In today’s fast-evolving tech landscape, Okta, Inc. and CCC Intelligent Solutions Holdings Inc. stand out as innovators within the software infrastructure industry. While Okta focuses on identity management and secure access solutions, CCC leverages AI and cloud technologies to transform the insurance ecosystem. Their shared emphasis on cutting-edge innovation and market disruption makes this comparison essential. Let’s explore which company offers the most compelling opportunity for investors in 2026.

Table of contents

Companies Overview

I will begin the comparison between Okta and CCC Intelligent Solutions by providing an overview of these two companies and their main differences.

Okta Overview

Okta, Inc. focuses on identity solutions for enterprises, SMBs, universities, non-profits, and government agencies globally. Its Okta Identity Cloud platform offers a comprehensive suite of products including Single Sign-On, Adaptive Multi-Factor Authentication, Lifecycle Management, and API Access Management. Okta aims to secure user identities and access across cloud and on-premise environments, supporting both security and user convenience.

CCC Intelligent Solutions Overview

CCC Intelligent Solutions Holdings Inc. provides cloud, mobile, AI, telematics, and hyperscale technologies specifically for the property and casualty insurance industry. Its SaaS platform digitizes workflows and connects businesses such as insurers, repairers, suppliers, and financial institutions. CCC’s solutions cover insurance processes, repair management, parts, and automotive manufacturing, focusing on enhancing operational efficiency in the insurance economy.

Key similarities and differences

Both Okta and CCC operate in the technology sector, delivering software infrastructure solutions via cloud platforms. Okta specializes in identity and access management across diverse industries, while CCC targets the insurance sector with AI-driven workflow and commerce tools. Each company leverages cloud and AI technologies but serves distinct markets and customer bases, reflecting differences in their strategic focus and product offerings.

Income Statement Comparison

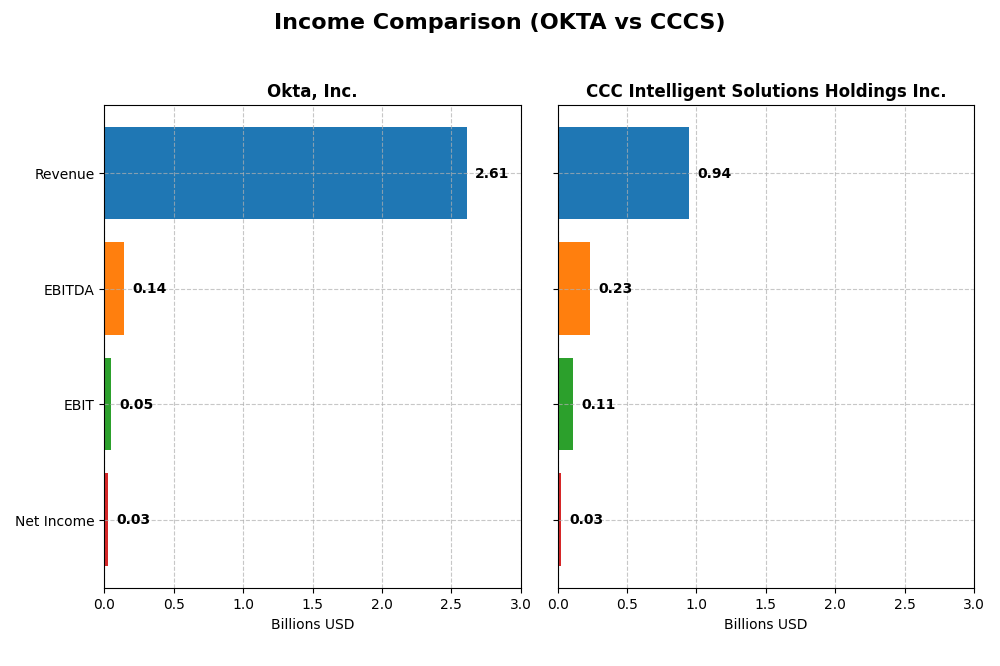

This table presents a side-by-side comparison of key income statement metrics for Okta, Inc. and CCC Intelligent Solutions Holdings Inc. based on their most recent fiscal year data.

| Metric | Okta, Inc. (OKTA) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Cap | 15.2B | 5.6B |

| Revenue | 2.61B | 945M |

| EBITDA | 139M | 233M |

| EBIT | 51M | 109M |

| Net Income | 28M | 26M |

| EPS | 0.17 | 0.043 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Okta, Inc.

Okta demonstrated strong revenue growth from $835M in 2021 to $2.61B in 2025, with net income turning positive to $28M in 2025 after years of losses. Gross margins remained consistently high around 76%, while net margins improved modestly to 1.07% in 2025. The latest fiscal year showed significant recovery in profitability and margin expansion, reflecting favorable operational leverage.

CCC Intelligent Solutions Holdings Inc.

CCC’s revenue increased steadily from $633M in 2020 to $945M in 2024, with net income recovering to $26M in 2024 from losses in prior years. The company maintained a favorable gross margin near 75.5%, and EBIT margins improved substantially to 11.5%. The recent year marked a strong turnaround with positive net margin growth and improved earnings per share, signaling operational efficiency enhancements.

Which one has the stronger fundamentals?

Both companies exhibit favorable income statement trends with robust revenue and net income growth, alongside improving margins. Okta shows exceptional top-line growth and margin recovery from a larger loss base, while CCC presents stronger EBIT margins and consistent profitability improvement. Each has strengths in fundamentals, reflecting positive momentum and operational progress over their respective periods.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Okta, Inc. and CCC Intelligent Solutions Holdings Inc. based on their most recent fiscal year data.

| Ratios | Okta, Inc. (2025) | CCC Intelligent Solutions (2024) |

|---|---|---|

| ROE | 0.44% | 1.31% |

| ROIC | -0.61% | 1.86% |

| P/E | 570.6 | 274.0 |

| P/B | 2.49 | 3.59 |

| Current Ratio | 1.35 | 3.65 |

| Quick Ratio | 1.35 | 3.65 |

| D/E | 0.15 | 0.42 |

| Debt-to-Assets | 10.1% | 26.7% |

| Interest Coverage | -14.8 | 1.24 |

| Asset Turnover | 0.28 | 0.30 |

| Fixed Asset Turnover | 22.31 | 4.68 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Okta, Inc.

Okta displays a mixed ratio profile, with unfavorable net margin (1.07%) and ROE (0.44%), alongside negative ROIC (-0.61%), signaling weak profitability and capital efficiency. However, favorable debt metrics, interest coverage (10.2), and quick ratio (1.35) suggest solid liquidity and manageable leverage. The company does not pay dividends, reflecting its reinvestment strategy focused on growth and product development.

CCC Intelligent Solutions Holdings Inc.

No ratio data is available for CCC Intelligent Solutions Holdings Inc. due to missing financial metrics, preventing a detailed analysis of its financial health or performance indicators. The absence of dividend information also precludes assessment of shareholder returns or capital distribution policies.

Which one has the best ratios?

Based on the available data, Okta presents a more comprehensive, albeit mixed, set of financial ratios, showing strengths in liquidity and leverage but weaknesses in profitability and valuation metrics. CCC Intelligent Solutions cannot be evaluated due to lack of ratio data, so no direct comparison or conclusion on superior ratios can be drawn.

Strategic Positioning

This section compares the strategic positioning of Okta and CCC Intelligent Solutions, focusing on market position, key segments, and exposure to technological disruption:

Okta, Inc.

- Market leader in identity solutions facing moderate pressure

- Focuses on identity cloud services including adaptive MFA

- Invests in advanced security tech, with limited disruption

CCC Intelligent Solutions Holdings Inc.

- Provides cloud and AI solutions primarily for the insurance sector

- Key segments include insurance workflow, repair, and parts supply

- Uses AI and telematics in insurance, exposed to sector-specific tech changes

Okta, Inc. vs CCC Intelligent Solutions Holdings Inc. Positioning

Okta pursues a diversified strategy across various industries with a strong focus on identity security, while CCC concentrates on the property and casualty insurance economy. Okta’s broader market reach contrasts with CCC’s specialized ecosystem approach.

Which has the best competitive advantage?

Okta shows a slightly unfavorable moat due to value destruction despite improving profitability, while CCC lacks sufficient data for moat evaluation, making Okta’s competitive advantage cautiously more assessable.

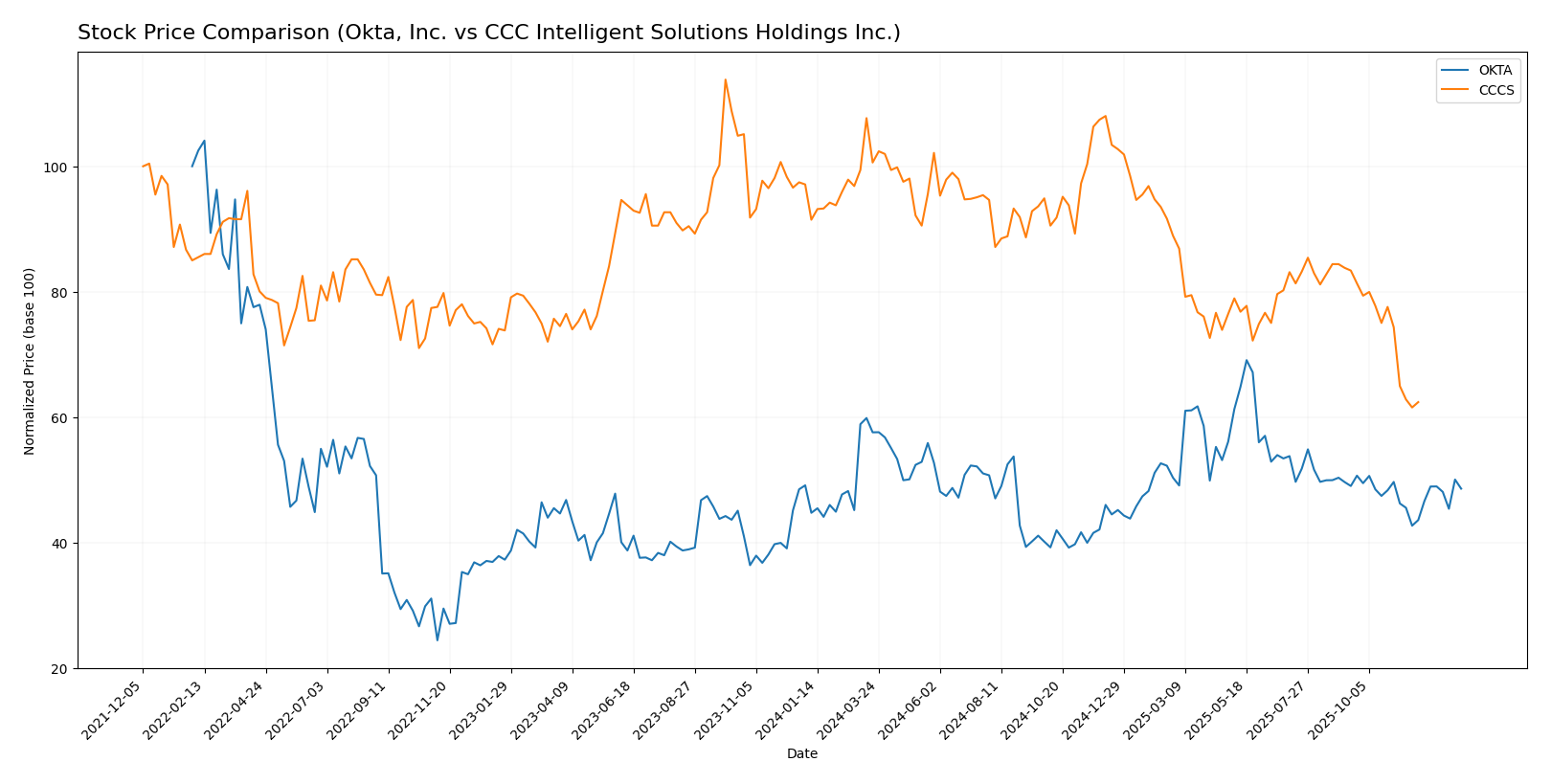

Stock Comparison

The stock price chart reveals significant divergence in performance over the past year, with Okta, Inc. showing a strong bullish momentum contrasted by a marked bearish trend in CCC Intelligent Solutions Holdings Inc.

Trend Analysis

Okta, Inc. experienced a 7.58% price increase over the past 12 months, indicating a bullish trend with acceleration, reaching a high of 127.3 and a low of 72.24, amid relatively high volatility (std deviation 11.38).

CCC Intelligent Solutions Holdings Inc. showed a 31.78% price decline over the same period, reflecting a bearish trend with deceleration, a high of 12.67, and a low of 7.22, supported by low volatility (std deviation 1.24).

Comparing both, Okta has delivered the highest market performance over the past year, with a positive price trend, whereas CCCS has significantly underperformed with a sharp downward trajectory.

Target Prices

The consensus target prices for Okta, Inc. and CCC Intelligent Solutions Holdings Inc. reflect moderate optimism from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Okta, Inc. | 140 | 60 | 110.67 |

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

Analysts expect Okta’s stock to appreciate from its current price of $89.55 toward a consensus target of $110.67, indicating potential upside. CCC’s consensus target at $11 slightly exceeds its current price of $8.75, suggesting modest growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Okta, Inc. and CCC Intelligent Solutions Holdings Inc.:

Rating Comparison

Okta, Inc. Rating

- Rating: B, considered Very Favorable overall

- Discounted Cash Flow Score: 4, Favorable

- ROE Score: 2, Moderate

- ROA Score: 3, Moderate

- Debt To Equity Score: 4, Favorable

- Overall Score: 3, Moderate

CCC Intelligent Solutions Holdings Inc. Rating

- No rating data available

- No score data available

- No score data available

- No score data available

- No score data available

- No score data available

Which one is the best rated?

Based strictly on the provided data, Okta, Inc. is better rated with a “B” rating classified as Very Favorable, supported by multiple financial scores. CCC Intelligent Solutions Holdings Inc. lacks any rating or score data for comparison.

Scores Comparison

The scores comparison between Okta, Inc. and CCC Intelligent Solutions Holdings Inc. is as follows:

Okta, Inc. Scores

- Altman Z-Score: 4.15, indicating a safe zone status

- Piotroski Score: 8, classified as very strong

CCC Intelligent Solutions Scores

- Altman Z-Score: 2.18, indicating a grey zone status

- Piotroski Score: 3, classified as very weak

Which company has the best scores?

Based on the provided data, Okta, Inc. has higher financial stability and strength scores than CCC Intelligent Solutions Holdings Inc., with both Altman Z-Score and Piotroski Score in stronger categories.

Grades Comparison

Here is a comparison of the recent grades assigned to the two companies by recognized grading firms:

Okta, Inc. Grades

The following table summarizes recent analyst grades for Okta, Inc. from established firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stephens & Co. | Upgrade | Overweight | 2026-01-14 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Jefferies | Upgrade | Buy | 2025-12-16 |

| Needham | Maintain | Buy | 2025-12-12 |

| BTIG | Maintain | Buy | 2025-12-04 |

| Susquehanna | Maintain | Neutral | 2025-12-03 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-03 |

| Scotiabank | Maintain | Sector Perform | 2025-12-03 |

Okta’s grades show a generally positive trend with multiple upgrades and consistent buy or overweight ratings from several reputable firms.

There are no reliable grades available for CCC Intelligent Solutions Holdings Inc. Analysts report a “Buy” consensus based on limited input, but no detailed grading data exists for deeper analysis.

Which company has the best grades?

Okta, Inc. has received a stronger and more detailed set of grades from multiple reputable firms compared to CCC Intelligent Solutions Holdings Inc., which lacks detailed grading data. This breadth of positive analyst opinions on Okta may provide investors with clearer confidence signals, while CCC’s limited data suggests higher uncertainty.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Okta, Inc. and CCC Intelligent Solutions Holdings Inc. based on the most recent available data.

| Criterion | Okta, Inc. | CCC Intelligent Solutions Holdings Inc. |

|---|---|---|

| Diversification | Focused on identity management with subscription and technology services; limited diversification | Primarily software subscriptions and other services; moderate diversification |

| Profitability | Low net margin (1.07%), negative ROIC (-0.61%), value destroying but improving ROIC trend | Data insufficient for profitability evaluation |

| Innovation | Strong growth in subscription revenue suggests ongoing innovation | Data insufficient for innovation evaluation |

| Global presence | Global cloud-based platform, strong enterprise customer base | Data insufficient to evaluate global presence |

| Market Share | Significant player in identity management with fast revenue growth (2.55B USD in 2025) | Leading provider in software for insurance claims with 906M USD software subscriptions in 2024 |

Key takeaways: Okta shows strong revenue growth and improving profitability trends but currently operates at low margins and negative returns, signaling risk. CCC Intelligent Solutions has solid subscription revenue but lacks sufficient financial data for a full assessment. Investors should weigh Okta’s growth potential against its current value destruction and await more data on CCC.

Risk Analysis

Below is a comparative table outlining the key risks for Okta, Inc. and CCC Intelligent Solutions Holdings Inc. based on their latest 2025-2026 data.

| Metric | Okta, Inc. | CCC Intelligent Solutions Holdings Inc. |

|---|---|---|

| Market Risk | Moderate (beta 0.76, tech sector volatility) | Moderate (beta 0.72, software industry cyclical risk) |

| Debt level | Low debt (D/E 0.15, favorable leverage) | Unknown (data unavailable) |

| Regulatory Risk | Moderate (identity/security compliance needs) | Moderate (insurance and tech-related regulations) |

| Operational Risk | Moderate (high PE ratio suggests growth pressure) | Unknown (data unavailable) |

| Environmental Risk | Low (tech sector, limited direct exposure) | Low (software services, limited direct exposure) |

| Geopolitical Risk | Moderate (global client base, cloud services) | Moderate (US-based, but global insurance economy exposure) |

The most impactful and likely risks for Okta center on market volatility and regulatory compliance related to identity security, despite its strong financial stability and low debt. CCC faces uncertainty due to missing financial data, but operational and regulatory risks remain notable given its niche in the insurance tech ecosystem. Both companies maintain low environmental risk typical of software firms.

Which Stock to Choose?

Okta, Inc. shows a favorable income statement with strong revenue and net income growth, but mixed financial ratios: solid liquidity and low debt contrast with low profitability and a high P/E ratio. Its rating is very favorable overall.

CCC Intelligent Solutions Holdings Inc. presents a favorable income statement with significant net income and EBIT growth, yet lacks available data on financial ratios and ratings. The stock’s trend has been bearish recently, with a notable price decline.

For investors, Okta’s very favorable rating and improving profitability might appeal to those prioritizing growth and quality, while CCC’s limited ratio data and price weakness may suggest a more cautious approach; risk-averse investors might find Okta’s profile more aligned with stability considerations.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Okta, Inc. and CCC Intelligent Solutions Holdings Inc. to enhance your investment decisions: