Home > Comparison > Industrials > CAT vs HY

The strategic rivalry between Caterpillar Inc. and Hyster-Yale Materials Handling, Inc. shapes the competitive landscape of the industrial machinery sector. Caterpillar, a capital-intensive industrial giant, dominates construction and mining equipment globally. In contrast, Hyster-Yale operates as a specialized manufacturer of lift trucks and aftermarket parts, focusing on niche markets. This analysis weighs their divergent operational models to identify which offers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

Caterpillar and Hyster-Yale stand as pivotal players in the agricultural machinery industry, shaping industrial operations globally.

Caterpillar Inc.: Global Construction and Mining Equipment Leader

Caterpillar dominates as a leading manufacturer of construction, mining equipment, and industrial engines. Its revenue relies heavily on heavy machinery sales and integrated energy solutions across multiple sectors. In 2026, Caterpillar focuses on expanding autonomous vehicle technology and digital fleet management to boost operational efficiency.

Hyster-Yale Materials Handling, Inc.: Specialist in Lift Trucks and Material Handling

Hyster-Yale excels as a niche manufacturer of lift trucks, attachments, and aftermarket parts. The company’s revenue stems from equipment sales and servicing through a global dealer network. In 2026, it emphasizes hydrogen fuel-cell technology and expanding its footprint in rough terrain forklifts and port equipment markets.

Strategic Collision: Similarities & Divergences

Both firms operate in industrial machinery but diverge sharply in scale and product scope. Caterpillar pursues broad infrastructure solutions with a focus on automation, while Hyster-Yale targets specialized material handling with green energy innovation. Their core battle is market share in heavy versus light industrial equipment. This contrast defines their unique risk and growth profiles for investors.

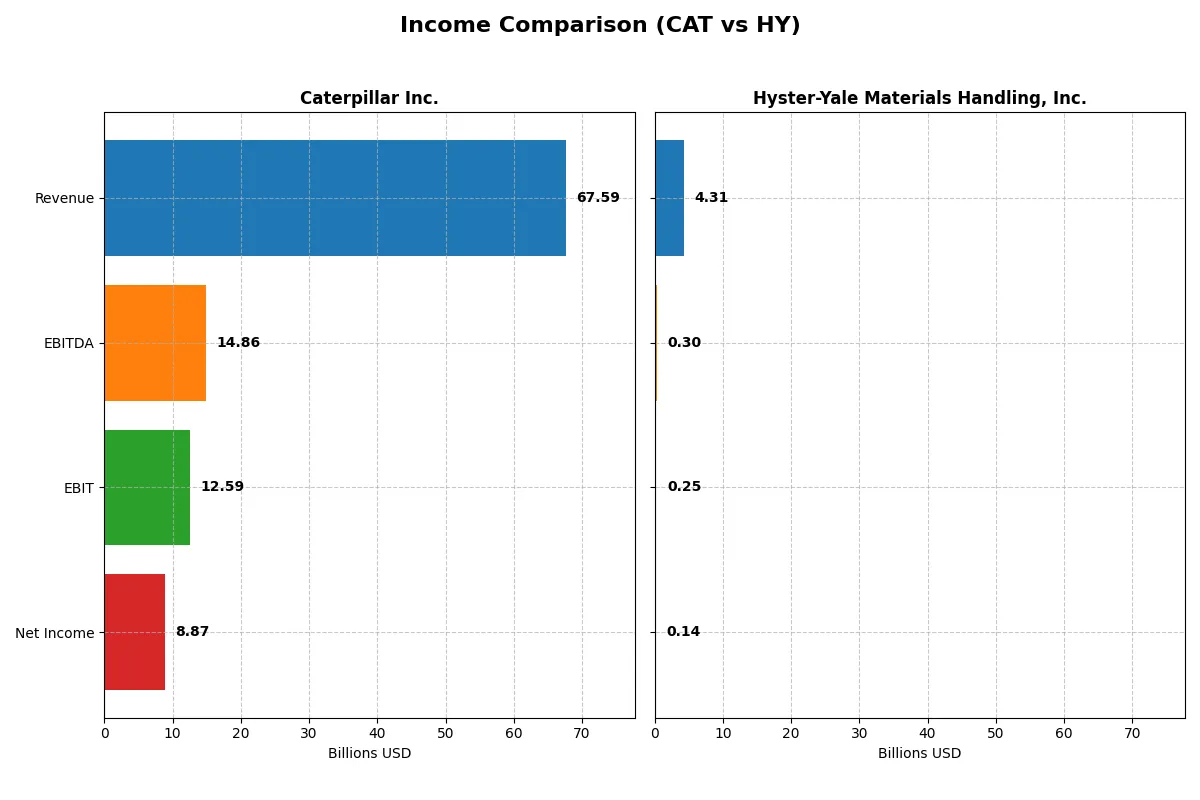

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Caterpillar Inc. (CAT) | Hyster-Yale Materials Handling, Inc. (HY) |

|---|---|---|

| Revenue | 67.6B | 4.31B |

| Cost of Revenue | 45.7B | 3.41B |

| Operating Expenses | 10.6B | 651M |

| Gross Profit | 21.9B | 896M |

| EBITDA | 14.9B | 300M |

| EBIT | 12.6B | 253M |

| Interest Expense | 1.03B | 34M |

| Net Income | 8.87B | 142M |

| EPS | 18.9 | 8.16 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company deploys its resources most efficiently to convert sales into profits.

Caterpillar Inc. Analysis

Caterpillar’s revenue climbed steadily from 51B in 2021 to nearly 68B in 2025, with net income growing 37% over five years. Its gross margin remains strong at 32.3%, though it slightly dipped in 2025. Net margin stands at a healthy 13.1%, reflecting solid cost control despite a recent decline in profitability and EPS momentum.

Hyster-Yale Materials Handling, Inc. Analysis

Hyster-Yale’s revenue rose from 2.8B in 2020 to 4.3B in 2024, with net income surging over 280% across the period. Gross margin improved to 20.8%, while net margin remains modest at 3.3%. The company recorded favorable growth in EBIT and EPS last year, signaling improving operational leverage and margin expansion from a smaller base.

Scale Dominance vs. Growth Leverage

Caterpillar dominates in absolute scale and margin robustness, delivering stable profitability and strong free cash flow. Hyster-Yale, although smaller, shows explosive net income growth and margin expansion, suggesting rising operational efficiency. For investors seeking large-cap stability, Caterpillar’s profile is compelling; those favoring growth potential may find Hyster-Yale’s upward momentum more attractive.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | Caterpillar Inc. (CAT) | Hyster-Yale Materials Handling, Inc. (HY) |

|---|---|---|

| ROE | 41.6% | 30.0% |

| ROIC | 11.4% | 13.6% |

| P/E | 30.1 | 6.2 |

| P/B | 12.5 | 1.9 |

| Current Ratio | 1.44 | 1.35 |

| Quick Ratio | 0.94 | 0.64 |

| D/E (Debt-to-Equity) | 2.03 | 1.14 |

| Debt-to-Assets | 44.0% | 26.7% |

| Interest Coverage | 10.9 | 7.2 |

| Asset Turnover | 0.69 | 2.12 |

| Fixed Asset Turnover | 4.46 | 14.05 |

| Payout ratio | 31.0% | 16.9% |

| Dividend yield | 1.03% | 2.70% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, revealing hidden risks and operational excellence essential for informed investment decisions.

Caterpillar Inc.

Caterpillar demonstrates strong profitability with a 41.6% ROE and favorable margins of 13.1%, but its valuation is stretched, reflected in a high P/E of 30.1 and a P/B of 12.5. The company balances shareholder returns with a modest 1.03% dividend yield, suggesting steady income and ongoing reinvestment in R&D at 3.18% of revenue for growth.

Hyster-Yale Materials Handling, Inc.

Hyster-Yale shows efficient capital use with a 29.9% ROE and a favorable ROIC of 13.6%. It trades at a low P/E of 6.2, indicating undervaluation relative to earnings. The firm supports shareholders with a higher 2.7% dividend yield, signaling cash returns alongside operational efficiency, though it faces a weak quick ratio and some leverage concerns.

Valuation Stretch vs. Operational Efficiency

Caterpillar commands a premium valuation on strong returns but carries higher leverage and stretched multiples. Hyster-Yale offers a better value profile with solid returns and shareholder dividends but some liquidity risks. Conservative investors may prefer Caterpillar’s stability, while value seekers might favor Hyster-Yale’s efficiency and yield.

Which one offers the Superior Shareholder Reward?

I compare Caterpillar Inc. (CAT) and Hyster-Yale Materials Handling, Inc. (HY) on their shareholder return strategies. CAT delivers a 1.03% dividend yield with a moderate 31% payout ratio, supported by strong free cash flow coverage (~88%). Its buyback program is substantial, enhancing total return sustainably. HY pays a higher dividend yield at 2.7%, but with a 17% payout ratio and weaker margin profiles. HY’s buybacks are modest, reflecting limited cash flow strength. CAT’s balance of dividends, buybacks, and robust cash flow makes it the superior choice for long-term total return in 2026.

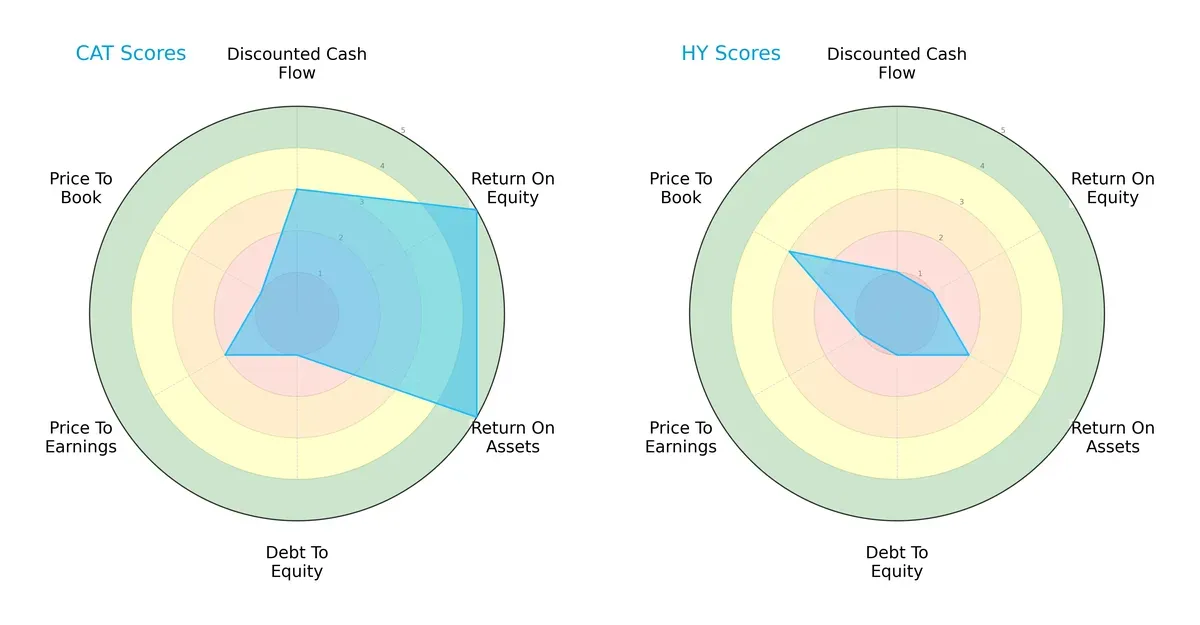

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Caterpillar Inc. and Hyster-Yale Materials Handling, reflecting their contrasting financial strengths and weaknesses:

Caterpillar displays strong operational efficiency with top scores in ROE (5) and ROA (5), while Hyster-Yale lags significantly with scores of 1 and 2 respectively. Both firms share a weak debt-to-equity score (1), signaling high leverage risk. Caterpillar maintains a more balanced profile across valuation metrics (PE 2, PB 1), whereas Hyster-Yale’s valuation scores indicate deeper undervaluation but with higher risk. Overall, Caterpillar’s edge lies in profitability and asset utilization; Hyster-Yale depends on potential valuation bargains.

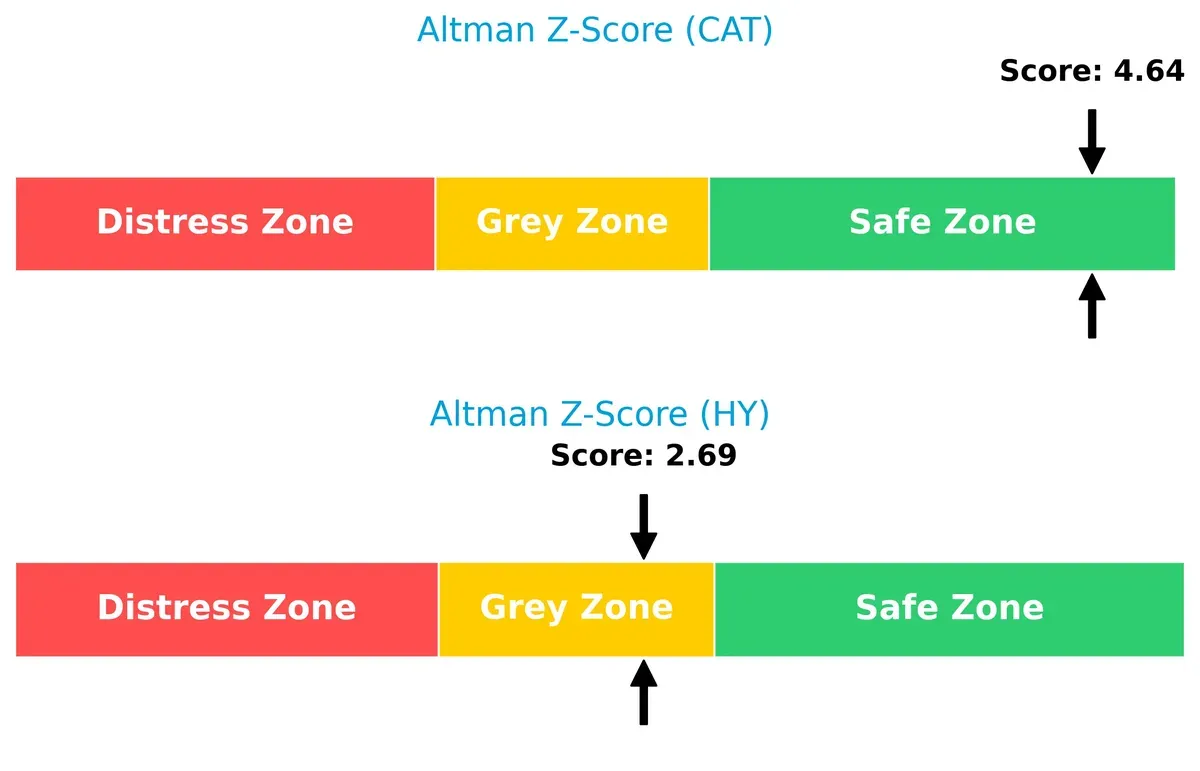

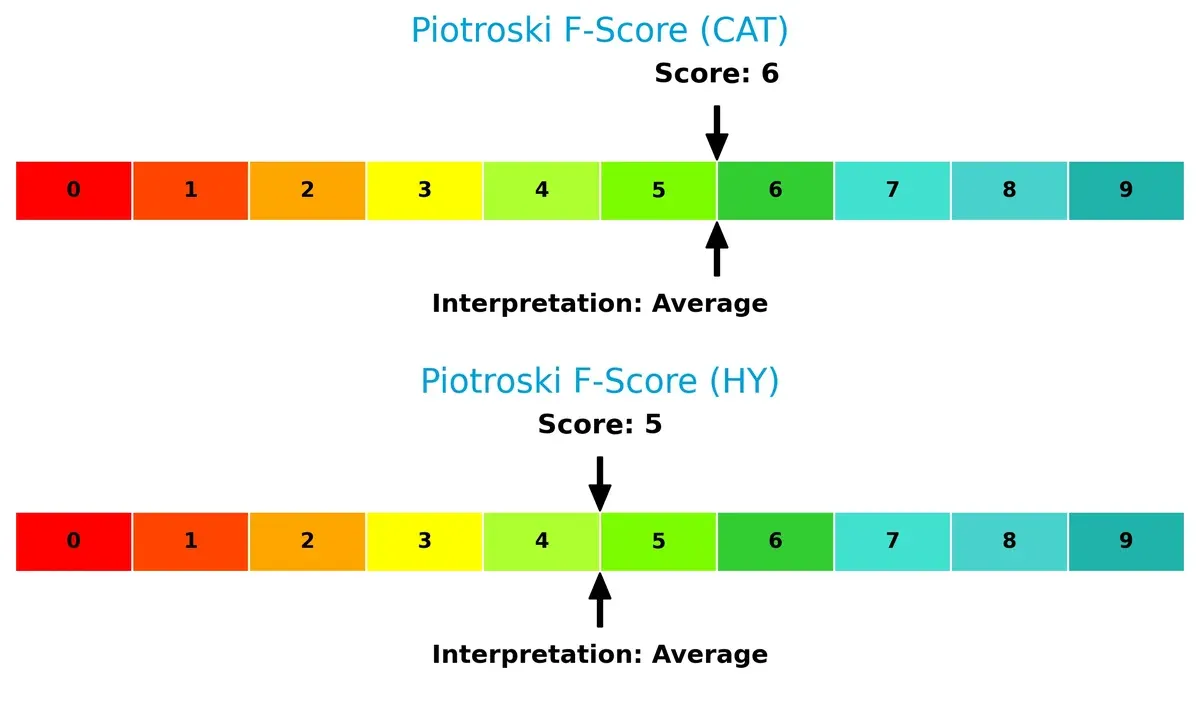

Bankruptcy Risk: Solvency Showdown

Caterpillar’s Altman Z-Score of 4.64 places it firmly in the safe zone, while Hyster-Yale’s 2.69 positions it in the grey zone, indicating moderate bankruptcy risk in this economic cycle:

Financial Health: Quality of Operations

Both companies show average Piotroski F-Scores: Caterpillar at 6 and Hyster-Yale at 5, reflecting moderate financial health without glaring red flags but room for improvement in operational quality:

How are the two companies positioned?

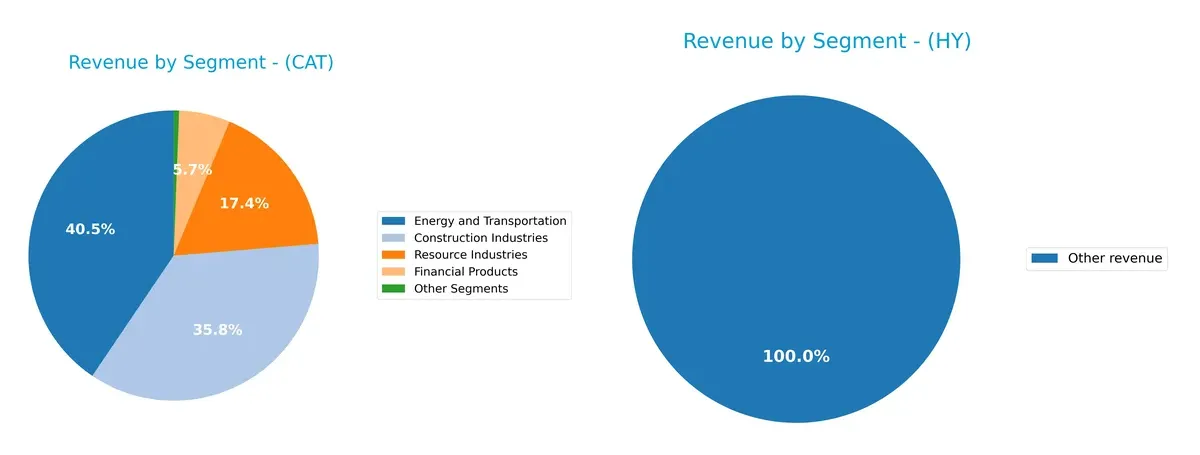

This section dissects the operational DNA of CAT and HY by comparing revenue distribution and internal dynamics, including strengths and weaknesses. The goal is to confront their economic moats and identify the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Caterpillar and Hyster-Yale diversify their income streams and where their primary sector bets lie:

Caterpillar anchors revenue across multiple robust segments: $28.9B in Energy and Transportation, $25.5B in Construction, and $12.4B in Resources. This diversification reduces concentration risk and leverages a broad infrastructure ecosystem. Hyster-Yale pivots heavily on its Lift truck business at $3.36B, with smaller contributions from Bolzoni and JAPIC. This reliance signals high exposure to material handling but a focused market niche with potential for specialized dominance.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Caterpillar Inc. and Hyster-Yale Materials Handling, Inc.:

Caterpillar Inc. Strengths

- Strong diversification across construction, energy, resources, and financial products

- High profitability with 13.13% net margin and 41.62% ROE

- Favorable ROIC at 11.42% above WACC

- Global presence with significant revenue in North America, EMEA, Asia Pacific, Latin America

- Solid market share in heavy equipment sectors

Hyster-Yale Materials Handling Strengths

- Favorable ROIC at 13.59% surpassing WACC

- Low P/E of 6.24 indicating value potential

- Favorable asset turnover of 2.12 and fixed asset turnover of 14.05

- Higher dividend yield at 2.7%

- Leaner debt structure with 26.7% debt-to-assets ratio

- Focused presence in Americas and EMEA with concentrated business segments

Caterpillar Inc. Weaknesses

- Elevated debt-to-equity ratio at 2.03 and high P/B at 12.54 may signal leverage and valuation concerns

- WACC at 10.18% slightly below ROIC but cost of capital remains high

- Neutral liquidity ratios with quick ratio below 1

- Slightly unfavorable P/E at 30.12 limits valuation appeal

- Market concentration risk in large geographic segments

Hyster-Yale Materials Handling Weaknesses

- Low net margin at 3.3% limiting profitability

- Quick ratio at 0.64 signals liquidity risks

- Debt-to-equity ratio of 1.14 flagged unfavorable

- Limited diversification with heavy reliance on lift truck business

- Smaller global footprint compared to peers reduces scale advantages

Overall, Caterpillar leverages broad diversification and global scale with strong profitability metrics but faces leverage and valuation challenges. Hyster-Yale shows operational efficiency and value pricing but contends with lower margins, liquidity constraints, and narrower market scope. These contrasts highlight distinct strategic positions within the industrial equipment sector.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion. Let’s break down how these two firms defend their turf:

Caterpillar Inc.: Scale and Brand Intangibles

Caterpillar’s moat stems from its massive scale and strong brand, reflected in stable gross margins near 32% and solid EBIT margins above 18%. Its growing ROIC signals improving capital efficiency, but its ROIC still lags WACC, implying value is not fully captured yet. Innovations in autonomous mining and energy solutions could deepen this moat in 2026, but global competition remains a threat.

Hyster-Yale Materials Handling, Inc.: Operational Efficiency and Niche Focus

Hyster-Yale relies on operational efficiency and specialized product niches, evident in its improving gross margin at 20.8% and a sharply rising ROIC that outpaces WACC by 5.5%. Unlike Caterpillar, it shows a very favorable moat with rapidly increasing profitability. Expansion in hydrogen fuel-cell technology could disrupt markets and further widen its competitive advantage.

Scale Dominance vs. Operational Excellence: Who Holds the Moat Edge?

I see Hyster-Yale’s moat as both wider and deeper, given its ROIC significantly exceeds WACC with a robust upward trend. Caterpillar’s scale and brand offer durability but lack current value creation. Hyster-Yale is better equipped to defend and grow its market share amid evolving industry dynamics.

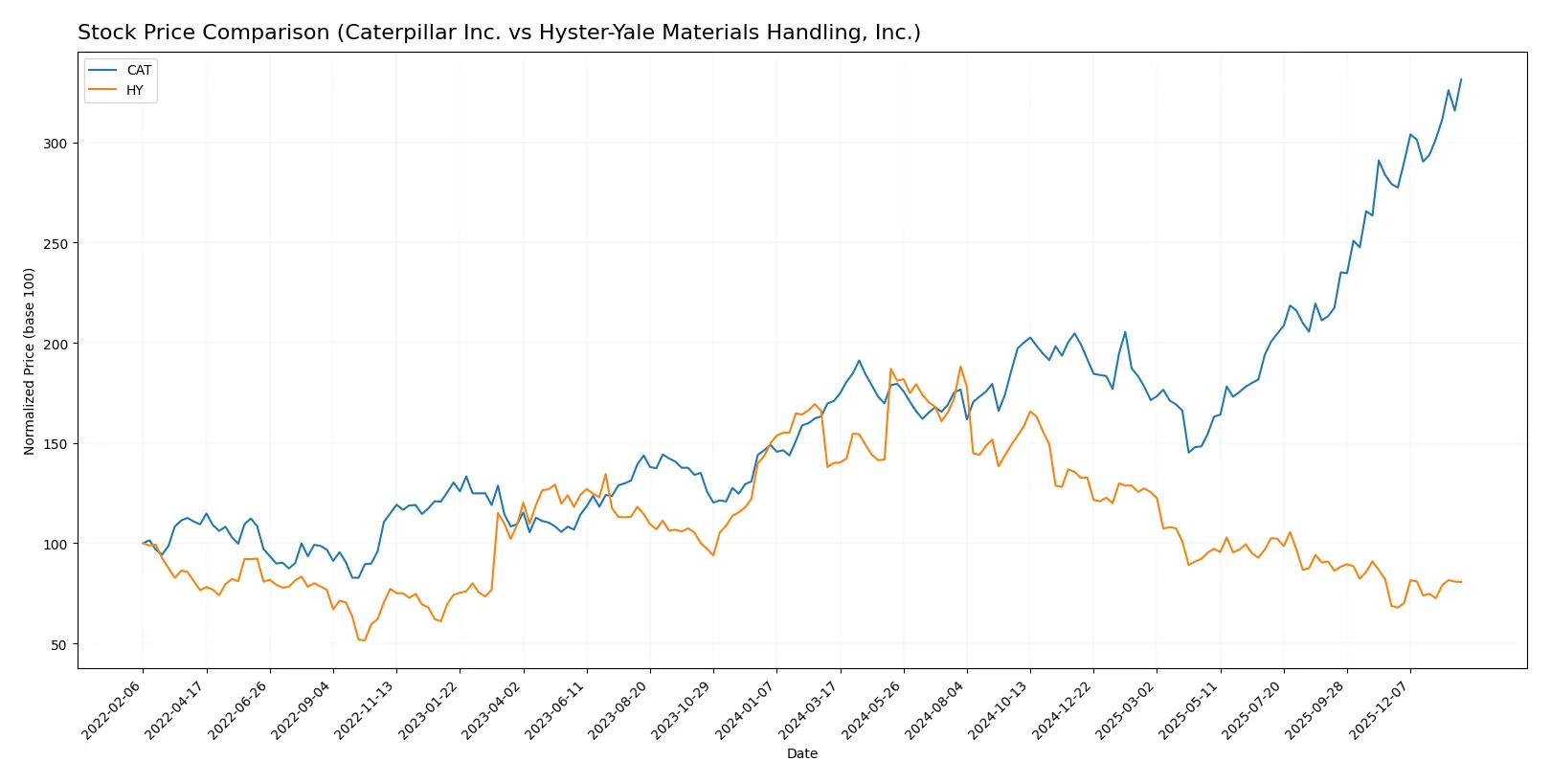

Which stock offers better returns?

The stock price chart highlights Caterpillar’s strong upward momentum and Hyster-Yale’s prolonged decline with recent modest recovery trends over the past year.

Trend Comparison

Caterpillar shows a bullish trend with a 93.8% price increase over the past 12 months, marked by accelerating gains and high volatility, peaking at 657.36.

Hyster-Yale exhibits a bearish trend with a 42.43% loss over the same period, despite recent slight recovery with a 17.37% rise, but overall acceleration remains negative.

Caterpillar clearly outperformed Hyster-Yale, delivering the highest market returns with sustained acceleration and stronger buyer dominance.

Target Prices

Analysts present a broad but constructive target consensus for Caterpillar Inc. and a firm target for Hyster-Yale Materials Handling, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Caterpillar Inc. | 395 | 805 | 666.92 |

| Hyster-Yale Materials Handling, Inc. | 40 | 40 | 40 |

Caterpillar’s consensus target price at $667 suggests upside from the current $657, reflecting confidence amid cyclicality. Hyster-Yale’s flat $40 target contrasts with its $33.45 price, implying moderate appreciation potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here are the latest institutional grades for Caterpillar Inc. and Hyster-Yale Materials Handling, Inc.:

Caterpillar Inc. Grades

The following table summarizes recent grades from major financial institutions for Caterpillar Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2024-10-14 |

| Morgan Stanley | Downgrade | Underweight | 2024-10-14 |

| Truist Securities | Maintain | Buy | 2024-10-09 |

| Citigroup | Maintain | Buy | 2024-10-09 |

| B of A Securities | Maintain | Buy | 2024-09-30 |

| Evercore ISI Group | Maintain | In Line | 2024-08-19 |

| B of A Securities | Maintain | Buy | 2024-08-07 |

| Truist Securities | Maintain | Buy | 2024-08-07 |

| UBS | Maintain | Sell | 2024-08-07 |

| Barclays | Maintain | Equal Weight | 2024-08-07 |

Hyster-Yale Materials Handling, Inc. Grades

Below is a summary of recent institutional grades for Hyster-Yale Materials Handling, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth MKM | Maintain | Buy | 2024-11-06 |

| Roth MKM | Maintain | Buy | 2024-08-08 |

| Roth MKM | Maintain | Buy | 2024-06-07 |

| Northland Capital Markets | Upgrade | Outperform | 2024-06-05 |

| Northland Capital Markets | Downgrade | Market Perform | 2024-05-10 |

| Roth MKM | Maintain | Buy | 2024-05-09 |

| EF Hutton | Maintain | Buy | 2023-05-04 |

| EF Hutton | Maintain | Buy | 2023-05-03 |

| EF Hutton | Maintain | Buy | 2023-03-01 |

| EF Hutton | Maintain | Buy | 2022-03-02 |

Which company has the best grades?

Caterpillar shows a mix of Buy and Overweight ratings with some Underweight and Sell calls, reflecting varied institutional views. Hyster-Yale consistently receives Buy ratings, with occasional upgrades and downgrades around Market Perform and Outperform. Investors might perceive Hyster-Yale’s grades as more stable, while Caterpillar’s wider spread suggests differing outlooks.

Risks specific to each company

In 2026, both firms face critical pressure points and systemic threats shaped by evolving market dynamics and sector-specific challenges. These risk categories highlight their key vulnerabilities:

1. Market & Competition

Caterpillar Inc.

- Dominates global construction and mining equipment with strong brand moat but faces pressure from emerging low-cost competitors.

Hyster-Yale Materials Handling, Inc.

- Niche in lift trucks and aftermarket parts, battling intense competition and limited scale compared to larger peers.

2. Capital Structure & Debt

Caterpillar Inc.

- High debt-to-equity ratio (2.03) signals elevated financial risk despite strong interest coverage (12.23x).

Hyster-Yale Materials Handling, Inc.

- Lower leverage (de 1.14) and better debt-to-assets ratio (26.7%) but quick ratio (0.64) raises liquidity concerns.

3. Stock Volatility

Caterpillar Inc.

- Beta of 1.568 indicates higher volatility than market; wider 52-week price range reflects cyclical exposure.

Hyster-Yale Materials Handling, Inc.

- Slightly lower beta at 1.441 but still volatile; narrower price range suggests somewhat more stable trading.

4. Regulatory & Legal

Caterpillar Inc.

- Global operations expose it to complex compliance regimes and environmental regulations, especially in mining and energy.

Hyster-Yale Materials Handling, Inc.

- Faces regulatory scrutiny primarily in emissions and safety standards for lift trucks and hydrogen fuel-cell products.

5. Supply Chain & Operations

Caterpillar Inc.

- Large-scale, global supply chain is vulnerable to raw material price swings and geopolitical disruptions.

Hyster-Yale Materials Handling, Inc.

- Smaller scale supply chain with reliance on specific component suppliers increases operational risk.

6. ESG & Climate Transition

Caterpillar Inc.

- Under pressure to accelerate climate transition; high emissions footprint from heavy machinery challenges ESG ratings.

Hyster-Yale Materials Handling, Inc.

- Innovates with hydrogen fuel-cell technology, positioning itself better for climate-aligned growth.

7. Geopolitical Exposure

Caterpillar Inc.

- Significant exposure to geopolitical tensions affecting global mining and construction markets.

Hyster-Yale Materials Handling, Inc.

- Limited international footprint reduces geopolitical risks but also restricts growth opportunities.

Which company shows a better risk-adjusted profile?

Caterpillar’s most impactful risk is its elevated leverage, which amplifies financial vulnerability despite strong profitability and cash flow. Hyster-Yale faces critical liquidity constraints and competitive pressure but benefits from a more conservative debt load and innovative product focus. Given these factors, I view Hyster-Yale as having a better risk-adjusted profile. Its favorable debt-to-assets ratio and climate-forward product line offer resilience, contrasting with Caterpillar’s heavier debt burden and broader geopolitical risks.

Final Verdict: Which stock to choose?

Caterpillar Inc. (CAT) stands out with its unmatched operational efficiency and strong cash flow generation. Its rising ROIC, despite a high WACC and leverage, signals improving profitability but warrants vigilance on debt levels. CAT suits investors seeking stable, long-term growth with a moderate risk appetite.

Hyster-Yale Materials Handling, Inc. (HY) impresses with a durable competitive moat, reflected in its ROIC well above WACC and rapid profitability growth. Its lower valuation multiples and conservative capital structure offer enhanced safety compared to CAT. HY fits best in a GARP portfolio emphasizing value and sustainable growth.

If you prioritize operational resilience and steady growth, CAT is the compelling choice due to its proven cash machine capabilities and market leadership. However, if you seek a deep value play with a durable moat and improving fundamentals, HY offers better stability and a more attractive risk-reward profile. Both present analytical scenarios tailored to distinct investor strategies.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Caterpillar Inc. and Hyster-Yale Materials Handling, Inc. to enhance your investment decisions: