In the dynamic world of information technology services, Fidelity National Information Services, Inc. (FIS) and CDW Corporation stand out as influential players shaping digital transformation. Both companies deliver innovative IT solutions, serving overlapping markets that range from financial services to government and business sectors. This comparison highlights their strategic positions and growth potential, guiding you to identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Fidelity National Information Services, Inc. and CDW Corporation by providing an overview of these two companies and their main differences.

Fidelity National Information Services, Inc. Overview

Fidelity National Information Services, Inc. delivers technology solutions to merchants, banks, and capital markets firms globally. Operating through Merchant, Banking, and Capital Market Solutions segments, it offers payment processing, digital banking, fraud management, securities processing, and asset management services. Founded in 1968 and based in Jacksonville, Florida, FIS employs 50,000 people and is a key player in the information technology services sector.

CDW Corporation Overview

CDW Corporation provides IT solutions across the US, UK, and Canada, serving government, education, healthcare, and business sectors. It operates through Corporate, Small Business, and Public segments, offering hardware, software, and integrated IT solutions including cloud, networking, and security. Founded in 1984 and headquartered in Vernon Hills, Illinois, CDW employs 15,100 people and focuses on delivering comprehensive technology products and services.

Key similarities and differences

Both companies operate in the information technology services sector, serving diverse customer bases with technology solutions. FIS emphasizes financial technology services for merchants and capital markets, while CDW focuses on IT hardware, software, and integrated solutions across multiple industries. FIS has a larger workforce and a broader global financial services reach, whereas CDW concentrates on IT product distribution and managed services primarily in North America and the UK.

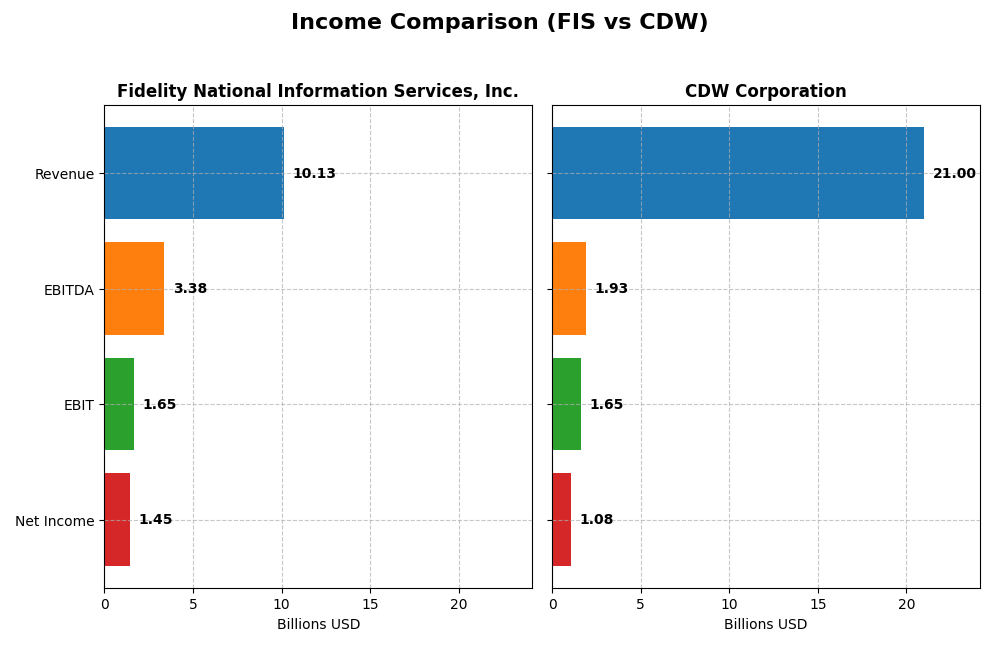

Income Statement Comparison

The table below compares the key income statement metrics of Fidelity National Information Services, Inc. and CDW Corporation for the most recent fiscal year 2024.

| Metric | Fidelity National Information Services, Inc. (FIS) | CDW Corporation (CDW) |

|---|---|---|

| Market Cap | 33.1B | 17.2B |

| Revenue | 10.1B | 21.0B |

| EBITDA | 3.39B | 1.93B |

| EBIT | 1.65B | 1.65B |

| Net Income | 1.45B | 1.08B |

| EPS | 1.42 | 8.06 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Fidelity National Information Services, Inc.

FIS’s revenue showed a slight increase from 9.7B in 2022 to 10.1B in 2024, with net income rebounding sharply to 1.45B in 2024 after large losses in prior years. Margins improved notably, with gross margin at 37.56% and net margin at 14.32%, both favorable. The recent year’s performance indicates recovery and margin expansion despite moderate revenue growth.

CDW Corporation

CDW’s revenue trended upward overall, reaching nearly 21B in 2024, though it dipped slightly by 1.77% from 2023. Net income rose to 1.08B in 2024 but with a slight decline in margins; gross margin stood at 21.92% and net margin at 5.13%, both favorable but with some margin contraction. The most recent year showed mild declines in growth and profitability metrics.

Which one has the stronger fundamentals?

FIS demonstrates stronger fundamentals with higher gross and net margins and impressive net income recovery, despite a moderate revenue growth rate. CDW shows consistent revenue growth over the longer period but faces recent declines in profitability and margins. FIS’s margin improvements and net income rebound suggest more favorable income statement dynamics overall.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Fidelity National Information Services, Inc. (FIS) and CDW Corporation (CDW) based on their most recent fiscal year data (2024).

| Ratios | Fidelity National Information Services, Inc. (FIS) | CDW Corporation (CDW) |

|---|---|---|

| ROE | 9.24% | 45.81% |

| ROIC | 3.99% | 13.13% |

| P/E | 30.80 | 21.61 |

| P/B | 2.85 | 9.90 |

| Current Ratio | 0.85 | 1.35 |

| Quick Ratio | 0.85 | 1.24 |

| D/E | 0.74 | 2.55 |

| Debt-to-Assets | 34.16% | 40.82% |

| Interest Coverage | 4.87 | 7.70 |

| Asset Turnover | 0.30 | 1.43 |

| Fixed Asset Turnover | 11.56 | 67.26 |

| Payout Ratio | 55.17% | 30.81% |

| Dividend Yield | 1.79% | 1.43% |

Interpretation of the Ratios

Fidelity National Information Services, Inc. (FIS)

FIS shows a mixed ratio profile with a favorable net margin of 14.32% but unfavorable returns on equity (9.24%) and invested capital (3.99%). Its current ratio at 0.85 signals liquidity concerns, while fixed asset turnover is strong at 11.56. The dividend yield is a neutral 1.79%, supported by moderate payout risks due to inconsistent free cash flow coverage and share repurchases.

CDW Corporation (CDW)

CDW’s ratios are generally strong, featuring a high return on equity of 45.81% and return on invested capital of 13.13%. Liquidity appears sound with a current ratio of 1.35 and quick ratio of 1.24. Despite a high debt-to-equity ratio of 2.55, interest coverage is favorable at 7.69. The dividend yield is a neutral 1.43%, reflecting steady distributions without evident payout strain.

Which one has the best ratios?

CDW holds the advantage with 50% favorable ratios, strong returns, and solid liquidity, contrasting with FIS’s 21.43% favorable ratios and weaker profitability metrics. However, FIS’s fixed asset turnover and net margin are positives. Overall, CDW’s profile is slightly more favorable, though both companies exhibit some ratio weaknesses investors should consider.

Strategic Positioning

This section compares the strategic positioning of Fidelity National Information Services, Inc. (FIS) and CDW Corporation, including market position, key segments, and exposure to technological disruption:

FIS

- Large market cap (~33B USD) facing competitive pressure in global IT services for finance.

- Diverse segments: Merchant, Banking, and Capital Market Solutions driving revenue growth.

- Exposure includes digital payments, core banking tech, and capital markets innovations.

CDW

- Mid-sized market cap (~17B USD) in IT solutions with competitive presence in US, UK, and Canada.

- Focused on hardware, software, and IT services across corporate, small business, and public.

- Exposure to cloud, hybrid, security, and integrated IT solutions, relying on third-party services.

FIS vs CDW Positioning

FIS pursues a diversified approach across financial technology sectors, offering broad solutions for merchants, banks, and capital markets. CDW concentrates on IT product distribution and services targeting corporate and public sectors. FIS’s diversification may mitigate segment risks; CDW’s focus delivers specialized IT capabilities.

Which has the best competitive advantage?

CDW shows a slightly favorable moat with ROIC exceeding WACC, indicating value creation despite declining profitability. FIS has a slightly unfavorable moat, shedding value but with improving ROIC trends, reflecting growing but currently unprofitable investments.

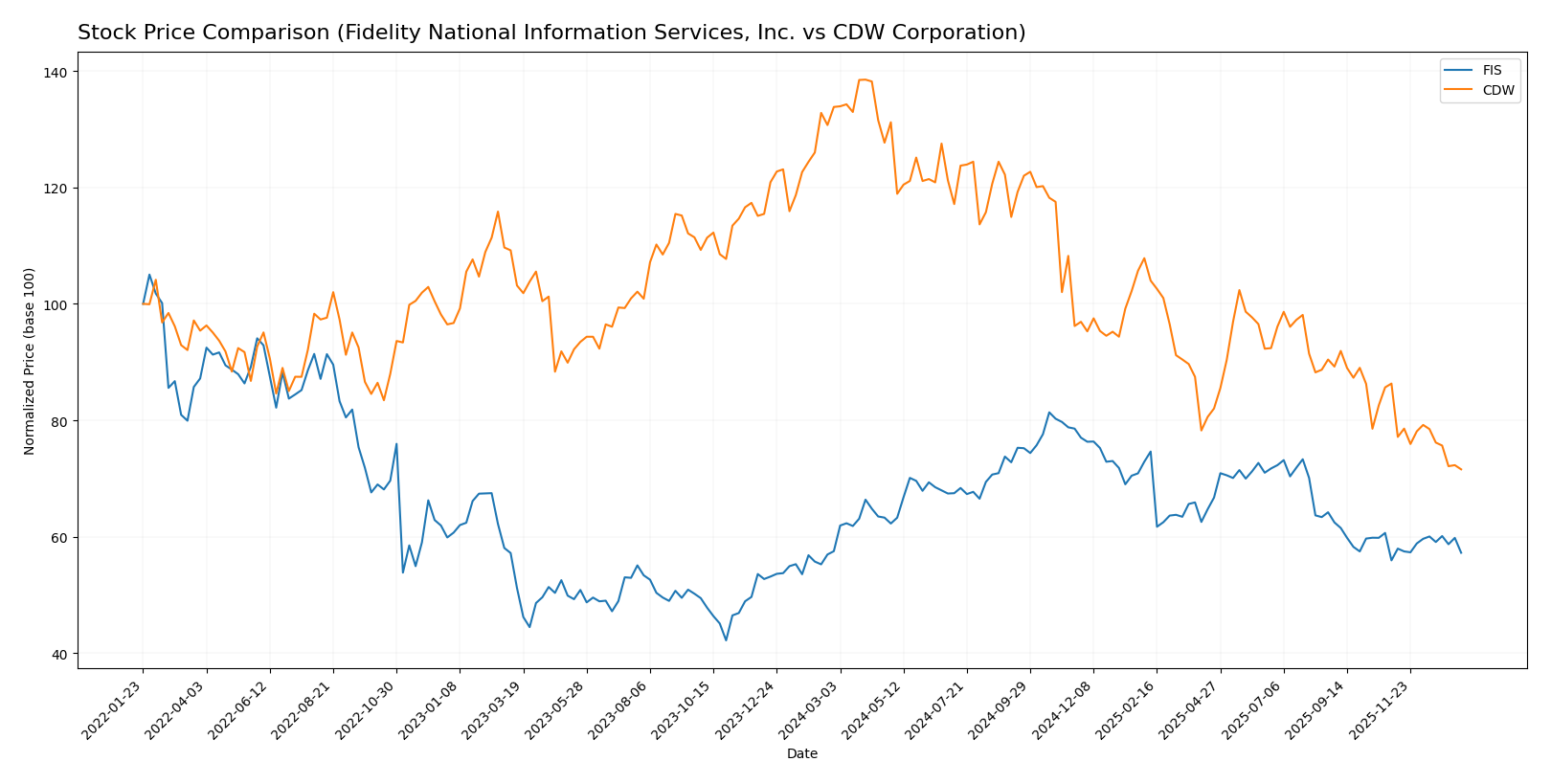

Stock Comparison

The stock price movements of Fidelity National Information Services, Inc. (FIS) and CDW Corporation (CDW) over the past 12 months reveal contrasting trading dynamics, with FIS showing minor fluctuations and CDW experiencing significant value decline.

Trend Analysis

FIS exhibited a mild bearish trend over the past year with a price decrease of 0.47%, accompanied by acceleration and moderate volatility (std deviation 7.01), peaking at 90.95 and bottoming at 62.52.

CDW demonstrated a strong bearish trend with a substantial 46.52% price decline over the same period, decelerating with high volatility (std deviation 33.89), ranging from a high of 255.78 to a low of 132.16.

Comparatively, FIS delivered the highest market performance with only a slight loss, while CDW faced a steep drop, indicating more pronounced depreciation in stock value.

Target Prices

Analysts present a clear target consensus for Fidelity National Information Services, Inc. and CDW Corporation, reflecting moderate upside potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Fidelity National Information Services, Inc. | 82 | 69 | 75.5 |

| CDW Corporation | 190 | 148 | 175 |

The target consensus for FIS suggests a potential 18% upside from the current price of 63.98 USD, while CDW’s consensus target of 175 USD indicates a roughly 32% upside compared to its current price of 132.16 USD. Overall, analysts expect moderate growth for both stocks relative to current market prices.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Fidelity National Information Services, Inc. (FIS) and CDW Corporation (CDW):

Rating Comparison

FIS Rating

- Rating: C+ with a very favorable status.

- Discounted Cash Flow Score: 4, indicating favorable DCF evaluation.

- ROE Score: 2, moderate efficiency in generating profit from equity.

- ROA Score: 2, moderate asset utilization effectiveness.

- Debt To Equity Score: 1, very unfavorable financial risk level.

- Overall Score: 2, moderate overall financial standing.

CDW Rating

- Rating: B with a very favorable status.

- Discounted Cash Flow Score: 4, also favorable.

- ROE Score: 5, very favorable efficiency in equity use.

- ROA Score: 4, favorable asset utilization.

- Debt To Equity Score: 1, very unfavorable financial risk.

- Overall Score: 3, moderate but higher than FIS.

Which one is the best rated?

Based strictly on the provided data, CDW holds a higher overall rating (B vs. C+) and stronger scores in ROE and ROA, despite both companies sharing an unfavorable debt-to-equity score. CDW is better rated overall.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Fidelity National Information Services, Inc. (FIS) and CDW Corporation (CDW):

FIS Scores

- Altman Z-Score: 0.46, in distress zone indicating high bankruptcy risk

- Piotroski Score: 8, very strong financial health

CDW Scores

- Altman Z-Score: 2.68, in grey zone indicating moderate bankruptcy risk

- Piotroski Score: 6, average financial health

Which company has the best scores?

Based on the scores, FIS shows a very strong Piotroski Score but a distress zone Altman Z-Score, while CDW has a better Altman Z-Score in the grey zone but only an average Piotroski Score. Neither company is clearly superior across both scores.

Grades Comparison

Here is the comparison of recent reliable grades for Fidelity National Information Services, Inc. and CDW Corporation:

Fidelity National Information Services, Inc. Grades

The table below shows recent grades issued by reputable financial institutions for FIS.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Hold | 2025-11-19 |

| RBC Capital | Maintain | Outperform | 2025-11-06 |

| JP Morgan | Maintain | Overweight | 2025-11-06 |

| UBS | Maintain | Buy | 2025-11-06 |

| Truist Securities | Maintain | Hold | 2025-10-24 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-10-01 |

| UBS | Upgrade | Buy | 2025-09-30 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-08-06 |

| Truist Securities | Maintain | Hold | 2025-07-17 |

FIS grades mostly range between Hold and Outperform, with several institutions maintaining their positions and UBS upgrading to Buy recently.

CDW Corporation Grades

The table below summarizes recent credible grades for CDW.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Raymond James | Upgrade | Strong Buy | 2025-11-25 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| UBS | Maintain | Buy | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-20 |

| UBS | Maintain | Buy | 2025-08-07 |

| Barclays | Maintain | Equal Weight | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-07-17 |

| Citigroup | Maintain | Neutral | 2025-07-11 |

| Barclays | Maintain | Equal Weight | 2025-05-08 |

CDW shows a broader range of grades, including a recent upgrade to Strong Buy and multiple Buy or Overweight ratings from major grading firms.

Which company has the best grades?

Both FIS and CDW hold a consensus “Buy” rating, but CDW has received more upgrades including a Strong Buy, suggesting higher confidence from some analysts. This may influence investors seeking stronger positive momentum, while FIS reflects a more cautious but stable outlook.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Fidelity National Information Services, Inc. (FIS) and CDW Corporation based on the latest financial and operational data.

| Criterion | Fidelity National Information Services, Inc. (FIS) | CDW Corporation |

|---|---|---|

| Diversification | Moderate diversification: strong in Banking and Capital Market Solutions, with growing Merchant Solutions segment | Highly diversified with strong hardware, software, and services segments |

| Profitability | Net margin 14.3% (favorable), but ROIC 4.0% below WACC, indicating value destruction despite improving profitability | ROIC 13.1% well above WACC, strong ROE 45.8%, consistent value creation but profitability trend declining |

| Innovation | Moderate: steady growth in ROIC suggests improving operational efficiency | Strong asset turnover and fixed asset turnover indicate effective innovation and asset use |

| Global presence | Significant global footprint in financial solutions, with revenues over $9B in banking and capital markets | Primarily North American presence, focused on IT hardware and services with $19B+ in total hardware sales |

| Market Share | Leading in financial technology with growing segments, but facing competitive pressure | Large market share in IT distribution and services, strong customer base across sectors |

Key takeaways: FIS shows growing profitability but currently destroys value due to ROIC below WACC, while CDW creates value with strong returns yet faces a declining ROIC trend. FIS benefits from global financial diversification, whereas CDW excels in IT product diversification and operational efficiency. Investors should weigh FIS’s growth potential against its profitability challenges and CDW’s stable returns amid margin pressures.

Risk Analysis

Below is a comparative table outlining key risks for Fidelity National Information Services, Inc. (FIS) and CDW Corporation based on 2024 data:

| Metric | Fidelity National Information Services, Inc. (FIS) | CDW Corporation (CDW) |

|---|---|---|

| Market Risk | Beta 0.94, moderate volatility | Beta 1.07, slightly higher volatility |

| Debt Level | Debt-to-Equity 0.74 (neutral), Altman Z-Score 0.46 (distress zone) | Debt-to-Equity 2.55 (unfavorable), Altman Z-Score 2.68 (grey zone) |

| Regulatory Risk | Moderate, operates globally in financial tech | Moderate, IT solutions across US, UK, Canada |

| Operational Risk | Medium, complexity in multiple tech segments | Medium, diversified IT hardware/software services |

| Environmental Risk | Generally low, typical for tech sector | Generally low, typical for tech sector |

| Geopolitical Risk | Moderate exposure due to global operations | Moderate exposure due to North American and UK markets |

FIS faces significant financial distress risk indicated by a low Altman Z-Score and unfavorable profitability ratios, despite moderate debt levels. CDW has higher leverage but a better financial health profile with a more favorable Altman Z-Score and stronger return ratios. Market and geopolitical risks remain moderate for both given their international footprints. Investors should weigh FIS’s financial fragility against CDW’s higher debt burden when managing portfolio risk.

Which Stock to Choose?

Fidelity National Information Services, Inc. (FIS) shows a favorable income statement with strong net margin growth of 121.15% over one year and an overall favorable profitability trend. However, its financial ratios indicate a slightly unfavorable outlook due to weak return on equity (9.24%) and return on invested capital (3.99%), coupled with moderate debt levels and a moderate rating of C+.

CDW Corporation presents a favorable income statement overall, despite recent declines in revenue and net margin growth. Its financial ratios are slightly favorable, featuring high return on equity (45.81%) and return on invested capital (13.13%), though it carries higher debt levels. CDW holds a better rating of B but shows a declining ROIC trend.

For investors prioritizing growth and improving profitability, FIS’s rising income metrics and profitability might appear attractive despite its financial ratio weaknesses. Conversely, investors focused on value or quality investing could find CDW’s stronger returns on equity and capital more favorable, albeit with caution due to its ROIC decline and higher leverage.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Fidelity National Information Services, Inc. and CDW Corporation to enhance your investment decisions: