Home > Comparison > Real Estate > INVH vs CPT

The strategic rivalry between Invitation Homes Inc. and Camden Property Trust shapes the residential real estate sector’s evolution. Invitation Homes operates as a single-family home leasing leader, focusing on high-quality, updated homes. Camden Property Trust specializes in multifamily apartment communities, emphasizing ownership, development, and management. This analysis contrasts their business models to identify which offers superior risk-adjusted returns for a diversified portfolio in today’s competitive real estate landscape.

Table of contents

Companies Overview

Invitation Homes Inc. and Camden Property Trust are key players shaping the U.S. residential real estate market.

Invitation Homes Inc.: Premier Single-Family Home Leasing Leader

Invitation Homes Inc. dominates the single-family home rental sector by offering updated homes near jobs and schools. Its core business revolves around leasing high-quality properties that cater to changing lifestyle needs. In 2026, the company emphasizes delivering superior resident experiences through high-touch service and well-located homes.

Camden Property Trust: Multifamily Apartment Community Specialist

Camden Property Trust excels in owning and operating multifamily apartment communities across the U.S. Its competitive advantage lies in managing a large portfolio of 167 properties with 56,850 homes, expanding to over 59,000 units soon. The company focuses on development and redevelopment to sustain growth and operational excellence this year.

Strategic Collision: Similarities & Divergences

Both companies operate in residential REITs but diverge in asset focus: single-family homes versus multifamily apartments. They compete on tenant satisfaction and location quality, targeting different renter demographics. Invitation Homes offers a more specialized niche, while Camden’s scale and diversification present a broader investment profile. Their distinct business models reflect varied risk and growth dynamics for investors.

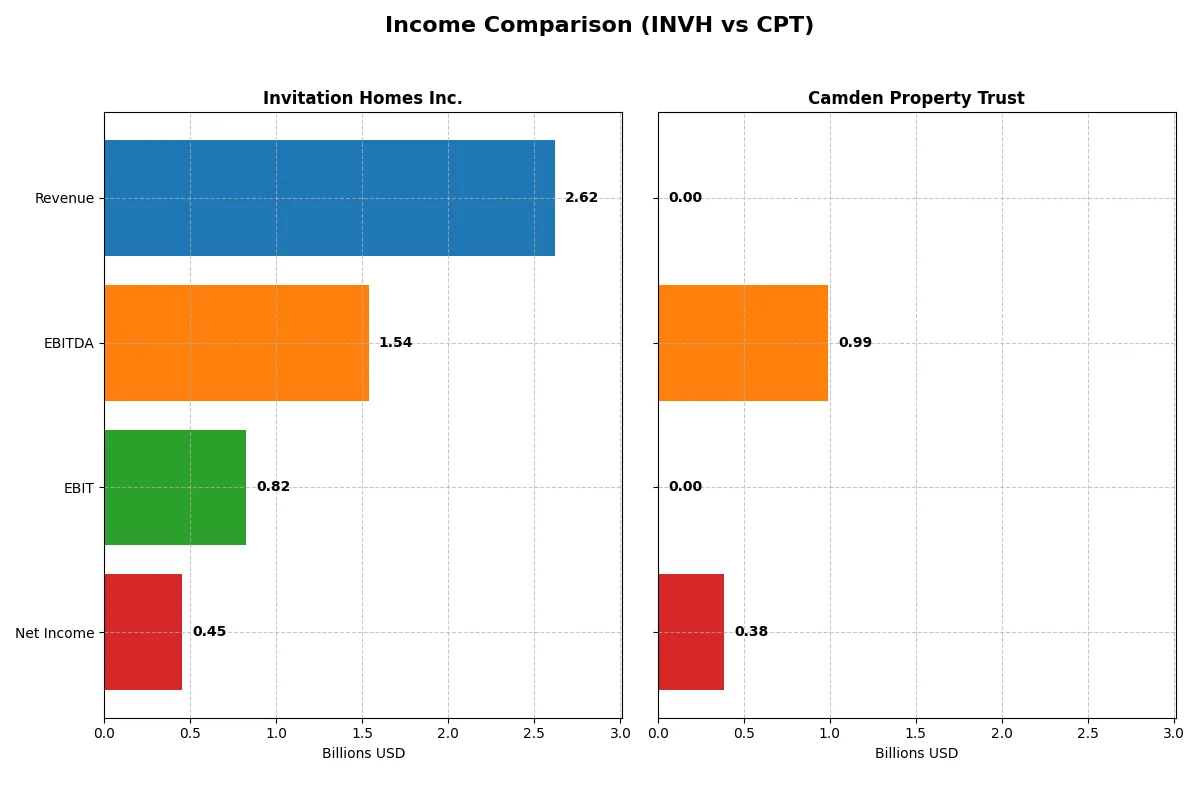

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Invitation Homes Inc. (INVH) | Camden Property Trust (CPT) |

|---|---|---|

| Revenue | 2.62B | 0 |

| Cost of Revenue | 1.07B | 0 |

| Operating Expenses | 805M | 79M |

| Gross Profit | 1.55B | 0 |

| EBITDA | 1.54B | 991M |

| EBIT | 821M | 0 |

| Interest Expense | 366M | 0 |

| Net Income | 454M | 384M |

| EPS | 0.74 | 3.54 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true operational efficiency and profitability trends behind each company’s financial performance.

Invitation Homes Inc. Analysis

Invitation Homes shows steady revenue growth from 1.8B in 2020 to 2.6B in 2024, with net income rising from 196M to 453M. Its gross margin remains healthy at 59%, and net margin stands at 17%, reflecting solid profitability despite an unfavorable 14% interest expense ratio. The slight dip in EBIT and net margin in 2024 signals pressure on operating efficiency.

Camden Property Trust Analysis

Camden’s revenue soared to 1.54B in 2024 but dropped to zero in 2025, causing a severe decline in gross and net margins. However, net income increased from 163M in 2024 to 384M in 2025, driven by non-operating factors and a sharp EPS surge. The absence of revenue in 2025 distorts margin analysis, highlighting an unusual year with questionable sustainability.

Operational Stability vs. Anomalous Spike

Invitation Homes delivers consistent revenue and profit growth with robust margins, though facing rising interest expenses. Camden exhibits volatile revenue and margin collapse in 2025, offset by a net income spike likely from one-off events. Invitation Homes’ profile offers a clearer, more reliable operational performance, while Camden’s 2025 results demand cautious scrutiny.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | Invitation Homes Inc. (INVH) | Camden Property Trust (CPT) |

|---|---|---|

| ROE | 4.65% | 3.49% |

| ROIC | 4.02% | 3.46% |

| P/E | 43.14 | 77.10 |

| P/B | 2.01 | 2.69 |

| Current Ratio | 0.82 | 0.10 |

| Quick Ratio | 0.82 | 0.10 |

| D/E (Debt-to-Equity) | 0.84 | 0.75 |

| Debt-to-Assets | 43.9% | 39.4% |

| Interest Coverage | 2.02 | 2.29 |

| Asset Turnover | 0.14 | 0.17 |

| Fixed Asset Turnover | 36.61 | 0 |

| Payout ratio | 152% | 276% |

| Dividend yield | 3.52% | 3.58% |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational strength beyond headline figures.

Invitation Homes Inc.

Invitation Homes shows modest profitability with a 4.65% ROE and a strong 17.33% net margin, signaling efficiency in operations. Its P/E ratio of 43.14 suggests the stock is stretched relative to earnings. The 3.52% dividend yield rewards shareholders, indicating a balanced capital allocation between payouts and growth.

Camden Property Trust

Camden Property posts a lower 3.49% ROE and a 10.58% net margin, reflecting moderate profitability. Its P/E ratio at 77.1 marks the stock as expensive, demanding high growth expectations. A 3.58% dividend yield supports income investors, but weak liquidity and coverage ratios raise caution on financial flexibility.

Premium Valuation vs. Operational Safety

Invitation Homes offers a better mix of operational efficiency and shareholder returns despite stretched valuation. Camden’s higher valuation and weaker ratios suggest greater risk. Investors seeking operational stability may prefer Invitation Homes, while those chasing growth must weigh Camden’s elevated price and financial risks.

Which one offers the Superior Shareholder Reward?

I compare Invitation Homes Inc. (INVH) and Camden Property Trust (CPT) based on their dividend yields, payout ratios, and share buybacks. INVH yields 3.52% with a payout ratio above 150%, signaling aggressive distribution but questionable sustainability. CPT offers a slightly higher yield at 3.58% but an even higher payout ratio near 276%, indicating elevated risk to dividend security. INVH’s free cash flow per share of 1.41B supports its dividend plus buybacks better than CPT’s weaker FCF coverage of 49%. Both companies deploy buybacks, but INVH’s capital expenditure coverage near 5x suggests more robust cash generation to fund returns. I see INVH’s distribution model as more sustainable long-term. Therefore, I favor INVH for superior total shareholder reward in 2026.

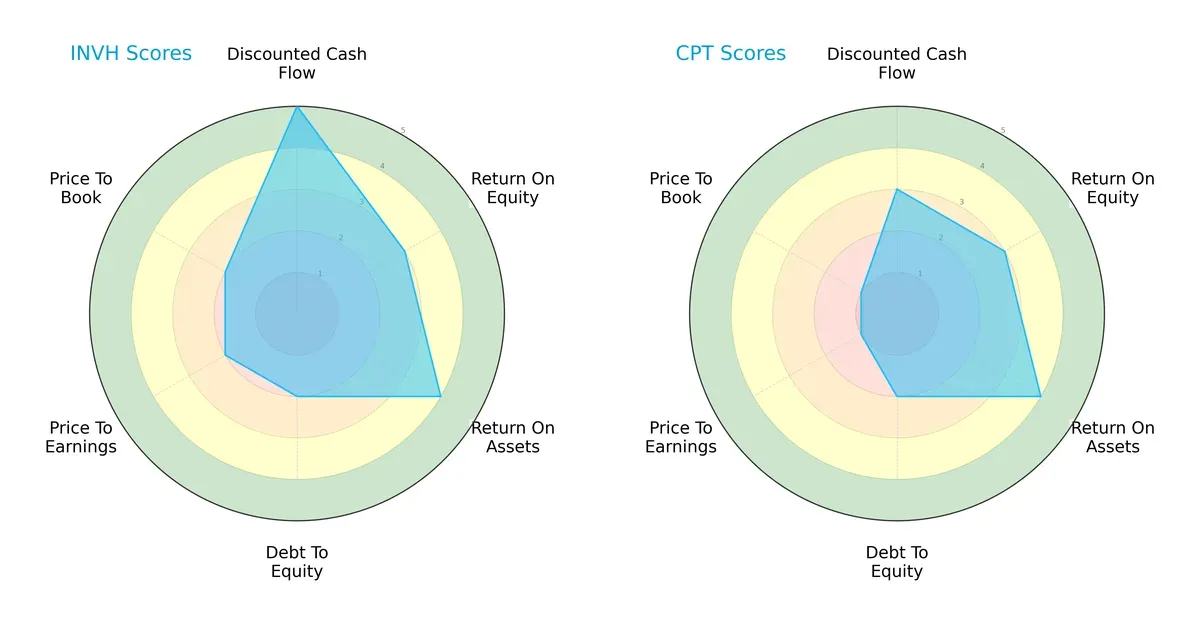

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Invitation Homes Inc. and Camden Property Trust, highlighting their core financial strengths and vulnerabilities:

Invitation Homes leads with a very favorable DCF score (5 vs. 3) and slightly better overall scores, reflecting stronger cash flow projections. Both firms show moderate ROE (3) and favorable ROA (4). However, both suffer from weak debt-to-equity (2) and valuation metrics, with Camden notably worse on P/E and P/B (1 vs. 2). Invitation Homes exhibits a more balanced profile, while Camden relies on operational efficiency amid valuation pressures.

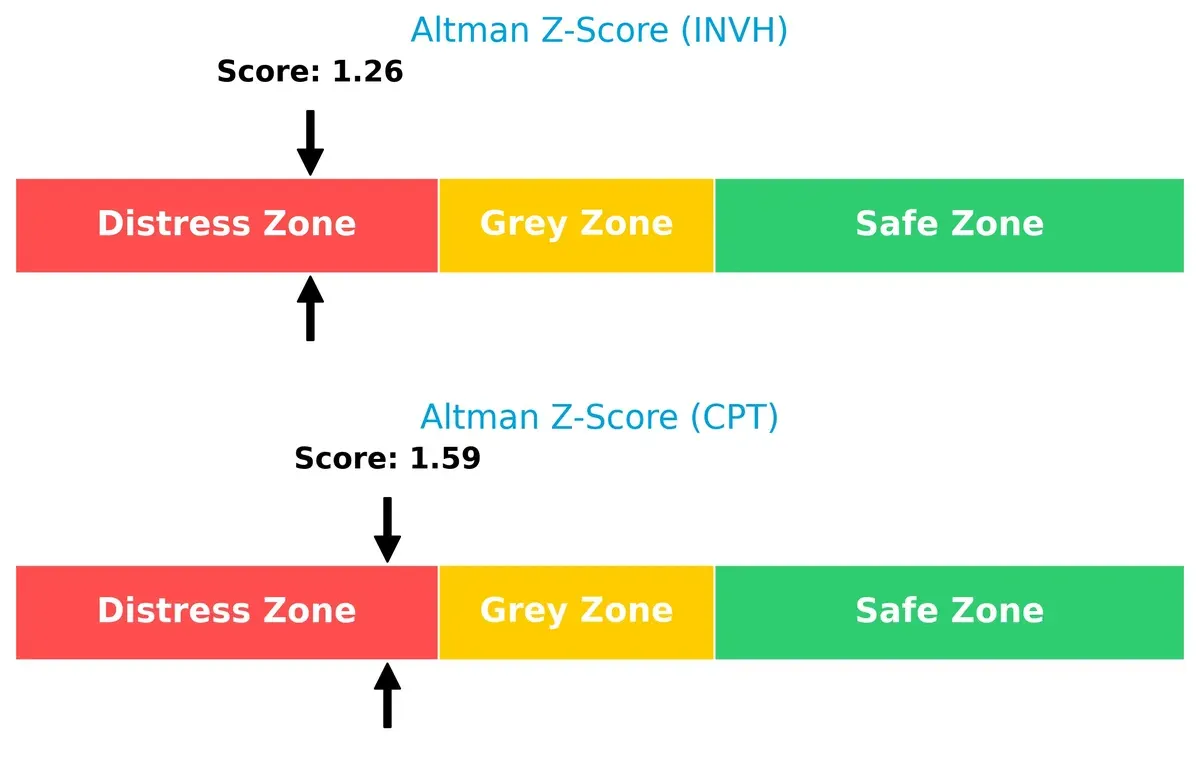

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores place both Invitation Homes (1.26) and Camden Property Trust (1.59) in the distress zone, signaling elevated bankruptcy risk in this cycle:

This proximity indicates both firms face financial strain, but Camden’s slightly higher score suggests marginally better solvency resilience.

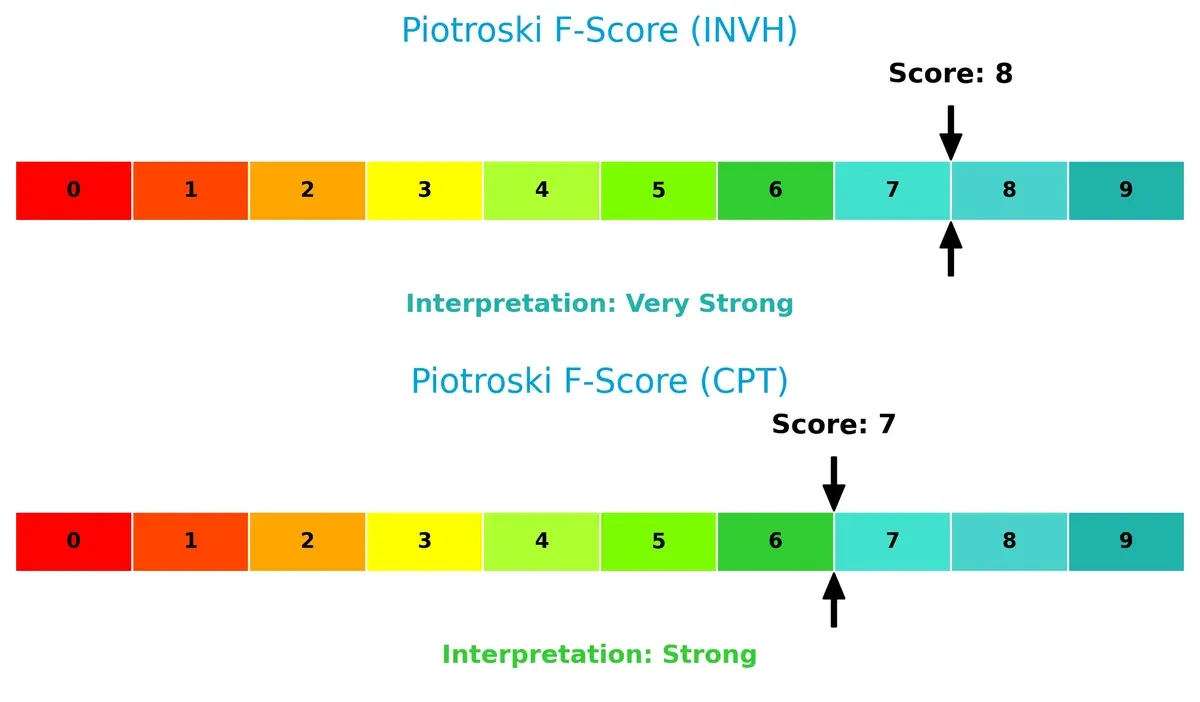

Financial Health: Quality of Operations

Invitation Homes scores an 8 on the Piotroski scale, indicating very strong financial health, while Camden scores 7, also strong but showing minor internal weaknesses:

Invitation Homes shows superior operational quality and fewer red flags, positioning it as the healthier operator despite similar external risks.

How are the two companies positioned?

This section dissects the operational DNA of INVH and CPT by comparing their revenue distribution and internal dynamics—strengths and weaknesses. The goal is to confront their economic moats and reveal which model offers the most resilient competitive advantage today.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Invitation Homes Inc. and Camden Property Trust:

INVH Strengths

- Higher net margin at 17.33% indicates stronger profitability

- Favorable WACC at 6.6% supports value creation

- Solid fixed asset turnover at 36.61 suggests efficient asset use

- Dividend yield at 3.52% offers steady investor returns

CPT Strengths

- Positive net margin at 10.58% confirms profitability

- Dividend yield at 3.58% slightly exceeds INVH

- Neutral debt-to-assets ratio at 39.38% supports balanced leverage

- Neutral price-to-book ratio at 2.69 reflects market valuation

INVH Weaknesses

- Low ROE of 4.65% signals weak equity returns

- ROIC at 4.02% below WACC of 6.6% implies value destruction

- Unfavorable PE ratio at 43.14 suggests overvaluation

- Current ratio at 0.82 indicates liquidity constraints

- Asset turnover at 0.14 points to lower operational efficiency

CPT Weaknesses

- Very low ROE of 3.49% and ROIC at 3.46% show poor capital returns

- PE ratio at 77.1 signals significant overvaluation risk

- Current and quick ratios at 0.1 reveal severe liquidity issues

- Interest coverage at 0 indicates financial distress

- Fixed asset turnover at 0 highlights asset underutilization

Invitation Homes demonstrates stronger profitability and asset efficiency but faces challenges in equity returns and liquidity. Camden exhibits weaker returns, liquidity stress, and valuation concerns, potentially impacting financial flexibility. Both companies must address capital efficiency and liquidity to support sustainable growth.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from relentless competition and market pressures. Without it, profits erode quickly, leaving companies vulnerable to disruption:

Invitation Homes Inc.: Cost Advantage Through Scale

Invitation Homes leverages scale in single-family home leasing to maintain a cost advantage. Its stable margins and improving ROIC trend reflect efficient capital use despite current value destruction. New markets and product upgrades may deepen this moat by 2026.

Camden Property Trust: Operational Excellence in Multifamily Apartments

Camden’s moat centers on operational efficiency and premium community management, contrasting Invitation’s scale focus. Its growing ROIC trend signals improving capital deployment. Expansion via development projects could reinforce its competitive edge in 2026.

Scale Efficiency vs. Operational Excellence: Who Holds the Stronger Moat?

Invitation Homes’ cost-driven moat shows wider scale advantages but currently destroys value. Camden’s operational moat lacks full ROIC data but demonstrates improving efficiency. Camden appears better positioned to defend market share through execution and growth opportunities.

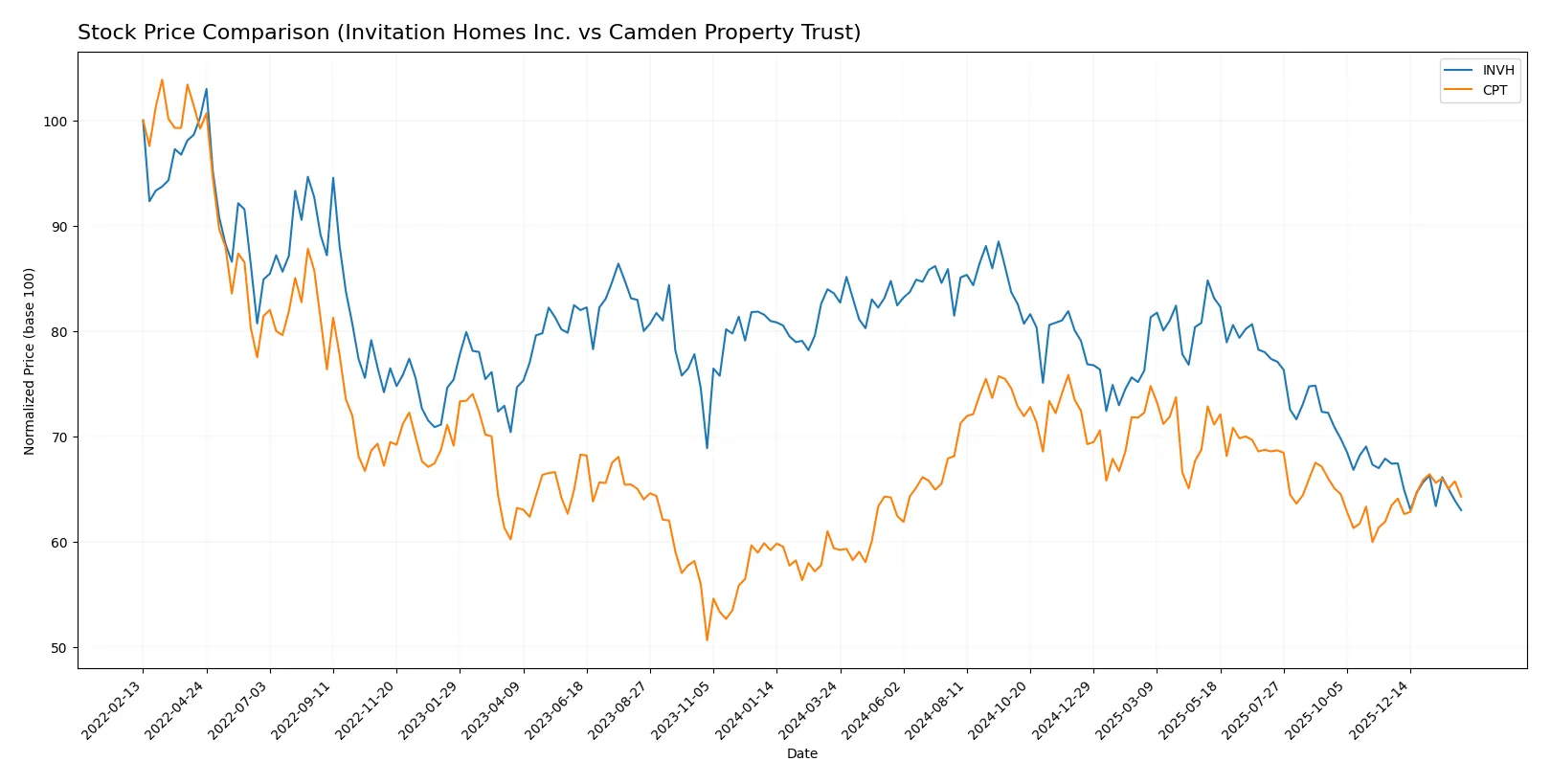

Which stock offers better returns?

Invitation Homes Inc. (INVH) and Camden Property Trust (CPT) show contrasting price trajectories over the past 12 months, with INVH declining steadily while CPT gains momentum amid accelerating bullish trends.

Trend Comparison

INVH’s stock fell 24.66% over the past year, reflecting a bearish trend with decelerating losses and a price range between 26.34 and 37.02. Recent months show continued decline of 6.56%.

CPT’s stock rose 8.26% over the same period, marking a bullish trend with accelerating gains and volatility. Prices reached highs of 125.8 and lows of 96.29, with recent modest growth of 1.33%.

CPT outperformed INVH significantly, delivering positive returns versus INVH’s substantial losses over the past 12 months.

Target Prices

Analysts present a moderately bullish consensus on Invitation Homes Inc. and Camden Property Trust.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Invitation Homes Inc. | 27 | 40 | 33.29 |

| Camden Property Trust | 105 | 133 | 113.95 |

Invitation Homes’ target consensus sits about 26% above its current price of 26.34, signaling upside potential. Camden Property Trust’s consensus target also exceeds its 106.63 price, suggesting modest growth expectations.

How do institutions grade them?

Here are the latest institutional grades for Invitation Homes Inc. and Camden Property Trust:

Invitation Homes Inc. Grades

This table summarizes recent grades from reputable financial institutions for Invitation Homes Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Scotiabank | maintain | Sector Perform | 2026-01-14 |

| Mizuho | downgrade | Neutral | 2026-01-08 |

| UBS | maintain | Buy | 2026-01-08 |

| Barclays | maintain | Overweight | 2025-11-25 |

| JP Morgan | maintain | Overweight | 2025-11-18 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-13 |

| B of A Securities | maintain | Neutral | 2025-11-12 |

| Scotiabank | maintain | Sector Perform | 2025-11-10 |

| Keefe, Bruyette & Woods | maintain | Market Perform | 2025-11-05 |

| RBC Capital | maintain | Sector Perform | 2025-10-31 |

Camden Property Trust Grades

This table shows recent grades from leading institutions for Camden Property Trust.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | maintain | Buy | 2026-01-20 |

| Barclays | maintain | Equal Weight | 2026-01-13 |

| Mizuho | maintain | Outperform | 2026-01-12 |

| UBS | maintain | Neutral | 2026-01-08 |

| JP Morgan | upgrade | Neutral | 2025-12-18 |

| Truist Securities | maintain | Buy | 2025-12-15 |

| Wells Fargo | maintain | Equal Weight | 2025-11-25 |

| Barclays | downgrade | Equal Weight | 2025-11-25 |

| Mizuho | maintain | Outperform | 2025-11-24 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-13 |

Which company has the best grades?

Camden Property Trust generally earns stronger grades, including multiple Buy and Outperform ratings. Invitation Homes Inc. mostly receives Neutral to Sector Perform grades, signaling weaker institutional enthusiasm. This difference could influence investor perception and portfolio positioning.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both Invitation Homes Inc. and Camden Property Trust in the 2026 market environment:

1. Market & Competition

Invitation Homes Inc.

- Dominates single-family home leasing, but faces pricing pressure from emerging competitors.

Camden Property Trust

- Focuses on multifamily apartments with strong brand recognition but intense urban competition.

2. Capital Structure & Debt

Invitation Homes Inc.

- Moderate leverage with debt-to-assets at 44%, interest coverage is adequate at 2.24x.

Camden Property Trust

- Slightly lower leverage at 39%, but interest coverage at zero signals high financial risk.

3. Stock Volatility

Invitation Homes Inc.

- Beta of 0.83 indicates below-market volatility, offering relatively stable price movements.

Camden Property Trust

- Beta of 0.83 also reflects stable volatility, but higher P/E ratio increases valuation risk.

4. Regulatory & Legal

Invitation Homes Inc.

- Subject to residential rental regulations amid evolving tenant protection laws.

Camden Property Trust

- Faces multifamily housing regulatory scrutiny and urban zoning challenges.

5. Supply Chain & Operations

Invitation Homes Inc.

- Operations concentrated on maintenance and upgrades of single-family homes, vulnerable to labor cost inflation.

Camden Property Trust

- Development pipeline of 7 properties may face construction delays and cost overruns.

6. ESG & Climate Transition

Invitation Homes Inc.

- ESG focus on sustainable home features but risks from rising energy costs and climate regulations.

Camden Property Trust

- Recognized for workplace culture, but climate transition risks in urban properties remain significant.

7. Geopolitical Exposure

Invitation Homes Inc.

- Primarily US-focused, with exposure to domestic housing market cycles and interest rates.

Camden Property Trust

- Also US-focused, sensitive to regional economic shifts and urban policy changes.

Which company shows a better risk-adjusted profile?

Invitation Homes faces its biggest threat from moderate leverage combined with a distressed Altman Z-Score, indicating financial vulnerability. Camden Property Trust struggles most with interest coverage at zero, signaling acute liquidity risk. Invitation Homes shows a slightly better risk-adjusted profile due to stronger interest coverage and a very strong Piotroski score of 8 versus Camden’s 7. However, both operate in the distress zone for bankruptcy risk, warranting caution. The zero interest coverage for Camden is a red flag, underscoring urgent debt servicing challenges.

Final Verdict: Which stock to choose?

Invitation Homes Inc. (INVH) stands out with its superpower in operational efficiency and a robust cash flow profile. Its growing profitability signals improving fundamentals. However, a low current ratio is a point of vigilance, suggesting liquidity pressures. INVH suits investors targeting aggressive growth with a tolerance for operational risks.

Camden Property Trust (CPT) boasts a strategic moat grounded in recurring rental income and solid asset management. Its safety profile appears more conservative compared to INVH, supported by steadier cash conversion cycles. CPT fits well within a GARP (Growth at a Reasonable Price) portfolio, appealing to those valuing stability alongside growth.

If you prioritize operational efficiency and growth potential, INVH is the compelling choice due to its improving profitability and cash generation. However, if you seek stability and a defensive income stream, CPT offers better stability with a resilient moat, despite weaker short-term liquidity. Each aligns with distinct investor profiles, warranting careful risk consideration.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Invitation Homes Inc. and Camden Property Trust to enhance your investment decisions: