Investors seeking promising opportunities in the software infrastructure sector will find Rubrik, Inc. and CCC Intelligent Solutions Holdings Inc. compelling contenders. Both companies specialize in innovative cloud-based platforms, yet serve distinct yet overlapping markets—Rubrik focuses on data security and cyber recovery, while CCC drives AI and telematics solutions for insurance. This comparison will help you navigate their strategies and market positions to identify which stock may best enhance your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Rubrik, Inc. and CCC Intelligent Solutions Holdings Inc. by providing an overview of these two companies and their main differences.

Rubrik, Inc. Overview

Rubrik, Inc. focuses on providing data security solutions globally, serving various sectors such as financial, retail, healthcare, and public sectors. Its offerings include enterprise data protection, cloud and SaaS data protection, data threat analytics, and cyber recovery solutions. Founded in 2013 and headquartered in Palo Alto, California, Rubrik operates within the software infrastructure industry with a market cap of 13.4B USD.

CCC Intelligent Solutions Holdings Inc. Overview

CCC Intelligent Solutions Holdings Inc. delivers cloud, AI, telematics, and hyperscale technologies tailored to the property and casualty insurance economy. Its SaaS platform supports AI-enabled workflows for insurance carriers, repairers, parts suppliers, and automotive manufacturers. Founded in 1980 and based in Chicago, Illinois, CCC operates in the software infrastructure sector with a 5.6B USD market cap.

Key similarities and differences

Both companies operate in the software infrastructure industry in the US, delivering cloud-based technology solutions. Rubrik’s focus centers on data security and protection across multiple sectors, while CCC targets AI-driven workflow digitization and commerce facilitation in the insurance ecosystem. Rubrik is larger by market cap and employee count, whereas CCC emphasizes specialized solutions for the insurance economy.

Income Statement Comparison

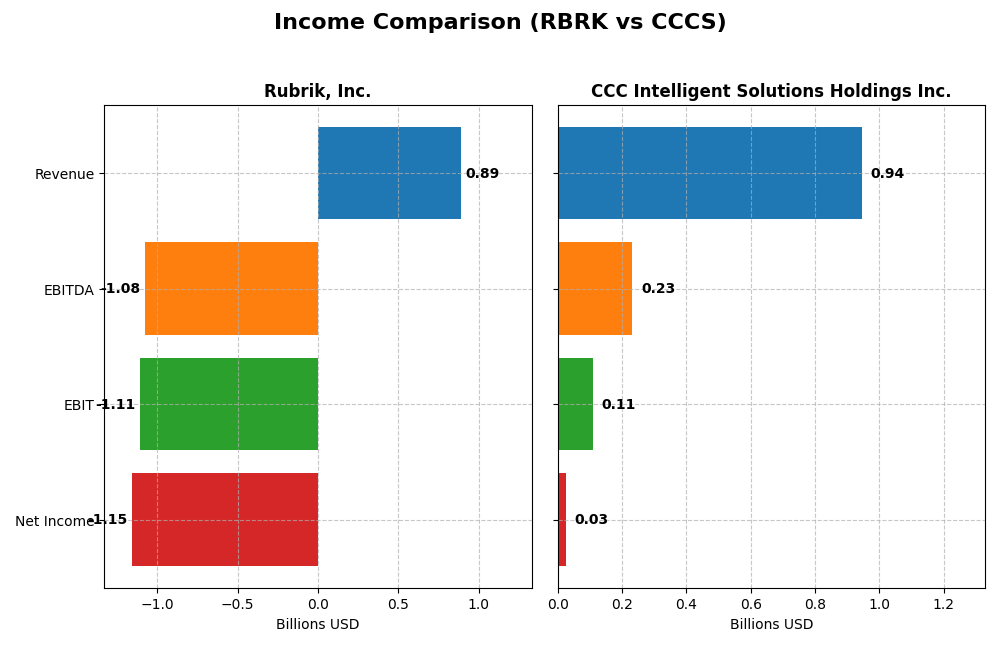

The table below compares the most recent fiscal year income statement metrics for Rubrik, Inc. and CCC Intelligent Solutions Holdings Inc., providing a snapshot of their financial performance.

| Metric | Rubrik, Inc. (RBRK) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Cap | 13.4B | 5.63B |

| Revenue | 887M | 945M |

| EBITDA | -1.08B | 233M |

| EBIT | -1.11B | 109M |

| Net Income | -1.15B | 26M |

| EPS | -7.48 | 0.043 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Rubrik, Inc.

Rubrik’s revenue grew significantly from $388M in 2021 to $887M in 2025, marking a 129% increase over five years. However, net income deteriorated from -$213M to -$1.15B, with net margins declining sharply to -130% in 2025. Despite a 41% revenue jump in the latest year, operating expenses grew proportionally, worsening EBIT and net losses considerably.

CCC Intelligent Solutions Holdings Inc.

CCC showed steady revenue growth from $633M in 2020 to $945M in 2024, a 49% rise. Net income shifted from a loss of $17M in 2020 to a positive $26M in 2024, with net margin improving to 2.77%. The latest year saw favorable growth across revenue, gross profit, and EBIT, reflecting improving profitability and controlled expenses relative to revenue growth.

Which one has the stronger fundamentals?

CCC Intelligent Solutions presents stronger fundamentals with consistent revenue growth, positive net income, and improving margins, supported by favorable EBIT and net margin trends. Rubrik, despite strong revenue gains, faces significant losses and unfavorable margin trends, highlighting ongoing profitability challenges. Overall, CCC’s income statement shows more favorable financial health and operational efficiency.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Rubrik, Inc. (RBRK) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on their most recent fiscal year data.

| Ratios | Rubrik, Inc. (RBRK) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| ROE | 2.09% | 1.31% |

| ROIC | -2.35% | 1.86% |

| P/E | -9.79 | 274.02 |

| P/B | -20.42 | 3.59 |

| Current Ratio | 1.13 | 3.65 |

| Quick Ratio | 1.13 | 3.65 |

| D/E | -0.63 | 0.42 |

| Debt-to-Assets | 24.65% | 26.65% |

| Interest Coverage | -27.49 | 1.24 |

| Asset Turnover | 0.62 | 0.30 |

| Fixed Asset Turnover | 16.67 | 4.68 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Rubrik, Inc.

Rubrik shows a mixed ratio profile with strong return on equity at 208.55% and favorable leverage metrics, including a debt-to-equity ratio of -0.63 and debt-to-assets at 24.65%. However, net margin is deeply negative at -130.26% and interest coverage is unfavorable at -26.84, indicating profitability and interest expenses concerns. Cash liquidity ratios are neutral to favorable. The company does not pay dividends, likely reflecting its reinvestment focus or growth phase.

CCC Intelligent Solutions Holdings Inc.

No ratio data is available for CCC Intelligent Solutions Holdings Inc., preventing any financial ratio evaluation or dividend analysis. The lack of data means I cannot assess its profitability, liquidity, leverage, or shareholder return metrics at this time.

Which one has the best ratios?

Based on available data, Rubrik has a predominantly favorable ratio profile with over 57% of ratios rated positively despite some profitability and interest coverage weaknesses. CCC cannot be evaluated due to missing ratio data, making Rubrik the only company with analyzable financial ratios in this comparison.

Strategic Positioning

This section compares the strategic positioning of Rubrik, Inc. and CCC Intelligent Solutions Holdings Inc., including Market position, Key segments, and Exposure to technological disruption:

Rubrik, Inc.

- Market position and competitive pressure

- Key segments and business drivers

- Exposure to technological disruption

CCC Intelligent Solutions Holdings Inc.

- Larger market cap at 13.4B, lower beta of 0.28, NYSE-listed

- Focus on data security: enterprise, cloud, SaaS protection, analytics

- Operates in evolving data security sector with cyber recovery focus

Rubrik, Inc. vs CCC Intelligent Solutions Holdings Inc. Positioning

Rubrik has a broader sector exposure across multiple industries focusing on data security, while CCC concentrates on the property and casualty insurance economy with AI and telematics innovations. Rubrik’s scale and diversified segments contrast with CCC’s niche specialization and ecosystem approach.

Which has the best competitive advantage?

Rubrik shows a very unfavorable MOAT evaluation with declining ROIC and value destruction, indicating weak competitive advantage. CCC’s MOAT data is unavailable, preventing a direct comparison of their competitive strengths.

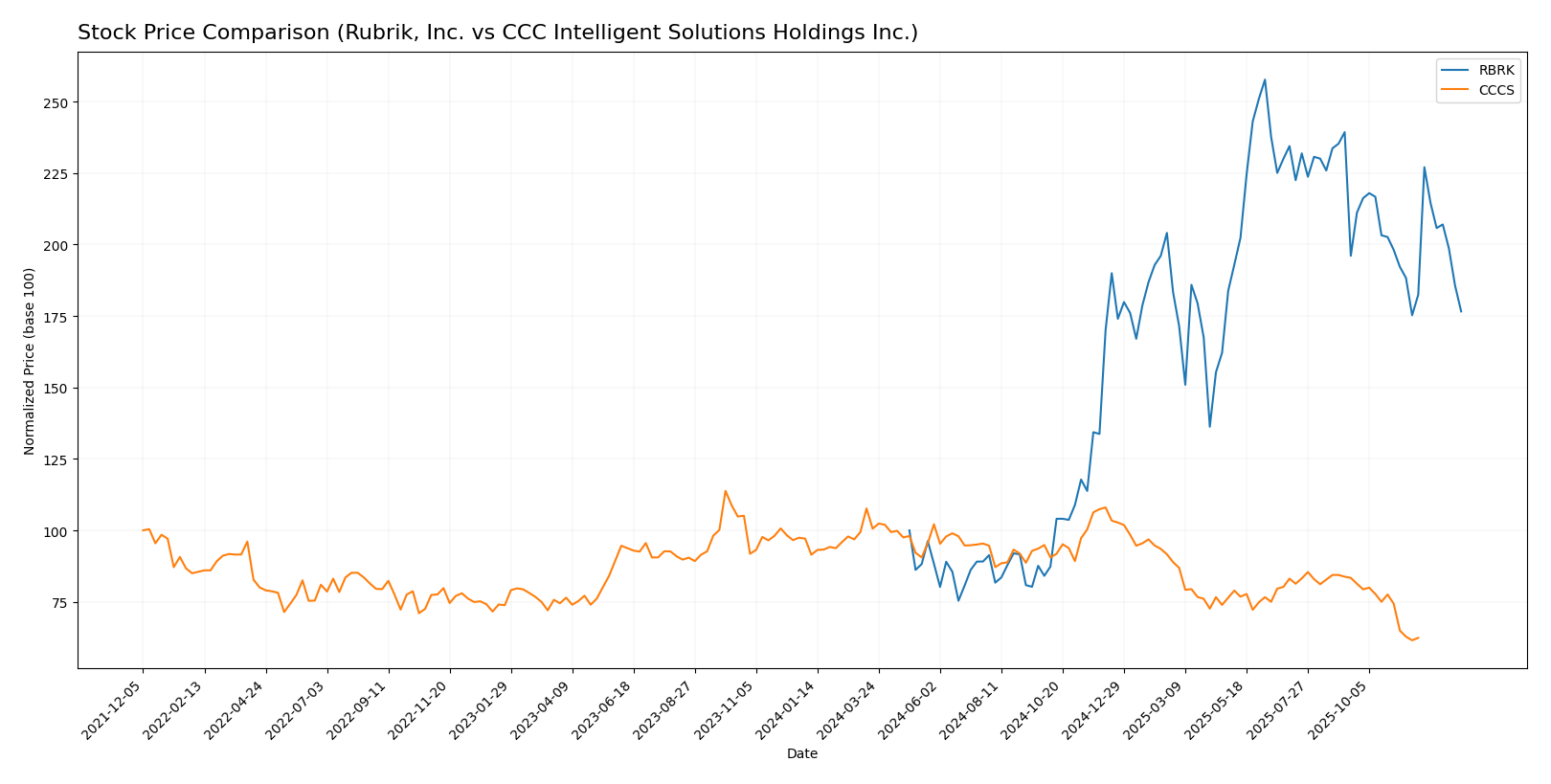

Stock Comparison

The stock price chart highlights significant divergence over the past 12 months, with Rubrik, Inc. showing strong gains despite recent deceleration, while CCC Intelligent Solutions Holdings Inc. experienced a marked decline and sustained bearish momentum.

Trend Analysis

Rubrik, Inc. (RBRK) exhibited a bullish trend over the past year with a 76.58% price increase, though recent months show a -10.85% pullback and decelerating momentum amid elevated volatility (21.4 std deviation).

CCC Intelligent Solutions Holdings Inc. (CCCS) demonstrated a bearish trend, losing 31.78% in value over 12 months, with continuing deceleration and lower volatility (1.24 std deviation); recent declines accelerated with a -25.15% drop.

Comparing the two, Rubrik, Inc. delivered the highest market performance with a robust overall gain, while CCC Intelligent Solutions Holdings faced significant losses and sustained negative momentum.

Target Prices

The current analyst consensus presents promising upside potential for both Rubrik, Inc. and CCC Intelligent Solutions Holdings Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rubrik, Inc. | 113 | 105 | 109.33 |

| CCC Intelligent Solutions | 11 | 11 | 11 |

Analysts expect Rubrik’s stock to rise significantly from its current price of $67.1, suggesting strong growth potential. CCC’s consensus target of $11 also indicates moderate upside from its current price of $8.75.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Rubrik, Inc. and CCC Intelligent Solutions Holdings Inc.:

Rating Comparison

RBRK Rating

- Rating: C, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 1, indicating a Very Unfavorable valuation.

- ROE Score: 5, representing a Very Favorable profitability from equity.

- ROA Score: 1, showing Very Unfavorable asset utilization.

- Debt To Equity Score: 1, reflecting Very Unfavorable financial risk profile.

- Overall Score: 2, considered Moderate overall financial standing.

CCCS Rating

- No rating data available.

- No score data available.

- No score data available.

- No score data available.

- No score data available.

- No overall score available.

Which one is the best rated?

Based strictly on the provided data, Rubrik, Inc. holds a rating of C with a Moderate overall score and mixed individual scores. CCC Intelligent Solutions Holdings Inc. lacks any analyst ratings or scores, making Rubrik the only company with an evaluable rating in this comparison.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Rubrik, Inc. and CCC Intelligent Solutions Holdings Inc.:

RBRK Scores

- Altman Z-Score: 1.41, indicating financial distress risk.

- Piotroski Score: 4, reflecting average financial strength.

CCCS Scores

- Altman Z-Score: 2.18, indicating moderate bankruptcy risk.

- Piotroski Score: 3, indicating very weak financial strength.

Which company has the best scores?

Based on the provided data, CCCS has a higher Altman Z-Score, placing it in the grey zone, while RBRK is in the distress zone. However, RBRK’s Piotroski Score is higher, showing better financial strength than CCCS.

Grades Comparison

The following presents the latest reliable grades for Rubrik, Inc. and CCC Intelligent Solutions Holdings Inc.:

Rubrik, Inc. Grades

This table summarizes recent grades and rating actions from recognized grading companies for Rubrik, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

Rubrik’s grades show a consistent pattern of “Buy,” “Overweight,” and “Outperform” ratings, with a recent upgrade by William Blair, indicating positive analyst sentiment.

No reliable grade data is available for CCC Intelligent Solutions Holdings Inc., as no grading company information was provided. The consensus rating for CCC is “Buy,” but with some hold and one sell rating, reflecting a more mixed analyst view.

Which company has the best grades?

Rubrik, Inc. has received consistently positive grades from multiple reputable firms, mainly “Buy,” “Overperform,” and “Overweight,” whereas CCC Intelligent Solutions Holdings Inc. lacks verified grading data and shows a more cautious consensus. This suggests Rubrik may currently enjoy stronger analyst confidence, potentially impacting investor perception of stability and growth prospects.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Rubrik, Inc. (RBRK) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the latest available data.

| Criterion | Rubrik, Inc. (RBRK) | CCC Intelligent Solutions (CCCS) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from subscriptions (828M) with smaller maintenance and other services segments | Moderate to High: Primarily software subscriptions (906M) plus other services (38M) |

| Profitability | Weak: Negative net margin (-130%) and declining ROIC, indicating value destruction | Data unavailable for evaluation |

| Innovation | Mixed: Favorable ROE (209%) suggests efficient equity use, but declining ROIC signals challenges | Data unavailable for evaluation |

| Global presence | Limited data; likely focused on select markets | Limited data; likely focused on North America |

| Market Share | Undisclosed; financial struggles may limit competitive edge | Undisclosed; growing subscription revenue suggests expanding footprint |

Key takeaways: Rubrik shows strong subscription revenue but suffers from significant profitability and value creation challenges, signaling caution. CCCS’s growing subscription base implies market traction, but lack of financial data requires careful monitoring before investment decisions.

Risk Analysis

Below is a comparative table highlighting key risk factors for Rubrik, Inc. (RBRK) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent data from 2025.

| Metric | Rubrik, Inc. (RBRK) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Risk | Low beta (0.28) indicates low volatility | Moderate beta (0.72) suggests moderate volatility |

| Debt level | Moderate debt-to-assets (24.65%), favorable leverage ratios | Data unavailable, caution advised due to missing info |

| Regulatory Risk | Moderate, operates in multiple regulated sectors | Moderate, insurance sector subject to evolving regulations |

| Operational Risk | Moderate, reliant on cloud and SaaS infrastructure | Moderate, dependent on AI and telematics platforms |

| Environmental Risk | Low, technology sector with limited direct impact | Low, primarily software services with minimal environmental footprint |

| Geopolitical Risk | Low, primarily US-based with no major global exposure | Low to moderate, US-based but industry could be affected by international insurance policies |

Rubrik presents a favorable risk profile with low market volatility and manageable debt, though its negative profitability and distress-level Altman Z-score (1.41) imply financial vulnerability, increasing bankruptcy risk. CCCS lacks detailed financial metrics but shows moderate market risk and a grey-zone Altman Z-score (2.18), indicating caution. The most impactful risks are Rubrik’s financial distress and CCCS’s uncertain financial data, requiring careful risk management before investment.

Which Stock to Choose?

Rubrik, Inc. (RBRK) shows strong revenue growth of 41.2% in 2025, with a favorable 70.0% gross margin but struggles with negative net margin (-130.3%) and declining profitability metrics. Its financial ratios are generally favorable, with a strong ROE of 208.6% but unfavorable ROIC and interest coverage. The company has a moderate overall rating C with some risks evident in debt and cash flow metrics.

CCC Intelligent Solutions Holdings Inc. (CCCS) displays steady revenue growth at 9.1% for 2024 and maintains a favorable gross margin of 75.6% alongside positive EBIT and net margin. The company’s liquidity is robust with a current ratio above 3.6, but its valuation and profitability scores are unavailable. The Altman Z-Score places it in a grey zone, indicating moderate financial distress risk.

Investors favoring growth and high return on equity might find Rubrik’s profile appealing despite its profitability challenges and value destruction signals. Conversely, those seeking stable income and better-margin consistency could view CCC Intelligent Solutions as more suitable, given its favorable income statement and liquidity, despite some financial distress risk. The choice could thus depend on investor risk tolerance and strategy focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Rubrik, Inc. and CCC Intelligent Solutions Holdings Inc. to enhance your investment decisions: