In the competitive healthcare distribution sector, Cencora, Inc. (COR) and Cardinal Health, Inc. (CAH) stand out as influential players with extensive market reach and innovative service offerings. Both companies operate globally, delivering pharmaceutical and medical products while advancing supply chain solutions and specialty services. This comparison aims to help investors identify which company presents the most promising opportunity in 2026. Let’s explore their strengths and prospects to guide your investment decision.

Table of contents

Companies Overview

I will begin the comparison between Cencora and Cardinal Health by providing an overview of these two companies and their main differences.

Cencora Overview

Cencora, Inc. operates as a pharmaceutical sourcing and distribution company, serving the U.S. and international markets. Its mission encompasses delivering a broad range of products including generic and injectable pharmaceuticals, vaccines, and specialty pharmaceutical products. With 47K employees, Cencora supports diverse clients such as hospitals, pharmacies, and healthcare providers, offering additional services like pharmacy management, supply software, and clinical trial support.

Cardinal Health Overview

Cardinal Health, Inc. is an integrated healthcare services and products company with operations across the U.S., Canada, Europe, and Asia. It serves hospitals, pharmacies, and healthcare providers through its Pharmaceutical and Medical segments. The company distributes branded and generic pharmaceuticals, provides specialty pharmaceutical services, and manufactures medical and surgical products. Cardinal Health employs 48K people and focuses on customized healthcare solutions and supply chain services.

Key similarities and differences

Both companies operate in the medical distribution industry with a focus on pharmaceuticals and healthcare products, targeting hospitals and pharmacies. They offer a blend of product distribution and healthcare services, including specialty pharmaceuticals and pharmacy management. However, Cencora has a stronger emphasis on international pharmaceutical wholesale and clinical trial support, while Cardinal Health integrates medical product manufacturing alongside its pharmaceutical distribution and operates a wider geographic footprint.

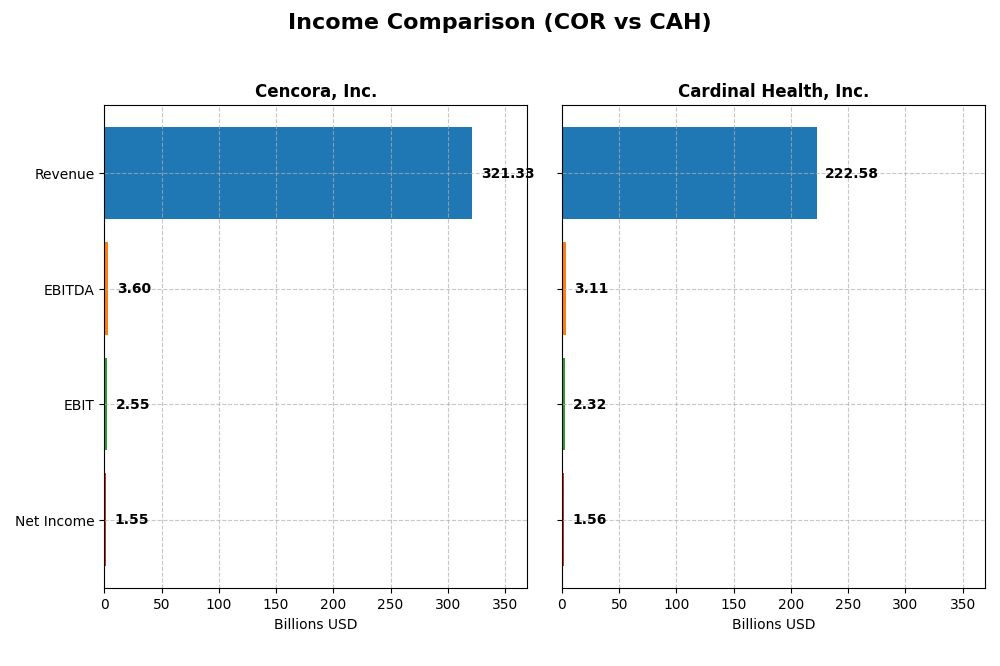

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Cencora, Inc. and Cardinal Health, Inc. for their most recent fiscal year.

| Metric | Cencora, Inc. | Cardinal Health, Inc. |

|---|---|---|

| Market Cap | 65B | 47.8B |

| Revenue | 321.3B | 222.6B |

| EBITDA | 3.6B | 3.1B |

| EBIT | 2.55B | 2.32B |

| Net Income | 1.55B | 1.56B |

| EPS | 8.02 | 6.48 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Cencora, Inc.

Cencora’s revenue rose steadily from 214B in 2021 to 321B in 2025, a 50% growth over five years, while net income remained relatively flat around 1.5B–1.7B. Margins saw neutrality overall, with gross margin at 3.57% and net margin at 0.48% in 2025. The latest year showed revenue growth of 9.3%, but net margin declined 5.8%, indicating some pressure on profitability despite higher sales.

Cardinal Health, Inc.

Cardinal Health’s revenue climbed from 162B in 2021 to 223B in 2025, a 37% increase, with net income improving significantly by 155% over the period to 1.56B in 2025. Margins were stable to improving, with a net margin of 0.7% and EBIT margin of 1.04% in 2025. The most recent year saw a slight revenue dip of 1.9%, but strong gains in EBIT (+85%) and net margin (+87%) suggest enhanced operational efficiency.

Which one has the stronger fundamentals?

Both companies present favorable income statement trends, but Cardinal Health exhibits stronger margin expansion and net income growth, particularly in recent years. Cencora shows robust revenue growth but faces margin contraction and stagnant net income. Cardinal’s higher percentage of favorable indicators (71% vs. 50%) and significant profitability improvements position it with comparatively stronger fundamentals based on income statement metrics.

Financial Ratios Comparison

The table below presents the key financial ratios for Cencora, Inc. (COR) and Cardinal Health, Inc. (CAH) based on their most recent fiscal year data, facilitating a straightforward comparison.

| Ratios | Cencora, Inc. (2025 FY) | Cardinal Health, Inc. (2025 FY) |

|---|---|---|

| ROE | 1.03 | -0.56 |

| ROIC | 9.66% | 11.37% |

| P/E | 39.0 | 25.9 |

| P/B | 40.2 | -14.6 |

| Current Ratio | 0.90 | 0.94 |

| Quick Ratio | 0.55 | 0.50 |

| D/E (Debt to Equity) | 5.08 | -3.36 |

| Debt-to-Assets | 10.0% | 17.6% |

| Interest Coverage | 9.02 | 10.6 |

| Asset Turnover | 4.20 | 4.19 |

| Fixed Asset Turnover | 126.6 | 77.9 |

| Payout ratio | 28.1% | 31.6% |

| Dividend yield | 0.72% | 1.22% |

Interpretation of the Ratios

Cencora, Inc.

Cencora shows a mixed ratio profile with strong returns on equity (103.06%) and favorable debt-to-assets (10%) and interest coverage (8.75) ratios. However, concerns arise from weak net margin (0.48%), high price-to-book (40.17) and price-to-earnings (38.98) ratios, and low liquidity indicated by a current ratio of 0.9. The company pays dividends with a low yield of 0.72%, suggesting cautious distribution amid these financial dynamics.

Cardinal Health, Inc.

Cardinal Health exhibits generally favorable ratios including a robust return on invested capital (11.37%), a solid interest coverage ratio (10.77), and a positive price-to-book value (-14.56). However, its negative return on equity (-56.13%) and weak net margin (0.7%) highlight operational challenges. The company maintains a dividend yield of 1.22%, which is neutral, reflecting a balanced approach to shareholder returns despite profitability issues.

Which one has the best ratios?

Cardinal Health’s ratios are overall more favorable, with 57.14% positive indicators compared to Cencora’s 42.86%. While both companies face liquidity challenges and weak profitability, Cardinal Health benefits from a stronger capital structure and better coverage ratios. Cencora’s exceptionally high return on equity is offset by valuation concerns and liquidity risks, resulting in a slightly unfavorable stance.

Strategic Positioning

This section compares the strategic positioning of Cencora, Inc. and Cardinal Health, Inc., including market position, key segments, and exposure to technological disruption:

Cencora, Inc.

- Leading pharmaceutical distributor with a strong presence in U.S. and international markets; faces competitive pressure in medical distribution.

- Key segments include pharmaceutical distribution, global commercialization services, and animal health; business driven by diversified healthcare solutions.

- Exposure to technological disruption includes supply management software and specialized pharmaceutical services; adapts through clinical trial and data analytics services.

Cardinal Health, Inc.

- Integrated healthcare services provider with significant operations in the U.S. and international markets; competes in pharmaceutical and medical distribution.

- Operates pharmaceutical and medical segments, including branded and generic drugs, medical products, and home healthcare solutions; business driven by integrated healthcare services.

- Faces technological disruption in specialty pharmaceuticals and medical supply chain; innovates via nuclear pharmacies and medication therapy management.

Cencora, Inc. vs Cardinal Health, Inc. Positioning

Cencora maintains a diversified healthcare distribution model with pharmaceutical, commercialization, and animal health segments, while Cardinal Health focuses on integrated healthcare services combining pharmaceutical and medical products. Cencora’s broad international footprint contrasts with Cardinal Health’s emphasis on specialized medical and pharmaceutical solutions.

Which has the best competitive advantage?

Based on MOAT evaluation, Cardinal Health shows a very favorable competitive advantage with growing ROIC and increasing profitability, while Cencora is creating value but experiences a declining ROIC, indicating a slightly favorable moat position.

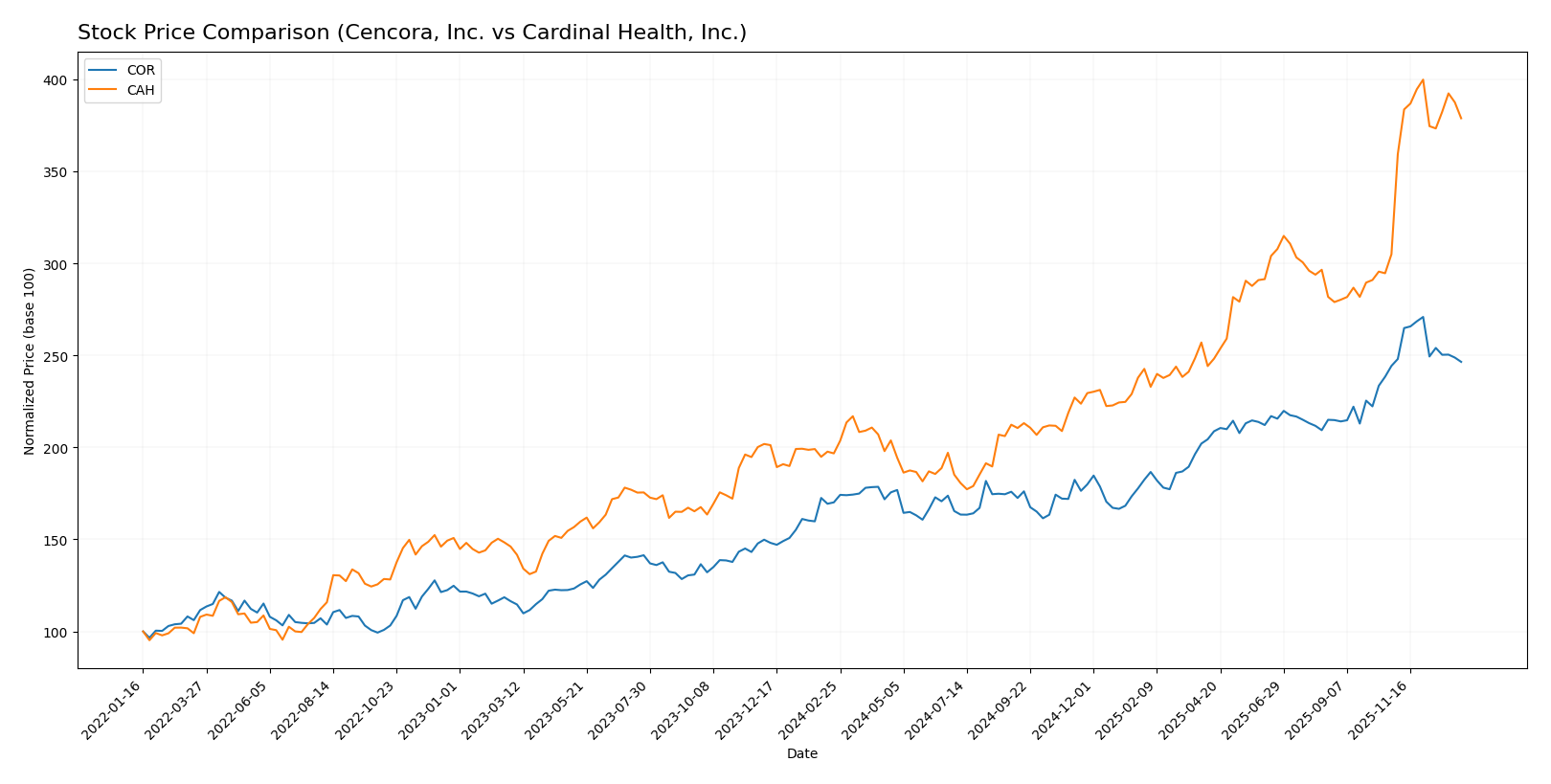

Stock Comparison

The past 12 months saw Cencora, Inc. (COR) and Cardinal Health, Inc. (CAH) display strong bullish momentum with CAH showing a notably higher price increase, while recent weeks reveal diverging short-term trends.

Trend Analysis

Cencora, Inc. (COR) experienced a 44.87% price increase over the past year, indicating a bullish trend with deceleration in momentum. The stock fluctuated between 218.89 and 368.93, showing high volatility (std deviation 40.3).

Cardinal Health, Inc. (CAH) posted a 92.54% gain during the same period, confirming a bullish trend with accelerating momentum. Its price ranged from 94.1 to 212.26, with somewhat lower volatility (std deviation 31.63).

Comparing both, CAH delivered the highest market performance with a stronger price surge and accelerating trend, outperforming COR’s more moderate but still positive returns.

Target Prices

Analysts present a positive target price consensus for both Cencora, Inc. and Cardinal Health, Inc., indicating potential upside from current levels.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cencora, Inc. | 415 | 330 | 375.86 |

| Cardinal Health, Inc. | 243 | 186 | 215 |

The target consensus prices for Cencora and Cardinal Health suggest expected appreciation, with Cencora’s consensus at $375.86 above its current $335.69 price and Cardinal Health’s consensus at $215 above its current $201.11 price. This reflects moderate analyst optimism for both stocks.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cencora, Inc. and Cardinal Health, Inc.:

Rating Comparison

Cencora, Inc. Rating

- Rating: B, considered very favorable

- Discounted Cash Flow Score: 5, very favorable

- ROE Score: 5, very favorable

- ROA Score: 3, moderate

- Debt To Equity Score: 1, very unfavorable

- Overall Score: 3, moderate

Cardinal Health, Inc. Rating

- Rating: C+, considered very favorable

- Discounted Cash Flow Score: 5, very favorable

- ROE Score: 1, very unfavorable

- ROA Score: 3, moderate

- Debt To Equity Score: 1, very unfavorable

- Overall Score: 2, moderate

Which one is the best rated?

Based strictly on the data, Cencora, Inc. holds a higher overall rating (B vs. C+) and better ROE score, indicating stronger profitability. Both have equal DCF and ROA scores, but Cencora’s overall score is moderately superior.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

COR Scores

- Altman Z-Score: 4.87, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 7, rated strong, showing good financial strength.

CAH Scores

- Altman Z-Score: 4.89, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 6, rated average, indicating moderate financial health.

Which company has the best scores?

Both companies have Altman Z-Scores in the safe zone, suggesting low bankruptcy risk. COR’s Piotroski Score is higher at 7 (strong) compared to CAH’s 6 (average), indicating COR shows better overall financial strength in this comparison.

Grades Comparison

The grades provided by established financial institutions for Cencora, Inc. and Cardinal Health, Inc. are as follows:

Cencora, Inc. Grades

The following table summarizes recent grades from recognized grading companies for Cencora, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Neutral | 2026-01-05 |

| Wells Fargo | Maintain | Overweight | 2025-11-11 |

| JP Morgan | Maintain | Overweight | 2025-11-11 |

| TD Cowen | Maintain | Buy | 2025-11-10 |

| UBS | Maintain | Buy | 2025-11-07 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Mizuho | Maintain | Outperform | 2025-11-06 |

| Mizuho | Maintain | Outperform | 2025-10-30 |

| UBS | Maintain | Buy | 2025-10-27 |

| Mizuho | Maintain | Outperform | 2025-10-16 |

Overall, Cencora, Inc. has consistently received positive ratings, with most institutions maintaining “Buy,” “Overweight,” or “Outperform” grades.

Cardinal Health, Inc. Grades

The following table summarizes recent grades from recognized grading companies for Cardinal Health, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2026-01-09 |

| Wells Fargo | Maintain | Overweight | 2025-11-05 |

| Mizuho | Maintain | Outperform | 2025-11-04 |

| TD Cowen | Maintain | Buy | 2025-11-03 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-31 |

| Citigroup | Maintain | Neutral | 2025-10-31 |

| UBS | Maintain | Buy | 2025-10-31 |

| Wells Fargo | Maintain | Overweight | 2025-08-13 |

| Baird | Maintain | Outperform | 2025-08-13 |

| Evercore ISI Group | Maintain | Outperform | 2025-08-13 |

Cardinal Health, Inc. shows a strong positive trend with multiple “Buy,” “Overweight,” and “Outperform” ratings, including a recent upgrade by Citigroup.

Which company has the best grades?

Both companies hold a consensus “Buy” rating, but Cencora, Inc. has a higher number of “Buy” ratings (31) compared to Cardinal Health, Inc. (18). This may indicate stronger analyst conviction for Cencora, Inc., potentially translating into greater investor confidence and market interest.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Cencora, Inc. (COR) and Cardinal Health, Inc. (CAH) based on the latest financial and operational data.

| Criterion | Cencora, Inc. (COR) | Cardinal Health, Inc. (CAH) |

|---|---|---|

| Diversification | Moderate: Primarily pharmaceutical distribution with smaller segments in commercialization and animal health. | Strong: Diverse segments including pharmaceutical, medical, and home health solutions. |

| Profitability | Mixed: High ROE (103%), but very low net margin (0.48%) and slightly unfavorable overall ratios. | Mixed: Favorable ROIC (11.37%) but negative ROE (-56.13%) and modest net margin (0.7%). |

| Innovation | Moderate: Innovation not clearly highlighted; declining ROIC trend suggests challenges maintaining profitability. | Strong: Growing ROIC and favorable financial ratios signal effective innovation and operational improvements. |

| Global presence | Significant: Large pharmaceutical distribution footprint with revenues over $198B in 2021. | Extensive: Major pharmaceutical member revenues of $205B in 2025 and expanding health segments. |

| Market Share | Large in pharmaceutical distribution but less diversified in other segments. | Broad market presence across pharma and medical sectors with increasing revenues in multiple segments. |

Key takeaways: Cencora is a value creator with strong ROE but faces profitability and liquidity challenges, reflected in a declining ROIC trend. Cardinal Health shows a very favorable moat with growing profitability and better diversification, though some profitability metrics remain weak. Investors should weigh stability and diversification against margin pressures in both cases.

Risk Analysis

Below is a comparative risk table for Cencora, Inc. (COR) and Cardinal Health, Inc. (CAH) based on the most recent financial and operational data from 2025.

| Metric | Cencora, Inc. (COR) | Cardinal Health, Inc. (CAH) |

|---|---|---|

| Market Risk | Moderate (Beta 0.665) | Moderate (Beta 0.654) |

| Debt Level | High (Debt-to-Equity 5.08, unfavorable) | Low/Negative (Debt-to-Equity -3.36, favorable) |

| Regulatory Risk | Moderate (Healthcare industry, US & global compliance) | Moderate (Healthcare industry, US & international regulations) |

| Operational Risk | Moderate (Complex supply chain, 47K employees) | Moderate (Integrated healthcare services, 48K employees) |

| Environmental Risk | Low to Moderate (Healthcare product distribution) | Low to Moderate (Healthcare products and services) |

| Geopolitical Risk | Moderate (International operations) | Moderate (International presence in multiple regions) |

In synthesis, both companies face moderate market, regulatory, operational, and geopolitical risks given the healthcare distribution sector’s complexity and international scope. Cencora’s notably high debt-to-equity ratio presents a significant financial risk, while Cardinal Health maintains a healthier debt profile. Investors should weigh Cencora’s financial leverage risk against its strong return on equity, and monitor regulatory developments impacting both firms.

Which Stock to Choose?

Cencora, Inc. (COR) shows favorable income growth with a 50.16% revenue increase over five years and moderate profitability, despite some unfavorable net margin trends. Its financial ratios are slightly unfavorable overall, with a strong ROE but high debt-to-equity and low liquidity. The company maintains a very favorable rating, supported by strong scores and a slightly favorable moat due to value creation but declining ROIC.

Cardinal Health, Inc. (CAH) exhibits favorable income improvement with strong net income and EPS growth over the period, though recent revenue declined slightly. Its financial ratios are favorable overall, with solid capital efficiency and manageable debt levels, despite a negative ROE. The firm holds a very favorable rating, supported by safe zone scores and a very favorable moat reflecting growing profitability.

Investors focused on stability and durable competitive advantage might view Cardinal Health as more favorable given its very favorable moat and improving profitability. Conversely, those prioritizing strong equity returns and moderate income growth could see Cencora as an attractive, albeit riskier, option given its slightly unfavorable ratios and declining ROIC.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cencora, Inc. and Cardinal Health, Inc. to enhance your investment decisions: