Informatica Inc. and CCC Intelligent Solutions Holdings Inc. are two prominent players in the software infrastructure industry, each leveraging artificial intelligence and cloud technologies to innovate within their markets. Informatica focuses on enterprise data management and integration, while CCC targets AI-driven workflows for the insurance economy. By comparing these industry leaders, I will help you uncover which company presents the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between Informatica Inc. and CCC Intelligent Solutions Holdings Inc. by providing an overview of these two companies and their main differences.

Informatica Inc. Overview

Informatica Inc. develops an AI-powered platform that connects, manages, and unifies data across multi-cloud and hybrid systems at enterprise scale. The company offers interoperable data management products including data integration, API management, data quality, and governance solutions. Headquartered in Redwood City, CA, Informatica serves large enterprises aiming to improve data accuracy, compliance, and accessibility in the US market.

CCC Intelligent Solutions Holdings Inc. Overview

CCC Intelligent Solutions Holdings Inc. provides cloud, mobile, AI, and telematics technologies for the property and casualty insurance economy. Its SaaS platform digitizes AI-enabled workflows and connects stakeholders such as insurers, repairers, and manufacturers. Based in Chicago, IL, CCC focuses on insurance-specific solutions including workflow, estimating, repair management, and ecosystem connectivity to drive efficiency in insurance processes.

Key similarities and differences

Both companies operate in the software infrastructure industry and leverage AI technologies to enhance business workflows. While Informatica emphasizes enterprise-scale data management across various sectors, CCC targets the insurance economy with specialized SaaS solutions. Informatica has a larger workforce (5,200 vs. 2,310) and market cap ($7.5B vs. $5.6B), reflecting its broader enterprise focus compared to CCC’s niche market approach.

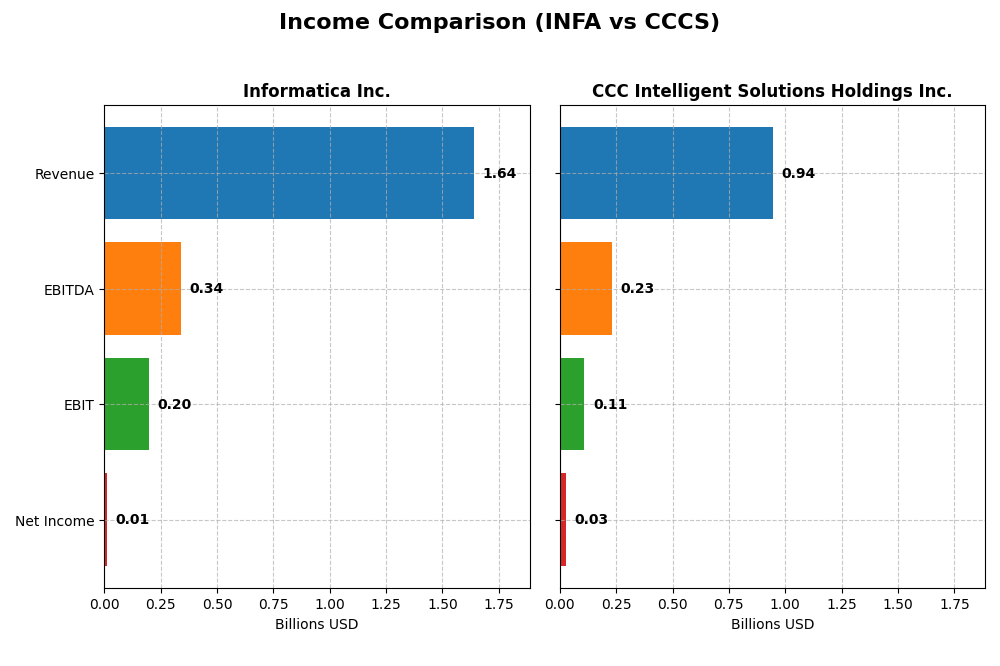

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Informatica Inc. (INFA) and CCC Intelligent Solutions Holdings Inc. (CCCS) for the fiscal year 2024.

| Metric | Informatica Inc. (INFA) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Cap | 7.5B | 5.6B |

| Revenue | 1.64B | 945M |

| EBITDA | 339M | 233M |

| EBIT | 199M | 109M |

| Net Income | 9.9M | 26.1M |

| EPS | 0.033 | 0.043 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Informatica Inc.

Informatica Inc. showed steady revenue growth from 2020 to 2024, increasing from $1.32B to $1.64B, with net income recovering from losses to a positive $9.9M in 2024. Margins remain strong, with a gross margin around 80%, and a slight improvement in EBIT margin to 12.15%. The latest year saw slowed revenue growth at 2.8%, but a notable rebound in EBIT and net margin.

CCC Intelligent Solutions Holdings Inc.

CCC Intelligent Solutions posted robust revenue growth, rising from $633M in 2020 to $945M in 2024, alongside a significant turnaround in net income from a loss of $16.9M to a profit of $26.1M. Gross margin held favorably at 75.55%, with EBIT margin improving to 11.53%. The recent year delivered strong double-digit growth in revenue and profitability, signaling accelerating operational efficiency.

Which one has the stronger fundamentals?

Both companies demonstrate favorable income statement fundamentals, but CCC exhibits stronger growth momentum with 49.2% revenue increase and 255% net income growth over five years, alongside improving margins and profitability. Informatica’s margins are higher, yet revenue growth slowed recently. CCC’s consistent upward trends and margin expansion suggest stronger earnings fundamentals at this time.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Informatica Inc. (INFA) and CCC Intelligent Solutions Holdings Inc. (CCCS) for the latest fiscal year 2024.

| Ratios | Informatica Inc. (INFA) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| ROE | 0.43% | 1.31% |

| ROIC | 0.56% | 1.86% |

| P/E | 788x | 274x |

| P/B | 3.39x | 3.59x |

| Current Ratio | 1.82 | 3.65 |

| Quick Ratio | 1.82 | 3.65 |

| D/E (Debt-to-Equity) | 0.81 | 0.42 |

| Debt-to-Assets | 35.2% | 26.7% |

| Interest Coverage | 0.87 | 1.24 |

| Asset Turnover | 0.31 | 0.30 |

| Fixed Asset Turnover | 8.75 | 4.68 |

| Payout Ratio | 0.12% | 0% |

| Dividend Yield | 0.00015% | 0% |

Interpretation of the Ratios

Informatica Inc.

Informatica’s ratios indicate moderate operational efficiency with a current ratio around 1.8, reflecting reasonable short-term liquidity. However, returns on assets and equity remain very low, close to zero, signaling limited profitability. The company does not pay dividends, likely due to negative free cash flow to equity and a focus on reinvestment in R&D, which accounts for nearly 19% of revenue, indicating a growth and development strategy.

CCC Intelligent Solutions Holdings Inc.

CCC Intelligent Solutions shows stronger liquidity with a current ratio above 3, and a better return on equity at around 1.3%. Despite this, profitability remains subdued, and free cash flow to equity is negative, consistent with high capital expenditures. Like Informatica, CCC does not pay dividends, presumably prioritizing investments in technology and growth initiatives over shareholder distributions, as evidenced by R&D expenses exceeding 21% of revenue.

Which one has the best ratios?

Comparing both, CCC Intelligent Solutions exhibits superior liquidity and marginally better profitability metrics, suggesting a slightly stronger financial position. However, both companies face challenges with negative free cash flow to equity and low returns, highlighting caution. Neither pays dividends, emphasizing reinvestment and growth focus rather than immediate shareholder returns.

Strategic Positioning

This section compares the strategic positioning of Informatica Inc. and CCC Intelligent Solutions Holdings Inc., focusing on Market position, Key segments, and Exposure to technological disruption:

Informatica Inc. (INFA)

- Larger market cap at 7.5B USD, faces competition in software infrastructure.

- Key segments: data management, integration, and governance with AI-powered platform.

- Heavy focus on AI-powered multi-cloud data management, indicating strong tech adoption.

CCC Intelligent Solutions Holdings Inc. (CCCS)

- Smaller market cap at 5.6B USD, operates in a niche insurance software market.

- Key segments: AI-enabled SaaS solutions for P&C insurance economy workflows.

- Uses AI, cloud, telematics, and hyperscale tech for digitizing insurance workflows.

Informatica Inc. vs CCC Intelligent Solutions Holdings Inc. Positioning

Informatica shows a diversified product portfolio across enterprise data and integration services, while CCC concentrates on insurance-specific AI-driven SaaS. Informatica’s broader scope may offer scale, whereas CCC’s focus targets specialized industry needs.

Which has the best competitive advantage?

No MOAT evaluation data is available for either company, so a definitive assessment of competitive advantage cannot be determined based on provided information.

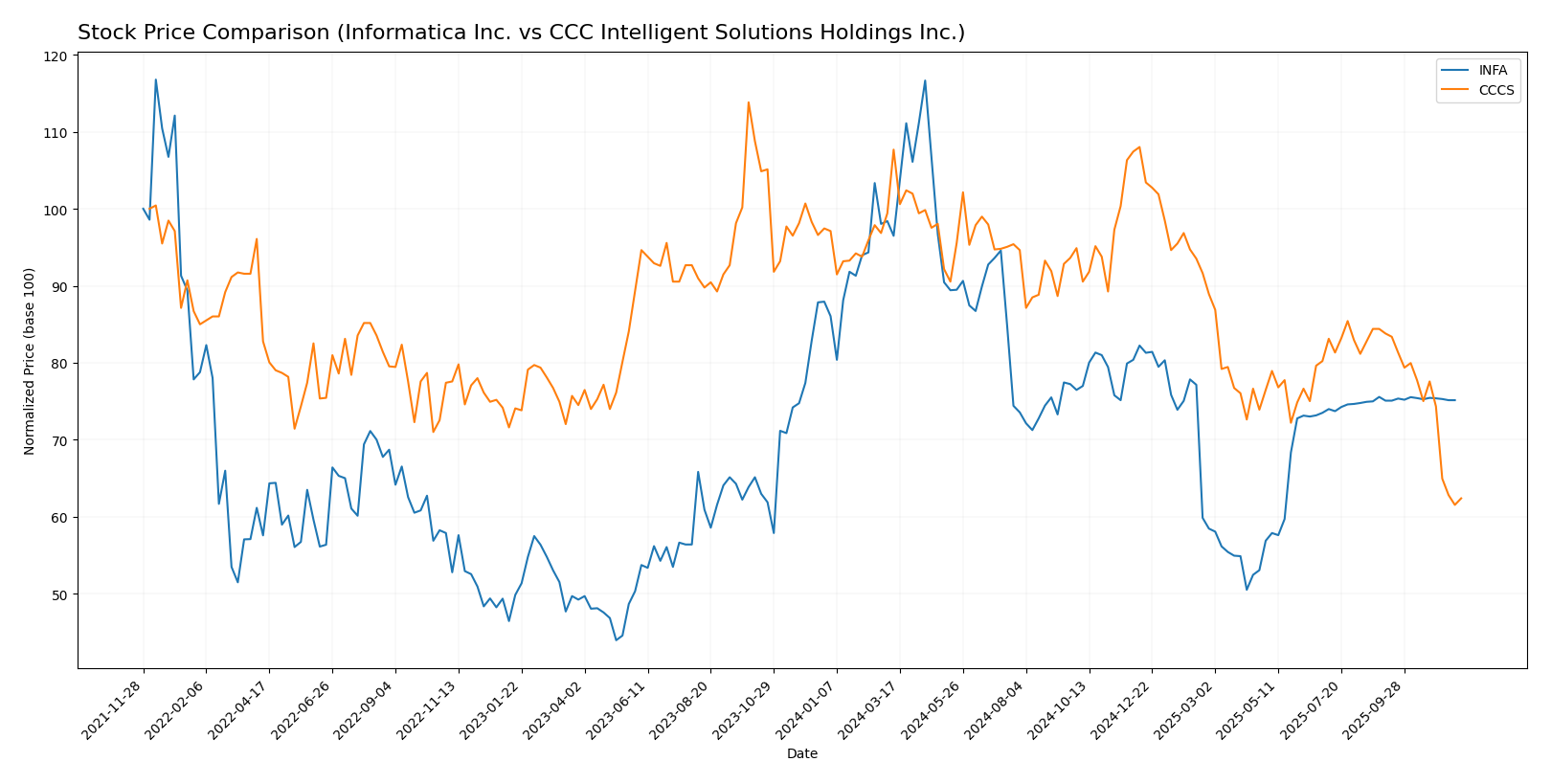

Stock Comparison

The past year revealed notable bearish trends for both Informatica Inc. and CCC Intelligent Solutions Holdings Inc., with Informatica showing accelerating decline and CCCS experiencing a decelerating downward movement amid shifting buyer-seller dynamics.

Trend Analysis

Informatica Inc. (INFA) experienced a bearish trend over the past 12 months, with a -12.68% price change and accelerating decline. The stock fluctuated between a high of 38.48 and a low of 16.67, showing increased volatility with a 4.46 standard deviation.

CCC Intelligent Solutions Holdings Inc. (CCCS) displayed a more pronounced bearish trend with a -31.78% price change over the same period, but this decline decelerated. Price ranged from 12.67 at peak to 7.22 at trough, with lower volatility indicated by a 1.24 standard deviation.

Comparing the two, Informatica’s stock outperformed CCCS over the past year, delivering the highest relative market performance despite both stocks trending downward.

Target Prices

Analysts present a clear target consensus for both Informatica Inc. and CCC Intelligent Solutions Holdings Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Informatica Inc. | 27 | 27 | 27 |

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

The target consensus for Informatica Inc. at $27 suggests modest upside compared to its current price of $24.79. CCC Intelligent Solutions Holdings shows a target consensus of $11, indicating potential gains from the present $8.75 stock price. Overall, analysts expect moderate appreciation for both stocks.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Informatica Inc. and CCC Intelligent Solutions Holdings Inc.:

Rating Comparison

Informatica Inc. Rating

- No rating information available

- No Discounted Cash Flow Score provided

- No ROE Score available

- No ROA Score available

- No Debt To Equity Score available

- No Overall Score provided

CCC Intelligent Solutions Holdings Inc. Rating

- No rating information available

- No Discounted Cash Flow Score provided

- No ROE Score available

- No ROA Score available

- No Debt To Equity Score available

- No Overall Score provided

Which one is the best rated?

No analyst ratings or scores are available for either Informatica Inc. or CCC Intelligent Solutions Holdings Inc., so no comparison or conclusion can be drawn from the provided data.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Informatica Inc. and CCC Intelligent Solutions Holdings Inc.:

INFA Scores

- Altman Z-Score: 1.94, in the grey zone indicating moderate bankruptcy risk

- Piotroski Score: 6, average financial strength

CCCS Scores

- Altman Z-Score: 2.18, in the grey zone indicating moderate bankruptcy risk

- Piotroski Score: 3, very weak financial strength

Which company has the best scores?

Informatica shows a stronger Piotroski Score indicating better financial strength, while both companies fall in the grey zone for Altman Z-Score, reflecting similar moderate bankruptcy risk.

Grades Comparison

Here is the grades comparison for Informatica Inc. and CCC Intelligent Solutions Holdings Inc.:

Informatica Inc. Grades

The following table shows recent grades from reputable grading companies for Informatica Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Downgrade | Neutral | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| Baird | Maintain | Neutral | 2025-05-28 |

| JP Morgan | Downgrade | Neutral | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | Downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-28 |

| Truist Securities | Downgrade | Hold | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-27 |

| UBS | Maintain | Neutral | 2025-05-16 |

Overall, Informatica’s grades show a trend toward neutrality and hold ratings with multiple downgrades from previous buy or outperform ratings.

Since no reliable grades are available for CCC Intelligent Solutions Holdings Inc., its risk profile cannot be assessed through grading data.

Which company has the best grades?

Informatica Inc. has received predominantly neutral to hold grades from established grading companies, whereas CCC Intelligent Solutions Holdings Inc. lacks verifiable grade data but shows a buy consensus from market ratings. Investors may interpret Informatica’s neutral stance as cautious, while CCC’s buy consensus suggests relatively higher market confidence.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses of Informatica Inc. (INFA) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on their latest available data.

| Criterion | Informatica Inc. (INFA) | CCC Intelligent Solutions (CCCS) |

|---|---|---|

| Diversification | Strong mix of subscription (1.1B) and professional services (78M) revenue streams | Mostly reliant on software subscriptions (906M) with limited other services (38M) |

| Profitability | Data unavailable, caution advised | Data unavailable, caution advised |

| Innovation | Transitioning to cloud and subscription models shows adaptability | Consistent growth in software subscriptions suggests effective product development |

| Global presence | Established global footprint, supported by diverse service offerings | More niche focus, potentially less diversified geographically |

| Market Share | Leading player in data management and integration software | Strong position in intelligent solutions software, but more specialized |

Key takeaways: Informatica shows strong revenue diversification and cloud adaptation, enhancing resilience. CCCS benefits from steady subscription growth but is more specialized, which may limit market breadth. Due to missing profitability data, I recommend cautious evaluation and monitoring of financial disclosures before investment decisions.

Risk Analysis

Below is a comparative risk assessment table for Informatica Inc. (INFA) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the latest available data in 2026:

| Metric | Informatica Inc. (INFA) | CCC Intelligent Solutions (CCCS) |

|---|---|---|

| Market Risk | Moderate (Beta 1.14) | Lower (Beta 0.72) |

| Debt Level | Data unavailable | Data unavailable |

| Regulatory Risk | Moderate (US tech sector) | Moderate (US tech & insurance tech) |

| Operational Risk | Medium (Cloud/software infrastructure) | Medium (Cloud/AI for insurance) |

| Environmental Risk | Low (Software industry) | Low (Software industry) |

| Geopolitical Risk | Moderate (US-based, global cloud exposure) | Moderate (US-based, insurance ecosystem) |

Both companies sit in a moderate market risk profile with Informatica showing a higher beta, indicating greater sensitivity to market swings. The absence of specific debt data requires caution; however, operational risks are typical for software infrastructure firms, relying heavily on cloud and AI technology stability. Regulatory challenges remain moderate given their US base but evolving data privacy and insurance regulations could impact both. Geopolitical tensions could affect cloud service continuity and global partnerships.

Informatica’s Altman Z-Score of ~1.94 and CCCS’s score of ~2.18 place both in the “grey zone,” indicating a moderate risk of financial distress. CCCS’s Piotroski score is weak (3), suggesting weaker financial health compared to Informatica’s average score (6). Overall, the most impactful risks are financial stability concerns and regulatory compliance in their specialized tech environments. Investors should monitor these factors closely.

Which Stock to Choose?

Informatica Inc. (INFA) shows a generally favorable income evolution with strong gross and EBIT margins, alongside robust income growth over 2020-2024. However, financial ratios indicate moderate debt levels with a net debt to EBITDA near 2.8 and an Altman Z-Score in the grey zone at 1.94, suggesting some financial caution.

CCC Intelligent Solutions Holdings Inc. (CCCS) presents favorable income growth, with a higher overall revenue increase and robust profitability margins. Its financial health shows a lower net debt to EBITDA ratio of about 1.93 but a weaker Piotroski score of 3, and an Altman Z-Score also in the grey zone at 2.18, reflecting moderate financial risk.

Investors prioritizing growth potential and improving profitability might find Informatica’s income momentum and profitability metrics suggestive of future value, while those favoring lower leverage and more conservative financial profiles could interpret CCC Intelligent Solutions’ steadier debt and income quality as preferable. The choice may depend on the tolerance for financial risk and investment strategy focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Informatica Inc. and CCC Intelligent Solutions Holdings Inc. to enhance your investment decisions: