In today’s fast-evolving tech landscape, choosing the right software infrastructure company can significantly impact your investment portfolio. GoDaddy Inc. (GDDY) and CCC Intelligent Solutions Holdings Inc. (CCCS) both operate in this sector but serve distinct markets—GoDaddy focuses on web presence and digital identity for businesses, while CCC leverages AI and cloud solutions for the insurance economy. This article will explore their strengths and risks to help you identify the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between GoDaddy and CCC Intelligent Solutions by providing an overview of these two companies and their main differences.

GoDaddy Overview

GoDaddy Inc. focuses on cloud-based technology products aimed at helping customers establish and grow their digital presence. It offers domain registration, website hosting, security tools, marketing services, and business applications. Serving small businesses, individuals, and developers, GoDaddy operates mainly in the software infrastructure industry with a market cap of $14.5B and is headquartered in Tempe, Arizona.

CCC Intelligent Solutions Overview

CCC Intelligent Solutions Holdings Inc. provides cloud, AI, telematics, and SaaS solutions for the property and casualty insurance sector. Its products digitize workflows and connect various players within the insurance economy, including carriers and repairers. Founded in 1980 and based in Chicago, CCC has a market cap of $5.6B and serves clients mainly through its AI-enabled platforms for insurance and automotive industries.

Key similarities and differences

Both companies operate in the software infrastructure sector and provide cloud-based solutions. However, GoDaddy targets a broader market focused on digital presence and e-commerce for small businesses and individuals, while CCC specializes in AI-driven SaaS products for the insurance and automotive economy. GoDaddy’s offerings are more diversified, including marketing and payment services, whereas CCC’s solutions primarily serve specialized insurance workflows and connected ecosystem players.

Income Statement Comparison

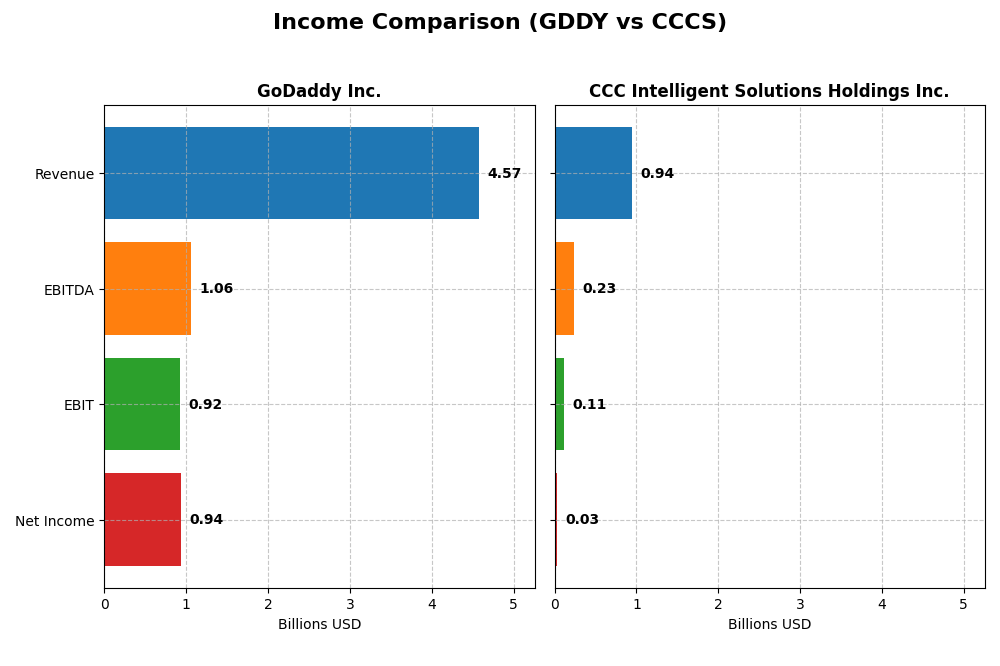

The table below compares key income statement metrics for GoDaddy Inc. and CCC Intelligent Solutions Holdings Inc. for the fiscal year 2024.

| Metric | GoDaddy Inc. (GDDY) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Cap | 14.5B | 5.6B |

| Revenue | 4.57B | 945M |

| EBITDA | 1.06B | 233M |

| EBIT | 924M | 109M |

| Net Income | 937M | 26M |

| EPS | 6.63 | 0.043 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

GoDaddy Inc.

GoDaddy’s revenue rose steadily from $3.3B in 2020 to $4.57B in 2024, with net income recovering from a -$495M loss in 2020 to $937M in 2024. Margins improved notably, with a gross margin of 63.9% and EBIT margin at 20.2% in 2024. Despite a 7.5% revenue growth in 2024, net margin and EPS declined, indicating margin pressures last year.

CCC Intelligent Solutions Holdings Inc.

CCC saw revenue growth from $633M in 2020 to $945M in 2024, with net income turning positive at $26M in 2024 after losses in earlier years. Margins expanded, highlighted by a strong 75.6% gross margin and an EBIT margin of 11.5% in 2024. The company posted robust one-year growth in revenue, EBIT, net margin, and EPS, reflecting improving profitability.

Which one has the stronger fundamentals?

Both companies show favorable income statement trends overall, but GoDaddy exhibits higher absolute revenues and stronger EBIT and net margins, albeit with recent margin softness. CCC demonstrates impressive margin expansion and profitability turnaround with consistent growth metrics. While GoDaddy’s scale and margins remain superior, CCC’s accelerating profitability and margin gains indicate strengthening fundamentals.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for GoDaddy Inc. (GDDY) and CCC Intelligent Solutions Holdings Inc. (CCCS) for the fiscal year 2024.

| Ratios | GoDaddy Inc. (GDDY) | CCC Intelligent Solutions (CCCS) |

|---|---|---|

| ROE | 135.4% | 1.31% |

| ROIC | 16.0% | 1.86% |

| P/E | 29.8 | 274.0 |

| P/B | 40.3 | 3.59 |

| Current Ratio | 0.72 | 3.65 |

| Quick Ratio | 0.72 | 3.65 |

| D/E | 5.63 | 0.42 |

| Debt-to-Assets | 47.3% | 26.7% |

| Interest Coverage | 5.64 | 1.24 |

| Asset Turnover | 0.56 | 0.30 |

| Fixed Asset Turnover | 22.2 | 4.68 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

GoDaddy Inc.

GoDaddy shows strong profitability with a 20.49% net margin and an exceptionally high 135.37% return on equity, indicating efficient capital use. However, liquidity ratios are weak, with a current ratio of 0.72, and leverage is elevated at a debt-to-equity ratio of 5.63, raising solvency concerns. The company does not pay dividends, reflecting a possible reinvestment or growth focus.

CCC Intelligent Solutions Holdings Inc.

Due to missing ratio and key metric data, a detailed analysis for CCC Intelligent Solutions is unavailable. The absence of dividend payments may suggest ongoing investment in growth, research, or acquisitions, or a response to negative earnings, but specifics cannot be confirmed without further financial details.

Which one has the best ratios?

GoDaddy presents a mixed profile with strong profitability and coverage ratios but weaker liquidity and high leverage. CCC Intelligent Solutions lacks sufficient data for a comprehensive evaluation. Based solely on available information, GoDaddy’s ratios provide more insight, though caution is warranted given its financial structure.

Strategic Positioning

This section compares the strategic positioning of GoDaddy Inc. and CCC Intelligent Solutions Holdings Inc. based on Market position, Key segments, and Exposure to technological disruption:

GoDaddy Inc.

- Large market cap at $14.5B with steady competitive pressure in cloud-based infrastructure software.

- Focus on domain registration, hosting, presence, and business applications driving revenue growth.

- Technology centered on cloud services and security products with evolving offerings in e-commerce and marketing tools.

CCC Intelligent Solutions Holdings Inc.

- Smaller market cap at $5.6B, operating in a niche insurance software market with moderate competitive pressure.

- Concentrated on SaaS for property and casualty insurance economy, including AI and telematics solutions.

- Heavy exposure to AI, mobile, and hyperscale technologies disrupting traditional insurance workflows.

GoDaddy Inc. vs CCC Intelligent Solutions Holdings Inc. Positioning

GoDaddy pursues a diversified strategy across domains, hosting, and commerce applications, benefiting from broad market exposure but facing varied competition. CCC concentrates on insurance-specific SaaS solutions, enabling focused innovation yet limiting market breadth.

Which has the best competitive advantage?

Based on MOAT evaluation, GoDaddy shows a very favorable moat with growing ROIC and durable competitive advantage. CCC lacks sufficient data for MOAT assessment, so GoDaddy holds the clearer competitive edge.

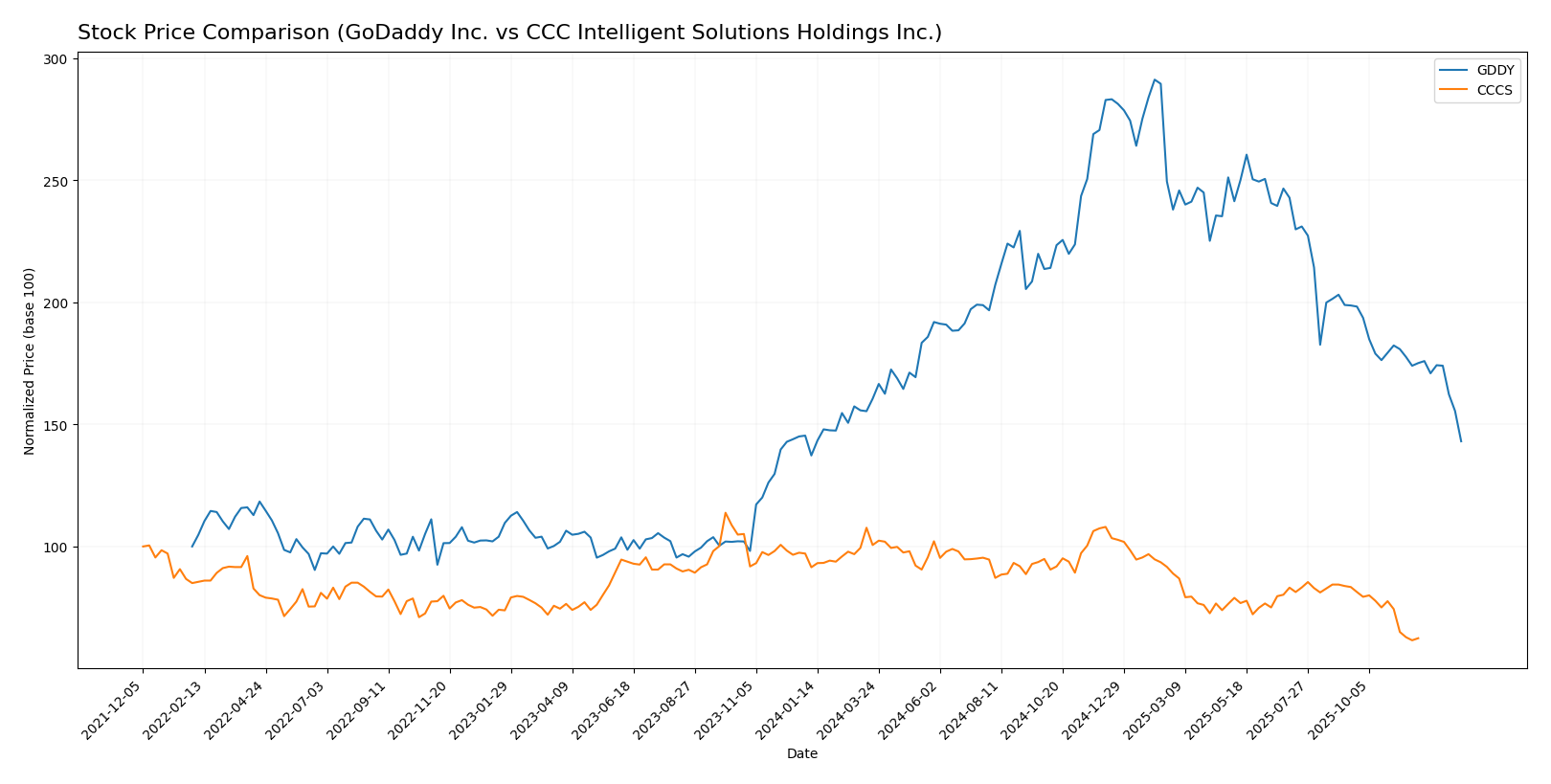

Stock Comparison

The past year reveals significant bearish trends for both GoDaddy Inc. and CCC Intelligent Solutions Holdings Inc., with marked price declines and distinct trading volume dynamics reflecting shifting investor sentiment.

Trend Analysis

GoDaddy Inc. experienced a -9.09% price decline over the past 12 months, indicating a bearish trend with decelerating downward momentum. The stock showed high volatility, with a std deviation of 27.35 and price ranging from 104.46 to 212.65.

CCC Intelligent Solutions Holdings Inc. posted a -31.78% decrease over the same period, also bearish with deceleration. Volatility was low at 1.24 std deviation, with prices fluctuating between 7.22 and 12.67.

Comparing the two, GoDaddy’s stock outperformed CCC’s, delivering a smaller percentage loss and higher volatility, signaling relatively better market performance over the past year.

Target Prices

Analysts provide a clear target price consensus indicating potential upside for GoDaddy Inc. and a steady outlook for CCC Intelligent Solutions Holdings Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| GoDaddy Inc. | 182 | 70 | 143.33 |

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

The target consensus for GoDaddy Inc. at 143.33 USD suggests a significant upside from the current price of 104.46 USD, reflecting strong analyst confidence. In contrast, CCC Intelligent Solutions Holdings Inc. targets a steady 11 USD, slightly above the current price of 8.75 USD, indicating moderate growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for GoDaddy Inc. and CCC Intelligent Solutions Holdings Inc.:

Rating Comparison

GoDaddy Inc. Rating

- Rating: B+ with a Very Favorable status.

- Discounted Cash Flow Score: 5, indicating Very Favorable valuation based on future cash flows.

- ROE Score: 5, Very Favorable, showing strong profit generation from equity.

- ROA Score: 4, Favorable, reflecting effective asset utilization.

- Debt To Equity Score: 1, Very Unfavorable, indicating high financial risk.

- Overall Score: 3, Moderate overall financial standing.

CCC Intelligent Solutions Holdings Inc. Rating

- No rating data available.

- No data available.

- No data available.

- No data available.

- No data available.

- No data available.

Which one is the best rated?

Based strictly on the provided data, GoDaddy Inc. is the only company with a published rating and scores. Its overall score is moderate, supported by very favorable cash flow and equity returns but weakened by a high debt-to-equity risk. CCC Intelligent Solutions Holdings Inc. lacks any rating data for comparison.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for GoDaddy Inc. and CCC Intelligent Solutions Holdings Inc.:

GoDaddy Inc. Scores

- Altman Z-Score: 1.53, in distress zone, high bankruptcy risk.

- Piotroski Score: 8, very strong financial health.

CCC Intelligent Solutions Scores

- Altman Z-Score: 2.18, in grey zone, moderate bankruptcy risk.

- Piotroski Score: 3, very weak financial health.

Which company has the best scores?

GoDaddy Inc. shows a lower Altman Z-Score indicating distress, but a very strong Piotroski Score of 8. CCC has a better Altman score in the grey zone but a weak Piotroski Score of 3. Overall, GoDaddy displays stronger financial health based on Piotroski.

Grades Comparison

Here is a comparison of the latest available grades for GoDaddy Inc. and CCC Intelligent Solutions Holdings Inc.:

GoDaddy Inc. Grades

The table below shows recent grades assigned to GoDaddy Inc. by reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

Overall, GoDaddy Inc.’s grades reflect a generally positive but cautious stance, with a majority of Buy and Neutral ratings.

Since no reliable grades are available for CCC Intelligent Solutions Holdings Inc., no table is provided.

Which company has the best grades?

GoDaddy Inc. has received more extensive and generally stronger grades than CCC Intelligent Solutions Holdings Inc., whose available consensus is less detailed. This suggests GoDaddy may be viewed with greater confidence by analysts, potentially impacting investor sentiment accordingly.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of GoDaddy Inc. (GDDY) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent available data.

| Criterion | GoDaddy Inc. (GDDY) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Diversification | High: Multiple revenue streams including Core Platform ($2.9B) and Applications & Commerce ($1.65B) in 2024 | Moderate: Mainly Software Subscriptions ($906M) with smaller Other Services ($38M) segment in 2024 |

| Profitability | Strong: Net margin 20.49%, ROIC 16.02%, ROE 135.37%, creating value with growing ROIC trend | Data unavailable for profitability metrics |

| Innovation | Solid: Demonstrated durable competitive advantage with increasing profitability | Data unavailable for innovation metrics |

| Global presence | Established: Large global footprint through domain registration and hosting services | Less clear: Primarily focused on insurance software solutions, likely more regional |

| Market Share | Significant in domain and web services markets | Niche player in insurance technology with smaller market size |

Key takeaway: GoDaddy shows robust diversification, strong profitability, and a durable competitive advantage, making it a solid contender for investment. CCCS, while showing growth in software subscriptions, lacks publicly available detailed financial data for a full assessment, signaling higher risk due to information opacity.

Risk Analysis

Below is a comparative risk assessment of GoDaddy Inc. (GDDY) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent available data from 2024 and 2026 market conditions.

| Metric | GoDaddy Inc. (GDDY) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Risk | Moderate (Beta 0.948) | Lower (Beta 0.721) |

| Debt level | High (Debt-to-Equity 5.63, Debt-to-Assets 47.29%) | Data unavailable |

| Regulatory Risk | Moderate (Tech sector compliance requirements) | Moderate (Insurance tech regulations) |

| Operational Risk | Moderate (Cloud infrastructure reliance) | Moderate (AI and SaaS platform complexity) |

| Environmental Risk | Low (Data centers with limited direct impact) | Low (Primarily software-based operations) |

| Geopolitical Risk | Moderate (US-based, global customers) | Moderate (US-based, insurance ecosystem focus) |

GoDaddy faces significant financial risk from its high debt levels despite strong profitability, with an Altman Z-score indicating distress risk. CCCS shows moderate market risk and operational complexity but lacks detailed financial data, increasing uncertainty. Investors should weigh GoDaddy’s leverage risk against its strong returns, while CCCS’s incomplete data advises caution.

Which Stock to Choose?

GoDaddy Inc. (GDDY) shows favorable income evolution with a strong gross margin of 63.88% and an EBIT margin of 20.2% in 2024. Its profitability is supported by a high ROE of 135.37% and a ROIC of 16.02%. However, financial ratios reveal mixed signals, including a low current ratio of 0.72 and high debt-to-equity at 5.63, resulting in a moderate overall rating of B+ despite a very favorable discounted cash flow score.

CCC Intelligent Solutions Holdings Inc. (CCCS) exhibits favorable income growth with a 9.05% revenue increase and solid EBIT margin of 11.53% in 2024. Profitability metrics are weaker, with a net margin of 2.77% and modest returns on equity and assets. Financial ratio data is missing, but scores indicate a moderate Altman Z-Score in the grey zone and a weak Piotroski Score of 3, reflecting potential financial risks.

Investors focused on strong profitability and a durable competitive advantage might find GoDaddy’s financial profile favorable due to its very favorable moat status and income statement. Conversely, those with a cautious stance may see CCC Intelligent Solutions’ moderate income growth combined with weaker financial health scores as a signal to await further data. The choice could depend on the investor’s risk tolerance and preference for established profitability versus growth potential.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of GoDaddy Inc. and CCC Intelligent Solutions Holdings Inc. to enhance your investment decisions: