Home > Comparison > Healthcare > CNC vs MOH

The strategic rivalry between Centene Corporation and Molina Healthcare defines the current trajectory of the U.S. healthcare plans sector. Centene operates as a multi-national healthcare enterprise with a broad service portfolio, while Molina Healthcare focuses on managed care primarily for low-income families across fewer states. This head-to-head contrasts scale and diversification against targeted regional expertise. This analysis will determine which corporate path offers superior risk-adjusted returns for a diversified portfolio in healthcare.

Table of contents

Companies Overview

Centene Corporation and Molina Healthcare, Inc. are pivotal players in U.S. government-subsidized healthcare markets.

Centene Corporation: Multi-National Healthcare Enterprise

Centene dominates the managed care sector by providing health plan coverage to under-insured and uninsured individuals primarily through Medicaid and Medicare programs. Its revenue engine spans a broad spectrum of healthcare services, including specialty pharmacy, behavioral health, and telehealth. In 2026, Centene’s strategy focuses on expanding its Specialty Services segment to enhance integrated care solutions.

Molina Healthcare, Inc.: Managed Care Specialist for Low-Income Families

Molina Healthcare centers on delivering managed healthcare services to Medicaid and Medicare beneficiaries across 18 states. Its core revenue derives from government-sponsored programs and state insurance marketplaces. Molina’s 2026 strategy prioritizes increasing membership and improving operational efficiencies within its Medicaid and Marketplace segments to strengthen market penetration.

Strategic Collision: Similarities & Divergences

Both companies target government-funded healthcare but differ in scale and diversification. Centene operates a multi-segment portfolio with broad service offerings. Molina specializes in Medicaid and Marketplace segments with a leaner operational footprint. They compete primarily on enrollment growth and service integration. Centene’s diversified profile contrasts with Molina’s focused model, shaping distinct risk and growth dynamics for investors.

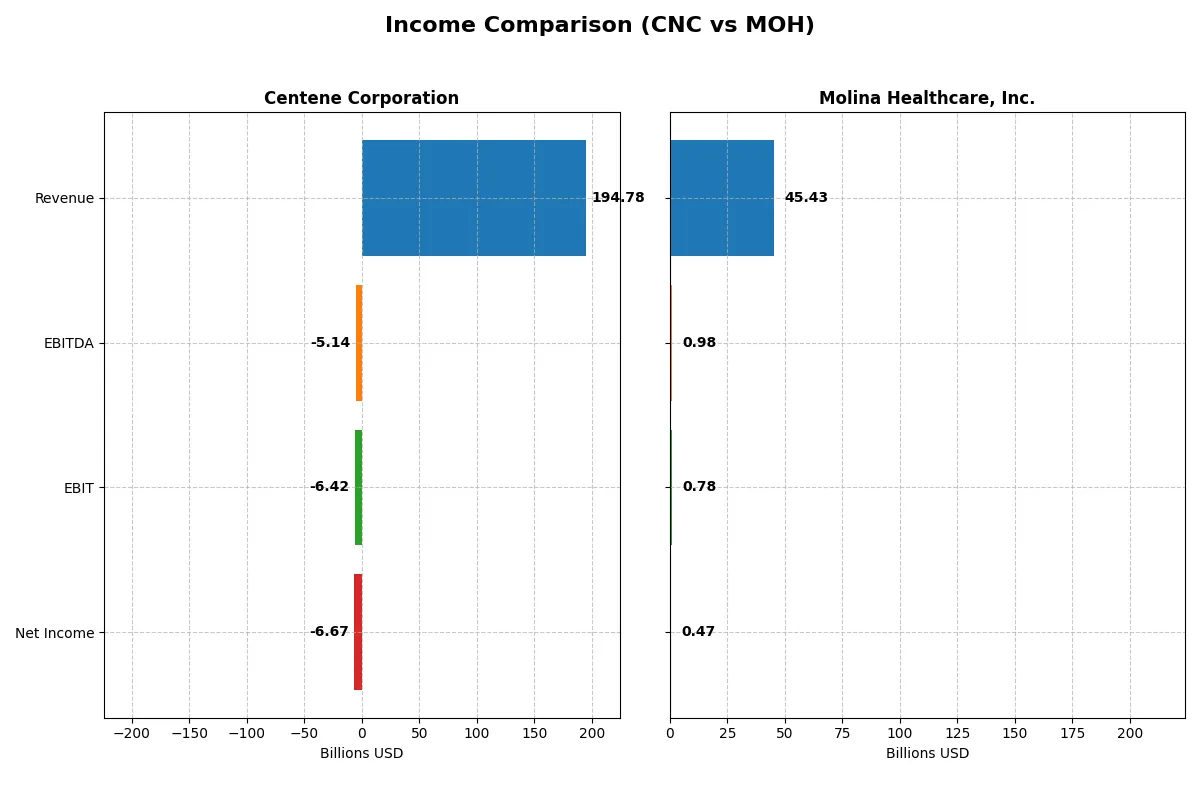

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Centene Corporation (CNC) | Molina Healthcare, Inc. (MOH) |

|---|---|---|

| Revenue | 195B | 45B |

| Cost of Revenue | 171B | 0 |

| Operating Expenses | 31.5B | 44.6B |

| Gross Profit | 23.8B | 0 |

| EBITDA | -5.1B | 976M |

| EBIT | -6.4B | 781M |

| Interest Expense | 678M | 192M |

| Net Income | -6.7B | 472M |

| EPS | -13.61 | 8.92 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company executes its business model with greater efficiency and sustainable profitability.

Centene Corporation Analysis

Centene’s revenue climbed sharply from 126B in 2021 to nearly 195B in 2025, reflecting robust top-line growth. However, net income swung from a 1.35B profit in 2021 to a 6.67B loss in 2025, signaling margin pressure. Gross margins stayed around 12%, but the negative EBIT and net margins in 2025 indicate deteriorating operational efficiency and costly overheads.

Molina Healthcare, Inc. Analysis

Molina’s revenue expanded steadily from 27.8B in 2021 to 45.4B in 2025, showing consistent growth. Net income rose from 659M to 472M in 2025, though it declined from prior years, reflecting margin compression. With a slim 1% net margin and a zero gross margin reported in 2025, Molina faces challenges maintaining profitability despite controlled interest expenses and moderate EBIT margin.

Margin Power vs. Revenue Scale

Centene dominates in revenue scale but suffers from sharply falling profitability and widening losses. Molina, while smaller, maintains positive net income and stable margins, though with lower growth momentum. Investors seeking scale and growth face higher risk with Centene, while Molina’s profile appeals more to those prioritizing margin stability and consistent earnings.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | Centene Corporation (CNC) | Molina Healthcare, Inc. (MOH) |

|---|---|---|

| ROE | -33.4% | 11.6% |

| ROIC | -18.9% | 7.6% |

| P/E | -3.03 | 19.45 |

| P/B | 1.01 | 2.26 |

| Current Ratio | 1.10 | 1.69 |

| Quick Ratio | 1.10 | 1.69 |

| D/E | 0.87 | 0.97 |

| Debt-to-Assets | 22.7% | 25.4% |

| Interest Coverage | -11.2 | 4.07 |

| Asset Turnover | 2.54 | 2.92 |

| Fixed Asset Turnover | 95.6 | 150.9 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering hidden risks and revealing operational strengths beyond surface-level figures.

Centene Corporation

Centene’s profitability struggles with a negative ROE of -33.4% and a net margin of -3.43%, indicating operational challenges. Despite this, valuation metrics like a modest P/E and P/B near 1.0 suggest the stock is attractively priced. The company pays no dividend, likely reinvesting cash flow into stabilizing operations or future growth.

Molina Healthcare, Inc.

Molina Healthcare posts a positive but modest ROE of 11.6% and a slim net margin of 1.04%, reflecting moderate profitability. Its P/E ratio of 19.45 signals a fairly valued stock compared to sector peers. Molina does not distribute dividends, suggesting a focus on reinvesting earnings to support steady operational efficiency and asset turnover.

Valuation Discipline vs. Profitability Resilience

Centene trades at a bargain valuation but suffers from significant profitability headwinds and negative returns. Molina offers a more stable profitability profile at a fair valuation. Investors prioritizing operational resilience may lean toward Molina, while those seeking value might consider Centene’s stretched performance with caution.

Which one offers the Superior Shareholder Reward?

Centene Corporation (CNC) and Molina Healthcare, Inc. (MOH) both forgo dividends, focusing on reinvestment and buybacks. CNC’s free cash flow per share stands at 8.8 in 2025, supporting moderate buybacks amid a net loss margin of -3.4%. MOH posts a negative free cash flow of -12B but boasts a positive net margin of 1.0%, hinting at growth investments. MOH’s stronger balance sheet and higher asset turnover (2.9 vs. CNC’s 2.5) suggest operational efficiency. However, CNC’s lower price-to-free-cash-flow ratio (4.7 vs. MOH’s -14.4) signals undervaluation. I view CNC’s capital allocation as more sustainable, offering a better total return profile in 2026 despite short-term challenges.

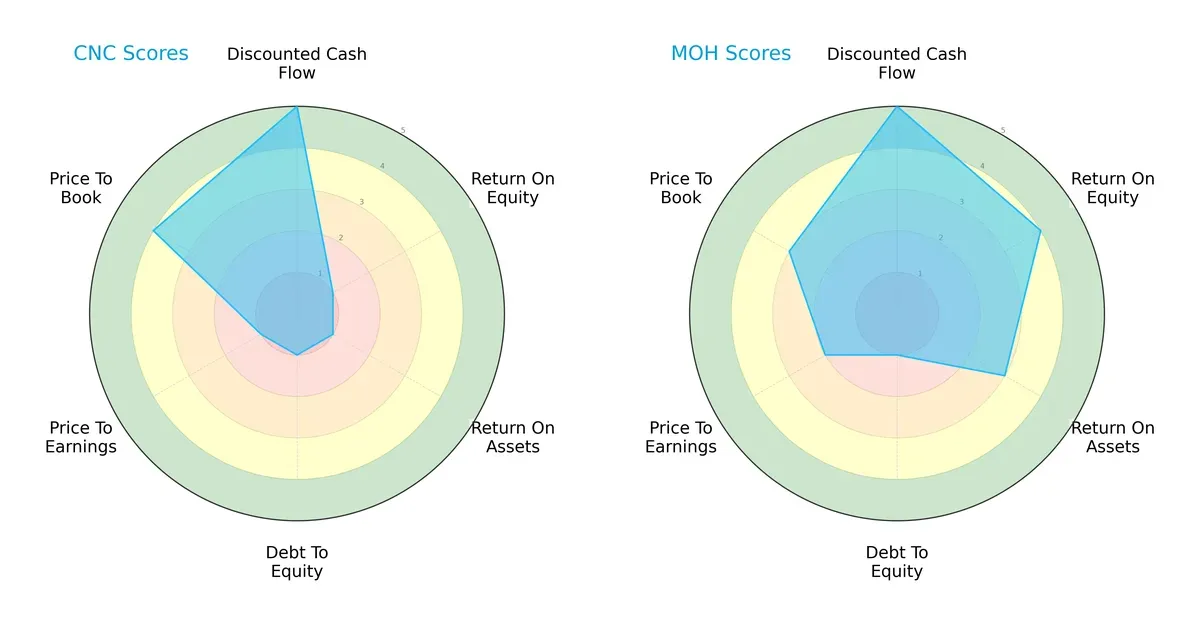

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Centene Corporation and Molina Healthcare, Inc., highlighting their financial strengths and vulnerabilities:

Centene boasts a very favorable discounted cash flow score and a favorable price-to-book ratio, yet struggles with profitability and leverage, indicated by very unfavorable ROE, ROA, debt-to-equity, and P/E scores. Molina Healthcare offers a more balanced profile with favorable ROE, moderate ROA, and moderately favorable valuation metrics but shares Centene’s high financial risk with an equally poor debt-to-equity score. Molina relies on consistent profitability, while Centene’s edge lies in cash flow valuation.

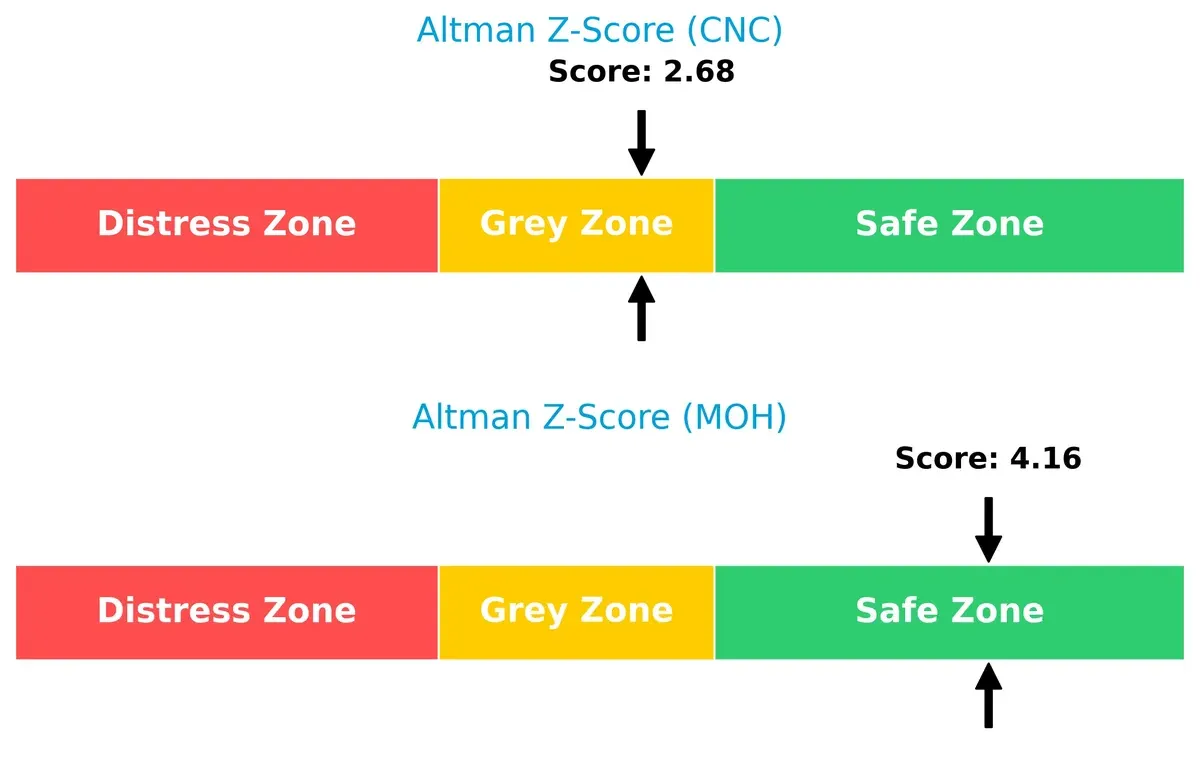

Bankruptcy Risk: Solvency Showdown

Molina Healthcare’s Altman Z-Score of 4.16 places it comfortably in the safe zone, signaling strong solvency and low bankruptcy risk. Centene’s 2.68 score lands in the grey zone, reflecting moderate financial distress risk in this cycle:

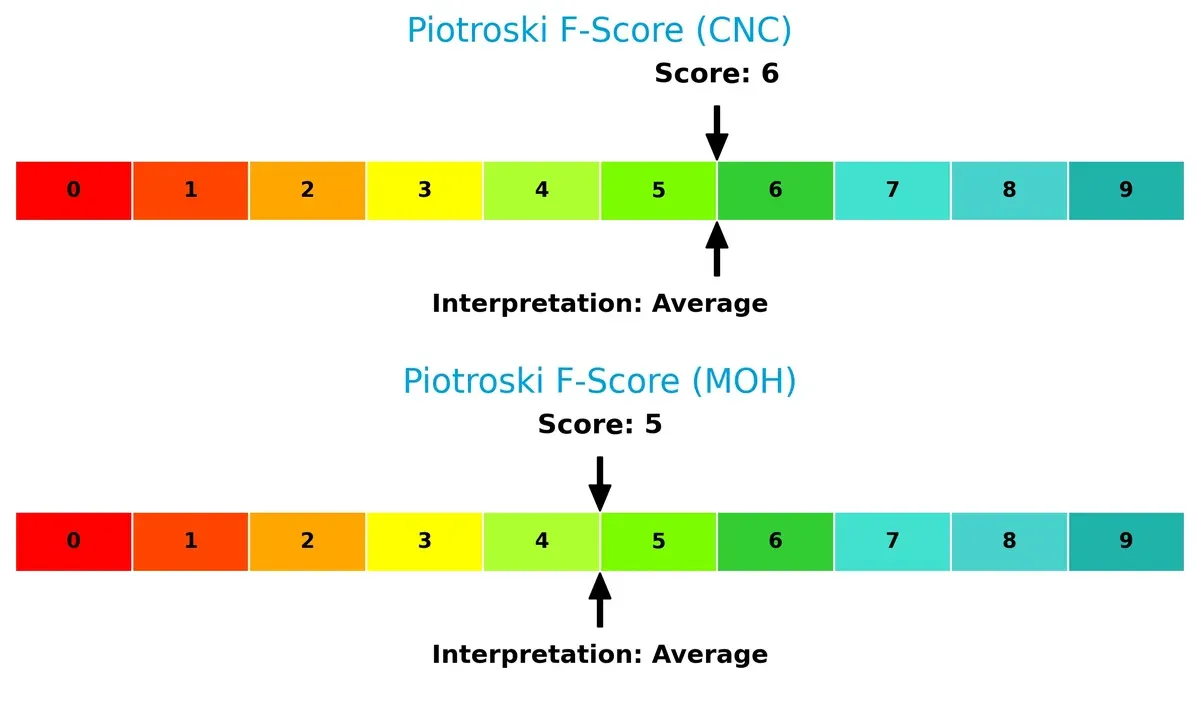

Financial Health: Quality of Operations

Centene’s Piotroski F-Score of 6 slightly surpasses Molina’s 5, indicating marginally stronger operational quality. Neither firm raises critical red flags, but both show room for improvement in internal financial robustness:

How are the two companies positioned?

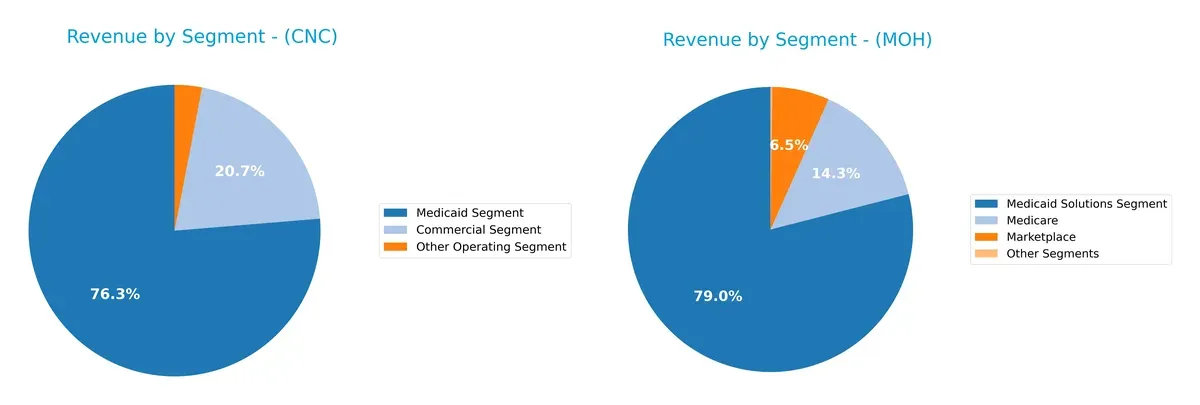

This section dissects CNC and MOH’s operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Centene Corporation and Molina Healthcare diversify income streams and highlights their primary sector bets:

Centene anchors 124B in Medicaid, dwarfs Molina’s 31B Medicaid Solutions, and adds 33.7B Commercial revenue, showing a more diversified mix. Molina pivots on Medicaid Solutions and Marketplace (2.5B), with Medicare at 5.5B. Centene’s broad footprint suggests ecosystem lock-in and infrastructure dominance. Molina’s reliance on Medicaid Solutions signals concentration risk but benefits from focused expertise in that niche.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Centene Corporation and Molina Healthcare, Inc.:

Centene Corporation Strengths

- Large Medicaid segment revenue of 124B USD

- Favorable WACC at 4.6% supports capital efficiency

- Strong asset turnover ratios indicating operational efficiency

Molina Healthcare Strengths

- Positive net margin of 1.04% shows profitability

- Favorable liquidity ratios with current ratio at 1.69

- High fixed asset turnover at 150.92 signals efficient asset use

Centene Corporation Weaknesses

- Negative profitability metrics: net margin -3.43%, ROE -33.44%, ROIC -18.85%

- Negative interest coverage ratio at -9.46 signals financial stress

- No dividend yield limits income for shareholders

Molina Healthcare Weaknesses

- Modest profitability with net margin just above zero

- Neutral ROE and ROIC suggest limited capital returns

- Dividend yield at 0% restricts shareholder income

Both companies show slightly favorable financial profiles but diverge in profitability and operational efficiency. Centene’s scale and asset utilization contrast with Molina’s stronger liquidity and positive net margin, highlighting distinct strategic positions.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from competitive erosion. Without it, gains vanish rapidly in crowded markets:

Centene Corporation: Government Program Scale Advantage

Centene leverages scale in Medicaid and Medicare managed care, driving stable government contracts. Its declining ROIC and margin pressure in 2026 threaten this cost advantage moat.

Molina Healthcare, Inc.: Focused Government Program Efficiency

Molina’s moat stems from efficient management of Medicaid and Medicare plans in fewer states. It creates value with positive ROIC versus WACC, yet faces margin compression and growth limits in 2026.

Scale Efficiency vs. Focused Execution: Which Moat Holds Stronger?

Centene’s broad scale offers potential depth but currently destroys value with falling ROIC. Molina’s narrower footprint yields positive returns despite slowing profitability. Molina better defends market share today.

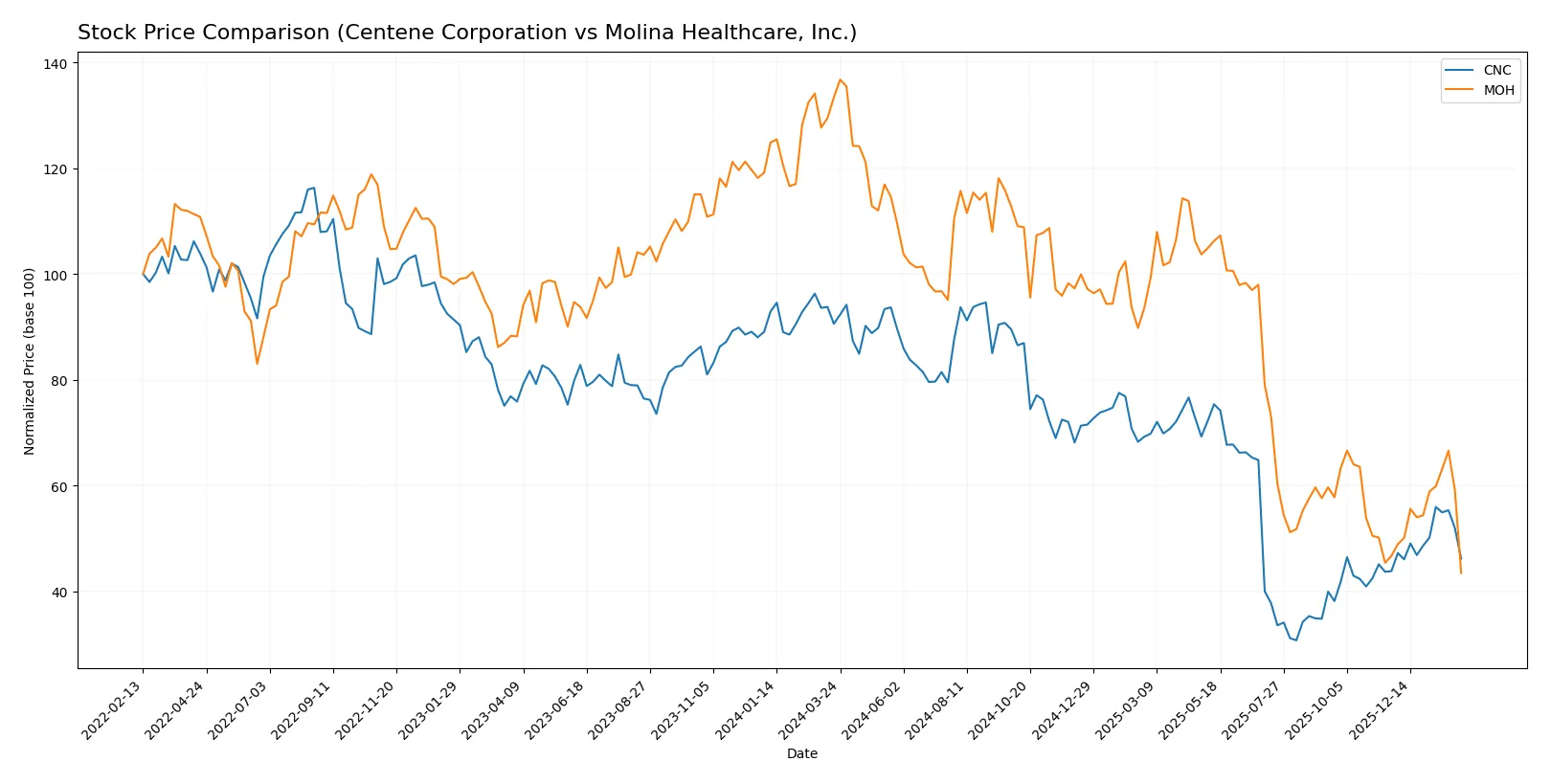

Which stock offers better returns?

The past year shows steep declines for both stocks, with Centene and Molina Healthcare experiencing sharp drops but diverging recent trends.

Trend Comparison

Centene Corporation’s stock declined 49.04% over the past year, marking a bearish trend with accelerating losses. The price ranged between 78.83 and 25.59, showing significant volatility.

Molina Healthcare, Inc. faced a harsher 67.43% drop, confirming a bearish trend with accelerating decline and extreme volatility. Prices fluctuated widely from 414.72 down to 131.72.

Comparing recent trends, Centene rebounded 5.37%, while Molina Healthcare fell 6.95%. Centene shows stronger market performance over the last quarter despite the overall bearish year.

Target Prices

Analysts present a mixed but generally optimistic target consensus for these healthcare plans providers.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Centene Corporation | 38 | 59 | 45.67 |

| Molina Healthcare, Inc. | 158 | 224 | 181 |

Centene’s target consensus at 45.67 suggests modest upside from the current 38.46 price. Molina’s consensus of 181 implies significant appreciation potential versus today’s 131.72.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent grades from reputable institutions for Centene Corporation and Molina Healthcare, Inc.:

Centene Corporation Grades

Below are recent grades assigned by major financial institutions for Centene Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-07 |

| Barclays | Upgrade | Overweight | 2026-01-05 |

| Bernstein | Maintain | Outperform | 2025-11-21 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-12 |

| JP Morgan | Maintain | Neutral | 2025-11-04 |

| Barclays | Maintain | Equal Weight | 2025-11-04 |

| TD Cowen | Maintain | Hold | 2025-10-31 |

| Goldman Sachs | Maintain | Sell | 2025-10-31 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-30 |

| Truist Securities | Maintain | Buy | 2025-10-30 |

Molina Healthcare, Inc. Grades

The table below shows recent grades from established financial firms for Molina Healthcare, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-07 |

| Barclays | Maintain | Underweight | 2026-01-05 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| UBS | Maintain | Neutral | 2025-10-24 |

| Barclays | Downgrade | Underweight | 2025-10-24 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-24 |

| Goldman Sachs | Maintain | Neutral | 2025-10-24 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-14 |

| Wells Fargo | Maintain | Overweight | 2025-10-07 |

| Bernstein | Maintain | Outperform | 2025-09-05 |

Which company has the best grades?

Centene Corporation has a wider distribution of grades, including several Outperform and Buy ratings, indicating stronger institutional confidence. Molina Healthcare shows a mix of Overweight and Underweight ratings, reflecting more divided views. Investors may see Centene’s grades as suggesting relatively higher institutional conviction.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Centene Corporation

- Faces intense competition in Medicaid and Medicare managed care, pressuring margins and growth.

Molina Healthcare, Inc.

- Competes in similar markets but with a smaller footprint and higher price volatility risk.

2. Capital Structure & Debt

Centene Corporation

- Moderate leverage (D/E 0.87) with unfavorable interest coverage (-9.46), signaling debt servicing risk.

Molina Healthcare, Inc.

- Similar leverage (D/E 0.97) but better interest coverage (4.07), though debt remains a concern.

3. Stock Volatility

Centene Corporation

- Low beta (0.488) indicates relative stock stability amid market fluctuations.

Molina Healthcare, Inc.

- Slightly higher beta (0.493) but recent 25% price drop raises volatility concerns.

4. Regulatory & Legal

Centene Corporation

- Operates in a highly regulated healthcare space with risks from policy shifts and reimbursement changes.

Molina Healthcare, Inc.

- Faces similar regulatory challenges, amplified by exposure to multiple state Medicaid programs.

5. Supply Chain & Operations

Centene Corporation

- Complex provider network and service offerings increase operational risks and costs.

Molina Healthcare, Inc.

- Smaller scale may limit operational complexity but also restricts bargaining power.

6. ESG & Climate Transition

Centene Corporation

- Increasing pressure to improve social and governance standards; climate impact less direct but emerging.

Molina Healthcare, Inc.

- ESG initiatives are growing focus areas; lagging behind peers may attract investor scrutiny.

7. Geopolitical Exposure

Centene Corporation

- Primarily U.S.-based, limiting direct geopolitical risks but sensitive to federal policy changes.

Molina Healthcare, Inc.

- Similar U.S. focus with state-level political shifts posing localized risks.

Which company shows a better risk-adjusted profile?

Molina Healthcare’s most impactful risk lies in its significant stock volatility and debt servicing threats. Centene faces deeper profitability and interest coverage issues despite lower stock volatility. Molina’s Altman Z-Score in the safe zone contrasts with Centene’s grey zone, signaling stronger financial stability. Molina’s recent 25% share price drop demands caution, but overall, Molina shows a better risk-adjusted profile due to healthier liquidity and operational metrics.

Final Verdict: Which stock to choose?

Centene Corporation’s superpower lies in its operational scale and asset turnover, reflecting efficient revenue generation despite current profitability challenges. Its steep decline in returns signals a point of vigilance. It fits portfolios willing to endure volatility for potential turnaround gains, suited for aggressive growth investors.

Molina Healthcare offers a strategic moat through stable capital allocation and value creation above its cost of capital. Its stronger liquidity and safer debt profile provide better financial resilience compared to Centene. It appeals to investors seeking a blend of growth with moderate risk, aligning with GARP portfolios.

If you prioritize operational efficiency and are comfortable with elevated risk, Centene might outshine due to its scale and potential for recovery. However, if you seek better stability and value creation with steadier fundamentals, Molina Healthcare offers a more prudent scenario despite slower momentum. Both require careful risk assessment within their respective investment frameworks.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Centene Corporation and Molina Healthcare, Inc. to enhance your investment decisions: