CoreWeave, Inc. (CRWV) and CCC Intelligent Solutions Holdings Inc. (CCCS) are two dynamic players in the software infrastructure sector, each driving innovation in cloud computing and AI-powered solutions. CoreWeave specializes in scalable GPU and CPU cloud platforms for GenAI workloads, while CCC focuses on AI-driven SaaS for the insurance economy. This article will explore their market positions and growth potential to help you decide which company deserves a place in your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between CoreWeave and CCC Intelligent Solutions by providing an overview of these two companies and their main differences.

CoreWeave Overview

CoreWeave, Inc. operates a cloud platform specializing in scaling, support, and acceleration for GenAI workloads. It builds infrastructure for enterprises, offering GPU and CPU compute, storage, networking, and managed services. The company also supports VFX rendering, AI model training, and mission control. Founded in 2017 and based in New Jersey, CoreWeave has a market cap of $50.4B and trades on NASDAQ under the ticker CRWV.

CCC Intelligent Solutions Overview

CCC Intelligent Solutions Holdings Inc. delivers cloud, AI, telematics, and hyperscale technologies primarily for the property and casualty insurance sector. Its SaaS platform digitizes AI-driven workflows and connects insurance carriers, repairers, and suppliers. Founded in 1980 and headquartered in Chicago, CCC has a market cap of $5.6B and trades on NASDAQ under the ticker CCCS. It employs over 2,300 staff and focuses on insurance-related software solutions.

Key similarities and differences

Both companies operate in the software infrastructure sector and provide cloud-based solutions leveraging AI technologies. CoreWeave focuses on compute and infrastructure for AI workloads across industries, while CCC targets the insurance economy with specialized SaaS platforms. CoreWeave’s market cap is substantially larger, reflecting different scales and market focuses, and their risk profiles differ as indicated by CoreWeave’s higher beta versus CCC’s more stable valuation.

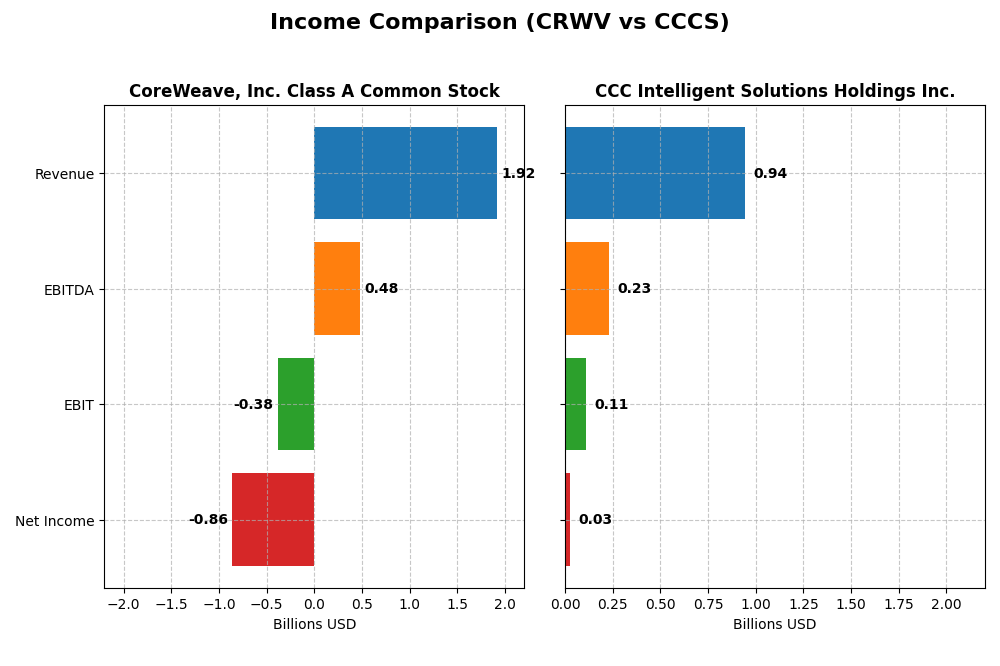

Income Statement Comparison

This table compares the key income statement metrics for CoreWeave, Inc. Class A Common Stock (CRWV) and CCC Intelligent Solutions Holdings Inc. (CCCS) for the fiscal year 2024.

| Metric | CoreWeave, Inc. (CRWV) | CCC Intelligent Solutions (CCCS) |

|---|---|---|

| Market Cap | 50.4B | 5.6B |

| Revenue | 1.92B | 945M |

| EBITDA | 480M | 233M |

| EBIT | -383M | 109M |

| Net Income | -863M | 26.1M |

| EPS | -2.33 | 0.0428 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

CoreWeave, Inc. Class A Common Stock

CoreWeave’s revenue soared from $15.8M in 2022 to $1.92B in 2024, reflecting rapid expansion. Despite a strong gross margin of 74.24%, net income remained negative, hitting -$863M in 2024 with a net margin of -45.08%. The latest year showed improved EBIT margin but persistent substantial losses and high interest expenses.

CCC Intelligent Solutions Holdings Inc.

CCC Intelligent Solutions displayed steady revenue growth from $633M in 2020 to $945M in 2024, maintaining a stable gross margin above 75%. Net income rebounded from losses in prior years to $26.15M in 2024, yielding a modest net margin of 2.77%. The firm’s profitability and EPS improved notably in 2024, supported by favorable EBIT margin expansion.

Which one has the stronger fundamentals?

CCC Intelligent Solutions holds stronger fundamentals with consistent revenue growth, positive net income, and expanding profitability margins. CoreWeave shows exceptional top-line growth but continues to face significant net losses and high interest burdens, reflecting pressure on margins and bottom-line performance despite favorable gross margin trends.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for CoreWeave, Inc. Class A Common Stock (CRWV) and CCC Intelligent Solutions Holdings Inc. (CCCS) for the fiscal year 2024.

| Ratios | CoreWeave, Inc. (CRWV) | CCC Intelligent Solutions (CCCS) |

|---|---|---|

| ROE | 2.09% | 1.31% |

| ROIC | 2.08% | 1.86% |

| P/E | -18.7 | 274.0 |

| P/B | -39.1 | 3.59 |

| Current Ratio | 0.39 | 3.65 |

| Quick Ratio | 0.39 | 3.65 |

| D/E (Debt-to-Equity) | -25.68 | 0.42 |

| Debt-to-Assets | 59.6% | 26.7% |

| Interest Coverage | 0.90 | 1.24 |

| Asset Turnover | 0.11 | 0.30 |

| Fixed Asset Turnover | 0.13 | 4.68 |

| Payout Ratio | -6.7% | 0% |

| Dividend Yield | 0.36% | 0% |

Interpretation of the Ratios

CoreWeave, Inc. Class A Common Stock

CoreWeave’s financial ratios generally reveal weaknesses, including a low current ratio of 0.39 and unfavorable debt-to-assets at 59.56%, indicating potential liquidity and leverage concerns. Despite a strong return on equity at 208.77%, other measures like net margin (-45.08%) and interest coverage (-1.06) remain unfavorable. The company does not pay dividends, consistent with its negative net margin and reinvestment focus in infrastructure and cloud services.

CCC Intelligent Solutions Holdings Inc.

Ratio data for CCC Intelligent Solutions Holdings Inc. is not available, preventing comprehensive financial ratio analysis. Consequently, dividend and shareholder returns cannot be assessed from the provided information. The absence of ratio data limits any definitive conclusions regarding the company’s financial health or dividend policy.

Which one has the best ratios?

Based solely on the available data, CoreWeave’s ratios present a mixed picture with more unfavorable than favorable metrics, primarily due to liquidity and profitability challenges. Without ratio data for CCC Intelligent Solutions, a direct comparison is not feasible. Therefore, CoreWeave is the only company with an evaluable ratio profile, albeit with a generally unfavorable outlook.

Strategic Positioning

This section compares the strategic positioning of CoreWeave (CRWV) and CCC Intelligent Solutions (CCCS) regarding market position, key segments, and exposure to technological disruption:

CoreWeave, Inc. Class A Common Stock

- Large market cap of 50B; high beta indicates significant competitive pressure and volatility in software infrastructure.

- Focuses on cloud infrastructure for GenAI, offering GPU/CPU compute, storage, networking, and AI-related services.

- Operates in a rapidly evolving cloud and AI infrastructure space with potential exposure to technological disruption from emerging compute platforms.

CCC Intelligent Solutions Holdings Inc.

- Smaller market cap of 5.6B; lower beta suggests moderate competitive pressure and less volatility in software infrastructure.

- Concentrates on SaaS for property and casualty insurance, including AI-enabled workflows, repair, parts, and financial ecosystem solutions.

- Utilizes AI and telematics to digitize insurance workflows, facing disruption risks tied to cloud and AI adoption in insurance technology.

CoreWeave vs CCC Intelligent Solutions Positioning

CoreWeave has a concentrated focus on cloud infrastructure for AI workloads, offering a broad technical product suite. CCC has a diversified SaaS approach targeting multiple insurance ecosystem segments, providing stable business drivers but within a niche industry vertical.

Which has the best competitive advantage?

Based on MOAT evaluation, CoreWeave shows unfavorable value creation with a negative ROIC vs WACC and stable profitability but is destroying value. CCC lacks sufficient data for MOAT assessment, preventing a clear competitive advantage conclusion.

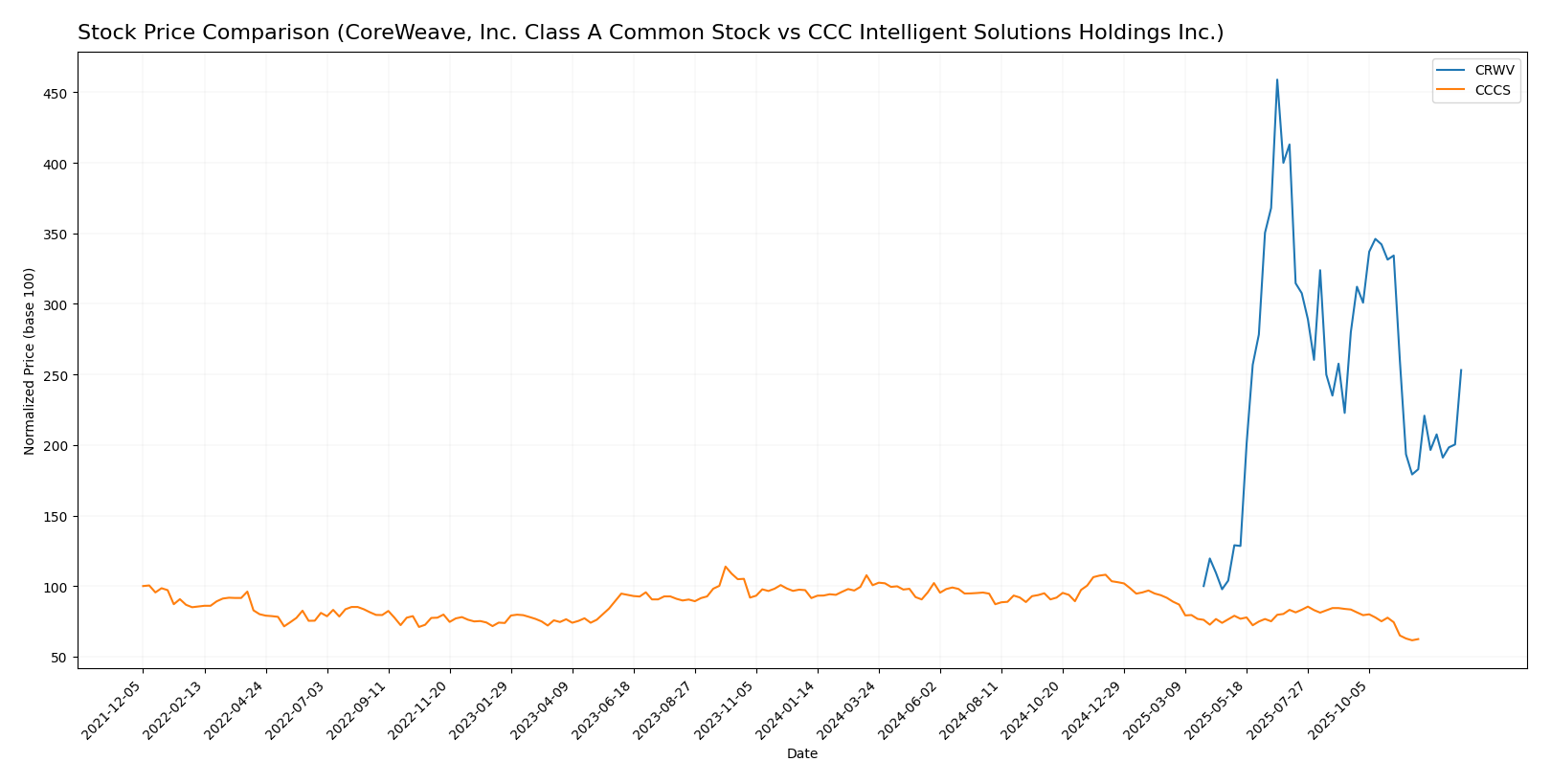

Stock Comparison

The stock price dynamics over the past 12 months reveal CoreWeave, Inc. Class A Common Stock (CRWV) experienced a strong overall bullish trend with high volatility, while CCC Intelligent Solutions Holdings Inc. (CCCS) showed a sustained bearish movement amid low price fluctuations.

Trend Analysis

CoreWeave, Inc. Class A Common Stock (CRWV) displayed a bullish trend with a 153.08% price increase over the past year, albeit with deceleration and notable volatility (std. dev. 35.67). The recent period shows a short-term bearish correction of -24.29%.

CCC Intelligent Solutions Holdings Inc. (CCCS) followed a bearish trend with a 31.78% price decline over the year, low volatility (std. dev. 1.24), and continued deceleration. Its recent trend also reflects a further 25.15% decrease.

Comparing both, CoreWeave delivered the highest market performance with a significant positive gain, contrasting with CCCS’s persistent loss over the analyzed period.

Target Prices

Analysts provide a clear consensus on target prices for CoreWeave, Inc. and CCC Intelligent Solutions Holdings Inc., outlining potential price ranges and investor expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CoreWeave, Inc. Class A Common Stock | 175 | 68 | 115.79 |

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

CoreWeave’s target consensus at $115.79 suggests upside potential from its current $101.23 price, reflecting optimism despite high volatility. CCC Intelligent Solutions’ consensus at $11 is modestly above its $8.75 price, indicating limited but steady growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CoreWeave, Inc. Class A Common Stock (CRWV) and CCC Intelligent Solutions Holdings Inc. (CCCS):

Rating Comparison

CRWV Rating

- Rating: D+ rating considered very favorable by evaluators.

- Discounted Cash Flow Score: 1, indicating very unfavorable valuation metrics.

- ROE Score: 1, reflecting very unfavorable return on equity performance.

- ROA Score: 1, showing very unfavorable asset utilization efficiency.

- Debt To Equity Score: 1, signaling very unfavorable financial leverage status.

- Overall Score: 1, considered very unfavorable overall financial standing.

CCCS Rating

- No rating data available.

- No data provided.

- No data provided.

- No data provided.

- No data provided.

- No data provided.

Which one is the best rated?

Based strictly on the available data, CRWV has a detailed rating with a D+ grade and multiple very unfavorable scores, while CCCS lacks any published ratings or scores for comparison. Therefore, CRWV is the only company with an evaluable rating in this dataset.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for CoreWeave (CRWV) and CCC Intelligent Solutions (CCCS):

CRWV Scores

- Altman Z-Score: 0.80, in distress zone, high bankruptcy risk

- Piotroski Score: 3, classified as very weak financial strength

CCCS Scores

- Altman Z-Score: 2.18, in grey zone, moderate bankruptcy risk

- Piotroski Score: 3, classified as very weak financial strength

Which company has the best scores?

CCCS shows a better Altman Z-Score than CRWV, placing it in the grey zone versus distress zone for CRWV. Both companies have equally weak Piotroski Scores of 3, indicating very weak financial strength.

Grades Comparison

Here is a comparison of the latest available grades for the two companies:

CoreWeave, Inc. Class A Common Stock Grades

The following table summarizes recent analyst grades for CoreWeave, Inc. Class A Common Stock:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Equal Weight | 2026-01-12 |

| Wells Fargo | maintain | Overweight | 2026-01-08 |

| Jefferies | maintain | Buy | 2026-01-05 |

| DA Davidson | upgrade | Neutral | 2026-01-05 |

| Goldman Sachs | maintain | Neutral | 2025-11-17 |

| HC Wainwright & Co. | maintain | Buy | 2025-11-12 |

| Wells Fargo | maintain | Overweight | 2025-11-12 |

| Barclays | maintain | Equal Weight | 2025-11-12 |

| Loop Capital | maintain | Buy | 2025-11-12 |

| B of A Securities | maintain | Neutral | 2025-11-11 |

Grades for CoreWeave show a stable to slightly positive trend, with multiple buy and overweight recommendations alongside neutral and equal weight ratings.

CCC Intelligent Solutions Holdings Inc. Grades

No reliable grading data is available for CCC Intelligent Solutions Holdings Inc. from recognized grading companies.

With no specific grade data, the risk profile for CCC Intelligent Solutions Holdings Inc. cannot be assessed through analyst grades.

Which company has the best grades?

CoreWeave, Inc. has received a broader and more positive range of grades, including buy and overweight ratings, compared to no reliable grades for CCC Intelligent Solutions Holdings Inc. This suggests clearer analyst confidence in CoreWeave’s near-term outlook, potentially impacting investor sentiment and portfolio decisions.

Strengths and Weaknesses

Below is a comparison table summarizing the key strengths and weaknesses of CoreWeave, Inc. (CRWV) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent data available.

| Criterion | CoreWeave, Inc. (CRWV) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Diversification | Limited product/service diversification; mainly focused on cloud computing solutions | Primarily focused on software subscriptions (~$906M in 2024) with some other services (~$38M) |

| Profitability | Negative net margin (-45.08%); value destroying (ROIC < WACC) | Data unavailable; profitability metrics not disclosed |

| Innovation | Moderate; high ROE (208.77%) suggests strong returns on equity | Insufficient data to evaluate innovation |

| Global presence | Not explicitly detailed; likely focused on niche markets | Not explicitly detailed; software subscription growth indicates expanding reach |

| Market Share | Not explicitly stated; facing profitability challenges | Not explicitly stated; steady revenue growth in subscriptions suggests growing market share |

Key takeaways: CoreWeave shows challenges in profitability and liquidity despite strong equity returns, indicating financial risk. CCC Intelligent Solutions demonstrates steady subscription revenue growth, but limited data restricts full assessment. Investors should exercise caution and monitor financial disclosures closely.

Risk Analysis

Below is a comparative table of key risks faced by CoreWeave, Inc. Class A Common Stock (CRWV) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent 2024 data:

| Metric | CoreWeave, Inc. (CRWV) | CCC Intelligent Solutions (CCCS) |

|---|---|---|

| Market Risk | Very high (Beta 21.65) | Moderate (Beta 0.72) |

| Debt level | High debt to assets (59.56%) | Data unavailable |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Elevated: negative margins, low liquidity ratios | Data unavailable |

| Environmental Risk | Low to moderate | Low to moderate |

| Geopolitical Risk | Moderate (US-based tech company) | Moderate (US-based tech company) |

CoreWeave shows very high market risk due to an extremely elevated beta, coupled with financial distress signals such as a low Altman Z-score (0.80, distress zone) and weak Piotroski score (3). Debt levels are significant, with unfavorable liquidity and coverage ratios, suggesting financial vulnerability. CCC Intelligent Solutions has a more moderate market risk and a grey zone Altman Z-score (2.18), but financial data gaps increase uncertainty. The most impactful risk for CoreWeave is its financial distress combined with market volatility, while CCC’s risk profile is less clear but likely moderate. Investors should exercise caution, prioritizing strong risk management strategies.

Which Stock to Choose?

CoreWeave, Inc. Class A Common Stock (CRWV) shows a strong revenue growth of 12,000% over 2022-2024, with a favorable gross margin of 74.24%, but suffers from negative net margin (-45.08%) and unfavorable financial ratios, including a low current ratio (0.39) and high debt-to-assets (59.56%). Its rating is very unfavorable overall despite a favorable ROE of 208.77%.

CCC Intelligent Solutions Holdings Inc. (CCCS) demonstrates moderate revenue growth of 49.24% over 2020-2024, with a favorable gross margin of 75.55% and positive EBIT margin (11.53%). Its financial data is incomplete for full ratio analysis, but income statement evaluations are largely favorable, with a healthy current ratio of 3.65 and net margin around 2.77%. The company’s Altman Z-Score places it in a grey zone for financial distress.

Investors focused on rapid growth might find CoreWeave’s exceptional revenue expansion appealing despite its financial challenges and unfavorable ratios. Conversely, those prioritizing income stability and moderate profitability may view CCC Intelligent Solutions as more aligned with risk-averse or quality investing profiles, given its consistent income metrics and better liquidity, though some financial risk remains.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CoreWeave, Inc. Class A Common Stock and CCC Intelligent Solutions Holdings Inc. to enhance your investment decisions: