Home > Comparison > Real Estate > MAA vs CPT

The strategic rivalry between Mid-America Apartment Communities, Inc. and Camden Property Trust defines the current trajectory of the residential REIT sector. MAA operates as a capital-intensive owner and developer with a broad geographic footprint, while CPT emphasizes operational efficiency in a slightly smaller, high-quality portfolio. This analysis pits scale against nimbleness, growth against value, to determine which REIT offers the superior risk-adjusted return for diversified investors.

Table of contents

Companies Overview

Mid-America Apartment Communities and Camden Property Trust both shape the US residential REIT landscape with substantial market footprints.

Mid-America Apartment Communities, Inc.: Regional Multifamily Powerhouse

Mid-America Apartment Communities, Inc. stands as a leading residential REIT focused on the Southeast, Southwest, and Mid-Atlantic US regions. Its core revenue derives from owning, managing, and developing over 102K apartment units. In 2020, the company emphasized full-cycle investment performance through strategic acquisitions and redevelopment to enhance asset quality and shareholder returns.

Camden Property Trust: National Growth and Workplace Excellence

Camden Property Trust operates as a multifamily apartment owner and operator with 167 properties and 57K homes nationwide. It generates revenue by acquiring, managing, and developing residential communities. In 2020, Camden prioritized portfolio expansion with 7 developments underway and bolstered its reputation through employee-focused recognition, including Fortune’s Best Companies to Work For.

Strategic Collision: Similarities & Divergences

Both firms pursue growth via acquisition and development in residential REITs but diverge in geographic scope—Mid-America’s regional dominance contrasts Camden’s more scattered national footprint. Their primary competition centers on capturing rental market share through asset quality and operational efficiency. Investors face distinct profiles: Mid-America offers scale and regional depth, while Camden combines growth potential with a strong corporate culture.

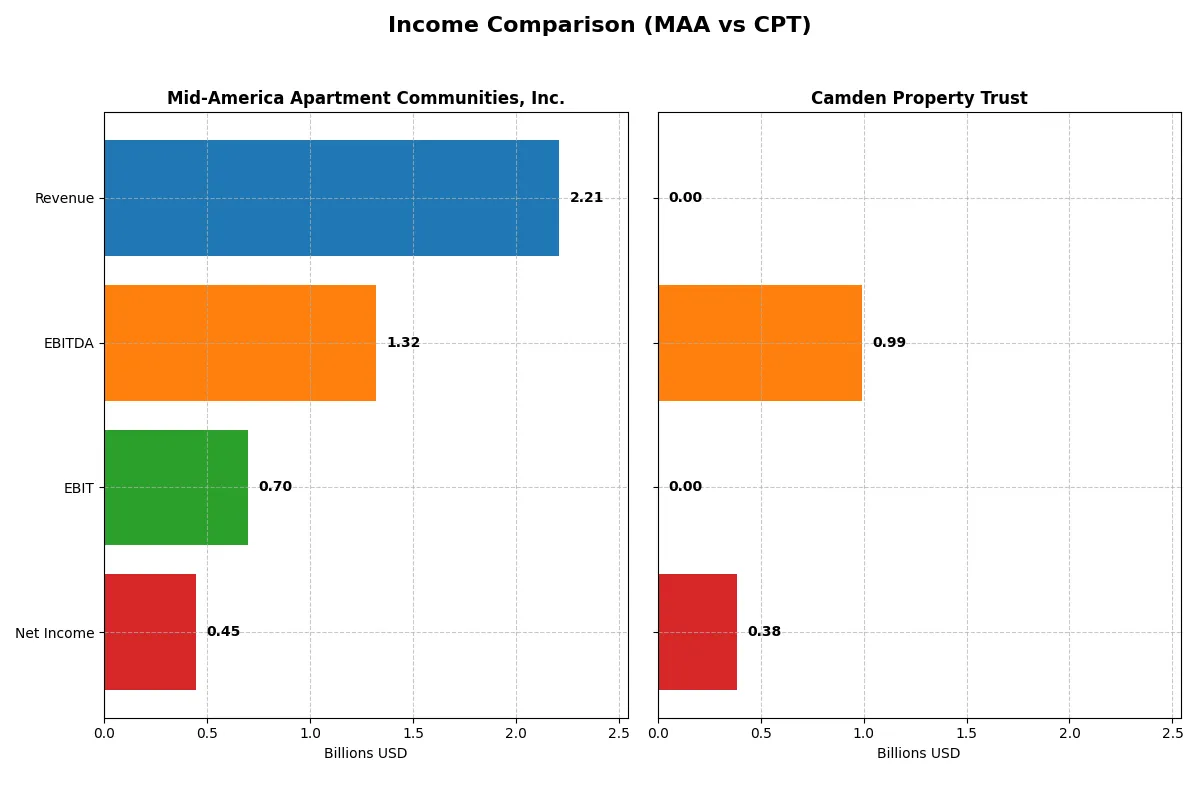

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Mid-America Apartment Communities, Inc. (MAA) | Camden Property Trust (CPT) |

|---|---|---|

| Revenue | 2.21B | 0 |

| Cost of Revenue | 1.51B | 0 |

| Operating Expenses | 83.6M | 79.3M |

| Gross Profit | 703M | 0 |

| EBITDA | 1.32B | 991M |

| EBIT | 696M | 0 |

| Interest Expense | 185M | 0 |

| Net Income | 447M | 384M |

| EPS | 3.79 | 3.54 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison unveils the true efficiency and profitability dynamics of two leading apartment REITs over recent years.

Mid-America Apartment Communities, Inc. (MAA) Analysis

MAA’s revenue grew steadily from 1.78B in 2021 to 2.21B in 2025, reflecting a solid 24.2% increase over five years. Net income, however, declined by 16.3% overall, down to 444M in 2025. The company maintains healthy gross (31.8%) and net margins (20.2%), though recent margin contraction and a 16% net margin drop signal emerging efficiency challenges.

Camden Property Trust (CPT) Analysis

CPT’s revenue surged consistently until 2024, peaking at 1.54B, but collapsed to zero in 2025, causing a drastic margin wipeout. Net income shows a mixed pattern, rising 26.5% over five years but falling sharply in 2024 before rebounding to 384M in 2025 despite no reported revenue. Margin metrics are unfavorable, reflecting operational discontinuities and volatility in earnings quality.

Divergent Paths: Stable Margins vs. Revenue Disruption

MAA demonstrates steady revenue growth and consistent margin strength, despite recent profit pressure. CPT faces severe revenue disruption in 2025, undermining margins despite net income resilience. Fundamentally, MAA’s profile offers more predictable profitability, while CPT’s erratic revenue and margin collapse pose significant risks for investors seeking stable income streams.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Mid-America Apartment Communities, Inc. (MAA) | Camden Property Trust (CPT) |

|---|---|---|

| ROE | 7.9% | 3.5% |

| ROIC | 10.2% | 3.5% |

| P/E | 36.4 | 77.1 |

| P/B | 2.87 | 2.69 |

| Current Ratio | 0.08 | 0.10 |

| Quick Ratio | 0.08 | 0.10 |

| D/E (Debt to Equity) | 0.95 | 0.75 |

| Debt-to-Assets | 45.1% | 39.4% |

| Interest Coverage | 3.34 | 2.29 |

| Asset Turnover | 0.18 | 0.17 |

| Fixed Asset Turnover | 0 | 0 |

| Payout ratio | 159% | 276% |

| Dividend yield | 4.36% | 3.58% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational excellence behind the financial statements.

Mid-America Apartment Communities, Inc. (MAA)

MAA shows solid net margins at 20.23%, but a modest ROE of 7.89% signals limited equity efficiency. Its P/E ratio at 36.36 suggests the stock trades at a premium. The 4.36% dividend yield rewards shareholders, reflecting steady income rather than aggressive reinvestment.

Camden Property Trust (CPT)

CPT posts a lower net margin of 10.58% and a weak ROE of 3.49%, indicating less efficient profit generation. Its P/E ratio of 77.1 marks the stock as expensive. A 3.58% dividend yield offers moderate shareholder returns amid limited growth signals.

Premium Valuation vs. Operational Safety

MAA balances stronger profitability with a more reasonable valuation than CPT’s stretched multiples and weaker returns. MAA’s higher dividend yield suits income-focused investors, while CPT’s profile fits those tolerating high valuation risk for potential growth.

Which one offers the Superior Shareholder Reward?

I compare Mid-America Apartment Communities (MAA) and Camden Property Trust (CPT) on dividends and buybacks. MAA yields 4.36% with a payout ratio above 130%, signaling aggressive income return but potential FCF strain. CPT offers a 3.58% yield with a higher payout ratio near 276%, risking sustainability. MAA’s free cash flow coverage is stronger, supporting its 2025 dividend of $6.06/share. Both deploy buybacks, but MAA’s lower debt-to-equity ratio (0.95 vs. CPT’s 0.75) and stable operating margins suggest more prudent capital allocation. I find MAA’s balanced distribution and buyback mix more sustainable and rewarding for 2026 investors.

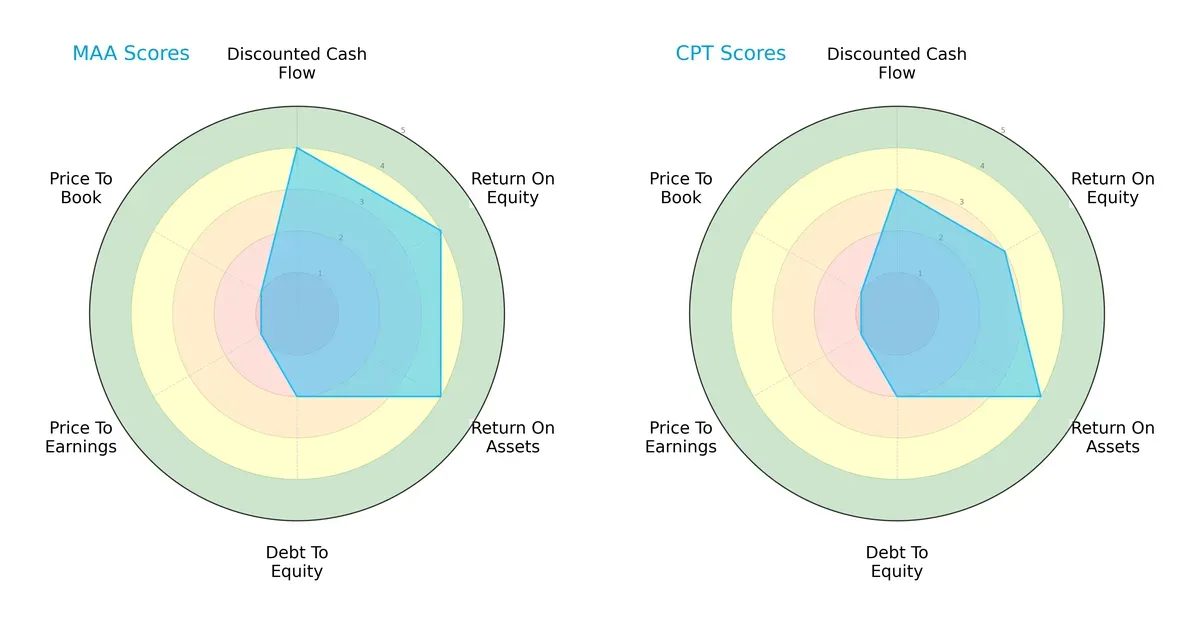

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Mid-America Apartment Communities, Inc. and Camden Property Trust, highlighting their strategic strengths and weaknesses:

Mid-America Apartment Communities (MAA) shows a more balanced profile with favorable scores in discounted cash flow, ROE, and ROA. Camden Property Trust (CPT) relies heavily on asset efficiency (ROA) but lags in overall and ROE scores. Both firms share weaknesses in debt management and valuation metrics, reflecting sector-wide valuation pressures.

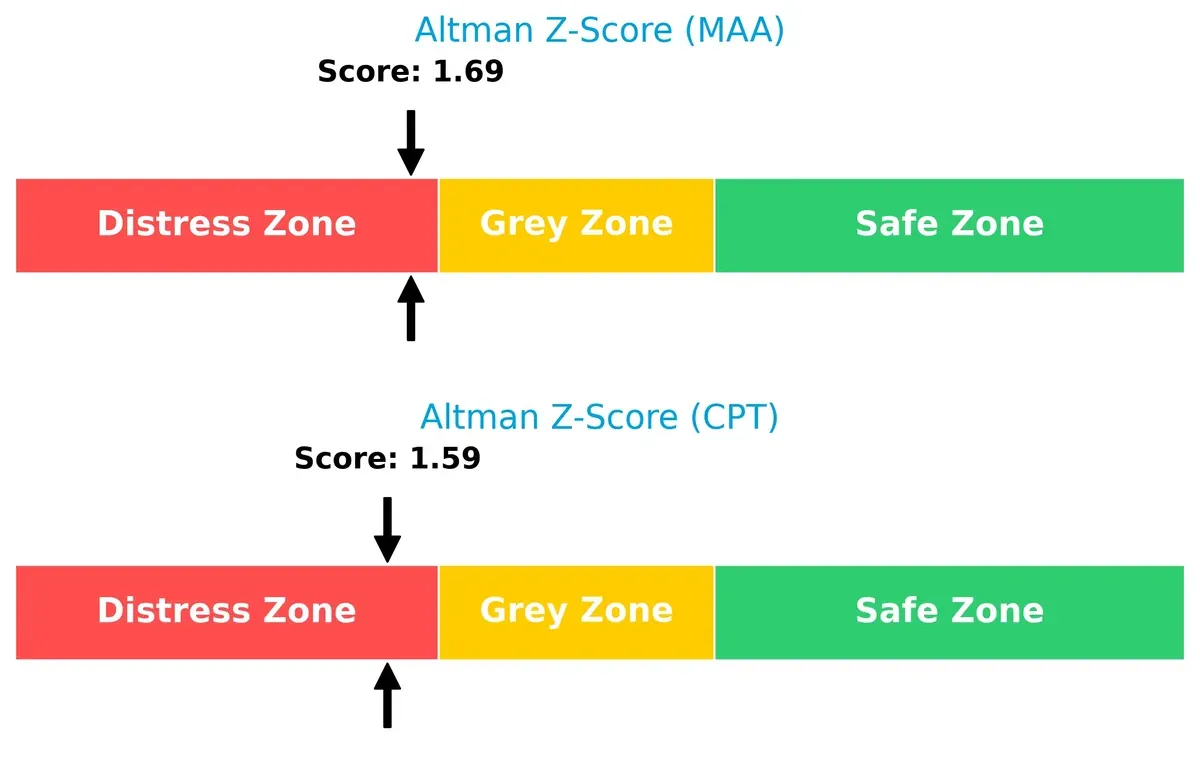

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score comparison indicates both companies remain in distress zones, signaling heightened bankruptcy risk in the current cycle:

Mid-America Apartment Communities scores 1.69, slightly above Camden’s 1.59, suggesting marginally better solvency but persistent financial stress for both.

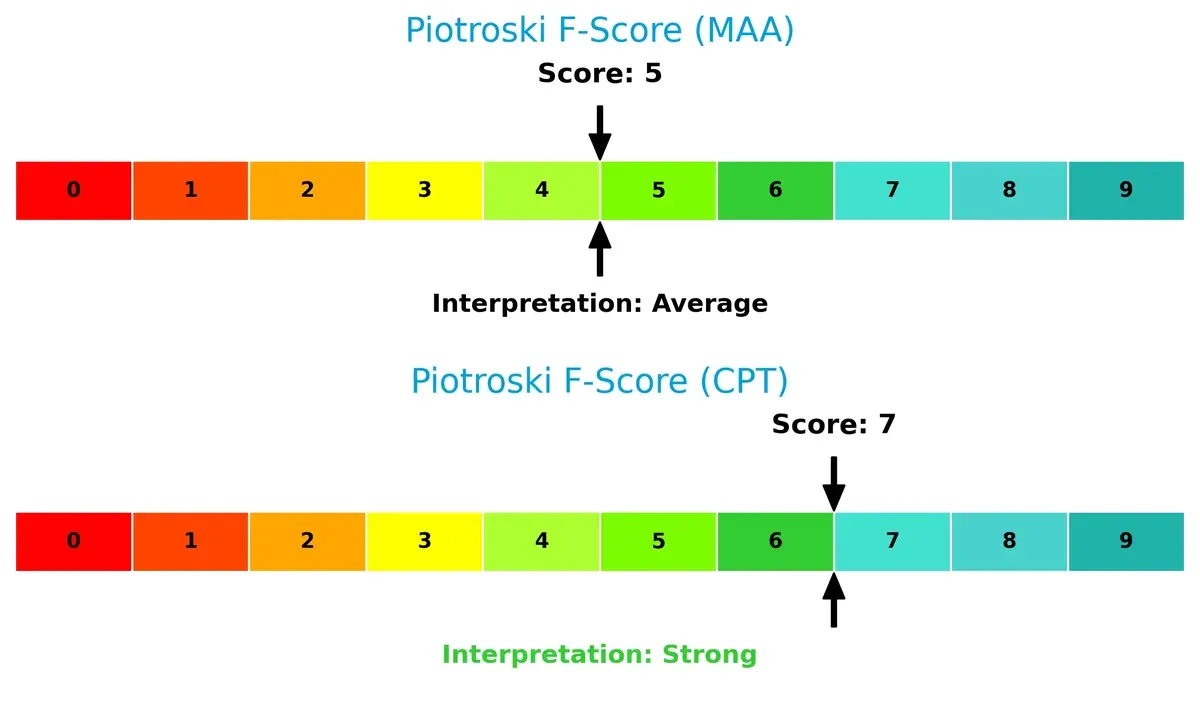

Financial Health: Quality of Operations

Piotroski F-Scores emphasize Camden Property Trust’s stronger financial health, outperforming Mid-America Apartment Communities in operational quality and risk management:

With a strong 7 versus a moderate 5 for MAA, Camden shows fewer red flags internally, indicating superior profitability and balance sheet controls.

How are the two companies positioned?

This section dissects the operational DNA of MAA and CPT by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to identify which model delivers the most resilient competitive advantage today.

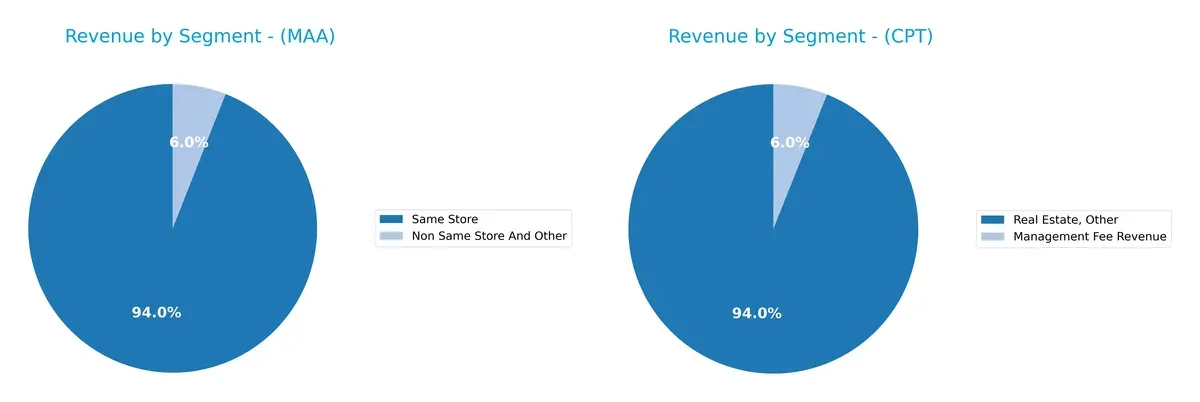

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Mid-America Apartment Communities and Camden Property Trust diversify their income streams and where their primary sector bets lie:

Mid-America Apartment Communities anchors its revenue heavily in the Same Store segment with $2.08B in 2025, dwarfing its $132M Non Same Store revenue. This concentration signals a focused strategy on stable, established properties. Camden Property Trust, by contrast, shows a leaner and less diversified mix with $112M in Real Estate, Other and a modest $7.2M in Management Fee Revenue, exposing it to higher concentration risk and less ecosystem lock-in than MAA.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Mid-America Apartment Communities, Inc. (MAA) and Camden Property Trust (CPT):

MAA Strengths

- High net margin at 20.23%

- Exceptional ROIC at 1017.71% above WACC

- Solid dividend yield of 4.36%

- Neutral leverage with debt-to-assets at 45.14%

- Large same store revenue exceeding 2B USD

CPT Strengths

- Positive net margin at 10.58%

- Neutral debt-to-assets at 39.38%

- Dividend yield of 3.58%

- Moderate debt-to-equity ratio at 0.75

MAA Weaknesses

- Unfavorable ROE at 7.89%

- Poor liquidity with zero current and quick ratios

- High P/E ratio of 36.36

- Low asset turnover at 0.18

- Several unfavorable financial ratios totaling 42.86%

CPT Weaknesses

- Low ROE at 3.49% and ROIC at 3.46%

- Unavailable WACC data

- Very high P/E ratio at 77.1

- Very weak liquidity with 0.1 current and quick ratios

- Zero interest coverage

- High ratio of unfavorable metrics at 57.14%

MAA displays strong profitability and capital efficiency but struggles with liquidity and valuation concerns. CPT shows weaker profitability and liquidity metrics, indicating higher financial risk. Both companies face challenges with asset utilization.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only barrier protecting long-term profits from competition’s relentless erosion:

Mid-America Apartment Communities, Inc.: Scale and Operational Excellence Moat

MAA leverages scale and operational efficiency, reflected in a very favorable ROIC surpassing WACC by over 1000%. Its growing ROIC signals deepening competitive advantage in key U.S. regions. New developments in 2026 could further widen this moat.

Camden Property Trust: Culture-Driven Growth and Development Moat

CPT’s moat centers on a strong corporate culture and steady development pipeline. While its ROIC data is unavailable, CPT shows a growing ROIC trend and a focused strategy to expand its portfolio selectively. This moat is narrower but benefits from employee loyalty and steady operational execution.

Wide-Scale Efficiency vs. Culture-Led Expansion

MAA’s scale-driven moat is wider and more quantifiable, underscored by robust, value-creating ROIC metrics. CPT’s moat is promising but less proven financially. MAA is better positioned to defend market share amid rising competition.

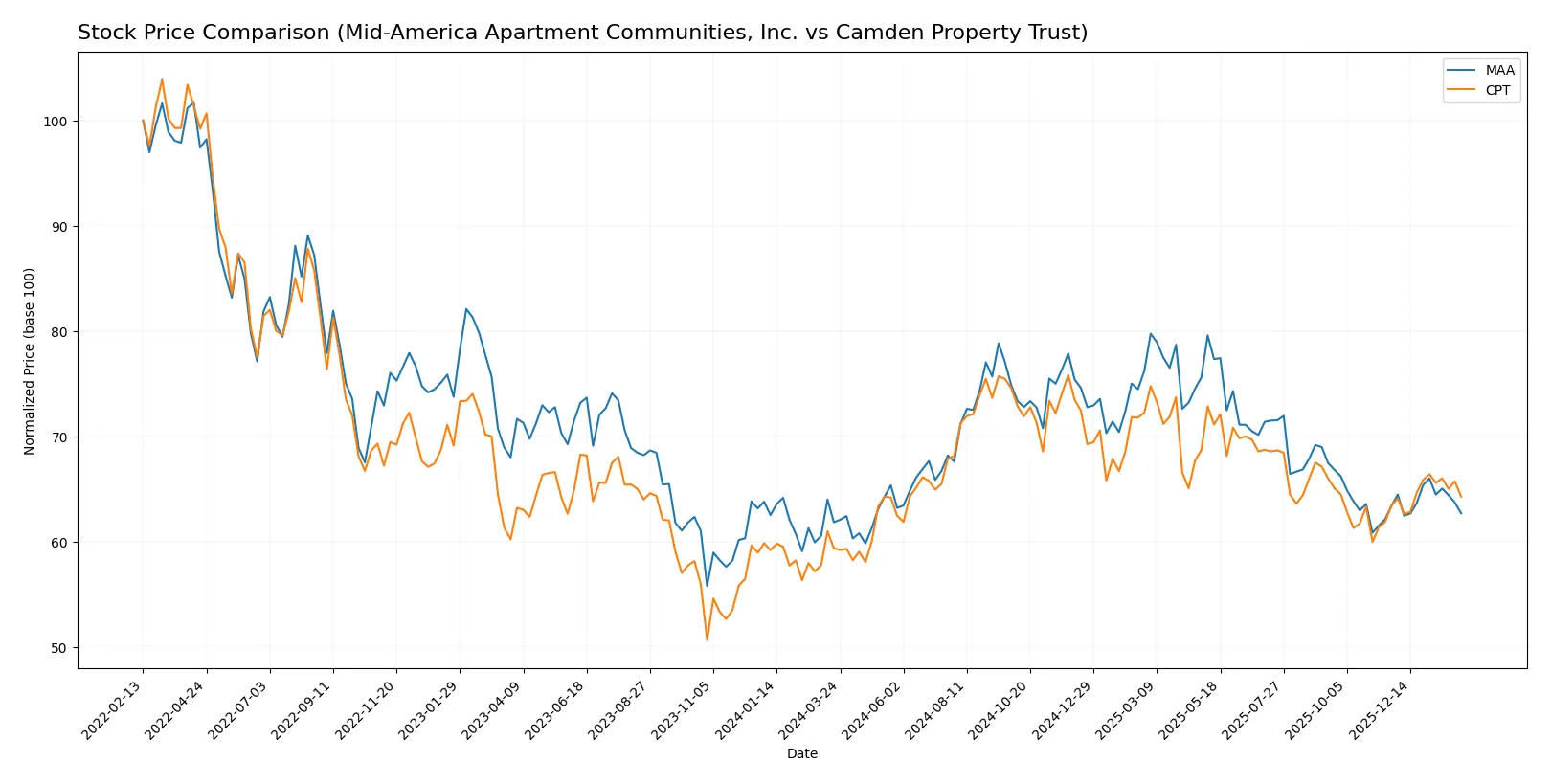

Which stock offers better returns?

The past year reveals distinct price movements for Mid-America Apartment Communities and Camden Property Trust, with both stocks showing acceleration but diverging in magnitude and recent trading dynamics.

Trend Comparison

Mid-America Apartment Communities shows a bullish trend with a 1.37% price increase over 12 months, marked by acceleration. The stock’s volatility is high with an 11.52 std deviation, peaking at 168.12 and bottoming at 126.08.

Camden Property Trust outperforms with an 8.26% bullish trend over the same period, also accelerating. Its volatility is lower at 7.56 std deviation, with a high of 125.8 and a low of 96.29.

Comparing trends, Camden Property Trust delivered stronger market performance and greater price appreciation than Mid-America Apartment Communities over the past year.

Target Prices

Analysts present a moderately optimistic target consensus for both Mid-America Apartment Communities and Camden Property Trust.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Mid-America Apartment Communities, Inc. | 134 | 158 | 143.38 |

| Camden Property Trust | 105 | 133 | 113.95 |

The consensus targets for both stocks exceed current prices, signaling expected appreciation. Mid-America’s consensus target is 8.5% above its current 132.13 price, while Camden’s target stands roughly 7% higher than its 106.63 trading price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Below is a summary of recent institutional grades for Mid-America Apartment Communities, Inc. and Camden Property Trust:

Mid-America Apartment Communities, Inc. Grades

This table shows recent grades and actions from major grading companies for MAA.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-02-06 |

| Mizuho | Maintain | Outperform | 2026-01-12 |

| BMO Capital | Upgrade | Outperform | 2026-01-09 |

| UBS | Maintain | Neutral | 2026-01-08 |

| Evercore ISI Group | Maintain | In Line | 2025-12-15 |

| Scotiabank | Downgrade | Sector Perform | 2025-12-05 |

| BTIG | Maintain | Buy | 2025-12-05 |

| Barclays | Maintain | Equal Weight | 2025-11-25 |

| Wells Fargo | Maintain | Overweight | 2025-11-25 |

| Mizuho | Maintain | Outperform | 2025-11-24 |

Camden Property Trust Grades

This table shows recent grades and actions from major grading companies for CPT.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-01-20 |

| Barclays | Maintain | Equal Weight | 2026-01-13 |

| Mizuho | Maintain | Outperform | 2026-01-12 |

| UBS | Maintain | Neutral | 2026-01-08 |

| JP Morgan | Upgrade | Neutral | 2025-12-18 |

| Truist Securities | Maintain | Buy | 2025-12-15 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-25 |

| Barclays | Downgrade | Equal Weight | 2025-11-25 |

| Mizuho | Maintain | Outperform | 2025-11-24 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-13 |

Which company has the best grades?

Mid-America Apartment Communities, Inc. holds more consistent outperform and buy ratings, including recent upgrades. Camden Property Trust shows a mix of buy and equal weight ratings with fewer upgrades. Investors may view MAA’s stronger grade trend as a signal of greater institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Mid-America Apartment Communities, Inc. (MAA)

- Operates 102,772 apartment units across 16 states with focus on quality redevelopment.

Camden Property Trust (CPT)

- Owns 56,850 units in 167 properties, expanding to 59,104 with 7 developments underway.

2. Capital Structure & Debt

Mid-America Apartment Communities, Inc. (MAA)

- Debt to equity ratio 0.95; interest coverage ratio 3.76, signaling manageable but leveraged debt.

Camden Property Trust (CPT)

- Debt to equity 0.75, but zero interest coverage is a red flag indicating difficulty meeting debt expenses.

3. Stock Volatility

Mid-America Apartment Communities, Inc. (MAA)

- Beta 0.78, less volatile than market average; stable price range $125.75–$173.38.

Camden Property Trust (CPT)

- Beta 0.83, slightly higher volatility; trading range $97.17–$126.55.

4. Regulatory & Legal

Mid-America Apartment Communities, Inc. (MAA)

- Subject to U.S. residential REIT regulations; no major legal issues reported.

Camden Property Trust (CPT)

- Similar regulatory environment; recognized for strong workplace culture, reducing legal risk from labor issues.

5. Supply Chain & Operations

Mid-America Apartment Communities, Inc. (MAA)

- Operating 2,532 employees; focus on acquisition and redevelopment may face construction delays.

Camden Property Trust (CPT)

- Smaller workforce (1,660); ongoing expansions risk supply chain disruptions in construction materials.

6. ESG & Climate Transition

Mid-America Apartment Communities, Inc. (MAA)

- No explicit ESG data but REITs face increasing pressure on energy efficiency and sustainable development.

Camden Property Trust (CPT)

- Recognized for strong workplace culture; ESG risks exist around environmental impact of developments.

7. Geopolitical Exposure

Mid-America Apartment Communities, Inc. (MAA)

- Concentrated in Southeast, Southwest, and Mid-Atlantic U.S.; limited international geopolitical risk.

Camden Property Trust (CPT)

- U.S.-focused portfolio; exposure mainly to domestic economic shifts and regional policy changes.

Which company shows a better risk-adjusted profile?

MAA’s most impactful risk is its distressed financial health indicated by a low Altman Z-score and unfavorable liquidity ratios. CPT’s greatest concern is its inability to cover interest expenses, signaling financial strain. Despite this, CPT’s stronger Piotroski score and lower leverage offer a marginally better risk-adjusted profile. Notably, CPT’s zero interest coverage ratio in 2024 demands caution, highlighting operational risks under debt pressure.

Final Verdict: Which stock to choose?

Mid-America Apartment Communities, Inc. (MAA) showcases an impressive ability to create value through a very favorable and growing ROIC that outpaces its cost of capital by a wide margin. This superpower signals strong operational efficiency and disciplined capital allocation. A point of vigilance remains its weak liquidity ratios, which may challenge short-term flexibility. MAA suits an aggressive growth portfolio that can tolerate some financial tightness for robust returns.

Camden Property Trust (CPT) offers a strategic moat rooted in consistent recurring revenue streams and solid income quality, although its overall financial profile appears less favorable than MAA’s. CPT’s weaker profitability metrics and distress-zone Altman Z-Score imply higher risk, but its stronger Piotroski score suggests improving financial health. CPT fits investors seeking growth at a reasonable price with a tilt toward stability.

If you prioritize sustained value creation and efficiency in capital use, MAA is the compelling choice due to its superior ROIC and dividend yield. However, if you seek a more moderate risk profile with potential for financial improvement, CPT offers better stability and a stronger fundamental rebound. Both present analytical scenarios worth monitoring closely given industry cyclicality and sector-specific headwinds.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Mid-America Apartment Communities, Inc. and Camden Property Trust to enhance your investment decisions: