In the competitive world of non-alcoholic beverages, Monster Beverage Corporation (MNST) and Celsius Holdings, Inc. (CELH) stand out as prominent players. Both companies focus on energy drinks but follow distinct innovation strategies and target overlapping markets. This comparison aims to shed light on their growth potential and market positioning. Join me as we explore which company offers the most compelling opportunity for investors in 2026.

Table of contents

Companies Overview

I will begin the comparison between Monster Beverage Corporation and Celsius Holdings, Inc. by providing an overview of these two companies and their main differences.

Monster Beverage Corporation Overview

Monster Beverage Corporation focuses on the development, marketing, sale, and distribution of energy drink beverages and concentrates globally. It operates through segments including Monster Energy Drinks and Strategic Brands, offering a wide range of carbonated and non-carbonated energy drinks, teas, juices, and other beverages. Founded in 1985 and based in Corona, California, Monster is a dominant player in the non-alcoholic beverage industry with a market cap of approximately 75.7B USD.

Celsius Holdings, Inc. Overview

Celsius Holdings, Inc. develops, markets, and sells functional energy drinks and liquid supplements internationally under various brands such as CELSIUS Originals and CELSIUS HEAT. The company distributes its products through retailers and health clubs, focusing on functional and dietary supplements. Founded in 2004 and headquartered in Boca Raton, Florida, Celsius is smaller with a market cap around 13.7B USD and targets a niche in functional beverages.

Key similarities and differences

Both companies operate in the non-alcoholic beverage sector, specializing in energy drinks aimed at health-conscious consumers. Monster offers a broader portfolio including sodas and juices, leveraging a more extensive global distribution network. Celsius emphasizes functional ingredients and supplements with a focus on fitness and wellness markets. While Monster is a larger, established leader, Celsius is a smaller, emerging competitor with a specialized product line.

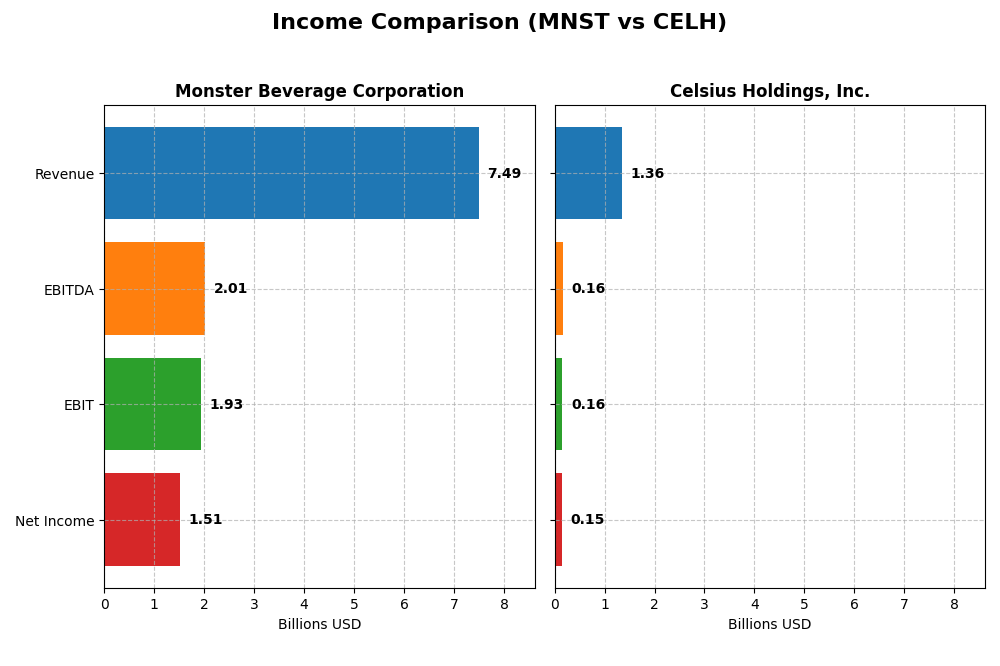

Income Statement Comparison

This table presents a side-by-side comparison of the key income statement metrics for Monster Beverage Corporation and Celsius Holdings, Inc. for the fiscal year 2024.

| Metric | Monster Beverage Corporation | Celsius Holdings, Inc. |

|---|---|---|

| Market Cap | 75.7B | 13.7B |

| Revenue | 7.49B | 1.36B |

| EBITDA | 2.01B | 163M |

| EBIT | 1.93B | 156M |

| Net Income | 1.51B | 145M |

| EPS | 1.50 | 0.46 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Monster Beverage Corporation

Monster Beverage’s revenue increased steadily from 4.6B in 2020 to 7.5B in 2024, with net income also rising overall to 1.5B. Margins remain strong, with a favorable gross margin above 54% and net margin around 20%. However, recent trends show slowed revenue growth at 4.9% and a slight decline in net income and EPS, indicating margin pressures in 2024.

Celsius Holdings, Inc.

Celsius Holdings experienced rapid revenue growth from 130M in 2020 to 1.36B in 2024, with net income turning positive and reaching 145M. Margins improved favorably, with gross margin above 50% and net margin at 10.7%. Despite a slowdown in revenue growth to 2.9% and declines in EBIT and EPS in 2024, the overall period shows strong expansion and margin gains.

Which one has the stronger fundamentals?

Both companies show favorable income statement fundamentals, yet Monster Beverage has higher absolute revenue and net income with stable margins. Celsius exhibits faster growth rates and improving margins but at a smaller scale and with recent profitability volatility. The choice depends on preference for scale and stability versus rapid growth and margin improvement.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Monster Beverage Corporation (MNST) and Celsius Holdings, Inc. (CELH) as of fiscal year 2024, enabling a straightforward side-by-side analysis.

| Ratios | Monster Beverage Corporation (MNST) | Celsius Holdings, Inc. (CELH) |

|---|---|---|

| ROE | 25.3% | 11.8% |

| ROIC | 22.1% | 8.2% |

| P/E | 35.0 | 42.4 |

| P/B | 8.9 | 5.0 |

| Current Ratio | 3.32 | 3.62 |

| Quick Ratio | 2.65 | 3.26 |

| D/E (Debt-to-Equity) | 6.3% | 1.7% |

| Debt-to-Assets | 4.8% | 1.1% |

| Interest Coverage | 69.2 | 0 (no reported coverage) |

| Asset Turnover | 0.97 | 0.77 |

| Fixed Asset Turnover | 7.16 | 17.51 |

| Payout Ratio | 0% | 18.9% |

| Dividend Yield | 0% | 0.45% |

Interpretation of the Ratios

Monster Beverage Corporation

Monster Beverage shows strong profitability with a net margin of 20.14% and a return on equity of 25.33%, both favorable indicators. Its low debt-to-equity ratio at 0.06 and high interest coverage suggest effective risk management. However, the company’s price-to-earnings (PE) ratio of 34.99 and price-to-book (PB) ratio of 8.86 are viewed as unfavorable, indicating a potentially high valuation. Monster does not pay dividends, likely prioritizing reinvestment or growth strategies.

Celsius Holdings, Inc.

Celsius Holdings presents a mixed financial profile with a favorable net margin of 10.7% but neutral returns on equity and invested capital, at 11.85% and 8.25%, respectively. Its debt levels are low and interest coverage is excellent, supporting financial stability. The PE ratio of 42.43 and PB ratio of 5.03 are unfavorable, reflecting market expectations. Celsius pays no dividends, which may signal reinvestment into growth or R&D investments.

Which one has the best ratios?

Monster Beverage holds a more favorable overall ratio profile, with 64.29% favorable ratios compared to Celsius’s 50%. While both companies face valuation concerns with high PE and PB ratios, Monster’s stronger profitability and risk metrics provide a comparatively healthier picture. Celsius’s ratios show moderate strengths but also greater neutrality, indicating a slightly less robust financial stance.

Strategic Positioning

This section compares the strategic positioning of Monster Beverage Corporation and Celsius Holdings, Inc., including market position, key segments, and exposure to technological disruption:

Monster Beverage Corporation

- Leading energy drink producer with expansive global reach, facing moderate competitive pressure.

- Diverse portfolio including energy drinks, alcohol brands, and strategic beverage segments.

- Limited explicit exposure to technological disruption mentioned in the data.

Celsius Holdings, Inc.

- Smaller market cap with growing presence in functional energy drinks, facing competitive pressure.

- Focused on functional energy drinks and liquid supplements with several product lines.

- No specific technological disruption exposure indicated in the data.

Monster Beverage Corporation vs Celsius Holdings, Inc. Positioning

Monster Beverage has a diversified product portfolio spanning energy drinks and alcohol brands, providing broader market coverage. Celsius is concentrated in functional energy drinks and supplements, which may limit diversification but focuses on a niche market segment.

Which has the best competitive advantage?

Monster Beverage shows a stronger competitive advantage, creating value with ROIC above WACC despite declining profitability. Celsius has improving ROIC but is still shedding value, indicating a less established competitive moat.

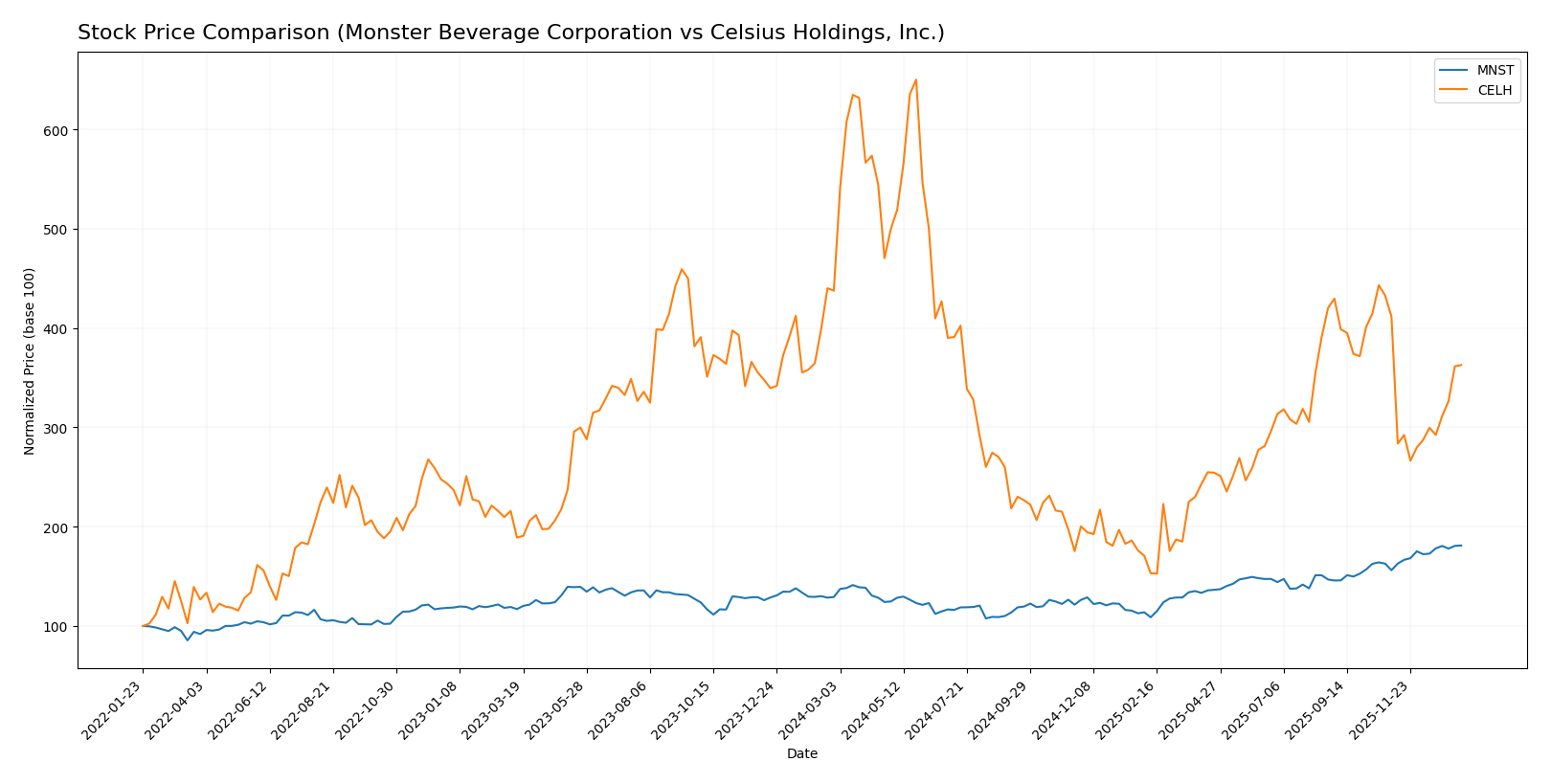

Stock Comparison

The past year has seen Monster Beverage Corporation’s stock rise sharply by 40.17%, showing accelerating bullish momentum, while Celsius Holdings, Inc. experienced a notable 17.11% decline under accelerating bearish pressure.

Trend Analysis

Monster Beverage Corporation’s stock price increased by 40.17% over the past year, reflecting a bullish trend with accelerating momentum and moderate volatility (8.13 std deviation). The stock peaked at 77.5 and bottomed at 46.06.

Celsius Holdings, Inc. showed a 17.11% decrease over the same period, marking a bearish trend with accelerating decline and higher volatility (18.64 std deviation). Its highest and lowest prices were 95.15 and 22.34, respectively.

Comparing both, Monster Beverage Corporation delivered the highest market performance with its strong bullish trend, contrasting with Celsius Holdings’ bearish trajectory.

Target Prices

Analysts provide a clear consensus on target prices for Monster Beverage Corporation and Celsius Holdings, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Monster Beverage Corporation | 87 | 70 | 79.44 |

| Celsius Holdings, Inc. | 74 | 60 | 68.33 |

The consensus target price for Monster Beverage at 79.44 slightly exceeds its current price of 77.5, suggesting modest upside potential. Celsius Holdings shows a consensus target of 68.33, well above its current 53.09, indicating more room for growth according to analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Monster Beverage Corporation and Celsius Holdings, Inc.:

Rating Comparison

MNST Rating

- Rating: B, considered very favorable overall.

- Discounted Cash Flow Score: 4, indicating favorable DCF.

- ROE Score: 5, very favorable, showing strong equity returns.

- ROA Score: 5, very favorable, reflecting excellent asset utilization.

- Debt To Equity Score: 1, very unfavorable, suggesting high financial risk.

- Overall Score: 3, moderate overall financial assessment.

CELH Rating

- Rating: C+, also noted as very favorable overall.

- Discounted Cash Flow Score: 3, a moderate rating.

- ROE Score: 2, moderate, indicating less efficient equity use.

- ROA Score: 2, moderate, showing lower asset efficiency.

- Debt To Equity Score: 3, moderate, implying balanced financial risk.

- Overall Score: 2, moderate but lower than MNST overall.

Which one is the best rated?

Based strictly on provided data, MNST holds a better rating with a “B” grade and higher scores in DCF, ROE, and ROA, despite a weaker debt-to-equity score. CELH scores lower overall, with moderate ratings in key categories.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score of Monster Beverage Corporation (MNST) and Celsius Holdings, Inc. (CELH):

MNST Scores

- Altman Z-Score: 25.33, indicating strong financial safety in the safe zone.

- Piotroski Score: 8, classified as very strong financial health.

CELH Scores

- Altman Z-Score: 3.66, also in the safe zone but much lower than MNST.

- Piotroski Score: 5, representing average financial strength.

Which company has the best scores?

Based strictly on the provided data, MNST has the best scores with a significantly higher Altman Z-Score and a very strong Piotroski Score compared to CELH’s moderate safe zone Altman Z-Score and average Piotroski Score.

Grades Comparison

Here is a comparison of the recent grades assigned to Monster Beverage Corporation and Celsius Holdings, Inc.:

Monster Beverage Corporation Grades

The table below presents the latest grades from reputable grading companies for Monster Beverage Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Hold | Hold | 2026-01-08 |

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-23 |

| Citigroup | Maintain | Buy | 2025-12-17 |

| Stifel | Maintain | Buy | 2025-12-12 |

| Wells Fargo | Maintain | Overweight | 2025-12-03 |

| Piper Sandler | Maintain | Overweight | 2025-12-03 |

| BMO Capital | Maintain | Market Perform | 2025-12-03 |

| RBC Capital | Maintain | Outperform | 2025-12-01 |

| Piper Sandler | Maintain | Overweight | 2025-12-01 |

The overall trend for Monster Beverage Corporation shows mostly positive ratings, with a consensus leaning towards “Buy” and several “Overweight” and “Buy” grades maintained.

Celsius Holdings, Inc. Grades

The following table lists the recent grades from established grading companies for Celsius Holdings, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-07 |

| B of A Securities | Maintain | Underperform | 2025-12-19 |

| Piper Sandler | Maintain | Overweight | 2025-12-17 |

| B of A Securities | Maintain | Underperform | 2025-11-07 |

| Stifel | Maintain | Buy | 2025-11-07 |

| JP Morgan | Maintain | Overweight | 2025-11-07 |

| Citigroup | Maintain | Buy | 2025-11-07 |

| UBS | Maintain | Buy | 2025-11-07 |

| Stifel | Maintain | Buy | 2025-10-24 |

| JP Morgan | Maintain | Overweight | 2025-10-24 |

Grades for Celsius Holdings, Inc. exhibit a mixed pattern with multiple “Buy” and “Overweight” ratings, but also notable “Underperform” grades from B of A Securities, reflecting a less uniform outlook.

Which company has the best grades?

Monster Beverage Corporation generally holds stronger and more consistent positive grades, including a consensus “Buy” with multiple “Overweight” and “Buy” ratings. Celsius Holdings, Inc. also has a “Buy” consensus but shows mixed ratings with some “Underperform” grades. This variation in Celsius’s grades may imply higher rating uncertainty compared to Monster Beverage Corporation.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Monster Beverage Corporation (MNST) and Celsius Holdings, Inc. (CELH) based on the most recent financial and operational data.

| Criterion | Monster Beverage Corporation (MNST) | Celsius Holdings, Inc. (CELH) |

|---|---|---|

| Diversification | Moderate: Dominated by Monster Energy Drinks (6.86B USD in 2024) with smaller Alcohol (172M) and Strategic Brands (432M). | Low: Single main segment with 1.36B USD revenue in 2024. |

| Profitability | High: Net margin 20.14%, ROIC 22.11%, ROE 25.33%, but declining ROIC trend. | Moderate: Net margin 10.7%, ROIC 8.25%, ROE 11.85%, with improving ROIC trend. |

| Innovation | Established product portfolio with steady growth but less emphasis on new product lines recently. | Growing profitability suggests improving innovation and market traction. |

| Global presence | Strong global footprint with widespread distribution. | Emerging global presence, still expanding market reach. |

| Market Share | Large and established market share in energy drinks segment globally. | Smaller market share but growing in niche and health-conscious segments. |

Key takeaways: Monster Beverage boasts strong profitability and global reach but faces a declining ROIC trend and moderate product diversification. Celsius Holdings shows growing profitability and innovation potential but has a smaller scale and narrower product base. Investors should weigh Monster’s stability against Celsius’s growth prospects.

Risk Analysis

Below is a comparison table of key risks for Monster Beverage Corporation (MNST) and Celsius Holdings, Inc. (CELH) based on the most recent financial and market data from 2024.

| Metric | Monster Beverage Corporation (MNST) | Celsius Holdings, Inc. (CELH) |

|---|---|---|

| Market Risk | Low beta (0.46) indicates lower volatility, but high P/E (35) suggests sensitivity to valuation shifts | Higher beta (0.88) implies moderate volatility; elevated P/E (42) increases valuation risk |

| Debt Level | Very low debt-to-equity (0.06) and debt-to-assets (4.84%) indicate strong balance sheet | Extremely low debt (debt-to-equity 0.02) with excellent interest coverage (infinite) |

| Regulatory Risk | Moderate, as beverage industry faces health-related scrutiny and labeling regulations | Similar exposure with functional drinks subject to evolving dietary supplement regulations |

| Operational Risk | Diversified product portfolio reduces risk; solid operational metrics | Smaller scale (1K employees) may increase operational vulnerability |

| Environmental Risk | Moderate, related to packaging waste and water use | Moderate, with growing pressure on sustainable sourcing and packaging |

| Geopolitical Risk | Low, primarily US-based with some international exposure | Low, but expanding international presence may increase exposure |

In summary, both companies exhibit low financial leverage and strong liquidity, minimizing bankruptcy risk. Monster’s lower beta and larger scale mitigate market and operational risks better than Celsius. However, both face regulatory and environmental challenges typical in the beverage sector. High valuation multiples for both suggest caution regarding market corrections.

Which Stock to Choose?

Monster Beverage Corporation (MNST) shows favorable income evolution with a 62.93% revenue growth over five years and solid profitability metrics, including a 20.14% net margin and 25.33% ROE. Its financial ratios are mostly favorable, supported by very strong scores and a very favorable B rating. The company maintains low debt levels and a strong interest coverage ratio, though some valuation ratios appear unfavorable.

Celsius Holdings, Inc. (CELH) exhibits significant revenue growth of 937% over five years but more modest profitability, with a 10.7% net margin and neutral to favorable financial ratios. Its scores are moderate, with a very favorable C+ rating. CELH benefits from low debt and strong liquidity but faces higher valuation multiples and a bearish recent price trend.

For investors, MNST might appear more suitable for those prioritizing consistent profitability and financial strength, while CELH could be of interest to those willing to accept higher volatility for rapid growth potential and improving profitability. The choice could depend on an investor’s risk tolerance and investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Monster Beverage Corporation and Celsius Holdings, Inc. to enhance your investment decisions: