In the competitive packaged foods industry, Campbell Soup Company (CPB) and Lamb Weston Holdings, Inc. (LW) stand out as prominent players with distinct product portfolios and market strategies. Campbell Soup excels in diverse meals and snacks, while Lamb Weston specializes in frozen potato products with global reach. This comparison explores their innovation approaches and market positioning to help you identify the most compelling investment opportunity in 2026. Let’s dive into which company deserves a place in your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Campbell Soup Company and Lamb Weston Holdings, Inc. by providing an overview of these two companies and their main differences.

Campbell Soup Company Overview

Campbell Soup Company operates in the packaged foods industry, focusing on manufacturing and marketing a wide range of food and beverage products in the US and internationally. The company divides its operations into Meals & Beverages and Snacks segments, offering products such as soups, sauces, snacks, and beverages. Founded in 1869 and headquartered in Camden, NJ, Campbell Soup is positioned as a diversified food company serving retail and foodservice markets.

Lamb Weston Holdings, Inc. Overview

Lamb Weston Holdings, Inc. specializes in producing and marketing value-added frozen potato products globally. The company operates through Global, Foodservice, Retail, and Other segments, offering items under its own brands and retailer labels. Founded in 1950 and based in Eagle, ID, Lamb Weston serves retail, foodservice, and specialty channels with a focus on frozen potatoes, appetizers, and related products in the packaged foods sector.

Key similarities and differences

Both Campbell Soup and Lamb Weston operate in the consumer defensive sector within the packaged foods industry, targeting retail and foodservice customers. While Campbell Soup has a broader product portfolio including soups, snacks, and beverages, Lamb Weston focuses primarily on frozen potato products and related items. Campbell’s market cap stands at $7.9B with a more diversified segment approach, whereas Lamb Weston, valued at $5.8B, emphasizes frozen potatoes and branded offerings.

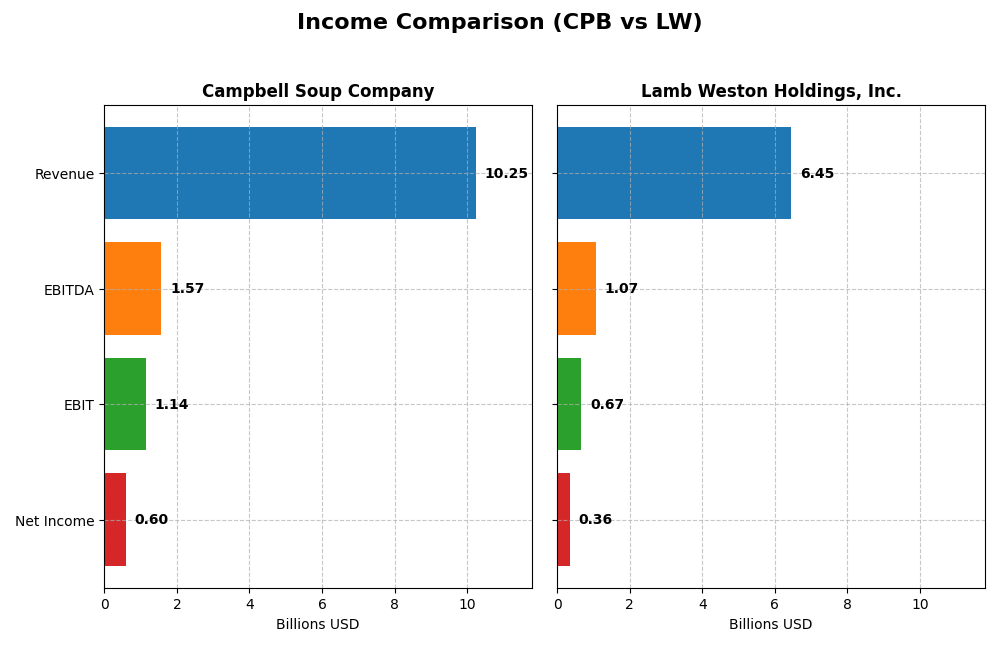

Income Statement Comparison

Below is a side-by-side comparison of key income statement metrics for Campbell Soup Company and Lamb Weston Holdings, Inc. for their most recent fiscal year.

| Metric | Campbell Soup Company | Lamb Weston Holdings, Inc. |

|---|---|---|

| Market Cap | 7.86B | 5.77B |

| Revenue | 10.25B | 6.45B |

| EBITDA | 1.58B | 1.07B |

| EBIT | 1.14B | 665M |

| Net Income | 602M | 357M |

| EPS | 2.02 | 2.51 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Campbell Soup Company

Campbell Soup Company’s revenue increased steadily from $8.48B in 2021 to $10.25B in 2025, reflecting a 21% growth over five years. Net income, however, declined from $1.00B in 2021 to $602M in 2025, showing a 40% decrease. Margins remained relatively stable with gross margin around 30%, but net margin slightly contracted. In 2025, revenue growth slowed to 6.4%, while EBIT improved by 13.4%, though net margin dipped marginally.

Lamb Weston Holdings, Inc.

Lamb Weston showed robust revenue growth from $3.67B in 2021 to $6.45B in 2025, a 76% increase overall. Net income rose from $318M in 2021 to $357M in 2025, though it peaked at $1.01B in 2023 before declining. Margins were favorable but contracted recently, with a gross margin near 22% and net margin around 5.5%. In 2025, revenue declined slightly by 0.25%, and EBIT fell sharply by 37.6%, signaling margin pressure.

Which one has the stronger fundamentals?

Campbell Soup exhibits steady revenue growth and improving EBIT margin, despite a declining net income trend and slight net margin contraction. Lamb Weston achieved stronger revenue expansion and net income growth over the period but faced significant margin compression and a recent sharp earnings decline. Overall, Campbell’s fundamentals appear more balanced, while Lamb Weston’s recent volatility presents uncertainty.

Financial Ratios Comparison

The table below presents key financial ratios for Campbell Soup Company and Lamb Weston Holdings, Inc. based on their most recent fiscal year data, highlighting profitability, liquidity, leverage, and operational efficiency metrics.

| Ratios | Campbell Soup Company (2025) | Lamb Weston Holdings, Inc. (2025) |

|---|---|---|

| ROE | 15.4% | 20.6% |

| ROIC | 8.0% | 7.4% |

| P/E | 16.0 | 22.2 |

| P/B | 2.47 | 4.56 |

| Current Ratio | 0.77 | 1.38 |

| Quick Ratio | 0.28 | 0.68 |

| D/E (Debt-to-Equity) | 1.85 | 2.39 |

| Debt-to-Assets | 48.4% | 56.2% |

| Interest Coverage | 3.92 | 3.70 |

| Asset Turnover | 0.69 | 0.87 |

| Fixed Asset Turnover | 3.71 | 1.68 |

| Payout Ratio | 76.2% | 57.9% |

| Dividend Yield | 4.77% | 2.61% |

Interpretation of the Ratios

Campbell Soup Company

Campbell Soup Company shows a mixed ratio profile with favorable returns on equity (15.43%) and weighted average cost of capital (4.2%), but weaknesses in liquidity, such as a current ratio of 0.77 and quick ratio of 0.28. Debt levels are relatively high with a debt-to-equity ratio of 1.85. The dividend yield is strong at 4.77%, indicating consistent shareholder returns supported by a balanced payout.

Lamb Weston Holdings, Inc.

Lamb Weston has favorable return on equity (20.56%) and WACC (4.8%), but less favorable liquidity and leverage ratios, including a current ratio of 1.38 and a debt-to-assets ratio of 56.21%. The price-to-book ratio of 4.56 is also unfavorable. Dividend yield stands at 2.61%, reflecting moderate returns to shareholders amid some financial constraints and elevated debt levels.

Which one has the best ratios?

Campbell Soup Company presents a slightly favorable overall ratio evaluation with better liquidity concerns but stronger dividend yield. Lamb Weston faces more unfavorable ratios, particularly in leverage and valuation metrics, despite higher profitability ratios. Based on the balance of strengths and weaknesses, Campbell Soup appears to have a more stable ratio profile in 2025.

Strategic Positioning

This section compares the strategic positioning of Campbell Soup Company and Lamb Weston Holdings, Inc. regarding market position, key segments, and exposure to technological disruption:

Campbell Soup Company

- Market leader in packaged foods with stable consumer demand, facing moderate competitive pressure.

- Diverse portfolio: baked snacks, beverages, soups; strong retail and foodservice presence in US, Canada, Latin America.

- No explicit data on technological disruption exposure provided.

Lamb Weston Holdings, Inc.

- Operates in frozen potato products globally, facing competition in retail and foodservice sectors.

- Focused on frozen potatoes and appetizers; segments include Global, Foodservice, Retail, and Other.

- No explicit data on technological disruption exposure provided.

Campbell Soup Company vs Lamb Weston Holdings, Inc. Positioning

Campbell Soup exhibits a diversified product range with multiple food segments, enhancing resilience but requiring broad management focus. Lamb Weston concentrates on frozen potato products, potentially benefiting from specialization yet facing sector-specific risks.

Which has the best competitive advantage?

Both companies show a slightly favorable moat, creating value with ROIC above WACC but experiencing declining profitability trends, indicating moderate competitive advantages without clear superiority based on the provided MOAT evaluations.

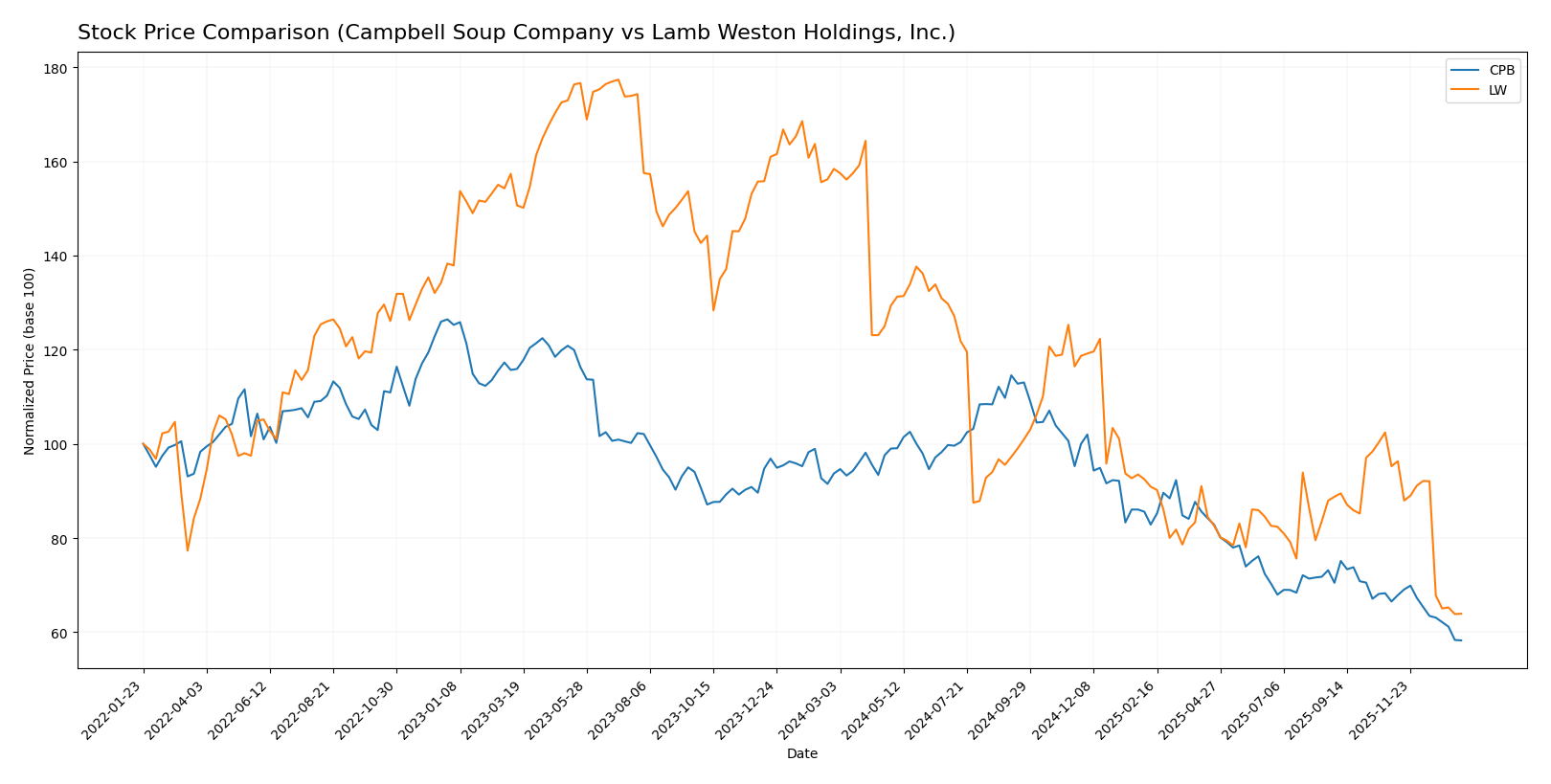

Stock Comparison

The past year shows clear bearish trends for both Campbell Soup Company and Lamb Weston Holdings, Inc., with significant price declines and decelerating momentum, highlighting persistent selling pressure and volatility disparities.

Trend Analysis

Campbell Soup Company (CPB) experienced a -37.83% price decline over the past 12 months, confirming a bearish trend with decelerating downward momentum and a standard deviation of 6.86. The stock peaked at 51.89 and bottomed at 26.39.

Lamb Weston Holdings, Inc. (LW) posted a more severe -59.65% price drop over the same period, also bearish with deceleration in trend strength and higher volatility at 15.2 standard deviation. The stock’s range extended from 106.53 high to 41.37 low.

Comparing the two, Campbell Soup Company outperformed Lamb Weston Holdings by delivering a smaller percentage loss, thus showing relatively better market performance despite both stocks trending downward.

Target Prices

The current analyst consensus shows moderate upside potential for both Campbell Soup Company and Lamb Weston Holdings, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Campbell Soup Company | 38 | 26 | 30.88 |

| Lamb Weston Holdings, Inc. | 68 | 46 | 52.67 |

Analysts expect Campbell Soup’s price to rise modestly above its current 26.39 USD, while Lamb Weston’s consensus target of 52.67 USD suggests significant upside from its current 41.43 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Campbell Soup Company and Lamb Weston Holdings, Inc.:

Rating Comparison

CPB Rating

- Rating: B- indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 5, very favorable, suggesting strong cash flow.

- ROE Score: 3, moderate efficiency in generating profit from equity.

- ROA Score: 2, moderate asset utilization to generate earnings.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk.

LW Rating

- Rating: B indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 4, favorable, indicating solid cash flow value.

- ROE Score: 5, very favorable, showing high profit generation efficiency.

- ROA Score: 4, favorable, demonstrating good asset utilization.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk.

Which one is the best rated?

Based solely on the data, LW holds a stronger position in profitability and asset efficiency with higher ROE and ROA scores, while both have the same overall score and unfavorable debt-to-equity risk. LW is better rated overall.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Campbell Soup Company and Lamb Weston Holdings, Inc.:

CPB Scores

- Altman Z-Score: 1.73, in distress zone indicating high bankruptcy risk

- Piotroski Score: 5, average financial strength

LW Scores

- Altman Z-Score: 2.75, in grey zone with moderate bankruptcy risk

- Piotroski Score: 9, very strong financial strength

Which company has the best scores?

Based strictly on the scores, LW shows a better financial position with a higher Altman Z-Score in the grey zone versus CPB’s distress zone and a very strong Piotroski Score compared to CPB’s average rating.

Grades Comparison

Here is a detailed comparison of the most recent grades assigned by reputable grading companies to both companies:

Campbell Soup Company Grades

The following table summarizes Campbell Soup Company’s grades from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Neutral | 2025-12-11 |

| RBC Capital | Maintain | Sector Perform | 2025-12-10 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-10 |

| Stifel | Maintain | Hold | 2025-12-10 |

| UBS | Maintain | Sell | 2025-12-10 |

| Bernstein | Maintain | Outperform | 2025-12-10 |

| Stephens & Co. | Maintain | Overweight | 2025-12-08 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-05 |

| UBS | Maintain | Sell | 2025-12-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-09-25 |

The overall trend for Campbell Soup Company shows a wide range of opinions, mostly clustered around neutral to hold ratings, with some sell and outperform views.

Lamb Weston Holdings, Inc. Grades

The table below lists Lamb Weston Holdings’ latest grades from credible financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2025-12-23 |

| Barclays | Maintain | Overweight | 2025-12-23 |

| B of A Securities | Maintain | Neutral | 2025-12-22 |

| Stifel | Maintain | Hold | 2025-12-22 |

| Deutsche Bank | Maintain | Hold | 2025-12-22 |

| Wells Fargo | Maintain | Overweight | 2025-10-01 |

| B of A Securities | Maintain | Neutral | 2025-10-01 |

| Barclays | Maintain | Overweight | 2025-07-25 |

| Wells Fargo | Maintain | Overweight | 2025-07-24 |

| Wells Fargo | Maintain | Overweight | 2025-07-09 |

The grades for Lamb Weston Holdings predominantly indicate positive sentiment, with multiple overweight ratings and fewer neutral or hold opinions.

Which company has the best grades?

Lamb Weston Holdings has consistently received better grades, with several overweight ratings compared to Campbell Soup’s mostly neutral to hold grades. This suggests stronger institutional confidence in Lamb Weston, potentially influencing investor perception of growth prospects and risk.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Campbell Soup Company (CPB) and Lamb Weston Holdings, Inc. (LW) based on the most recent financial and operational data.

| Criterion | Campbell Soup Company (CPB) | Lamb Weston Holdings, Inc. (LW) |

|---|---|---|

| Diversification | Strong product mix: baked snacks (4.43B), beverages (3.05B), soups (2.78B) | Focused segments: Global (2.93B), Foodservice (1.49B), Retail (0.80B) |

| Profitability | Neutral net margin (5.87%), favorable ROE (15.43%), ROIC 7.96% with declining trend | Neutral net margin (5.54%), favorable ROE (20.56%), ROIC 7.43% with declining trend |

| Innovation | Moderate innovation indicated by stable product categories and consistent revenue streams | Innovation needed to counteract declining ROIC and higher debt levels |

| Global presence | Moderate global exposure through diverse product lines | Strong global segment driving majority revenue, but higher debt levels |

| Market Share | Established in snacks and soups with consistent revenues | Leading in frozen potato products with strong foodservice presence |

Key takeaways: Both companies create value with ROIC above WACC but face profitability declines. CPB benefits from broader diversification and stable earnings, while LW’s higher ROE is offset by rising debt and less diversification, suggesting slightly higher risk. Investors should weigh diversification against financial leverage when choosing between them.

Risk Analysis

Below is a comparative overview of key risks for Campbell Soup Company (CPB) and Lamb Weston Holdings, Inc. (LW) as of 2025:

| Metric | Campbell Soup Company (CPB) | Lamb Weston Holdings, Inc. (LW) |

|---|---|---|

| Market Risk | Low beta (-0.04) indicates low market volatility exposure | Moderate beta (0.44) suggests moderate market sensitivity |

| Debt Level | Debt-to-equity 1.85 (unfavorable), debt-to-assets 48.4% (neutral) | Debt-to-equity 2.39 (unfavorable), debt-to-assets 56.2% (unfavorable) |

| Regulatory Risk | Moderate, typical for food sector compliance | Moderate, with potential exposure in global markets |

| Operational Risk | Moderate, with diversified product lines in packaged foods | Moderate, reliant on frozen potato products and supply chain stability |

| Environmental Risk | Moderate, food production impacts with sustainability initiatives | Moderate, agricultural sourcing and processing impact |

| Geopolitical Risk | Moderate, exposure to US and international markets | Moderate, global distribution channels could be affected by trade policies |

Synthesis: Both companies face moderate operational and regulatory risks typical of the packaged food industry. Lamb Weston carries higher financial risk due to heavier debt load and moderately higher market risk. Campbell Soup’s low market beta indicates defensive characteristics, but its Altman Z-score places it in the distress zone, signaling caution. Lamb Weston’s stronger Piotroski score and grey zone Altman score suggest better financial health despite elevated leverage. Investors should closely monitor debt management and market conditions.

Which Stock to Choose?

Campbell Soup Company (CPB) shows a generally favorable income statement with stable gross and EBIT margins, though net margin declined slightly. Its financial ratios are slightly favorable overall, supported by a decent ROE of 15.43% and a dividend yield of 4.77%, despite unfavorable liquidity and leverage ratios. The company is creating value with a ROIC above WACC but sees a declining profitability trend. Its rating is very favorable (B-), balancing moderate scores and some financial risks.

Lamb Weston Holdings, Inc. (LW) presents a neutral income statement with mixed growth signals, including a recent decline in revenue and profitability but positive net income growth over the longer term. Financial ratios are slightly unfavorable overall, with a strong ROE of 20.56% but higher leverage and weaker valuation metrics. The company also creates value with ROIC above WACC but experiences a sharper decline in ROIC. Its rating is very favorable (B), enhanced by a very strong Piotroski score despite some financial vulnerabilities.

For investors prioritizing steady income and dividend yield, Campbell Soup’s favorable income metrics and dividend strength might appear more attractive, especially given its moderate risk profile. Conversely, those focused on growth and financial robustness could find Lamb Weston’s higher ROE and strong Piotroski score appealing, albeit with greater leverage and recent earnings volatility. The choice could thus depend on whether the investor favors stability or growth potential, considering each company’s value creation and risk factors.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Campbell Soup Company and Lamb Weston Holdings, Inc. to enhance your investment decisions: