In the rapidly evolving software infrastructure sector, CyberArk Software Ltd. and CCC Intelligent Solutions Holdings Inc. stand out as innovators with distinct approaches to security and digital transformation. CyberArk specializes in privileged access security, while CCC focuses on AI-driven solutions for the insurance ecosystem. Comparing these two offers valuable insights into their market positioning and innovation strategies. Join me as we explore which company presents a more compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between CyberArk Software Ltd. and CCC Intelligent Solutions Holdings Inc. by providing an overview of these two companies and their main differences.

CyberArk Overview

CyberArk Software Ltd. focuses on developing and marketing software-based security solutions worldwide. Its offerings include privileged access management, endpoint security, and cloud entitlements management designed to protect organizations from cyber threats. The company serves various industries such as financial services, healthcare, and government agencies, leveraging both direct sales and partner channels from its headquarters in Petah Tikva, Israel.

CCC Overview

CCC Intelligent Solutions Holdings Inc. delivers cloud, AI, mobile, and telematics technologies aimed at the property and casualty insurance economy. Its SaaS platform digitizes workflows and connects stakeholders including insurers, repairers, and manufacturers. Headquartered in Chicago, Illinois, CCC’s solutions span insurance, repair, parts supply, and financial services, supporting commerce and operational efficiency across the insurance value chain.

Key similarities and differences

Both CyberArk and CCC operate within the technology sector, specifically offering software infrastructure solutions. CyberArk specializes in cybersecurity with a broad industry focus, while CCC concentrates on AI-driven solutions tailored to the insurance ecosystem. Although both use SaaS models, CyberArk emphasizes identity and access management, whereas CCC focuses on workflow digitization and ecosystem connectivity in insurance. Their geographic bases and customer segments also differ significantly.

Income Statement Comparison

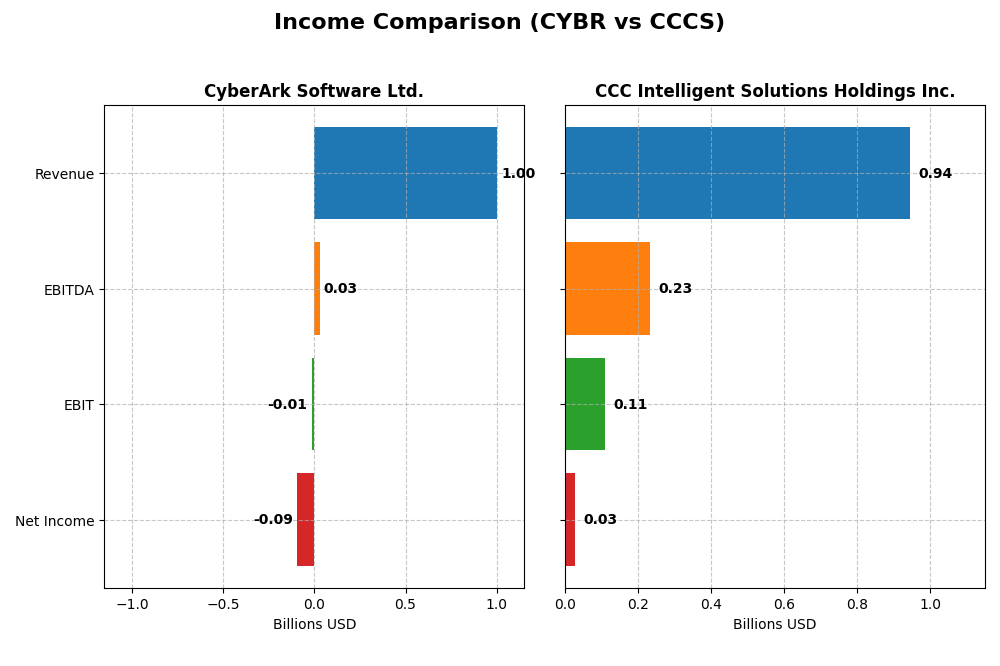

This table provides a side-by-side comparison of key income statement metrics for CyberArk Software Ltd. and CCC Intelligent Solutions Holdings Inc. for the fiscal year 2024.

| Metric | CyberArk Software Ltd. | CCC Intelligent Solutions Holdings Inc. |

|---|---|---|

| Market Cap | 22.9B | 5.6B |

| Revenue | 1.00B | 945M |

| EBITDA | 29M | 233M |

| EBIT | -13.3M | 109M |

| Net Income | -93.5M | 26.1M |

| EPS | -2.12 | 0.0428 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

CyberArk Software Ltd.

CyberArk’s revenue showed strong growth from 2020 to 2024, increasing by over 115%, but net income declined significantly, with losses widening over the period. Gross margins remained high and favorable at 79.18%, yet EBIT and net margins stayed negative in 2024. The latest year showed a 33.1% revenue increase and improved EBIT growth, but net margin and EPS deteriorated.

CCC Intelligent Solutions Holdings Inc.

CCC Intelligent Solutions posted steady revenue growth of around 49% over five years, with net income turning positive after previous losses. Gross margin was favorable at 75.55%, while EBIT and net margins improved to positive territory by 2024. The latest fiscal year saw a 9.05% revenue rise, significant EBIT growth of over 600%, and strong net margin and EPS improvements.

Which one has the stronger fundamentals?

Comparing fundamentals, CyberArk boasts higher gross margins but struggles with recurring net losses and negative EBIT margins, reflecting profitability challenges. CCC shows consistent revenue growth, positive EBIT, and net margins, with a favorable overall income statement rating. Thus, CCC demonstrates more favorable earnings quality and margin stability over the period.

Financial Ratios Comparison

The table below presents the most recent financial ratios for CyberArk Software Ltd. and CCC Intelligent Solutions Holdings Inc., reflecting their fiscal year 2024 performance.

| Ratios | CyberArk Software Ltd. (CYBR) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| ROE | -3.94% | 1.31% |

| ROIC | -2.85% | 1.86% |

| P/E | -157.49 | 274.02 |

| P/B | 6.21 | 3.59 |

| Current Ratio | 1.48 | 3.65 |

| Quick Ratio | 1.48 | 3.65 |

| D/E (Debt-to-Equity) | 0.01 | 0.42 |

| Debt-to-Assets | 0.88% | 26.65% |

| Interest Coverage | -17.90 | 1.24 |

| Asset Turnover | 0.30 | 0.30 |

| Fixed Asset Turnover | 51.11 | 4.68 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

CyberArk Software Ltd.

CyberArk exhibits a mixed financial profile with 35.7% favorable ratios but 50% unfavorable, leading to a slightly unfavorable overall assessment. Key weaknesses include negative net margin (-9.34%) and return on equity (-3.94%), alongside poor interest coverage (-3.27). However, low debt levels and a strong fixed asset turnover (51.11) are positives. The company does not pay dividends, likely reflecting reinvestment priorities or growth focus.

CCC Intelligent Solutions Holdings Inc.

No financial ratios or key metrics are available for CCC Intelligent Solutions, preventing detailed ratio analysis. The lack of data means dividend or shareholder return insights cannot be assessed. Investors should consider the absence of such information when evaluating the company’s financial health and shareholder policies.

Which one has the best ratios?

Based on the available data, CyberArk provides a clearer but slightly unfavorable financial ratio profile with some strengths in asset management and low leverage. CCC Intelligent Solutions lacks sufficient ratio data, making direct comparison impossible. Thus, CyberArk’s ratios offer more information but reveal mixed financial health with caution warranted.

Strategic Positioning

This section compares the strategic positioning of CyberArk Software Ltd. and CCC Intelligent Solutions Holdings Inc. in terms of market position, key segments, and exposure to technological disruption:

CyberArk Software Ltd.

- Leading global cybersecurity provider with strong NASDAQ presence, facing competitive pressure in software infrastructure

- Key segments include SaaS, self-hosted subscriptions, maintenance, and professional services across multiple industries

- Exposed to disruption through cloud-native security solutions and adaptive identity management services

CCC Intelligent Solutions Holdings Inc.

- Mid-cap software firm focused on insurance tech, operating primarily in the P&C insurance economy

- Concentrated on SaaS subscriptions and other services for insurance carriers, repairers, and automotive sectors

- Leverages AI, telematics, and hyperscale cloud technologies to digitize insurance workflows, facing evolving tech demands

CyberArk Software Ltd. vs CCC Intelligent Solutions Holdings Inc. Positioning

CyberArk offers a diversified cybersecurity portfolio across industries with multiple delivery models, while CCC targets a concentrated niche in insurance technology driven by AI and cloud-based SaaS. CyberArk’s broad industry exposure contrasts with CCC’s specialized ecosystem approach.

Which has the best competitive advantage?

CyberArk’s MOAT evaluation is very unfavorable, indicating value destruction and declining profitability, while CCC’s MOAT data is unavailable, limiting comparative assessment of competitive advantage.

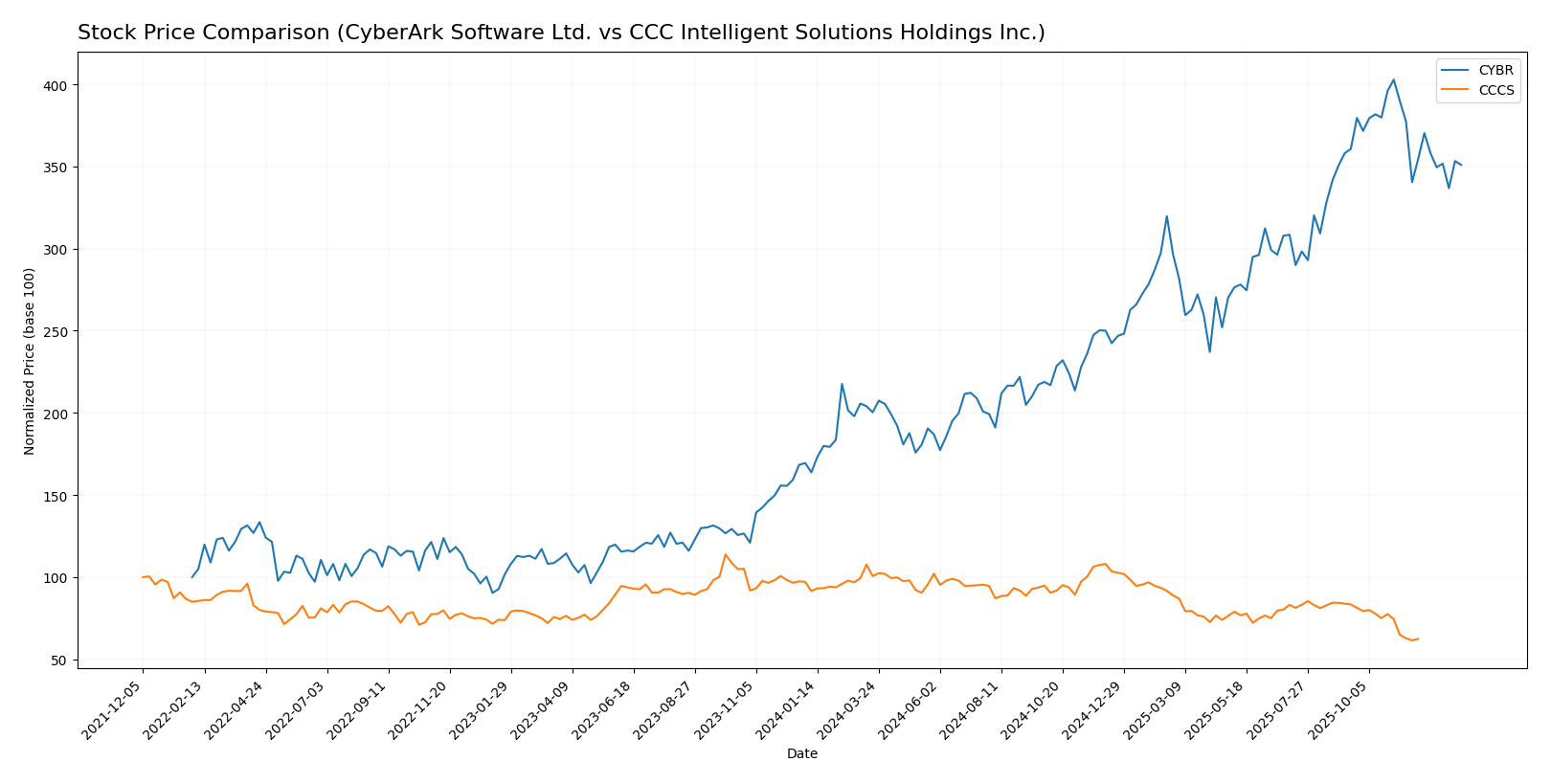

Stock Comparison

The stock prices of CyberArk Software Ltd. (CYBR) and CCC Intelligent Solutions Holdings Inc. (CCCS) have shown divergent dynamics over the past 12 months, with CYBR exhibiting significant gains and CCCS facing declines, both experiencing shifts in recent trading momentum.

Trend Analysis

CyberArk Software Ltd. (CYBR) recorded a strong bullish trend over the past year with a 77.27% price increase, though the trend showed deceleration. The stock reached a high of 520.78 and a low of 227.32, with notable volatility (std deviation 82.45).

CCC Intelligent Solutions Holdings Inc. (CCCS) experienced a bearish trend with a 31.78% decline over the same period, also with deceleration. Price ranged between 7.22 and 12.67, showing low volatility (std deviation 1.24).

Comparing both, CYBR delivered the highest market performance with a strong positive price change, contrasting with CCCS’s significant losses and lower volatility.

Target Prices

The current analyst consensus shows clear target price ranges for CyberArk Software Ltd. and CCC Intelligent Solutions Holdings Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CyberArk Software Ltd. | 520 | 440 | 479.22 |

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

Analysts expect CyberArk’s stock price to rise moderately from its current 453.65 USD towards a consensus near 479 USD. Meanwhile, CCC Intelligent Solutions’ target price of 11 USD suggests potential upside from its current 8.75 USD market price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CyberArk Software Ltd. and CCC Intelligent Solutions Holdings Inc.:

Rating Comparison

CyberArk Rating

- Rating: C- rated as Very Favorable overall.

- Discounted Cash Flow Score: 3, considered Moderate.

- ROE Score: 1, assessed as Very Unfavorable.

- ROA Score: 1, assessed as Very Unfavorable.

- Debt To Equity Score: 2, considered Moderate.

- Overall Score: 1, considered Very Unfavorable.

CCC Intelligent Solutions Rating

- No rating data available.

- No score data available.

- No score data available.

- No score data available.

- No score data available.

- No score data available.

Which one is the best rated?

Based strictly on the provided data, CyberArk has a complete set of ratings and scores, though mostly unfavorable except for a moderate DCF and debt-to-equity score. CCC Intelligent Solutions lacks any rating data, making CyberArk the only company with available analyst evaluations in this comparison.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for CyberArk Software Ltd. and CCC Intelligent Solutions Holdings Inc.:

CyberArk Scores

- Altman Z-Score: 6.52, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 3, categorized as very weak financial strength.

CCC Scores

- Altman Z-Score: 2.18, placing the company in a grey zone with moderate bankruptcy risk.

- Piotroski Score: 3, also rated as very weak financial strength.

Which company has the best scores?

CyberArk has a significantly higher Altman Z-Score, indicating greater financial stability than CCC. Both companies share the same very weak Piotroski Score, reflecting similar concerns about financial strength.

Grades Comparison

Here is a comparison of recent grades provided by recognized grading companies for the two companies:

CyberArk Software Ltd. Grades

The table below summarizes the latest grades from established financial analysts for CyberArk Software Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2024-10-22 |

| Keybanc | Maintain | Overweight | 2024-10-18 |

| Mizuho | Maintain | Outperform | 2024-10-17 |

| BTIG | Maintain | Buy | 2024-10-09 |

| Barclays | Maintain | Overweight | 2024-10-07 |

| Wedbush | Maintain | Outperform | 2024-10-01 |

| Jefferies | Maintain | Buy | 2024-09-24 |

| DA Davidson | Maintain | Buy | 2024-08-09 |

| Rosenblatt | Maintain | Buy | 2024-08-09 |

| Susquehanna | Maintain | Positive | 2024-08-09 |

Overall, CyberArk’s grades consistently reflect a positive outlook, with multiple “Buy,” “Outperform,” and “Overweight” ratings maintained across reputable analysts.

No reliable grades were found for CCC Intelligent Solutions Holdings Inc. Only a consensus rating of “Buy” is available, which indicates moderate market confidence but lacks detailed grading from recognized firms.

Which company has the best grades?

CyberArk Software Ltd. has received significantly more detailed and consistently positive grades from multiple reputable grading companies compared to CCC Intelligent Solutions Holdings Inc., which lacks such data. This difference may influence investor perception of CyberArk’s potential stability and growth prospects.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for CyberArk Software Ltd. (CYBR) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent available data.

| Criterion | CyberArk Software Ltd. (CYBR) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Diversification | Moderate diversification across SaaS, subscription, maintenance, and professional services. | Revenue mainly from Software Subscriptions and Other Services; less diversified. |

| Profitability | Negative net margin (-9.34%), negative ROE (-3.94%), and negative ROIC (-2.85%), indicating value destruction. | Data unavailable for profitability analysis. |

| Innovation | Strong presence in cybersecurity SaaS with growing SaaS revenue (up to $469M in 2024). | No recent data on innovation or product development. |

| Global presence | Global market reach given cybersecurity focus; detailed geographic data unavailable. | Geographic details unavailable; presumed focused on US market. |

| Market Share | Established leader in privileged access management but facing profitability challenges. | Market share data unavailable; revenue growth in software subscriptions suggests expanding footprint. |

Key takeaways: CyberArk shows strong revenue growth in SaaS but suffers from declining profitability and value destruction, signaling caution. CCCS lacks detailed financial data, limiting a comprehensive assessment, but its growing subscription revenue indicates potential market expansion. Investors should weigh CyberArk’s innovation against its financial risks and seek updated data for CCCS before committing.

Risk Analysis

Below is a comparative table summarizing key risks for CyberArk Software Ltd. (CYBR) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent available data for 2024-2026.

| Metric | CyberArk Software Ltd. (CYBR) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Risk | Moderate (Beta 0.915) | Lower (Beta 0.721) |

| Debt level | Very low (D/E 0.01; Debt to Assets 0.88%) | Unknown (data missing) |

| Regulatory Risk | Moderate, operates globally including US, Europe, Middle East | Moderate, US-focused insurance tech sector |

| Operational Risk | Medium, reliant on SaaS security solutions; net margin negative | Medium, high volatility in revenue; no recent financial ratios |

| Environmental Risk | Low, software sector with limited direct impact | Low, software & cloud services sector |

| Geopolitical Risk | Moderate, headquartered in Israel with global sales | Moderate, US-based but subject to global insurance regulations |

Synthesizing these risks, CyberArk’s most impactful concerns are its negative profitability and operational challenges despite a strong balance sheet and low debt. CCCS faces uncertainty due to missing financial data and exposure to insurance sector cyclicality. Both have moderate regulatory and geopolitical risks given their international and US market exposure. Investors should weigh CyberArk’s financial weakness against its robust Altman Z-score and CCCS’s unclear financial health before investing.

Which Stock to Choose?

CyberArk Software Ltd. (CYBR) shows strong revenue growth of 33.1% in 2024 and a favorable gross margin near 79%, but suffers from negative profitability ratios, including a -9.34% net margin and declining returns on equity and invested capital. Its debt is low and well managed, with a very favorable debt-to-equity ratio, yet the overall financial ratios assessment is slightly unfavorable. The company’s rating is very favorable (C-), but with mixed scores indicating financial challenges.

CCC Intelligent Solutions Holdings Inc. (CCCS) demonstrates moderate revenue growth of 9.05% and a solid EBIT margin of 11.53% in 2024, supported by a favorable net margin of 2.77%. Its financial data is incomplete, but income statement evaluations are largely favorable, with strong income growth over the period and a current ratio indicating good liquidity. The Altman Z-Score places it in the grey zone, signaling moderate financial risk, and the Piotroski score suggests weak financial strength.

For investors prioritizing growth potential, CyberArk’s rapid revenue expansion and strong market capitalization might appear attractive despite profitability pressures and value destruction signals. Conversely, CCC Intelligent Solutions’ steadier income performance and more favorable profitability metrics may appeal to those seeking stability amid incomplete data. The choice could depend on whether an investor is more risk-tolerant with a focus on growth or prefers a cautious approach favoring operational income quality.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CyberArk Software Ltd. and CCC Intelligent Solutions Holdings Inc. to enhance your investment decisions: