Home > Comparison > Consumer Defensive > PEP vs CELH

The competitive dynamic between PepsiCo, Inc. and Celsius Holdings, Inc. shapes the non-alcoholic beverages sector’s evolution. PepsiCo operates as a diversified consumer defensive powerhouse with extensive global reach and a broad product portfolio. Celsius Holdings, a nimble challenger, focuses on functional energy drinks targeting niche health-conscious consumers. This analysis will evaluate which business model delivers superior risk-adjusted returns, guiding investors seeking balanced exposure in a rapidly evolving industry.

Table of contents

Companies Overview

PepsiCo and Celsius Holdings each hold distinctive positions in the non-alcoholic beverages market, shaping consumer preferences globally.

PepsiCo, Inc.: Global Food and Beverage Powerhouse

PepsiCo dominates the consumer defensive sector with a diversified portfolio spanning snacks and beverages. Its core revenue derives from manufacturing and distributing products like chips, cereals, and ready-to-drink beverages worldwide. In 2026, PepsiCo focuses on expanding its global reach and optimizing supply chains to sustain its competitive advantage in scale and variety.

Celsius Holdings, Inc.: Innovator in Functional Energy Drinks

Celsius Holdings is a niche player in the functional beverages segment, generating revenue through carbonated and non-carbonated energy drinks with health-oriented formulations. The company’s 2026 strategy centers on broadening its international footprint and leveraging direct-to-retailer channels to capture growing demand for wellness-focused drinks.

Strategic Collision: Similarities & Divergences

PepsiCo embraces a broad product ecosystem, while Celsius bets on targeted functional beverages with a health-conscious appeal. Their primary battleground is the energy and ready-to-drink segment, where consumer preferences are rapidly evolving. PepsiCo’s vast scale contrasts with Celsius’s agility, defining unique investment profiles shaped by market maturity and growth potential.

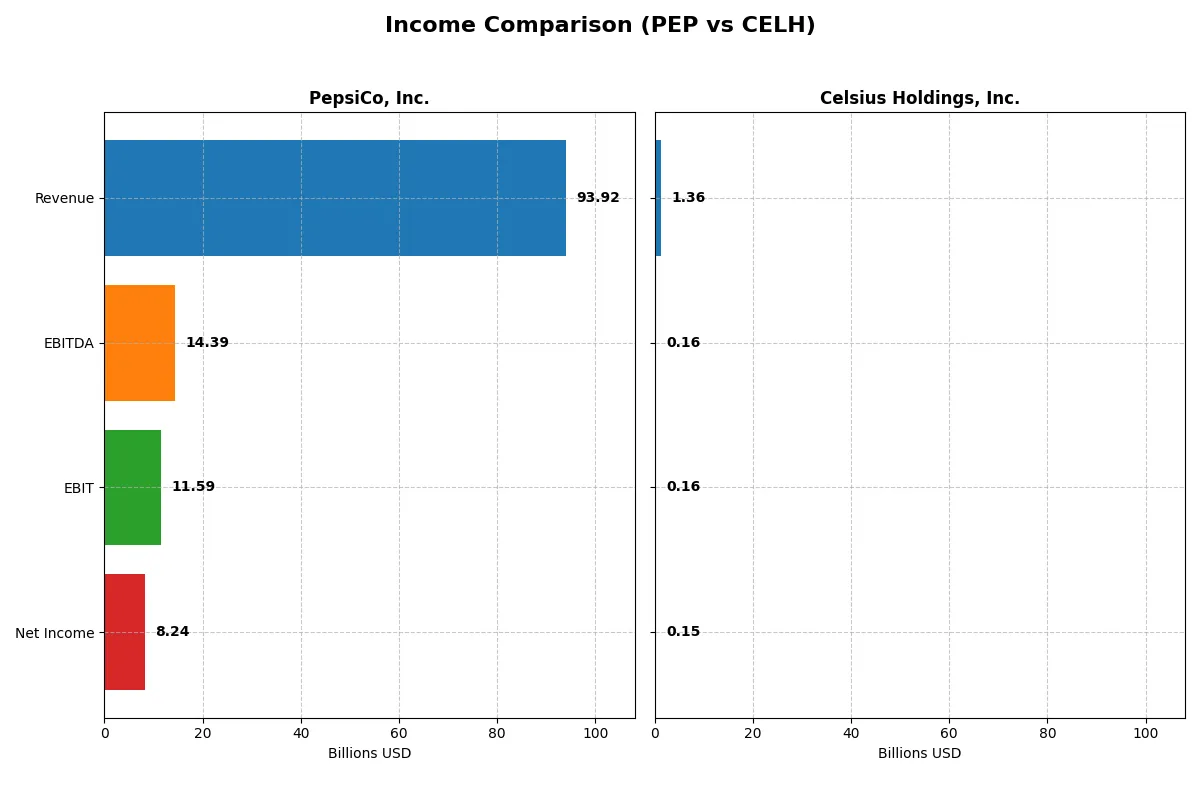

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | PepsiCo, Inc. (PEP) | Celsius Holdings, Inc. (CELH) |

|---|---|---|

| Revenue | 93.9B | 1.36B |

| Cost of Revenue | 43.1B | 675M |

| Operating Expenses | 39.4B | 524M |

| Gross Profit | 50.9B | 680M |

| EBITDA | 14.4B | 163M |

| EBIT | 11.6B | 156M |

| Interest Expense | 1.12B | 0 |

| Net Income | 8.24B | 145M |

| EPS | 6.01 | 0.46 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes which company optimizes its revenue into profit most efficiently in a challenging market landscape.

PepsiCo, Inc. Analysis

PepsiCo’s revenue climbs steadily from $79B in 2021 to $94B in 2025, with net income rising from $7.6B to $8.2B over the same period. Its gross margin stays robust at 54.15%, and net margin remains solid at 8.77%. However, recent signs show a 10% EBIT decline and a 16% net margin contraction in 2025, signaling margin pressure despite revenue gains.

Celsius Holdings, Inc. Analysis

Celsius’s revenue soared from $130M in 2020 to $1.36B in 2024, with net income surging from a loss of $198M to a profit of $108M. Maintaining a healthy gross margin of 50.18% and net margin of 10.7%, Celsius displays impressive growth momentum. Yet, its EBIT and net margin fell sharply by over 40% in 2024, reflecting volatility in scaling expenses alongside revenue growth.

Margin Strength vs. Growth Momentum

PepsiCo delivers consistent scale with stable margins, though recent margin declines warrant caution. Celsius impresses with explosive revenue and net income growth but faces notable short-term margin compression. For investors, PepsiCo’s steady profitability suits those prioritizing resilience, while Celsius appeals to growth-seekers willing to tolerate margin swings.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | PepsiCo, Inc. (PEP) | Celsius Holdings, Inc. (CELH) |

|---|---|---|

| ROE | 40.4% | 11.8% |

| ROIC | 11.3% | 8.2% |

| P/E | 23.9 | 42.4 |

| P/B | 9.66 | 5.03 |

| Current Ratio | 0.85 | 3.62 |

| Quick Ratio | 0.67 | 3.26 |

| D/E (Debt-to-Equity) | 2.45 | 0.02 |

| Debt-to-Assets | 46.5% | 1.1% |

| Interest Coverage | 10.3 | 0 |

| Asset Turnover | 0.87 | 0.77 |

| Fixed Asset Turnover | 2.79 | 17.5 |

| Payout Ratio | 92.7% | 18.9% |

| Dividend Yield | 3.87% | 0.45% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing underlying risks and operational strengths crucial for investment decisions.

PepsiCo, Inc.

PepsiCo posts a robust 40.4% ROE and solid 8.8% net margin, indicating strong profitability. Its P/E ratio near 24 signals a neutral valuation, neither cheap nor expensive. The firm delivers shareholder value through a 3.9% dividend yield, reflecting steady income in lieu of aggressive buybacks or R&D spending.

Celsius Holdings, Inc.

Celsius shows a moderate 11.9% ROE and superior 10.7% net margin, signaling efficient operations. However, its P/E of 42.4 marks a stretched valuation relative to earnings. The company offers minimal dividends at 0.45%, suggesting reinvestment favors growth initiatives over shareholder payouts.

Premium Valuation vs. Operational Safety

PepsiCo balances strong returns with reasonable valuation and reliable dividends, showcasing operational safety. Celsius, while operationally efficient, trades at a premium, implying higher risk for future growth. Investors seeking stable income may prefer PepsiCo; those chasing growth might lean toward Celsius’s riskier profile.

Which one offers the Superior Shareholder Reward?

I compare PepsiCo’s steady dividend yield around 3.7% and high payout ratio near 75-92%, with consistent buybacks supporting total returns. Celsius Holdings pays a negligible yield below 0.5%, focusing on reinvestment and moderate buybacks. PepsiCo’s mature, cash-generative model offers more sustainable long-term rewards than Celsius’s growth-heavy strategy. I favor PepsiCo for superior total shareholder return in 2026.

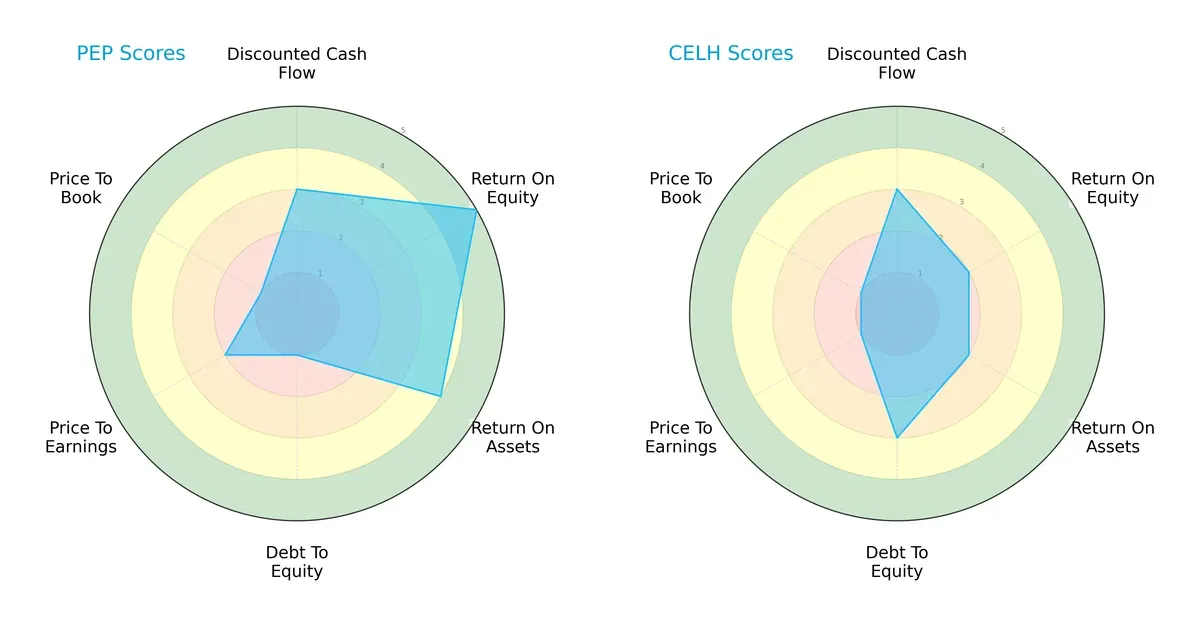

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of PepsiCo, Inc. and Celsius Holdings, Inc., highlighting their financial strengths and vulnerabilities:

PepsiCo shows a balanced profile with strong ROE (5) and ROA (4) scores but suffers from very unfavorable debt-to-equity (1) and valuation metrics (PE at 2, PB at 1). Celsius relies more on moderate debt management (debt-to-equity 3) but lags on profitability with weaker ROE (2) and ROA (2) scores. PepsiCo’s advantage lies in operational efficiency, while Celsius shows cautious leverage management but weaker earnings power.

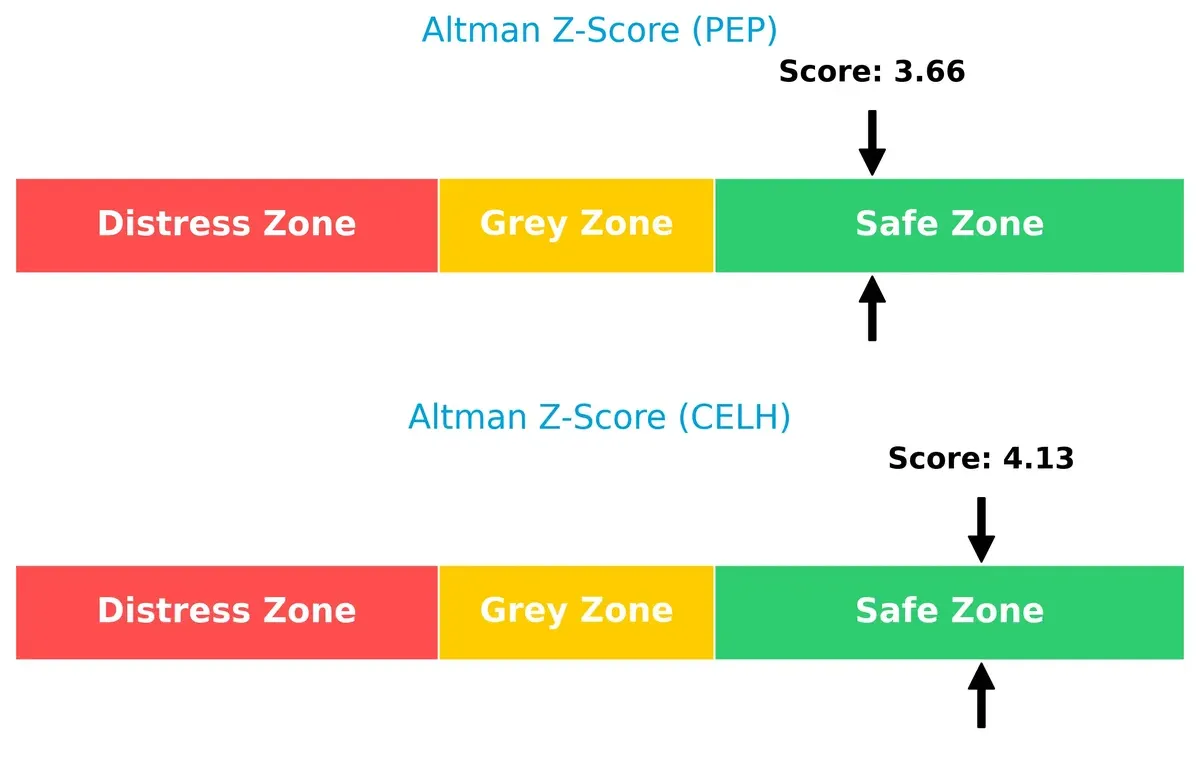

Bankruptcy Risk: Solvency Showdown

PepsiCo’s Altman Z-Score of 3.66 versus Celsius’s 4.13 places both firms firmly in the safe zone, with Celsius slightly safer. This implies both companies have robust long-term survival prospects in the current cycle:

Financial Health: Quality of Operations

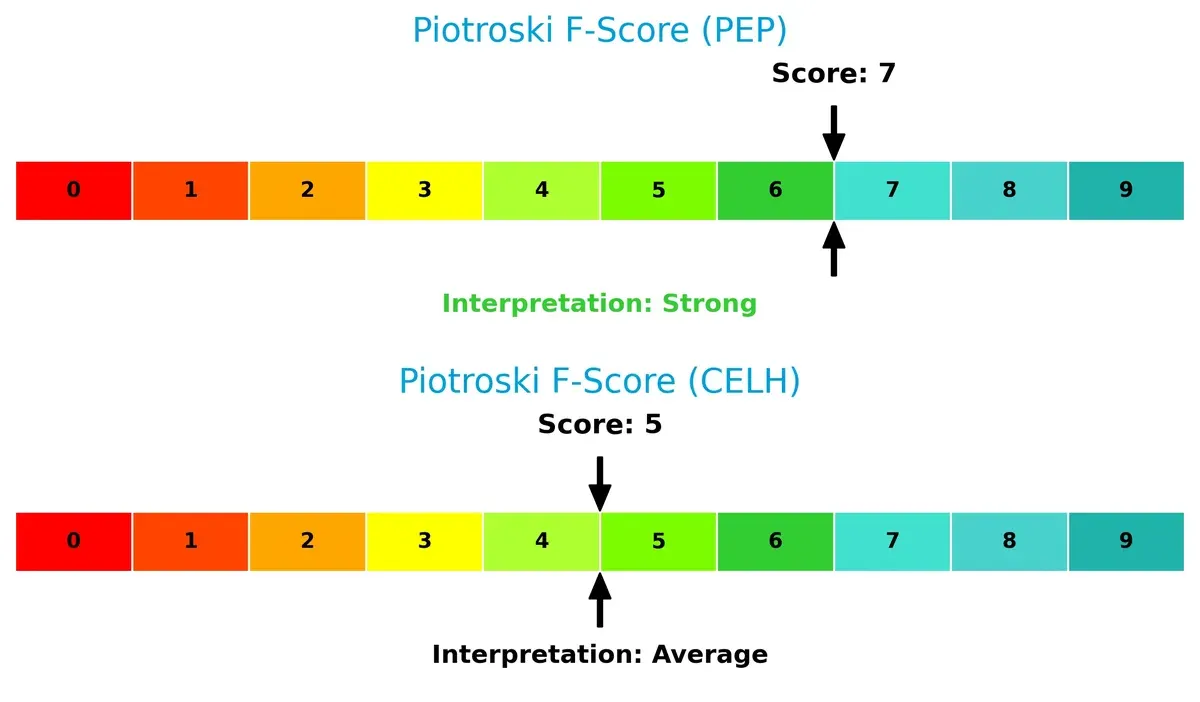

PepsiCo’s Piotroski F-Score of 7 indicates strong financial health, outperforming Celsius, which scores 5. PepsiCo’s internal metrics show fewer red flags and better operational quality:

How are the two companies positioned?

This section dissects the operational DNA of PepsiCo and Celsius by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to reveal which business model offers the most resilient, sustainable competitive advantage today.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of PepsiCo, Inc. and Celsius Holdings, Inc.:

PepsiCo Strengths

- Diversified global presence with strong revenues across Americas, Europe, Asia, and Africa

- Favorable ROE (40.38%) and ROIC (11.3%) indicating efficient capital use

- Strong interest coverage (10.34) and dividend yield (3.87%)

Celsius Strengths

- Favorable net margin (10.7%) and WACC (7.91%) reflecting cost-effective capital structure

- Very low debt-to-equity (0.02) and debt-to-assets (1.15%) levels

- High fixed asset turnover (17.51) and favorable quick ratio (3.26)

PepsiCo Weaknesses

- Low liquidity ratios (current ratio 0.85, quick ratio 0.67) signal potential short-term financial strain

- High debt-to-equity (2.45) and unfavorable price-to-book (9.66) ratios

- Neutral net margin (8.77%) and slightly unfavorable asset turnover (0.87)

Celsius Weaknesses

- Unfavorable high P/E ratio (42.43) and low dividend yield (0.45%)

- Unfavorable current ratio (3.62) despite strong quick ratio

- Neutral ROE (11.85%) and ROIC (8.25%) indicate moderate profitability

PepsiCo’s strengths lie in its extensive diversification and capital efficiency, offset by liquidity concerns and leverage risks. Celsius shows efficient asset use and a strong balance sheet but faces valuation challenges and moderate profitability. These factors shape each company’s strategic financial positioning.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion:

PepsiCo, Inc.: Diversified Brand Power and Scale Moat

PepsiCo’s moat stems from intangible assets and scale, reflected in a solid 6% ROIC premium over WACC despite a recent decline. Its broad global reach and product diversity stabilize margins. New product innovation and emerging markets in 2026 could deepen this moat but require vigilance against shifting consumer trends.

Celsius Holdings, Inc.: Emerging Growth with Innovation Moat

Celsius relies on product innovation and brand positioning in functional beverages, showing a growing ROIC trend but still near WACC, signaling weak current moat depth. Unlike PepsiCo, Celsius aggressively expands in North America and Europe, aiming for disruption but faces risk from larger incumbents and margin pressure.

Legacy Scale vs. Emerging Innovation: Who Defends the Future?

PepsiCo’s wider moat benefits from entrenched brand equity and global scale, providing a stronger defensive position. Celsius’s improving profitability signals potential but remains vulnerable. I see PepsiCo better equipped to defend and extend market share in 2026’s competitive landscape.

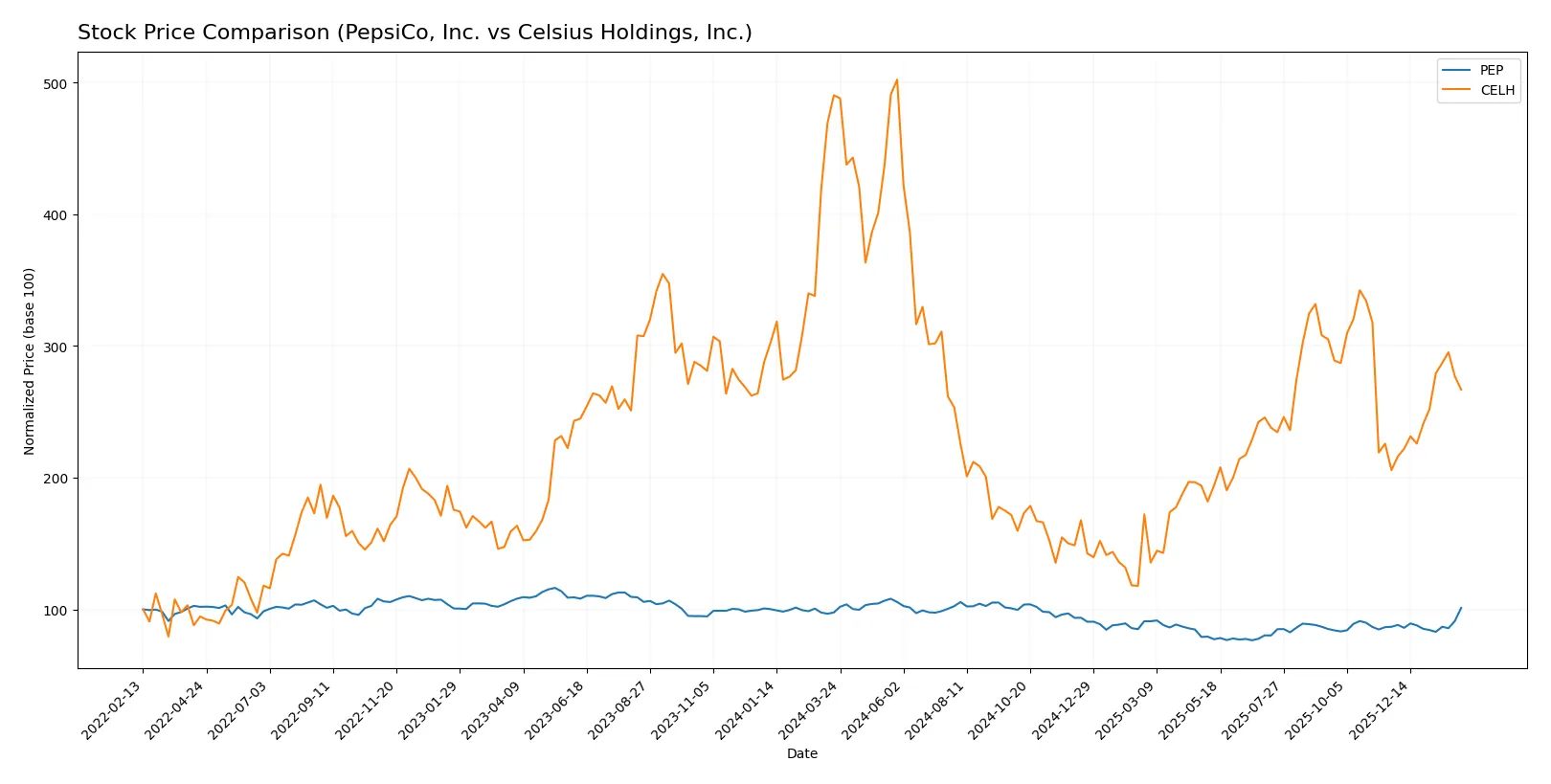

Which stock offers better returns?

The past year showed clear divergence: PepsiCo’s stock advanced steadily, while Celsius Holdings experienced a significant decline, reflecting contrasting market dynamics and investor sentiment.

Trend Comparison

PepsiCo’s stock rose 3.54% over the past 12 months, marking a bullish trend with accelerating momentum. It traded between $129.07 and $182.19, showing moderate volatility (14.65% std deviation).

Celsius Holdings’ stock fell 45.57% over the same period, confirming a bearish trend with accelerating losses. Prices fluctuated widely from $22.34 to $95.15, reflecting higher volatility (17.84% std deviation).

PepsiCo delivered stronger market performance over the year, sustaining gains. Celsius Holdings showed heavy losses despite recent recovery signs in the last quarter.

Target Prices

Analysts present a cautiously optimistic consensus for PepsiCo, Inc. and Celsius Holdings, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| PepsiCo, Inc. | 144 | 191 | 167.75 |

| Celsius Holdings, Inc. | 60 | 74 | 68.89 |

PepsiCo’s consensus target sits slightly below its current price of 170.49, implying limited upside. Celsius Holdings shows a more significant gap, with targets well above its 50.57 share price, suggesting growth potential.

How do institutions grade them?

The following tables summarize recent institutional grades for PepsiCo, Inc. and Celsius Holdings, Inc.:

PepsiCo, Inc. Grades

This table presents recent grade actions from major financial institutions for PepsiCo, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-04 |

| JP Morgan | Maintain | Overweight | 2026-02-04 |

| Wells Fargo | Maintain | Equal Weight | 2026-02-04 |

| UBS | Maintain | Buy | 2026-01-14 |

| Citigroup | Maintain | Buy | 2025-12-17 |

| Barclays | Maintain | Equal Weight | 2025-12-11 |

| JP Morgan | Upgrade | Overweight | 2025-12-10 |

| Piper Sandler | Maintain | Overweight | 2025-12-09 |

| Piper Sandler | Maintain | Overweight | 2025-11-21 |

| Freedom Capital Markets | Downgrade | Hold | 2025-10-23 |

Celsius Holdings, Inc. Grades

This table presents recent grade actions from major financial institutions for Celsius Holdings, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2026-01-29 |

| Piper Sandler | Maintain | Overweight | 2026-01-29 |

| UBS | Maintain | Buy | 2026-01-14 |

| Needham | Maintain | Buy | 2026-01-07 |

| B of A Securities | Maintain | Underperform | 2025-12-19 |

| Piper Sandler | Maintain | Overweight | 2025-12-17 |

| Citigroup | Maintain | Buy | 2025-11-07 |

| UBS | Maintain | Buy | 2025-11-07 |

| B of A Securities | Maintain | Underperform | 2025-11-07 |

| JP Morgan | Maintain | Overweight | 2025-11-07 |

Which company has the best grades?

PepsiCo holds generally stable grades with multiple Buy and Overweight ratings from top firms. Celsius shows a mix of Buy and Overweight ratings but also has Underperform grades from B of A Securities. PepsiCo’s grades suggest broader institutional confidence, potentially favoring investor perception of stability and upside.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

PepsiCo, Inc.

- Dominates global non-alcoholic beverage markets with established brands and diverse segments.

Celsius Holdings, Inc.

- Faces intense competition in niche functional drink space with smaller scale and brand recognition.

2. Capital Structure & Debt

PepsiCo, Inc.

- High debt-to-equity ratio (2.45) signals leverage risk despite strong interest coverage (10.34x).

Celsius Holdings, Inc.

- Minimal debt (D/E 0.02) provides financial flexibility and low leverage risk.

3. Stock Volatility

PepsiCo, Inc.

- Beta of 0.41 indicates low volatility, appealing for risk-averse investors.

Celsius Holdings, Inc.

- Beta of 0.88 reflects higher volatility, increasing risk in turbulent markets.

4. Regulatory & Legal

PepsiCo, Inc.

- Global footprint exposes to complex regulations across food and beverage sectors.

Celsius Holdings, Inc.

- Smaller footprint reduces regulatory complexity but limits scale advantages.

5. Supply Chain & Operations

PepsiCo, Inc.

- Extensive global supply chain offers resilience but vulnerability to geopolitical disruptions.

Celsius Holdings, Inc.

- More localized supply chain reduces complexity but risks scale inefficiencies.

6. ESG & Climate Transition

PepsiCo, Inc.

- Large-scale ESG initiatives underway, but legacy operations pose transition challenges.

Celsius Holdings, Inc.

- Emerging company with opportunity to embed ESG but lacks scale for impact.

7. Geopolitical Exposure

PepsiCo, Inc.

- Significant exposure to emerging markets entails currency and political risks.

Celsius Holdings, Inc.

- Limited international presence mitigates geopolitical risk but caps growth potential.

Which company shows a better risk-adjusted profile?

PepsiCo’s biggest risk is its high leverage amid a complex global environment. Celsius faces greater market volatility but benefits from minimal debt. I see PepsiCo’s strong cash flow and scale temper risks better, granting it a superior risk-adjusted profile despite debt concerns. Celsius’s high P/E ratio and volatility highlight growth uncertainty.

Final Verdict: Which stock to choose?

PepsiCo’s superpower lies in its resilient cash flow generation and strong capital returns, underpinned by a wide economic moat. Its key point of vigilance is the declining ROIC trend and stretched balance sheet metrics. It suits investors focused on stable, dividend-oriented portfolios with moderate growth.

Celsius Holdings leverages a strategic moat in rapid profitability improvement and a lean, low-debt structure. It offers greater liquidity and a growing ROIC, presenting a more agile growth profile than PepsiCo. This fits portfolios targeting high growth with tolerance for volatility and valuation risk.

If you prioritize steady value creation and income, PepsiCo outshines with proven capital efficiency and dividend yield despite slower growth. However, if you seek aggressive expansion and improving profitability, Celsius offers better growth momentum but commands a premium for its higher risk. Each stock appeals to distinct investor avatars balancing stability versus growth.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of PepsiCo, Inc. and Celsius Holdings, Inc. to enhance your investment decisions: