In today’s fast-evolving tech landscape, Cloudflare, Inc. (NET) and CCC Intelligent Solutions Holdings Inc. (CCCS) stand out as innovative players in the software infrastructure sector. While Cloudflare focuses on cloud security and performance solutions for diverse industries, CCCS specializes in AI-driven SaaS platforms for the property and casualty insurance market. This comparison will help you identify which company offers the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Cloudflare and CCC Intelligent Solutions by providing an overview of these two companies and their main differences.

Cloudflare Overview

Cloudflare, Inc. operates as a cloud services provider delivering integrated security and performance solutions globally. Its offerings include cloud firewall, bot management, DDoS protection, and content delivery, targeting diverse platforms such as public and private clouds, SaaS, and IoT devices. Founded in 2009 and based in San Francisco, Cloudflare serves industries including technology, healthcare, and financial services, with a market cap of 64.5B USD.

CCC Intelligent Solutions Overview

CCC Intelligent Solutions Holdings Inc. provides cloud, AI, and telematics technologies tailored to the property and casualty insurance economy. Its SaaS platform digitizes workflows, supports commerce, and connects businesses like insurers, repairers, and automotive manufacturers. Founded in 1980 and headquartered in Chicago, CCC has a market cap of 5.6B USD and serves the insurance ecosystem with solutions spanning insurance, repair, and parts management.

Key similarities and differences

Both Cloudflare and CCC operate in the software infrastructure industry, leveraging cloud-based technologies and SaaS platforms to serve specific markets. Cloudflare focuses broadly on cybersecurity and performance optimization across multiple industries, while CCC specializes in digital solutions for the insurance economy. Cloudflare’s market cap and employee base significantly exceed those of CCC, reflecting differences in scale and market reach.

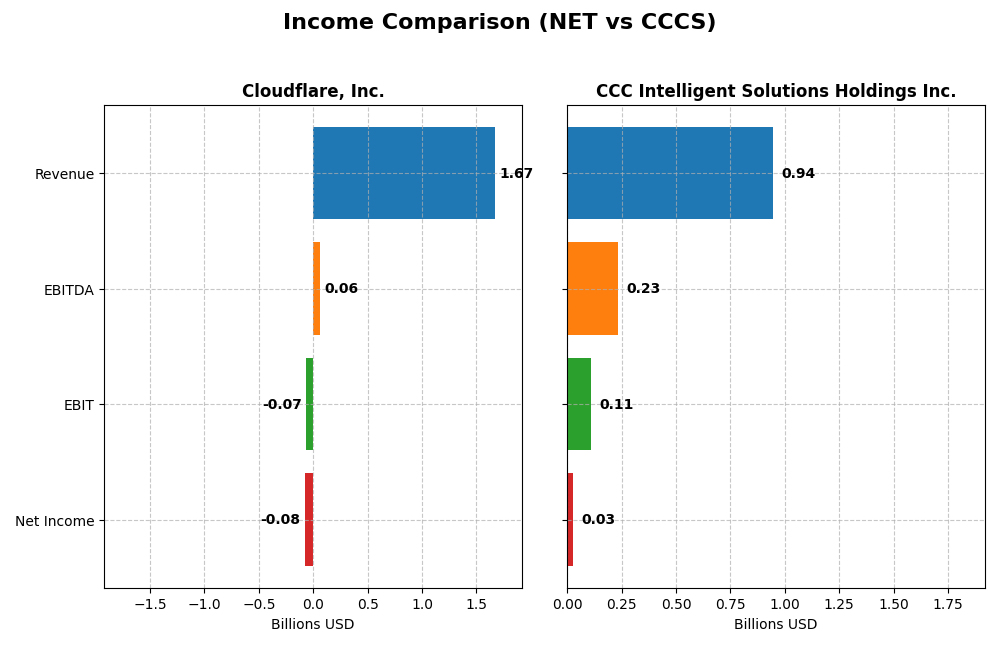

Income Statement Comparison

This table compares key income statement metrics for Cloudflare, Inc. and CCC Intelligent Solutions Holdings Inc. for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | Cloudflare, Inc. (NET) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Cap | 64.5B | 5.63B |

| Revenue | 1.67B | 945M |

| EBITDA | 62M | 233M |

| EBIT | -65.7M | 109M |

| Net Income | -78.8M | 26.1M |

| EPS | -0.23 | 0.0428 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Cloudflare, Inc.

Cloudflare’s revenue grew significantly from 2020 to 2024, reaching $1.67B in 2024, with net income losses narrowing from -$260M in 2021 to -$78.8M in 2024. The gross margin remained strong at 77.3%, but EBIT and net margins stayed negative. In 2024, revenue growth accelerated by 28.8%, and margins improved, signaling progress toward profitability.

CCC Intelligent Solutions Holdings Inc.

CCC’s revenue increased steadily to $945M in 2024, with net income turning positive to $26.1M after losses in prior years. Gross margin held favorably at 75.6%, while EBIT and net margins improved to positive 11.5% and 2.8%, respectively. The company showed strong EBIT growth of 619% in 2024, reflecting operational improvements and margin expansion.

Which one has the stronger fundamentals?

Both companies present favorable income statement trends with growing revenues and improving margins. Cloudflare exhibits faster overall revenue growth but remains unprofitable at the net income level. CCC demonstrates consistent profitability improvement and positive EBIT margins. The choice depends on whether investors prioritize rapid growth or current profitability in fundamentals.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Cloudflare, Inc. (NET) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on their latest fiscal year data ending 2024.

| Ratios | Cloudflare, Inc. (NET) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| ROE | -7.53% | 1.31% |

| ROIC | -6.06% | 1.86% |

| P/E | -466.5 | 274.0 |

| P/B | 35.1 | 3.59 |

| Current Ratio | 2.86 | 3.65 |

| Quick Ratio | 2.86 | 3.65 |

| D/E (Debt-to-Equity) | 1.40 | 0.42 |

| Debt-to-Assets | 44.3% | 26.7% |

| Interest Coverage | -29.8 | 1.24 |

| Asset Turnover | 0.51 | 0.30 |

| Fixed Asset Turnover | 2.63 | 4.68 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Cloudflare, Inc.

Cloudflare exhibits mostly unfavorable financial ratios in 2024, including negative net margin (-4.72%), return on equity (-7.53%), and return on invested capital (-6.06%). Its current and quick ratios are favorable at 2.86, indicating good short-term liquidity, but the high price-to-book ratio (35.14) and negative interest coverage (-12.64) raise concerns. The company does not pay dividends, reflecting a reinvestment and growth strategy.

CCC Intelligent Solutions Holdings Inc.

No ratio or key financial metrics data are available for CCC Intelligent Solutions Holdings Inc. for 2024. Consequently, it is not possible to assess the strength or weakness of its financial ratios or comment on dividend payments and shareholder returns based on the provided information.

Which one has the best ratios?

Based on the available data, Cloudflare, Inc. shows a predominance of unfavorable ratios despite some liquidity strengths, while no financial ratio data exist for CCC Intelligent Solutions Holdings Inc. Therefore, a comparative judgment on which company holds the best ratios cannot be established with the given information.

Strategic Positioning

This section compares the strategic positioning of Cloudflare and CCC Intelligent Solutions, focusing on Market position, Key segments, and Exposure to technological disruption:

Cloudflare, Inc.

- Large market cap of 64.5B with high beta, operating globally in cloud infrastructure.

- Offers integrated cloud security, performance, reliability, and developer solutions across multiple industries.

- Exposure to evolving cloud security and networking technologies, addressing broad digital threats.

CCC Intelligent Solutions Holdings Inc.

- Smaller market cap of 5.6B, lower beta, focused on insurance tech SaaS.

- Provides AI, cloud, telematics SaaS for property and casualty insurance economy.

- Focused on AI and telematics disruption within the insurance sector ecosystem.

Cloudflare vs CCC Intelligent Solutions Positioning

Cloudflare pursues a diversified cloud infrastructure approach serving various sectors, with broad security and performance solutions. CCC concentrates on specialized insurance ecosystem software, relying heavily on AI and telematics innovation, reflecting different industry focuses and scales.

Which has the best competitive advantage?

Based on MOAT evaluation, Cloudflare shows a slightly unfavorable position with value destruction but improving profitability. CCC lacks sufficient data for MOAT analysis, limiting comparative competitive advantage assessment.

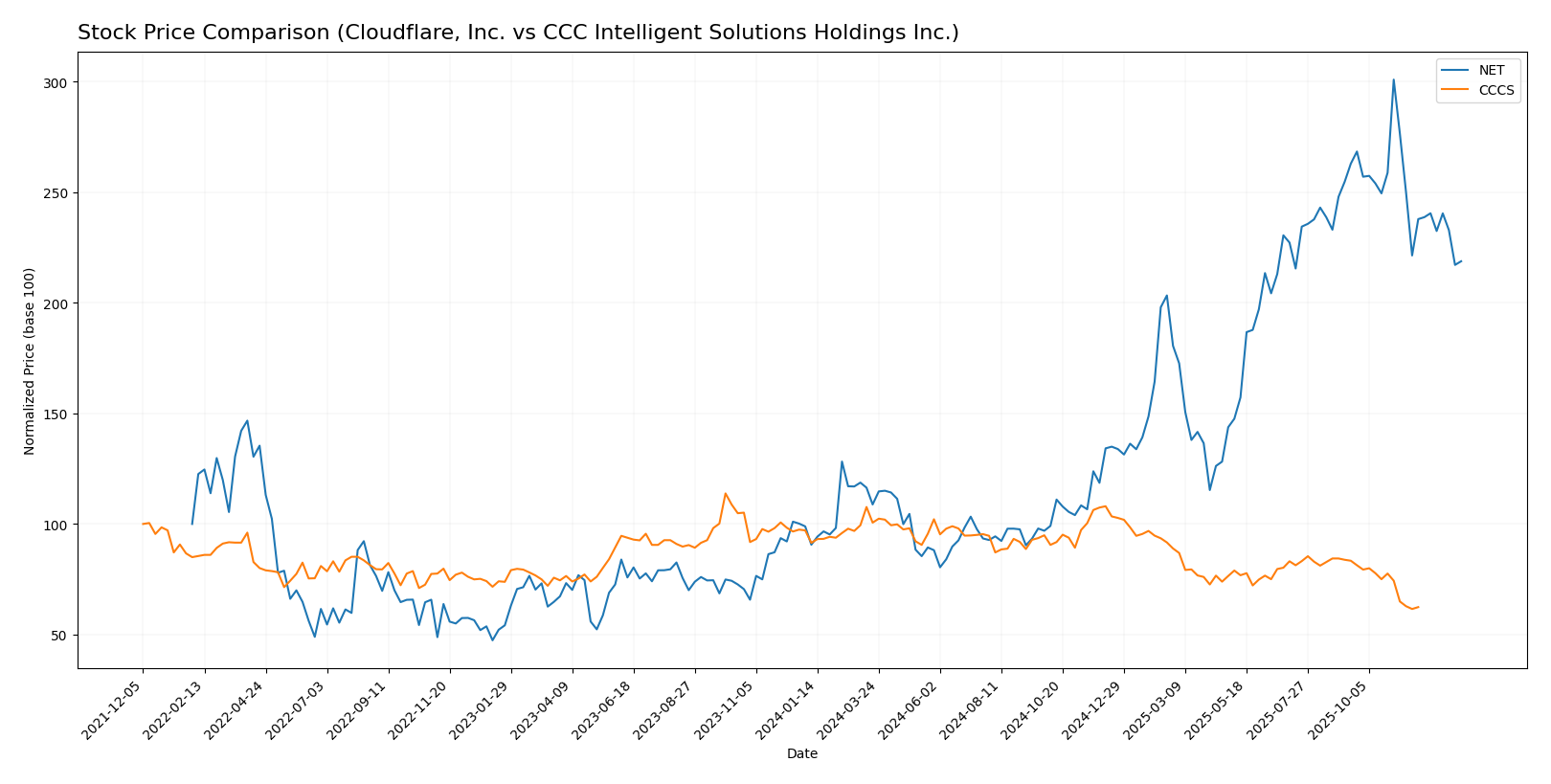

Stock Comparison

The stock price chart over the past 12 months reveals significant divergence in price movements, with Cloudflare, Inc. exhibiting strong gains despite recent deceleration, while CCC Intelligent Solutions Holdings Inc. has experienced sustained declines.

Trend Analysis

Cloudflare, Inc. (NET) shows a bullish trend over the past year with an 87.07% price increase, though recent months indicate a deceleration and a 27.29% drop. Price volatility is high with a standard deviation of 52.73.

CCC Intelligent Solutions Holdings Inc. (CCCS) displays a bearish trend with a 31.78% price decline over 12 months, continuing recent losses of 25.15%. Volatility remains low, with a standard deviation of 1.24.

Comparatively, Cloudflare, Inc. has delivered the highest market performance, outperforming CCC Intelligent Solutions Holdings Inc. by a wide margin over the analyzed period.

Target Prices

The current analyst target consensus for these companies highlights varied expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cloudflare, Inc. | 300 | 210 | 248.86 |

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

Analysts project Cloudflare’s stock to appreciate significantly from its current $184.17 price, indicating strong growth potential. CCC Intelligent Solutions’ consensus target of $11 is modestly above its current $8.75 price, suggesting limited upside.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cloudflare, Inc. and CCC Intelligent Solutions Holdings Inc.:

Rating Comparison

Cloudflare, Inc. Rating

- Rating: D+ with a “Very Favorable” status from analysts.

- Discounted Cash Flow Score: 1, indicating a “Very Unfavorable” valuation perspective.

- ROE Score: 1, reflecting “Very Unfavorable” profitability efficiency.

- ROA Score: 1, showing “Very Unfavorable” asset utilization.

- Debt To Equity Score: 1, indicating “Very Unfavorable” financial risk.

- Overall Score: 1, marked as “Very Unfavorable” in overall financial assessment.

CCC Intelligent Solutions Holdings Inc. Rating

- No rating data available to compare.

- No data provided.

- No data provided.

- No data provided.

- No data provided.

- No data provided.

Which one is the best rated?

Based on the provided data, Cloudflare, Inc. has detailed ratings and scores, all marked as very unfavorable except the overall rating which is very favorable. CCC Intelligent Solutions Holdings Inc. lacks any rating data, making Cloudflare the only company with an analyzable rating profile in this comparison.

Scores Comparison

Here is a comparison of the key financial scores for Cloudflare, Inc. and CCC Intelligent Solutions Holdings Inc.:

Cloudflare, Inc. Scores

- Altman Z-Score: 9.47, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 2, classified as very weak financial strength.

CCC Intelligent Solutions Scores

- Altman Z-Score: 2.18, placing the company in the grey zone with moderate bankruptcy risk.

- Piotroski Score: 3, also classified as very weak financial strength.

Which company has the best scores?

Cloudflare, Inc. demonstrates a much stronger Altman Z-Score compared to CCC Intelligent Solutions, suggesting better financial stability. Both companies have very weak Piotroski Scores, indicating limited financial strength. Overall, Cloudflare shows a safer credit profile based on these metrics.

Grades Comparison

The grades from recognized financial institutions for both companies are as follows:

Cloudflare, Inc. Grades

The table below shows recent grades from major financial firms for Cloudflare, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-11-10 |

| Susquehanna | Maintain | Neutral | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-31 |

| Stifel | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Overall, Cloudflare’s analyst grades show a balanced mix of Buy and Neutral ratings, reflecting moderate confidence in its outlook.

CCC Intelligent Solutions Holdings Inc. Grades

No reliable grading data is available for CCC Intelligent Solutions Holdings Inc. from recognized grading companies.

Which company has the best grades?

Cloudflare, Inc. has received more comprehensive and predominantly positive grades, primarily Buy and Overweight recommendations, whereas CCC Intelligent Solutions Holdings Inc. lacks available grade data. This suggests Cloudflare may currently enjoy stronger analyst support, which investors often interpret as a sign of confidence in future performance.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Cloudflare, Inc. (NET) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent available data.

| Criterion | Cloudflare, Inc. (NET) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Diversification | Limited product diversification, mainly cloud services | Moderate diversification with software subscriptions and other services |

| Profitability | Unfavorable profitability metrics; negative margins and ROIC; value destroying but improving ROIC trend | Data unavailable; cannot assess profitability |

| Innovation | Strong focus on innovation in cybersecurity and cloud technology | Data unavailable; innovation status unclear |

| Global presence | Established global footprint in cloud infrastructure | Data unavailable; likely more regional or sector-specific presence |

| Market Share | Significant market share in cloud security and CDN space | Data unavailable; market share not specified |

Key takeaway: Cloudflare shows strong innovation and global presence but currently struggles with profitability and value creation, albeit with improving trends. CCC Intelligent Solutions lacks sufficient public data for a thorough evaluation, limiting investment decision clarity. Caution and further data are advised before considering CCCS.

Risk Analysis

Below is a comparative table highlighting key risk factors for Cloudflare, Inc. (NET) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent data available for 2026:

| Metric | Cloudflare, Inc. (NET) | CCC Intelligent Solutions (CCCS) |

|---|---|---|

| Market Risk | High beta (1.97) indicates elevated volatility. | Lower beta (0.72) suggests less market fluctuation risk. |

| Debt Level | Debt-to-equity ratio 1.4, moderate leverage. | Data unavailable, but likely moderate given sector norms. |

| Regulatory Risk | Moderate, due to data security and privacy laws worldwide. | Moderate, impacted by evolving insurance and data regulations. |

| Operational Risk | Elevated, due to cloud infrastructure dependency and cybersecurity threats. | Moderate, reliant on software platform stability and integration. |

| Environmental Risk | Low, technology sector with minimal direct environmental impact. | Low, primarily software services with limited environmental footprint. |

| Geopolitical Risk | Moderate, global operations subject to international policy shifts. | Moderate, exposure through insurance ecosystem and supply chains. |

The most impactful and likely risks for Cloudflare stem from its high market volatility and operational challenges in cybersecurity and cloud infrastructure. CCC Intelligent Solutions faces moderate risks primarily related to regulatory changes in the insurance sector and operational stability. Investors should weigh Cloudflare’s growth potential against its financial instability and market fluctuations, while CCCS’s risk profile is less volatile but lacks full financial transparency.

Which Stock to Choose?

Cloudflare, Inc. (NET) shows a strong income growth with a 287% revenue increase over five years and favorable income statement metrics despite negative profitability ratios. Its financial ratios are largely unfavorable, with a high debt level and negative returns. The company’s rating is low, reflecting challenges in profitability and financial stability.

CCC Intelligent Solutions Holdings Inc. (CCCS) has moderate income growth and positive income statement margins, including an 11.5% EBIT margin and a 2.8% net margin. However, detailed financial ratios and ratings are unavailable, limiting full evaluation, though scores indicate a moderate risk profile with a grey zone Altman Z-Score.

Investors seeking growth might find Cloudflare’s rapid revenue expansion and improving income metrics appealing despite financial weaknesses. Conversely, those favoring more stable income and moderate profitability could consider CCC Intelligent Solutions, noting the absence of comprehensive ratio data. The choice may hinge on risk tolerance and preference for growth versus stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cloudflare, Inc. and CCC Intelligent Solutions Holdings Inc. to enhance your investment decisions: