In the dynamic landscape of information technology services, Leidos Holdings, Inc. (LDOS) and CDW Corporation (CDW) stand out as prominent players with distinct yet overlapping market focuses. Leidos excels in defense and government solutions, while CDW specializes in IT hardware and integrated services for diverse sectors. Comparing these companies offers valuable insights into their innovation strategies and market positioning. Join me as we explore which firm presents the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Leidos Holdings, Inc. and CDW Corporation by providing an overview of these two companies and their main differences.

Leidos Holdings, Inc. Overview

Leidos Holdings, Inc. operates in the information technology services sector, providing solutions primarily to defense, intelligence, civil, and health markets globally. Its business is divided into Defense Solutions, Civil, and Health segments, delivering technology and large-scale systems to government and commercial clients. Founded in 1969 and headquartered in Reston, Virginia, Leidos emphasizes national security, IT modernization, and health-related digital transformation services.

CDW Corporation Overview

CDW Corporation is an IT solutions provider serving customers in the US, UK, and Canada across corporate, small business, and public sectors. Its offerings include hardware, software, and integrated IT solutions with capabilities in cloud, data center, networking, and security. Founded in 1984 and based in Vernon Hills, Illinois, CDW focuses on delivering end-to-end IT products and services, including advisory, implementation, and managed services, to a broad customer base spanning government, education, healthcare, and businesses.

Key similarities and differences

Both companies operate within the technology sector, specifically focusing on IT services, but their business models differ significantly. Leidos concentrates on government and defense-related contracts with specialized technology solutions, while CDW emphasizes commercial IT distribution and integrated services across multiple sectors. Leidos has a broader global defense and health market focus, whereas CDW targets more diverse commercial and public customers with a wide range of hardware and software products alongside managed services.

Income Statement Comparison

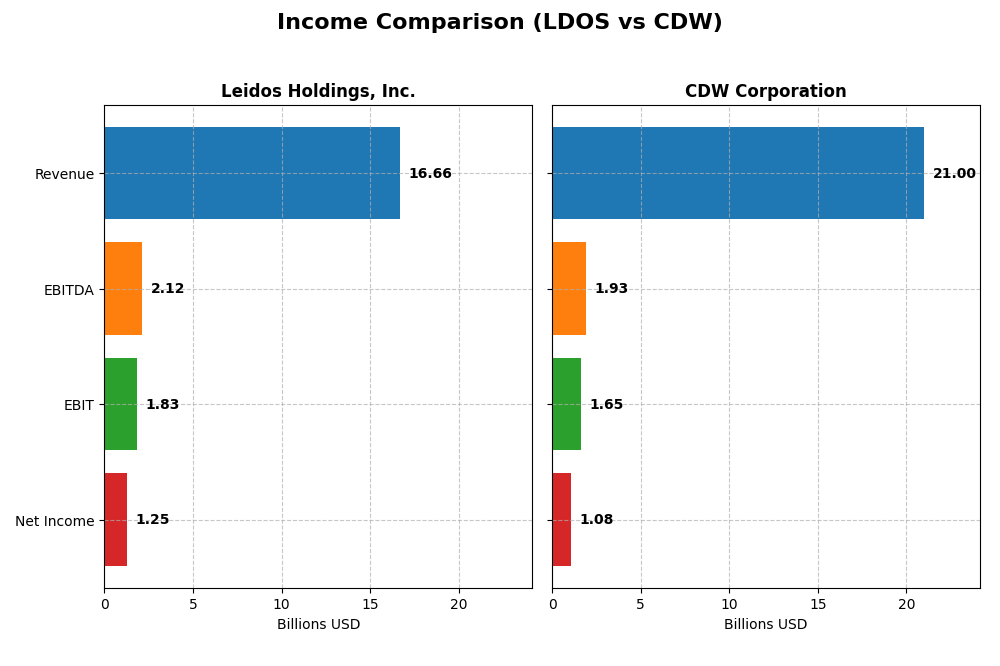

This table compares key income statement metrics for Leidos Holdings, Inc. and CDW Corporation for the most recent fiscal year, providing a snapshot of their financial performance.

| Metric | Leidos Holdings, Inc. (LDOS) | CDW Corporation (CDW) |

|---|---|---|

| Market Cap | 24.4B | 17.2B |

| Revenue | 16.7B | 21.0B |

| EBITDA | 2.12B | 1.93B |

| EBIT | 1.83B | 1.65B |

| Net Income | 1.25B | 1.08B |

| EPS | 9.36 | 8.06 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Leidos Holdings, Inc.

Leidos Holdings demonstrated consistent revenue growth from 2020 to 2024, reaching $16.7B in 2024, nearly a 36% increase over the period. Net income surged significantly, almost doubling to $1.25B. Margins showed positive trends, with a stable gross margin near 16.8% and a favorable net margin of 7.53%. The 2024 year marked strong earnings growth, with net income expanding by 484% year-over-year.

CDW Corporation

CDW’s revenue grew by approximately 14% from 2020 to 2024, peaking at $21B in 2024 but declined slightly by 1.8% in the last year. Net income increased over the period to $1.08B, though it dipped marginally in 2024. Gross margin remains strong at nearly 22%, while net margin improved to 5.13%. The recent year shows some contraction in growth and margins, reflecting a cautious performance.

Which one has the stronger fundamentals?

Leidos holds stronger fundamentals with more pronounced revenue and net income growth, particularly in the latest year, alongside improving margins and earnings per share. CDW, despite a higher gross margin, experienced recent declines in revenue and profitability growth, leading to mixed signals. Overall, Leidos’s income statement portrays a more robust and favorable financial trajectory.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Leidos Holdings, Inc. (LDOS) and CDW Corporation (CDW) based on their most recent fiscal year data from 2024.

| Ratios | Leidos Holdings, Inc. (LDOS) | CDW Corporation (CDW) |

|---|---|---|

| ROE | 28.4% | 45.8% |

| ROIC | 13.9% | 13.1% |

| P/E | 15.7 | 21.6 |

| P/B | 4.47 | 9.90 |

| Current Ratio | 1.21 | 1.35 |

| Quick Ratio | 1.13 | 1.24 |

| D/E (Debt-to-Equity) | 1.20 | 2.55 |

| Debt-to-Assets | 40.4% | 40.8% |

| Interest Coverage | 9.47 | 7.70 |

| Asset Turnover | 1.27 | 1.43 |

| Fixed Asset Turnover | 10.7 | 67.3 |

| Payout ratio | 16.6% | 30.8% |

| Dividend yield | 1.05% | 1.43% |

Interpretation of the Ratios

Leidos Holdings, Inc.

Leidos shows a balanced financial profile with favorable returns on equity (28.42%) and invested capital (13.85%), supported by a low weighted average cost of capital (5.87%). Neutral net margin and current ratio highlight operational stability, though high price-to-book (4.47) and debt-to-equity (1.2) ratios are concerns. The 1.05% dividend yield is covered by cash flow, signaling moderate shareholder returns.

CDW Corporation

CDW demonstrates strong profitability with a high return on equity (45.81%) and solid return on invested capital (13.13%). Its liquidity ratios are favorable, but elevated debt-to-equity (2.55) and price-to-book (9.9) ratios suggest higher leverage and valuation risks. The dividend yield stands at 1.43%, indicating consistent shareholder returns supported by robust cash flow.

Which one has the best ratios?

Both companies present a slightly favorable global ratios opinion with 50% favorable and 14.29% unfavorable ratios. Leidos offers a more conservative leverage profile, while CDW boasts higher profitability and asset efficiency but with greater financial risk. The choice depends on investors’ risk tolerance and focus on either stability or higher returns.

Strategic Positioning

This section compares the strategic positioning of Leidos Holdings, Inc. and CDW Corporation, including market position, key segments, and exposure to technological disruption:

Leidos Holdings, Inc.

- Leading defense and government IT services provider facing stable competitive pressure in national security.

- Diverse segments: Defense Solutions, Civil systems integration, and Health IT services drive business.

- Moderate exposure through technology integration in defense and cloud-based IT modernization.

CDW Corporation

- Major IT solutions reseller with competitive pressure from hardware and software markets.

- Focused on hardware, software products, and IT services across corporate, small business, and public sectors.

- High exposure with hybrid cloud, networking, and digital workspace solutions in fast-evolving IT landscape.

Leidos Holdings, Inc. vs CDW Corporation Positioning

Leidos holds a diversified portfolio targeting defense, civil, and health markets with a focus on national security technologies. CDW concentrates on IT hardware and software distribution plus services, emphasizing corporate and public sectors, presenting differing risk and growth profiles.

Which has the best competitive advantage?

Leidos demonstrates a very favorable moat with growing ROIC and strong value creation, indicating durable competitive advantage. CDW creates value but shows a declining ROIC trend, reflecting a slightly favorable moat and less sustainable profitability.

Stock Comparison

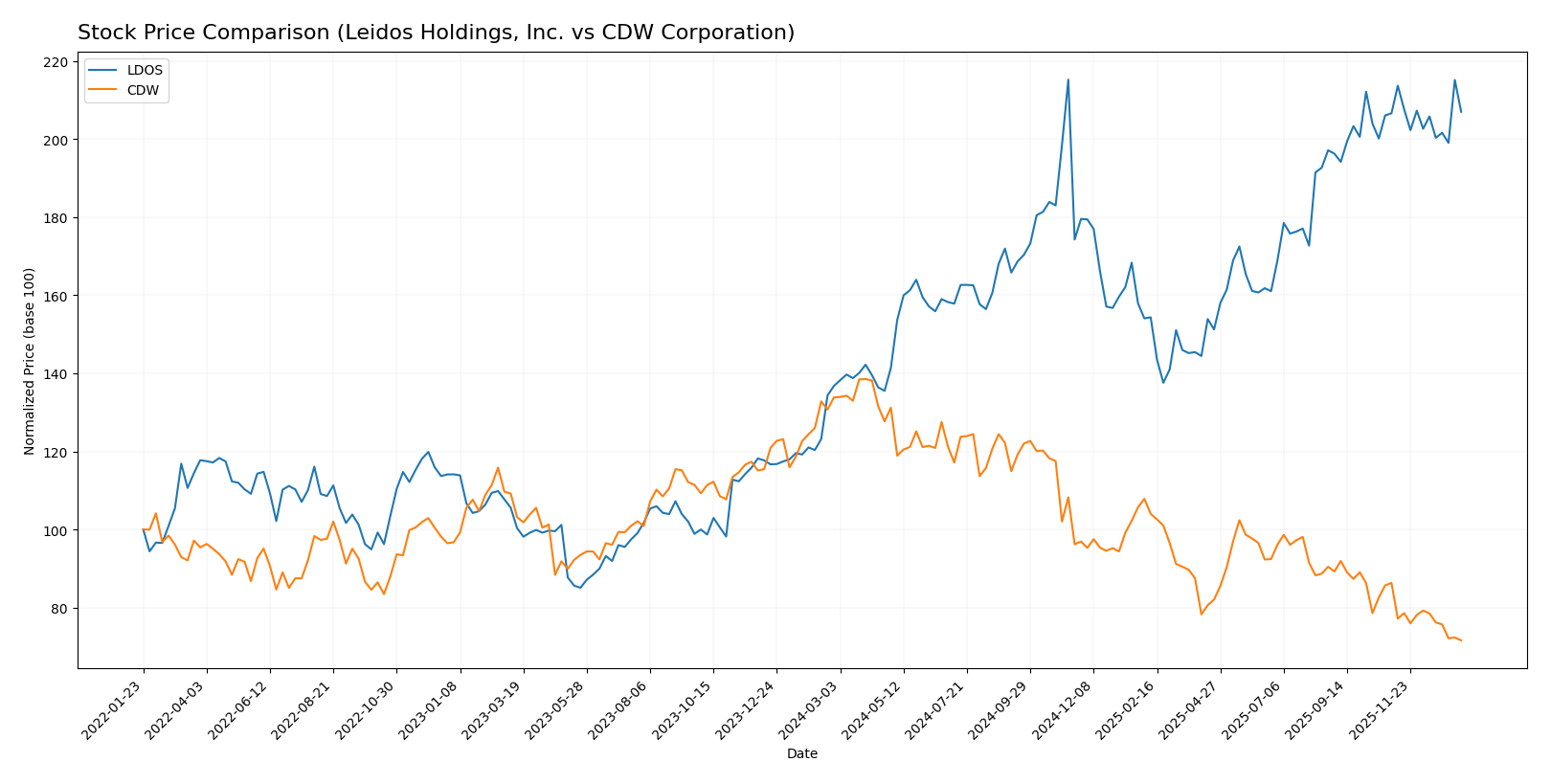

The stock price chart highlights significant divergence in price movements over the past 12 months, with Leidos Holdings, Inc. showing a strong upward trajectory while CDW Corporation experiences a substantial decline.

Trend Analysis

Leidos Holdings, Inc. exhibited a bullish trend over the past year with a 51.37% price increase, though the growth rate has decelerated recently, showing a near-neutral 0.18% change over the last two and a half months.

CDW Corporation demonstrated a bearish trend with a 46.52% price drop over the past year, and this decline accelerated recently, with a 17.07% decrease from November 2025 to January 2026.

Comparatively, Leidos Holdings delivered the highest market performance, outperforming CDW by a wide margin in terms of overall price appreciation during the analyzed period.

Target Prices

Analysts provide a positive target price consensus for both Leidos Holdings, Inc. and CDW Corporation, indicating potential upside from current levels.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Leidos Holdings, Inc. | 230 | 216 | 222.2 |

| CDW Corporation | 190 | 148 | 175 |

Leidos Holdings’ consensus target of 222.2 suggests a roughly 16% upside from the current price of 190.82. CDW’s target consensus of 175 indicates a significant potential increase from its current 132.16 price, reflecting generally optimistic analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Leidos Holdings, Inc. and CDW Corporation:

Rating Comparison

Leidos Holdings, Inc. Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating favorable valuation.

- Return on Equity Score: 5, showing very favorable profit generation.

- Return on Assets Score: 4, demonstrating favorable asset utilization.

- Debt To Equity Score: 1, reflecting very unfavorable financial risk.

- Overall Score: 3, reflecting a moderate overall financial standing.

CDW Corporation Rating

- Rating: B, also considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating favorable valuation.

- Return on Equity Score: 5, showing very favorable profit generation.

- Return on Assets Score: 4, demonstrating favorable asset utilization.

- Debt To Equity Score: 1, reflecting very unfavorable financial risk.

- Overall Score: 3, reflecting a moderate overall financial standing.

Which one is the best rated?

Leidos Holdings, Inc. has a slightly higher rating (B+) than CDW Corporation (B) while both share identical scores across financial metrics. Thus, Leidos is marginally better rated based strictly on the provided data.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Leidos Holdings, Inc. and CDW Corporation:

Leidos Holdings, Inc. Scores

- Altman Z-Score: 4.15, indicating a safe zone from bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

CDW Corporation Scores

- Altman Z-Score: 2.68, placing the company in the grey zone.

- Piotroski Score: 6, considered average financial strength.

Which company has the best scores?

Leidos Holdings, Inc. shows stronger financial stability with a safe zone Altman Z-Score and a very strong Piotroski Score compared to CDW’s grey zone Altman Z-Score and average Piotroski Score. This suggests Leidos has comparatively better financial health based on these metrics.

Grades Comparison

Here is a comparison of the recent grades assigned by reliable financial institutions for the two companies:

Leidos Holdings, Inc. Grades

This table summarizes recent grades for Leidos Holdings, Inc. from leading grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| Stifel | Downgrade | Hold | 2026-01-08 |

| B of A Securities | Maintain | Buy | 2025-11-07 |

| Truist Securities | Maintain | Buy | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-11-05 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-31 |

| Argus Research | Maintain | Buy | 2025-09-24 |

| B of A Securities | Maintain | Buy | 2025-09-04 |

| RBC Capital | Upgrade | Outperform | 2025-09-04 |

| UBS | Maintain | Neutral | 2025-08-07 |

Overall, Leidos shows mostly Buy ratings with a few Neutral and Hold grades, indicating moderate confidence with some caution.

CDW Corporation Grades

This table presents recent grades for CDW Corporation from established grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Raymond James | Upgrade | Strong Buy | 2025-11-25 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| UBS | Maintain | Buy | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-20 |

| UBS | Maintain | Buy | 2025-08-07 |

| Barclays | Maintain | Equal Weight | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-07-17 |

| Citigroup | Maintain | Neutral | 2025-07-11 |

| Barclays | Maintain | Equal Weight | 2025-05-08 |

CDW’s grades range from Strong Buy and Overweight to Equal Weight and Neutral, showing a generally positive outlook with some mixed sentiment.

Which company has the best grades?

CDW Corporation has received a higher number of stronger ratings, including a Strong Buy and Overweight, compared to Leidos Holdings, which mostly has Buy and Neutral grades. This suggests investors may perceive CDW as having greater upside potential, though both companies maintain a Buy consensus overall.

Strengths and Weaknesses

Below is a comparative overview of Leidos Holdings, Inc. (LDOS) and CDW Corporation (CDW) highlighting their key strengths and weaknesses based on recent financial and operational data.

| Criterion | Leidos Holdings, Inc. (LDOS) | CDW Corporation (CDW) |

|---|---|---|

| Diversification | Strong diversification in National Security, Defense, and Civil segments with $9.55B in National Security solutions and $2.03B Defense in 2024. | Diversified portfolio with dominant Hardware sales ($15.2B) complemented by Software ($3.8B) and Services ($1.87B) in 2024. |

| Profitability | Favorable ROIC at 13.85% and ROE at 28.42%, indicating efficient capital use and solid returns. | Favorable ROIC at 13.13% and very strong ROE at 45.81%, though with a declining ROIC trend. |

| Innovation | Demonstrates a durable competitive advantage with growing ROIC (+67%) suggesting innovation in defense and national security tech. | Creating value but experiencing declining ROIC (-15%), which may indicate weakening innovation or competitive pressure. |

| Global presence | Strong U.S.-focused government and defense contracts, with less emphasis on global commercial markets. | Broad commercial footprint with significant hardware and software distribution capabilities, mainly in North America. |

| Market Share | Leading position in government and defense sectors with consistent growth in National Security Solutions segment. | Major player in IT hardware and software distribution, commanding a significant market share in the private and public sectors. |

Key takeaways: Leidos exhibits strong growth driven by innovation in defense and government sectors with favorable profitability metrics. CDW maintains a solid market presence and profitability but faces challenges with a declining ROIC trend, signaling the need for strategic focus on innovation and operational efficiency. Both companies offer value but with different risk and growth profiles.

Risk Analysis

Below is a comparative risk assessment table for Leidos Holdings, Inc. (LDOS) and CDW Corporation (CDW) based on the most recent available data for 2024:

| Metric | Leidos Holdings, Inc. (LDOS) | CDW Corporation (CDW) |

|---|---|---|

| Market Risk | Beta 0.59 (low volatility) | Beta 1.07 (moderate volatility) |

| Debt Level | Debt-to-Equity 1.2 (unfavorable, moderate debt) | Debt-to-Equity 2.55 (unfavorable, high debt) |

| Regulatory Risk | Moderate (government contracts, defense sector) | Moderate (IT solutions, data privacy regulations) |

| Operational Risk | Moderate (complex government projects) | Moderate (supply chain and integration risks) |

| Environmental Risk | Low to Moderate (some infrastructure and energy services) | Low (primarily IT products and services) |

| Geopolitical Risk | Elevated (defense and intelligence exposure) | Moderate (international operations in US, UK, Canada) |

The most significant risks for both companies stem from their debt levels, with CDW carrying a higher leverage burden, increasing financial risk. Leidos faces notable geopolitical risk due to its defense contracts and government dependencies, which could impact revenue amid shifting policies. Both companies maintain moderate operational risks tied to their complex service offerings and regulatory environments. Investors should weigh these factors carefully, prioritizing debt management and sector-specific sensitivities when considering these stocks.

Which Stock to Choose?

Leidos Holdings, Inc. (LDOS) shows a favorable income evolution with a 7.93% revenue growth in 2024 and strong profitability metrics, including a 28.42% ROE and 13.85% ROIC. Despite moderate debt levels (D/E 1.2) and a neutral current ratio (1.21), its overall rating is very favorable with a B+ grade, supported by a very favorable moat indicating durable competitive advantage.

CDW Corporation (CDW) exhibits a mixed income evolution, with a slight revenue decline of -1.77% in 2024 but maintains favorable profitability (45.81% ROE, 13.13% ROIC). It carries higher debt (D/E 2.55) and a neutral current ratio (1.35). The rating remains very favorable at B, though its moat is slightly favorable due to a declining ROIC trend, reflecting some pressure on profitability.

For investors, LDOS could appear more attractive for those valuing growth and strong competitive positioning, given its improving income and very favorable moat. Conversely, CDW might be interpreted as fitting for those prioritizing established profitability despite recent revenue softness, though its declining ROIC could signal caution for risk-averse profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Leidos Holdings, Inc. and CDW Corporation to enhance your investment decisions: