Home > Comparison > Technology > VRSN vs CCCS

The strategic rivalry between VeriSign, Inc. and CCC Intelligent Solutions Holdings Inc. shapes the future of technology infrastructure. VeriSign dominates as a domain name registry and internet security provider, while CCC leads with AI-driven SaaS solutions for the insurance economy. This analysis contrasts their operational models and growth dynamics to identify which offers a superior risk-adjusted return for diversified portfolios in the evolving tech sector.

Table of contents

Companies Overview

VeriSign and CCC Intelligent Solutions hold pivotal roles in the software infrastructure landscape.

VeriSign, Inc.: Internet Infrastructure Pioneer

VeriSign dominates domain name registry services and operates critical internet infrastructure, including root zone maintainer services. Its revenue stems from managing authoritative resolution for .com and .net domains, a backbone for global e-commerce. In 2026, VeriSign focuses on maintaining security, stability, and resiliency of internet services, ensuring uninterrupted global connectivity.

CCC Intelligent Solutions Holdings Inc.: AI-Driven Insurance Tech

CCC Intelligent Solutions leads in cloud and AI-powered software for the property and casualty insurance sector. The company’s SaaS platform digitizes workflows and connects stakeholders like insurance carriers and auto manufacturers. In 2026, CCC prioritizes expanding its AI-enabled ecosystem to enhance commerce and operational efficiency within the insurance economy.

Strategic Collision: Similarities & Divergences

Both companies operate in technology infrastructure but serve distinct markets: VeriSign secures internet navigation, while CCC digitizes insurance workflows. VeriSign follows a closed ecosystem model rooted in domain registry control; CCC embraces an open, AI-driven platform connecting diverse insurance players. Their battleground is digital infrastructure, yet they offer unique investment profiles shaped by differing competitive moats and sector dynamics.

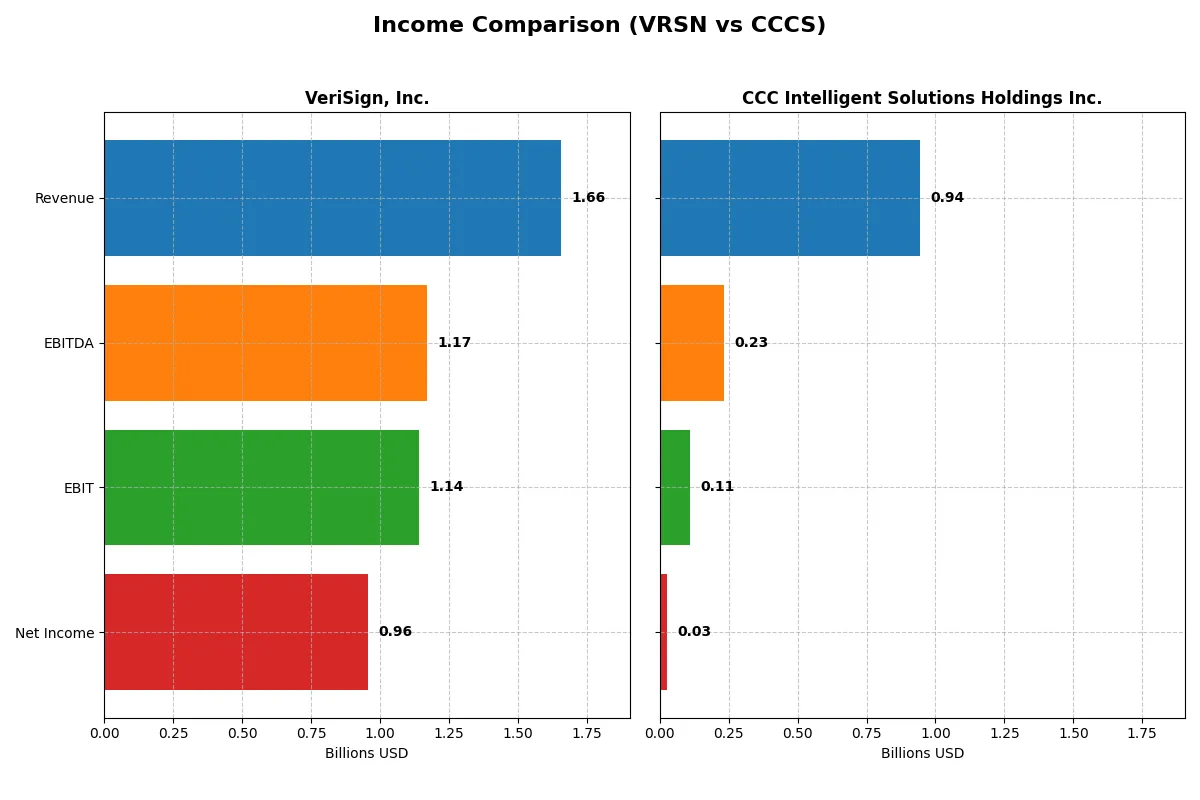

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | VeriSign, Inc. (VRSN) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Revenue | 1.66B | 945M |

| Cost of Revenue | 196M | 231M |

| Operating Expenses | 339M | 634M |

| Gross Profit | 1.46B | 714M |

| EBITDA | 1.17B | 233M |

| EBIT | 1.14B | 109M |

| Interest Expense | 77M | 65M |

| Net Income | 956M | 26M |

| EPS | 8.83 | 0.043 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes the true operational efficiency and profitability momentum of VeriSign and CCC Intelligent Solutions.

VeriSign, Inc. Analysis

VeriSign shows a steady revenue rise from $1.33B in 2021 to $1.66B in 2025, with net income growing from $785M to $955M. Its gross margin consistently exceeds 88%, reflecting exceptional cost control. The 2025 net margin of 57.7% confirms a robust, highly profitable model with strong earnings momentum and efficient capital allocation.

CCC Intelligent Solutions Holdings Inc. Analysis

CCC’s revenue grew sharply from $633M in 2020 to $945M in 2024, paralleled by a turnaround from a net loss of $17M to a net income of $26M. Gross margin improved to 75.6%, and EBIT margin climbed to 11.5%, signaling operational recovery. Despite low net margin (2.8%), CCC shows accelerating profitability and rapid growth in earnings per share.

Margin Dominance vs. Growth Revival

VeriSign dominates with superior margins and consistent net income growth, delivering stable, high-quality profits. CCC impresses with fast revenue expansion and a strong rebound from losses, but its profitability remains modest. VeriSign’s profile suits investors prioritizing efficiency and sustained earnings, while CCC appeals to those seeking high-growth turnaround potential.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | VeriSign, Inc. (VRSN) | CCC Intelligent Solutions (CCCS) |

|---|---|---|

| ROE | -0.65 | 0.013 |

| ROIC | -1.52 | 0.019 |

| P/E | 23.49 | 274.02 |

| P/B | -15.23 | 3.59 |

| Current Ratio | 0.49 | 3.65 |

| Quick Ratio | 0.49 | 3.65 |

| D/E (Debt/Equity) | -1.21 | 0.42 |

| Debt-to-Assets | 2.66 | 0.27 |

| Interest Coverage | 14.56 | 1.24 |

| Asset Turnover | 2.46 | 0.30 |

| Fixed Asset Turnover | 7.75 | 4.68 |

| Payout ratio | 0.23 | 0.00 |

| Dividend yield | 0.96% | 0.00% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational excellence essential for evaluating investment quality.

VeriSign, Inc.

VeriSign shows a high net margin of 57.7% but struggles with a deeply negative return on equity at -64.8%. Its P/E ratio of 23.5 suggests a fairly valued stock. The company returns modest dividends at 0.96%, indicating limited shareholder yield despite efficient asset turnover.

CCC Intelligent Solutions Holdings Inc.

No ratio data is available for CCC Intelligent Solutions, preventing a direct profitability or valuation analysis. This lack of transparency introduces uncertainty around its operational efficiency and shareholder return profile compared to VeriSign.

Transparency vs. Uncertainty: VeriSign’s Clear Metrics Win

VeriSign offers a clearer risk-reward balance with detailed ratio insights, despite some profitability concerns. CCC’s missing data raises caution. VeriSign suits investors prioritizing operational clarity; CCC’s profile remains undefined for cautious allocation.

Which one offers the Superior Shareholder Reward?

VeriSign (VRSN) pays a modest 0.96% dividend yield with a sustainable 22.5% payout ratio, backed by strong free cash flow of $11.6/share and aggressive buybacks boosting shareholder value. CCC Intelligent Solutions (CCCS) pays no dividend and reinvests heavily in growth, but its low free cash flow of $0.38/share and weaker margins limit near-term returns. I see VeriSign’s balanced mix of dividends and buybacks as the superior shareholder reward in 2026.

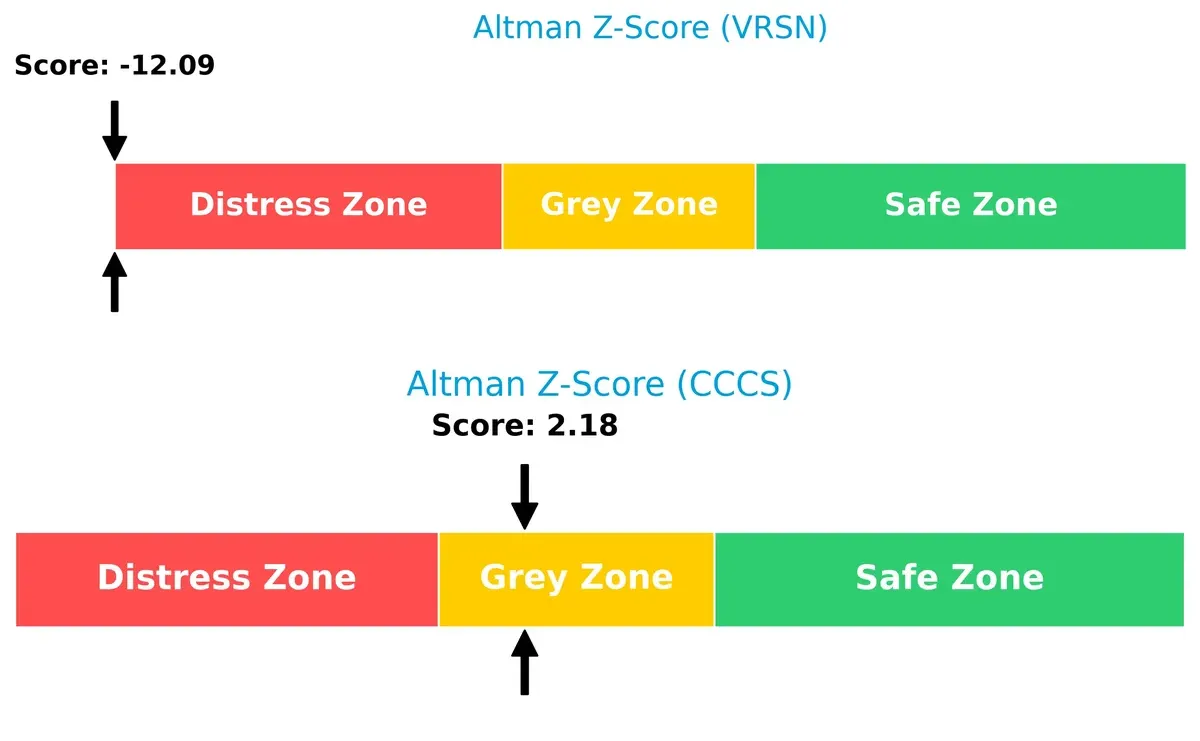

Bankruptcy Risk Duel (Altman Z-Score)

Bankruptcy Risk: Solvency Showdown

I analyze a stark contrast in Altman Z-Scores, where VeriSign (-12.1) plunges deep into distress, while CCC Intelligent Solutions (2.2) lingers in the grey zone:

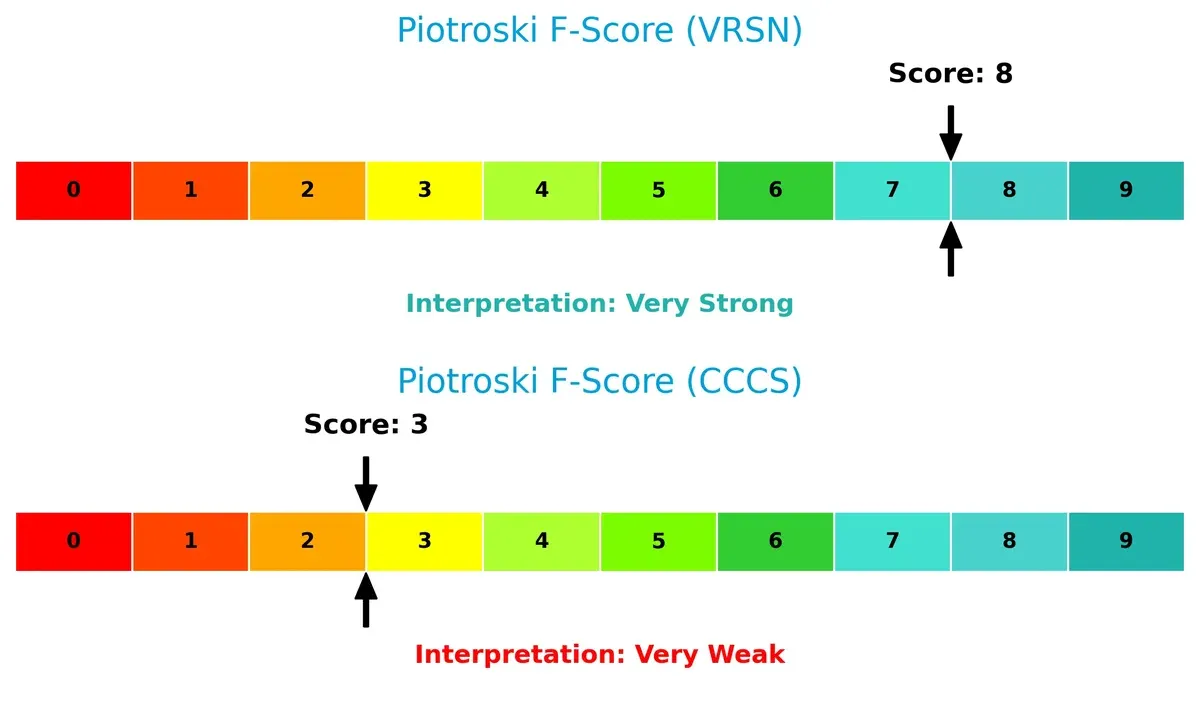

Financial Strength Showdown (Piotroski F-Score)

Financial Health: Quality of Operations

VeriSign posts a robust Piotroski F-Score of 8, signaling peak financial health. CCC Intelligent Solutions scores 3, raising red flags on internal financial metrics:

How are the two companies positioned?

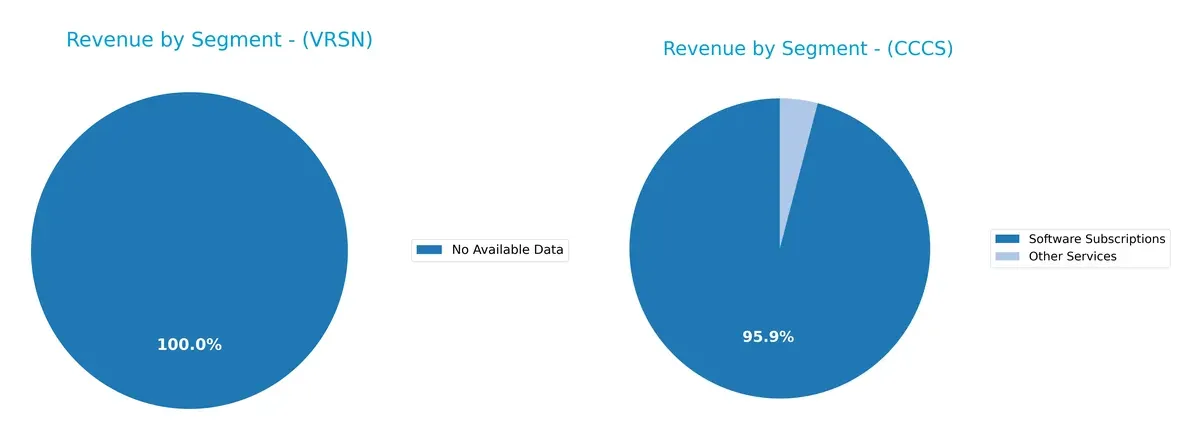

This section dissects the operational DNA of VeriSign and CCC Intelligent Solutions by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model delivers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how VeriSign, Inc. and CCC Intelligent Solutions Holdings diversify their income streams and reveals their primary sector bets:

VeriSign lacks available segment data, so I cannot assess its revenue mix. CCC Intelligent Solutions heavily leans on Software Subscriptions, generating $906M in 2024, dwarfing its $38M Other Services. This concentration anchors CCC’s strategy in scalable software, creating recurring revenue but exposing it to subscription market risks. In contrast, VeriSign’s unknown segmentation poses uncertainty about its diversification and potential risk concentration.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of VeriSign, Inc. and CCC Intelligent Solutions Holdings Inc.:

VeriSign Strengths

- Strong net margin of 57.68%

- Favorable WACC at 7.02%

- High asset and fixed asset turnover

- Solid interest coverage at 14.81

- Diversified global revenue with strong US and EMEA presence

CCC Intelligent Solutions Strengths

- Steady revenue growth in software subscriptions reaching 906M in 2024

- Dominant Americas market share with 938M revenue

- Consistent increase in Other Services revenue

- Focused specialization in software subscription services

VeriSign Weaknesses

- Negative ROE (-64.84%) and ROIC (-151.96%) indicate weak capital efficiency

- Low current and quick ratios at 0.49 raise liquidity concerns

- High debt to assets ratio at 265.55% signals leverage risk

- Negative PB ratio and low dividend yield

CCC Intelligent Solutions Weaknesses

- Lack of available financial ratios and key metrics limits transparency

- Heavy concentration in Americas region with minimal exposure in China

- Limited diversification outside software subscriptions and services

VeriSign exhibits strong profitability and global diversification but struggles with capital efficiency and liquidity. CCC Intelligent Solutions shows robust revenue growth and market focus but faces transparency and geographic concentration challenges. Both companies’ strategic resilience depends on addressing these core financial and market structure issues.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield preserving long-term profits against relentless competitive pressures:

VeriSign, Inc.: Network Effects Fortress

VeriSign’s moat hinges on network effects, owning critical domain registries like .com and .net. This dominance yields high ROIC and stable 57.7% net margins. However, its declining ROIC signals creeping threats in 2026, requiring innovation to sustain strength.

CCC Intelligent Solutions Holdings Inc.: Data-Driven Switching Costs

CCC leverages proprietary AI and cloud platforms to lock in insurance clients, creating switching costs unlike VeriSign’s registry control. Its 9% revenue growth and rapid margin expansion highlight a moat widening through tech innovation and ecosystem integration.

Network Effects vs. Switching Costs: The Moat Face-Off

VeriSign’s moat is historically deep but currently eroding, while CCC’s moat is actively expanding with technology-led customer lock-in. CCC appears better positioned to defend and grow market share in 2026.

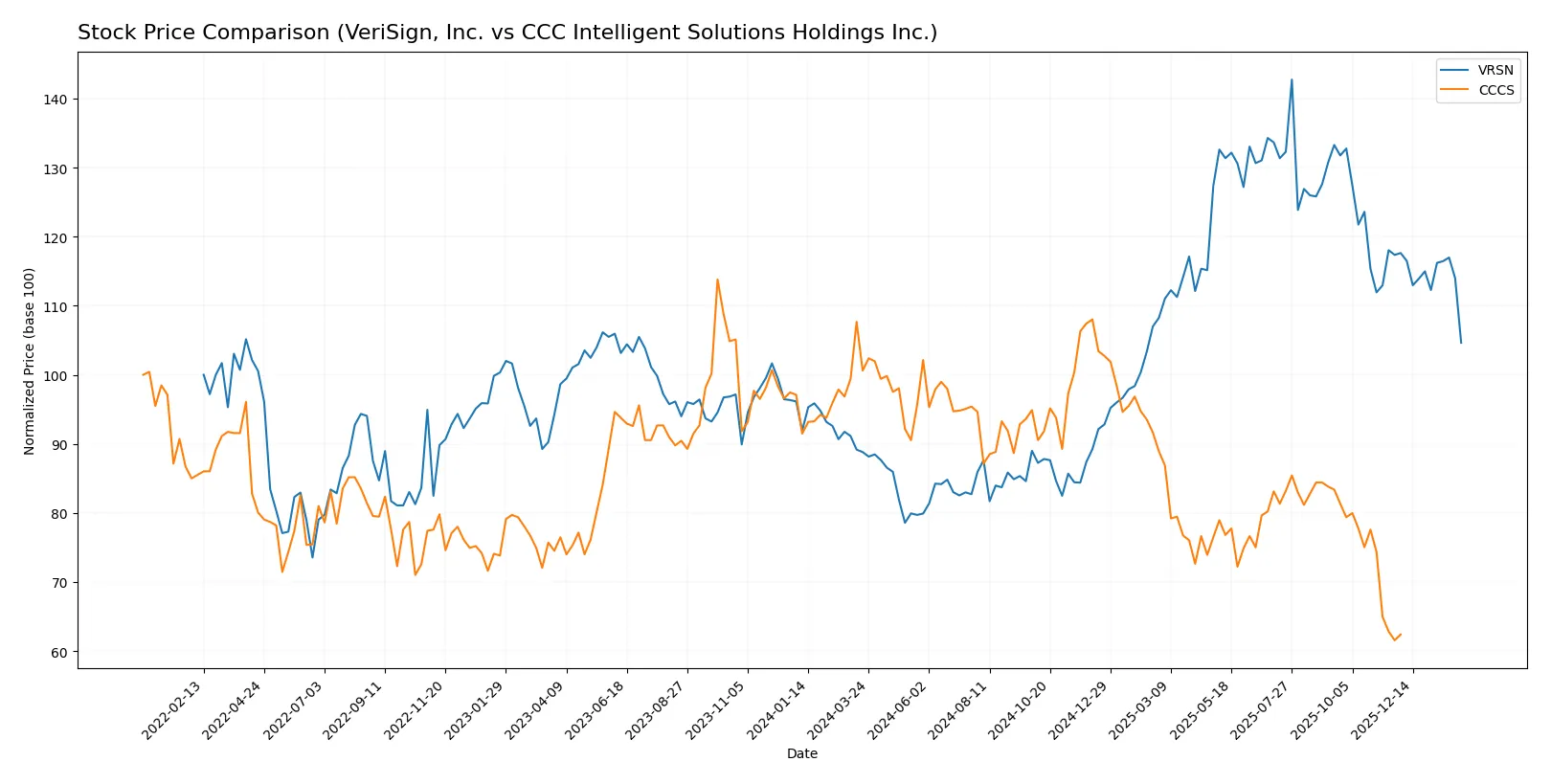

Which stock offers better returns?

The past year shows VeriSign’s strong 17.8% price gain despite recent deceleration, contrasting with CCC Intelligent Solutions’ steady decline of 31.8%, reflecting divergent market dynamics.

Trend Comparison

VeriSign, Inc. shows a bullish trend with a 17.8% price increase over 12 months, though momentum slowed recently. Volatility is high, with prices ranging from 168.32 to 305.79.

CCC Intelligent Solutions Holdings Inc. exhibits a bearish trend, dropping 31.8% over the year with decelerating losses. Price range is narrow, between 7.22 and 12.67, and volatility remains low.

VeriSign outperformed CCC by a wide margin over the past year, delivering positive returns while CCC’s stock declined sharply.

Target Prices

Analysts set clear target prices for VeriSign, Inc. and CCC Intelligent Solutions Holdings Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| VeriSign, Inc. | 325 | 325 | 325 |

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

Both stocks show unanimous target values, indicating strong analyst conviction. VeriSign’s target implies a 45% upside from current levels, while CCC suggests a 26% gain potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a comparison of recent institutional grades for VeriSign, Inc. and CCC Intelligent Solutions Holdings Inc.:

VeriSign, Inc. Grades

The following table summarizes recent grades from reputable financial institutions for VeriSign, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2026-01-06 |

| Baird | Maintain | Outperform | 2025-07-01 |

| Baird | Maintain | Outperform | 2025-04-25 |

| Baird | Maintain | Outperform | 2025-04-01 |

| Citigroup | Maintain | Buy | 2025-02-04 |

| Citigroup | Maintain | Buy | 2025-01-03 |

| Baird | Upgrade | Outperform | 2024-12-09 |

| Baird | Maintain | Neutral | 2024-06-27 |

| Baird | Maintain | Neutral | 2024-04-26 |

| Citigroup | Maintain | Buy | 2024-04-02 |

CCC Intelligent Solutions Holdings Inc. Grades

No reliable institutional grades are available for CCC Intelligent Solutions Holdings Inc.

Which company has the best grades?

VeriSign, Inc. has consistently received Outperform and Buy ratings from reputable firms, indicating stronger institutional confidence. CCC Intelligent Solutions lacks comparable data, limiting investor insight into its market perception.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

VeriSign, Inc.

- Dominates domain registry with strong moats in .com and .net domains. Faces pressure from emerging decentralized web technologies.

CCC Intelligent Solutions Holdings Inc.

- Operates in competitive SaaS insurance tech market with rapid innovation. Faces risk from larger incumbents and fast-evolving AI competitors.

2. Capital Structure & Debt

VeriSign, Inc.

- High debt-to-assets (265%) signals leverage risk despite strong interest coverage. Current ratio at 0.49 is a red flag for liquidity.

CCC Intelligent Solutions Holdings Inc.

- Data unavailable; IPO in 2020 suggests evolving capital structure but risk assessment is limited by lack of financial transparency.

3. Stock Volatility

VeriSign, Inc.

- Beta 0.75 indicates moderate market sensitivity with recent 7.6% price drop reflecting sector rotation impacts.

CCC Intelligent Solutions Holdings Inc.

- Beta 0.72 with greater relative volume suggests volatility heightened by lower liquidity and price range fluctuations.

4. Regulatory & Legal

VeriSign, Inc.

- Operates critical internet infrastructure under regulatory scrutiny; compliance essential to maintain domain authority.

CCC Intelligent Solutions Holdings Inc.

- Faces regulatory risks tied to data privacy and insurance industry compliance, which could increase operational costs.

5. Supply Chain & Operations

VeriSign, Inc.

- Relies on high-availability distributed servers; operational resilience is a competitive advantage but vulnerable to cyber threats.

CCC Intelligent Solutions Holdings Inc.

- Cloud and AI infrastructure requires robust tech partnerships; supply chain disruptions in software services may impact client delivery.

6. ESG & Climate Transition

VeriSign, Inc.

- Limited direct environmental impact but must address data center energy efficiency and governance transparency.

CCC Intelligent Solutions Holdings Inc.

- Faces pressure to incorporate ESG in software solutions and reduce carbon footprint in cloud operations amid growing investor scrutiny.

7. Geopolitical Exposure

VeriSign, Inc.

- Global domain registry presence exposes it to shifting data sovereignty laws and cyber warfare risks.

CCC Intelligent Solutions Holdings Inc.

- US-focused client base reduces geopolitical risk but international expansion could increase exposure to trade tensions.

Which company shows a better risk-adjusted profile?

VeriSign’s dominant market position balances some leverage and liquidity risks, while CCC Intelligent Solutions suffers from limited financial transparency. VeriSign’s Altman Z-score in distress contrasts with CCC’s grey zone, but VeriSign’s strong operational moat and Piotroski score demonstrate resilience. CCC’s weak Piotroski score and unavailable detailed financials increase uncertainty. Recent leverage concerns and liquidity red flags at VeriSign warrant caution, yet CCC’s opaque metrics and higher volatility present a less favorable risk-adjusted profile overall.

Final Verdict: Which stock to choose?

VeriSign, Inc. (VRSN) excels as a cash-generating powerhouse with robust profit margins and operational efficiency. Its main point of vigilance lies in a stretched balance sheet and declining ROIC, signaling value erosion risks. VRSN fits portfolios seeking aggressive growth with tolerance for financial leverage concerns.

CCC Intelligent Solutions Holdings Inc. (CCCS) boasts a strategic moat rooted in its recurring revenue model and high income quality. It offers a safer balance sheet profile compared to VeriSign despite a bearish price trend. CCCS suits investors targeting GARP—growth at a reasonable price—with a focus on stability over explosive returns.

If you prioritize high-margin cash flow and are comfortable navigating financial leverage, VeriSign outshines as the compelling choice due to its operational dominance. However, if you seek steadier growth with a stronger balance sheet cushion, CCCS offers better stability despite recent price weakness. Each appeals to distinct investor profiles balancing growth ambition and risk tolerance.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of VeriSign, Inc. and CCC Intelligent Solutions Holdings Inc. to enhance your investment decisions: