Synopsys, Inc. (SNPS) and CCC Intelligent Solutions Holdings Inc. (CCCS) both operate within the software infrastructure sector, yet they serve distinct niches—integrated circuit design automation and AI-driven insurance solutions, respectively. Their innovative approaches reflect rising technology trends influencing varied markets. Comparing these companies offers insight into how innovation and market focus impact growth potential. Join me as we explore which stock could be the better addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Synopsys and CCC Intelligent Solutions by providing an overview of these two companies and their main differences.

Synopsys Overview

Synopsys, Inc. specializes in electronic design automation software used to design and test integrated circuits. The company offers a broad range of solutions including digital design, verification, FPGA design products, and intellectual property for various applications. Headquartered in Mountain View, California, Synopsys serves sectors such as electronics, automotive, and financial services, positioning itself as a key player in infrastructure software with a market cap near 99B USD.

CCC Intelligent Solutions Overview

CCC Intelligent Solutions Holdings Inc. delivers cloud, mobile, AI, telematics, and hyperscale technology solutions tailored for the property and casualty insurance economy. Its SaaS platform supports AI-driven workflows connecting insurance carriers, repairers, parts suppliers, and other stakeholders. Founded in 1980 and based in Chicago, Illinois, CCC has a market cap of approximately 5.6B USD and focuses on digitizing mission-critical processes within the insurance sector.

Key similarities and differences

Both companies operate in the software infrastructure industry, emphasizing technology-driven solutions to improve specialized markets. Synopsys centers on electronic design automation and semiconductor IP, catering to varied industries including automotive and medicine. In contrast, CCC focuses on AI-enabled SaaS platforms within the insurance ecosystem. Synopsys is a larger, more diversified firm, while CCC targets a niche market with cloud-based insurance economy solutions.

Income Statement Comparison

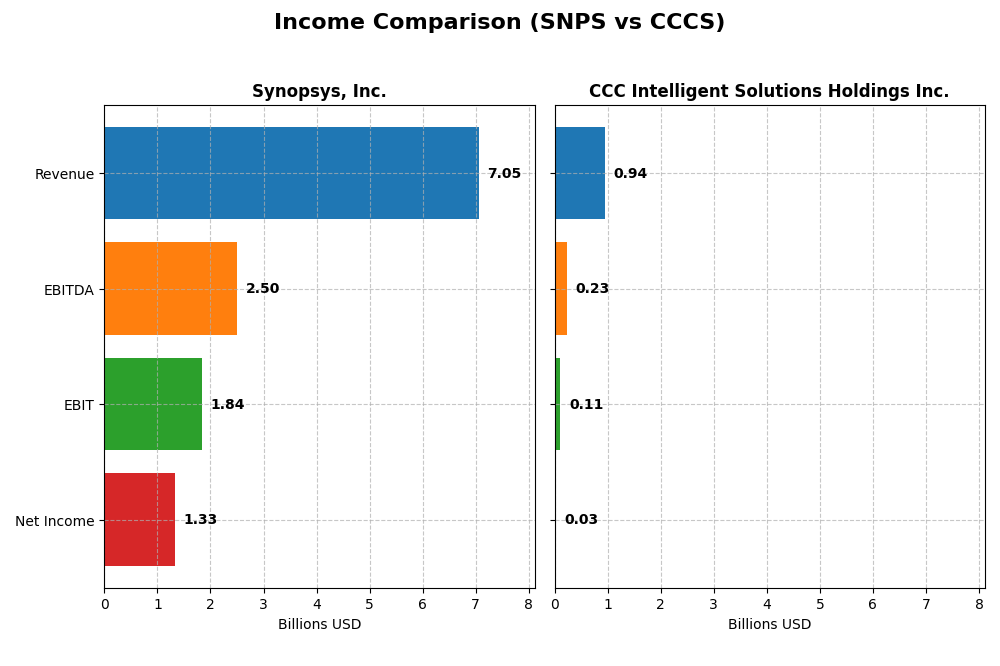

This table presents a side-by-side comparison of key income statement metrics for Synopsys, Inc. and CCC Intelligent Solutions Holdings Inc. for their most recent fiscal years.

| Metric | Synopsys, Inc. (SNPS) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Cap | 98.8B | 5.63B |

| Revenue | 7.05B | 945M |

| EBITDA | 2.50B | 233M |

| EBIT | 1.84B | 109M |

| Net Income | 1.33B | 26.1M |

| EPS | 8.13 | 0.0428 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Synopsys, Inc.

Synopsys saw steady revenue growth from $4.2B in 2021 to $7.1B in 2025, with net income rising from $758M to $1.33B over the same period. Margins generally improved, with a gross margin near 77% and EBIT margin above 26% in 2025. However, net margin and EPS declined in the latest year, reflecting margin pressure despite strong top-line and EBIT growth.

CCC Intelligent Solutions Holdings Inc.

CCC’s revenues increased from $633M in 2020 to $945M in 2024, with net income swinging from a loss of $17M in 2020 to a positive $26M in 2024. Margins improved notably, with a gross margin above 75% and EBIT margin rising to 11.5% in 2024. The company showed strong earnings growth last year, reversing prior losses with increased profitability and expanding net margins.

Which one has the stronger fundamentals?

Both companies demonstrate favorable income statement trends, but Synopsys exhibits stronger absolute scale and consistent margin levels, with a higher net margin of 18.9% versus CCC’s 2.8%. CCC shows impressive growth rates and margin improvements from a lower base, yet Synopsys maintains more robust profitability and stable operational efficiency, indicating stronger fundamental income statement metrics overall.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for Synopsys, Inc. (SNPS) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on their most recent fiscal year data.

| Ratios | Synopsys, Inc. (SNPS) 2025 | CCC Intelligent Solutions (CCCS) 2024 |

|---|---|---|

| ROE | 4.72% | 1.31% |

| ROIC | 1.97% | 1.86% |

| P/E | 54.36 | 274.02 |

| P/B | 2.57 | 3.59 |

| Current Ratio | 1.62 | 3.65 |

| Quick Ratio | 1.52 | 3.65 |

| D/E | 0.50 | 0.42 |

| Debt-to-Assets | 29.6% | 26.7% |

| Interest Coverage | 2.05 | 1.24 |

| Asset Turnover | 0.15 | 0.30 |

| Fixed Asset Turnover | 5.04 | 4.68 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Synopsys, Inc.

Synopsys presents a mixed ratio profile with favorable net margin, current and quick ratios, and fixed asset turnover, indicating operational efficiency and liquidity strength. However, its low return on equity and invested capital, alongside a high PE ratio, raise concerns about profitability and valuation. The company does not pay dividends, likely reinvesting earnings for growth or R&D priority.

CCC Intelligent Solutions Holdings Inc.

No financial ratio data are available for CCC Intelligent Solutions Holdings Inc., restricting any thorough assessment. The absence of dividends could suggest a reinvestment strategy or a growth phase typical for its sector, but without key metrics, no definitive analysis of financial health or shareholder returns can be made.

Which one has the best ratios?

Based on available data, Synopsys shows a balanced mix of strengths and weaknesses in its ratios, while CCC Intelligent Solutions lacks sufficient information for comparison. Therefore, Synopsys offers a clearer financial picture, though its overall ratio stance is neutral due to equal favorable and unfavorable indicators.

Strategic Positioning

This section compares the strategic positioning of Synopsys, Inc. and CCC Intelligent Solutions Holdings Inc., including their market position, key segments, and exposure to technological disruption:

Synopsys, Inc.

- Leading electronic design automation software provider with strong competitive pressure in tech infrastructure.

- Key segments: License and Maintenance, Technology Services, and IP solutions driving revenue in electronics and industrial sectors.

- Exposure to disruption through advanced platforms in digital design, security, and virtual prototyping technology.

CCC Intelligent Solutions Holdings Inc.

- Focused on cloud and AI solutions for property and casualty insurance, facing moderate competitive pressure.

- Key segments: Software subscriptions and services focused on insurance economy, collision repair, and automotive.

- Exposure to disruption via AI, telematics, and hyperscale cloud technologies in insurance workflow digitization.

Synopsys, Inc. vs CCC Intelligent Solutions Holdings Inc. Positioning

Synopsys has a diversified approach with multiple technology platforms serving broad industries, while CCC is more concentrated on insurance-related software subscriptions and services. Synopsys benefits from broader market exposure but faces more intense competition.

Which has the best competitive advantage?

Synopsys’s MOAT evaluation indicates a very unfavorable position with declining ROIC and value destruction, while CCC lacks sufficient data for MOAT assessment, making Synopsys’s competitive advantage currently weak.

Stock Comparison

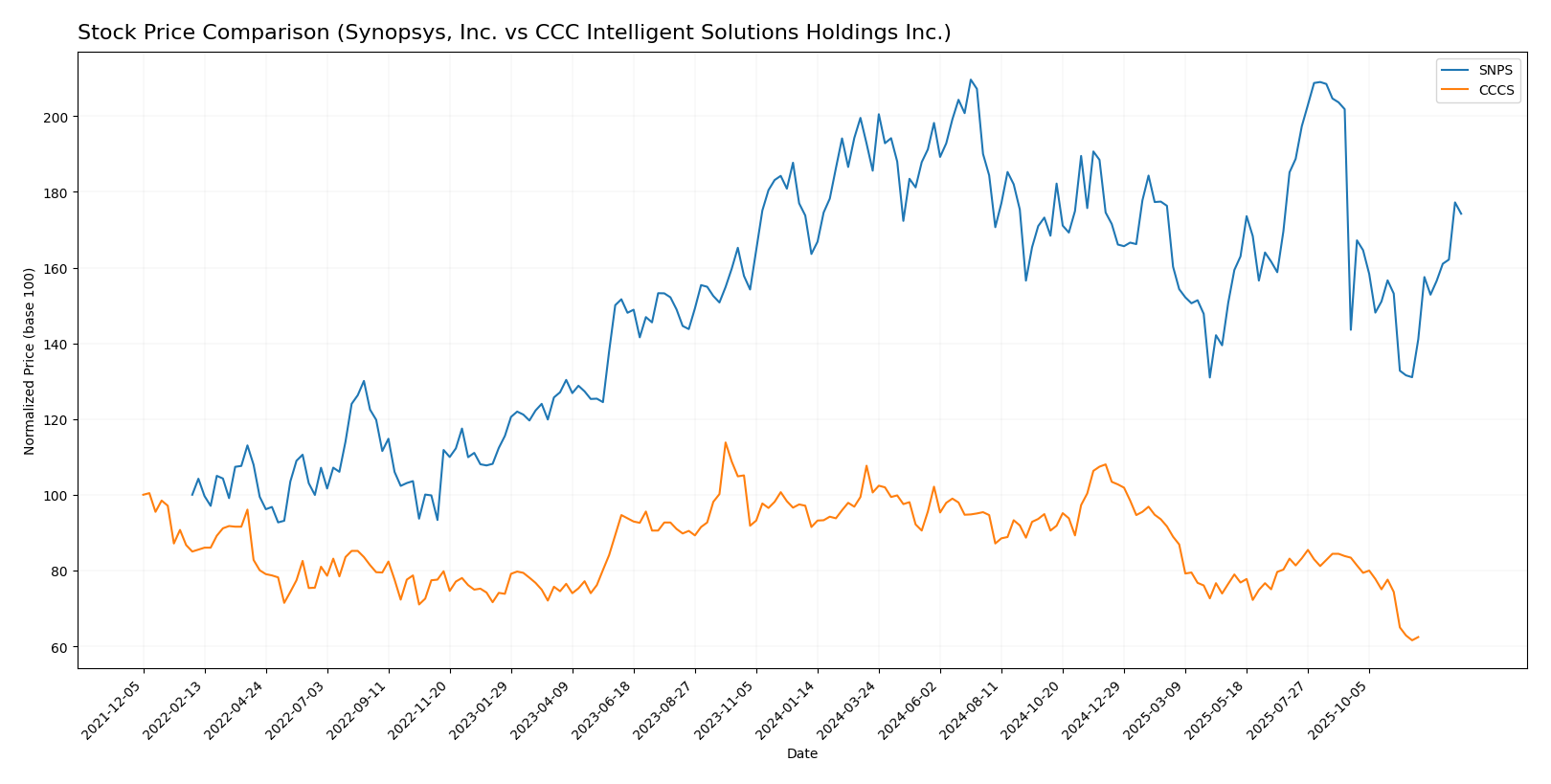

The stock price movements of Synopsys, Inc. and CCC Intelligent Solutions Holdings Inc. over the past year reveal contrasting bearish trends with varied acceleration and volatility characteristics.

Trend Analysis

Synopsys, Inc. (SNPS) experienced a bearish trend with a -10.31% price change over the past 12 months, showing acceleration and high volatility with a standard deviation of 58.85. The stock ranged between 388.13 and 621.3 during this period.

CCC Intelligent Solutions Holdings Inc. (CCCS) also displayed a bearish trend, with a more pronounced -31.78% decline over the year, accompanied by deceleration and low volatility (std deviation 1.24). Its price fluctuated between 7.22 and 12.67.

Comparing these trends, Synopsys delivered the higher market performance with a smaller price decline (-10.31%) versus CCCS’s steeper drop (-31.78%) over the analyzed 12-month period.

Target Prices

The current analyst consensus provides clear target price ranges for both Synopsys, Inc. and CCC Intelligent Solutions Holdings Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Synopsys, Inc. | 600 | 425 | 530 |

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

Analysts expect Synopsys to appreciate moderately above its current price of 516.31 USD, with a consensus target of 530 USD. CCC Intelligent Solutions faces a flat target at 11 USD, suggesting limited near-term upside from the current 8.75 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Synopsys, Inc. and CCC Intelligent Solutions Holdings Inc.:

Rating Comparison

SNPS Rating

- Rating: B-, classified as very favorable

- Discounted Cash Flow Score: 3, moderate status

- ROE Score: 3, moderate status

- ROA Score: 3, moderate status

- Debt To Equity Score: 2, moderate status

- Overall Score: 3, moderate status

CCCS Rating

- No rating data available

- No data

- No data

- No data

- No data

- No data

Which one is the best rated?

Based solely on the provided data, Synopsys, Inc. (SNPS) holds a B- rating with moderate scores across key financial metrics, while CCC Intelligent Solutions Holdings Inc. lacks any rating or score information. Therefore, SNPS is the better rated company in this comparison.

Scores Comparison

Here is a comparison of the financial scores for Synopsys, Inc. and CCC Intelligent Solutions Holdings Inc.:

SNPS Scores

- Altman Z-Score: 3.54, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

CCCS Scores

- Altman Z-Score: 2.18, indicating a grey zone with moderate bankruptcy risk.

- Piotroski Score: 3, reflecting very weak financial strength.

Which company has the best scores?

Synopsys, Inc. holds a higher Altman Z-Score in the safe zone and a marginally stronger Piotroski Score than CCC Intelligent Solutions, which remains in the grey zone with weaker financial strength.

Grades Comparison

The grades for Synopsys, Inc. and CCC Intelligent Solutions Holdings Inc. are compared below:

Synopsys, Inc. Grades

This table shows recent grades and rating actions from major financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Morgan Stanley | Maintain | Overweight | 2025-12-12 |

| Rosenblatt | Maintain | Buy | 2025-12-11 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| Piper Sandler | Maintain | Overweight | 2025-12-11 |

| Needham | Maintain | Buy | 2025-12-11 |

| B of A Securities | Upgrade | Buy | 2025-12-11 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-11 |

| Rosenblatt | Upgrade | Buy | 2025-12-09 |

Overall, Synopsys shows a predominantly positive consensus with multiple “Buy” and “Overweight” ratings, although a recent downgrade to “Neutral” from Piper Sandler indicates some caution.

CCC Intelligent Solutions Holdings Inc. Grades

No reliable grading data is available for CCC Intelligent Solutions Holdings Inc.

Which company has the best grades?

Synopsys, Inc. has received significantly more professional analyst coverage with mostly positive grades such as “Buy” and “Overweight.” CCC Intelligent Solutions Holdings Inc. lacks such reliable data, potentially increasing perceived risk and uncertainty for investors.

Strengths and Weaknesses

Below is a comparison of Synopsys, Inc. (SNPS) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on their most recent available data.

| Criterion | Synopsys, Inc. (SNPS) | CCC Intelligent Solutions (CCCS) |

|---|---|---|

| Diversification | Strong in software licensing, maintenance, and tech services with $3.5B in license & maintenance revenue (2025) | Focused mainly on software subscriptions ($906M in 2024) with smaller other services segment ($38M) |

| Profitability | Moderate net margin at 19%, but ROIC (1.97%) below WACC (8.3%), indicating value destruction | Insufficient data for profitability evaluation |

| Innovation | High investment in technology services ($1.55B in 2025), but declining ROIC trend signals challenges | Insufficient data for innovation assessment |

| Global presence | Global footprint with diversified product lines in semiconductor design software | Primarily North American market with SaaS offerings |

| Market Share | Established leader in electronic design automation software | Niche market player in insurance claims tech |

Key takeaways: Synopsys shows strong product diversification and reasonable profitability but suffers from declining capital efficiency and value destruction risks. CCC Intelligent Solutions operates in a niche with growing software subscriptions but lacks sufficient public data for a full financial and strategic assessment. Caution and further analysis are advised before investing.

Risk Analysis

Below is a comparison of key risks for Synopsys, Inc. (SNPS) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent data from 2025.

| Metric | Synopsys, Inc. (SNPS) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Risk | Moderate (Beta 1.12, tech sector volatility) | Lower (Beta 0.72, less volatile but lower liquidity) |

| Debt level | Moderate (Debt/Equity 0.5, debt-to-assets 29.6%) | Unknown (no recent data available) |

| Regulatory Risk | Moderate (Technology and IP regulations) | Moderate to high (Insurance tech sector, subject to compliance changes) |

| Operational Risk | Moderate (Complex software development, global supply chains) | Moderate (Cloud-based SaaS platform dependencies) |

| Environmental Risk | Low (Primarily software, limited direct impact) | Low (Software services, minimal environmental footprint) |

| Geopolitical Risk | Moderate (Global operations, US-China tech tensions) | Moderate (US-based, but insurance ecosystem exposed to regulatory shifts) |

Synopsys faces typical tech sector market volatility and moderate leverage but benefits from a strong Altman Z-score (3.54, safe zone). CCCS shows a grey zone Altman Z-score (2.18) indicating moderate bankruptcy risk and very weak Piotroski score, signaling financial fragility. Market risk and regulatory uncertainty are the most impactful for both, with CCCS carrying higher financial and operational risk due to its weaker financial health and less available data.

Which Stock to Choose?

Synopsys, Inc. (SNPS) shows favorable income growth with a 67.79% revenue increase over 2021-2025 and strong profitability metrics, including an 18.89% net margin. However, financial ratios are mixed, with a moderate debt profile and a neutral global ratio opinion. Its economic moat is very unfavorable due to declining ROIC below WACC, indicating value destruction. The company holds a very favorable overall rating but moderate scores for financial stability.

CCC Intelligent Solutions Holdings Inc. (CCCS) presents favorable income statement growth, notably a 254.92% net income increase over 2020-2024 and improving net margin. However, detailed financial ratios and key metrics are missing, limiting comprehensive assessment. Scores place it in a grey zone for bankruptcy risk, with a very weak Piotroski score. Its stock price trend is bearish with recent deceleration.

For investors prioritizing stable and historically favorable income and rating profiles, Synopsys may appear more attractive despite challenges in profitability sustainability. Conversely, those focused on strong recent income growth but accepting higher uncertainty might find CCC Intelligent Solutions’ performance indicative of potential, albeit with limited data and higher risk. The choice could depend on the investor’s risk tolerance and confidence in incomplete data.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Synopsys, Inc. and CCC Intelligent Solutions Holdings Inc. to enhance your investment decisions: