In today’s fast-evolving technology sector, Salesforce, Inc. (CRM) and Cadence Design Systems, Inc. (CDNS) stand out as leaders in software innovation, each targeting distinct yet overlapping markets. Salesforce excels in customer relationship management and enterprise cloud solutions, while Cadence focuses on cutting-edge electronic design automation tools essential for chip development. This article will help you discern which company presents a more compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Salesforce and Cadence Design Systems by providing an overview of these two companies and their main differences.

Salesforce Overview

Salesforce, Inc. specializes in customer relationship management (CRM) technology, aiming to connect companies and customers worldwide through its Customer 360 platform. The company offers a broad suite of services including sales, service, marketing, commerce, analytics, and integration tools designed to enhance customer engagement. Headquartered in San Francisco, Salesforce serves diverse industries such as financial services, healthcare, and manufacturing.

Cadence Design Systems Overview

Cadence Design Systems, Inc. provides software, hardware, and services focused on integrated circuit (IC) design and verification. Its offerings include functional verification platforms, digital IC design tools, custom IC simulation, and system analysis products for markets like 5G, aerospace, automotive, and healthcare. Based in San Jose, Cadence supports customers with IP products, education, and technical support to optimize chip design and manufacturing readiness.

Key similarities and differences

Both companies operate in the technology sector and develop application software solutions, targeting specialized business needs. Salesforce concentrates on customer experience and relationship management platforms, while Cadence focuses on electronic design automation for ICs and system design. Salesforce’s business model emphasizes cloud-based CRM and analytics, whereas Cadence’s model centers on software and hardware tools for chip design and verification across multiple high-tech industries.

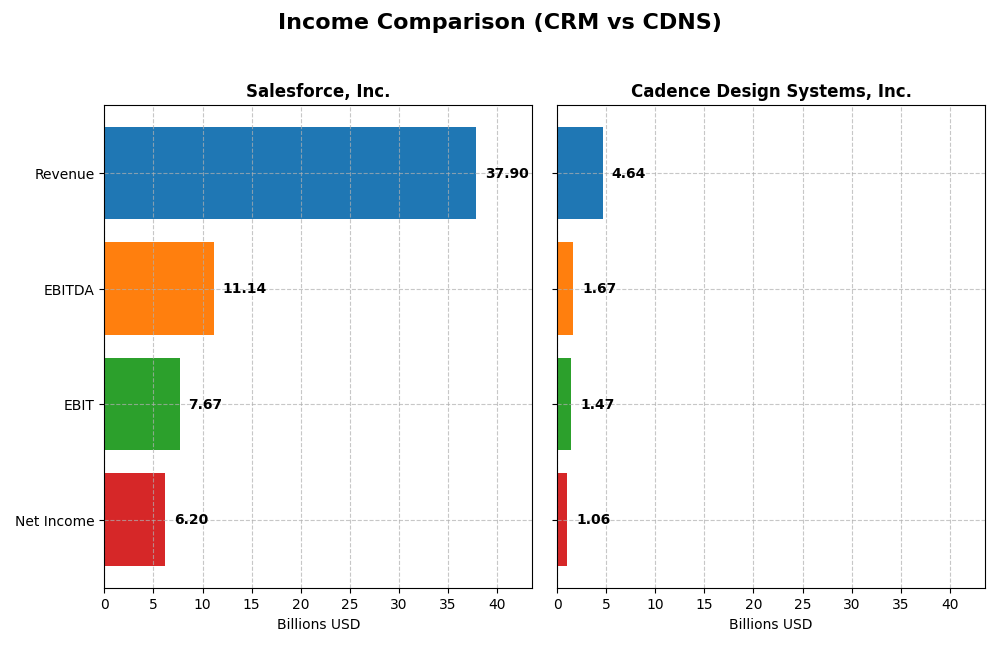

Income Statement Comparison

The table below compares key income statement metrics for Salesforce, Inc. and Cadence Design Systems, Inc. for their most recent fiscal years.

| Metric | Salesforce, Inc. (CRM) | Cadence Design Systems, Inc. (CDNS) |

|---|---|---|

| Market Cap | 219.4B | 86.2B |

| Revenue | 37.9B | 4.64B |

| EBITDA | 11.1B | 1.67B |

| EBIT | 7.67B | 1.47B |

| Net Income | 6.20B | 1.06B |

| EPS | 6.44 | 3.89 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Salesforce, Inc.

Salesforce’s revenue and net income showed robust growth from 2021 to 2025, with revenue increasing by 78.31% and net income by 52.19%. Gross and EBIT margins remained favorable, although net margin declined slightly over the period. In 2025, growth accelerated with an 8.72% revenue increase and a sharp 37.82% net margin improvement, indicating stronger profitability despite a minor overall net margin dip.

Cadence Design Systems, Inc.

Cadence demonstrated solid revenue and net income growth from 2020 to 2024, with gains of 72.99% and 78.7%, respectively. Gross and EBIT margins were strong and stable, supported by a favorable interest expense ratio. However, net margin contracted 10.66% in the most recent year, offset by steady revenue growth of 13.48%, while EPS growth remained flat, reflecting mixed margin dynamics in 2024.

Which one has the stronger fundamentals?

Both companies exhibit favorable fundamentals with strong revenue and net income growth over their respective periods. Salesforce shows higher overall margin stability and significant net margin and EPS improvements recently, while Cadence maintains superior gross and EBIT margins but faced margin pressure last year. Salesforce’s higher margin growth contrasts with Cadence’s steadier EPS growth, offering a nuanced view of financial strength.

Financial Ratios Comparison

Below is a comparative overview of the most recent key financial ratios for Salesforce, Inc. (CRM) and Cadence Design Systems, Inc. (CDNS) based on their fiscal year 2025 and 2024 data respectively.

| Ratios | Salesforce, Inc. (CRM) FY 2025 | Cadence Design Systems, Inc. (CDNS) FY 2024 |

|---|---|---|

| ROE | 10.13% | 22.58% |

| ROIC | 7.95% | 13.43% |

| P/E | 53.04 | 77.20 |

| P/B | 5.37 | 17.44 |

| Current Ratio | 1.06 | 2.93 |

| Quick Ratio | 1.06 | 2.74 |

| D/E (Debt-to-Equity) | 0.19 | 0.55 |

| Debt-to-Assets | 11.07% | 28.80% |

| Interest Coverage | 26.49 | 17.77 |

| Asset Turnover | 0.37 | 0.52 |

| Fixed Asset Turnover | 7.03 | 7.68 |

| Payout ratio | 24.80% | 0% |

| Dividend yield | 0.47% | 0% |

Interpretation of the Ratios

Salesforce, Inc.

Salesforce shows a slightly favorable ratio profile with strengths in debt management and interest coverage, but concerns remain with high price-to-earnings and price-to-book ratios, indicating valuation risks. The company pays dividends with a low yield of 0.47%, suggesting modest shareholder returns, and potential risks stem from its payout ratio and buybacks coverage by free cash flow.

Cadence Design Systems, Inc.

Cadence presents a favorable ratio stance, marked by strong profitability and liquidity ratios, including a high net margin and return on equity. Its lack of dividends reflects a reinvestment strategy focused on growth and innovation, prioritizing R&D over shareholder payouts, which aligns with its operational metrics and industry positioning.

Which one has the best ratios?

Cadence Design Systems exhibits a more favorable ratio profile overall, with higher profitability, better liquidity, and efficient asset use compared to Salesforce. While Salesforce maintains solid financial health, Cadence’s stronger returns and reinvestment approach position it as having superior financial ratios, despite both companies facing valuation challenges.

Strategic Positioning

This section compares the strategic positioning of Salesforce, Inc. and Cadence Design Systems, Inc., including market position, key segments, and exposure to technological disruption:

Salesforce, Inc.

- Leading CRM software provider with strong competitive pressure in application software

- Diversified revenue from Sales, Service, Marketing Clouds, Analytics, and Platform services

- Exposure to disruption through cloud computing, analytics, and platform innovation

Cadence Design Systems, Inc.

- Specialized in IC design software with moderate competitive pressure in software applications

- Concentrated revenue in product maintenance and technology services for IC design and verification

- Exposure to disruption through advances in IC design verification and system-level integration tools

Salesforce vs Cadence Positioning

Salesforce has a diversified portfolio across multiple cloud-based CRM segments, providing broad market coverage but facing intense competition. Cadence focuses on specialized IC design software, offering niche expertise but with narrower market scope and exposure to hardware design cycles.

Which has the best competitive advantage?

Cadence shows a slightly favorable moat with value creation despite declining profitability, indicating efficient capital use. Salesforce has a slightly unfavorable moat, shedding value but improving profitability, suggesting less sustainable competitive advantage currently.

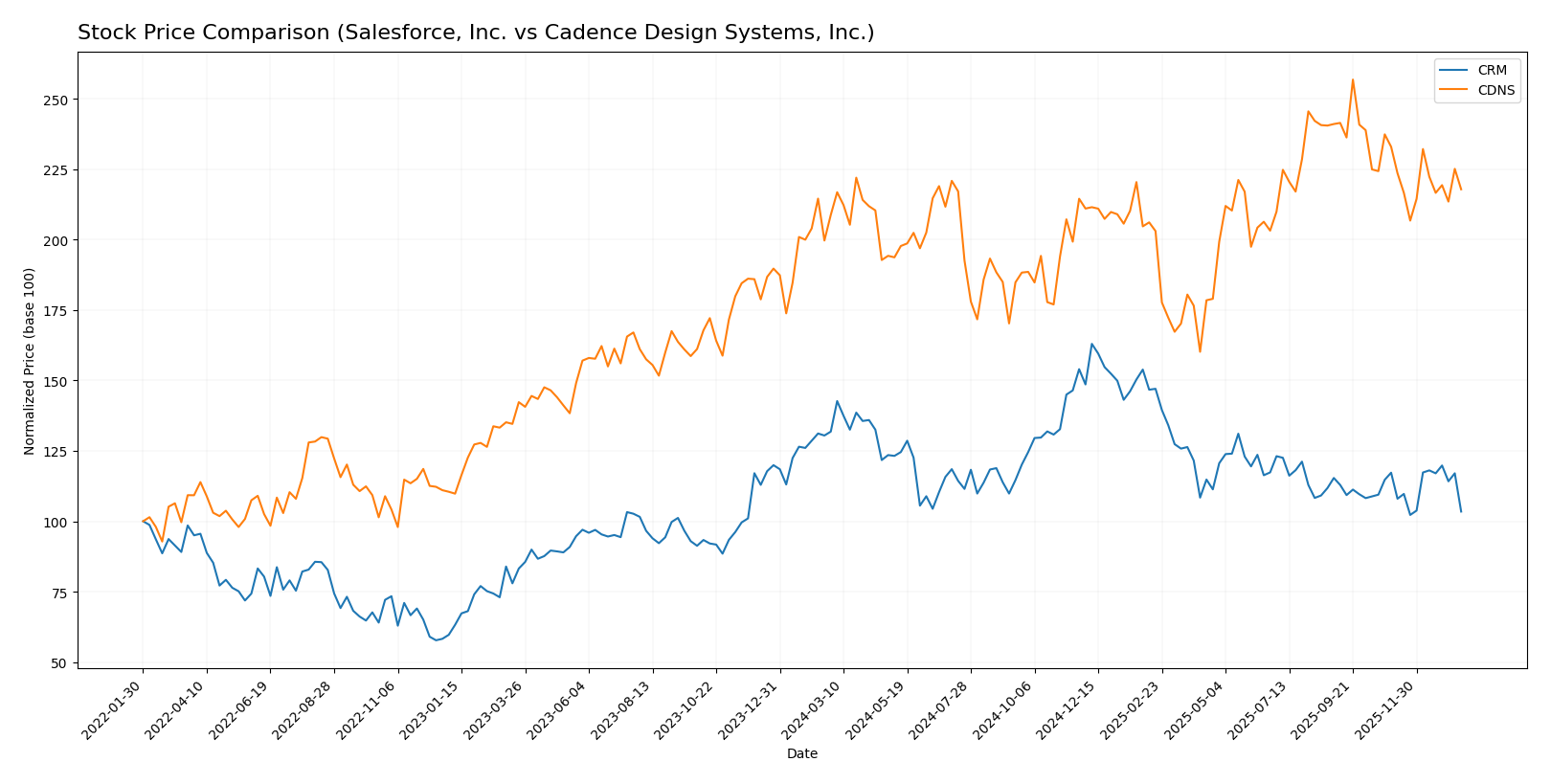

Stock Comparison

The stock price chart over the past 12 months reveals contrasting dynamics: Salesforce, Inc. (CRM) exhibited a pronounced bearish trend with accelerating decline, while Cadence Design Systems, Inc. (CDNS) showed a mild bullish trend with decelerating gains, both amid rising trading volumes.

Trend Analysis

Salesforce, Inc. (CRM) experienced a bearish trend over the past year with a -21.53% price decline, marked by accelerating downward momentum and high volatility (std deviation 31.78). Recent months show some deceleration in losses but remain negative (-11.77%).

Cadence Design Systems, Inc. (CDNS) recorded a bullish trend with a 4.35% gain over the year, though the uptrend slowed down (deceleration) and volatility was moderate (std deviation 29.12). The recent period shows a short-term negative trend (-6.48%).

Comparatively, Cadence Design Systems outperformed Salesforce with a positive annual return versus a significant loss, indicating stronger market performance despite recent short-term weakness.

Target Prices

The consensus target prices from verified analysts suggest positive upside potential for both Salesforce, Inc. and Cadence Design Systems, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Salesforce, Inc. | 400 | 250 | 324.17 |

| Cadence Design Systems, Inc. | 418 | 275 | 381 |

Analysts expect Salesforce’s price to rise significantly above the current 229.5 USD, while Cadence’s consensus target of 381 USD also indicates substantial potential upside from its current 316.5 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Salesforce, Inc. (CRM) and Cadence Design Systems, Inc. (CDNS):

Rating Comparison

CRM Rating

- Rating: B+, categorized as Very Favorable

- Discounted Cash Flow Score: 4, Favorable

- ROE Score: 4, Favorable

- ROA Score: 4, Favorable

- Debt To Equity Score: 3, Moderate

- Overall Score: 3, Moderate

CDNS Rating

- Rating: B, categorized as Very Favorable

- Discounted Cash Flow Score: 3, Moderate

- ROE Score: 4, Favorable

- ROA Score: 5, Very Favorable

- Debt To Equity Score: 2, Moderate

- Overall Score: 3, Moderate

Which one is the best rated?

Based on the provided data, CRM holds a slightly higher overall rating (B+) and a better discounted cash flow score compared to CDNS. However, CDNS outperforms CRM in return on assets and has a lower debt-to-equity score. Both have equal overall scores.

Scores Comparison

The scores comparison of Salesforce, Inc. and Cadence Design Systems, Inc. shows the following financial health indicators:

Salesforce Scores

- Altman Z-Score: 5.26, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial strength.

Cadence Design Scores

- Altman Z-Score: 14.51, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial strength.

Which company has the best scores?

Cadence Design Systems has a significantly higher Altman Z-Score than Salesforce, indicating a stronger financial stability. Both have equal Piotroski Scores, showing similar financial strength. Overall, Cadence shows the best scores based on this data.

Grades Comparison

Here is a detailed comparison of the latest grades provided by reputable grading companies for both Salesforce, Inc. and Cadence Design Systems, Inc.:

Salesforce, Inc. Grades

The following table summarizes recent grades from major financial institutions for Salesforce, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-09 |

| Citigroup | Maintain | Neutral | 2025-12-08 |

| DA Davidson | Maintain | Neutral | 2025-12-05 |

| Citizens | Maintain | Market Outperform | 2025-12-04 |

| Deutsche Bank | Maintain | Buy | 2025-12-04 |

| Wedbush | Maintain | Outperform | 2025-12-04 |

| Northland Capital Markets | Maintain | Market Perform | 2025-12-04 |

| Canaccord Genuity | Maintain | Buy | 2025-12-04 |

Salesforce’s grades predominantly range from Neutral to Buy/Outperform, indicating stable to positive analyst sentiment.

Cadence Design Systems, Inc. Grades

The table below presents the most recent grades from recognized financial institutions for Cadence Design Systems, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-12-22 |

| Wells Fargo | Maintain | Overweight | 2025-10-28 |

| Baird | Maintain | Outperform | 2025-10-28 |

| Needham | Maintain | Buy | 2025-10-28 |

| JP Morgan | Maintain | Overweight | 2025-10-28 |

| Oppenheimer | Maintain | Underperform | 2025-10-28 |

| Rosenblatt | Maintain | Neutral | 2025-10-28 |

| Rosenblatt | Maintain | Neutral | 2025-10-22 |

| Needham | Maintain | Buy | 2025-07-29 |

| Loop Capital | Maintain | Buy | 2025-07-29 |

Cadence’s grades are mostly Buy or Outperform, with some Neutral and one Underperform, showing a generally positive but slightly mixed analyst consensus.

Which company has the best grades?

Both companies have a consensus rating of “Buy,” but Salesforce shows a broader distribution from Neutral to strong Buy and Outperform grades, while Cadence has more concentrated Buy/Outperform ratings but also includes an Underperform. Investors may interpret Salesforce’s consistent but varied grades as moderate confidence, whereas Cadence’s grades suggest a stronger buy interest tempered by some caution.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of Salesforce, Inc. (CRM) and Cadence Design Systems, Inc. (CDNS) based on recent financial and strategic data.

| Criterion | Salesforce, Inc. (CRM) | Cadence Design Systems, Inc. (CDNS) |

|---|---|---|

| Diversification | Highly diversified with multiple cloud segments including Sales, Service, Marketing, and Platform generating $38B+ in 2025 revenue | Less diversified, mainly focused on product maintenance ($4.2B) and technology services ($0.4B) |

| Profitability | Moderate net margin (16.35%), neutral ROIC (7.95%) below WACC, indicating slight value destruction but with improving profitability | Higher net margin (22.74%), strong ROIC (13.43%) above WACC, indicating value creation despite declining ROIC |

| Innovation | Strong innovation focus on cloud platforms and analytics with growing revenue streams | Innovation focused on electronic design automation tools, steady product and maintenance revenue growth |

| Global presence | Extensive global footprint in enterprise cloud software | Global presence concentrated in semiconductor and software design markets |

| Market Share | Leading CRM and cloud platform provider with broad market penetration | Leading position in electronic design automation with a solid niche market share |

In summary, Salesforce offers strong diversification and innovation in cloud solutions but faces challenges with profitability efficiency. Cadence excels in profitability and niche market strength, although its ROIC trend is declining, signaling the need for cautious monitoring. Both companies present interesting investment profiles with distinct risk and growth dynamics.

Risk Analysis

Below is a comparison of key risks for Salesforce, Inc. (CRM) and Cadence Design Systems, Inc. (CDNS) based on the most recent data available:

| Metric | Salesforce, Inc. (CRM) | Cadence Design Systems, Inc. (CDNS) |

|---|---|---|

| Market Risk | Beta 1.27 – moderately sensitive to market swings | Beta 1.02 – near market average volatility |

| Debt level | Low leverage (D/E 0.19), favorable debt ratios | Moderate leverage (D/E 0.55), manageable debt |

| Regulatory Risk | Moderate – operates globally with potential compliance challenges | Moderate – global tech regulations impact |

| Operational Risk | High complexity in integrated CRM services and Slack platform | High complexity in IC design software and hardware |

| Environmental Risk | Moderate – tech sector impact, data center energy use | Moderate – tech industry standards and energy use |

| Geopolitical Risk | Moderate exposure due to global customer base | Moderate exposure, especially in semiconductor supply chain |

Salesforce’s moderate market risk and low debt level reduce financial vulnerability, but its high operational complexity and global regulatory environment remain notable risks. Cadence benefits from strong financial health but faces higher leverage and significant operational challenges amid evolving global semiconductor regulations. Both companies are in the safe zone regarding bankruptcy risk but require monitoring of geopolitical and regulatory shifts impacting technology sectors.

Which Stock to Choose?

Salesforce, Inc. (CRM) has shown a favorable income evolution with 8.72% revenue growth in 2025 and strong profitability metrics, including a 16.35% net margin. Its financial ratios are slightly favorable, reflecting low debt (net debt to EBITDA 0.23) and solid interest coverage, but some valuation ratios are unfavorable. The company’s rating is very favorable with a B+ score, while its MOAT evaluation is slightly unfavorable due to ROIC below WACC despite a growing ROIC trend.

Cadence Design Systems, Inc. (CDNS) exhibits a favorable income statement with 13.48% revenue growth in 2024 and higher profitability, including a 22.74% net margin. Its financial ratios are favorable overall, with moderate debt and strong liquidity ratios. The rating is very favorable with a B score, supported by excellent return on assets. The MOAT evaluation is slightly favorable, indicating value creation despite a declining ROIC trend.

Investors focused on growth might see Salesforce’s improving profitability and moderate valuation as attractive, while those prioritizing profitability and financial strength could find Cadence’s higher margins and liquidity more appealing. The ratings and income evaluations suggest Salesforce carries slightly more risk, whereas Cadence shows a stronger value creation profile but with some profitability challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Salesforce, Inc. and Cadence Design Systems, Inc. to enhance your investment decisions: