In today’s fast-evolving technology landscape, choosing the right software infrastructure company is crucial for any investor looking to capitalize on innovation and market growth. CCC Intelligent Solutions Holdings Inc. and Teradata Corporation both operate in the software infrastructure sector, offering distinct cloud-based and AI-driven solutions that address data management and analytics challenges. This article will guide you through their strengths to help determine which company presents the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between CCC Intelligent Solutions Holdings Inc. and Teradata Corporation by providing an overview of these two companies and their main differences.

CCC Intelligent Solutions Holdings Inc. Overview

CCC Intelligent Solutions Holdings Inc. focuses on delivering cloud, mobile, AI, telematics, and hyperscale technologies specifically for the property and casualty insurance economy. Its SaaS platform digitizes critical AI-enabled workflows and connects various stakeholders, such as insurers, repairers, and manufacturers. Founded in 1980 and based in Chicago, the company operates within the software infrastructure industry with a market cap of about 5.6B USD.

Teradata Corporation Overview

Teradata Corporation provides a connected multi-cloud data platform aimed at enterprise analytics through its Teradata Vantage platform. It supports data integration, migration to the cloud, and offers consulting services to enhance data-driven decision-making. Incorporated in 1979 and headquartered in San Diego, Teradata serves multiple sectors globally and holds a market cap near 2.8B USD in the software infrastructure sector.

Key similarities and differences

Both companies operate in the software infrastructure industry and offer technology solutions supporting enterprise data and workflow management. CCC Intelligent Solutions targets the insurance economy with AI-driven SaaS applications, while Teradata emphasizes multi-cloud data platforms and analytics across diverse industries. CCC’s focus is more specialized on insurance workflows, whereas Teradata provides broader data analytics and consulting services globally.

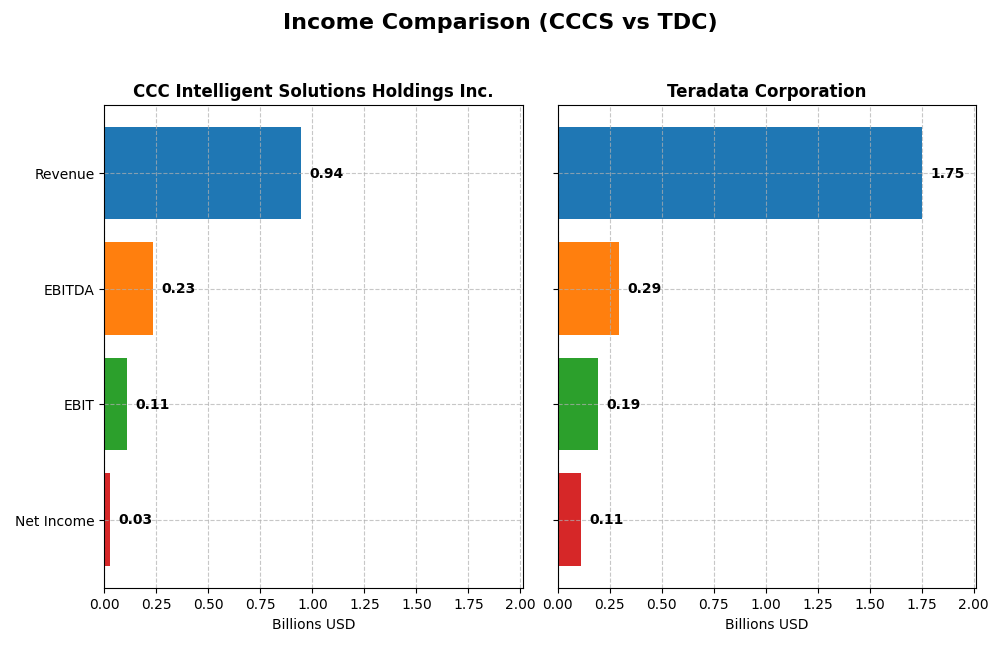

Income Statement Comparison

This table presents a side-by-side comparison of the most recent fiscal year income statement figures for CCC Intelligent Solutions Holdings Inc. and Teradata Corporation.

| Metric | CCC Intelligent Solutions Holdings Inc. | Teradata Corporation |

|---|---|---|

| Market Cap | 5.63B | 2.81B |

| Revenue | 945M | 1.75B |

| EBITDA | 233M | 293M |

| EBIT | 109M | 193M |

| Net Income | 26.1M | 114M |

| EPS | 0.0428 | 1.18 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

CCC Intelligent Solutions Holdings Inc.

CCC Intelligent Solutions Holdings Inc. showed strong revenue growth from 2020 to 2024, increasing from $633M to $945M, with net income recovering from a loss of $25M in 2021 to a positive $26M in 2024. Gross and EBIT margins remained favorable, around 75.55% and 11.53%, respectively. The latest year saw a 9.05% revenue increase and a significant EBIT turnaround, indicating improved operational efficiency.

Teradata Corporation

Teradata Corporation experienced a slight revenue decline from $1.84B in 2020 to $1.75B in 2024, with net income decreasing overall from $129M to $114M. Margins remain solid, with a gross margin of 60.46% and an EBIT margin of 11.03%. The recent year showed a 4.53% revenue drop but a 31.29% EBIT growth, reflecting better cost control despite top-line pressures.

Which one has the stronger fundamentals?

CCC Intelligent Solutions demonstrates stronger fundamentals with consistent revenue and net income growth, favorable margin expansions, and significant improvements in profitability metrics. Teradata, while maintaining decent margins and positive earnings, shows overall revenue and net income declines over the period, indicating more challenges in sustaining growth. CCC’s higher proportion of favorable income statement indicators suggests better financial momentum.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for CCC Intelligent Solutions Holdings Inc. (CCCS) and Teradata Corporation (TDC) for the fiscal year ending 2024.

| Ratios | CCC Intelligent Solutions Holdings Inc. (CCCS) | Teradata Corporation (TDC) |

|---|---|---|

| ROE | 1.31% | 85.71% |

| ROIC | 1.86% | 16.89% |

| P/E | 274.0 | 26.3 |

| P/B | 3.59 | 22.58 |

| Current Ratio | 3.65 | 0.81 |

| Quick Ratio | 3.65 | 0.79 |

| D/E | 0.42 | 4.33 |

| Debt-to-Assets | 26.7% | 33.8% |

| Interest Coverage | 1.24 | 7.21 |

| Asset Turnover | 0.30 | 1.03 |

| Fixed Asset Turnover | 4.68 | 9.07 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

CCC Intelligent Solutions Holdings Inc.

CCC Intelligent Solutions shows mixed financial signals with a current ratio of 3.65, indicating strong short-term liquidity, but a net debt to EBITDA near 1.93 suggests moderate leverage. Profitability ratios like return on equity at 1.31% remain very low, and free cash flow to equity is negative, signaling cash generation challenges. The company does not pay dividends, likely focusing on growth and reinvestment in R&D and operations.

Teradata Corporation

Teradata presents a favorable return on equity of 85.71% and a solid return on invested capital at 16.89%, reflecting efficient capital use. However, liquidity ratios such as current and quick ratios are below 1.0, indicating potential short-term financial stress. Debt to equity is high at 4.33, suggesting significant leverage. Teradata pays no dividends, possibly allocating resources to growth and share repurchases instead.

Which one has the best ratios?

Teradata exhibits stronger profitability and capital efficiency ratios than CCC Intelligent Solutions, despite weaker liquidity and higher leverage. CCC has better liquidity but struggles with profitability and cash flow. Overall, Teradata’s performance appears more favorable in key return metrics, while CCC’s financial health shows more cautionary signs.

Strategic Positioning

This section compares the strategic positioning of CCC Intelligent Solutions Holdings Inc. and Teradata Corporation in terms of Market position, Key segments, and Exposure to technological disruption:

CCC Intelligent Solutions Holdings Inc.

- Market leader in P&C insurance technology SaaS with moderate competitive pressure

- Focuses on SaaS subscriptions and services for insurance economy and automotive sectors

- Leverages AI, telematics, and cloud but with no explicit disruption risk data

Teradata Corporation

- Provides connected multi-cloud data platform with competition in enterprise analytics market

- Diversified revenue from consulting, recurring products, and subscription software across multiple industries

- Faces technological disruption with emphasis on cloud migration and multi-cloud ecosystem integration

CCC Intelligent Solutions Holdings Inc. vs Teradata Corporation Positioning

CCC is concentrated in cloud and AI-driven insurance solutions, offering strong niche focus. Teradata pursues diversification with multi-cloud analytics and consulting services, serving broader industries, balancing risk with wider market exposure.

Which has the best competitive advantage?

Teradata shows a very favorable moat with growing ROIC above WACC, indicating durable competitive advantage and efficient capital use. CCC lacks sufficient data for moat evaluation, limiting assessment of its competitive advantage.

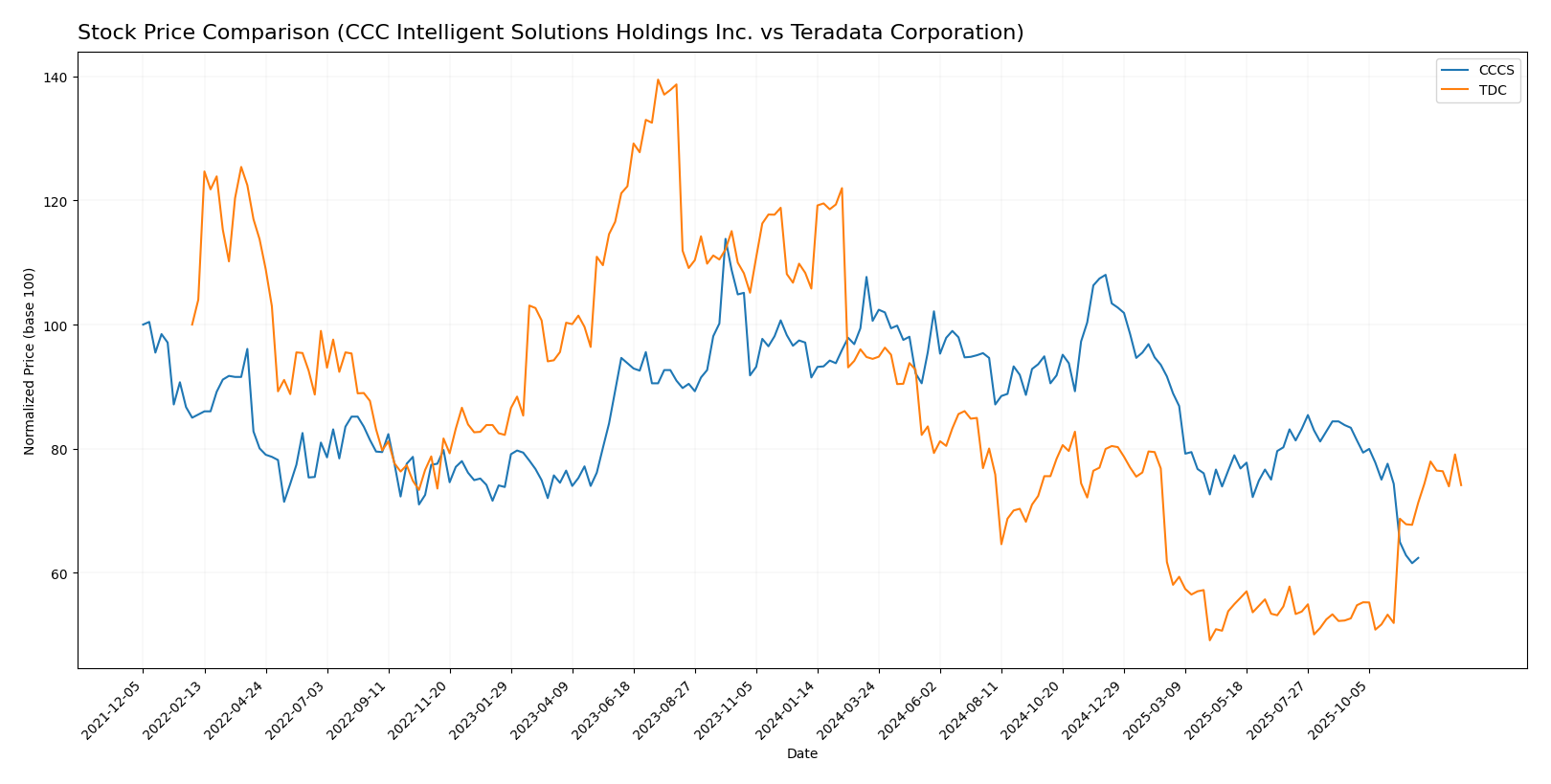

Stock Comparison

The stock prices of CCC Intelligent Solutions Holdings Inc. (CCCS) and Teradata Corporation (TDC) have shown contrasting dynamics over the past year, with CCCS experiencing a notable decline while TDC’s trend reflects recent positive momentum amid broader bearish pressure.

Trend Analysis

Over the past 12 months, CCC Intelligent Solutions Holdings Inc. (CCCS) displayed a bearish trend with a price decline of -31.78%, marked by a deceleration in downward momentum and a relatively low volatility of 1.24. The stock peaked at 12.67 and bottomed at 7.22.

Teradata Corporation (TDC) also exhibited a bearish trend over the last year, declining -21.26%, but with accelerating negative momentum and higher volatility at 5.63. The price ranged between 19.73 and 38.67. Recent weeks indicate a reversal, with a +42.78% gain and moderate volatility of 2.81.

Comparing both, TDC outperformed CCCS over the past year, delivering the highest market performance despite an overall bearish trend, supported by a strong recent rebound.

Target Prices

The consensus target prices from respected analysts indicate potential upside for both companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

| Teradata Corporation | 35 | 27 | 31 |

Analysts expect CCC Intelligent Solutions to rise from its current price of $8.75 to $11, while Teradata’s $31 consensus target suggests moderate appreciation from $29.77.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CCC Intelligent Solutions Holdings Inc. (CCCS) and Teradata Corporation (TDC):

Rating Comparison

CCCS Rating

- No rating data available for CCCS.

- No discounted cash flow score available.

- No return on equity score available.

- No return on assets score available.

- No debt to equity score available.

- No overall score available.

TDC Rating

- Rating: B+, considered Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation based on future cash flows.

- Return on Equity Score: 5, seen as Very Favorable for profit generation from shareholders’ equity.

- Return on Assets Score: 4, Favorable for effective asset utilization.

- Debt To Equity Score: 1, considered Very Unfavorable due to high financial risk.

- Overall Score: 3, rated Moderate overall financial standing.

Which one is the best rated?

Based strictly on the available data, TDC is the only company with analyst ratings and financial scores. It holds a B+ rating with favorable scores for valuation, profitability, and asset use, though it shows a very unfavorable debt position. CCCS lacks rating data for comparison.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for CCC Intelligent Solutions Holdings Inc. (CCCS) and Teradata Corporation (TDC):

CCCS Scores

- Altman Z-Score: 2.18, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

TDC Scores

- Altman Z-Score: 0.81, in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial strength.

Which company has the best scores?

Based on the provided data, CCCS shows a lower bankruptcy risk with a grey zone Altman Z-Score but weak financial strength. TDC has a higher bankruptcy risk but very strong financial strength. Each score highlights different risk and strength aspects.

Grades Comparison

Here is a comparison of the latest available grades and ratings for the two companies:

CCC Intelligent Solutions Holdings Inc. Grades

This table summarizes recent consensus grades from market analysts for CCC Intelligent Solutions Holdings Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Consensus | Buy | Buy | 2026 |

CCC Intelligent Solutions Holdings Inc. shows a consensus rating of “Buy,” indicating a generally positive outlook from analysts.

Teradata Corporation Grades

This table reflects recent grades assigned by several reputable financial institutions for Teradata Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Underweight | 2026-01-12 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Citizens | Upgrade | Market Outperform | 2025-11-10 |

| Barclays | Maintain | Underweight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Guggenheim | Maintain | Buy | 2025-05-07 |

| Barclays | Maintain | Underweight | 2025-04-21 |

Teradata Corporation’s grades vary from Underweight to Overweight, with a notable number of Hold and Neutral ratings, reflecting mixed analyst sentiment.

Which company has the best grades?

CCC Intelligent Solutions Holdings Inc. holds a consensus “Buy” rating, while Teradata Corporation displays a broader range from “Underweight” to “Overweight” with an overall consensus of “Hold.” This suggests CCC Intelligent Solutions currently receives more uniformly positive analyst support, which may influence investor confidence and portfolio decisions differently.

Strengths and Weaknesses

Below is a comparative overview of strengths and weaknesses for CCC Intelligent Solutions Holdings Inc. (CCCS) and Teradata Corporation (TDC) based on the most recent available data.

| Criterion | CCC Intelligent Solutions Holdings Inc. (CCCS) | Teradata Corporation (TDC) |

|---|---|---|

| Diversification | Moderate, focused mainly on Software Subscriptions (~$906M in 2024) with limited other services (~$38M). | Strong diversification across consulting, recurring products and services, subscription licenses, and hardware, totaling several billion dollars. |

| Profitability | Data not available for precise evaluation. | Favorable ROIC of 16.9%, ROE 85.7%, net margin at 6.5% (neutral). Overall profitable with efficient capital use. |

| Innovation | Data not sufficient to assess innovation capacity. | Demonstrates durable competitive advantage with growing ROIC and strong profitability, indicating effective innovation and execution. |

| Global presence | Limited data, likely smaller international footprint. | Strong global presence with revenues segmented between U.S. and international markets, supported by consulting and recurring services. |

| Market Share | Data unavailable for accurate market share assessment. | Significant market share in data analytics and enterprise software sectors, supported by diverse revenue streams. |

Key takeaways: Teradata shows a robust and diversified business model with strong profitability and a durable competitive moat. CCC Intelligent Solutions has a narrower focus on software subscriptions but lacks sufficient data to fully assess financial health and competitive positioning. Investors should consider Teradata’s proven value creation and global reach, while treating CCCS with caution due to data gaps.

Risk Analysis

Below is a comparative risk table for CCC Intelligent Solutions Holdings Inc. (CCCS) and Teradata Corporation (TDC) based on the most recent data from 2026.

| Metric | CCC Intelligent Solutions (CCCS) | Teradata Corporation (TDC) |

|---|---|---|

| Market Risk | Moderate beta (0.72), price volatility within range $7.50–$12.88 | Lower beta (0.57), broader price range $18.43–$33.03 |

| Debt level | Data unavailable; Altman Z-Score in grey zone (2.18) suggests moderate financial risk | Moderate debt-to-assets (33.8%), high debt-to-equity (4.33, unfavorable) |

| Regulatory Risk | Moderate, operates in insurance tech sector with evolving regulations | Moderate, serves multiple regulated sectors including government and healthcare |

| Operational Risk | SaaS platform dependent, possible tech disruptions | Multi-cloud platform complexity, risk in integration and migration services |

| Environmental Risk | Low to moderate, no direct exposure to heavy industry | Low, primarily software and analytics services |

| Geopolitical Risk | Low, US-based with global clients but limited direct exposure | Moderate, global operations expose it to geopolitical tensions |

Synthesis: Teradata faces higher financial risk due to significant leverage and moderate liquidity issues, despite strong profitability scores. CCC Intelligent Solutions shows moderate market risk and financial caution due to limited debt data and a weak Piotroski score. Both companies have manageable regulatory and operational risks, with Teradata’s global footprint increasing geopolitical exposure. Investors should weigh Teradata’s financial leverage risks against CCCS’s weaker financial health indicators.

Which Stock to Choose?

CCC Intelligent Solutions Holdings Inc. (CCCS) shows a favorable income evolution with strong revenue and net income growth, solid gross and EBIT margins, and a neutral net margin. Its financial ratios and profitability are mixed, with a current ratio above 3 but limited debt data and no formal rating available.

Teradata Corporation (TDC) demonstrates a favorable income statement despite recent revenue declines. Its financial ratios are neutral overall, with favorable returns on equity and capital employed but unfavorable liquidity and valuation metrics. The company holds a very favorable B+ rating and a very strong Piotroski score, though with an Altman Z-Score in the distress zone.

For investors, TDC’s strong rating and consistent value creation indicated by a high ROIC above WACC may appeal to those seeking quality and value investing profiles. Conversely, CCCS’s robust income growth but limited financial risk data might attract growth-oriented investors who are comfortable with less transparency.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CCC Intelligent Solutions Holdings Inc. and Teradata Corporation to enhance your investment decisions: