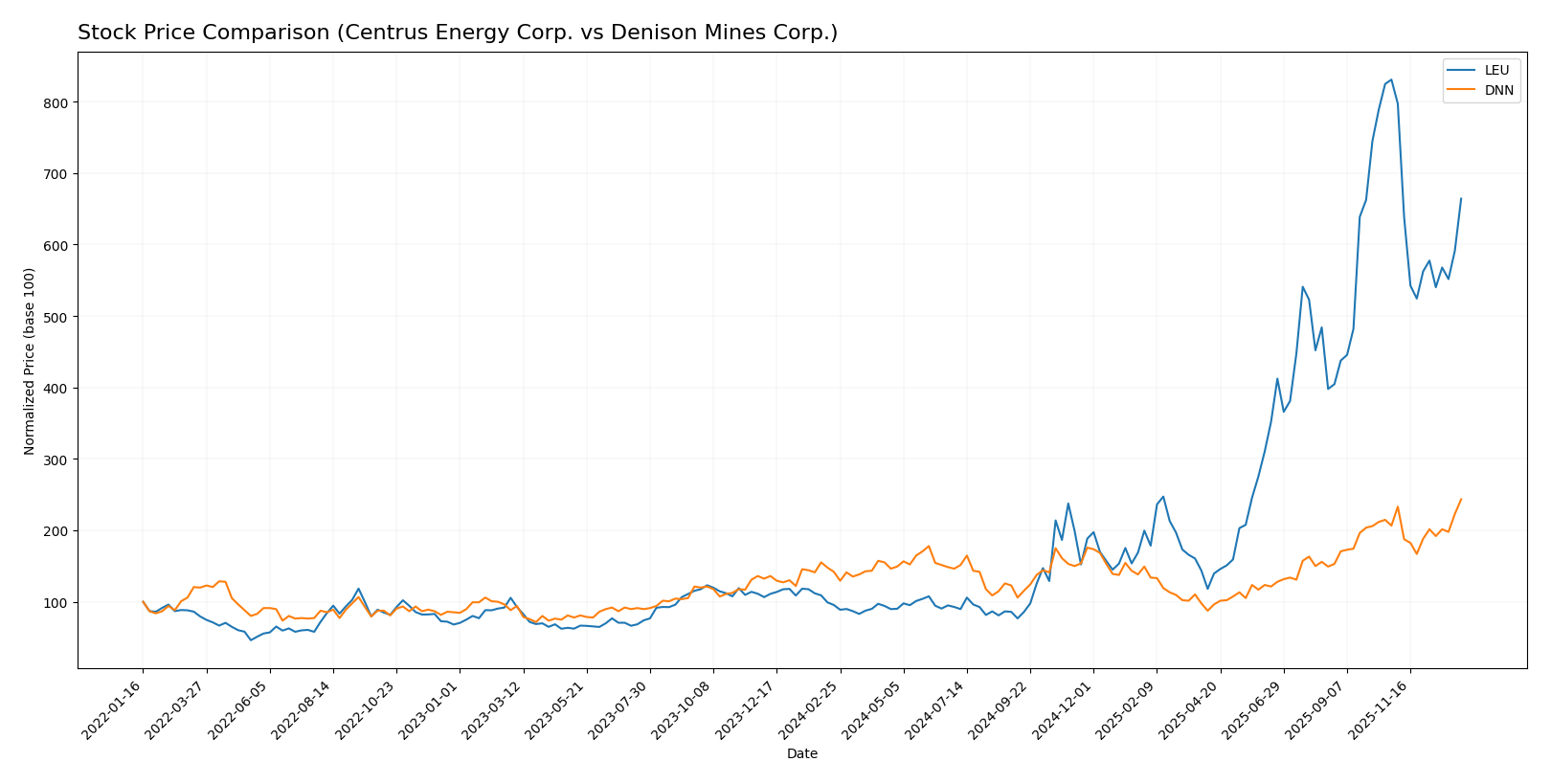

Stock Comparison

The past year has seen Centrus Energy Corp. (LEU) exhibit a strong bullish trend with significant price appreciation, while Denison Mines Corp. (DNN) also recorded positive gains but with a steadier acceleration in its upward movement.

Trend Analysis

Centrus Energy Corp. (LEU) showed a bullish trend over the past 12 months with a 595.57% price increase, though recent months indicate a deceleration and a 20.05% decline in the last quarter. Denison Mines Corp. (DNN) experienced a 71.5% bullish trend over the year with accelerating gains and a positive 17.79% price change recently. Comparing both, LEU delivered the highest market performance despite recent short-term weakness, significantly outperforming DNN’s more moderate but accelerating growth.

Target Prices

Analysts provide a mixed but insightful target consensus for Centrus Energy Corp. and Denison Mines Corp.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Centrus Energy Corp. | 390 | 125 | 288.4 |

| Denison Mines Corp. | 2.6 | 2.6 | 2.6 |

For Centrus Energy, the consensus target price of 288.4 is slightly below the current price of 306.19, suggesting some caution. Denison Mines shows a stable target at 2.6, well below its current price of 3.31, indicating potential overvaluation risk according to analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Centrus Energy Corp. and Denison Mines Corp.:

Rating Comparison

LEU Rating

- Rated B, classified as Very Favorable overall rating.

- Discounted Cash Flow Score is 4, indicating a Favorable assessment of future cash flow.

- Return on Equity Score is 5, the highest, indicating Very Favorable efficiency in profit use.

- Return on Assets Score is 4, showing Favorable asset utilization.

- Debt To Equity Score is 1, marked as Very Unfavorable, indicating high financial risk.

- Overall Score is 3, indicating a Moderate overall financial standing.

DNN Rating

- Rated C-, also classified as Very Favorable overall rating.

- Discounted Cash Flow Score is 3, reflecting a Moderate view on future cash flow.

- Return on Equity Score is 1, signaling a Very Unfavorable efficiency in profit use.

- Return on Assets Score is 1, considered Very Unfavorable asset utilization.

- Debt To Equity Score is 1, also Very Unfavorable, indicating similar high financial risk.

- Overall Score is 1, indicating a Very Unfavorable overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Centrus Energy (LEU) is better rated with higher scores in discounted cash flow, return on equity, and return on assets, while both companies share a low debt-to-equity score. Denison Mines (DNN) has lower overall and efficiency scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Centrus Energy Corp. and Denison Mines Corp.:

Centrus Energy Corp. Scores

- Altman Z-Score: 2.70, indicating a moderate bankruptcy risk in the grey zone.

- Piotroski Score: 5, reflecting average financial strength.

Denison Mines Corp. Scores

- Altman Z-Score: 0.73, indicating high bankruptcy risk in the distress zone.

- Piotroski Score: 4, reflecting average financial strength.

Which company has the best scores?

Centrus Energy Corp. has a higher Altman Z-Score, placing it in a less risky grey zone compared to Denison Mines Corp.’s distress zone. Both companies have similar average Piotroski Scores, with Centrus slightly higher.

Grades Comparison

Here is a detailed comparison of the recent grades and ratings for Centrus Energy Corp. and Denison Mines Corp.:

Centrus Energy Corp. Grades

The following table summarizes the latest grades assigned by recognized grading companies for Centrus Energy Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth Capital | Maintain | Neutral | 2026-01-08 |

| B. Riley Securities | Maintain | Buy | 2025-12-22 |

| Needham | Maintain | Buy | 2025-12-22 |

| UBS | Maintain | Neutral | 2025-11-25 |

| JP Morgan | Maintain | Neutral | 2025-11-07 |

| JP Morgan | Maintain | Neutral | 2025-10-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-26 |

| Evercore ISI Group | Maintain | Outperform | 2025-08-08 |

| B of A Securities | Downgrade | Neutral | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-08-07 |

Centrus Energy Corp. shows a mix of neutral and buy ratings, with a consensus of “Hold” reflecting a cautious stance among analysts.

Denison Mines Corp. Grades

Below is a summary of the most recent grades from known grading firms for Denison Mines Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth MKM | Maintain | Buy | 2024-10-23 |

| TD Securities | Maintain | Speculative Buy | 2023-06-27 |

| Raymond James | Maintain | Outperform | 2023-06-27 |

| TD Securities | Maintain | Speculative Buy | 2023-06-26 |

| Raymond James | Maintain | Outperform | 2023-06-26 |

Denison Mines Corp. has predominantly buy and outperform grades, with a consensus rating of “Buy,” indicating a more optimistic outlook from analysts.

Which company has the best grades?

Denison Mines Corp. holds generally stronger grades with multiple “Buy,” “Speculative Buy,” and “Outperform” ratings compared to Centrus Energy Corp.’s mix of “Neutral” and “Buy” grades. This suggests Denison may be viewed as having higher growth potential or a more favorable risk/reward profile by market analysts, which could influence investor interest accordingly.

Strengths and Weaknesses

Below is a comparative table highlighting the key strengths and weaknesses of Centrus Energy Corp. (LEU) and Denison Mines Corp. (DNN) based on the most recent financial and operational data available for 2024 and the overall 2020-2024 period.

| Criterion | Centrus Energy Corp. (LEU) | Denison Mines Corp. (DNN) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from separative work units and uranium products; limited diversification outside nuclear fuel cycle services | Low: Primarily focused on uranium mining with limited diversification in product/service lines |

| Profitability | Favorable net margin (16.56%) and ROE (45.35%); however, ROIC (4.02%) below WACC (9.06%) signals value destruction | Unfavorable profitability with large negative net margin (-2264.95%) and negative ROE (-16.15%); ROIC also negative (-10.03%) |

| Innovation | Moderate: Strong fixed asset turnover (47.02) indicates efficient use of assets; ongoing investments in separative work unit capacity | Low: Very low asset turnover (0.01) and fixed asset turnover (0.02) indicate underutilization and limited operational efficiency |

| Global presence | Moderate: Presence in US nuclear fuel cycle markets with growing product revenue | Limited: Primarily focused on Canadian uranium assets, with limited global footprint |

| Market Share | Stable to growing: Increasing revenues in separative work units and uranium segments | Small and struggling: Negative financial metrics suggest difficulty in maintaining or growing market share |

Key takeaways: Centrus Energy shows operational strength with favorable profitability metrics aside from ROIC, indicating some inefficiency in capital use but solid revenue growth. Denison Mines struggles with profitability and asset utilization, reflecting significant financial and operational challenges. Investors should exercise caution with DNN, while LEU presents a more balanced risk profile despite some value destruction concerns.

Risk Analysis

Below is a comparative table summarizing key risk factors for Centrus Energy Corp. (LEU) and Denison Mines Corp. (DNN) based on the most recent data from 2024.

| Metric | Centrus Energy Corp. (LEU) | Denison Mines Corp. (DNN) |

|---|---|---|

| Market Risk | Moderate (Beta 1.25) | High (Beta 1.89) |

| Debt level | Moderate (D/E 0.97) | None (D/E 0.00) |

| Regulatory Risk | Elevated due to uranium sector regulations in US, Japan, Belgium | Elevated, with Canadian uranium mining regulations |

| Operational Risk | Moderate; technical solutions segment complexity | High; early-stage project development (Wheeler River) |

| Environmental Risk | Moderate; nuclear fuel supply chain impact | High; mining exploration and extraction impacts |

| Geopolitical Risk | Moderate; global uranium market sensitivity | Moderate; Canadian jurisdiction but global uranium demand |

Centrus Energy presents moderate market and operational risks with a balanced debt profile, but benefits from diversified international nuclear fuel supply. Denison Mines faces higher market volatility and operational risks due to exploration stage projects and weaker financial stability, as reflected in its distress zone Altman Z-score. Regulatory and environmental challenges remain significant for both given the uranium industry’s sensitive nature.

Which Stock to Choose?

Centrus Energy Corp. (LEU) shows a favorable income evolution with 38% revenue growth in the past year and a 34.56% net income increase over five years. Its profitability is strong, evidenced by a 16.56% net margin and a high 45.35% ROE. Debt levels are moderate with a 14.36% debt-to-assets ratio, and its overall rating is very favorable with a B grade.

Denison Mines Corp. (DNN) exhibits an unfavorable income trend, with negative net margin (-2264.95%) and declining profitability metrics. Despite a 116.87% revenue growth last year, its long-term net income has sharply decreased (-459.6%). The company carries no debt but suffers from poor financial ratios and an overall very unfavorable rating of C-.

For investors, LEU’s favorable rating and positive income statement might signal potential for those valuing profitability and financial stability, whereas DNN’s unfavorable ratios and income might appeal to risk-tolerant investors focusing on turnaround opportunities or growth potential despite current weaknesses.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Centrus Energy Corp. and Denison Mines Corp. to enhance your investment decisions: