In today’s fast-evolving tech landscape, choosing the right investment requires a clear understanding of market leaders and innovators. CDW Corporation and Datadog, Inc. stand out as key players in the technology sector, each shaping IT solutions and cloud-based monitoring, respectively. Their overlapping focus on digital transformation and enterprise services makes them compelling candidates for comparison. Join me as we explore which company offers the most promising opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between CDW Corporation and Datadog, Inc. by providing an overview of these two companies and their main differences.

CDW Corporation Overview

CDW Corporation delivers information technology solutions across the United States, United Kingdom, and Canada. It operates through Corporate, Small Business, and Public segments, offering hardware and software products alongside integrated IT solutions such as on-premise, hybrid, and cloud capabilities. The company serves a broad customer base including government, education, healthcare, and businesses of all sizes.

Datadog, Inc. Overview

Datadog, Inc. specializes in a cloud-based monitoring and analytics platform designed for developers, IT operations, and business users globally. Its SaaS platform integrates infrastructure, application performance, log, and security monitoring to deliver real-time observability. The company also provides features like user experience monitoring, cloud security, and incident management, focusing on delivering comprehensive tech stack insights.

Key similarities and differences

Both CDW and Datadog operate in the technology sector but differ in focus and delivery models. CDW provides hardware, software, and IT solutions with a hybrid approach across various industries, emphasizing physical products and services. In contrast, Datadog offers a purely software-based SaaS platform centered on cloud monitoring and analytics. Both target enterprise customers but serve distinct needs within the IT ecosystem.

Income Statement Comparison

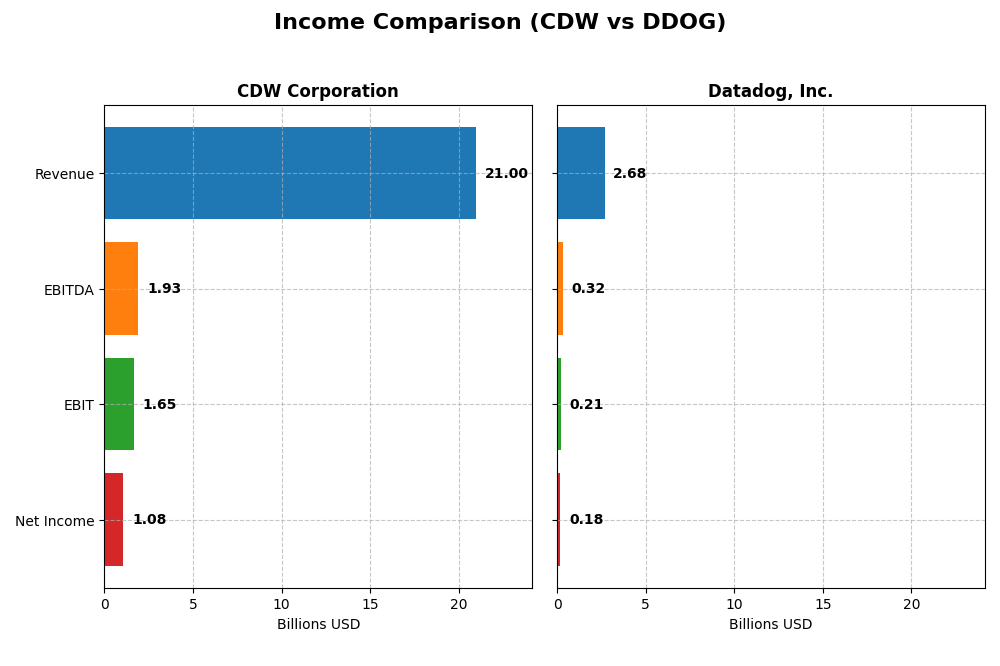

The table below presents a side-by-side comparison of the latest fiscal year income statement metrics for CDW Corporation and Datadog, Inc., highlighting key financial figures for 2024.

| Metric | CDW Corporation | Datadog, Inc. |

|---|---|---|

| Market Cap | 17.3B | 46.9B |

| Revenue | 21.0B | 2.68B |

| EBITDA | 1.93B | 318M |

| EBIT | 1.65B | 211M |

| Net Income | 1.08B | 184M |

| EPS | 8.06 | 0.55 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

CDW Corporation

CDW’s revenue and net income showed overall growth from 2020 to 2024, with revenue increasing by 13.7% and net income by 36.7%. Margins remained relatively stable with a gross margin near 22% and net margin around 5.1%. In 2024, revenue and net income experienced slight declines, signaling a slowdown despite favorable long-term margin trends.

Datadog, Inc.

Datadog demonstrated strong upward trends from 2020 to 2024, with revenue growing 345% and net income surging 849%. The company maintained a high gross margin of 80.8% and improved net margin to 6.9%. The 2024 fiscal year saw significant acceleration in revenue, net income, and margin growth, reflecting robust operational expansion and profitability improvements.

Which one has the stronger fundamentals?

Datadog exhibits stronger fundamentals with consistently favorable growth metrics and higher margins, reflecting rapid expansion and improving profitability. CDW, while showing steady long-term growth and solid margins, faced recent declines in revenue and earnings. This contrast highlights Datadog’s greater momentum, though both companies maintain favorable income statement profiles overall.

Financial Ratios Comparison

Below is a comparison of key financial ratios for CDW Corporation and Datadog, Inc. for the fiscal year 2024, providing insight into their profitability, liquidity, leverage, and market valuation.

| Ratios | CDW Corporation | Datadog, Inc. |

|---|---|---|

| ROE | 45.81% | 6.77% |

| ROIC | 13.13% | 1.07% |

| P/E | 21.61 | 261.42 |

| P/B | 9.90 | 17.70 |

| Current Ratio | 1.35 | 2.64 |

| Quick Ratio | 1.24 | 2.64 |

| D/E | 2.55 | 0.68 |

| Debt-to-Assets | 40.82% | 31.84% |

| Interest Coverage | 7.70 | 7.68 |

| Asset Turnover | 1.43 | 0.46 |

| Fixed Asset Turnover | 67.26 | 6.72 |

| Payout ratio | 30.81% | 0% |

| Dividend yield | 1.43% | 0% |

Interpretation of the Ratios

CDW Corporation

CDW shows a balanced ratio profile with favorable returns on equity (45.81%) and invested capital (13.13%), supported by solid interest coverage (7.69) and asset turnover (1.43). However, a high price-to-book ratio (9.9) and debt-to-equity of 2.55 indicate some leverage concerns. The company pays dividends with a 1.43% yield, reflecting a stable payout supported by free cash flow, though cautious monitoring is advised to avoid unsustainable distributions.

Datadog, Inc.

Datadog presents mixed ratios with neutral net margin (6.85%) but unfavorable returns on equity (6.77%) and invested capital (1.07%), alongside a very high price-to-earnings ratio (261.42) and price-to-book (17.7). The liquidity ratios are favorable, with current and quick ratios both at 2.64. It does not pay dividends, focusing on reinvestment and growth, which aligns with its high R&D expenditure and lack of payout.

Which one has the best ratios?

CDW exhibits a stronger overall ratio profile, with half of its key metrics rated favorable and only a few concerns notably on leverage. Datadog has a higher proportion of unfavorable ratios, particularly in profitability and valuation metrics, reflecting its growth-stage status. Consequently, CDW’s ratios suggest a more balanced financial position compared to Datadog’s riskier and growth-oriented profile.

Strategic Positioning

This section compares the strategic positioning of CDW Corporation and Datadog, Inc., focusing on market position, key segments, and exposure to technological disruption:

CDW Corporation

- Established IT solutions provider with strong market presence in US, UK, and Canada facing moderate competitive pressure.

- Diverse revenue streams: hardware dominates ($15.2B in 2024), plus significant software ($3.8B) and services ($1.9B) segments.

- Traditional IT infrastructure services with on-premise, hybrid, and cloud solutions; moderate exposure to cloud technology trends.

Datadog, Inc.

- SaaS platform leader in cloud monitoring with international reach, operating in a highly competitive software market.

- Focused on cloud-based monitoring and analytics platform targeting developers, IT operations, and business users globally.

- High exposure to cloud-native technological disruption with continuous innovation in real-time observability and security monitoring.

CDW Corporation vs Datadog, Inc. Positioning

CDW exhibits a diversified business model with substantial hardware and services, while Datadog concentrates on SaaS cloud monitoring solutions. CDW benefits from broad market segments but faces slower growth in traditional IT, whereas Datadog leverages rapid cloud adoption but bears higher competitive risks.

Which has the best competitive advantage?

CDW shows a slightly favorable moat with value creation despite declining profitability, indicating moderate competitive strength. Datadog, however, currently destroys value but improves profitability, suggesting an evolving competitive position yet lacking a strong moat.

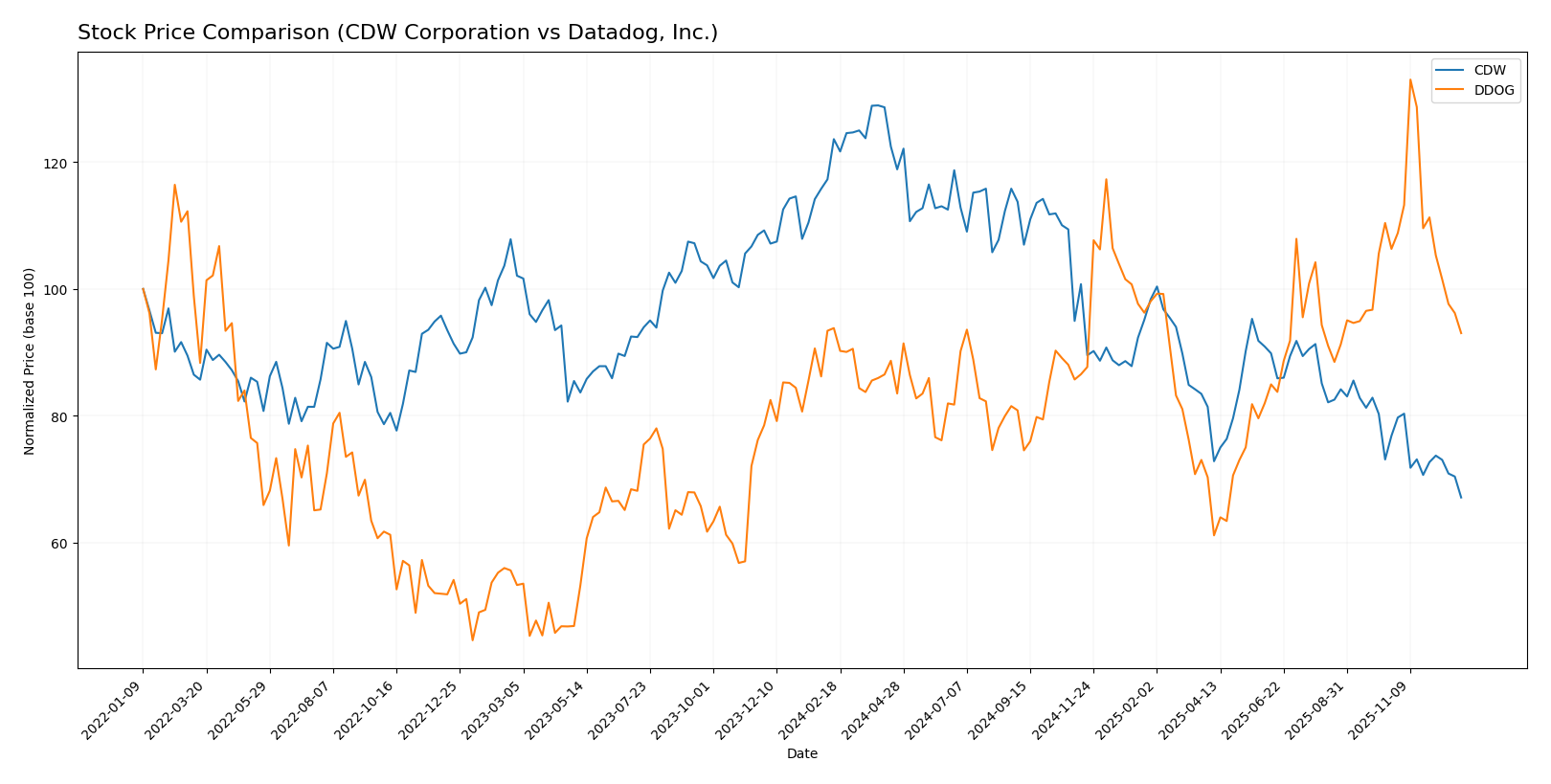

Stock Comparison

The stock price movements of CDW Corporation and Datadog, Inc. over the past year reveal significant declines, with both stocks experiencing bearish trends and decelerating downward momentum.

Trend Analysis

CDW Corporation’s stock shows a bearish trend with a 45.7% decline over the past 12 months, accompanied by deceleration and high volatility, with prices ranging from 255.78 to 133.16.

Datadog, Inc. experienced a slight 0.85% decline over the same period, also bearish with deceleration, moderate volatility, and price fluctuations between 191.24 and 87.93.

Comparing both, CDW’s stock delivered the largest negative market performance, significantly underperforming Datadog’s more moderate decline over the past year.

Target Prices

Analysts present a clear target price consensus for both CDW Corporation and Datadog, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CDW Corporation | 190 | 148 | 175 |

| Datadog, Inc. | 215 | 105 | 180.87 |

The consensus target prices suggest significant upside potential compared to current prices: CDW trades near 133.16 USD versus a 175 USD consensus, and Datadog trades near 133.77 USD versus a 180.87 USD consensus. Analysts generally expect both stocks to appreciate.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CDW Corporation and Datadog, Inc.:

Rating Comparison

CDW Corporation Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating favorable valuation.

- ROE Score: 5, showing very strong profitability efficiency.

- ROA Score: 4, reflecting favorable asset utilization.

- Debt To Equity Score: 1, considered very unfavorable, high risk.

- Overall Score: 3, considered moderate overall rating.

Datadog, Inc. Rating

- Rating: C+, also noted as very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating favorable valuation.

- ROE Score: 2, indicating moderate profitability efficiency.

- ROA Score: 3, reflecting moderate asset utilization.

- Debt To Equity Score: 2, showing moderate financial risk.

- Overall Score: 2, considered moderate overall rating.

Which one is the best rated?

Based on the data, CDW holds a higher rating (B vs. C+) and outperforms Datadog in ROE and ROA scores, despite a less favorable debt-to-equity score. CDW’s overall score is also superior, indicating it is the better-rated company here.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

CDW Scores

- Altman Z-Score: 2.74, indicating a grey zone with moderate bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

DDOG Scores

- Altman Z-Score: 12.36, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

Which company has the best scores?

DDOG has a significantly higher Altman Z-Score, placing it in the safe zone, while CDW remains in the grey zone. Both companies share the same average Piotroski Score of 6. Thus, DDOG shows stronger financial stability based on these scores.

Grades Comparison

Here is a detailed comparison of the latest reliable grades for CDW Corporation and Datadog, Inc.:

CDW Corporation Grades

The following table presents recent grades from recognized financial institutions for CDW Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Raymond James | Upgrade | Strong Buy | 2025-11-25 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| UBS | Maintain | Buy | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-20 |

| UBS | Maintain | Buy | 2025-08-07 |

| Barclays | Maintain | Equal Weight | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-07-17 |

| Citigroup | Maintain | Neutral | 2025-07-11 |

| Barclays | Maintain | Equal Weight | 2025-05-08 |

Overall, CDW Corporation’s grades show a stable to positive trend with multiple “Buy,” “Outperform,” and “Strong Buy” ratings, indicating confidence among analysts.

Datadog, Inc. Grades

Below is the latest grading data for Datadog, Inc. from established financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-11-12 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-07 |

| Rosenblatt | Maintain | Buy | 2025-11-07 |

| RBC Capital | Maintain | Outperform | 2025-11-07 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-07 |

| Wells Fargo | Maintain | Overweight | 2025-11-07 |

| UBS | Maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-07 |

| Goldman Sachs | Maintain | Buy | 2025-11-07 |

| Truist Securities | Maintain | Hold | 2025-11-07 |

Datadog, Inc. displays consistent “Buy,” “Outperform,” and “Overweight” ratings, reflecting sustained analyst optimism with a few more cautious perspectives.

Which company has the best grades?

Both companies have strong analyst support, but CDW Corporation has a slightly more varied range including “Strong Buy” and solid “Outperform” ratings, while Datadog, Inc. predominantly holds steady “Buy” and “Outperform” grades. This variation suggests differing analyst confidence levels that could impact investor perception of growth potential and risk.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for CDW Corporation and Datadog, Inc. based on the most recent financial and operational data available as of 2026.

| Criterion | CDW Corporation | Datadog, Inc. |

|---|---|---|

| Diversification | Strong hardware (15.2B), software (3.8B), and services (1.9B) revenues provide balanced business streams | Primarily focused on cloud monitoring and analytics, less diversified |

| Profitability | Favorable ROIC (13.13%), ROE (45.81%), net margin neutral at 5.13% | Lower ROIC (1.07%) and ROE (6.77%), net margin neutral at 6.85% |

| Innovation | Moderate innovation with steady software product sales but declining ROIC trend | High innovation with rapidly growing ROIC (+224%), but currently shedding value |

| Global presence | Established global distribution network through hardware and services | Strong presence in cloud-native markets, mainly US and Europe |

| Market Share | Large market share in IT hardware distribution | Growing market share in cloud monitoring but faces stiff competition |

Key takeaways: CDW Corporation demonstrates a well-diversified business with solid profitability and stable market presence, though its profitability shows signs of decline. Datadog offers promising innovation and growth potential but currently struggles with profitability and value creation. Investors should balance CDW’s stability against Datadog’s growth risks.

Risk Analysis

Below is a comparative table highlighting key risks for CDW Corporation and Datadog, Inc. based on the most recent data from 2024.

| Metric | CDW Corporation | Datadog, Inc. |

|---|---|---|

| Market Risk | Moderate, beta 1.06 | Higher, beta 1.23 |

| Debt level | High, Debt-to-Equity 2.55 (unfavorable) | Moderate, Debt-to-Equity 0.68 (neutral) |

| Regulatory Risk | Moderate, operates in IT services with government contracts | Moderate, SaaS provider with global cloud regulations |

| Operational Risk | Moderate, complex supply chain and service delivery | Moderate, dependency on cloud infrastructure uptime |

| Environmental Risk | Low, primarily IT hardware/software distribution | Low, cloud software with minor direct environmental impact |

| Geopolitical Risk | Moderate, US/UK/Canada operations | Moderate, international cloud service exposure |

The most impactful risks are CDW’s elevated debt level, which could pressure financial stability despite favorable profitability, and Datadog’s high market volatility and stretched valuation, reflected in its high P/E ratio. Both companies face operational risks tied to technology infrastructure and regulatory environments, requiring vigilant risk management.

Which Stock to Choose?

CDW Corporation shows a favorable income statement with a 13.7% revenue growth over five years and solid profitability metrics, including a 45.8% ROE and a 13.1% ROIC, despite recent slight declines. Its debt ratios present some concerns, but overall, the rating is very favorable.

Datadog, Inc. has a strong income growth profile with 344.8% revenue growth and improving profitability, although ROE and ROIC remain low at 6.8% and 1.1%, respectively. Debt levels are moderate, and its rating is very favorable, but some ratios indicate financial challenges.

Investors focused on value and quality might find CDW’s stable profitability and value creation appealing, while those prioritizing high growth potential could view Datadog’s rapid income expansion and improving returns as attractive, despite its current financial risks.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CDW Corporation and Datadog, Inc. to enhance your investment decisions: