Home > Comparison > Technology > IBM vs CDW

The strategic rivalry between International Business Machines Corporation (IBM) and CDW Corporation shapes the evolution of the technology services sector. IBM operates as a diversified technology powerhouse, combining software, consulting, infrastructure, and financing. In contrast, CDW focuses on integrated IT solutions and hardware distribution across corporate and public sectors. This analysis evaluates which business model delivers superior risk-adjusted returns amid shifting industry dynamics and investor priorities.

Table of contents

Companies Overview

International Business Machines Corporation and CDW Corporation are key players reshaping the information technology services landscape.

International Business Machines Corporation: Global IT Services Pioneer

International Business Machines Corporation dominates as a hybrid cloud and software solutions provider. Its core revenue engine spans software, consulting, infrastructure, and financing services. In 2026, the company focuses strategically on expanding its open-source hybrid cloud platform and AI-driven business automation to solidify its competitive edge in enterprise IT.

CDW Corporation: Integrated IT Solutions Specialist

CDW Corporation leads as a comprehensive IT solutions provider across the US, UK, and Canada. It generates revenue by selling hardware, software, and integrated IT services tailored for corporate, small business, and public sectors. Its 2026 strategy emphasizes enhancing cloud capabilities and security solutions to meet evolving hybrid and digital workspace demands.

Strategic Collision: Similarities & Divergences

IBM and CDW share a commitment to hybrid cloud and IT services but diverge sharply in scale and integration philosophy. IBM champions a platform-centric model focusing on open-source ecosystems and AI innovation, while CDW pursues a solutions-driven approach combining hardware and services. Their primary battleground lies in enterprise IT transformation. Investment profiles differ: IBM boasts a vast global footprint, while CDW offers nimble, market-specific execution.

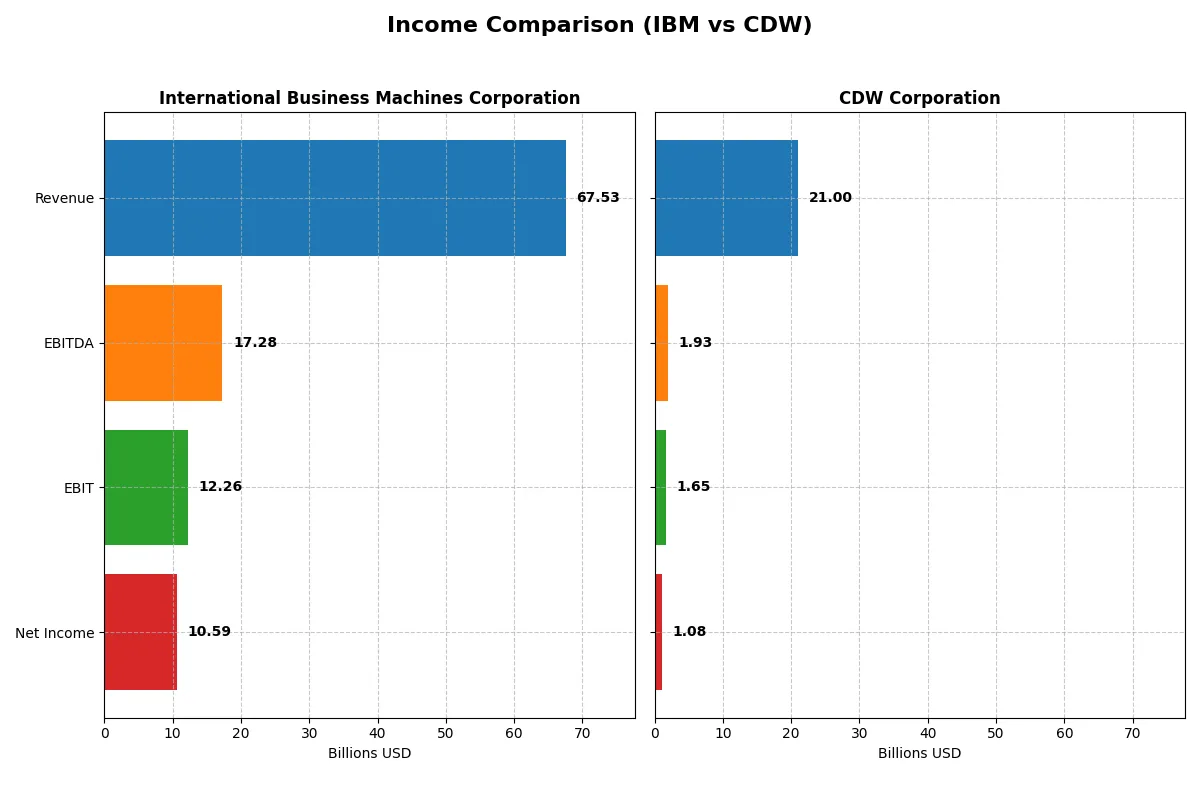

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | International Business Machines Corporation (IBM) | CDW Corporation (CDW) |

|---|---|---|

| Revenue | 67.5B | 21.0B |

| Cost of Revenue | 27.4B | 16.4B |

| Operating Expenses | 29.9B | 2.95B |

| Gross Profit | 40.2B | 4.60B |

| EBITDA | 17.3B | 1.93B |

| EBIT | 12.3B | 1.65B |

| Interest Expense | 1.94B | 0.215B |

| Net Income | 10.6B | 1.08B |

| EPS | 11.36 | 8.06 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates its financial engine with greater efficiency and momentum.

International Business Machines Corporation (IBM) Analysis

IBM’s revenue climbed steadily from $57.4B in 2021 to $67.5B in 2025, with net income surging from $5.7B to $10.6B. Its gross margin stands strong at 59.5%, while net margin improved to 15.7%. The 2025 results show accelerating profitability, driven by a 63% EBIT growth and a 77% EPS increase, signaling robust operational leverage.

CDW Corporation Analysis

CDW’s revenue peaked at $23.7B in 2022 but slightly declined to $21.0B by 2024. Net income followed a similar trend, rising from $789M in 2020 to $1.11B in 2022, then falling to $1.08B in 2024. The gross margin of 21.9% is healthy, but EBIT margin at 7.9% and net margin at 5.1% remain modest. Recent declines in revenue and earnings highlight emerging challenges in sustaining growth momentum.

Margin Strength vs. Revenue Momentum

IBM outperforms CDW with superior margin expansion and faster earnings growth. IBM’s strong 15.7% net margin and 63% EBIT growth contrast with CDW’s flatter margins and recent revenue decline. For investors prioritizing operational efficiency and profit acceleration, IBM presents a more compelling profile.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | International Business Machines Corporation (IBM) | CDW Corporation (CDW) |

|---|---|---|

| ROE | N/A | N/A |

| ROIC | N/A | N/A |

| P/E | 26.1 | 21.6 |

| P/B | N/A | 9.90 |

| Current Ratio | 0 | 1.35 |

| Quick Ratio | 0 | 1.24 |

| D/E | 0 | 2.55 |

| Debt-to-Assets | 0 | 0.41 |

| Interest Coverage | 5.46 | 7.70 |

| Asset Turnover | 0 | 1.43 |

| Fixed Asset Turnover | 0 | 67.3 |

| Payout ratio | 0.59 | 0.31 |

| Dividend yield | 2.27% | 1.43% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as the company’s DNA, uncovering operational strengths and hidden risks that shape investor decisions.

International Business Machines Corporation

IBM shows a favorable net margin of 15.69% but reports an unfavorable 0% ROE and ROIC, signaling weak profitability efficiency. Its P/E ratio of 26.07 suggests a stretched valuation. The company offers a 2.27% dividend yield, rewarding shareholders despite operational challenges, reflecting a cautious capital allocation approach.

CDW Corporation

CDW posts a moderate 5.13% net margin but excels with a strong 45.81% ROE and 13.13% ROIC, demonstrating high operational efficiency. Its P/E of 21.61 appears fairly valued amid a high P/B ratio of 9.9. Shareholders receive a modest 1.43% dividend yield, while the firm reinvests for growth, balancing returns and expansion.

Operational Efficiency Outweighs Valuation Stretch

CDW offers superior profitability metrics and operational efficiency, while IBM shows a higher margin but weaker returns on equity. CDW’s slightly favorable ratio profile fits growth-focused investors. IBM’s higher dividend yield suits those seeking income despite stretched valuation and operational concerns.

Which one offers the Superior Shareholder Reward?

I compare IBM and CDW’s shareholder rewards by analyzing their dividend yields, payout ratios, and buyback activities. IBM offers a robust dividend yield around 2.3%-4.9%, with payout ratios nearing or exceeding 80%, supported by strong free cash flow coverage above 1.7x. IBM combines dividends with steady buybacks, signaling a balanced return strategy. CDW yields a modest 1.0%-1.4% dividend with payout ratios near 30%, conserving cash to fuel growth. Its buybacks are less emphasized but free cash flow coverage remains solid near 2.8x. Historically, IBM’s higher yield with solid FCF coverage and buybacks suggests a more sustainable distribution. CDW prioritizes reinvestment and moderate dividends, appealing to growth-focused investors. For 2026, I find IBM’s total return profile more attractive for income-oriented investors, while CDW suits those seeking growth with modest cash returns.

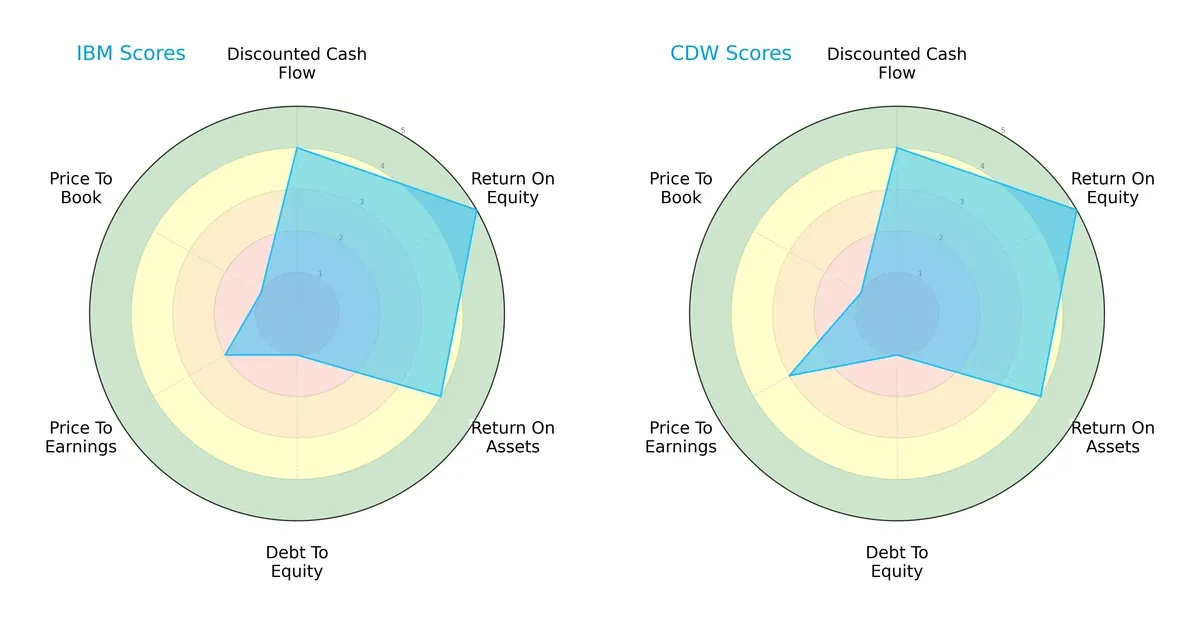

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of International Business Machines Corporation and CDW Corporation:

Both companies share strengths in discounted cash flow (4), return on equity (5), and return on assets (4), signaling efficient profitability and asset utilization. However, both suffer from very unfavorable debt-to-equity (1) and price-to-book (1) scores, indicating high leverage and weak book value support. CDW edges out IBM in price-to-earnings (3 vs. 2), suggesting a slightly better valuation balance. Overall, CDW presents a marginally more balanced profile, while IBM leans heavily on operational efficiency but struggles with capital structure risks.

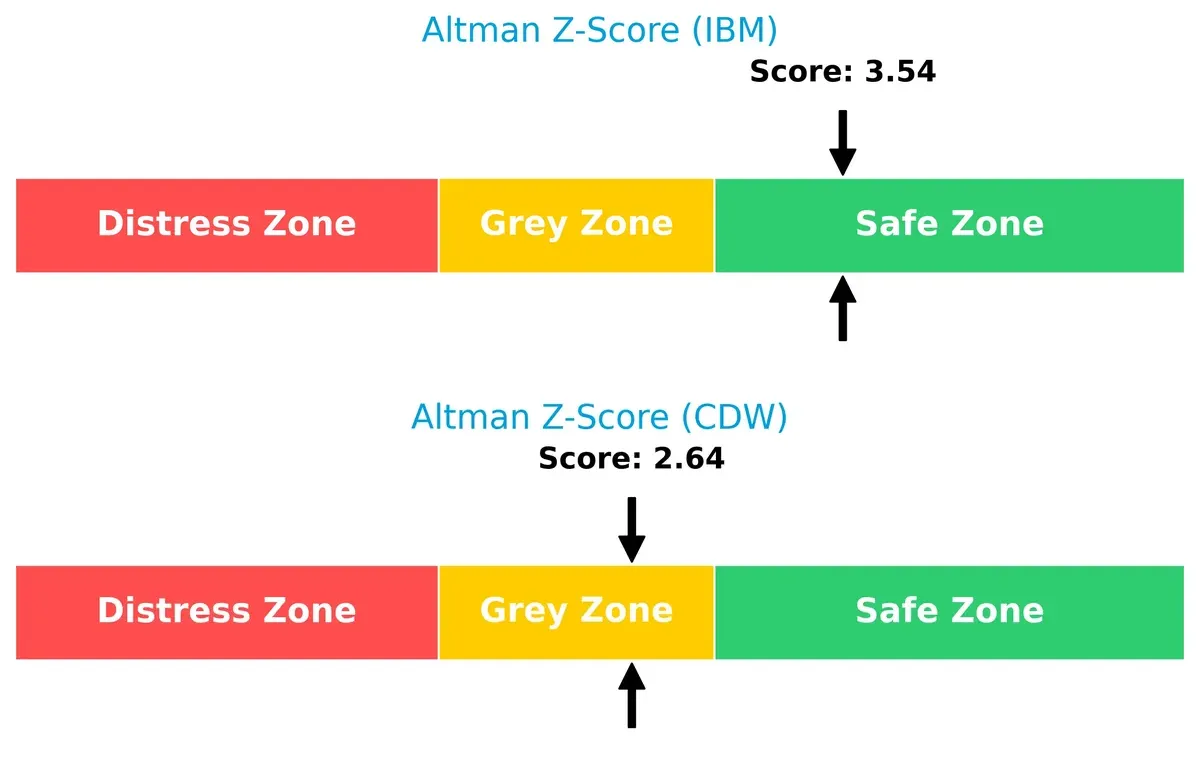

Bankruptcy Risk: Solvency Showdown

IBM’s Altman Z-Score of 3.54 places it securely in the safe zone, whereas CDW’s 2.64 resides in the grey zone. This gap implies IBM maintains stronger solvency and lower bankruptcy risk in today’s volatile environment:

Financial Health: Quality of Operations

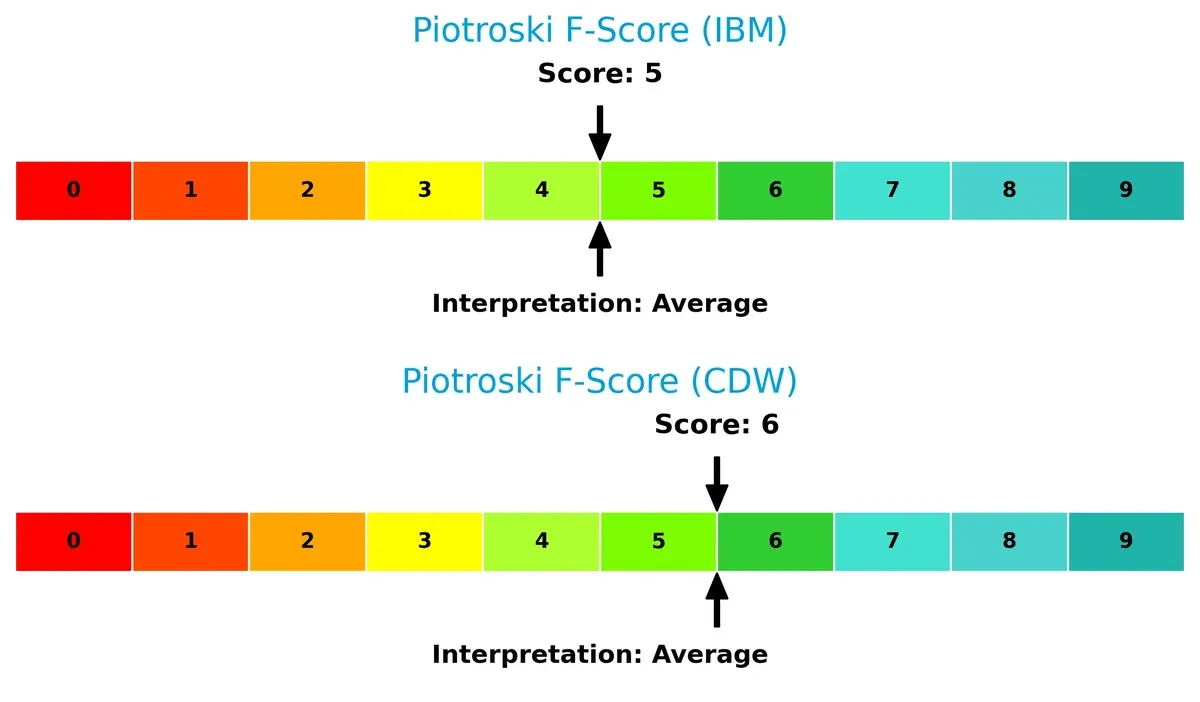

IBM scores 5 and CDW 6 on the Piotroski F-Score scale, both reflecting average financial health. CDW’s slightly higher score suggests marginally better internal financial controls and operational quality, but neither company exhibits peak financial robustness:

How are the two companies positioned?

This section dissects IBM and CDW’s operational DNA by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

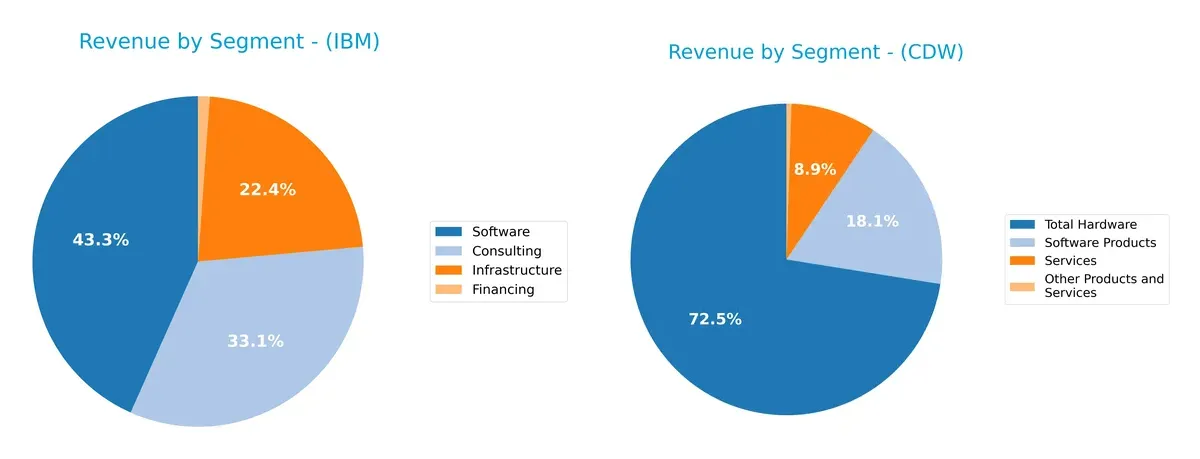

This comparison dissects how International Business Machines Corporation and CDW Corporation diversify their income streams and where their primary sector bets lie:

IBM shows a balanced revenue mix with Software leading at $27B, followed by Consulting at $20.7B and Infrastructure at $14B. CDW pivots heavily on Total Hardware at $15.2B, while Software Products and Services trail at $3.8B and $1.9B, respectively. IBM’s diversified profile reduces concentration risk, while CDW’s hardware dominance signals reliance on infrastructure sales and potential vulnerability to market shifts.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of IBM and CDW based on diversification, profitability, financials, innovation, global presence, and market share:

IBM Strengths

- Diverse revenue streams including software, consulting, infrastructure, and financing

- Strong global presence across Americas, EMEA, Asia Pacific

- Favorable net margin at 15.69%

- Low debt-to-assets ratio and solid interest coverage

- Consistent dividend yield of 2.27%

CDW Strengths

- High returns on equity (45.81%) and invested capital (13.13%)

- Favorable weighted average cost of capital at 7.31%

- Efficient asset turnover ratios

- Strong liquidity with quick ratio above 1.2

- Dominant US market share with $18.5B revenue, plus growing non-US sales

IBM Weaknesses

- Unfavorable returns on equity and invested capital (0%)

- Poor liquidity ratios with current and quick ratios at 0

- Unavailable WACC data limits cost of capital assessment

- Asset turnover ratios unfavorable, signaling inefficiency

- High P/E ratio (26.07) flagged as unfavorable

CDW Weaknesses

- High debt-to-equity ratio (2.55) raises leverage concerns

- Price-to-book ratio at 9.9 signals potential overvaluation

- Lower net margin at 5.13%, neutral profitability

- Moderate dividend yield of 1.43% less attractive to income investors

Overall, IBM offers diversified global operations and steady profitability but struggles with operational efficiency and liquidity. CDW demonstrates strong capital returns and US market dominance but carries higher leverage and valuation risks. Each company’s profile implies different strategic priorities concerning financial health and market positioning.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield protecting long-term profits from relentless competition and market disruption. Let’s dissect the competitive moats of two IT giants:

International Business Machines Corporation: Intangible Assets Powerhouse

IBM’s moat stems from its vast intangible assets, including patented software and hybrid cloud expertise. This manifests in robust 18% EBIT margins and stable 15.7% net margins. However, declining ROIC signals pressure; new cloud initiatives must deepen this moat by 2026 to sustain advantage.

CDW Corporation: Cost and Service Integration Advantage

CDW’s moat relies on integrated IT solutions and efficient hardware sourcing, driving a favorable gross margin near 22%. Its ROIC exceeds WACC by nearly 6%, indicating value creation despite a slight ROIC decline. Expanding managed services in North America could bolster this moat further.

Intangible Assets vs. Integrated Solutions: Who Defends Market Share Better?

IBM’s intangible asset moat is deeper but shows signs of erosion with declining returns. CDW’s cost and service integration moat is narrower yet more consistent in value creation. I see IBM better positioned if it revitalizes innovation; otherwise, CDW’s focused execution offers steadier defense.

Which stock offers better returns?

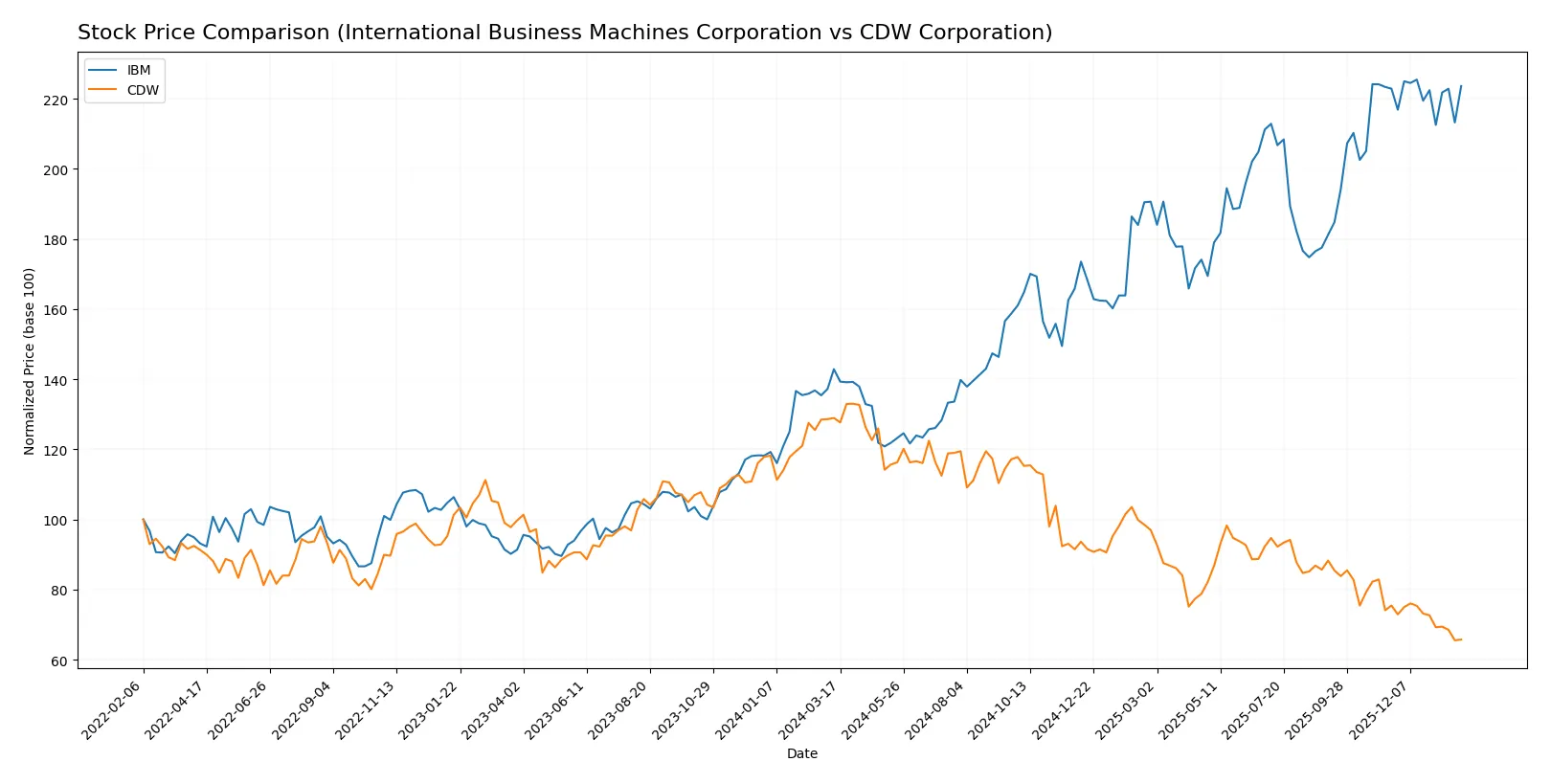

The past year reveals starkly divergent price movements and trading dynamics between the two stocks, highlighting a clear contest in market performance.

Trend Comparison

International Business Machines Corporation (IBM) shows a strong bullish trend over the past 12 months, with a 56.52% price increase but decelerating momentum. Its price ranged from 165.71 to a high of 309.24.

CDW Corporation exhibits a bearish trend, with a 49.03% price decline over the same period and decelerating losses. Its price fell from a high of 255.78 to a low of 126.0.

IBM outperformed CDW significantly, delivering positive returns while CDW’s stock fell nearly half in value over the past year.

Target Prices

Analysts present a confident target consensus for IBM and CDW, signaling potential upside relative to current prices.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| International Business Machines Corporation | 304 | 380 | 349.5 |

| CDW Corporation | 141 | 190 | 168.8 |

IBM’s target consensus at 349.5 suggests a 14% upside from the current 306.7, reflecting optimism in its hybrid cloud and AI growth. CDW’s consensus at 168.8 implies a significant 33% potential gain from 126.39, highlighting strong market confidence in its IT solutions business.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

International Business Machines Corporation Grades

The following table summarizes recent grade actions from leading financial institutions for IBM:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2026-01-29 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-29 |

| RBC Capital | Maintain | Outperform | 2026-01-29 |

| Jefferies | Maintain | Buy | 2026-01-29 |

| UBS | Maintain | Sell | 2026-01-29 |

| Stifel | Maintain | Buy | 2026-01-29 |

| Wedbush | Maintain | Outperform | 2026-01-29 |

| JP Morgan | Maintain | Neutral | 2026-01-21 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-20 |

| B of A Securities | Maintain | Buy | 2026-01-13 |

CDW Corporation Grades

This table shows recent grading updates for CDW Corporation by reputable analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Downgrade | Equal Weight | 2026-01-20 |

| Citigroup | Maintain | Neutral | 2026-01-20 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Raymond James | Upgrade | Strong Buy | 2025-11-25 |

| UBS | Maintain | Buy | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-20 |

| UBS | Maintain | Buy | 2025-08-07 |

| Barclays | Maintain | Equal Weight | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-07-17 |

Which company has the best grades?

IBM holds consistently positive grades, including multiple Outperform and Buy ratings, though one Sell rating signals some caution. CDW’s grades vary more, with recent downgrades but a Strong Buy upgrade earlier. IBM’s steadier positive grades may offer investors a more consistent outlook, while CDW’s mixed ratings suggest greater uncertainty.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

International Business Machines Corporation

- Faces pressure from cloud and AI competitors with mixed profitability signals.

CDW Corporation

- Competes in IT solutions with strong asset utilization but lower net margin.

2. Capital Structure & Debt

International Business Machines Corporation

- Maintains favorable debt-to-equity ratio with strong interest coverage.

CDW Corporation

- Exhibits higher debt levels and weaker debt-to-equity score, increasing financial risk.

3. Stock Volatility

International Business Machines Corporation

- Lower beta at 0.698, indicating less sensitivity to market swings.

CDW Corporation

- Higher beta of 1.073, reflecting greater volatility and market risk.

4. Regulatory & Legal

International Business Machines Corporation

- Operates globally with complex compliance requirements in tech and finance sectors.

CDW Corporation

- Faces regulatory scrutiny mainly in US, UK, and Canada IT markets.

5. Supply Chain & Operations

International Business Machines Corporation

- Relies on hybrid cloud infrastructure and legacy systems; complexity could impair agility.

CDW Corporation

- Exposure to hardware supply chain risks but benefits from diversified service offerings.

6. ESG & Climate Transition

International Business Machines Corporation

- Increasing focus on sustainable cloud solutions but lacks clear ESG score data.

CDW Corporation

- Emerging ESG initiatives but higher operational emissions due to hardware distribution.

7. Geopolitical Exposure

International Business Machines Corporation

- Global footprint exposes IBM to geopolitical tensions and trade restrictions.

CDW Corporation

- Primarily North American and UK exposure, somewhat limiting geopolitical risk.

Which company shows a better risk-adjusted profile?

IBM’s strongest risk lies in its operational complexity amid fast-evolving tech markets. CDW’s critical risk is its elevated leverage, raising financial vulnerability. Between the two, IBM’s conservative capital structure and lower volatility present a better risk-adjusted profile. I note IBM’s Altman Z-Score firmly in the safe zone (3.54) versus CDW’s grey zone (2.64), reinforcing this conclusion.

Final Verdict: Which stock to choose?

International Business Machines Corporation (IBM) showcases a superpower in its ability to deliver solid income growth and maintain strong profitability. Its bullish trend and robust cash flow generation position it as a cash machine. However, investors should keep an eye on its declining ROIC trend and liquidity concerns. IBM suits an aggressive growth portfolio seeking turnaround potential.

CDW Corporation stands out with a strategic moat in efficient capital allocation and superior return on equity, reflecting a strong competitive advantage in its niche. Compared to IBM, CDW offers a safer financial profile with better asset utilization, despite a recent bearish price trend. It fits well in a GARP (Growth At a Reasonable Price) portfolio focused on quality returns and stability.

If you prioritize robust income growth and market momentum, IBM is the compelling choice due to its strong profitability and cash generation despite liquidity risks. However, if you seek disciplined capital efficiency and financial safety, CDW offers better stability and a clear value-creation moat, albeit with recent share price weakness. Each presents distinct strategic scenarios for different investor risk appetites.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of International Business Machines Corporation and CDW Corporation to enhance your investment decisions: