Investing in the uranium sector requires careful consideration of companies that balance resource control with innovative fuel solutions. Cameco Corporation (CCJ) and Centrus Energy Corp. (LEU) are two key players in this space, both serving the nuclear energy market but with distinct approaches: Cameco focuses on uranium production and fuel services, while Centrus emphasizes nuclear fuel supply and technical innovations. This analysis will help you identify which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Cameco Corporation and Centrus Energy Corp. by providing an overview of these two companies and their main differences.

Cameco Overview

Cameco Corporation operates in the uranium industry with a mission to produce and sell uranium and related fuel services. Headquartered in Saskatoon, Canada, it conducts exploration, mining, milling, refining, and fabrication of uranium concentrate. Cameco serves nuclear utilities across the Americas, Europe, and Asia, positioning itself as a major player with a market cap of 46.8B USD and a diversified business model spanning uranium and fuel services.

Centrus Overview

Centrus Energy Corp., based in Bethesda, Maryland, supplies nuclear fuel and services primarily to the U.S., Japan, Belgium, and other international markets. It operates through Low-Enriched Uranium (LEU) and Technical Solutions segments, providing separative work units, uranium components, and engineering services. With a market cap of 5.4B USD, Centrus focuses on niche technical and fuel supply solutions within the nuclear energy sector.

Key similarities and differences

Both Cameco and Centrus operate in the uranium industry, supplying nuclear fuel to utilities worldwide. They share a two-segment structure, blending fuel supply and technical services. However, Cameco has a broader global reach and larger market capitalization, with significant mining and milling operations, whereas Centrus emphasizes specialized LEU supply and technical solutions, concentrating heavily on the U.S. market and engineering services.

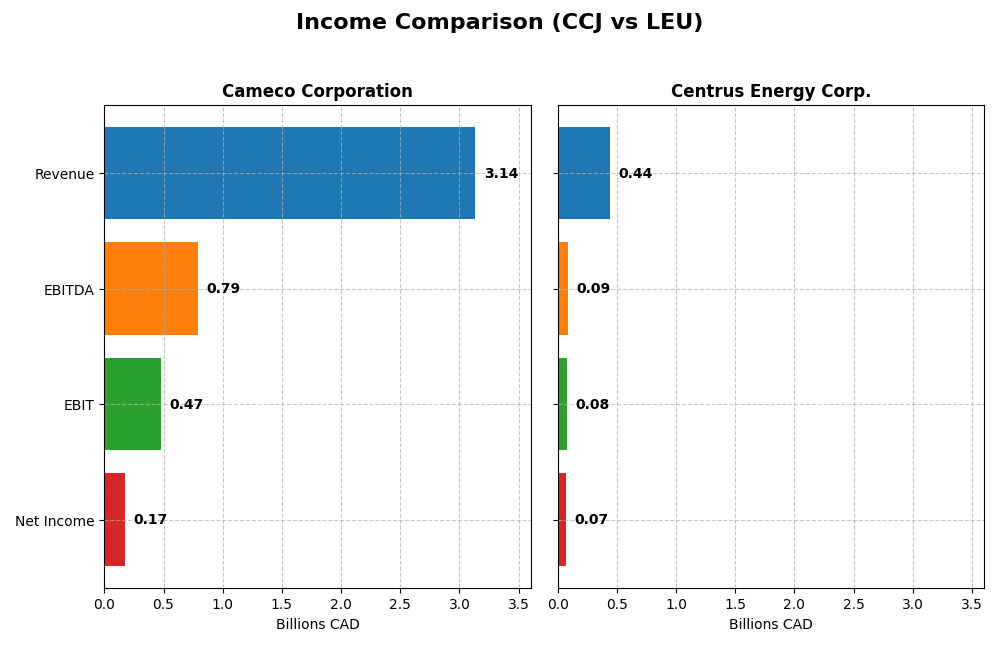

Income Statement Comparison

The table below presents a side-by-side comparison of the most recent full fiscal year income statement figures for Cameco Corporation and Centrus Energy Corp.

| Metric | Cameco Corporation (CAD) | Centrus Energy Corp. (USD) |

|---|---|---|

| Market Cap | 46.8B | 5.4B |

| Revenue | 3.14B | 442M |

| EBITDA | 789M | 86.5M |

| EBIT | 475M | 75.7M |

| Net Income | 172M | 73.2M |

| EPS | 0.40 | 4.49 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Cameco Corporation

Cameco’s revenue showed a strong upward trend, growing 74.2% from 2020 to 2024, with net income rising 423.2% over the same period. Margins improved markedly, with a gross margin of 33.91% and a net margin of 5.48%, both favorable. However, in 2024, net income and EBIT declined significantly, indicating recent profitability challenges despite solid top-line growth.

Centrus Energy Corp.

Centrus posted a 78.8% revenue increase from 2020 to 2024, with net income growing 34.6%, though net margin contracted by 24.7%. The company maintained a strong EBIT margin of 17.13% and a net margin of 16.56%. The latest year saw revenue growth of 38%, but declines in gross profit, EBIT, and net margin suggest some margin pressure despite expanding sales.

Which one has the stronger fundamentals?

Cameco displays stronger long-term net income and margin improvements, signaling robust fundamental growth, but recent declines in profitability pose caution. Centrus shows consistent revenue growth and higher current net margins, yet margin contraction and earnings declines are concerns. Both companies have favorable income statement trends, with Cameco’s fundamentals appearing more volatile recently.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Cameco Corporation (CCJ) and Centrus Energy Corp. (LEU) based on their most recent fiscal year 2024 data.

| Ratios | Cameco Corporation (CCJ) | Centrus Energy Corp. (LEU) |

|---|---|---|

| ROE | 2.70% | 45.35% |

| ROIC | 3.79% | 4.02% |

| P/E | 187.0 | 14.8 |

| P/B | 5.05 | 6.73 |

| Current Ratio | 1.62 | 2.93 |

| Quick Ratio | 0.80 | 2.46 |

| D/E (Debt-to-Equity) | 0.20 | 0.97 |

| Debt-to-Assets | 13.1% | 14.4% |

| Interest Coverage | 4.60 | 17.78 |

| Asset Turnover | 0.32 | 0.40 |

| Fixed Asset Turnover | 0.95 | 47.02 |

| Payout ratio | 40.5% | 0% |

| Dividend yield | 0.22% | 0% |

Interpretation of the Ratios

Cameco Corporation

Cameco shows a mixed ratio profile with only 21.43% favorable metrics versus 50% unfavorable, resulting in a slightly unfavorable overall view. Key concerns include low return on equity (2.7%) and high price-to-earnings ratio (187.01), indicating valuation risks. Its dividend yield is low at 0.22%, reflecting modest shareholder returns but a consistent payout.

Centrus Energy Corp.

Centrus Energy exhibits a stronger ratio set, with 57.14% favorable and just 28.57% unfavorable, giving a favorable overall impression. It boasts high net margin (16.56%) and return on equity (45.35%), supported by a low P/E of 14.84. The company does not pay dividends, likely due to reinvestment priorities or growth focus.

Which one has the best ratios?

Centrus Energy offers a more favorable ratio profile with superior profitability, liquidity, and valuation metrics, while Cameco displays multiple weaknesses and higher valuation concerns. The dividend presence for Cameco contrasts with Centrus’s dividend absence, emphasizing different capital allocation strategies. Overall, Centrus’s ratios appear stronger based on the given data.

Strategic Positioning

This section compares the strategic positioning of Cameco Corporation and Centrus Energy Corp., including market position, key segments, and exposure to disruption:

Cameco Corporation

- Leading uranium producer with diversified operations in mining and fuel services across Americas, Europe, and Asia.

- Operates two segments: Uranium exploration/mining and Fuel Services including refining, conversion, and fuel fabrication.

- Exposure to nuclear fuel cycle technologies but no explicit data on disruption or innovation impact.

Centrus Energy Corp.

- Smaller market cap supplier focused on low-enriched uranium and technical solutions, mainly serving the US and select international markets.

- Operates two segments: Low-Enriched Uranium sales and Technical Solutions with engineering and manufacturing services.

- Involvement in engineering and testing of American Centrifuge technology suggests some exposure to technological innovation risks.

Cameco Corporation vs Centrus Energy Corp. Positioning

Cameco shows a more diversified model spanning uranium mining to fuel fabrication, leveraging larger scale and geographic reach. Centrus is more concentrated on uranium enrichment and technical services, focusing on niche technology and U.S.-centric markets. Diversification may provide broader revenue streams; concentration might limit market risk but increase dependence on specific segments.

Which has the best competitive advantage?

Based on MOAT evaluation, both companies are shedding value versus their cost of capital. Cameco shows a growing ROIC trend and a slightly unfavorable moat, while Centrus has a declining ROIC trend and a very unfavorable moat. This suggests Cameco currently holds a relatively stronger competitive advantage.

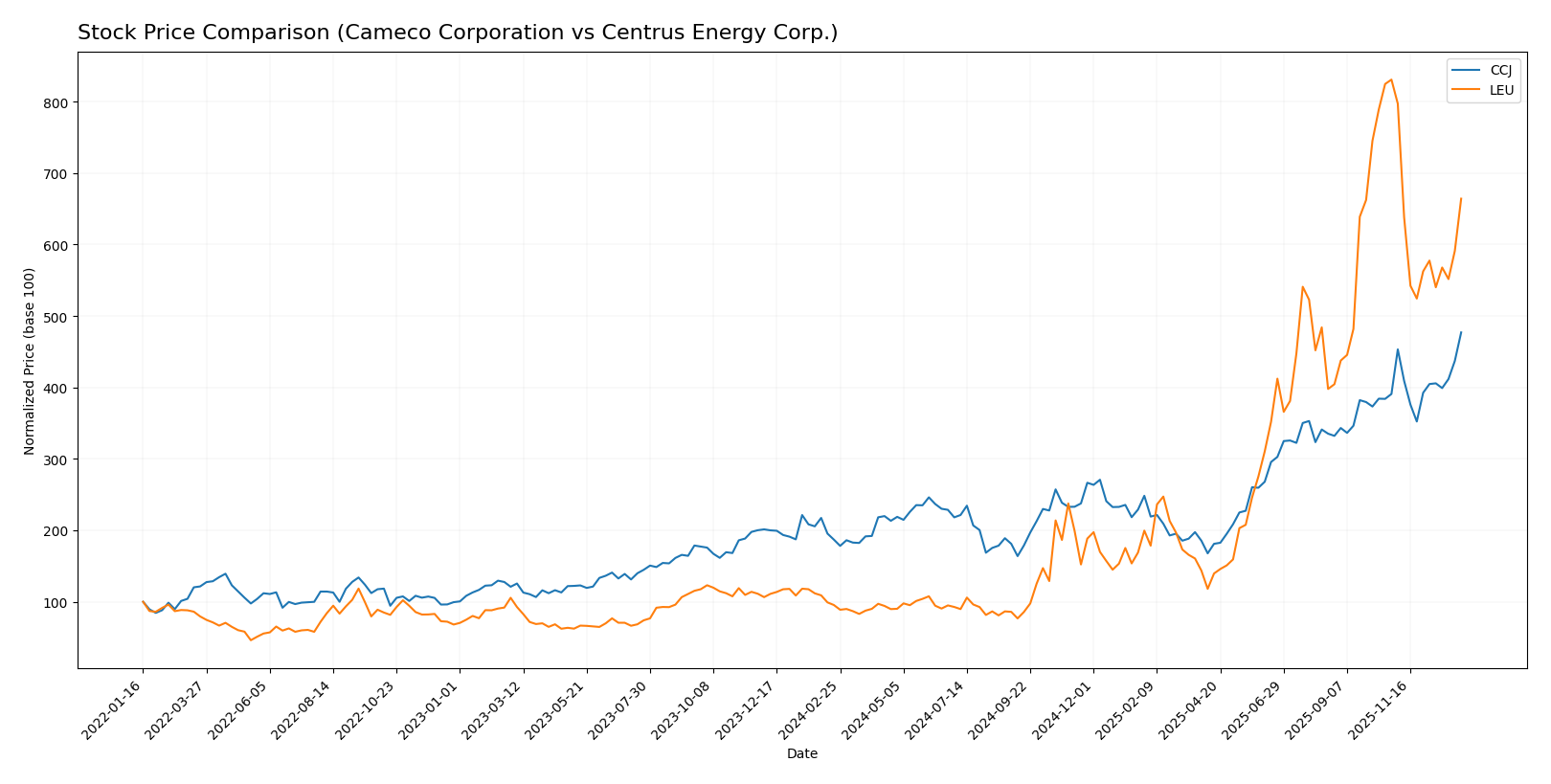

Stock Comparison

The past year has seen significant bullish momentum for both Cameco Corporation and Centrus Energy Corp., with Cameco accelerating its gains while Centrus experienced a recent deceleration and short-term decline.

Trend Analysis

Cameco Corporation (CCJ) exhibited a strong bullish trend over the past 12 months, with a 155.0% price increase and accelerating momentum, reaching a high of 107.56 and maintaining moderate volatility with a 17.73 std deviation.

Centrus Energy Corp. (LEU) showed an even more pronounced bullish trend over the same period, gaining 595.57%, but with deceleration recently and a 20.05% drop in the last months, accompanied by higher volatility (97.12 std deviation).

Comparing both stocks, Centrus Energy delivered the highest overall market performance during the analyzed year, despite its recent short-term downturn, surpassing Cameco’s gains substantially.

Target Prices

The current target price consensus shows a positive outlook for both Cameco Corporation and Centrus Energy Corp.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cameco Corporation | 109 | 99.74 | 102.75 |

| Centrus Energy Corp. | 390 | 125 | 288.4 |

Analysts expect Cameco’s price to remain near its current level of 107.56 USD, while Centrus Energy shows strong upside potential from its current 306.19 USD, reflecting greater bullish sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cameco Corporation and Centrus Energy Corp.:

Rating Comparison

CCJ Rating

- Rating: B, considered Very Favorable overall.

- Discounted Cash Flow Score: 3, Moderate valuation outlook based on future cash flows.

- ROE Score: 4, Favorable efficiency in generating profit from shareholders’ equity.

- ROA Score: 4, Favorable asset utilization for earnings generation.

- Debt To Equity Score: 3, Moderate financial risk with balanced debt use.

- Overall Score: 3, Moderate overall financial standing.

LEU Rating

- Rating: B, considered Very Favorable overall.

- Discounted Cash Flow Score: 4, Favorable valuation outlook based on future cash flows.

- ROE Score: 5, Very Favorable efficiency in generating profit from shareholders’ equity.

- ROA Score: 4, Favorable asset utilization for earnings generation.

- Debt To Equity Score: 1, Very Unfavorable financial risk due to high debt relative to equity.

- Overall Score: 3, Moderate overall financial standing.

Which one is the best rated?

Both Cameco and Centrus have equal overall ratings of B and moderate overall scores. Centrus shows stronger cash flow and equity returns but carries higher financial risk with a low debt-to-equity score. Cameco presents a more balanced debt profile with slightly lower profitability metrics.

Scores Comparison

Here is a comparison of the financial scores for Cameco Corporation and Centrus Energy Corp.:

CCJ Scores

- Altman Z-Score: 10.76, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

LEU Scores

- Altman Z-Score: 2.70, in the grey zone with moderate bankruptcy risk.

- Piotroski Score: 5, considered average financial strength.

Which company has the best scores?

Based on the provided data, CCJ has higher scores in both Altman Z-Score and Piotroski Score, indicating stronger financial stability and health compared to LEU.

Grades Comparison

Here is a comparison of the recent grades assigned to Cameco Corporation and Centrus Energy Corp.:

Cameco Corporation Grades

The following table summarizes recent grades from established grading companies for Cameco Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Outperform | 2025-11-13 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

| Goldman Sachs | Maintain | Buy | 2025-10-29 |

| RBC Capital | Maintain | Outperform | 2025-08-01 |

| RBC Capital | Maintain | Outperform | 2025-06-20 |

| GLJ Research | Maintain | Buy | 2025-06-12 |

| Goldman Sachs | Maintain | Buy | 2025-06-11 |

| GLJ Research | Maintain | Buy | 2025-03-12 |

| RBC Capital | Maintain | Outperform | 2025-03-04 |

| Scotiabank | Maintain | Outperform | 2024-08-19 |

Cameco Corporation’s grades consistently indicate a strong buy sentiment, with multiple “Outperform” and “Buy” ratings maintained over time.

Centrus Energy Corp. Grades

Below is a table summarizing recent grades from recognized grading companies for Centrus Energy Corp.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth Capital | Maintain | Neutral | 2026-01-08 |

| B. Riley Securities | Maintain | Buy | 2025-12-22 |

| Needham | Maintain | Buy | 2025-12-22 |

| UBS | Maintain | Neutral | 2025-11-25 |

| JP Morgan | Maintain | Neutral | 2025-11-07 |

| JP Morgan | Maintain | Neutral | 2025-10-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-26 |

| Evercore ISI Group | Maintain | Outperform | 2025-08-08 |

| B of A Securities | Downgrade | Neutral | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-08-07 |

Centrus Energy Corp.’s grades show a moderate consensus, mostly “Neutral” with some “Buy” and one “Outperform,” indicating a more cautious outlook.

Which company has the best grades?

Cameco Corporation has received stronger and more consistent buy-side grades compared to Centrus Energy Corp., which shows a mix of neutral and buy ratings. For investors, this difference suggests higher confidence in Cameco’s prospects by analysts, potentially implying a more favorable risk-reward profile.

Strengths and Weaknesses

Below is a comparative table highlighting key strengths and weaknesses of Cameco Corporation (CCJ) and Centrus Energy Corp. (LEU) based on the most recent financial and operational data available.

| Criterion | Cameco Corporation (CCJ) | Centrus Energy Corp. (LEU) |

|---|---|---|

| Diversification | Limited product diversification; primarily uranium-focused | More diversified product line including Separative Work Units and Services |

| Profitability | Neutral net margin (5.48%), but unfavorable ROE (2.7%) and ROIC (3.79%) | Strong profitability with high net margin (16.56%) and ROE (45.35%) |

| Innovation | Moderate; innovation impact unclear, low asset turnover | Higher innovation efficiency indicated by very high fixed asset turnover (47.02) |

| Global presence | Established global uranium supplier with moderate market penetration | Growing global footprint with expanding product and service offerings |

| Market Share | Strong in uranium mining but challenged by high valuation multiples (PE 187) | Competitive market position with reasonable valuation (PE 14.84) |

Key takeaways: Cameco shows improving profitability but struggles with value creation and operational efficiency. Centrus Energy demonstrates stronger financial health, better diversification, and operational effectiveness, making it more favorable for investors prioritizing growth and stability. However, both companies face challenges in sustaining long-term value.

Risk Analysis

Below is a comparative risk table for Cameco Corporation (CCJ) and Centrus Energy Corp. (LEU) based on the most recent 2024 financial data and market conditions:

| Metric | Cameco Corporation (CCJ) | Centrus Energy Corp. (LEU) |

|---|---|---|

| Market Risk | Moderate (Beta 1.217, uranium price volatility) | Moderate (Beta 1.252, niche uranium market) |

| Debt level | Low (D/E 0.2, favorable) | Moderate to High (D/E 0.97, neutral) |

| Regulatory Risk | High (Nuclear sector, international regulations) | High (US-centric nuclear regulations) |

| Operational Risk | Moderate (Mining and fuel services complexity) | Moderate (Technical solutions and fuel supply) |

| Environmental Risk | Moderate (Mining impact, regulatory scrutiny) | Moderate (Fuel processing and enrichment impact) |

| Geopolitical Risk | Moderate to High (Global uranium markets, Canada-based) | High (US-based, sensitive to geopolitical shifts) |

The most impactful risks are regulatory and geopolitical due to the nuclear energy sector’s strict compliance requirements and international dependencies. Centrus faces higher debt risk and geopolitical exposure, while Cameco benefits from lower leverage but must manage global market fluctuations and regulatory challenges.

Which Stock to Choose?

Cameco Corporation (CCJ) shows a favorable income statement with strong revenue and net income growth over 2020-2024 but has slightly unfavorable financial ratios overall, including low ROE and high valuation multiples. Debt levels are manageable, and its rating is very favorable.

Centrus Energy Corp. (LEU) presents a favorable income statement with solid revenue growth and high net margin, alongside mostly favorable financial ratios, including excellent ROE but higher debt relative to equity. Its rating is also very favorable, though some valuation ratios are less attractive.

For investors prioritizing quality and stability, CCJ’s steady profitability and conservative debt profile might appear more appealing, whereas those with a growth or risk-tolerant profile could find LEU’s higher returns and stronger earnings yield indicative of greater upside potential despite its higher leverage and recent price volatility.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cameco Corporation and Centrus Energy Corp. to enhance your investment decisions: