In today’s fast-evolving tech landscape, Zscaler, Inc. and CCC Intelligent Solutions Holdings Inc. stand out as key players in the software infrastructure sector. Both companies leverage cloud technology and AI to innovate within overlapping markets, focusing on cybersecurity and insurance ecosystems respectively. Their distinct approaches to digital transformation make comparing them a compelling exercise. Join me as we explore which company offers the most promising investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Zscaler and CCC Intelligent Solutions by providing an overview of these two companies and their main differences.

Zscaler Overview

Zscaler, Inc. is a cloud security company headquartered in San Jose, California. It provides secure access solutions for users, servers, and IoT devices to managed applications both externally and internally hosted, including SaaS and cloud environments. Zscaler’s platform includes digital experience monitoring and workload segmentation to mitigate risks and ensure compliance across multiple industries such as healthcare, finance, and technology.

CCC Intelligent Solutions Overview

CCC Intelligent Solutions Holdings Inc., based in Chicago, Illinois, delivers cloud, AI, and telematics technologies specifically for the property and casualty insurance sector. Its SaaS platform supports AI-enabled workflows that connect carriers, repairers, parts suppliers, and financial institutions. CCC offers various solutions for insurance workflow, repair management, parts, automotive manufacturers, and international markets, serving the insurance economy with a focus on digital transformation.

Key similarities and differences

Both Zscaler and CCC operate in the software infrastructure industry, leveraging cloud-based platforms to serve specialized sectors. Zscaler focuses on cybersecurity across diverse industries, emphasizing secure access and workload segmentation, while CCC concentrates on the insurance economy with AI-driven workflow digitization and ecosystem connectivity. Despite their technology-driven models, their market focus and application scope differ significantly, reflecting distinct customer bases and use cases.

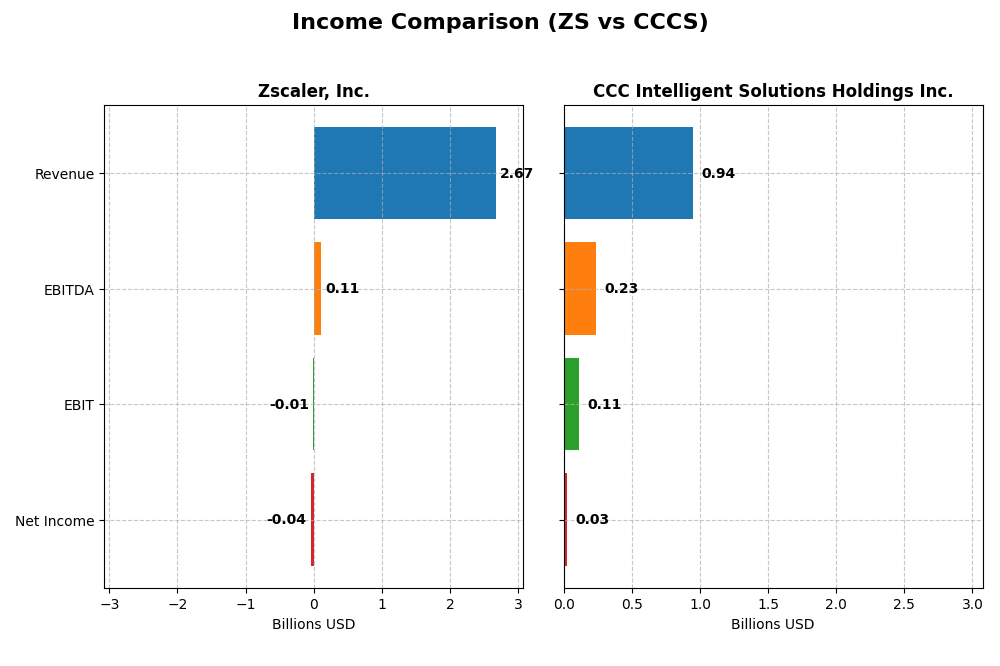

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Zscaler, Inc. and CCC Intelligent Solutions Holdings Inc. for their most recent fiscal years.

| Metric | Zscaler, Inc. (ZS) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Cap | 34.1B | 5.63B |

| Revenue | 2.67B | 945M |

| EBITDA | 112M | 233M |

| EBIT | -8.8M | 109M |

| Net Income | -41.5M | 26.1M |

| EPS | -0.27 | 0.0428 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Zscaler, Inc.

Zscaler’s revenue rose substantially from $673M in 2021 to $2.67B in 2025, with net income losses narrowing from -$262M to -$41M. The gross margin remained strong at 76.87%, but EBIT and net margins stayed negative, though improving. The 2025 fiscal year showed favorable growth across revenue, EBIT, and net margin, indicating margin improvement despite ongoing losses.

CCC Intelligent Solutions Holdings Inc.

CCC Intelligent Solutions’ revenue increased steadily from $633M in 2020 to $945M in 2024, with net income shifting from a loss of -$17M to a profit of $26M. Gross margin held stable near 75.55%, and EBIT margin was positive at 11.53%. The latest year showed strong EBIT and net margin growth, with net profitability achieved after previous losses, reflecting improving fundamentals.

Which one has the stronger fundamentals?

Both companies demonstrate favorable revenue and margin trends with stable gross margins above 75%. Zscaler shows rapid revenue growth and margin improvement but remains unprofitable. CCC Intelligent Solutions has slower revenue growth but turned net positive with solid EBIT margins. CCC’s positive net income and EBIT margins provide a stronger current profitability base, while Zscaler’s faster growth and narrowing losses indicate potential but with higher risk.

Financial Ratios Comparison

The table below presents a factual comparison of key financial ratios for Zscaler, Inc. (ZS) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on their most recent fiscal year data.

| Ratios | Zscaler, Inc. (2025) | CCC Intelligent Solutions Holdings Inc. (2024) |

|---|---|---|

| ROE | -2.31% | 1.31% |

| ROIC | -3.18% | 1.86% |

| P/E | -1063 | 274.02 |

| P/B | 24.51 | 3.59 |

| Current Ratio | 2.01 | 3.65 |

| Quick Ratio | 2.01 | 3.65 |

| D/E (Debt-to-Equity) | 1.00 | 0.42 |

| Debt-to-Assets | 28.0% | 26.7% |

| Interest Coverage | -13.49 | 1.24 |

| Asset Turnover | 0.42 | 0.30 |

| Fixed Asset Turnover | 4.22 | 4.68 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Zscaler, Inc.

Zscaler’s 2025 financial ratios reveal mixed strength, with favorable liquidity indicated by a current ratio of 2.01 and a debt to assets ratio at 27.98%. However, profitability ratios such as net margin (-1.55%), return on equity (-2.31%), and return on invested capital (-3.18%) are unfavorable, signaling persistent losses. The company does not pay dividends, reflecting its reinvestment strategy and focus on growth.

CCC Intelligent Solutions Holdings Inc.

No financial ratio data is available for CCC Intelligent Solutions Holdings Inc. as of 2025. This absence limits the ability to analyze its financial strength, profitability, or liquidity. The company also does not pay dividends, possibly indicating a reinvestment approach or growth phase, but this cannot be confirmed without more data.

Which one has the best ratios?

Based on the available information, Zscaler, Inc. shows a more comprehensive financial profile with both favorable and unfavorable ratios, though its overall evaluation is slightly unfavorable. CCC Intelligent Solutions Holdings Inc.’s lack of data prevents any comparative assessment, making Zscaler the only company with a measurable ratio performance at this time.

Strategic Positioning

This section compares the strategic positioning of Zscaler, Inc. and CCC Intelligent Solutions Holdings Inc., including their market position, key segments, and exposure to technological disruption:

Zscaler, Inc.

- Leading cloud security provider with strong market presence and moderate competitive pressure.

- Specializes in cloud security, SaaS access, workload segmentation, serving diverse industries.

- Positioned in advanced cloud security with ongoing innovation mitigating technological disruption.

CCC Intelligent Solutions Holdings Inc.

- Focused on property and casualty insurance software with smaller market capitalization.

- Offers AI-enabled SaaS platforms for insurance economy including repair, parts, and payments.

- Relies on cloud, AI, and telematics in insurance, facing moderate disruption from tech evolution.

Zscaler, Inc. vs CCC Intelligent Solutions Holdings Inc. Positioning

Zscaler has a diversified, multi-industry cloud security platform supporting broad digital transformation, while CCC concentrates on insurance sector SaaS solutions. Zscaler’s larger scale may offer advantages in innovation pace, CCC’s niche focus may limit exposure but constrain growth scope.

Which has the best competitive advantage?

Based on MOAT evaluation, Zscaler is currently shedding value but shows improving profitability, indicating a slightly unfavorable moat. CCC lacks sufficient data for MOAT assessment, preventing a definitive competitive advantage comparison.

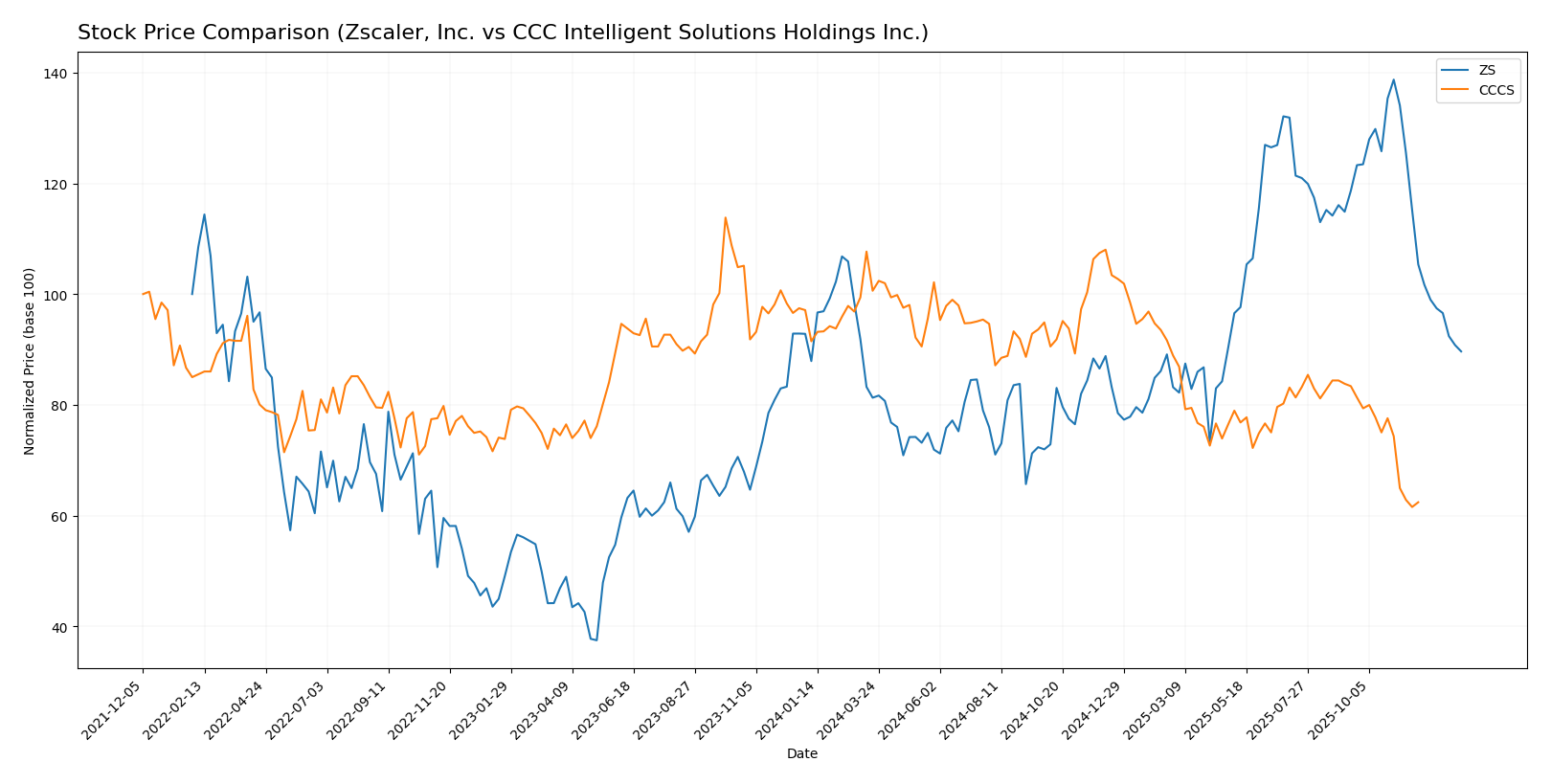

Stock Comparison

The past year has seen both Zscaler, Inc. and CCC Intelligent Solutions Holdings Inc. experience notable declines, with pronounced bearish trends and differing volatility profiles, reflecting distinct market dynamics and investor sentiment.

Trend Analysis

Zscaler, Inc. shows a bearish trend over the past 12 months with a -9.03% price change and decelerating downward momentum. The stock exhibited high volatility, ranging from 156.78 to 331.14, with recent steep declines.

CCC Intelligent Solutions Holdings Inc. also follows a bearish trend with a -31.78% decrease over the last year and deceleration in the downward trend. The stock’s price ranged narrowly between 7.22 and 12.67, showing much lower volatility than ZS.

Comparing the two, Zscaler, Inc. has delivered a less severe market performance decline than CCC Intelligent Solutions, maintaining relatively higher price levels despite both stocks trending downward.

Target Prices

The current analyst consensus indicates promising upside potential for Zscaler, Inc. and stable expectations for CCC Intelligent Solutions Holdings Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Zscaler, Inc. | 360 | 260 | 311.41 |

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

Analysts expect Zscaler’s price to rise significantly from its current 213.98 USD to a consensus target of 311.41 USD, suggesting strong growth potential. CCC Intelligent Solutions has a stable consensus target of 11 USD, modestly above its current price of 8.75 USD, indicating limited but positive upside.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Zscaler, Inc. and CCC Intelligent Solutions Holdings Inc.:

Rating Comparison

ZS Rating

- Rating: C- with a “Very Favorable” status according to provided evaluation.

- Discounted Cash Flow Score: 4, indicating a “Favorable” valuation.

- ROE Score: 1, classified as “Very Unfavorable,” reflecting weak equity returns.

- ROA Score: 1, also “Very Unfavorable,” showing poor asset utilization.

- Debt To Equity Score: 1, “Very Unfavorable,” indicating high financial risk.

- Overall Score: 1, rated as “Very Unfavorable.”

CCCS Rating

- No rating data available for CCCS.

- No data on Discounted Cash Flow Score.

- No Return on Equity Score provided.

- No Return on Assets Score available.

- No Debt To Equity Score data present.

- No overall score available for comparison.

Which one is the best rated?

Based strictly on the provided data, Zscaler, Inc. holds a C- rating with detailed scores, though most are very unfavorable except for a favorable DCF score. CCC Intelligent Solutions Holdings Inc. lacks any rating or score data, making Zscaler the only company with available analyst evaluations.

Scores Comparison

The comparison of Zscaler, Inc. and CCC Intelligent Solutions Holdings Inc. scores is as follows:

Zscaler, Inc. Scores

- Altman Z-Score: 4.89, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 3, categorized as very weak financial strength.

CCC Intelligent Solutions Holdings Inc. Scores

- Altman Z-Score: 2.18, placing the company in a grey zone with moderate bankruptcy risk.

- Piotroski Score: 3, also categorized as very weak financial strength.

Which company has the best scores?

Zscaler, Inc. shows a stronger Altman Z-Score, indicating better financial stability compared to CCC Intelligent Solutions. Both companies share equally low Piotroski Scores, reflecting similarly weak financial strength.

Grades Comparison

The following section presents a comparison of the latest available grades for the two companies:

Zscaler, Inc. Grades

This table summarizes recent grades from notable financial institutions for Zscaler, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Mizuho | Upgrade | Outperform | 2025-12-16 |

| Bernstein | Downgrade | Market Perform | 2025-12-01 |

| Citigroup | Maintain | Buy | 2025-12-01 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Baird | Maintain | Outperform | 2025-11-26 |

| BTIG | Maintain | Buy | 2025-11-26 |

Zscaler’s grades predominantly indicate a positive outlook with multiple “Buy,” “Overweight,” and “Outperform” ratings, though a recent downgrade to “Market Perform” shows some caution.

CCC Intelligent Solutions Holdings Inc. has no available reliable grading data to report. The risk profile should be assessed using other metrics as grades are not provided.

Which company has the best grades?

Zscaler, Inc. has received a broader and generally more favorable set of grades compared to CCC Intelligent Solutions Holdings Inc., which lacks reliable grading data. This suggests clearer analyst confidence in Zscaler, potentially influencing investor perception and portfolio decisions towards more established analyst support.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Zscaler, Inc. (ZS) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent available data.

| Criterion | Zscaler, Inc. (ZS) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Diversification | Primarily focused on cloud security; limited diversification but strong in its niche | Mainly software subscriptions and services; moderate diversification within software sector |

| Profitability | Negative net margin (-1.55%), ROE (-2.31%), and ROIC (-3.18%); slightly unfavorable | Data unavailable; unable to assess profitability accurately |

| Innovation | Strong innovation in cloud security with growing ROIC trend despite current losses | Innovation level not assessed due to data limitations |

| Global presence | Global cloud security provider with expanding international footprint | Primarily North American presence with steady growth |

| Market Share | Significant market share in cloud security with $2.67B revenue in 2025 | Smaller scale with $906M in software subscriptions (2024) |

Key takeaways: Zscaler shows strong innovation and market presence but struggles with profitability and value creation, indicating risk. CCC Intelligent Solutions lacks sufficient data for a full analysis but operates with moderate diversification in software subscriptions. Caution and further data are advised for CCCS investments.

Risk Analysis

Below is a comparison of key risks for Zscaler, Inc. (ZS) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent data available for 2025-2026.

| Metric | Zscaler, Inc. (ZS) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Risk | Beta 1.02, moderate volatility | Beta 0.72, lower volatility |

| Debt level | Debt-to-Assets 28%, moderate debt | Data unavailable, potential uncertainty |

| Regulatory Risk | Moderate, tech/cloud compliance | Moderate, insurance tech regulations |

| Operational Risk | Medium, cloud security service reliance | Medium, SaaS platform complexity |

| Environmental Risk | Low, mostly digital operations | Low, primarily software-based |

| Geopolitical Risk | Moderate, US-based with global clients | Moderate, US-based with insurance sector exposure |

Zscaler faces moderate market and operational risks due to its cloud security focus and ongoing unprofitability, despite a strong Altman Z-score indicating financial stability. CCCS shows lower market volatility but lacks recent financial transparency, reflected in its Altman Z-score in the grey zone. Investors should monitor Zscaler’s operational risks and CCCS’s financial disclosures closely.

Which Stock to Choose?

Zscaler, Inc. (ZS) has shown strong income growth with a 297% revenue increase over five years and mostly favorable income statement metrics, despite negative profitability ratios and some debt concerns. Its rating is mixed, with a very favorable overall rating but very unfavorable underlying financial scores, indicating a slightly unfavorable global financial ratio evaluation.

CCC Intelligent Solutions Holdings Inc. (CCCS) reports favorable income growth and profitability, including an 11.5% EBIT margin and positive net margin, with moderate debt levels. However, due to missing detailed ratio and rating data, the overall financial health and risk profile are less clear, though score evaluations place it in the Altman Z-Score grey zone, suggesting moderate financial risk.

For investors, those focused on growth and strong income expansion might find ZS’s improving profitability and high income growth appealing despite its financial ratio challenges. Conversely, investors prioritizing moderate profitability and clearer debt metrics might see CCCS as potentially more stable, though incomplete data advises caution. Each stock’s profile may appear more or less favorable depending on risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Zscaler, Inc. and CCC Intelligent Solutions Holdings Inc. to enhance your investment decisions: