In the fast-evolving technology sector, CDW Corporation and Zscaler, Inc. stand out as influential players with distinct but overlapping market roles. CDW specializes in broad IT solutions and hardware integration, while Zscaler leads in cloud security innovation. Both companies address critical enterprise needs, making their comparison essential for investors seeking growth balanced with stability. Join me as we analyze which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between CDW Corporation and Zscaler, Inc. by providing an overview of these two companies and their main differences.

CDW Corporation Overview

CDW Corporation delivers information technology solutions across the United States, the United Kingdom, and Canada. It operates through segments that serve corporate, small business, and public sectors. CDW offers hardware and software products alongside integrated IT solutions including on-premise, hybrid, and cloud services, focusing on areas such as data centers, networking, digital workspace, and security.

Zscaler, Inc. Overview

Zscaler, Inc. is a global cloud security company providing secure access solutions for users, servers, and devices to applications hosted externally or internally. Its offerings include Internet access security, private access, digital experience monitoring, and workload segmentation to reduce risk and enhance compliance. Zscaler serves diverse industries worldwide, emphasizing safeguarding cloud and SaaS environments.

Key similarities and differences

Both companies operate in the technology sector with a focus on IT and security solutions. CDW primarily delivers hardware, software, and integrated IT services across various customer sizes and sectors, while Zscaler specializes in cloud-based security software and access management. CDW’s offerings include physical products and services, whereas Zscaler concentrates on SaaS and cloud security platforms.

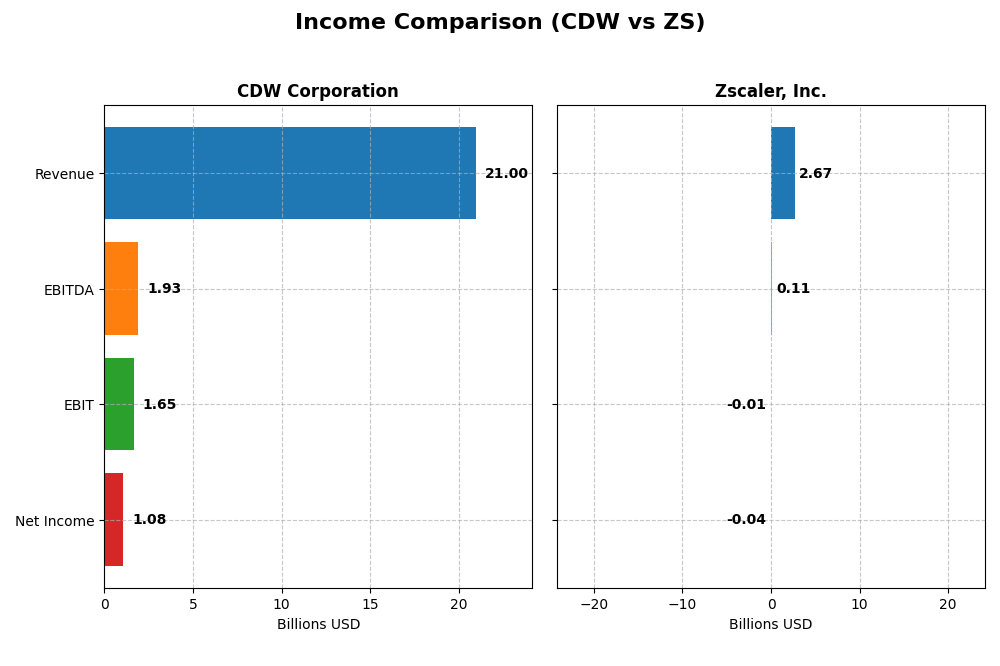

Income Statement Comparison

The following table summarizes the key income statement metrics for CDW Corporation and Zscaler, Inc. for their most recent fiscal years, providing a clear financial snapshot for comparison.

| Metric | CDW Corporation | Zscaler, Inc. |

|---|---|---|

| Market Cap | 17.3B | 34.4B |

| Revenue | 21.0B | 2.7B |

| EBITDA | 1.9B | 112M |

| EBIT | 1.6B | -8.8M |

| Net Income | 1.1B | -41.5M |

| EPS | 8.06 | -0.27 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

CDW Corporation

CDW Corporation has shown a favorable overall growth in revenue (13.71%) and net income (36.69%) over the 2020-2024 period, accompanied by a 20.21% increase in net margin. However, the latest fiscal year saw a slight decline in revenue (-1.77%) and net income (-0.65%), with margins remaining stable but slightly pressured. The gross margin stands at a favorable 21.92% while EBIT margin is neutral at 7.86%, reflecting steady but cautious profitability.

Zscaler, Inc.

Zscaler, Inc. has experienced strong growth in revenue (+297.13%) and net income (+84.17%) over the 2021-2025 period, with a significant improvement in net margin (96.01%). The most recent year continued this positive trend, posting a 23.31% revenue increase and a 41.71% net margin improvement. Despite a negative EBIT margin of -0.33%, the company maintains a favorable gross margin of 76.87%, highlighting high operational leverage amid fast expansion.

Which one has the stronger fundamentals?

Both companies display favorable income statement growth, but Zscaler’s rapid revenue and net income expansion, along with substantial margin improvements, contrast with CDW’s more modest but stable performance. CDW exhibits solid profitability and lower risk, while Zscaler shows impressive growth but with negative EBIT margins, indicating higher operational challenges. Fundamentally, Zscaler’s growth dynamism is balanced against CDW’s consistent earnings quality.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for CDW Corporation and Zscaler, Inc. based on their most recent fiscal data, highlighting differences in profitability, liquidity, leverage, and market valuation.

| Ratios | CDW Corporation (2024) | Zscaler, Inc. (2025) |

|---|---|---|

| ROE | 45.81% | -2.31% |

| ROIC | 13.13% | -3.18% |

| P/E | 21.61 | -1063.01 |

| P/B | 9.90 | 24.51 |

| Current Ratio | 1.35 | 2.01 |

| Quick Ratio | 1.24 | 2.01 |

| D/E (Debt-to-Equity) | 2.55 | 1.00 |

| Debt-to-Assets | 40.82% | 27.98% |

| Interest Coverage | 7.70 | -13.49 |

| Asset Turnover | 1.43 | 0.42 |

| Fixed Asset Turnover | 67.26 | 4.22 |

| Payout ratio | 30.81% | 0% |

| Dividend yield | 1.43% | 0% |

Interpretation of the Ratios

CDW Corporation

CDW shows a balanced profile with favorable return on equity (45.81%) and return on invested capital (13.13%), alongside a neutral net margin of 5.13%. Debt levels appear somewhat elevated, with debt-to-equity rated unfavorable at 2.55, but interest coverage is strong at 7.69. The company pays dividends with a 1.43% yield, supported by a stable payout and moderate risk of over-distribution.

Zscaler, Inc.

Zscaler’s financial ratios reveal challenges, including negative net margin (-1.55%) and returns such as ROE (-2.31%) and ROIC (-3.18%), all marked unfavorable. Liquidity is solid, with current and quick ratios above 2.0, but interest coverage is negative, indicating financial stress. The company does not pay dividends, likely prioritizing reinvestment and growth, with no share buybacks reported.

Which one has the best ratios?

Based on the evaluations, CDW Corporation presents a stronger financial ratio profile, with half of its ratios favorable and only a small portion unfavorable. Conversely, Zscaler faces more unfavorable ratios, particularly in profitability and coverage metrics. Thus, CDW’s ratios are generally more robust compared to Zscaler’s slightly unfavorable overall ratio standing.

Strategic Positioning

This section compares the strategic positioning of CDW Corporation and Zscaler, Inc., focusing on market position, key segments, and exposure to technological disruption:

CDW Corporation

- Established IT solutions provider with presence in US, UK, Canada facing moderate competitive pressure.

- Diverse segments: Corporate, Small Business, Public; business driven by hardware, software, and services.

- Exposure to disruption through integrated IT solutions including cloud capabilities in data center and networking.

Zscaler, Inc.

- Cloud security specialist with a global footprint in software infrastructure, operating in a highly competitive market.

- Single reportable segment focused solely on cloud security software solutions.

- Positioned in cloud security, providing SaaS and cloud access solutions, directly addressing evolving tech risks.

CDW Corporation vs Zscaler, Inc. Positioning

CDW’s diversified approach spans hardware, software, and services across multiple customer segments, while Zscaler concentrates exclusively on cloud security software. CDW benefits from broad market coverage; Zscaler focuses on innovation in a high-growth niche.

Which has the best competitive advantage?

CDW shows a slightly favorable moat with positive value creation but declining profitability; Zscaler has a slightly unfavorable moat, currently destroying value but improving profitability, indicating differing competitive strengths and risks.

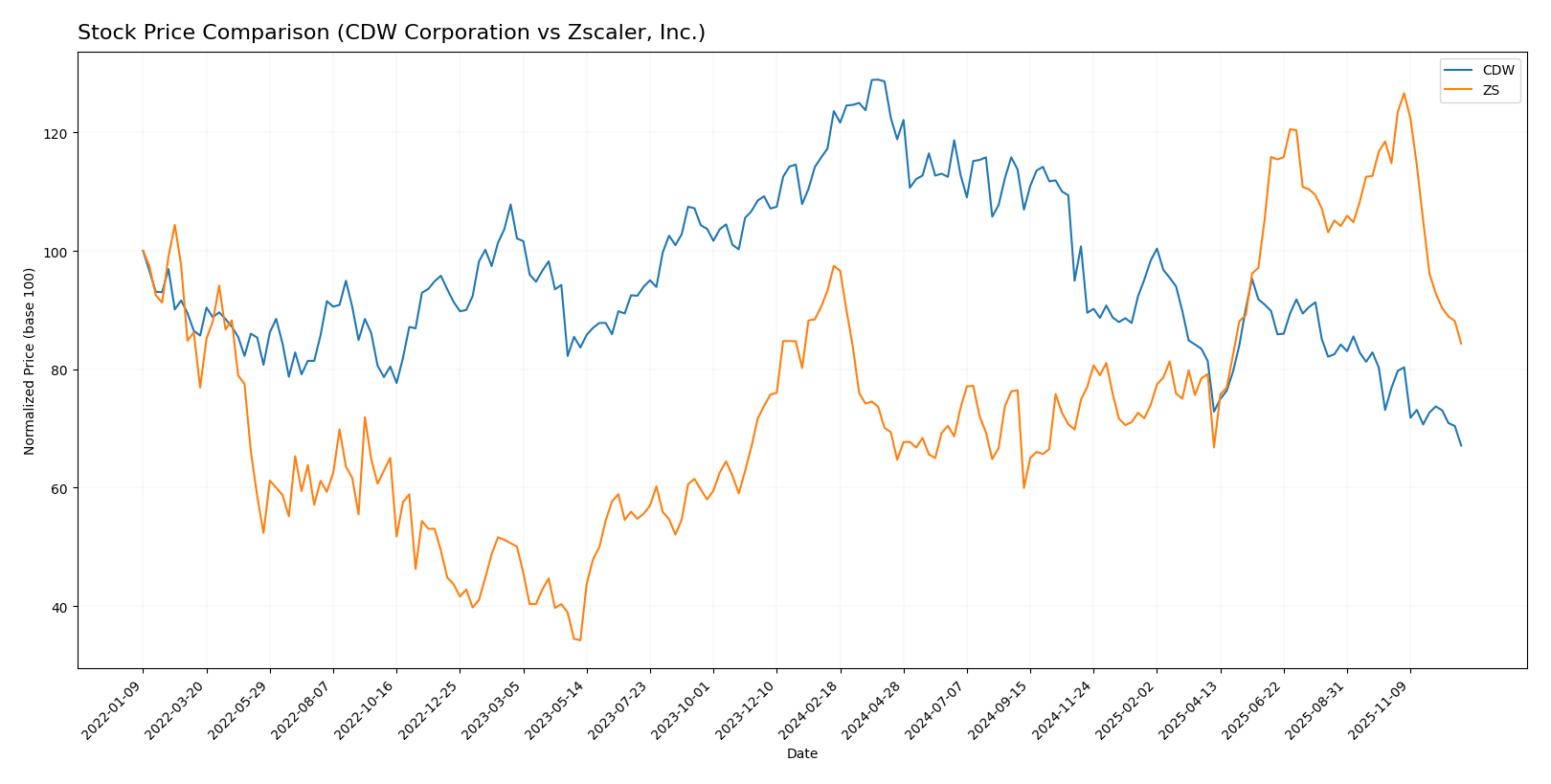

Stock Comparison

The stock prices of CDW Corporation and Zscaler, Inc. over the past year reveal significant declines with distinct trading volume dynamics and decelerating bearish trends.

Trend Analysis

CDW Corporation’s stock price fell sharply by 45.7% over the past 12 months, reflecting a bearish trend with deceleration. The price ranged from a high of 255.78 to a low of 133.16, with moderate volatility (std deviation 33.71).

Zscaler, Inc. experienced a bearish trend as well, with a 13.48% decline over the same period and deceleration in losses. Its price fluctuated between 331.14 and 156.78, showing higher volatility (std deviation 47.29).

Comparing both, CDW’s stock underperformed Zscaler’s with the largest price drop over the past year, indicating weaker market performance despite Zscaler’s higher volatility and seller dominance in recent trading.

Target Prices

The target price consensus for CDW Corporation and Zscaler, Inc. reflects optimistic analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CDW Corporation | 190 | 148 | 175 |

| Zscaler, Inc. | 360 | 264 | 319.6 |

Analysts foresee significant upside for both stocks, with consensus targets well above current prices: CDW at $133.16 and Zscaler at $220.57, indicating potential growth opportunities.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for CDW Corporation and Zscaler, Inc.:

Rating Comparison

CDW Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating favorable valuation.

- ROE Score: 5, very favorable, showing efficient profit generation.

- ROA Score: 4, favorable, reflecting effective asset use.

- Debt To Equity Score: 1, very unfavorable, indicating high financial risk.

- Overall Score: 3, moderate overall financial standing.

ZS Rating

- Rating: C-, also noted as very favorable.

- Discounted Cash Flow Score: 4, also favorable.

- ROE Score: 1, very unfavorable, indicating weak returns on equity.

- ROA Score: 1, very unfavorable, showing poor asset utilization.

- Debt To Equity Score: 1, very unfavorable, suggesting financial risk.

- Overall Score: 1, very unfavorable overall rating.

Which one is the best rated?

Based strictly on the provided data, CDW holds a higher overall score and stronger performance in ROE and ROA compared to ZS. Despite both having unfavorable debt-to-equity scores, CDW is better rated overall.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for CDW and ZS:

CDW Scores

- Altman Z-Score: 2.74, indicating a grey zone with moderate risk.

- Piotroski Score: 6, rated average for financial strength.

ZS Scores

- Altman Z-Score: 5.24, indicating a safe zone with low risk.

- Piotroski Score: 3, rated very weak for financial strength.

Which company has the best scores?

ZS has a stronger Altman Z-Score indicating better bankruptcy safety, but CDW has a higher Piotroski Score reflecting stronger financial health. The scores show mixed strengths for each company.

Grades Comparison

Here is a comparison of the latest reliable grades assigned to CDW Corporation and Zscaler, Inc.:

CDW Corporation Grades

The following table shows recent grades from reputable financial institutions for CDW Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Raymond James | Upgrade | Strong Buy | 2025-11-25 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| UBS | Maintain | Buy | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-20 |

| UBS | Maintain | Buy | 2025-08-07 |

| Barclays | Maintain | Equal Weight | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-07-17 |

| Citigroup | Maintain | Neutral | 2025-07-11 |

| Barclays | Maintain | Equal Weight | 2025-05-08 |

CDW’s grades trend mostly around “Buy,” “Overweight,” and “Outperform,” with one upgrade to “Strong Buy,” indicating a generally positive outlook from analysts.

Zscaler, Inc. Grades

The following table lists recent grades from recognized grading companies for Zscaler, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Upgrade | Outperform | 2025-12-16 |

| Bernstein | Downgrade | Market Perform | 2025-12-01 |

| Citigroup | Maintain | Buy | 2025-12-01 |

| UBS | Maintain | Buy | 2025-11-26 |

| Bernstein | Maintain | Outperform | 2025-11-26 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-26 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Stifel | Maintain | Buy | 2025-11-26 |

| Needham | Maintain | Buy | 2025-11-26 |

| Mizuho | Maintain | Neutral | 2025-11-26 |

Zscaler’s grades exhibit a mix of “Buy,” “Outperform,” and “Overweight” ratings, with one downgrade to “Market Perform,” reflecting some divergence in analyst views.

Which company has the best grades?

Both companies have received predominantly positive grades, but CDW Corporation shows a slightly stronger consensus with fewer downgrades and an upgrade to “Strong Buy.” This may indicate a more stable analyst confidence, potentially impacting investor sentiment towards greater conviction in CDW.

Strengths and Weaknesses

Below is a comparative table highlighting key strengths and weaknesses of CDW Corporation and Zscaler, Inc. based on recent financial and strategic data.

| Criterion | CDW Corporation | Zscaler, Inc. |

|---|---|---|

| Diversification | Highly diversified with strong revenue from hardware ($15.2B), software ($3.8B), and services ($1.87B) | Revenue concentrated in a single reportable segment ($2.67B), less diversified |

| Profitability | Favorable ROIC (13.13%), ROE (45.81%), and net margin (5.13%), though ROIC is declining | Negative ROIC (-3.18%), ROE (-2.31%), and net margin (-1.55%) but improving ROIC trend |

| Innovation | Moderate innovation focus, steady software revenue | High innovation in cloud security with rapidly growing ROIC trend (+76%) |

| Global presence | Strong presence primarily in North America with established private and public sector clients | Expanding global footprint as a cloud security provider but smaller scale |

| Market Share | Leading player in IT solutions and hardware distribution | Emerging player in cloud security with growth potential but currently smaller market share |

Key takeaways: CDW shows solid, diversified revenues and strong profitability metrics, though its profitability is slightly declining. Zscaler faces current profitability challenges but demonstrates promising growth and innovation potential in cloud security, with improving returns on capital. Investors should weigh CDW’s stability against Zscaler’s growth prospects.

Risk Analysis

Below is a comparative risk table for CDW Corporation and Zscaler, Inc., based on the most recent financial and operational data available for 2025-2026.

| Metric | CDW Corporation | Zscaler, Inc. |

|---|---|---|

| Market Risk | Moderate beta (1.06), price range $132.98–222.92, recent price down 2.23% | Moderate beta (1.07), wider price range $164.78–336.99, recent price down 1.93% |

| Debt level | High debt-to-equity (2.55, unfavorable), debt-to-assets 40.82% (neutral) | Moderate debt-to-equity (1.0, neutral), debt-to-assets 27.98% (favorable) |

| Regulatory Risk | Moderate, operates in IT services with government and healthcare sectors exposure | Moderate, cloud security software subject to data privacy and cybersecurity regulations worldwide |

| Operational Risk | Established with 15.1K employees, diversified IT solutions; moderate complexity | Smaller workforce (7.3K), reliance on cloud infrastructure and SaaS model; higher operational agility but sensitive to tech disruptions |

| Environmental Risk | Moderate, standard IT environmental footprint | Moderate, cloud data centers’ energy use and sustainability under scrutiny |

| Geopolitical Risk | Exposure to US, UK, Canada markets; moderate international risk | Global cloud services with broader international client base; higher exposure to geopolitical tensions affecting data flows |

In summary, CDW faces higher financial leverage risk with its elevated debt levels, while Zscaler contends with profitability pressures and operational risks linked to its cloud-centric business model. The most impactful risk for CDW is its debt load, which could affect financial flexibility. For Zscaler, the key risk is sustained unprofitability and valuation concerns amid competitive and regulatory challenges. Both companies operate in sectors sensitive to geopolitical and regulatory changes, warranting cautious monitoring.

Which Stock to Choose?

CDW Corporation shows a favorable global income statement with solid profitability, including a 45.81% ROE and 13.13% ROIC, despite a slight revenue decline last year. Debt levels are moderate, with some unfavorable leverage ratios, yet the overall rating remains very favorable.

Zscaler, Inc. demonstrates strong revenue growth and improving profitability trends, though it currently posts negative net margins and returns. Its balance sheet is healthier with lower debt ratios, but key financial ratios and ratings are mostly unfavorable, reflecting challenges in profitability and asset efficiency.

Investors seeking stability and strong profitability might find CDW’s financial metrics and rating slightly more favorable, while those focused on rapid growth and potential turnaround could see Zscaler’s improving income trends as promising, albeit with higher risk.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CDW Corporation and Zscaler, Inc. to enhance your investment decisions: