In the rapidly evolving technology sector, CCC Intelligent Solutions Holdings Inc. (CCCS) and Veritone, Inc. (VERI) stand out as innovators in software infrastructure with distinct yet overlapping AI-driven solutions. CCCS focuses on property and casualty insurance workflows, while Veritone delivers an AI operating system catering to diverse industries. Comparing their strategies and market positions will help you identify which company holds the most promise for your investment portfolio. Let’s explore which one deserves your attention.

Table of contents

Companies Overview

I will begin the comparison between CCC Intelligent Solutions Holdings Inc. and Veritone, Inc. by providing an overview of these two companies and their main differences.

CCC Intelligent Solutions Holdings Inc. Overview

CCC Intelligent Solutions Holdings Inc. focuses on delivering cloud, mobile, AI, telematics, and hyperscale technologies tailored to the property and casualty insurance economy. Its SaaS platform supports AI-enabled workflows and commerce connections across insurance carriers, repairers, parts suppliers, and financial institutions. Founded in 1980 and based in Chicago, CCC holds a strong position in software infrastructure within the insurance sector.

Veritone, Inc. Overview

Veritone, Inc. specializes in AI computing solutions through its aiWARE platform, which applies machine learning and cognitive processes to analyze structured and unstructured data. Serving markets such as media, government, and legal compliance, Veritone also offers media advertising agency services. Founded in 2014 and headquartered in Denver, the company operates within the software infrastructure industry with a focus on AI-driven data insights and media solutions.

Key similarities and differences

Both companies operate in the software infrastructure sector with a focus on AI technologies. CCC targets the insurance economy with specialized SaaS platforms for workflow digitization and commerce, while Veritone emphasizes AI-driven data analytics and media services. CCC is larger in market capitalization and employee count, reflecting a broader industry footprint, whereas Veritone’s higher beta indicates greater stock volatility. Their business models reflect distinct market verticals despite shared technological foundations.

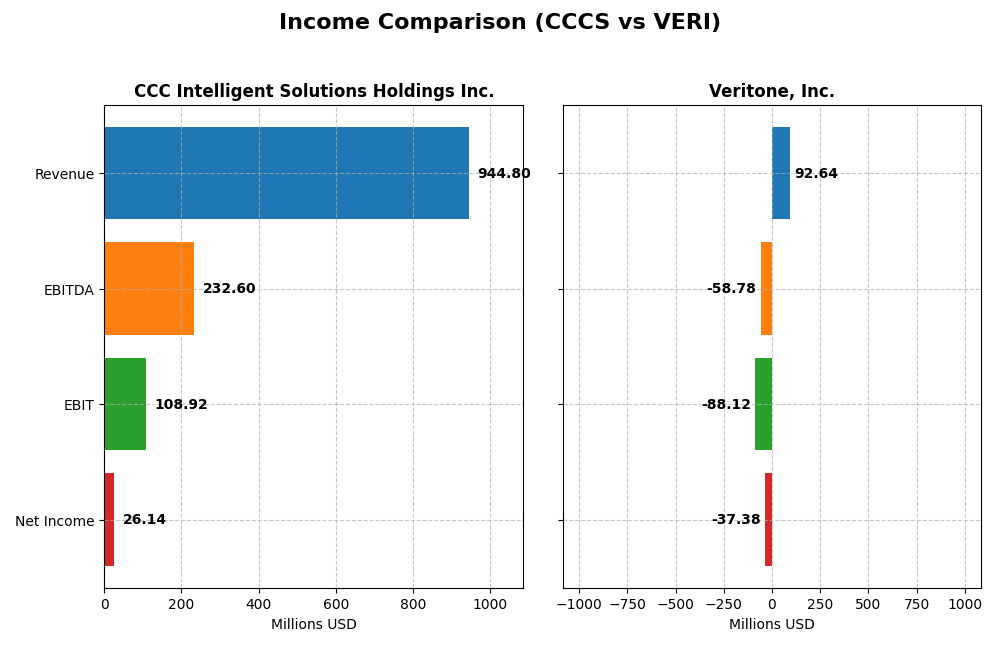

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for CCC Intelligent Solutions Holdings Inc. and Veritone, Inc. for the fiscal year 2024.

| Metric | CCC Intelligent Solutions Holdings Inc. | Veritone, Inc. |

|---|---|---|

| Market Cap | 5.63B | 225M |

| Revenue | 945M | 93M |

| EBITDA | 233M | -59M |

| EBIT | 109M | -88M |

| Net Income | 26M | -37M |

| EPS | 0.043 | -0.98 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

CCC Intelligent Solutions Holdings Inc.

CCC Intelligent Solutions showed a steady revenue increase from $633M in 2020 to $945M in 2024, with net income turning positive in 2022 and growing to $26M by 2024. Gross and EBIT margins improved to 75.55% and 11.53%, respectively, reflecting operational efficiency. In 2024, revenue growth slowed slightly to 9%, but margins and net income growth remained robust.

Veritone, Inc.

Veritone’s revenue grew overall from $58M in 2020 to $93M in 2024 but declined 7.35% in the last year. Net income remained negative, though losses narrowed from -$65M in 2021 to -$37M in 2024. Gross margin stayed favorable at 70.58%, but EBIT and net margins were deeply negative, indicating ongoing profitability challenges despite some recent margin improvements.

Which one has the stronger fundamentals?

CCC Intelligent Solutions presents stronger fundamentals with consistent revenue and net income growth, improving profitability margins, and positive EBIT in 2024. Veritone’s fundamentals are weaker due to persistent net losses, negative EBIT margin, and recent revenue decline, despite favorable gross margins and some growth improvements over the longer period. Overall, CCC demonstrates more stable and favorable income statement metrics.

Financial Ratios Comparison

The table below presents key financial ratios for CCC Intelligent Solutions Holdings Inc. and Veritone, Inc. as reported for fiscal year 2024, providing a snapshot of their profitability, liquidity, leverage, and market valuation metrics.

| Ratios | CCC Intelligent Solutions Holdings Inc. (CCCS) | Veritone, Inc. (VERI) |

|---|---|---|

| ROE | 1.31% | -277.91% |

| ROIC | 1.86% | -58.27% |

| P/E | 274.02 | -3.34 |

| P/B | 3.59 | 9.27 |

| Current Ratio | 3.65 | 0.97 |

| Quick Ratio | 3.65 | 0.97 |

| D/E (Debt-to-Equity) | 0.42 | 8.91 |

| Debt-to-Assets | 26.65% | 60.54% |

| Interest Coverage | 1.24 | -7.31 |

| Asset Turnover | 0.30 | 0.47 |

| Fixed Asset Turnover | 4.68 | 8.51 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

CCC Intelligent Solutions Holdings Inc.

CCC Intelligent Solutions shows mixed financial ratios with a strong current ratio of 3.65, indicating good short-term liquidity. However, returns on assets, equity, and invested capital remain very low or negative, suggesting weak profitability. Intangibles account for a large asset portion, and net debt to EBITDA is moderate. The company does not pay dividends, likely prioritizing reinvestment and growth.

Veritone, Inc.

Veritone’s ratios are largely unfavorable, with a net margin of -40.36% and a return on equity of -277.91%, signaling significant losses and poor profitability. The current ratio is below 1, reflecting liquidity concerns, and debt levels are high with a debt-to-assets ratio above 60%. Veritone does not pay dividends, consistent with its negative earnings and focus on AI platform development.

Which one has the best ratios?

CCC Intelligent Solutions holds relatively better ratios, particularly in liquidity and some operational metrics, despite weak profitability. Veritone faces numerous financial challenges, including poor margins, high leverage, and liquidity pressures, leading to a very unfavorable overall ratios assessment. Thus, CCC Intelligent Solutions presents a comparatively stronger financial profile.

Strategic Positioning

This section compares the strategic positioning of CCC Intelligent Solutions Holdings Inc. and Veritone, Inc., including market position, key segments, and exposure to technological disruption:

CCC Intelligent Solutions Holdings Inc.

- Strong market cap of 5.6B, operating in insurance tech with moderate competitive pressure

- Focus on SaaS software subscriptions and ecosystem services in insurance and automotive sectors

- Uses AI, cloud, mobile, and telematics technologies focused on property and casualty insurance workflows

Veritone, Inc.

- Smaller market cap of 225M, higher volatility, serving diverse verticals with intense competition

- Diverse revenue streams from AI platform licensing, managed services, advertising, and media solutions

- AI computing platform with machine learning and cognitive applications across multiple industries

CCC Intelligent Solutions Holdings Inc. vs Veritone, Inc. Positioning

CCC targets a concentrated insurance technology market with scalable SaaS solutions, benefiting from a specialized ecosystem. Veritone pursues a diversified AI platform strategy across various sectors, which may dilute focus but offers multiple growth drivers.

Which has the best competitive advantage?

Veritone’s MOAT evaluation is very unfavorable, indicating value destruction and declining profitability. CCC’s MOAT data is unavailable, so advantage assessment is inconclusive based on provided information.

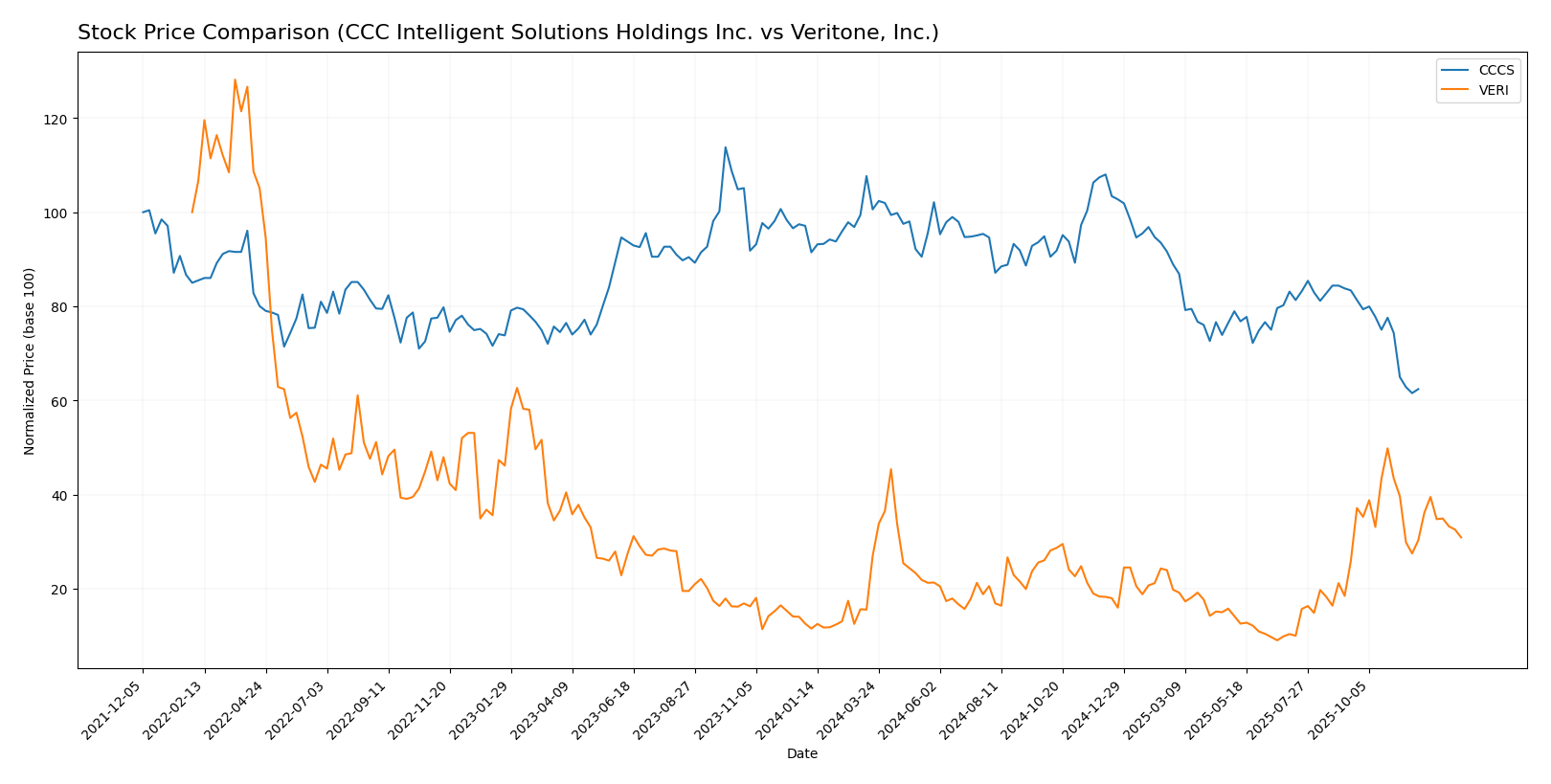

Stock Comparison

The stock price chart highlights significant divergences in performance over the past 12 months, with one company experiencing a marked decline and the other showing strong growth despite recent pullbacks.

Trend Analysis

CCC Intelligent Solutions Holdings Inc. (CCCS) exhibits a bearish trend with a -31.78% price change over the past year, showing deceleration and a recent negative slope of -0.25 from September to November 2025. Veritone, Inc. (VERI) shows a bullish trend over the same period, with a 147.22% increase, although recent months reveal a decelerating decline of -28.91% from November 2025 to January 2026. Comparing both stocks, VERI delivered the highest market performance with substantial overall gains, while CCCS faced significant losses.

Target Prices

The current analyst consensus for target prices indicates moderate upside potential for these technology companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

| Veritone, Inc. | 10 | 9 | 9.5 |

Analysts expect CCC Intelligent Solutions to reach $11, above its current $8.75 price, suggesting upside. Veritone’s consensus target of $9.5 also implies potential growth from its $4.45 market price.

Analyst Opinions Comparison

This section compares analysts’ ratings and scores for CCC Intelligent Solutions Holdings Inc. (CCCS) and Veritone, Inc. (VERI):

Rating Comparison

CCCS Rating

- No rating data available.

- No DCF score data available.

- No ROE score data available.

- No ROA score data available.

- No Debt to Equity score data available.

- No overall score data available.

VERI Rating

- Rated C with an overall score of 2, indicating a moderate rating.

- Discounted Cash Flow score is 5, rated very favorable.

- Return on Equity score is 1, rated very unfavorable.

- Return on Assets score is 1, rated very unfavorable.

- Debt to Equity score is 1, rated very unfavorable.

- Overall score is 2, evaluated as moderate.

Which one is the best rated?

Based strictly on the provided data, only VERI has available ratings and scores. VERI’s overall rating is moderate, supported by a very favorable discounted cash flow score but offset by very unfavorable profitability and leverage metrics. CCCS has no rating data for comparison.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for CCC Intelligent Solutions Holdings Inc. and Veritone, Inc.:

CCCS Scores

- Altman Z-Score: 2.18, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 3, classified as very weak financial strength.

VERI Scores

- Altman Z-Score: -0.07, indicating high bankruptcy risk in the distress zone.

- Piotroski Score: 3, classified as very weak financial strength.

Which company has the best scores?

Based on the provided data, CCC Intelligent Solutions has a higher Altman Z-Score, placing it in the grey zone, while Veritone falls into the distress zone. Both companies share the same very weak Piotroski Score of 3.

Grades Comparison

Here is a comparison of the recent grades assigned to the two companies by professional grading firms and consensus data:

Veritone, Inc. Grades

The table below summarizes recent grades from recognized grading companies for Veritone, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| D. Boral Capital | Maintain | Buy | 2025-12-09 |

| D. Boral Capital | Maintain | Buy | 2025-12-04 |

| Needham | Maintain | Buy | 2025-12-02 |

| D. Boral Capital | Maintain | Buy | 2025-12-02 |

| D. Boral Capital | Maintain | Buy | 2025-11-07 |

| D. Boral Capital | Maintain | Buy | 2025-10-28 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-20 |

| D. Boral Capital | Maintain | Buy | 2025-10-15 |

| D. Boral Capital | Maintain | Buy | 2025-09-24 |

| D. Boral Capital | Maintain | Buy | 2025-09-09 |

Veritone, Inc. consistently maintains a “Buy” rating from multiple credible sources over several months, indicating stable positive sentiment.

CCC Intelligent Solutions Holdings Inc. Grades

No reliable grading company data is available for CCC Intelligent Solutions Holdings Inc., only consensus ratings.

The consensus rating for CCC Intelligent Solutions Holdings Inc. is “Buy,” based on 6 buy, 3 hold, and 1 sell recommendations, showing moderate optimism but with some reservations.

Which company has the best grades?

Veritone, Inc. has received more frequent and consistently positive grades from professional grading companies than CCC Intelligent Solutions Holdings Inc., whose data is limited to consensus ratings. This may imply stronger analyst conviction for Veritone, potentially influencing investor confidence and portfolio decisions.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for CCC Intelligent Solutions Holdings Inc. (CCCS) and Veritone, Inc. (VERI) based on the most recent financial and operational data available.

| Criterion | CCC Intelligent Solutions Holdings Inc. (CCCS) | Veritone, Inc. (VERI) |

|---|---|---|

| Diversification | Primarily focused on software subscriptions (906M in 2024) with limited other service revenue (38M) | Diverse revenue streams including software products (61M), managed services (32M), and licensing (19M) in 2024 |

| Profitability | Data unavailable due to missing financial ratios | Negative profitability with net margin at -40.36% and ROE at -277.91% in 2024 |

| Innovation | Strong growth in software subscriptions revenue from 662M (2021) to 906M (2024) indicates product adoption | Innovation challenges reflected in declining ROIC (-58.27%) and unfavorable overall moat assessment |

| Global presence | No specific data, implied moderate presence given software subscription scale | Likely limited global reach; revenues concentrated in niche AI and advertising sectors |

| Market Share | Leading position in its niche software subscription market implied by consistent revenue growth | Market share likely constrained by financial struggles and high debt levels (D/E ratio 8.91) |

Key takeaways: CCC Intelligent Solutions shows strong growth in its core software subscription business, supporting its innovation strength despite lack of profitability data. Veritone faces significant profitability and efficiency challenges, with declining returns and high leverage signaling investment risks. Investors should weigh CCCS’s growth potential against VERI’s financial headwinds carefully.

Risk Analysis

Below is a comparison of key risks for CCC Intelligent Solutions Holdings Inc. (CCCS) and Veritone, Inc. (VERI) based on the most recent data from 2024-2026.

| Metric | CCC Intelligent Solutions (CCCS) | Veritone, Inc. (VERI) |

|---|---|---|

| Market Risk | Moderate (Beta 0.72, stable sector) | High (Beta 2.05, volatile stock) |

| Debt Level | Data unavailable | High (Debt/Equity 8.91, 60.5% assets financed by debt) |

| Regulatory Risk | Moderate (Tech & insurance sector regulations) | Moderate to high (AI and data privacy regulations) |

| Operational Risk | Moderate (AI platform complexity) | High (AI platform and media services, smaller scale) |

| Environmental Risk | Low (Software sector, minimal direct impact) | Low (Software sector, minimal direct impact) |

| Geopolitical Risk | Moderate (US based, global insurance clients) | Moderate (US/UK presence, sensitive to international data laws) |

The most impactful risks are Veritone’s high leverage and weak profitability, placing it in financial distress with a very weak Piotroski score and unfavorable profitability ratios. CCCS, with moderate market risk and insufficient debt data, appears less risky but lacks full financial transparency. Investors should be cautious with VERI due to its financial instability and operational vulnerabilities.

Which Stock to Choose?

CCC Intelligent Solutions Holdings Inc. (CCCS) shows a favorable income evolution with consistent revenue and net income growth, supported by strong gross and EBIT margins. Financial ratios suggest moderate profitability, manageable debt levels, and a neutral rating environment, though some score indicators point to financial weakness.

Veritone, Inc. (VERI) exhibits mixed income results, with a favorable overall income statement despite negative margins and declining profitability ratios. Its financial ratios are largely unfavorable, highlighting high debt, poor returns, and liquidity challenges, but the company maintains a very favorable rating score in some aspects.

Investors focused on growth and improving income trends might find CCCS appealing due to its favorable income growth and more stable financial ratios, while those who consider valuation metrics and rating scores could interpret VERI’s profile as a potential turnaround candidate despite its financial challenges. The choice may depend on the investor’s risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CCC Intelligent Solutions Holdings Inc. and Veritone, Inc. to enhance your investment decisions: