In the dynamic world of information technology services, Fiserv, Inc. and CDW Corporation stand out as influential players shaping the industry’s future. Both companies operate in overlapping markets, offering innovative technology solutions that cater to diverse business needs, from financial services to IT infrastructure. This comparison explores their strategic approaches and growth potential, guiding investors to identify which company presents the most compelling opportunity for their portfolio.

Table of contents

Companies Overview

I will begin the comparison between Fiserv and CDW by providing an overview of these two companies and their main differences.

Fiserv Overview

Fiserv, Inc. is a prominent player in the financial technology sector, delivering payment and financial services technology worldwide. The company operates through Acceptance, Fintech, and Payments segments, offering solutions like point-of-sale merchant acquiring, digital commerce, digital banking, and card transaction processing. Headquartered in Milwaukee, Wisconsin, Fiserv serves a diverse clientele including businesses, banks, credit unions, and financial institutions, with a market cap of approximately 36.7B USD.

CDW Overview

CDW Corporation provides comprehensive IT solutions across the United States, United Kingdom, and Canada. Its operations span Corporate, Small Business, and Public segments, offering hardware, software, and integrated IT services such as cloud, digital workspace, and security solutions. Based in Vernon Hills, Illinois, CDW caters to government, education, healthcare, and business customers, employing around 15,100 people and holding a market cap near 17.2B USD.

Key similarities and differences

Both Fiserv and CDW operate in the technology sector, focusing on IT services but targeting different niches: Fiserv specializes in financial services technology, while CDW delivers broader IT solutions including hardware and software products. Fiserv’s business model emphasizes payment processing and financial software, whereas CDW integrates hardware sales with IT consulting and managed services. Their market caps and employee counts differ significantly, reflecting their distinct scales and market focuses.

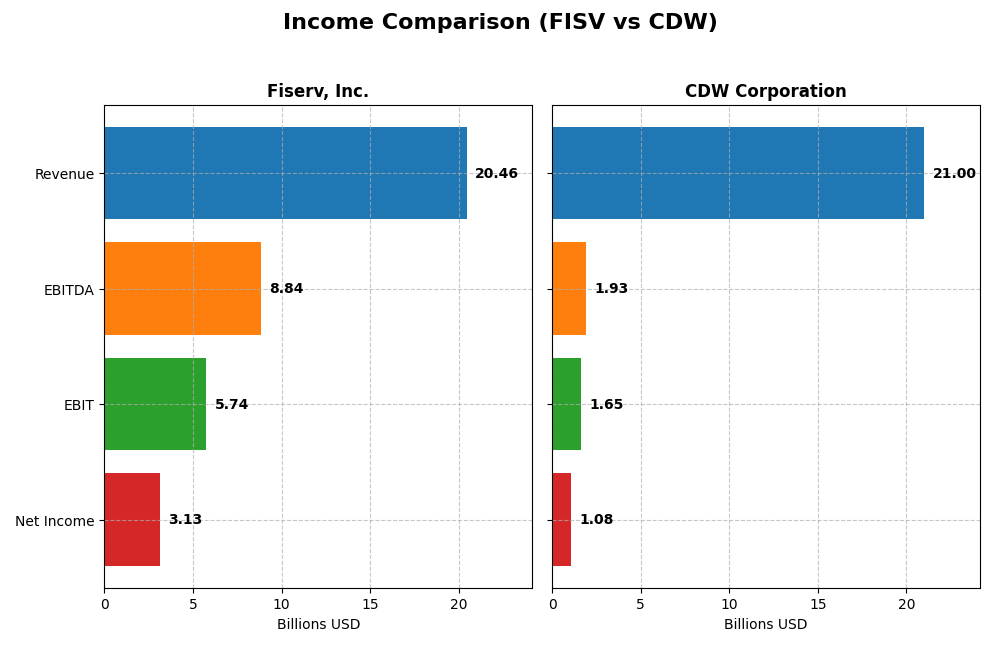

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Fiserv, Inc. and CDW Corporation for the fiscal year 2024.

| Metric | Fiserv, Inc. (FISV) | CDW Corporation (CDW) |

|---|---|---|

| Market Cap | 36.7B | 17.2B |

| Revenue | 20.5B | 21.0B |

| EBITDA | 8.8B | 1.9B |

| EBIT | 5.7B | 1.6B |

| Net Income | 3.1B | 1.1B |

| EPS | 5.41 | 8.06 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Fiserv, Inc.

Fiserv showed consistent revenue growth from 14.9B in 2020 to 20.5B in 2024, with net income rising sharply from 958M to 3.13B. Gross and EBIT margins improved, reaching favorable levels of 60.8% and 28.1% in 2024. Despite a slight dip in net margin growth last year, EPS increased by 8%, indicating overall margin efficiency and profitable expansion.

CDW Corporation

CDW’s revenue grew 13.7% over five years but declined 1.8% in 2024 to 21B, with net income dropping slightly to 1.08B. Gross margin remained favorable at 21.9%, while EBIT margin was neutral at 7.9%. The company faced unfavorable growth metrics in 2024, including revenue, gross profit, and net margin declines, signaling recent operational pressure despite steady longer-term expansion.

Which one has the stronger fundamentals?

Fiserv exhibits stronger fundamentals with higher and improving margins, robust revenue and net income growth, and positive EPS momentum over the period. CDW, while maintaining favorable gross margin and steady growth overall, shows recent declines in key income statement metrics and weaker EBIT margins. Fiserv’s income statement performance is more consistently favorable, suggesting a more resilient operational profile.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Fiserv, Inc. and CDW Corporation based on their latest fiscal year data (2024).

| Ratios | Fiserv, Inc. (FISV) | CDW Corporation (CDW) |

|---|---|---|

| ROE | 11.57% | 45.81% |

| ROIC | 8.70% | 13.13% |

| P/E | 37.97 | 21.61 |

| P/B | 4.39 | 9.90 |

| Current Ratio | 1.06 | 1.35 |

| Quick Ratio | 1.06 | 1.24 |

| D/E (Debt-to-Equity) | 0.92 | 2.55 |

| Debt-to-Assets | 32.34% | 40.82% |

| Interest Coverage | 4.75 | 7.70 |

| Asset Turnover | 0.27 | 1.43 |

| Fixed Asset Turnover | 8.62 | 67.26 |

| Payout Ratio | 0.00 | 30.81% |

| Dividend Yield | 0.00% | 1.43% |

Interpretation of the Ratios

Fiserv, Inc.

Fiserv shows a mixed ratio profile with a favorable net margin (15.31%) and WACC (6.11%) but unfavorable valuation multiples like PE at 37.97 and PB at 4.39, indicating potentially stretched pricing. Liquidity ratios are neutral to favorable, while asset turnover is weak. The company does not pay dividends, reflecting a possible reinvestment or growth strategy.

CDW Corporation

CDW displays generally strong ratios, including favorable ROE (45.81%), ROIC (13.13%), and asset turnover (1.43), supported by good interest coverage (7.69). However, its debt-to-equity ratio is unfavorable at 2.55, and the price-to-book ratio is high at 9.9. CDW pays dividends with a 1.43% yield, indicating shareholder returns with a moderate payout.

Which one has the best ratios?

CDW presents a more favorable overall ratio profile with half of its ratios rated positively and stronger profitability and efficiency metrics. Fiserv’s ratios are more balanced but include notable valuation and turnover weaknesses. The difference in dividend policies also reflects contrasting capital allocation approaches between the two firms.

Strategic Positioning

This section compares the strategic positioning of Fiserv and CDW, including market position, key segments, and exposure to technological disruption:

Fiserv, Inc.

- Leading global payment and financial services provider facing competition in fintech and payments sectors.

- Operates Acceptance, Fintech, and Payments segments focusing on payment processing, digital banking, and fraud protection.

- Exposure includes digital payment technologies and cloud-based platforms, addressing fraud and security challenges.

CDW Corporation

- IT solutions provider competing in hardware, software, and services markets in North America and UK.

- Focuses on Corporate, Small Business, and Public segments offering hardware, software products, and integrated IT solutions.

- Exposure primarily in IT hardware, software, and cloud services with evolving customer demands and technology shifts.

Fiserv vs CDW Positioning

Fiserv pursues a diversified strategy with multiple financial technology segments, providing broad payment and banking services. CDW concentrates on IT hardware, software, and integrated solutions, serving distinct customer sectors with focused offerings.

Which has the best competitive advantage?

Fiserv shows a very favorable moat with growing ROIC above WACC, indicating durable competitive advantage. CDW also creates value but has a slightly favorable moat with declining ROIC, suggesting less sustainable profitability.

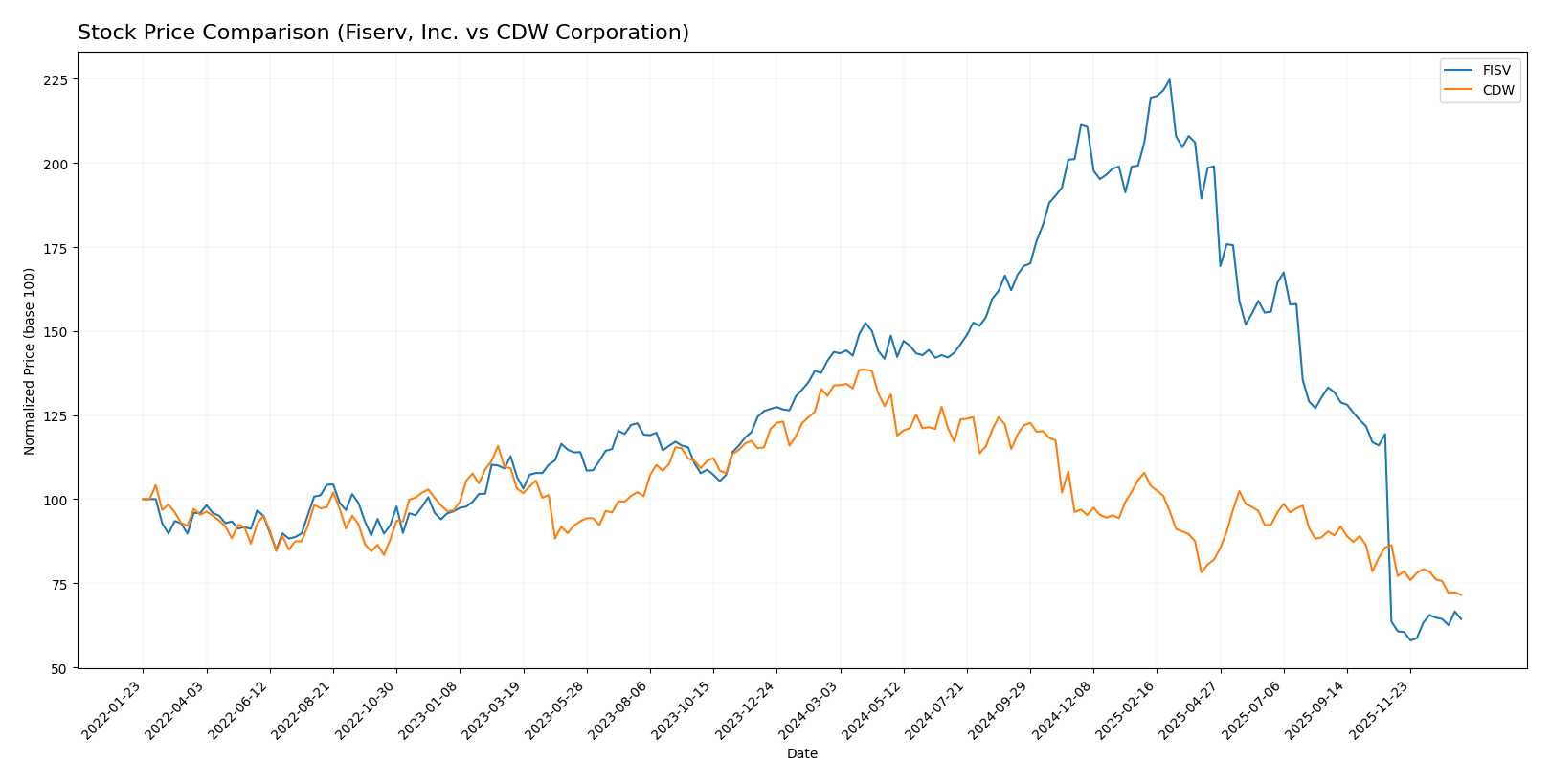

Stock Comparison

The stock price movements of Fiserv, Inc. (FISV) and CDW Corporation (CDW) over the past 12 months reveal significant declines with differing acceleration patterns and recent trading dynamics.

Trend Analysis

Fiserv, Inc. experienced a 55.23% price decline over the past year, indicating a strong bearish trend with accelerating downward momentum. The stock showed high volatility, with prices ranging from 60.84 to 235.69.

CDW Corporation’s stock fell by 46.52% over the same period, also reflecting a bearish trend but with decelerating losses. Volatility was lower than Fiserv’s, with prices between 132.16 and 255.78.

Comparing the two, CDW’s stock outperformed Fiserv’s by delivering a smaller loss percentage, making it the better performer in this 12-month span.

Target Prices

The current analyst consensus for target prices shows a wide range of expectations for both Fiserv, Inc. and CDW Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Fiserv, Inc. | 180 | 62 | 111.39 |

| CDW Corporation | 190 | 148 | 175 |

Fiserv’s consensus target price at 111.39 is significantly above its current price of 67.5, indicating potential upside. CDW’s consensus target of 175 also suggests a strong positive outlook compared to its current price of 132.16.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Fiserv, Inc. and CDW Corporation:

Rating Comparison

Fiserv, Inc. Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: 5, indicating a very favorable valuation based on future cash flows.

- ROE Score: 4, a favorable measure of profit generation efficiency from equity.

- ROA Score: 3, moderate effectiveness in asset utilization to generate earnings.

- Debt To Equity Score: 1, very unfavorable indicating high financial risk.

- Overall Score: 3, moderate overall financial standing.

CDW Corporation Rating

- Rating: B, also considered very favorable by analysts.

- Discounted Cash Flow Score: 4, showing a favorable valuation based on future cash flows.

- ROE Score: 5, very favorable in efficiently generating profit from shareholders’ equity.

- ROA Score: 4, favorable effectiveness in asset utilization to generate earnings.

- Debt To Equity Score: 1, very unfavorable also indicating high financial risk.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Fiserv holds a slightly better overall rating (B+) compared to CDW’s B. However, CDW scores higher in ROE and ROA, while both share the same moderate overall and debt-to-equity scores.

Scores Comparison

Here is the comparison of Fiserv, Inc. and CDW Corporation based on their Altman Z-Score and Piotroski Score:

Fiserv Scores

- Altman Z-Score: 1.41, in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

CDW Scores

- Altman Z-Score: 2.68, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 6, classified as average financial health.

Which company has the best scores?

Based on the provided data, CDW has a better Altman Z-Score indicating lower bankruptcy risk, while Fiserv has a stronger Piotroski Score reflecting better overall financial strength.

Grades Comparison

The following presents a comparison of recent reliable grades and ratings for Fiserv, Inc. and CDW Corporation:

Fiserv, Inc. Grades

This table summarizes recent grades and rating changes from reputable financial firms for Fiserv, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | Maintain | Buy | 2025-12-31 |

| Mizuho | Maintain | Outperform | 2025-12-22 |

| Goldman Sachs | Downgrade | Neutral | 2025-10-30 |

| Bernstein | Downgrade | Market Perform | 2025-10-30 |

| Argus Research | Downgrade | Hold | 2025-10-30 |

| Morgan Stanley | Downgrade | Equal Weight | 2025-10-30 |

| Truist Securities | Downgrade | Hold | 2025-10-30 |

| JP Morgan | Maintain | Overweight | 2025-10-30 |

| Citigroup | Maintain | Neutral | 2025-10-30 |

| RBC Capital | Maintain | Outperform | 2025-10-30 |

Fiserv shows a mixed trend with several downgrades in late 2025, though some firms maintained or reiterated positive grades.

CDW Corporation Grades

This table summarizes recent grades and rating changes from reputable financial firms for CDW Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Raymond James | Upgrade | Strong Buy | 2025-11-25 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| UBS | Maintain | Buy | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-20 |

| UBS | Maintain | Buy | 2025-08-07 |

| Barclays | Maintain | Equal Weight | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-07-17 |

| Citigroup | Maintain | Neutral | 2025-07-11 |

| Barclays | Maintain | Equal Weight | 2025-05-08 |

CDW’s grades show consistency with mostly maintained positive ratings and one recent upgrade to Strong Buy.

Which company has the best grades?

Both Fiserv and CDW have a consensus “Buy” rating, but CDW has a higher proportion of strong positive grades, including a recent upgrade to Strong Buy. This suggests potentially stronger analyst confidence in CDW’s outlook, which may influence investor sentiment and portfolio decisions accordingly.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Fiserv, Inc. (FISV) and CDW Corporation (CDW) based on their latest financial and market data.

| Criterion | Fiserv, Inc. (FISV) | CDW Corporation (CDW) |

|---|---|---|

| Diversification | Strong in payments and processing services, with product offerings growing steadily (Processing & Services: $16.6B in 2024) | Highly diversified hardware, software, and services portfolio (Hardware: $15.2B, Software: $3.8B, Services: $1.9B in 2024) |

| Profitability | Solid net margin (15.3%) but moderate ROIC (8.7%), with stable capital efficiency and moderate PE (37.97) | Lower net margin (5.1%) but excellent ROIC (13.1%) and strong ROE (45.8%), with more attractive PE (21.6) |

| Innovation | Demonstrates durable competitive advantage with growing ROIC trend (ROIC > WACC by 2.6%), indicating strong value creation | Creates value (ROIC > WACC by 5.8%) but ROIC is declining, signaling some challenges in sustaining profitability growth |

| Global presence | Extensive, supported by broad financial institution services and payment processing globally | Strong presence in North American markets with expanding product and service segments |

| Market Share | Leading in financial technology services and payment processing | Significant market share in IT hardware and software distribution, with consistent revenue growth |

Key takeaways: Fiserv exhibits a durable economic moat with growing profitability and strong payment-processing focus, while CDW shows higher profitability ratios but faces a declining ROIC trend. Investors should weigh Fiserv’s stable value creation against CDW’s broader diversification and higher current returns but with caution on profitability sustainability.

Risk Analysis

Below is a comparative table highlighting key risks for Fiserv, Inc. and CDW Corporation in 2024, helping investors understand potential challenges.

| Metric | Fiserv, Inc. (FISV) | CDW Corporation (CDW) |

|---|---|---|

| Market Risk | Moderate (Beta 0.80) | Moderate-High (Beta 1.07) |

| Debt level | Moderate (D/E 0.92, Neutral) | Elevated (D/E 2.55, Unfavorable) |

| Regulatory Risk | Medium (Fintech sector) | Medium (IT solutions sector) |

| Operational Risk | Moderate (Cloud & payment tech) | Moderate (IT hardware/software integration) |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate (Global payment footprint) | Moderate (North America & UK focus) |

Fiserv faces moderate market and operational risks largely tied to payment technology and fintech regulation; its debt is manageable but warrants careful monitoring. CDW shows higher financial leverage risk, though it benefits from strong operational efficiency. Both companies face typical sector regulatory challenges, with geopolitical and environmental risks currently low.

Which Stock to Choose?

Fiserv, Inc. (FISV) shows favorable income evolution with significant growth in net income (+227% over 2020-2024) and a strong gross margin of 60.83%. Financial ratios present a neutral overall picture, with some favorable profitability metrics but unfavorable valuation multiples. Debt levels are moderate with a neutral assessment, and the company holds a very favorable B+ rating.

CDW Corporation (CDW) exhibits a mixed income evolution, with modest revenue growth (+14% over 2020-2024) but recent declines in revenue and profitability. Its financial ratios are slightly favorable, highlighting strong returns on equity and capital but elevated debt. CDW’s rating is very favorable with a B grade, supported by robust profitability scores despite some valuation concerns.

For investors, FISV’s very favorable rating and strong income growth suggest it might appeal to growth-oriented profiles seeking durable competitive advantages. Conversely, CDW’s solid returns and slightly favorable ratios could be seen as attractive for those prioritizing quality and yield but with a tolerance for recent earnings volatility. The choice might depend on whether the investor values rapid growth or consistent profitability amid different risk exposures.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Fiserv, Inc. and CDW Corporation to enhance your investment decisions: