In the dynamic packaged foods sector, The Magnum Ice Cream Company N.V. (MICC) and Campbell Soup Company (CPB) stand out with distinct approaches to consumer staples. MICC focuses on the indulgent ice cream market, leveraging innovation in frozen treats, while CPB offers a broad portfolio spanning soups, snacks, and beverages. This comparison explores their market strategies and growth potential to help you identify the more compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between The Magnum Ice Cream Company N.V. and Campbell Soup Company by providing an overview of these two companies and their main differences.

The Magnum Ice Cream Company N.V. Overview

The Magnum Ice Cream Company N.V. focuses on the ice cream segment within the packaged foods industry. Based in Amsterdam, Netherlands, the company operates in the consumer defensive sector with a workforce of 18,582 employees. It is listed on the New York Stock Exchange and has a market capitalization of approximately 9.3B USD.

Campbell Soup Company Overview

Campbell Soup Company is a longstanding player in the packaged foods industry, manufacturing and marketing food and beverage products primarily in the US and internationally. Headquartered in Camden, New Jersey, with 14,400 employees, it operates through Meals & Beverages and Snacks segments. Campbell is listed on NASDAQ with a market cap near 7.9B USD and pays dividends to shareholders.

Key similarities and differences

Both companies belong to the consumer defensive sector and specialize in packaged foods, yet their product focuses differ: Magnum is concentrated exclusively on ice cream, whereas Campbell offers a diversified portfolio including soups, beverages, snacks, and sauces. Magnum is newer to public markets with an IPO in 2025, while Campbell has a long-established market presence dating back to 1954. Their geographic headquarters also differ, reflecting their respective operational bases in Europe and the US.

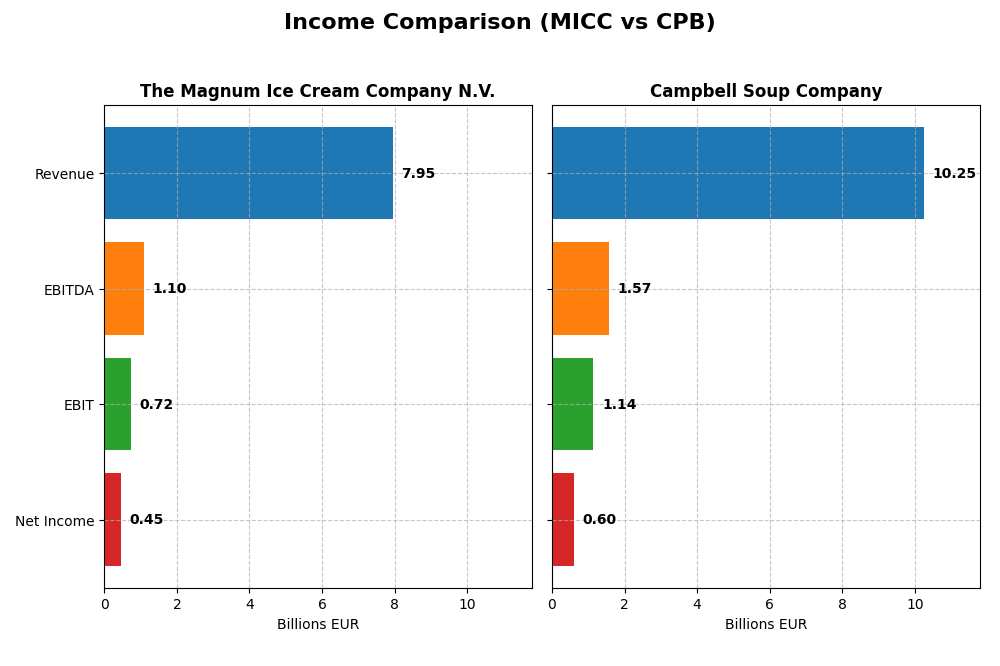

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for The Magnum Ice Cream Company N.V. (MICC) and Campbell Soup Company (CPB) for their most recent fiscal years.

| Metric | The Magnum Ice Cream Company N.V. (MICC) | Campbell Soup Company (CPB) |

|---|---|---|

| Market Cap | 9.3B EUR | 7.9B USD |

| Revenue | 7.95B EUR (2024) | 10.25B USD (2025) |

| EBITDA | 1.10B EUR (2024) | 1.58B USD (2025) |

| EBIT | 725M EUR (2024) | 1.14B USD (2025) |

| Net Income | 450M EUR (2024) | 602M USD (2025) |

| EPS | 0.74 EUR (2024) | 2.02 USD (2025) |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

The Magnum Ice Cream Company N.V.

The Magnum Ice Cream Company showed moderate revenue growth of 5.88% over 2022-2024, with a 4.32% increase in 2024 alone. Gross margin remained favorable at 34.91%, while EBIT margin held steady at 9.12%. However, net income declined by 11.59% overall, with net margin and EPS contracting, indicating margin pressure and slower profitability in the latest year.

Campbell Soup Company

Campbell Soup posted a solid 20.97% revenue rise from 2021 to 2025, including a 6.4% increase in 2025. Gross and EBIT margins stood favorably at 30.42% and 11.13%, respectively. EBIT grew 13.42% in the latest year, with EPS up 6.35%, though net margin fell slightly by 0.22%. Overall, the company maintained generally favorable earnings growth and margin stability.

Which one has the stronger fundamentals?

Campbell Soup demonstrates stronger fundamentals with more favorable margin profiles, higher revenue growth, and positive EBIT and EPS trends recently. Magnum Ice Cream’s revenue growth is modest and accompanied by declining net income and margins, which weigh on its fundamental outlook. Campbell’s higher proportion of favorable income statement metrics supports a more robust earnings performance.

Financial Ratios Comparison

This table compares key financial ratios for The Magnum Ice Cream Company N.V. (MICC) and Campbell Soup Company (CPB) based on their most recent fiscal data available for 2024 and 2025 respectively.

| Ratios | MICC (2024) | CPB (2025) |

|---|---|---|

| ROE | 16.2% | 15.4% |

| ROIC | 16.4% | 8.0% |

| P/E | 19.6 | 16.0 |

| P/B | 3.18 | 2.47 |

| Current Ratio | 0.80 | 0.77 |

| Quick Ratio | 0.35 | 0.28 |

| D/E (Debt to Equity) | 0.068 | 1.85 |

| Debt-to-Assets | 3.4% | 48.4% |

| Interest Coverage | 5.18 | 3.92 |

| Asset Turnover | 1.44 | 0.69 |

| Fixed Asset Turnover | 3.37 | 3.71 |

| Payout Ratio | 2.4% | 76.2% |

| Dividend Yield | 0.12% | 4.77% |

Interpretation of the Ratios

The Magnum Ice Cream Company N.V.

The Magnum Ice Cream Company shows a favorable return on equity (16.2%) and return on invested capital (16.42%), indicating efficient use of capital. However, its liquidity ratios are weak, with a current ratio of 0.8 and quick ratio of 0.35, signaling potential short-term financial stress. The company does not pay dividends, possibly reflecting a reinvestment strategy or growth phase.

Campbell Soup Company

Campbell’s exhibits a favorable return on equity at 15.43%, but its return on invested capital is neutral at 7.96%, suggesting moderate capital efficiency. The company struggles with liquidity, having a current ratio of 0.77 and quick ratio of 0.28, and carries high debt-to-equity of 1.85, which is unfavorable. It pays dividends with a strong 4.77% yield, supporting shareholder returns.

Which one has the best ratios?

Comparing both, Magnum Ice Cream has a higher proportion of favorable ratios (57.14%) versus Campbell’s 28.57%. Magnum’s stronger capital returns and low leverage contrast with Campbell’s weaker liquidity and high debt. However, Campbell offers a significantly higher dividend yield, which impacts total shareholder returns differently. Overall, Magnum presents a more favorable ratio profile.

Strategic Positioning

This section compares the strategic positioning of The Magnum Ice Cream Company N.V. (MICC) and Campbell Soup Company (CPB) in terms of market position, key segments, and exposure to technological disruption:

The Magnum Ice Cream Company N.V. (MICC)

- Focuses on ice cream market niche with stable competitive pressure.

- Concentrated on ice cream products; no detailed segment revenue disclosed.

- No explicit data on technological disruption exposure available.

Campbell Soup Company (CPB)

- Operates in packaged foods with multiple segments facing varied competition.

- Diversified across baked snacks, beverages, and soups driving revenue.

- No explicit data on technological disruption exposure available.

The Magnum Ice Cream Company N.V. vs Campbell Soup Company Positioning

MICC pursues a concentrated strategy focused solely on ice cream, which may limit diversification benefits but could enhance brand specialization. CPB’s broad segment diversification spreads risk but may dilute focus. Each approach presents distinct strategic trade-offs.

Which has the best competitive advantage?

MICC shows a favorable moat with stable ROIC above WACC indicating consistent value creation. CPB also creates value but with a declining ROIC trend, suggesting a slightly less robust competitive advantage over time.

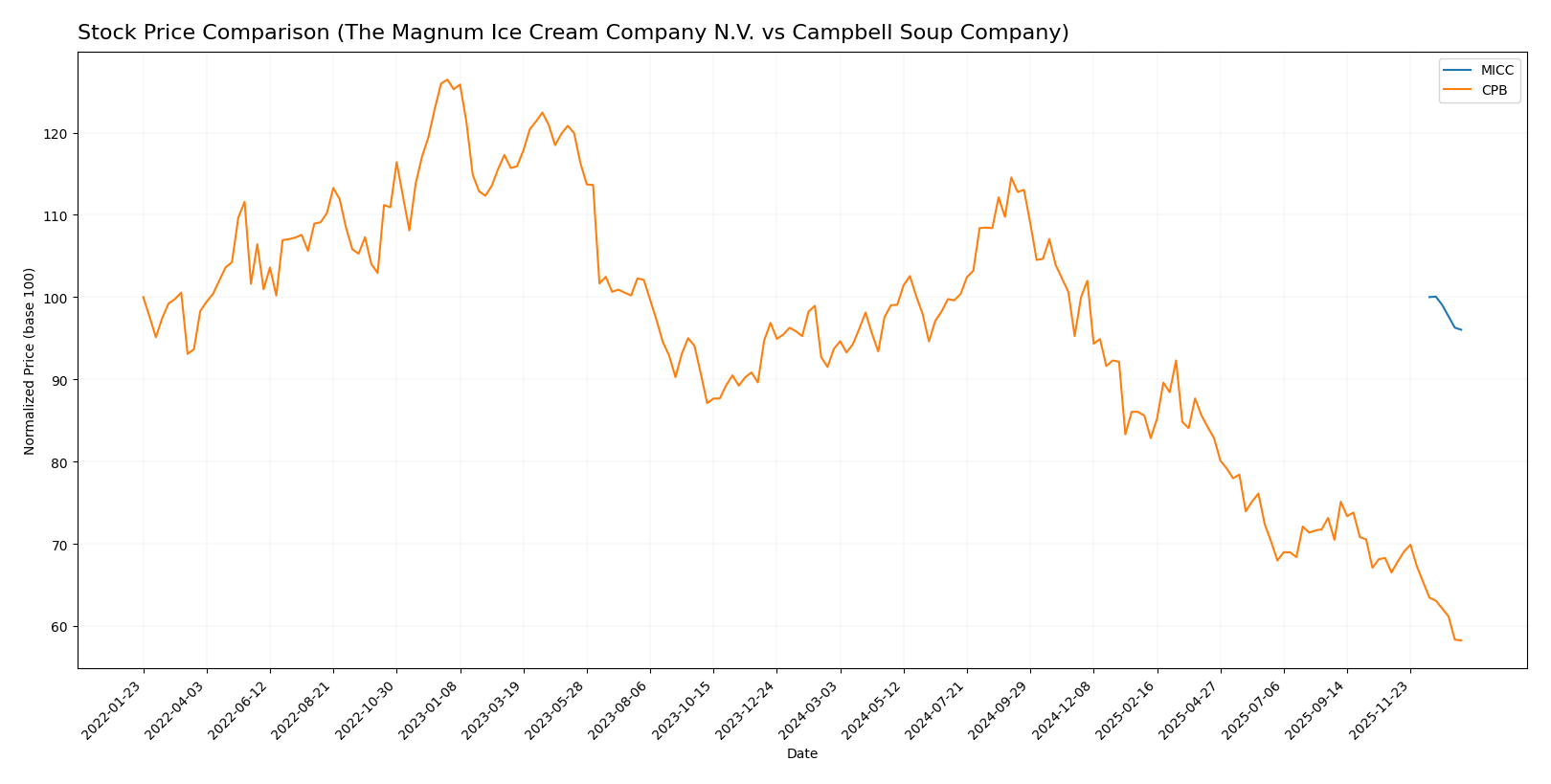

Stock Comparison

The stock price movements of The Magnum Ice Cream Company N.V. (MICC) and Campbell Soup Company (CPB) over the past 12 months reveal distinct bearish trends with divergent volatility and trading volumes.

Trend Analysis

The Magnum Ice Cream Company N.V. (MICC) experienced a moderate bearish trend with a -3.97% price change over the past year, showing stable acceleration and low volatility (std deviation 0.26). The stock price ranged narrowly between 15.24 and 15.88.

Campbell Soup Company (CPB) displayed a pronounced bearish trend with a -37.83% decline over the same period, alongside decelerating price movement and high volatility (std deviation 6.86). The stock’s price fluctuated significantly from 26.39 to 51.89.

Comparing both, MICC outperformed CPB in market performance over the past year, as MICC’s decline was substantially less severe than CPB’s steep drop.

Target Prices

The current target price consensus reflects moderate upside potential for these companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Magnum Ice Cream Company N.V. | 16 | 16 | 16 |

| Campbell Soup Company | 38 | 26 | 30.88 |

Analysts expect The Magnum Ice Cream Company’s price to hold steady near $16, slightly above the current $15.24. Campbell Soup’s consensus target of $30.88 suggests a moderate increase from its current $26.39.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for The Magnum Ice Cream Company N.V. (MICC) and Campbell Soup Company (CPB):

Rating Comparison

MICC Rating

- Rating: B- with a very favorable overall status.

- Discounted Cash Flow Score: 1, very unfavorable indicating potential overvaluation risks.

- ROE Score: 5, very favorable showing high efficiency in generating profit from equity.

- ROA Score: 4, favorable use of assets to generate earnings.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk.

CPB Rating

- Rating: B- with a very favorable overall status.

- Discounted Cash Flow Score: 5, very favorable suggesting undervaluation potential.

- ROE Score: 3, moderate efficiency in profit generation from equity.

- ROA Score: 2, moderate effectiveness in asset utilization.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk.

Which one is the best rated?

Both companies share the same overall rating of B- with moderate overall scores. MICC shows stronger profitability metrics (ROE and ROA) but weaker discounted cash flow and debt profiles, while CPB has a very favorable discounted cash flow score but moderate profitability and equally unfavorable debt metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

MICC Scores

- No Altman Z-Score data available

- No Piotroski Score data available

CPB Scores

- Altman Z-Score of 1.73, placing CPB in the distress zone

- Piotroski Score of 5, indicating average financial strength

Which company has the best scores?

Based strictly on the provided data, only CPB has available scores. CPB’s Altman Z-Score suggests financial distress, while its Piotroski Score indicates average financial health. MICC’s scores are not available for comparison.

Grades Comparison

Here is a summary of recent grades from recognized grading companies for the two companies:

Campbell Soup Company Grades

The table below shows the latest grades and actions by reputable grading companies for Campbell Soup Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Neutral | 2025-12-11 |

| RBC Capital | Maintain | Sector Perform | 2025-12-10 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-10 |

| Stifel | Maintain | Hold | 2025-12-10 |

| UBS | Maintain | Sell | 2025-12-10 |

| Bernstein | Maintain | Outperform | 2025-12-10 |

| Stephens & Co. | Maintain | Overweight | 2025-12-08 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-05 |

| UBS | Maintain | Sell | 2025-12-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-09-25 |

Overall, Campbell Soup Company’s grades show a broad range from Sell to Outperform, with a consensus rating of Hold, indicating mixed sentiment among analysts.

The Magnum Ice Cream Company N.V. has no reliable grade data available to analyze.

Which company has the best grades?

Campbell Soup Company has the only available and reliable grades, showing a varied but generally cautious stance with a Hold consensus. The absence of grades for The Magnum Ice Cream Company N.V. limits direct comparison, but Campbell’s mixed ratings suggest moderate market confidence, impacting investor expectations accordingly.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of The Magnum Ice Cream Company N.V. (MICC) and Campbell Soup Company (CPB) based on the latest financial and strategic data.

| Criterion | The Magnum Ice Cream Company N.V. (MICC) | Campbell Soup Company (CPB) |

|---|---|---|

| Diversification | Limited product range, focused on ice cream | Broad product portfolio: baked snacks, beverages, soups |

| Profitability | Strong ROIC at 16.42%, favorable ROE at 16.2% | Moderate ROIC at 7.96%, favorable ROE at 15.43% |

| Innovation | Stable profitability, neutral ROIC trend | Declining ROIC trend (-16.7%), needs reinvigoration |

| Global presence | Moderate, focused markets | Extensive, with a wide global footprint |

| Market Share | Niche leader in premium ice cream | Strong in multiple food categories, especially baked snacks and soups |

Key takeaways: MICC excels in profitability and efficient capital use with a stable competitive advantage but lacks diversification. CPB offers broader market exposure and product variety but faces challenges with declining profitability and weaker capital efficiency trends. Investors should weigh MICC’s focused strength against CPB’s diversified but pressured position.

Risk Analysis

Below is a comparative table of key risks for The Magnum Ice Cream Company N.V. (MICC) and Campbell Soup Company (CPB) based on the most recent data from 2025-2026.

| Metric | The Magnum Ice Cream Company N.V. (MICC) | Campbell Soup Company (CPB) |

|---|---|---|

| Market Risk | Moderate (Beta = 0, limited volatility) | Moderate (Beta = -0.043, low volatility) |

| Debt level | Low (Debt-to-Equity 0.07, favorable) | High (Debt-to-Equity 1.85, unfavorable) |

| Regulatory Risk | Moderate (EU food regulations) | Moderate (US and international regulations) |

| Operational Risk | Moderate (Newly public since 2025) | Moderate (Established operations, supply chain complexity) |

| Environmental Risk | Moderate (Consumer defensive sector impact) | Moderate (Packaging and food production) |

| Geopolitical Risk | Moderate (Exposure mainly Europe) | Moderate to High (Operations in US, Canada, Latin America) |

In synthesis, both companies face moderate market and regulatory risks typical of the consumer defensive sector. MICC benefits from a very low debt level, reducing financial risk, whereas CPB’s high leverage poses a notable risk, especially given its distress-zone Altman Z-score. Operational risks for MICC stem from recent IPO-related adjustments, while CPB’s broader geographic exposure increases geopolitical risk. Investors should weigh CPB’s higher dividend yield against its financial leverage and bankruptcy risk.

Which Stock to Choose?

The Magnum Ice Cream Company N.V. (MICC) shows a moderate income growth with a neutral net margin but faces a decline in net income and EPS. Its financial ratios are largely favorable, particularly ROE and ROIC, with low debt levels and a very favorable overall rating of B-. The company demonstrates a stable competitive advantage with a favorable moat status.

Campbell Soup Company (CPB) presents a favorable income statement with steady revenue growth and EBIT improvement, although net income and margins have declined over the long term. Its financial ratios are slightly favorable with moderate debt concerns and a very favorable B- rating. CPB’s moat is slightly favorable but shows a declining ROIC trend, indicating lowering profitability.

Investors focused on growth and solid capital efficiency might find MICC’s stable profitability and favorable financial metrics appealing, while those prioritizing a favorable income statement trend and dividend yield could see CPB as more aligned with their profile. The choice could depend on the investor’s tolerance for declining profitability versus stable value creation.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Magnum Ice Cream Company N.V. and Campbell Soup Company to enhance your investment decisions: