Investors seeking growth in the technology sector often weigh options between innovative software powerhouses. Cadence Design Systems, Inc. (CDNS) specializes in integrated circuit design tools and verification, serving critical industries like 5G and aerospace. Datadog, Inc. (DDOG), on the other hand, leads in cloud infrastructure monitoring and analytics, enabling real-time observability for enterprises. This article will help you decide which company aligns best with your investment goals.

Table of contents

Companies Overview

I will begin the comparison between Cadence Design Systems, Inc. and Datadog, Inc. by providing an overview of these two companies and their main differences.

Cadence Design Systems, Inc. Overview

Cadence Design Systems, Inc. is a technology firm specializing in software, hardware, services, and reusable integrated circuit design blocks. It offers comprehensive solutions for functional verification, digital IC design, physical implementation, and custom IC design, serving markets such as 5G communications, aerospace, automotive, industrial, and computing. Founded in 1987, the company is headquartered in San Jose, CA, with a market cap of approximately 86.4B USD.

Datadog, Inc. Overview

Datadog, Inc. is a technology company providing a SaaS monitoring and analytics platform for developers, IT operations, and business users globally. Its platform integrates infrastructure and application performance monitoring, log management, security monitoring, and incident management, delivering real-time observability across cloud environments. Incorporated in 2010 and based in New York City, Datadog has a market cap of about 41.7B USD.

Key similarities and differences

Both companies operate in the software application sector and offer technology solutions focused on improving operational efficiency and performance monitoring. Cadence emphasizes hardware design automation and integrated circuit verification, catering to semiconductor and electronics industries. In contrast, Datadog focuses on cloud-based monitoring and analytics for IT infrastructure and application performance. Their business models differ in product scope but share a reliance on software innovation to serve diverse technology markets.

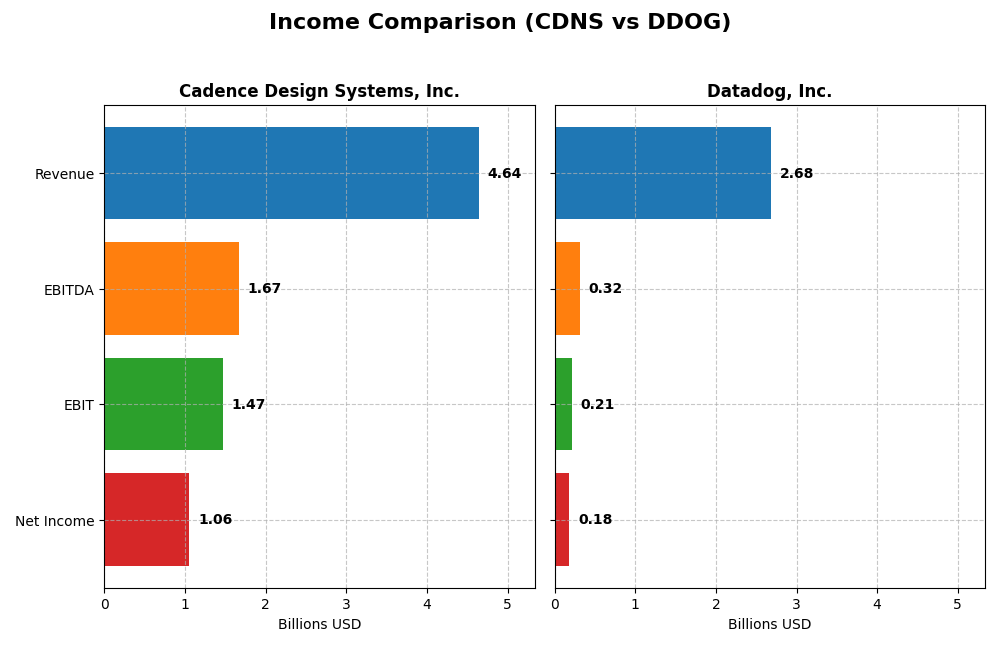

Income Statement Comparison

This table compares the key income statement metrics for Cadence Design Systems, Inc. and Datadog, Inc. for the fiscal year 2024, illustrating their financial performance and profitability.

| Metric | Cadence Design Systems, Inc. | Datadog, Inc. |

|---|---|---|

| Market Cap | 86.4B | 41.7B |

| Revenue | 4.64B | 2.68B |

| EBITDA | 1.67B | 318M |

| EBIT | 1.47B | 211M |

| Net Income | 1.06B | 184M |

| EPS | 3.89 | 0.55 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Cadence Design Systems, Inc.

Cadence Design Systems, Inc. displayed consistent revenue growth from $2.68B in 2020 to $4.64B in 2024, with net income rising from $590M to $1.06B over the same period. Margins remained strong and stable, with a gross margin of 86.05% and net margin of 22.74% in 2024. The latest year showed solid revenue growth of 13.48%, though net margin slightly declined by 10.66%.

Datadog, Inc.

Datadog, Inc. experienced rapid revenue expansion, jumping from $603M in 2020 to $2.68B in 2024, with net income shifting from a loss of $25M to a profit of $184M. Gross margin stayed favorable at 80.76%, while EBIT margin was moderate at 7.86% in 2024. The most recent year reflected strong growth, including a 26.12% revenue increase and substantial improvement in net margin by 199.98%.

Which one has the stronger fundamentals?

Cadence Design Systems offers strong, stable profitability with consistently high margins and steady growth, reflecting mature business fundamentals. Datadog shows impressive high growth and margin expansion from a smaller base, with improving profitability but lower absolute margins. Both show favorable income statements, with Cadence excelling in margin stability and Datadog in growth momentum.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Cadence Design Systems, Inc. (CDNS) and Datadog, Inc. (DDOG) based on their most recent fiscal year data (2024).

| Ratios | Cadence Design Systems, Inc. (CDNS) | Datadog, Inc. (DDOG) |

|---|---|---|

| ROE | 22.6% | 6.8% |

| ROIC | 13.4% | 1.1% |

| P/E | 77.2 | 261.4 |

| P/B | 17.4 | 17.7 |

| Current Ratio | 2.93 | 2.64 |

| Quick Ratio | 2.74 | 2.64 |

| D/E | 0.55 | 0.68 |

| Debt-to-Assets | 28.8% | 31.8% |

| Interest Coverage | 17.8 | 7.7 |

| Asset Turnover | 0.52 | 0.46 |

| Fixed Asset Turnover | 7.68 | 6.72 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Cadence Design Systems, Inc.

Cadence exhibits strong profitability ratios including a net margin of 22.74% and ROE of 22.58%, indicating efficient earnings generation. Liquidity ratios are favorable, with a current ratio of 2.93 and quick ratio of 2.74. However, valuation metrics like P/E at 77.2 and P/B at 17.44 are unfavorable, suggesting a high market price relative to earnings and book value. The company does not pay dividends, reflecting a reinvestment strategy to support growth and innovation.

Datadog, Inc.

Datadog shows weaker profitability with a net margin of 6.85% and ROE of 6.77%, both less favorable compared to peers. Liquidity is adequate, with current and quick ratios at 2.64, but asset turnover is unfavorable at 0.46, indicating less efficient asset use. High valuation multiples, including a P/E of 261.42 and P/B of 17.7, may reflect growth expectations. No dividends are paid, consistent with reinvestment focus in R&D and expansion efforts.

Which one has the best ratios?

Cadence Design Systems presents a more favorable overall ratio profile, with stronger profitability and liquidity metrics and a balanced leverage position. Datadog’s ratios are mixed, with weaker returns and efficiency but solid liquidity. While Cadence’s valuation ratios are high, its financial health indicators compare more positively against Datadog’s slightly unfavorable ratio set.

Strategic Positioning

This section compares the strategic positioning of Cadence Design Systems, Inc. and Datadog, Inc., including market position, key segments, and exposure to technological disruption:

Cadence Design Systems, Inc.

- Established market leader in software for IC design with moderate competitive pressure.

- Key segments: IC design software, functional verification, custom IC design, and IP products.

- Exposure to disruption through evolving semiconductor and design technologies.

Datadog, Inc.

- Growing player in cloud monitoring software facing strong competition.

- Key segments: cloud monitoring, application performance, log, and security monitoring.

- Exposure to disruption from fast-changing cloud and SaaS technologies.

Cadence Design Systems, Inc. vs Datadog, Inc. Positioning

Cadence has a diversified portfolio across semiconductor design and verification, while Datadog focuses on cloud-based monitoring solutions. Cadence’s broad product range supports multiple technology markets; Datadog’s concentration offers agility in cloud observability but with narrower scope.

Which has the best competitive advantage?

Cadence is creating value with a slightly favorable moat despite declining profitability, reflecting efficient capital use. Datadog is shedding value but shows improving profitability, indicating an emerging but less stable competitive advantage.

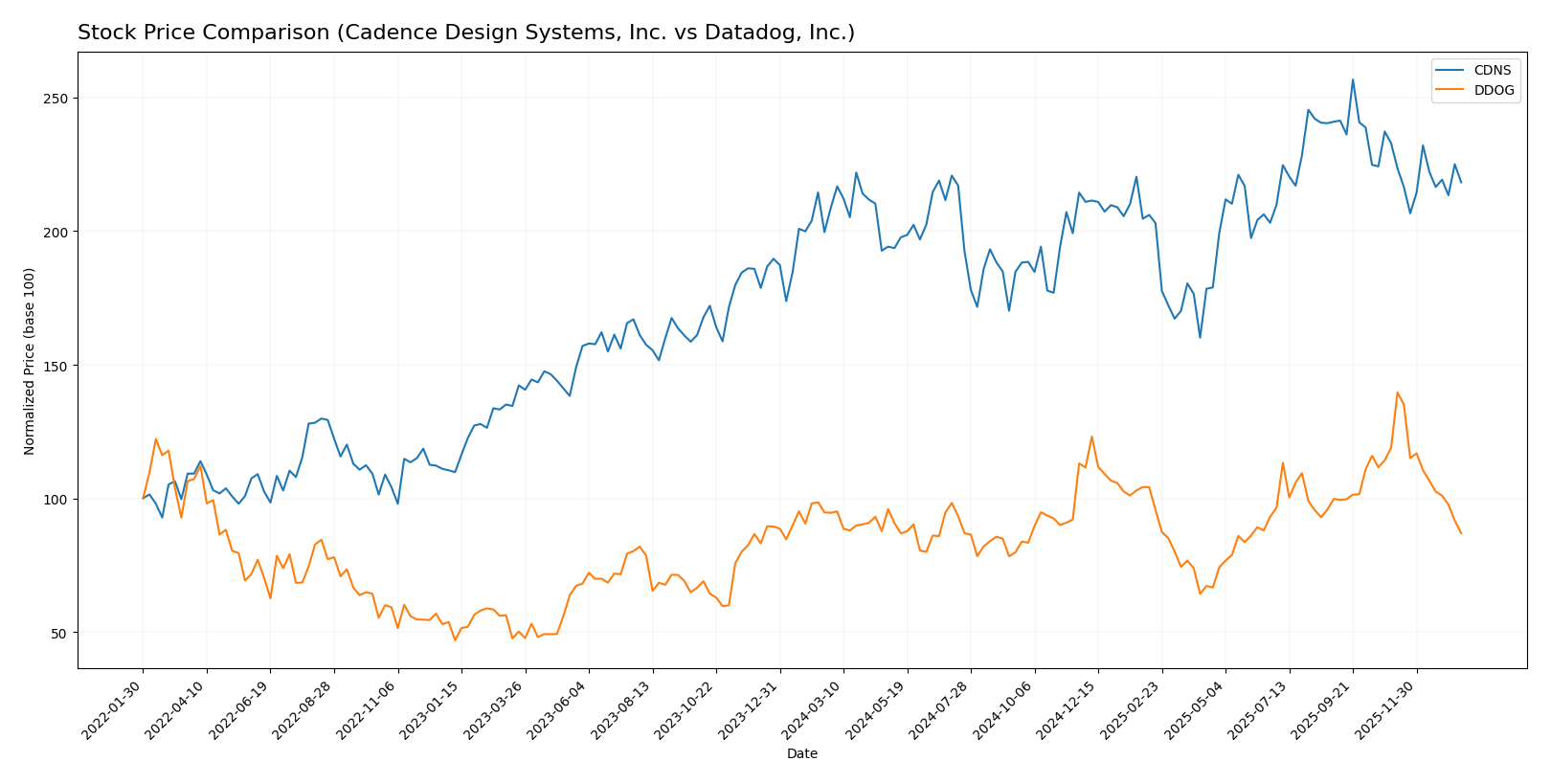

Stock Comparison

The stock prices of Cadence Design Systems, Inc. (CDNS) and Datadog, Inc. (DDOG) show contrasting trajectories over the past 12 months, with significant changes in trading dynamics and recent downward pressure on both.

Trend Analysis

Cadence Design Systems, Inc. (CDNS) exhibited a bullish trend over the past year with a 4.59% price increase, though the upward momentum decelerated. The stock reached a high of 373.35 and a low of 232.88, with a standard deviation of 29.12. Recently, CDNS faced a 6.27% decline, indicating a short-term bearish phase.

Datadog, Inc. (DDOG) experienced a bearish trend over the same period, with an 8.1% price decrease and decelerating downside momentum. The stock’s volatility was moderate, with a 18.63 standard deviation, hitting a high of 191.24 and a low of 87.93. The recent trend shows a sharper decline of 26.9%, reflecting increased selling pressure.

Comparing both stocks, Cadence Design Systems delivered the highest market performance over the past year, showing positive overall growth, whereas Datadog’s stock price declined significantly.

Target Prices

The current analyst consensus shows promising upside potential for both Cadence Design Systems, Inc. and Datadog, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cadence Design Systems, Inc. | 418 | 275 | 381 |

| Datadog, Inc. | 215 | 105 | 177.67 |

Analysts expect Cadence’s stock to trade significantly above its current price of $317.45, while Datadog shows upside potential compared to its current price of $119.02. Both stocks reflect positive market expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cadence Design Systems, Inc. (CDNS) and Datadog, Inc. (DDOG):

Rating Comparison

CDNS Rating

- Rating: B, classified as Very Favorable.

- Discounted Cash Flow Score: 3, Moderate valuation outlook.

- ROE Score: 4, indicating favorable efficiency in profit generation.

- ROA Score: 5, very favorable asset utilization.

- Debt To Equity Score: 2, moderate financial risk.

- Overall Score: 3, moderate overall financial standing.

DDOG Rating

- Rating: C+, classified as Very Favorable.

- Discounted Cash Flow Score: 4, Favorable valuation outlook.

- ROE Score: 2, indicating moderate profit generation efficiency.

- ROA Score: 3, moderate asset utilization.

- Debt To Equity Score: 2, moderate financial risk.

- Overall Score: 2, moderate overall financial standing.

Which one is the best rated?

Based on the provided data, CDNS holds a better overall rating of B compared to DDOG’s C+. CDNS also scores higher in ROE and ROA, reflecting stronger profitability and asset use, while both share moderate debt risk.

Scores Comparison

The scores comparison between Cadence Design Systems, Inc. and Datadog, Inc. is as follows:

Cadence Design Systems Scores

- Altman Z-Score: 14.51, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Datadog Scores

- Altman Z-Score: 11.37, also in the safe zone with low bankruptcy risk.

- Piotroski Score: 6, classified as average financial health.

Which company has the best scores?

Cadence Design Systems shows a higher Altman Z-Score and a stronger Piotroski Score than Datadog. Based strictly on these scores, Cadence demonstrates better financial stability and strength.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Cadence Design Systems, Inc. and Datadog, Inc.:

Cadence Design Systems, Inc. Grades

The following table shows the recent grades from reliable grading companies for Cadence Design Systems, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-12-22 |

| Wells Fargo | Maintain | Overweight | 2025-10-28 |

| Baird | Maintain | Outperform | 2025-10-28 |

| Needham | Maintain | Buy | 2025-10-28 |

| JP Morgan | Maintain | Overweight | 2025-10-28 |

| Oppenheimer | Maintain | Underperform | 2025-10-28 |

| Rosenblatt | Maintain | Neutral | 2025-10-28 |

| Rosenblatt | Maintain | Neutral | 2025-10-22 |

| Needham | Maintain | Buy | 2025-07-29 |

| Loop Capital | Maintain | Buy | 2025-07-29 |

Overall, Cadence Design Systems’ grades predominantly reflect positive ratings with a consistent “Buy” and “Overweight” consensus, tempered by a single “Underperform” and some “Neutral” ratings.

Datadog, Inc. Grades

Below is the recent grading data from established grading firms for Datadog, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Hold | 2026-01-07 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| Truist Securities | Maintain | Hold | 2025-11-07 |

| DA Davidson | Maintain | Buy | 2025-11-07 |

Datadog, Inc. shows a strong pattern of positive ratings, including multiple “Overweight” and “Buy” grades, with some “Hold” ratings and a recent upgrade to “Overweight.”

Which company has the best grades?

Datadog, Inc. has received a higher number of “Overweight” and “Buy” ratings, including a recent upgrade, compared to Cadence Design Systems, which has more mixed ratings including “Neutral” and “Underperform.” This suggests investors might view Datadog as having stronger near-term growth prospects or momentum, while Cadence displays a more conservative but stable outlook.

Strengths and Weaknesses

Below is a comparative overview of Cadence Design Systems, Inc. (CDNS) and Datadog, Inc. (DDOG) based on key financial and strategic criteria as of 2026.

| Criterion | Cadence Design Systems, Inc. (CDNS) | Datadog, Inc. (DDOG) |

|---|---|---|

| Diversification | Moderate: Primarily software and technology services with growing product maintenance revenue (4.2B USD in 2024) | Limited: Focused on cloud monitoring and analytics platforms |

| Profitability | Strong: Net margin 22.74%, ROIC 13.43%, creating value but with declining ROIC trend | Weak: Net margin 6.85%, ROIC 1.07%, currently shedding value but improving profitability |

| Innovation | Solid: Continuous product updates and technology services growth | High: Rapidly growing ROIC trend reflects innovation efforts |

| Global presence | Established global footprint in semiconductor and software sectors | Expanding global reach in cloud services |

| Market Share | Significant in EDA software market | Growing in cloud monitoring but still smaller than CDNS |

Key takeaways: Cadence excels in profitability and value creation, though its ROIC is declining, signaling caution. Datadog shows promising growth and innovation with improving profitability but remains unprofitable overall. Investors should weigh stability vs growth potential carefully.

Risk Analysis

Below is a comparative table summarizing key risk factors for Cadence Design Systems, Inc. (CDNS) and Datadog, Inc. (DDOG) based on the latest 2024 data.

| Metric | Cadence Design Systems, Inc. (CDNS) | Datadog, Inc. (DDOG) |

|---|---|---|

| Market Risk | Moderate beta of 1.022, sensitive to tech sector swings | Higher beta of 1.263, more volatile in market cycles |

| Debt level | Moderate with a debt-to-equity (D/E) of 0.55, favorable debt-to-assets at 28.8% | Slightly higher leverage, D/E of 0.68, debt-to-assets neutral at 31.84% |

| Regulatory Risk | Medium, typical for US-based software companies | Medium, with increasing scrutiny on cloud data platforms |

| Operational Risk | Low, strong product diversity and solid operational metrics | Moderate, reliant on cloud infrastructure and SaaS platform stability |

| Environmental Risk | Low, technology sector with limited direct impact | Low, focus on software with minimal environmental footprint |

| Geopolitical Risk | Moderate, exposure to global customers but US-based | Moderate, international presence with some geopolitical sensitivities |

The most impactful risks include market volatility and regulatory pressures, particularly for Datadog due to its higher beta and cloud-based business model. Cadence’s moderate debt and strong operational performance reduce financial risk, while Datadog’s higher leverage and valuation multiples warrant caution. Both companies remain in the safe zone for bankruptcy risk, but investors should monitor market and regulatory developments closely.

Which Stock to Choose?

Cadence Design Systems, Inc. (CDNS) shows favorable income evolution with 13.48% revenue growth in 2024 and strong profitability, including a 22.74% net margin. Its financial ratios are largely favorable, reflecting solid returns and manageable debt levels, supported by a very favorable B rating.

Datadog, Inc. (DDOG) exhibits rapid income growth, with 26.12% revenue increase and a 6.85% net margin, but its profitability and financial ratios are mixed, with several unfavorable metrics and a slightly unfavorable moat status, though it holds a favorable C+ rating.

Investors seeking stability and strong financial health might find CDNS more aligned with their profile, while those focusing on high growth potential despite valuation and profitability challenges could see DDOG as more appealing; overall, the ratings and income evaluations suggest differing risk-return trade-offs.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cadence Design Systems, Inc. and Datadog, Inc. to enhance your investment decisions: