Investors often seek to balance innovation with market potential, and comparing leaders in the software application industry can reveal valuable insights. Cadence Design Systems, Inc. (CDNS) excels in advanced IC design and verification software, while Dayforce Inc (DAY) specializes in cloud-based human capital management solutions. Both companies drive innovation but target distinct segments within technology. In this article, I will help you determine which company presents the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Cadence Design Systems, Inc. and Dayforce Inc by providing an overview of these two companies and their main differences.

Cadence Design Systems, Inc. Overview

Cadence Design Systems, Inc. specializes in software, hardware, and services for integrated circuit (IC) design and verification worldwide. Its product suite includes functional verification platforms, digital IC design tools, custom IC simulation, and system design analysis. Cadence serves multiple markets such as 5G communications, aerospace, automotive, and healthcare, positioning itself as a critical provider in the semiconductor design industry.

Dayforce Inc Overview

Dayforce Inc operates as a human capital management (HCM) software provider offering a cloud platform that integrates human resources, payroll, benefits, workforce, and talent management. It targets businesses primarily in the US, Canada, and other international markets. Dayforce also delivers payroll services through Bureau solutions and caters to small businesses with its Powerpay product, emphasizing cloud-based HCM solutions.

Key similarities and differences

Both Cadence and Dayforce operate in the software application industry within the technology sector, focusing on specialized enterprise solutions. Cadence targets the semiconductor and electronics market with design and verification tools, while Dayforce concentrates on HCM software and payroll services. Their business models differ in end markets and product types, with Cadence focusing on IC design innovation and Dayforce on workforce management automation.

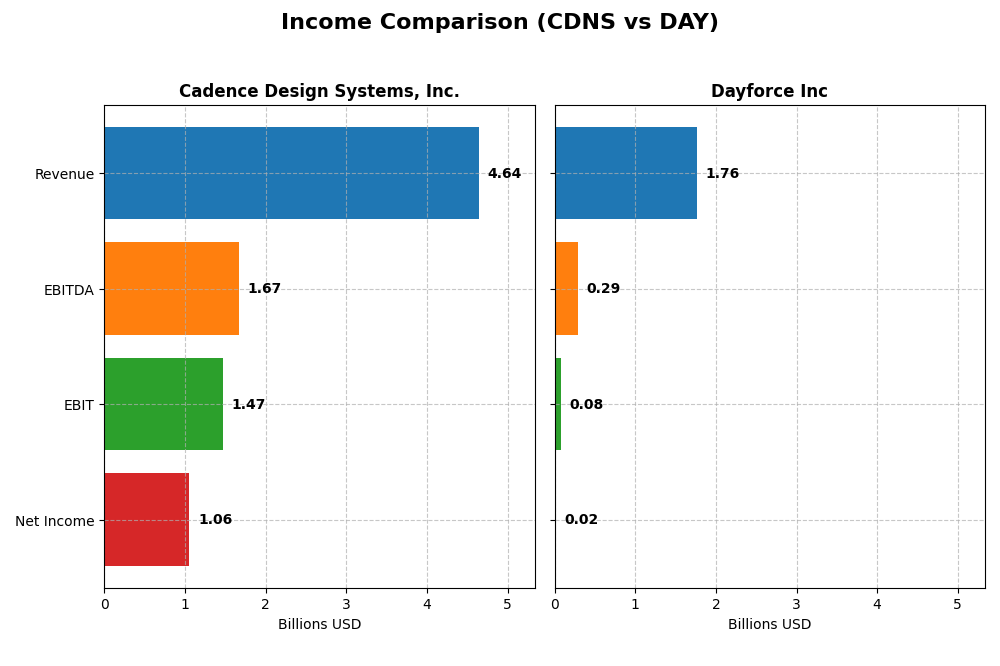

Income Statement Comparison

This table presents the key income statement metrics for Cadence Design Systems, Inc. and Dayforce Inc for the fiscal year 2024, allowing a direct financial performance comparison.

| Metric | Cadence Design Systems, Inc. (CDNS) | Dayforce Inc (DAY) |

|---|---|---|

| Market Cap | 86.4B | 11.1B |

| Revenue | 4.64B | 1.76B |

| EBITDA | 1.67B | 288M |

| EBIT | 1.47B | 78.2M |

| Net Income | 1.06B | 18.1M |

| EPS | 3.89 | 0.11 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Cadence Design Systems, Inc.

Cadence Design Systems has shown strong revenue and net income growth from 2020 to 2024, with revenue increasing nearly 73% and net income rising about 79%. Margins remain robust and stable, boasting an 86.05% gross margin and a 22.74% net margin in 2024. Despite a slight net margin decline last year, overall profitability improved, supported by a 13.48% revenue growth in 2024.

Dayforce Inc

Dayforce reported significant revenue growth over the 2020-2024 period, doubling its revenue with a 109% increase and a substantial 553% net income rise. However, margins are thinner, with a 46.14% gross margin and just over 1% net margin in 2024. The recent year saw a slowdown in profitability, with net margin and EPS declining sharply, despite a 16.27% revenue growth.

Which one has the stronger fundamentals?

Cadence Design Systems exhibits stronger fundamentals with consistently high margins and steady profitability growth over the years. Dayforce shows impressive growth in revenue and net income overall, but faces margin pressure and recent declines in profitability metrics. Cadence’s more favorable margin profile and stable earnings suggest a more resilient income statement performance.

Financial Ratios Comparison

The table below presents the latest available financial ratios for Cadence Design Systems, Inc. and Dayforce Inc, highlighting key performance and financial health indicators for 2024.

| Ratios | Cadence Design Systems, Inc. (CDNS) | Dayforce Inc (DAY) |

|---|---|---|

| ROE | 22.6% | 0.7% |

| ROIC | 13.4% | 1.3% |

| P/E | 77.2 | 633.3 |

| P/B | 17.4 | 4.5 |

| Current Ratio | 2.93 | 1.13 |

| Quick Ratio | 2.74 | 1.13 |

| D/E | 0.55 | 0.48 |

| Debt-to-Assets | 28.8% | 13.5% |

| Interest Coverage | 17.8 | 2.6 |

| Asset Turnover | 0.52 | 0.19 |

| Fixed Asset Turnover | 7.68 | 7.46 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Cadence Design Systems, Inc.

Cadence Design Systems shows strong profitability with a net margin of 22.74% and a high return on equity of 22.58%, indicating efficient capital use. Liquidity ratios are robust, with a current ratio of 2.93, reflecting good short-term financial health. However, valuation multiples like P/E at 77.2 and P/B at 17.44 appear overstretched. The company does not pay dividends, likely prioritizing reinvestment and growth.

Dayforce Inc

Dayforce exhibits weak profitability with a net margin of just 1.03% and a low return on equity of 0.71%, signaling limited earnings generation. Liquidity is moderate, with a current ratio of 1.13, while interest coverage is low at 1.93, raising concerns about debt servicing. Valuation multiples are very high (P/E of 633.29). The company pays no dividends, possibly due to reinvestment needs or growth phase priorities.

Which one has the best ratios?

Cadence Design Systems has the best ratios overall, showing a favorable balance of profitability, liquidity, and capital efficiency despite high valuation multiples. In contrast, Dayforce’s ratios indicate profitability and leverage challenges, leading to an unfavorable overall assessment relative to Cadence.

Strategic Positioning

This section compares the strategic positioning of Cadence Design Systems, Inc. (CDNS) and Dayforce Inc (DAY) including Market position, Key segments, and disruption:

Cadence Design Systems, Inc. (CDNS)

- Leading software provider in IC design and verification with strong market presence in technology sector.

- Key segments include software, hardware, services for IC design and verification; business driven by product and maintenance revenue of $4.2B in 2024.

- Exposure to disruption through advanced IC design technologies and verification platforms for evolving semiconductor needs.

Dayforce Inc (DAY)

- Focused on human capital management software with presence in US, Canada, and international markets.

- Key segments include cloud HCM platform and payroll solutions; recurring revenue of $1.5B in 2024.

- Exposure to cloud-based HCM software trends, adapting with growing ROIC despite current value destruction.

Cadence Design Systems, Inc. vs Dayforce Inc Positioning

Cadence shows a diversified technology portfolio focused on integrated circuit design and verification, generating higher revenues. Dayforce concentrates on cloud HCM software with growing profitability but currently lower market value and smaller scale.

Which has the best competitive advantage?

Cadence holds a slightly favorable moat with positive value creation despite declining profitability. Dayforce has a slightly unfavorable moat, destroying value but showing improving returns, indicating less competitive advantage currently.

Stock Comparison

The stock prices of Cadence Design Systems, Inc. (CDNS) and Dayforce Inc (DAY) over the past 12 months show contrasting trends, with CDNS exhibiting a moderate bullish movement while DAY reflects a bearish drift amid shifting trading volumes.

Trend Analysis

Cadence Design Systems, Inc. (CDNS) demonstrated a 4.59% price increase over the past year, indicating a bullish trend with deceleration. The stock ranged between 232.88 and 373.35, with recent weakening shown by a -6.27% change.

Dayforce Inc (DAY) showed a -3.16% price change over the same period, marking a bearish trend with deceleration. Its price fluctuated from 49.46 to 81.14, but recent weeks saw a slight positive movement of 0.61%.

Comparing the two, CDNS delivered the highest market performance with a 4.59% gain, outperforming DAY’s 3.16% decline over the past year.

Target Prices

The current analyst consensus provides a clear outlook on target prices for Cadence Design Systems, Inc. and Dayforce Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cadence Design Systems, Inc. | 418 | 275 | 381 |

| Dayforce Inc | 70 | 70 | 70 |

Analysts expect Cadence Design Systems’ stock to appreciate, with a consensus target of 381 versus the current price of 317.45 USD. Dayforce’s target price is stable at 70, slightly above its current 69.16 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cadence Design Systems, Inc. (CDNS) and Dayforce Inc (DAY):

Rating Comparison

CDNS Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: 3, moderate valuation.

- ROE Score: 4, favorable profitability from equity.

- ROA Score: 5, very favorable asset utilization.

- Debt To Equity Score: 2, moderate financial risk.

- Overall Score: 3, moderate overall financial standing.

DAY Rating

- Rating: C-, also described as very favorable by analysts.

- Discounted Cash Flow Score: 2, moderate valuation.

- ROE Score: 1, very unfavorable profitability from equity.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 2, moderate financial risk.

- Overall Score: 1, very unfavorable overall financial standing.

Which one is the best rated?

Based strictly on the provided data, CDNS holds stronger scores in ROE, ROA, and overall financial standing, making it better rated than DAY, which shows very unfavorable scores in key profitability metrics.

Scores Comparison

The comparison of company scores highlights their financial stability and strength evaluations:

CDNS Scores

- Altman Z-Score: 14.51, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

DAY Scores

- Altman Z-Score: 1.24, indicating distress zone with high bankruptcy risk.

- Piotroski Score: 5, classified as average financial health.

Which company has the best scores?

Based on provided data, CDNS shows significantly stronger financial stability with a high Altman Z-Score in the safe zone and a strong Piotroski score. DAY’s scores indicate financial distress and only average financial health.

Grades Comparison

The following presents a comparison of recent grades from verifiable grading companies for Cadence Design Systems, Inc. and Dayforce Inc.:

Cadence Design Systems, Inc. Grades

This table shows the latest ratings from reputable grading companies for Cadence Design Systems, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-12-22 |

| Wells Fargo | Maintain | Overweight | 2025-10-28 |

| Baird | Maintain | Outperform | 2025-10-28 |

| Needham | Maintain | Buy | 2025-10-28 |

| JP Morgan | Maintain | Overweight | 2025-10-28 |

| Oppenheimer | Maintain | Underperform | 2025-10-28 |

| Rosenblatt | Maintain | Neutral | 2025-10-28 |

| Rosenblatt | Maintain | Neutral | 2025-10-22 |

| Needham | Maintain | Buy | 2025-07-29 |

| Loop Capital | Maintain | Buy | 2025-07-29 |

Grades for Cadence Design Systems, Inc. show a strong tilt toward buy and outperform ratings, with few neutral and only one underperform, indicating a generally positive analyst stance.

Dayforce Inc Grades

This table presents recent ratings from verified grading companies for Dayforce Inc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Hold | 2025-10-30 |

| Stifel | Downgrade | Hold | 2025-09-19 |

| Citigroup | Downgrade | Neutral | 2025-09-17 |

| Wells Fargo | Upgrade | Equal Weight | 2025-08-22 |

| BMO Capital | Downgrade | Market Perform | 2025-08-22 |

| Keybanc | Downgrade | Sector Weight | 2025-08-22 |

| Needham | Downgrade | Hold | 2025-08-22 |

| Barclays | Maintain | Equal Weight | 2025-08-22 |

| Deutsche Bank | Maintain | Hold | 2025-08-22 |

| Jefferies | Maintain | Hold | 2025-08-21 |

Grades for Dayforce Inc reveal a predominance of hold and neutral ratings with multiple downgrades, reflecting a more cautious analyst view.

Which company has the best grades?

Cadence Design Systems, Inc. has received predominantly buy and outperform grades, while Dayforce Inc mainly holds neutral or hold ratings with some downgrades. This suggests Cadence may be viewed more favorably by analysts, potentially impacting investor sentiment and portfolio decisions accordingly.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Cadence Design Systems, Inc. (CDNS) and Dayforce Inc (DAY) based on their latest financial and operational data.

| Criterion | Cadence Design Systems, Inc. (CDNS) | Dayforce Inc (DAY) |

|---|---|---|

| Diversification | Moderate: Mainly software products & maintenance (4.2B USD in 2024), some technology services (428M USD) | Moderate: Focus on cloud recurring services (1.5B USD in 2024) and professional services (243M USD) |

| Profitability | Strong: Net margin 22.74%, ROE 22.58%, ROIC 13.43% | Weak: Net margin 1.03%, ROE 0.71%, ROIC 1.31% |

| Innovation | High: Consistent product development, good fixed asset turnover (7.68) | Improving: ROIC growth strong but overall profitability low |

| Global presence | Strong: Established global client base in electronic design automation | Moderate: Growing cloud service adoption, expanding footprint |

| Market Share | Strong in its niche segment, reflected by favorable financial ratios and value creation | Smaller share, struggling with profitability but improving operational metrics |

Key takeaways: Cadence Design Systems demonstrates robust profitability and value creation despite a slight decline in ROIC, supported by strong innovation and global presence. Dayforce faces profitability challenges but shows promising ROIC growth and expanding cloud services, indicating potential for future improvement.

Risk Analysis

Below is a summary table of key risk factors for Cadence Design Systems, Inc. (CDNS) and Dayforce Inc. (DAY) based on the most recent 2024 data:

| Metric | Cadence Design Systems, Inc. (CDNS) | Dayforce Inc. (DAY) |

|---|---|---|

| Market Risk | Moderate (Beta 1.02) | Elevated (Beta 1.18) |

| Debt level | Moderate (Debt/Equity 0.55) | Low (Debt/Equity 0.48) |

| Regulatory Risk | Moderate (Tech sector compliance) | Moderate (HCM software sector) |

| Operational Risk | Low (Strong operational metrics) | Moderate (Lower profitability) |

| Environmental Risk | Low (Tech industry standard) | Low (Cloud software focus) |

| Geopolitical Risk | Moderate (Global supply chains) | Moderate (International presence) |

The most impactful risks are market volatility for Dayforce, given its higher beta and weak profitability, and Cadence’s high valuation ratios which suggest vulnerability to market corrections. Dayforce’s Altman Z-Score signals financial distress risk, while Cadence remains in a safe zone financially. Investors should exercise caution with Dayforce due to weak earnings and coverage metrics.

Which Stock to Choose?

Cadence Design Systems, Inc. (CDNS) shows a favorable income evolution with 13.48% revenue growth in 2024, strong profitability (22.74% net margin), and solid financial ratios including a 22.58% ROE and a low debt-to-assets ratio of 28.8%. Its credit rating is very favorable.

Dayforce Inc (DAY) reports a favorable revenue growth of 16.27% in 2024 but struggles with low profitability, evidenced by a 1.03% net margin and weak ROE at 0.71%. Its financial ratios are mostly unfavorable despite a slightly favorable debt profile. The rating is very favorable overall but with mixed financial health scores.

Investors focused on consistent profitability and value creation might find CDNS more favorable due to its strong income statement and financial ratios. Conversely, those inclined towards growth potential and improving profitability trends could view DAY as a developing opportunity, considering its rising ROIC despite current value destruction.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cadence Design Systems, Inc. and Dayforce Inc to enhance your investment decisions: