Home > Comparison > Technology > CDW vs G

The strategic rivalry between CDW Corporation and Genpact Limited defines the current trajectory of the Information Technology Services sector. CDW operates as a capital-intensive IT solutions provider serving corporate and public clients primarily in North America. In contrast, Genpact focuses on high-volume business process outsourcing and technology services across global markets. This analysis explores which model offers superior risk-adjusted returns amid evolving industry dynamics, guiding portfolio allocation decisions.

Table of contents

Companies Overview

Two influential players shape the Information Technology Services landscape with distinct market approaches.

CDW Corporation: Integrated IT Solutions Powerhouse

CDW Corporation dominates IT solutions in the US, UK, and Canada. Its core revenue stems from hardware, software, and integrated IT services covering data centers, networking, and security. In 2026, CDW sharpened its focus on hybrid and cloud capabilities to maintain leadership across corporate and public sectors.

Genpact Limited: Global Business Process Innovator

Genpact Limited excels in business process outsourcing and IT services across Asia, the Americas, and Europe. Its revenue engine revolves around finance, supply chain, and transformation services, including ESG advisory. In 2026, Genpact prioritized digital transformation and analytics to deepen its foothold in finance and manufacturing verticals.

Strategic Collision: Similarities & Divergences

CDW pursues a hardware-software integrated model, while Genpact leverages service-driven, process-centric expertise. They compete primarily in enterprise digital transformation, yet CDW emphasizes on-premise solutions; Genpact bets on cloud-enabled outsourcing. Their investment profiles diverge: CDW offers stability through tangible assets; Genpact offers growth via scalable global services.

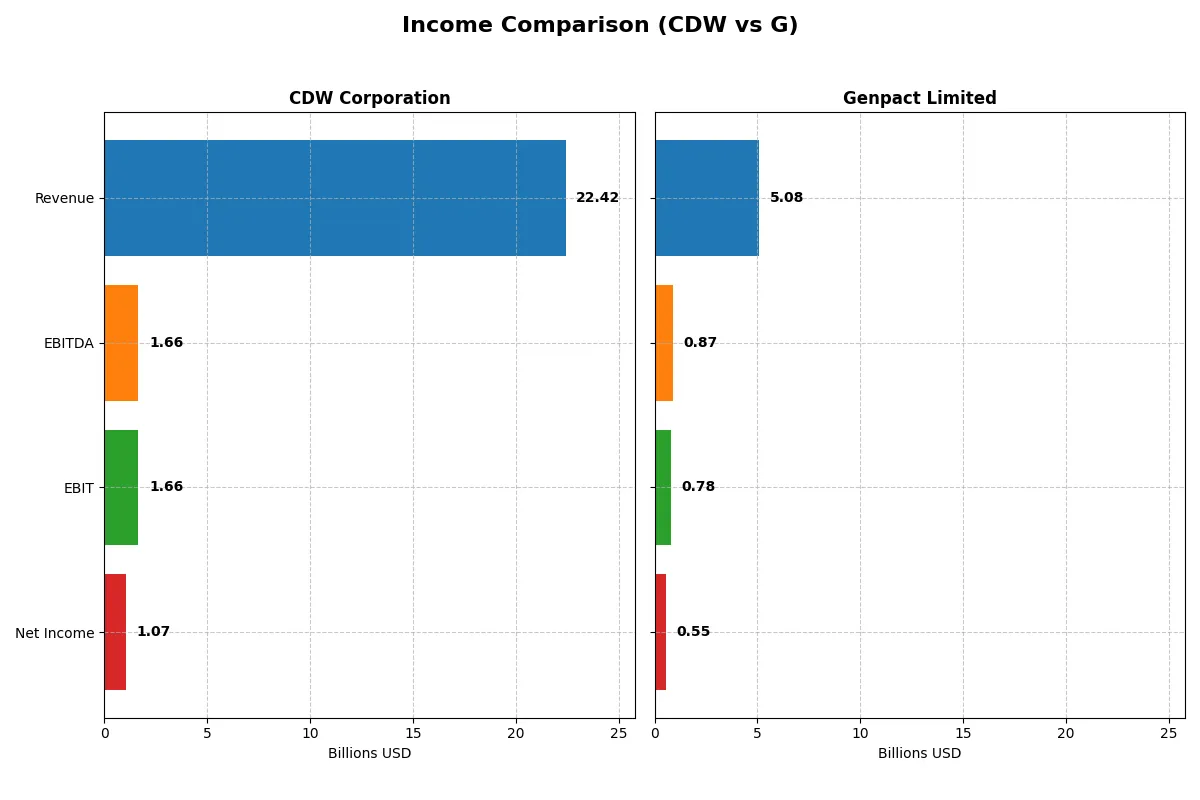

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | CDW Corporation (CDW) | Genpact Limited (G) |

|---|---|---|

| Revenue | 22.4B | 5.08B |

| Cost of Revenue | 17.6B | 3.25B |

| Operating Expenses | 3.22B | 1.05B |

| Gross Profit | 4.87B | 1.83B |

| EBITDA | 1.66B | 875M |

| EBIT | 1.66B | 780M |

| Interest Expense | 227M | 50M |

| Net Income | 1.07B | 552M |

| EPS | 8.13 | 3.18 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability of two distinct corporate engines in 2025.

CDW Corporation Analysis

CDW’s revenue rose modestly to 22.4B in 2025, with net income nearly flat at 1.07B. Gross margin holds steady at 21.7%, reflecting solid cost control. However, net margin contracted slightly to 4.8%, indicating pressure on bottom-line efficiency despite stable EBIT margins.

Genpact Limited Analysis

Genpact’s 2025 revenue climbed to 5.08B, with net income surging 7.6% to 552M. Gross margin improved to 36%, driving a strong 15.4% EBIT margin. Net margin at 10.9% outpaces CDW, highlighting superior operational leverage and consistent profitability momentum.

Margin Efficiency vs. Scale Advantage

Genpact delivers higher margins and faster net income growth, demonstrating stronger profitability and margin expansion over the period. CDW boasts scale with over four times Genpact’s revenue but struggles with margin compression. For investors prioritizing efficiency and margin growth, Genpact’s profile appears more attractive.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies:

| Ratios | CDW Corporation (CDW) | Genpact Limited (G) |

|---|---|---|

| ROE | 40.9% | 21.7% |

| ROIC | 12.2% | 12.3% |

| P/E | 16.8 | 14.7 |

| P/B | 6.86 | 3.19 |

| Current Ratio | 1.18 | 1.66 |

| Quick Ratio | 1.10 | 1.66 |

| D/E (Debt to Equity) | 2.42 | 0.23 |

| Debt-to-Assets | 39.3% | 9.9% |

| Interest Coverage | 7.28 | 15.32 |

| Asset Turnover | 1.40 | 0.87 |

| Fixed Asset Turnover | 72.8 | 13.6 |

| Payout Ratio | 30.8% | 21.3% |

| Dividend Yield | 1.84% | 1.45% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and operational strengths that drive investment decisions.

CDW Corporation

CDW shows robust profitability with a 40.9% ROE and a solid 12.2% ROIC surpassing its 7.25% WACC, signaling efficient capital use. Its P/E of 16.8 is neutral, but a high P/B at 6.86 indicates a stretched valuation. The 1.84% dividend yield offers moderate shareholder returns alongside prudent financial management.

Genpact Limited

Genpact delivers strong core profitability with a 21.7% ROE and a favorable 12.3% ROIC, closely aligned with a low WACC of 7.21%. Its P/E of 14.7 is attractive, suggesting the stock is reasonably priced. The company maintains low leverage and a 1.45% dividend yield, reflecting balanced capital allocation and growth focus.

Premium Valuation vs. Operational Safety

Genpact offers a more favorable ratio profile with higher margin efficiency, lower leverage, and a cheaper valuation. CDW’s elevated P/B and debt levels introduce risk despite superior returns. Investors seeking stability and value may lean toward Genpact, while those prioritizing high ROE might consider CDW’s growth potential.

Which one offers the Superior Shareholder Reward?

I see CDW Corporation and Genpact Limited both pay dividends but differ in yield and buyback intensity. CDW yields roughly 1.8% with a payout ratio around 31%, supported by strong free cash flow coverage near 90%. It also maintains a robust buyback program, enhancing total shareholder returns. Genpact offers a similar yield near 1.4%, with a slightly lower payout ratio around 21%, focusing more on reinvestment given its higher margins and lower leverage. Its buybacks are moderate but less aggressive than CDW’s. I judge CDW’s balanced distribution through dividends and vigorous buybacks more sustainable. It offers a superior total return profile for 2026 investors seeking income plus capital appreciation.

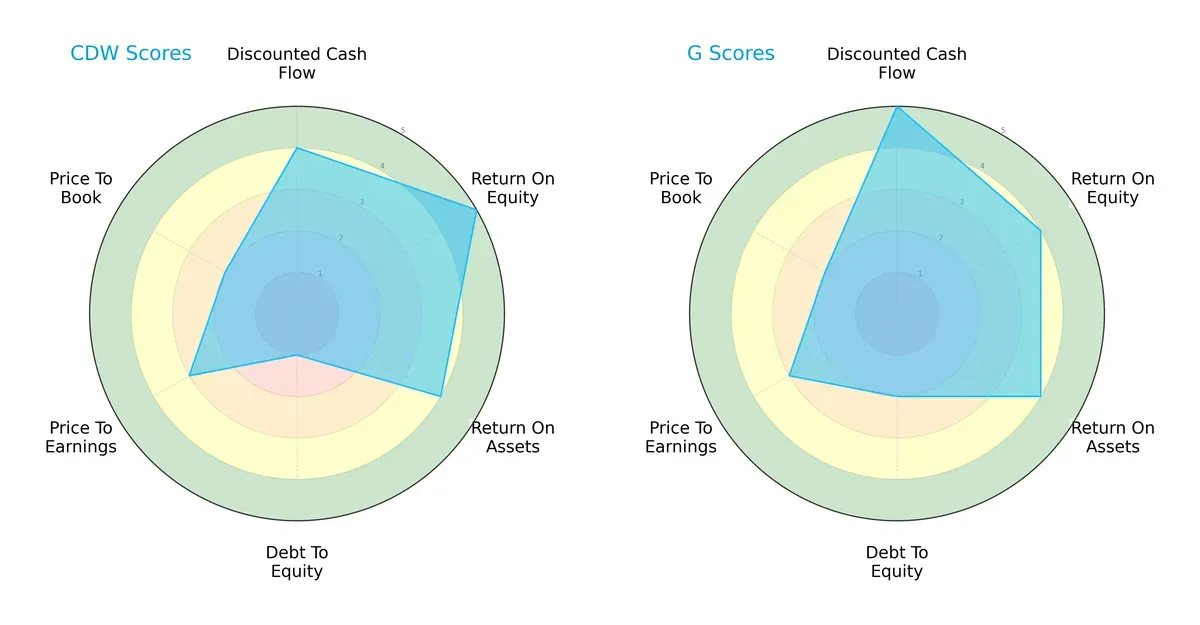

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of CDW Corporation and Genpact Limited, showcasing their distinct financial strengths and strategic balances:

Genpact leads with a more balanced profile, scoring very favorably in discounted cash flow and overall score (4 vs. 3). CDW excels in return on equity (5 vs. 4) but suffers from a very unfavorable debt-to-equity score (1 vs. 2). Both share moderate valuation metrics, yet Genpact’s stronger DCF and lower financial leverage create a more resilient investment thesis.

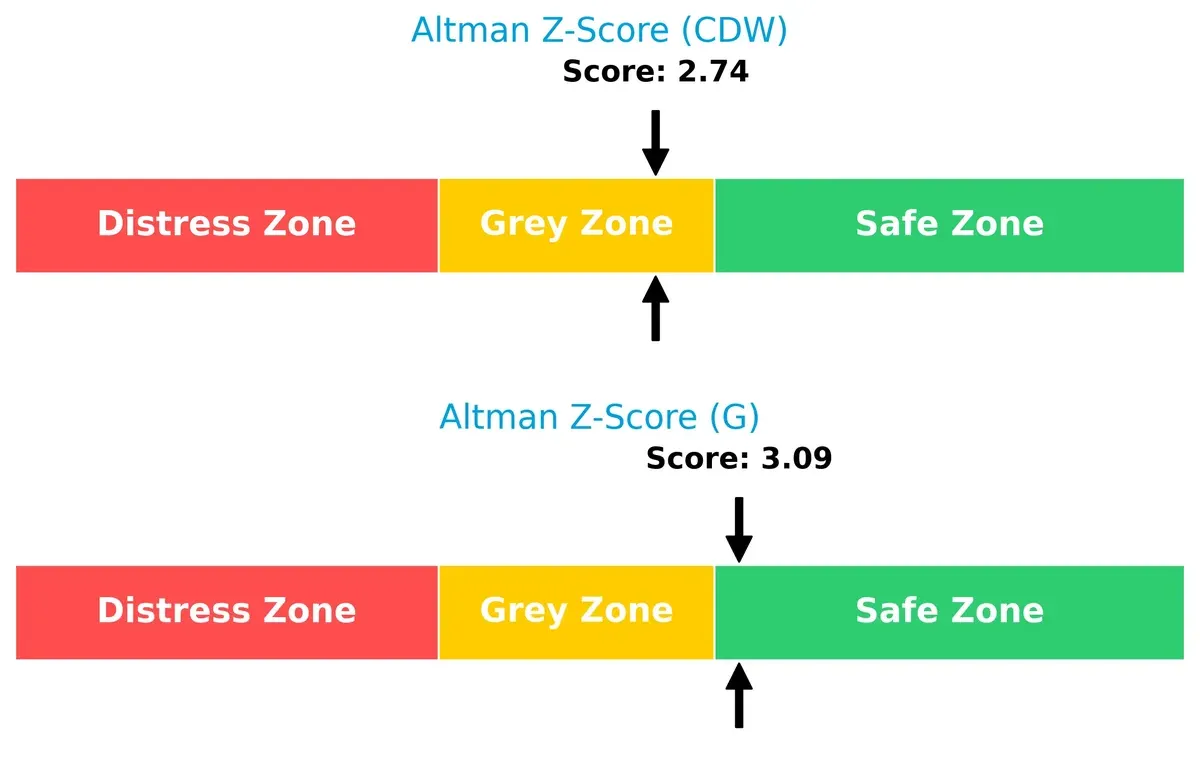

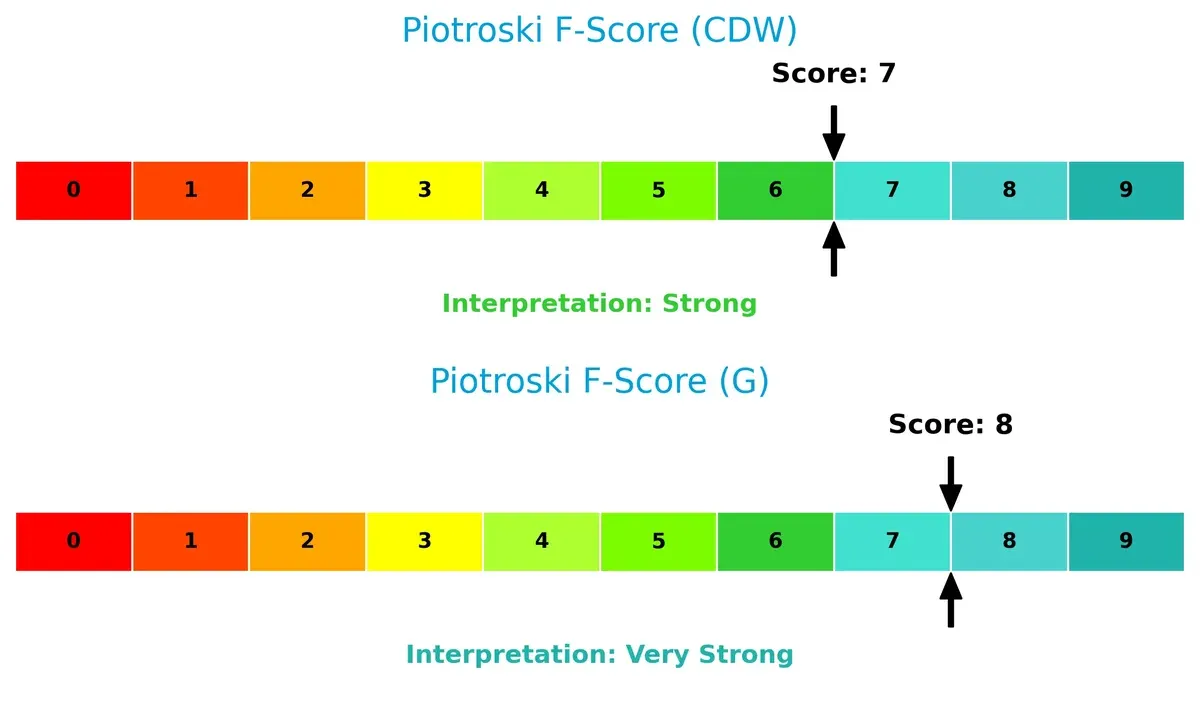

Bankruptcy Risk: Solvency Showdown

Genpact’s Altman Z-Score of 3.1 places it securely in the safe zone, while CDW’s 2.7 keeps it in the grey zone, signaling moderate bankruptcy risk in this cycle:

Financial Health: Quality of Operations

Genpact scores an 8 on the Piotroski F-Score, indicating very strong financial health. CDW’s 7 shows strength but also hints at minor operational red flags compared to Genpact:

How are the two companies positioned?

This section dissects CDW and Genpact’s operational DNA by comparing revenue distribution and internal dynamics, including strengths and weaknesses. The goal is to confront their economic moats to identify the more resilient and sustainable competitive advantage today.

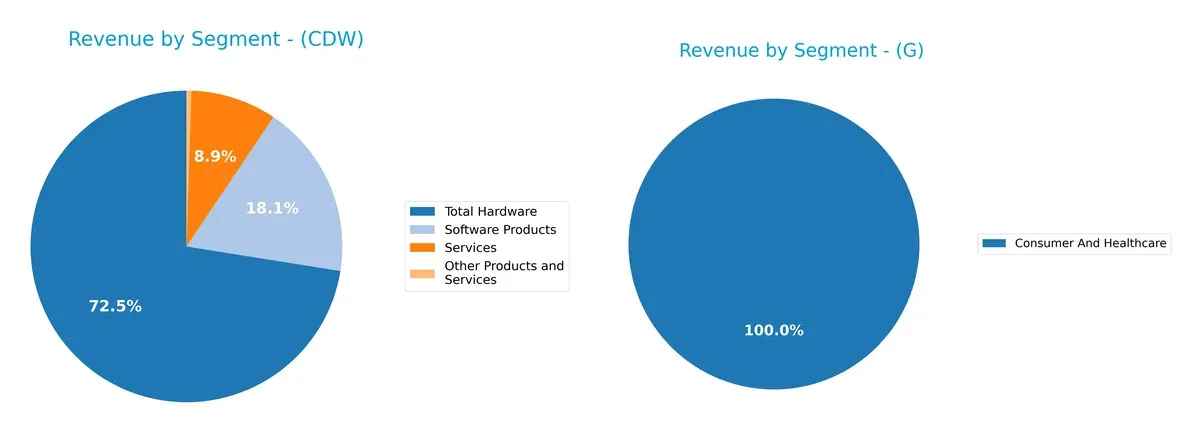

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how both firms diversify their income streams and where their primary sector bets lie:

CDW anchors its revenue in Total Hardware with $15.2B in 2024, dwarfing its Software Products at $3.8B and Services at $1.87B. This signals a hardware-driven ecosystem dominance but exposes concentration risk. In contrast, Genpact’s $1.69B from Consumer and Healthcare in 2024 highlights a focused sector bet, lacking CDW’s diversification. However, Genpact’s historical segments show more balanced exposure across Business Process Outsourcing and IT Services, indicating a pivot towards service diversification.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of CDW Corporation and Genpact Limited based on diversification, profitability, financials, innovation, global presence, and market share:

CDW Strengths

- Diverse hardware and software product lines

- Strong asset turnover ratios

- Favorable ROIC and ROE indicating efficient capital use

- Solid interest coverage ratio supports debt servicing

Genpact Strengths

- Higher net margin and strong profitability metrics

- Favorable debt levels with low debt-to-assets ratio

- Broad geographic presence including India, Americas, Europe, Asia

- Strong fixed asset turnover and very favorable overall financial ratios

CDW Weaknesses

- Unfavorable net margin and high debt-to-equity ratio pose financial risks

- Elevated price-to-book ratio suggests possible overvaluation

- Moderate current ratio limits liquidity cushion

Genpact Weaknesses

- Unfavorable price-to-book ratio signals valuation concerns

- Moderate asset turnover may reflect less efficient use of assets

CDW excels in efficient capital allocation and product diversity but faces margin pressure and leverage risks. Genpact demonstrates robust profitability and global diversification, with some valuation and asset efficiency concerns. These factors shape each company’s strategic focus on financial health and market expansion.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable barrier protecting long-term profits from relentless competition erosion. Let’s dissect the moats of two IT services giants:

CDW Corporation: Integrated IT Solutions with Cost Advantage

CDW’s moat stems from its cost advantage in delivering comprehensive IT hardware and software solutions. It sustains moderate ROIC above WACC but shows a declining profitability trend in 2026, signaling potential margin pressure.

Genpact Limited: Business Process Outsourcing with Operational Excellence

Genpact leverages operational scale and process expertise as its moat, reflected in a higher and growing ROIC versus WACC. Its expanding digital and ESG service offerings deepen its competitive positioning for 2026.

Cost Leadership vs. Operational Scale: Who Defends Better?

Genpact’s growing ROIC and broad service innovation create a deeper moat than CDW’s eroding cost advantage. I see Genpact better equipped to defend and expand market share in the evolving IT services landscape.

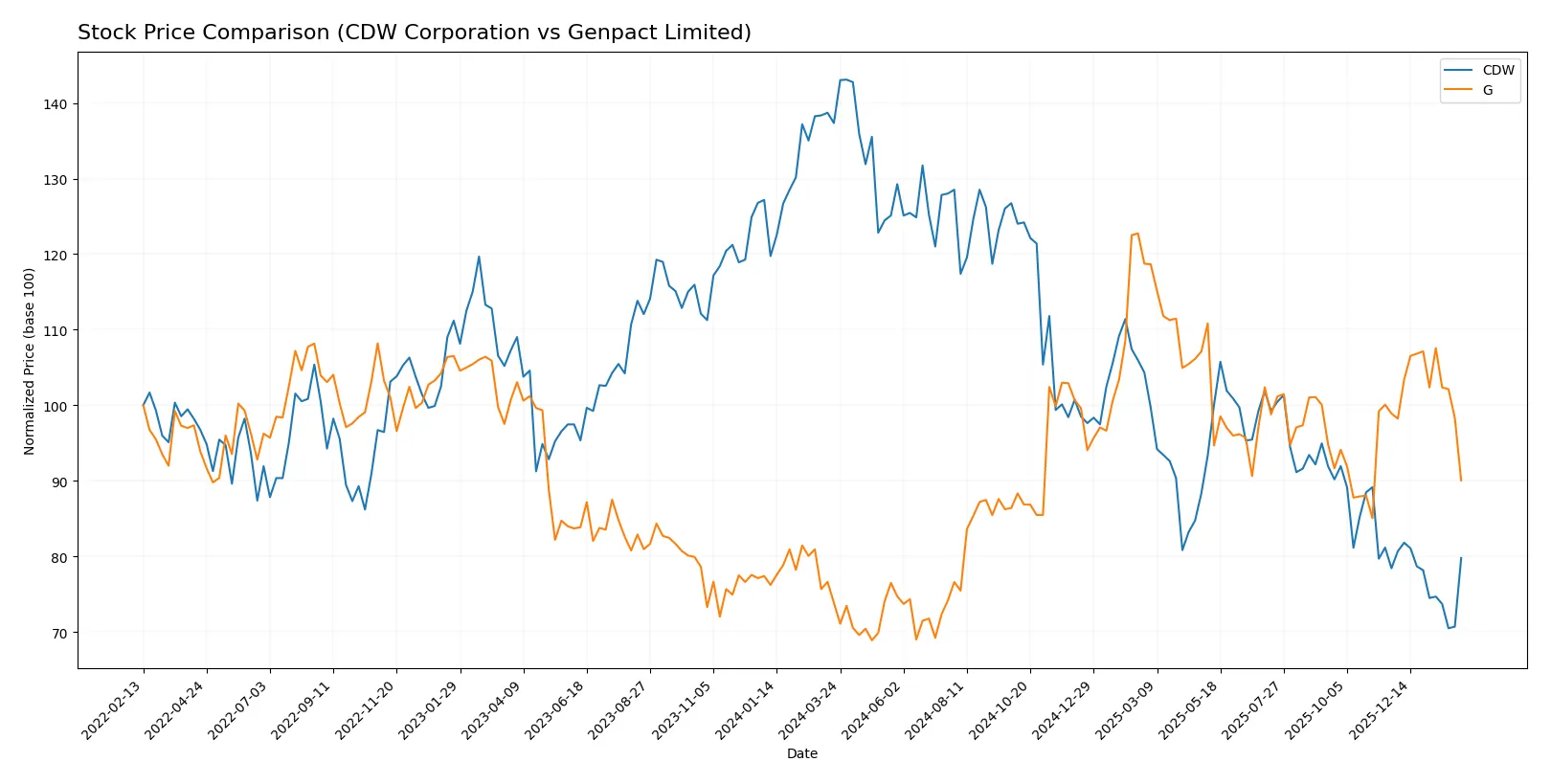

Which stock offers better returns?

The past year reveals contrasting stock trajectories: CDW Corporation’s price plunged sharply, while Genpact Limited gained notably before showing signs of recent weakness.

Trend Comparison

CDW Corporation’s stock fell 41.91% over the past 12 months, marking a bearish trend with deceleration. Price volatility is high, with a standard deviation of 33.75. The stock peaked at 255.78 and bottomed at 126.0 during this period.

Genpact Limited’s stock rose 21.95% in the last year, reflecting a bullish trend that also shows deceleration. Volatility is moderate, with a 6.04 standard deviation. The highest price recorded was 55.05, and the lowest was 30.9.

Comparing both, Genpact Limited outperformed CDW Corporation, delivering positive returns while CDW saw a significant decline in market value.

Target Prices

Analysts present a constructive consensus on target prices for CDW Corporation and Genpact Limited.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| CDW Corporation | 141 | 185 | 162.4 |

| Genpact Limited | 42 | 50 | 46 |

The target consensus for CDW at 162.4 implies upside from the current 142.62 price, signaling confidence in its IT solutions growth. Genpact’s consensus of 46 also suggests room for appreciation above its 40.39 market price, reflecting optimism in its outsourcing services.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Institutional grades for CDW Corporation and Genpact Limited are summarized below:

CDW Corporation Grades

This table shows recent institutional grades for CDW Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-02-05 |

| UBS | Maintain | Buy | 2026-02-05 |

| Morgan Stanley | Maintain | Equal Weight | 2026-02-05 |

| JP Morgan | Maintain | Neutral | 2026-02-05 |

| Barclays | Maintain | Equal Weight | 2026-02-05 |

| Morgan Stanley | Downgrade | Equal Weight | 2026-01-20 |

| Citigroup | Maintain | Neutral | 2026-01-20 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Raymond James | Upgrade | Strong Buy | 2025-11-25 |

| UBS | Maintain | Buy | 2025-11-05 |

Genpact Limited Grades

This table shows recent institutional grades for Genpact Limited:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-02-06 |

| JP Morgan | Maintain | Neutral | 2025-08-20 |

| Needham | Maintain | Buy | 2025-08-08 |

| Mizuho | Maintain | Neutral | 2025-07-01 |

| Needham | Maintain | Buy | 2025-06-30 |

| TD Cowen | Maintain | Buy | 2025-06-27 |

| Baird | Maintain | Neutral | 2025-05-08 |

| Needham | Maintain | Buy | 2025-05-08 |

| Mizuho | Maintain | Neutral | 2025-02-10 |

| Needham | Maintain | Buy | 2025-02-07 |

Which company has the best grades?

Genpact Limited consistently receives “Buy” ratings from Needham and others, showing stronger consensus optimism. CDW Corporation’s ratings vary more, with a mix of “Neutral,” “Equal Weight,” and some “Buy” grades. Investors may perceive Genpact’s steadier buy ratings as a positive signal of market confidence.

Risks specific to each company

In the challenging 2026 market, these categories reveal critical pressure points and systemic threats facing CDW Corporation and Genpact Limited:

1. Market & Competition

CDW Corporation

- Faces intense competition in IT hardware and integrated solutions; market saturation pressures margins.

Genpact Limited

- Competes in the crowded BPO and IT services sector; differentiation hinges on digital transformation capabilities.

2. Capital Structure & Debt

CDW Corporation

- High debt-to-equity ratio at 2.42 signals elevated leverage risk despite strong interest coverage.

Genpact Limited

- Low debt-to-equity ratio at 0.23 indicates conservative leverage, enhancing financial stability.

3. Stock Volatility

CDW Corporation

- Beta near 1.05 suggests market-level volatility; price range moderately wide (123–195).

Genpact Limited

- Beta of 0.73 reflects below-market volatility; recent price surge (+7.1%) signals speculative moves.

4. Regulatory & Legal

CDW Corporation

- Exposure to US, UK, and Canadian regulatory frameworks; potential risks from evolving data security laws.

Genpact Limited

- Operates globally including India and Europe; faces complex multi-jurisdictional compliance and outsourcing regulations.

5. Supply Chain & Operations

CDW Corporation

- Dependence on third-party providers for hardware and services may disrupt supply chains amid geopolitical tensions.

Genpact Limited

- Global delivery model sensitive to regional disruptions; operational complexity in managing diverse service lines.

6. ESG & Climate Transition

CDW Corporation

- Limited disclosure on ESG initiatives; technology hardware sector under pressure to reduce carbon footprint.

Genpact Limited

- Offers ESG advisory services, positioning itself as a leader; however, must balance growth with sustainability commitments.

7. Geopolitical Exposure

CDW Corporation

- Primarily North American and UK focus limits direct geopolitical risk but raises dependency concerns.

Genpact Limited

- Broad geographic footprint including Asia and Latin America increases exposure to trade tensions and regulatory uncertainty.

Which company shows a better risk-adjusted profile?

Genpact’s low leverage, strong Altman Z-Score in the safe zone, and very strong Piotroski Score give it a clear edge. CDW’s higher debt-to-equity ratio and borderline Altman Z-Score in the grey zone raise caution despite solid profitability metrics.

Genpact’s biggest risk lies in geopolitical and operational complexity given its global spread. CDW’s critical risk is elevated financial leverage that could strain flexibility if market conditions deteriorate. Genpact’s recent 7.1% price surge highlights investor confidence but also potential volatility. Overall, Genpact presents a superior risk-adjusted profile in 2026.

Final Verdict: Which stock to choose?

CDW Corporation’s superpower lies in its robust capital efficiency, generating returns well above its cost of capital. However, its declining profitability trend and elevated leverage remain points of vigilance. This profile aligns best with investors seeking aggressive growth fueled by strong operational execution but willing to tolerate higher risk.

Genpact Limited stands out with a durable competitive moat supported by growing ROIC and a strong margin profile. Its conservative balance sheet and superior liquidity offer better safety than CDW. It fits investors aiming for growth at a reasonable price (GARP), blending steady expansion with financial prudence.

If you prioritize capital efficiency and are comfortable with elevated leverage and volatility, CDW is the compelling choice due to its potent returns on invested capital. However, if you seek a more stable growth trajectory with stronger balance sheet resilience, Genpact offers better stability and a sustainable competitive advantage.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CDW Corporation and Genpact Limited to enhance your investment decisions: