Home > Comparison > Financial Services > COIN vs CBOE

The strategic rivalry between Coinbase Global, Inc. and Cboe Global Markets, Inc. shapes the financial data and stock exchange landscape. Coinbase operates as a high-growth platform in the cryptoeconomy, leveraging innovative technology. Cboe serves as a diversified, established options and equities exchange with global reach. This analysis assesses which firm’s operational model offers a superior risk-adjusted return, guiding investors seeking resilience and growth in financial services.

Table of contents

Companies Overview

The battle between Coinbase Global and Cboe Global Markets shapes the evolving landscape of financial exchanges.

Coinbase Global, Inc.: Crypto Infrastructure Pioneer

Coinbase Global, Inc. leads the financial infrastructure sector for the cryptoeconomy. Its core revenue engine stems from providing a primary financial account for consumers and a liquidity marketplace for institutional crypto transactions. In 2026, Coinbase focuses strategically on expanding its technology services enabling developers to build crypto applications and accept crypto payments securely.

Cboe Global Markets, Inc.: Options and Derivatives Powerhouse

Cboe Global Markets, Inc. operates a diversified exchange platform with a strong foothold in options, equities, futures, and FX markets. Its competitive advantage lies in its multi-asset market segments and strategic partnerships with leading index providers. The company’s 2026 strategy emphasizes expanding global derivatives and exchange-traded products, leveraging its institutional trading expertise.

Strategic Collision: Similarities & Divergences

Coinbase and Cboe both dominate financial data and exchange services but differ fundamentally. Coinbase drives an open crypto ecosystem enabling decentralized finance innovation. Cboe focuses on traditional, regulated markets with a closed infrastructure and broad asset coverage. Their primary battleground is market share in evolving digital and institutional trading platforms. Investors face contrasting profiles: Coinbase offers high growth but higher volatility; Cboe provides steady income with lower beta risk.

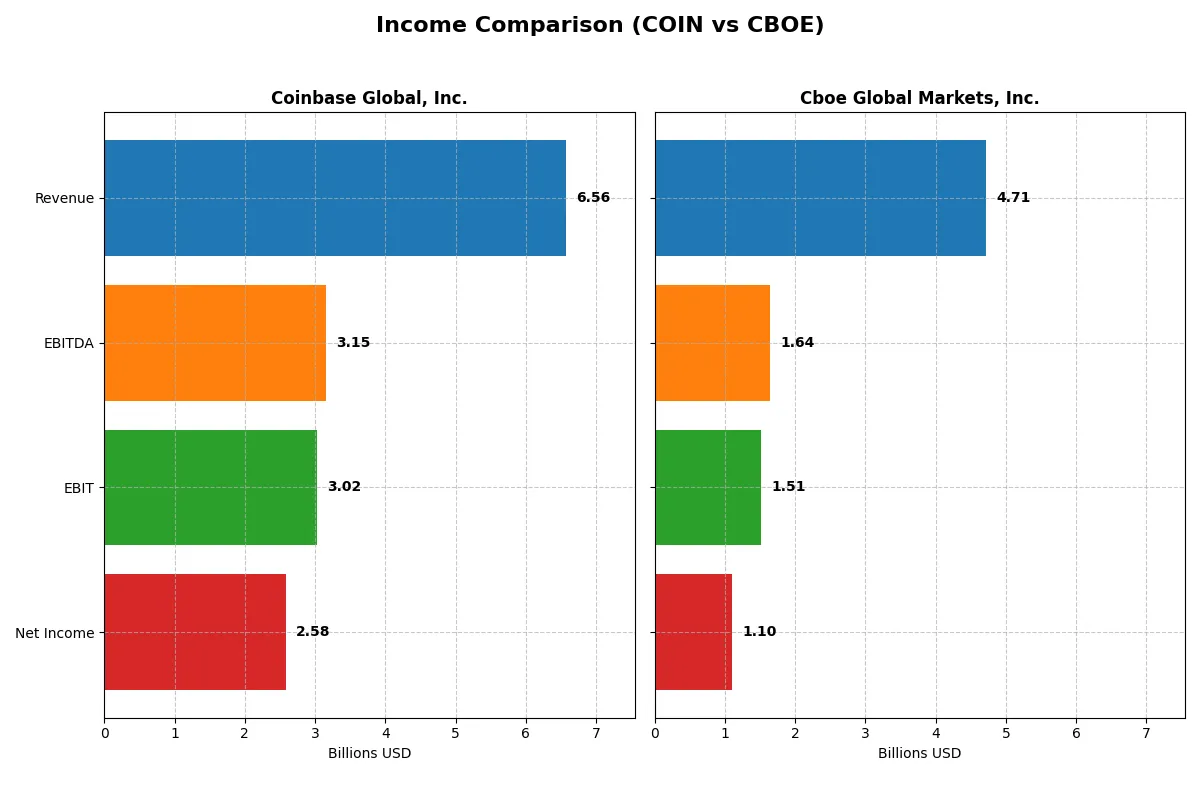

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Coinbase Global, Inc. (COIN) | Cboe Global Markets, Inc. (CBOE) |

|---|---|---|

| Revenue | 6.56B | 4.71B |

| Cost of Revenue | 1.66B | 2.41B |

| Operating Expenses | 2.60B | 723M |

| Gross Profit | 4.91B | 2.31B |

| EBITDA | 3.15B | 1.64B |

| EBIT | 3.02B | 1.51B |

| Interest Expense | 81M | -52M |

| Net Income | 2.59B | 1.09B |

| EPS | 10.42 | 10.46 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability momentum of Coinbase Global, Inc. and Cboe Global Markets, Inc. as corporate engines.

Coinbase Global, Inc. Analysis

Coinbase’s revenue surged from 3.1B in 2023 to 6.6B in 2024, more than doubling. Net income exploded to 2.6B, reflecting a dramatic margin recovery from prior years. Gross margin stands strong at 74.75%, with net margin at 39.29%, signaling superior cost control and operational leverage. The recent financial year shows remarkable efficiency gains and rapid profit acceleration.

Cboe Global Markets, Inc. Analysis

Cboe grew revenue steadily by 15% year-over-year to 4.7B in 2025. Net income rose 44.5% to 1.1B, supported by a solid gross margin near 49% and a net margin of 23.33%. While its profit growth is less explosive than Coinbase’s, Cboe maintains consistent margin expansion and reliable operational discipline, reflecting stable momentum in a mature market.

Explosive Growth vs. Steady Expansion

Coinbase outpaces Cboe with far superior revenue and net income growth, demonstrating high scalability and margin expansion. Cboe offers steadier, more predictable profit growth with moderate margins. For investors, Coinbase’s profile appeals to those seeking rapid profit acceleration, while Cboe suits those favoring sustained, lower-volatility earnings growth.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Coinbase Global, Inc. (COIN) | Cboe Global Markets, Inc. (CBOE) |

|---|---|---|

| ROE | 25.1% | 21.4% |

| ROIC | 13.6% | 15.3% |

| P/E | 23.8 | 23.9 |

| P/B | 6.0 | 5.1 |

| Current Ratio | 2.28 | 1.87 |

| Quick Ratio | 2.28 | 1.87 |

| D/E (Debt-to-Equity) | 0.45 | 0.33 |

| Debt-to-Assets | 20.5% | 18.1% |

| Interest Coverage | 28.6 | -29.0 |

| Asset Turnover | 0.29 | 0.51 |

| Fixed Asset Turnover | 23.3 | 19.3 |

| Payout Ratio | 0% | 26% |

| Dividend Yield | 0% | 1.08% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as the company’s DNA, unveiling hidden risks and operational strengths crucial for sound investment decisions.

Coinbase Global, Inc.

Coinbase shows a strong 25.1% ROE and a robust 39.3% net margin, signaling solid profitability despite an unfavorable ROIC below WACC. The P/E of 23.8 suggests a fairly valued stock, yet a high P/B of 6 signals premium pricing. Coinbase does not pay dividends, focusing on heavy reinvestment in R&D at 22% of revenue to fuel growth.

Cboe Global Markets, Inc.

Cboe posts a respectable 21.4% ROE and a 23.3% net margin, reflecting efficient operations with a favorable ROIC well above WACC. Its P/E of 23.9 aligns closely with Coinbase, though a slightly lower P/B of 5.1 indicates less valuation stretch. Cboe offers a modest 1.1% dividend yield, balancing shareholder returns with steady cash flow management.

Premium Valuation vs. Operational Safety

Both companies trade at similar P/E multiples, but Cboe combines solid profitability with a favorable cost of capital and dividend income, enhancing its risk-reward profile. Coinbase’s aggressive R&D reinvestment suits growth-oriented investors, while Cboe fits those seeking operational stability and income.

Which one offers the Superior Shareholder Reward?

I see Coinbase (COIN) pays no dividend, favoring reinvestment in growth and innovation. Its free cash flow per share stands strong at 10.3, supporting future expansion. Cboe (CBOE) offers a consistent dividend yield around 1.1%, with a payout ratio near 26–36%, balancing income with buybacks. Cboe’s buyback activity complements its dividend, enhancing total returns. Coinbase’s buybacks are less visible; focus remains on capital allocation to scale. For 2026, Cboe provides a more sustainable, shareholder-friendly distribution model, blending yield and buybacks. I conclude Cboe delivers the superior total shareholder reward today.

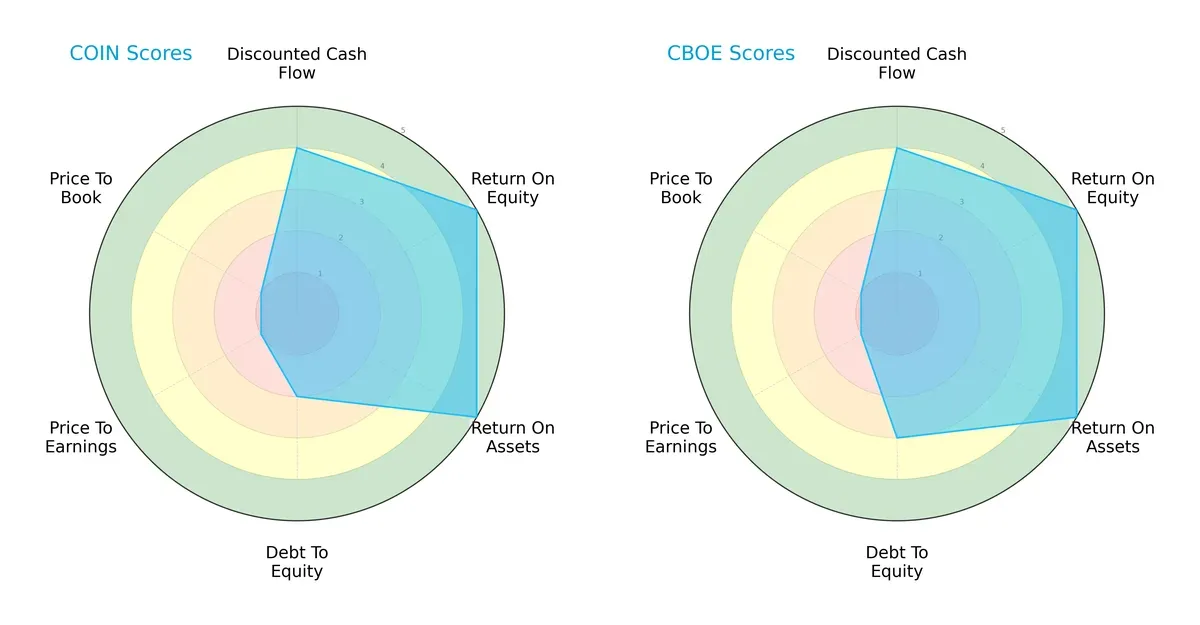

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Coinbase Global, Inc. and Cboe Global Markets, Inc., highlighting their financial strengths and weaknesses:

Both companies share strong DCF, ROE, and ROA scores, reflecting efficient asset use and profitability. However, Cboe edges out Coinbase with a better debt-to-equity score (3 vs. 2), signaling a more balanced capital structure. Both suffer from poor valuation scores, indicating market skepticism. Coinbase leans heavily on profitability but carries higher financial risk, while Cboe presents a more stable profile.

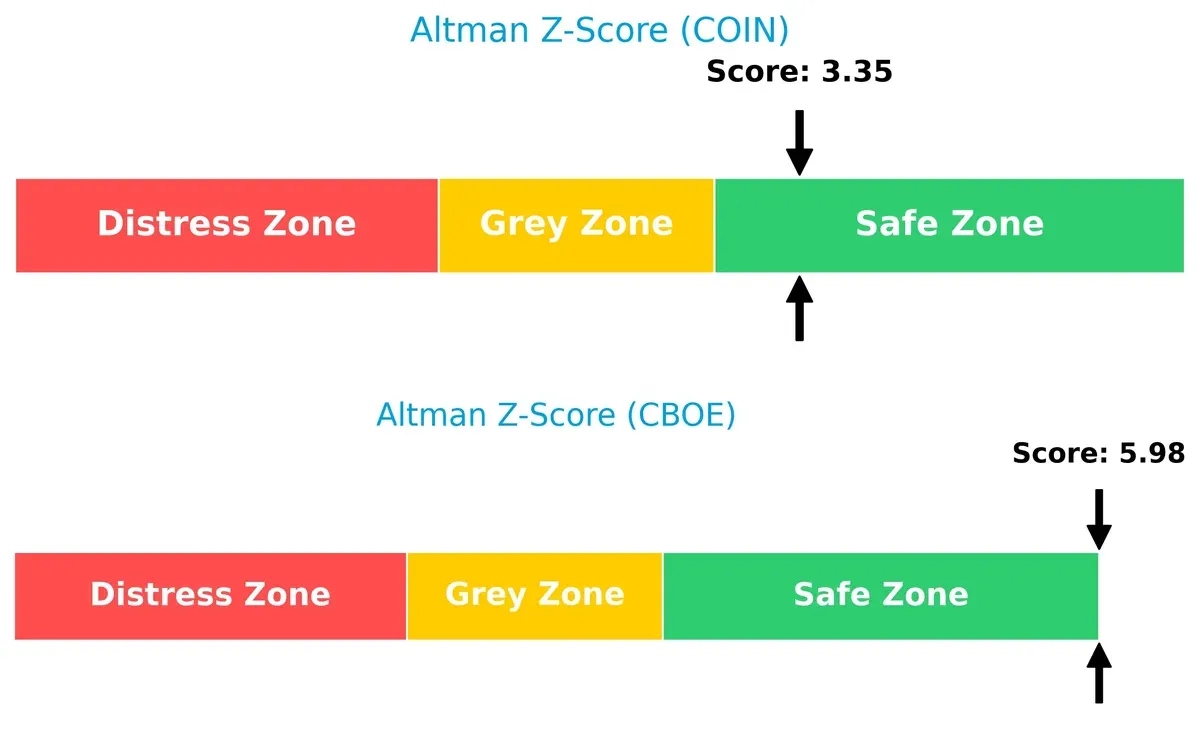

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap favors Cboe, with 5.98 compared to Coinbase’s 3.35, both safely above distress thresholds, but Cboe’s score signals stronger long-term solvency and resilience in this cycle:

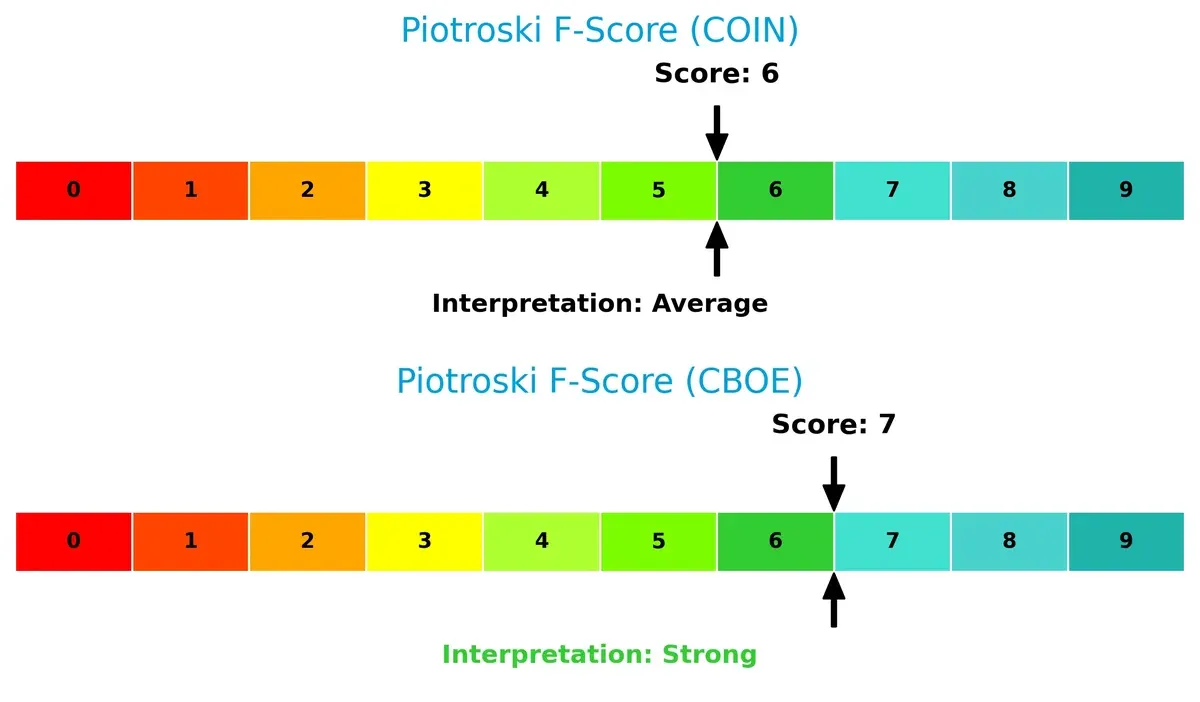

Financial Health: Quality of Operations

Cboe’s Piotroski F-Score of 7 outperforms Coinbase’s 6, indicating stronger internal financial metrics. While both companies are healthy, Coinbase shows slight red flags in operational efficiency compared to Cboe’s more robust score:

How are the two companies positioned?

This section dissects COIN and CBOE’s operational DNA by comparing revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

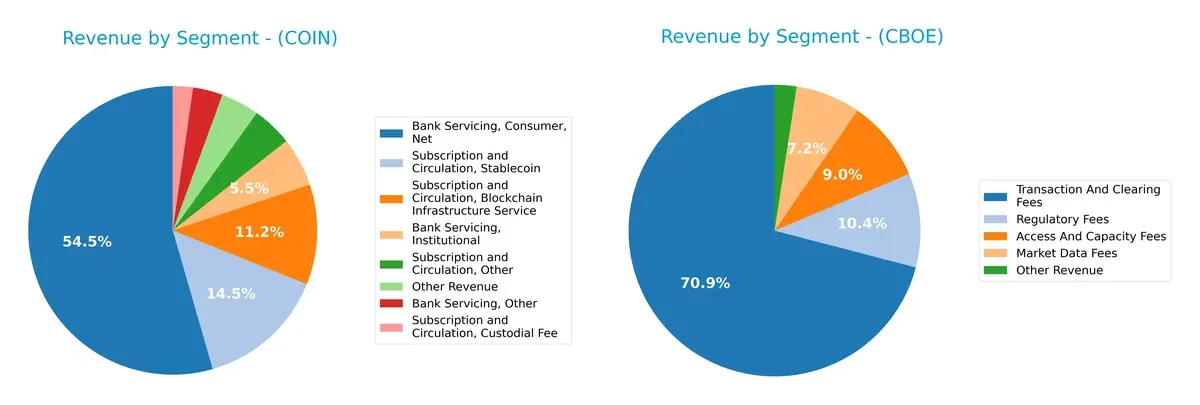

This comparison dissects how Coinbase Global, Inc. and Cboe Global Markets, Inc. diversify their income streams and reveals their primary sector bets based on recent fiscal data:

Coinbase anchors its revenue in Bank Servicing, Consumer, netting $3.43B in 2024, with Subscription and Circulation segments adding depth. Cboe leans heavily on Transaction and Clearing Fees at $2.9B, but balances with Regulatory and Market Data Fees. Coinbase’s focus exposes it to crypto market volatility, while Cboe’s diversified fees suggest resilient infrastructure dominance with less concentration risk.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Coinbase Global, Inc. and Cboe Global Markets, Inc.:

Coinbase Strengths

- Strong U.S. and Rest of World revenue diversification

- High net margin of 39.29%

- Favorable ROE at 25.1%

- Solid liquidity ratios above 2.0

- Low debt-to-assets at 20.54%

- Robust fixed asset turnover at 23.34

Cboe Strengths

- Favorable ROIC above WACC (15.31% vs 5.28%)

- Solid net margin at 23.33%

- Favorable ROE at 21.41%

- Well-managed debt levels with low DE ratio 0.33

- Diversified revenue streams across fees and markets

- Global market presence through derivatives and data services

Coinbase Weaknesses

- ROIC below WACC indicates capital inefficiency

- High PB ratio suggests possible overvaluation

- Lower asset turnover at 0.29

- No dividend yield, limiting income appeal

- Heavy reliance on U.S. market with limited global diversification

Cboe Weaknesses

- Negative interest coverage ratio signals financial stress

- Unfavorable PB ratio at 5.11

- Neutral asset turnover at 0.51

- Dividend yield only neutral at 1.08%

- Lack of disclosed geographic revenue diversification

Both companies exhibit strong profitability and leverage control but face distinct challenges. Coinbase’s limited global reach and capital efficiency contrast with Cboe’s interest coverage risk and geographic opacity. These factors influence each firm’s strategic focus on market expansion and financial stability.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from competitive erosion. Without it, market share and margins vanish quickly:

Coinbase Global, Inc.: Innovation-Driven Volatility Moat

Coinbase’s advantage centers on intangible assets and network effects in crypto. Yet, declining ROIC signals weakening capital efficiency. Expansion into new crypto markets could either deepen or erode its fragile moat by 2026.

Cboe Global Markets, Inc.: Proven Market Infrastructure Moat

Cboe builds on cost advantages and regulatory barriers, driving strong ROIC and margin growth. Its expanding derivatives and FX products strengthen its moat deeper than Coinbase’s, with steady profitability growth expected in 2026.

Traditional Market Infrastructure vs. Crypto Innovation: Who Holds the Deeper Moat?

Cboe delivers a wider, more sustainable moat with 10% ROIC above WACC and rising profitability. Coinbase’s negative ROIC trend exposes vulnerability. Cboe is better equipped to defend its market share amid intensifying competition.

Which stock offers better returns?

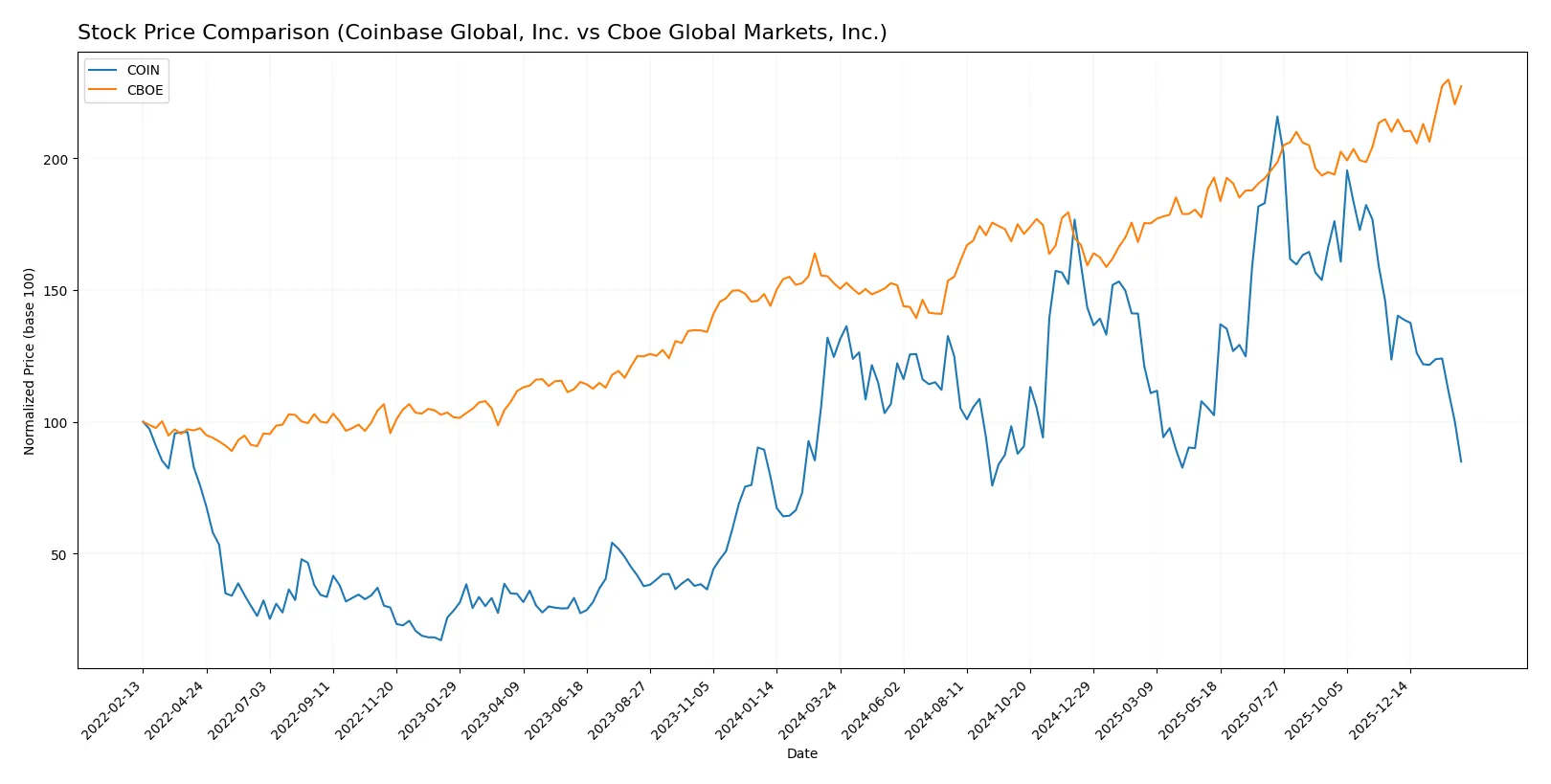

The past year reveals a sharp divergence: Coinbase Global, Inc. declines steeply while Cboe Global Markets, Inc. advances robustly, reflecting contrasting trading dynamics and investor sentiment.

Trend Comparison

Coinbase Global, Inc. shows a bearish trend with a -31.87% price drop over 12 months. The trend decelerates, hitting a high of 419.78 and a low of 147.35, amid high volatility (58.94 std. dev.).

Cboe Global Markets, Inc. presents a bullish trend with a 48.95% price increase over 12 months. The trend accelerates, reaching a high of 276.39 and a low of 167.6, with moderate volatility (27.47 std. dev.).

Cboe Global Markets outperforms Coinbase Global, delivering stronger returns and clearer upward momentum throughout the period analyzed.

Target Prices

Analysts present a clear target price consensus for Coinbase Global, Inc. and Cboe Global Markets, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Coinbase Global, Inc. | 230 | 440 | 336.44 |

| Cboe Global Markets, Inc. | 240 | 295 | 274 |

Coinbase’s consensus target of 336.44 implies a substantial upside from the current 165.12 price. Cboe’s target of 274 aligns closely with its current 273.09 price, signaling limited near-term price appreciation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a summary of the recent institutional grades for Coinbase Global, Inc. and Cboe Global Markets, Inc.:

Coinbase Global, Inc. Grades

The following table shows recent grades from reputable financial institutions for Coinbase Global, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-02-05 |

| Piper Sandler | Maintain | Neutral | 2026-01-14 |

| Oppenheimer | Maintain | Outperform | 2026-01-12 |

| Barclays | Maintain | Equal Weight | 2026-01-08 |

| B of A Securities | Upgrade | Buy | 2026-01-08 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-18 |

| BTIG | Maintain | Buy | 2025-12-18 |

| Compass Point | Maintain | Sell | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-12-12 |

| Argus Research | Downgrade | Hold | 2025-11-25 |

Cboe Global Markets, Inc. Grades

Below are the latest institutional grades for Cboe Global Markets, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Hold | 2026-01-14 |

| Piper Sandler | Maintain | Overweight | 2026-01-14 |

| Barclays | Maintain | Overweight | 2026-01-08 |

| UBS | Maintain | Neutral | 2026-01-07 |

| Morgan Stanley | Maintain | Underweight | 2025-12-22 |

| Barclays | Upgrade | Overweight | 2025-12-12 |

| Barclays | Maintain | Equal Weight | 2025-11-03 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2025-11-03 |

| Citigroup | Maintain | Neutral | 2025-11-03 |

| UBS | Maintain | Neutral | 2025-11-03 |

Which company has the best grades?

Coinbase Global, Inc. holds a broader range of ratings, including multiple Buy and Outperform grades, indicating stronger institutional confidence. Cboe Global Markets, Inc. mostly receives Overweight and Hold ratings, suggesting moderate outlooks. Investors may regard Coinbase as having more optimistic institutional support, though grade variability signals caution.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Coinbase Global, Inc.

- Faces intense competition in crypto infrastructure with rapid innovation and regulatory uncertainty.

Cboe Global Markets, Inc.

- Competes in traditional exchanges with diversified segments but faces pressure from fintech disruption.

2. Capital Structure & Debt

Coinbase Global, Inc.

- Maintains moderate leverage (D/E 0.45) with strong interest coverage (37.5x), but cost of capital (WACC 19.5%) exceeds ROIC.

Cboe Global Markets, Inc.

- Lower leverage (D/E 0.33) but negative interest coverage (-28.95) signals risks servicing debt despite favorable WACC (5.3%).

3. Stock Volatility

Coinbase Global, Inc.

- High beta (3.7) reflects extreme price swings and crypto market sensitivity.

Cboe Global Markets, Inc.

- Very low beta (0.36) indicates stable stock with limited market volatility exposure.

4. Regulatory & Legal

Coinbase Global, Inc.

- Crypto regulation remains evolving and unpredictable, posing compliance and operational risks.

Cboe Global Markets, Inc.

- Established regulatory framework with traditional exchanges but exposed to evolving derivatives and FX rules.

5. Supply Chain & Operations

Coinbase Global, Inc.

- Relies heavily on technology infrastructure and liquidity providers; operational disruptions could impact service.

Cboe Global Markets, Inc.

- Diverse operational footprint across geographies and products reduces single-point operational risks.

6. ESG & Climate Transition

Coinbase Global, Inc.

- Faces scrutiny over crypto energy consumption and social governance amid rising ESG demands.

Cboe Global Markets, Inc.

- More aligned with ESG norms due to traditional market operations; climate risks less direct.

7. Geopolitical Exposure

Coinbase Global, Inc.

- Global crypto markets expose it to sanctions, cross-border regulatory conflicts, and geopolitical volatility.

Cboe Global Markets, Inc.

- International segments diversify risk but expose firm to regional regulatory and political instability.

Which company shows a better risk-adjusted profile?

Coinbase’s highest risk is its market volatility amplified by crypto regulatory uncertainty. Cboe’s largest concern is its negative interest coverage, risking debt servicing under stress. Despite Coinbase’s volatility, Cboe’s debt servicing weakness and interest coverage alarm me more. Cboe’s stable beta and diversified operations provide steadiness, but its financial strain narrows its margin for error. Coinbase, although volatile, shows stronger interest coverage and liquidity buffers, granting it a comparatively better risk-adjusted profile.

Final Verdict: Which stock to choose?

Coinbase Global, Inc. leverages its superpower as a cash-generating growth engine with robust profitability and strong free cash flow. Its declining ROIC versus WACC signals a point of vigilance for long-term value creation. Coinbase fits portfolios targeting aggressive growth and high beta exposure.

Cboe Global Markets, Inc. boasts a strategic moat rooted in a sustainable competitive advantage and a rising ROIC, reflecting efficient capital use. It offers better balance sheet stability and consistent earnings growth, making it suitable for investors seeking GARP (Growth at a Reasonable Price) profiles with lower volatility.

If you prioritize high-growth potential and can tolerate cyclical risks, Coinbase’s dynamic expansion outshines. However, if you seek stable value creation with a durable moat and steady returns, Cboe offers better stability and a more favorable risk-reward balance. Each represents a distinct analytical scenario aligned with different investor strategies.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Coinbase Global, Inc. and Cboe Global Markets, Inc. to enhance your investment decisions: