In the fast-evolving technology sector, choosing the right stock demands careful analysis of market positioning and innovation strategies. CrowdStrike Holdings, Inc. (CRWD) and CCC Intelligent Solutions Holdings Inc. (CCCS) both operate in software infrastructure but serve distinct yet overlapping markets with cloud-driven, AI-enabled solutions. This comparison will help you understand which company offers the most promising investment potential in 2026. Let’s explore their strengths and risks to guide your decision.

Table of contents

Companies Overview

I will begin the comparison between CrowdStrike Holdings, Inc. and CCC Intelligent Solutions Holdings Inc. by providing an overview of these two companies and their main differences.

CrowdStrike Overview

CrowdStrike Holdings, Inc. specializes in cloud-delivered protection across endpoints, cloud workloads, identity, and data. Its Falcon platform offers threat intelligence, managed security, IT operations, and Zero Trust identity protection. Founded in 2011 and based in Austin, Texas, CrowdStrike operates globally, primarily selling subscriptions through direct sales and channel partners, positioning itself as a leader in cybersecurity infrastructure.

CCC Intelligent Solutions Overview

CCC Intelligent Solutions Holdings Inc. delivers cloud, mobile, AI, and telematics technologies tailored to the property and casualty insurance economy. Its SaaS platform digitizes AI-enabled workflows and connects insurers, repairers, suppliers, and financial institutions. Founded in 1980 and headquartered in Chicago, Illinois, CCC focuses on insurance and automotive ecosystems, providing diverse solutions from claim management to repair quality and payment services.

Key similarities and differences

Both companies operate in the software infrastructure sector with cloud-based platforms, but CrowdStrike focuses on cybersecurity and endpoint protection, while CCC targets the insurance and automotive industries with AI-driven workflow solutions. CrowdStrike has a larger market cap and employee base, reflecting its broader global cybersecurity reach, whereas CCC’s niche specialization serves a defined insurance ecosystem with a smaller scale and lower beta.

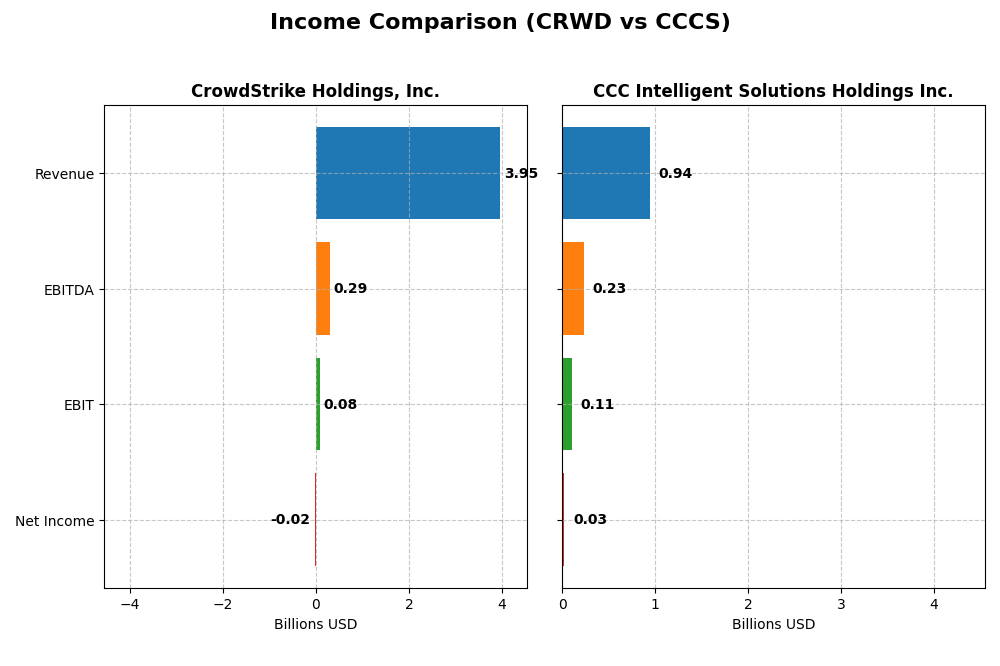

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for CrowdStrike Holdings, Inc. and CCC Intelligent Solutions Holdings Inc. for their most recent fiscal years.

| Metric | CrowdStrike Holdings, Inc. (CRWD) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Cap | 114.4B | 5.63B |

| Revenue | 3.95B | 944.8M |

| EBITDA | 295M | 233M |

| EBIT | 81M | 109M |

| Net Income | -19.3M | 26.1M |

| EPS | -0.08 | 0.043 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

CrowdStrike Holdings, Inc.

CrowdStrike’s revenue grew significantly from 874M in 2021 to 3.95B in 2025, with net income fluctuating from a loss of 93M in 2021 to a 89M profit in 2024, then a slight loss of 19M in 2025. Gross margins remained favorable near 75%, while EBIT margins were neutral. The latest year showed strong revenue growth but deteriorating profitability and margins.

CCC Intelligent Solutions Holdings Inc.

CCC’s revenue increased steadily from 633M in 2020 to 945M in 2024, with net income recovering from a loss of 25M in 2021 to a profit of 26M in 2024. Gross margin stayed consistently favorable around 75%, with EBIT margin improving to 11.5% in 2024. The most recent year reflected healthy growth across revenue, profitability, and margins, signaling operational improvement.

Which one has the stronger fundamentals?

CCC demonstrates stronger fundamentals with consistent revenue growth, improving profitability, and favorable margins including a solid EBIT margin of 11.5%. CrowdStrike shows impressive top-line expansion but struggles with recent net losses and margin pressure. CCC’s overall income statement presents less risk and a more stable financial trajectory.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for CrowdStrike Holdings, Inc. (CRWD) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on their most recent fiscal year data.

| Ratios | CrowdStrike Holdings, Inc. (CRWD) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| ROE | -0.59% | 1.31% |

| ROIC | 0.70% | 1.86% |

| P/E | -5056 | 274 |

| P/B | 29.7 | 3.59 |

| Current Ratio | 1.67 | 3.65 |

| Quick Ratio | 1.67 | 3.65 |

| D/E (Debt-to-Equity) | 0.24 | 0.42 |

| Debt-to-Assets | 9.07% | 26.7% |

| Interest Coverage | -4.58 | 1.24 |

| Asset Turnover | 0.45 | 0.30 |

| Fixed Asset Turnover | 4.76 | 4.68 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

CrowdStrike Holdings, Inc.

CrowdStrike shows mixed financial ratios with nearly equal favorable and unfavorable marks. While the current and quick ratios at 1.67 indicate healthy liquidity, negative net margin (-0.49%) and return on equity (-0.59%) reveal profitability challenges. The company does not pay dividends, likely reinvesting earnings in growth and R&D, given the technology sector’s dynamics.

CCC Intelligent Solutions Holdings Inc.

No ratio data is available for CCC Intelligent Solutions Holdings Inc., preventing a thorough analysis of financial strength or weaknesses. Additionally, the company does not pay dividends, which may reflect a focus on reinvestment or development typical for firms in evolving technology markets.

Which one has the best ratios?

Based solely on available data, CrowdStrike presents a more complete picture with a balanced ratio profile and solid liquidity, despite profitability weaknesses. CCC Intelligent Solutions lacks published ratio data, limiting comparative evaluation. Therefore, CrowdStrike currently offers more transparent financial insights for assessment.

Strategic Positioning

This section compares the strategic positioning of CrowdStrike and CCC Intelligent Solutions, focusing on market position, key segments, and exposure to technological disruption:

CrowdStrike (CRWD)

- Leading cybersecurity provider with strong market cap of 114B, facing tech sector competition.

- Key driver is subscription revenue from cloud-delivered endpoint security; professional services complement.

- High exposure to cloud and cybersecurity tech innovation, leveraging threat intelligence and Zero Trust models.

CCC Intelligent Solutions (CCCS)

- Smaller player with 5.6B market cap, operating in software infrastructure with moderate competition.

- Focused on AI-enabled SaaS for property and casualty insurance workflows and ecosystem connectivity.

- Exposed to AI, telematics, and hyperscale technologies disrupting insurance software and digital workflows.

CrowdStrike vs CCC Intelligent Solutions Positioning

CrowdStrike pursues a concentrated strategy in cybersecurity subscriptions, while CCC targets diversified SaaS solutions across insurance ecosystem segments. CrowdStrike benefits from scale and cloud focus; CCC emphasizes specialized AI and telematics for insurance workflows.

Which has the best competitive advantage?

Based on MOAT evaluation, CrowdStrike shows slightly unfavorable value creation despite growing profitability, while CCC lacks sufficient data. Thus, CrowdStrike’s competitive advantage appears limited but improving in its sector.

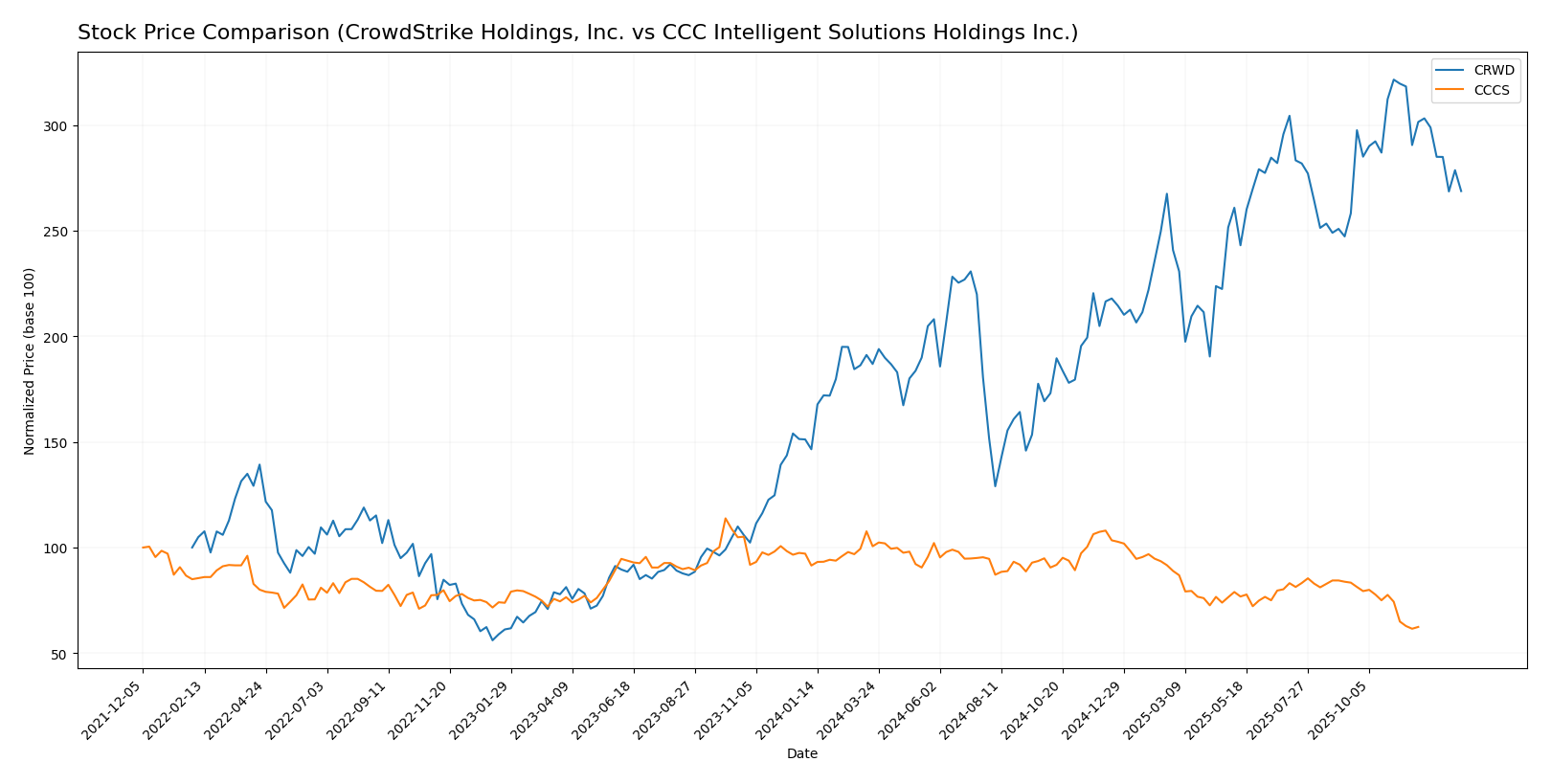

Stock Comparison

The stock price movements of CrowdStrike Holdings, Inc. (CRWD) and CCC Intelligent Solutions Holdings Inc. (CCCS) over the past year reveal contrasting trends, with CRWD showing significant gains and CCCS experiencing notable declines.

Trend Analysis

CrowdStrike Holdings, Inc. (CRWD) exhibited a bullish trend over the past 12 months, with a 45.71% price increase, despite a recent deceleration and a -16.41% drop from November 2025 to January 2026. CCC Intelligent Solutions Holdings Inc. (CCCS) showed a bearish trend over the same period, declining by 31.78%, with decelerating losses and a -25.15% decrease between September and November 2025. Comparing both, CRWD delivered the highest market performance over the past year, outperforming CCCS by a substantial margin.

Target Prices

The current analyst consensus reveals optimistic target prices for CrowdStrike Holdings, Inc. and stable expectations for CCC Intelligent Solutions Holdings Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 353 | 553.47 |

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

Analysts expect CrowdStrike’s stock to rise significantly above its current price of $453.88, indicating growth potential, while CCC Intelligent Solutions shows a flat target consensus above its current price of $8.75.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CrowdStrike Holdings, Inc. and CCC Intelligent Solutions Holdings Inc.:

Rating Comparison

CRWD Rating

- Rating: C, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation.

- ROE Score: 1, considered Very Unfavorable, showing low profitability on equity.

- ROA Score: 1, Very Unfavorable, reflecting poor asset utilization.

- Debt To Equity Score: 3, Moderate risk level in financial leverage.

- Overall Score: 2, Moderate overall financial standing.

CCCS Rating

- No rating data available for CCCS.

- No discounted cash flow score available.

- No ROE score data available.

- No ROA score data available.

- No debt to equity score available.

- No overall score data available.

Which one is the best rated?

Based strictly on the available data, CRWD holds a comprehensive rating classified as Very Favorable with detailed scores, while CCC Intelligent Solutions Holdings Inc. lacks any rating or score information, making CRWD the better-rated company by default.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for CrowdStrike Holdings and CCC Intelligent Solutions:

CRWD Scores

- Altman Z-Score: 12.38, indicating a safe zone.

- Piotroski Score: 4, categorized as average.

CCCS Scores

- Altman Z-Score: 2.18, indicating a grey zone.

- Piotroski Score: 3, categorized as very weak.

Which company has the best scores?

Based on the provided data, CrowdStrike (CRWD) shows stronger financial stability with a much higher Altman Z-Score in the safe zone and a slightly better Piotroski Score categorized as average versus CCC Intelligent Solutions (CCCS).

Grades Comparison

Here is a comparison of the latest available grades from recognized grading companies for the two companies:

CrowdStrike Holdings, Inc. Grades

The table below summarizes recent grades assigned by reputable firms for CrowdStrike Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

Overall, CrowdStrike’s grades trend mostly positive with multiple upgrades and sustained buy ratings, though some firms maintain neutral stances.

CCC Intelligent Solutions Holdings Inc. Grades

No reliable grading data from verifiable grading companies is available for CCC Intelligent Solutions Holdings Inc.

Given the absence of reliable grades for CCC Intelligent Solutions, the risk evaluation should consider other factors such as beta or market conditions.

Which company has the best grades?

CrowdStrike Holdings, Inc. clearly holds better grades with a consensus “Buy” supported by several upgrades and strong buy-side sentiment, whereas CCC Intelligent Solutions lacks verifiable grades. This disparity may influence investors seeking well-covered stocks with clearer analyst support.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for CrowdStrike Holdings, Inc. (CRWD) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent available data.

| Criterion | CrowdStrike Holdings, Inc. (CRWD) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Diversification | Moderate: Primarily cybersecurity subscription services with growing professional services segment | Moderate: Mainly software subscriptions with some other services; less diversified data |

| Profitability | Weak: Negative net margin (-0.49%), ROIC slightly positive but below WACC, indicating value destruction | Data unavailable for profitability analysis |

| Innovation | High: Strong revenue growth in subscription and professional services suggests ongoing innovation | Data unavailable for innovation assessment |

| Global presence | Strong: Significant global reach as a cybersecurity leader | Moderate: More regional focus, less global footprint |

| Market Share | Significant in cybersecurity with expanding customer base | Smaller market share in software subscriptions sector |

Key takeaways: CrowdStrike demonstrates strong innovation and global presence but struggles with profitability and value creation. CCC Intelligent Solutions shows steady revenue in software subscriptions but lacks sufficient data for a full financial or competitive assessment. Investors should weigh CrowdStrike’s growth potential against its current financial challenges.

Risk Analysis

Below is a comparative table summarizing key risks for CrowdStrike Holdings, Inc. (CRWD) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent data from 2025 and early 2026.

| Metric | CrowdStrike Holdings, Inc. (CRWD) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Risk | Moderate (Beta 1.03, tech sector volatility) | Lower (Beta 0.72, smaller market cap) |

| Debt level | Low (Debt/Equity 0.24, favorable) | Moderate (Data unavailable, watch caution) |

| Regulatory Risk | Moderate (Cybersecurity industry compliance) | Moderate (Insurance tech sector regulations) |

| Operational Risk | Moderate (Reliance on Falcon platform, innovation pace) | Moderate (Dependence on AI and SaaS platforms) |

| Environmental Risk | Low (Tech sector, minimal direct impact) | Low (Tech sector, minimal direct impact) |

| Geopolitical Risk | Moderate (Global customer base exposure) | Moderate (US-based, some international exposure) |

The most significant risk for CrowdStrike lies in market volatility and operational dependence on continuous innovation, though its low debt level offers some financial stability. CCC Intelligent Solutions faces moderate regulatory and operational risks with less financial data transparency, placing it in a grey zone regarding financial distress. Investors should monitor CrowdStrike’s innovation execution and CCCS’s financial disclosures closely.

Which Stock to Choose?

CrowdStrike Holdings, Inc. (CRWD) shows strong revenue growth of 29.4% in the last year and 352% over five years, with favorable gross margin at 74.9%. Despite negative net margin and returns on equity and assets, it maintains low debt levels and a current ratio of 1.67. Its global financial ratios evaluation is neutral, and the rating is very favorable.

CCC Intelligent Solutions Holdings Inc. (CCCS) reports steady income growth with a 9.1% revenue increase last year and 49.2% over five years, combined with a strong gross margin of 75.5% and positive EBIT margin at 11.5%. Debt ratios are higher, with net debt to EBITDA at 1.93, and liquidity is strong with a current ratio above 3. Data on financial ratios and rating are incomplete, limiting full assessment.

For investors prioritizing growth and income statement momentum, CRWD’s expanding revenue and improving profitability metrics might appear more attractive, while those valuing stable margins and liquidity could find CCCS’s consistent profitability and strong current ratio more appealing despite limited ratio data. The choice could depend on risk tolerance and preference for growth versus stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and CCC Intelligent Solutions Holdings Inc. to enhance your investment decisions: