In the dynamic world of non-alcoholic beverages, Coca-Cola Europacific Partners PLC and Celsius Holdings, Inc. stand out as key players with distinct approaches. While Coca-Cola Europacific Partners leverages a vast global portfolio and established market presence, Celsius focuses on innovative functional energy drinks targeting health-conscious consumers. This article will explore both companies’ strategies and market positions to help you identify which one offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Coca-Cola Europacific Partners PLC and Celsius Holdings, Inc. by providing an overview of these two companies and their main differences.

Coca-Cola Europacific Partners PLC Overview

Coca-Cola Europacific Partners PLC produces, distributes, and sells a wide range of non-alcoholic ready-to-drink beverages. The company offers soft drinks, waters, energy drinks, and ready-to-drink tea and coffee under well-known brands like Coca-Cola, Fanta, Sprite, and Monster Energy. Headquartered in the UK, it serves approximately 600M consumers and operates with 41K employees, positioning itself as a global leader in the beverage industry.

Celsius Holdings, Inc. Overview

Celsius Holdings, Inc. develops and markets functional drinks and liquid supplements internationally, focusing on energy and dietary supplement beverages. Its product lines include carbonated and non-carbonated functional energy drinks, dietary supplements, and powdered formulas distributed through various retail channels and e-commerce. Based in Florida, the company employs 1,073 people and has a growing presence in North America, Europe, and Asia.

Key similarities and differences

Both companies operate in the non-alcoholic beverage industry within the consumer defensive sector, offering products aimed at health-conscious consumers. Coca-Cola Europacific Partners has a broad portfolio with established global brand recognition and large-scale operations, whereas Celsius Holdings specializes in functional energy drinks with a smaller workforce and a focus on niche markets. Their distribution models differ, with Coca-Cola emphasizing bottling and mass retail, while Celsius targets specialized retailers and direct delivery.

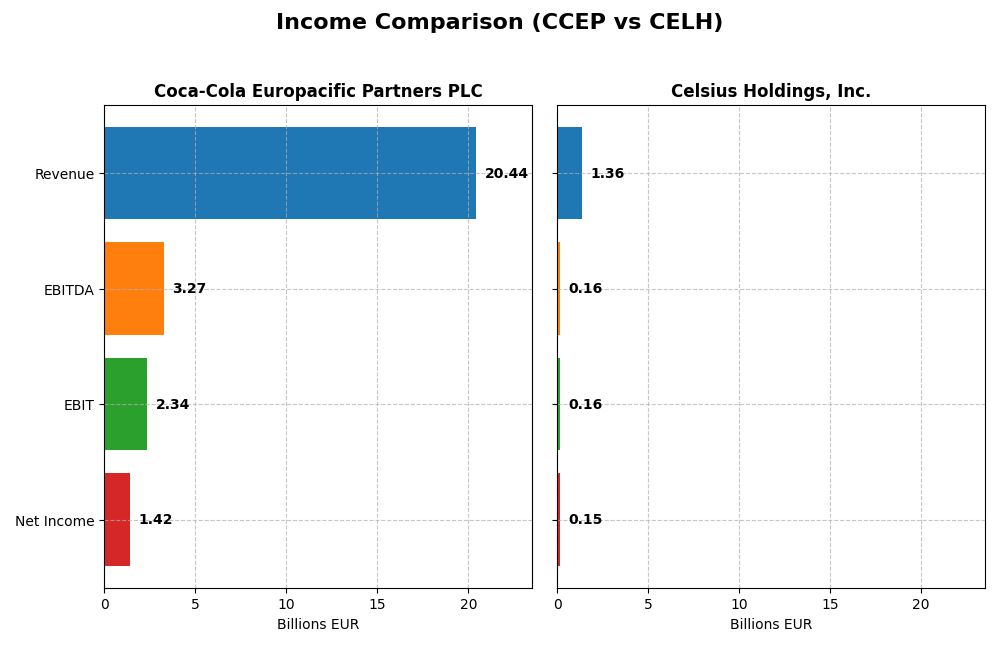

Income Statement Comparison

The table below compares key income statement metrics for Coca-Cola Europacific Partners PLC and Celsius Holdings, Inc. for the fiscal year 2024, showing their financial performance side by side.

| Metric | Coca-Cola Europacific Partners PLC (CCEP) | Celsius Holdings, Inc. (CELH) |

|---|---|---|

| Market Cap | 40.4B EUR | 13.7B USD |

| Revenue | 20.4B EUR | 1.36B USD |

| EBITDA | 3.27B EUR | 163M USD |

| EBIT | 2.34B EUR | 156M USD |

| Net Income | 1.42B EUR | 145M USD |

| EPS | 3.08 EUR | 0.46 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Coca-Cola Europacific Partners PLC

From 2020 to 2024, Coca-Cola Europacific Partners PLC showed consistent revenue growth, rising from €10.6B to €20.4B, with net income increasing from €498M to €1.42B. Gross and EBIT margins remained stable and favorable, around 35.6% and 11.4% respectively. However, in 2024, net income declined by nearly 15%, reflecting margin pressure despite revenue growth of 11.7%.

Celsius Holdings, Inc.

Celsius Holdings experienced rapid expansion from 2020 to 2024, with revenue surging from $130M to $1.36B and net income rising sharply from a loss of $198M to a profit of $108M. Gross margin improved favorably to over 50%, while EBIT margin stayed around 11.5%. The latest year saw slower revenue growth at 2.9%, accompanied by a significant 41.5% EBIT decline and shrinking net margins.

Which one has the stronger fundamentals?

Both companies show favorable overall income statement trends and strong long-term growth, with Coca-Cola Europacific Partners demonstrating more stable margins and steady profitability. Celsius Holdings boasts higher growth rates and expanding margins but faces more volatility and recent earnings pressure. The fundamentals reflect a balance between mature, stable performance and rapid, yet less consistent growth.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Coca-Cola Europacific Partners PLC (CCEP) and Celsius Holdings, Inc. (CELH) based on the latest available fiscal year data (2024).

| Ratios | Coca-Cola Europacific Partners PLC (CCEP) | Celsius Holdings, Inc. (CELH) |

|---|---|---|

| ROE | 16.7% | 11.8% |

| ROIC | 6.5% | 8.2% |

| P/E | 24.1 | 42.4 |

| P/B | 4.02 | 5.03 |

| Current Ratio | 0.81 | 3.62 |

| Quick Ratio | 0.62 | 3.26 |

| D/E (Debt-to-Equity) | 1.33 | 0.02 |

| Debt-to-Assets | 36.4% | 1.1% |

| Interest Coverage | 8.81 | 0 (not available) |

| Asset Turnover | 0.66 | 0.77 |

| Fixed Asset Turnover | 3.18 | 17.51 |

| Payout Ratio | 64.2% | 18.9% |

| Dividend Yield | 2.66% | 0.45% |

Interpretation of the Ratios

Coca-Cola Europacific Partners PLC

Coca-Cola Europacific Partners shows a mix of favorable and unfavorable ratios. The company benefits from a strong return on equity (16.7%) and interest coverage (9.67), but its liquidity ratios are weak, with a current ratio of 0.81 and quick ratio of 0.62, indicating potential short-term solvency concerns. The dividend yield is attractive at 2.66%, supported by a payout ratio that appears sustainable given free cash flow coverage, though caution is warranted due to elevated leverage (debt-to-equity of 1.33).

Celsius Holdings, Inc.

Celsius Holdings presents favorable profitability ratios, such as a 10.7% net margin and solid return on invested capital (8.25%). It maintains very low leverage (debt-to-equity of 0.02) and excellent liquidity with a current ratio of 3.62. The company does not pay dividends, reflecting a growth-focused strategy, likely prioritizing reinvestment and R&D over shareholder distributions, which aligns with its moderate return on equity (11.85%) and higher valuation multiples.

Which one has the best ratios?

Both companies hold a slightly favorable overall rating. Coca-Cola Europacific Partners shows strength in profitability and dividend yield but faces liquidity and leverage challenges. Celsius excels in liquidity and low debt, with strong profitability but no dividend payout and higher valuation multiples. The best ratio profile depends on investor priorities regarding income versus growth and risk tolerance.

Strategic Positioning

This section compares the strategic positioning of Coca-Cola Europacific Partners PLC and Celsius Holdings, Inc. with respect to market position, key segments, and exposure to technological disruption:

Coca-Cola Europacific Partners PLC

- Large market cap of 40B with established global beverage presence; moderate competitive pressure.

- Diverse portfolio including soft drinks, waters, energy drinks, tea, coffee, and juices.

- No explicit mention of technological disruption exposure in data.

Celsius Holdings, Inc.

- Market cap of 13.7B focused on functional drinks with higher beta and niche competition.

- Concentrated on functional energy drinks, liquid supplements, and dietary products.

- No explicit mention of technological disruption exposure in data.

Coca-Cola Europacific Partners PLC vs Celsius Holdings, Inc. Positioning

Coca-Cola Europacific Partners shows a diversified product range and global footprint, while Celsius concentrates on functional beverages and supplements. Coca-Cola’s scale offers breadth, whereas Celsius’s focus targets specialized market segments, each with inherent strategic trade-offs.

Which has the best competitive advantage?

Both companies currently shed value but show growing ROIC trends. Their economic moats are rated slightly favorable, indicating improving profitability but no clear sustainable competitive advantage based on the available data.

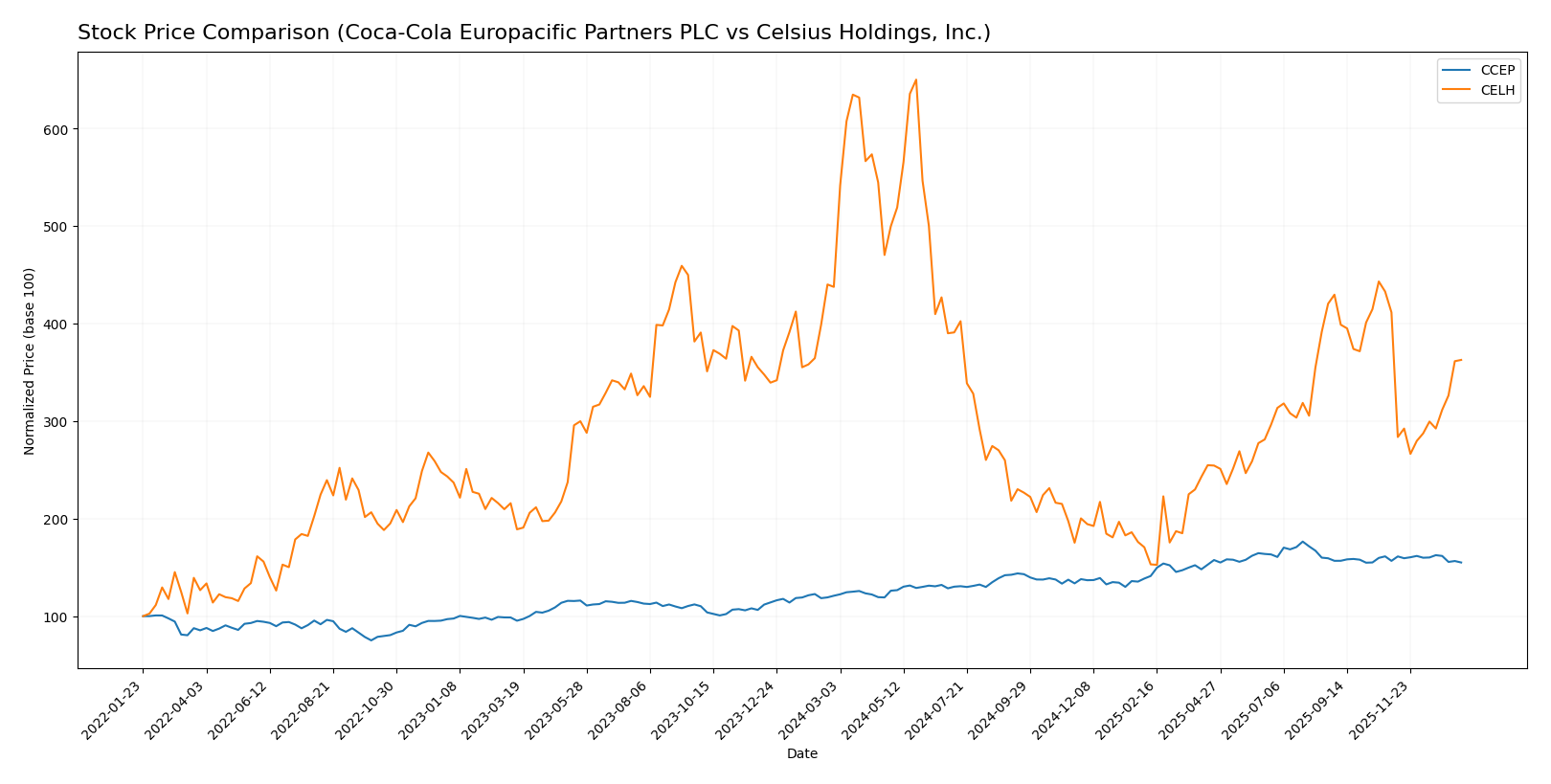

Stock Comparison

The stock prices of Coca-Cola Europacific Partners PLC (CCEP) and Celsius Holdings, Inc. (CELH) exhibited contrasting trends over the past year, with CCEP showing a strong bullish movement and CELH facing a bearish decline amid differing trading volumes and buyer dominance.

Trend Analysis

Coca-Cola Europacific Partners PLC (CCEP) experienced a bullish trend over the past 12 months with a 28.19% price increase, though the trend is decelerating. The stock ranged between 67.58 and 100.04, with moderate volatility (std deviation 8.26).

Celsius Holdings, Inc. (CELH) showed a bearish trend over the same period, with a 17.11% price decline and accelerating downward momentum. The stock had higher volatility (std deviation 18.64), fluctuating between 22.34 and 95.15.

Comparing both, CCEP delivered the highest market performance with a strong positive gain, whereas CELH faced a significant loss, reflecting divergent investor sentiment and price momentum.

Target Prices

Analysts present a clear consensus on target prices for Coca-Cola Europacific Partners PLC and Celsius Holdings, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Coca-Cola Europacific Partners PLC | 114 | 114 | 114 |

| Celsius Holdings, Inc. | 74 | 60 | 68.33 |

The target consensus suggests Coca-Cola Europacific Partners PLC has strong upside potential from the current price of 87.89 USD. Celsius Holdings, Inc. also shows expected growth, with targets well above its current price of 53.09 USD.

Analyst Opinions Comparison

This section compares the analysts’ ratings and grades for Coca-Cola Europacific Partners PLC and Celsius Holdings, Inc.:

Rating Comparison

CCEP Rating

- Rating: B, considered very favorable overall.

- Discounted Cash Flow Score: 5, indicating a very favorable valuation outlook.

- ROE Score: 5, showing very efficient profit generation from equity.

- ROA Score: 3, a moderate level of asset utilization effectiveness.

- Debt To Equity Score: 1, very unfavorable due to higher financial risk.

- Overall Score: 3, representing a moderate overall financial standing.

CELH Rating

- Rating: C+, also regarded as very favorable overall.

- Discounted Cash Flow Score: 3, suggesting a moderate valuation outlook.

- ROE Score: 2, indicating moderate efficiency in generating profit from equity.

- ROA Score: 2, reflecting moderate asset utilization efficiency.

- Debt To Equity Score: 3, moderate financial risk with better debt management.

- Overall Score: 2, a moderate but lower overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Coca-Cola Europacific Partners PLC (CCEP) holds a better rating (B vs. C+), with higher scores in discounted cash flow, ROE, and overall evaluation. However, it has a less favorable debt to equity score compared to Celsius Holdings, Inc.

Scores Comparison

The scores comparison between Coca-Cola Europacific Partners PLC and Celsius Holdings, Inc. is as follows:

CCEP Scores

- Altman Z-Score: 3.17, indicating financial safety zone.

- Piotroski Score: 5, showing average financial strength.

CELH Scores

- Altman Z-Score: 3.66, indicating financial safety zone.

- Piotroski Score: 5, showing average financial strength.

Which company has the best scores?

Both companies are in the safe zone for Altman Z-Score, with CELH slightly higher at 3.66 versus CCEP’s 3.17. Both share an identical Piotroski Score of 5, indicating comparable average financial strength.

Grades Comparison

Here is a comparison of the recent grades assigned by reputable grading companies for the two companies:

Coca-Cola Europacific Partners PLC Grades

The table below summarizes recent grades from well-known financial institutions for Coca-Cola Europacific Partners PLC:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Buy | Buy | 2026-01-08 |

| Barclays | Hold | Overweight | 2025-08-08 |

| Barclays | Hold | Overweight | 2025-07-15 |

| UBS | Buy | Buy | 2025-07-02 |

| Barclays | Hold | Overweight | 2025-05-01 |

| UBS | Buy | Buy | 2025-04-30 |

| Barclays | Hold | Overweight | 2025-04-11 |

| Barclays | Hold | Overweight | 2025-03-27 |

| Barclays | Hold | Overweight | 2025-03-06 |

| Evercore ISI Group | Hold | Outperform | 2025-02-18 |

Overall, Coca-Cola Europacific Partners PLC consistently maintains “Buy” and “Overweight” grades, indicating a stable positive outlook from major grading firms.

Celsius Holdings, Inc. Grades

Recent grades from recognized grading firms for Celsius Holdings, Inc. are summarized below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Buy | Buy | 2026-01-07 |

| B of A Securities | Sell | Underperform | 2025-12-19 |

| Piper Sandler | Hold | Overweight | 2025-12-17 |

| B of A Securities | Sell | Underperform | 2025-11-07 |

| Stifel | Buy | Buy | 2025-11-07 |

| JP Morgan | Hold | Overweight | 2025-11-07 |

| Citigroup | Buy | Buy | 2025-11-07 |

| UBS | Buy | Buy | 2025-11-07 |

| Stifel | Buy | Buy | 2025-10-24 |

| JP Morgan | Hold | Overweight | 2025-10-24 |

Celsius Holdings, Inc. shows a mixed grade pattern with several “Buy” ratings but also multiple “Underperform” grades, reflecting differing analyst opinions.

Which company has the best grades?

Coca-Cola Europacific Partners PLC displays more consistent positive grades, mainly “Buy” and “Overweight,” while Celsius Holdings, Inc. has a more polarized rating profile including some “Underperform” grades. This contrast may influence investor confidence and risk perception differently for each company.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of Coca-Cola Europacific Partners PLC (CCEP) and Celsius Holdings, Inc. (CELH) based on recent financial performance, market position, and operational metrics.

| Criterion | Coca-Cola Europacific Partners PLC (CCEP) | Celsius Holdings, Inc. (CELH) |

|---|---|---|

| Diversification | Strong global product portfolio, wide market coverage in beverages | Focused on energy drinks, less diversified product range |

| Profitability | Moderate net margin (6.94%), solid ROE (16.7%), stable ROIC (6.53%) | Higher net margin (10.7%), moderate ROE (11.85%), ROIC at 8.25% |

| Innovation | Established brand with incremental innovation | Agile innovation in energy drink segment |

| Global presence | Extensive global footprint, strong in Europe and Pacific regions | Limited global presence, primarily North America |

| Market Share | Large market share in carbonated and non-carbonated beverages | Growing market share in niche energy drink market |

Key takeaways: CCEP benefits from strong diversification and a broad global presence, supporting steady profitability but with moderate growth. CELH is more focused and innovative in its segment, showing higher profitability margins but limited diversification and geographic reach. Both companies display slightly favorable financial health, but risk profiles differ due to scale and market focus.

Risk Analysis

Below is a comparative table highlighting key risks for Coca-Cola Europacific Partners PLC (CCEP) and Celsius Holdings, Inc. (CELH) based on their latest financial and operational data from 2024.

| Metric | Coca-Cola Europacific Partners PLC (CCEP) | Celsius Holdings, Inc. (CELH) |

|---|---|---|

| Market Risk | Low beta (0.36) suggests lower volatility | Moderate beta (0.88), higher volatility |

| Debt level | Debt-to-equity 1.33 (unfavorable) | Very low debt-to-equity 0.02 (favorable) |

| Regulatory Risk | Moderate, operates globally with complex compliance | Moderate, expanding in multiple regions with evolving regulations |

| Operational Risk | Large scale with 41K employees; supply chain complexity | Smaller scale (1K employees), operational agility but growth risks |

| Environmental Risk | Increasing pressure on sustainability in beverage sector | Focus on natural and functional drinks, moderate risk |

| Geopolitical Risk | Exposure due to global footprint including Europe and Asia | Primarily US-based with growing international presence |

The most significant risks are market volatility for CELH due to its higher beta and elevated valuation multiples, and CCEP’s higher leverage, exposing it to interest and refinancing risks. Both companies face moderate regulatory and environmental pressures, but CCEP’s global footprint adds geopolitical complexity. Investors should weigh these factors carefully against growth prospects.

Which Stock to Choose?

Coca-Cola Europacific Partners PLC (CCEP) shows a favorable income statement with 11.67% revenue growth in 2024 and strong profitability indicators like a 16.7% ROE and a 2.66% dividend yield. However, some liquidity ratios and debt levels remain unfavorable despite a very favorable overall rating of B.

Celsius Holdings, Inc. (CELH) presents a favorable income statement with a high 10.7% net margin and significant long-term growth, although recent EBIT and EPS declines are unfavorable. Its financial ratios show strengths in low debt and liquidity, yet valuation metrics are unfavorable, reflected in a very favorable C+ rating.

For investors prioritizing stable profitability and dividend income, CCEP’s consistent returns and favorable rating might appear more attractive, whereas those inclined toward growth and low leverage may find CELH’s improving profitability and balance sheet appealing despite valuation challenges. Both companies exhibit slightly favorable moats with growing ROIC but are still shedding value relative to cost of capital.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Coca-Cola Europacific Partners PLC and Celsius Holdings, Inc. to enhance your investment decisions: