Home > Comparison > Industrials > EXPD vs CHRW

The strategic rivalry between Expeditors International of Washington, Inc. and C.H. Robinson Worldwide, Inc. shapes the competitive landscape of the integrated freight and logistics sector. Expeditors operates as a global, asset-light logistics provider emphasizing air and ocean freight consolidation. In contrast, C.H. Robinson leverages a broad transportation brokerage network paired with specialized produce logistics. This analysis will identify which business model delivers superior risk-adjusted returns for a diversified industrials portfolio.

Table of contents

Companies Overview

Expeditors and C.H. Robinson anchor the global integrated freight and logistics sector with distinct market footprints.

Expeditors International of Washington, Inc.: Global Logistics Integrator

Expeditors leads as a logistics service provider focused on air, ocean freight, and customs brokerage. Its revenue depends heavily on supply chain solutions, including freight consolidation and specialized cargo tracking. In 2026, it prioritizes enhancing trade compliance and optimization services globally to strengthen operational efficiency.

C.H. Robinson Worldwide, Inc.: Freight and Produce Logistics Specialist

C.H. Robinson commands a vast network offering truckload, intermodal, and global forwarding services. Its core revenue derives from freight brokerage and value-added logistics, including fresh produce distribution under Robinson Fresh. The company’s 2026 strategy emphasizes expanding managed transportation services and leveraging contractual ties with 85,000 carriers worldwide.

Strategic Collision: Similarities & Divergences

Both companies operate in integrated logistics but diverge sharply in approach. Expeditors leans on a technology-driven supply chain platform, while C.H. Robinson builds scale via extensive carrier contracts and diversified freight brokerage. They compete primarily in global freight forwarding and managed transportation services. Their investment profiles differ: Expeditors bets on operational excellence and compliance, C.H. Robinson on network breadth and service diversification.

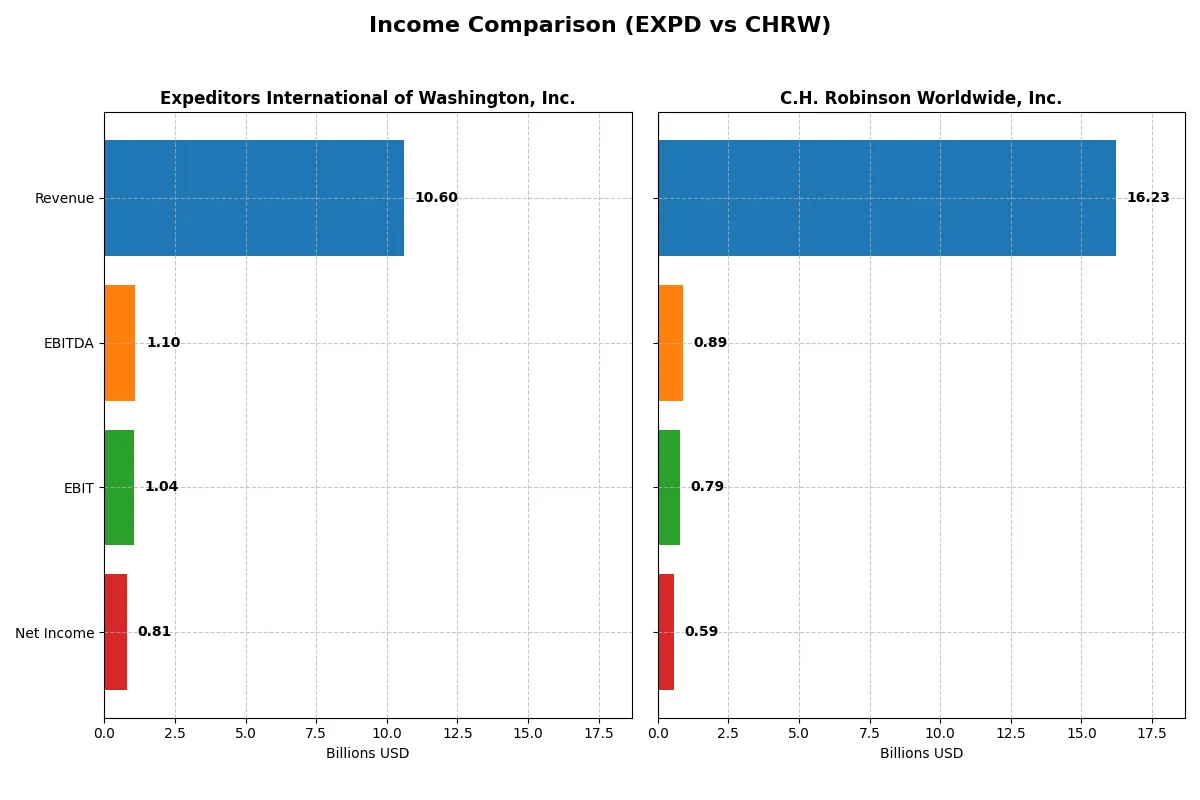

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Expeditors International of Washington, Inc. (EXPD) | C.H. Robinson Worldwide, Inc. (CHRW) |

|---|---|---|

| Revenue | 10.6B | 17.7B |

| Cost of Revenue | 9.3B | 16.4B |

| Operating Expenses | 308M | 640M |

| Gross Profit | 1.3B | 1.3B |

| EBITDA | 1.1B | 766M |

| EBIT | 1.0B | 669M |

| Interest Expense | 0 | 90M |

| Net Income | 810M | 466M |

| EPS | 5.75 | 3.89 |

| Fiscal Year | 2024 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable corporate engine over recent years.

Expeditors International of Washington, Inc. Analysis

Expeditors shows steady revenue growth, reaching $10.6B in 2024, with net income climbing to $810M. Its gross margin holds firm near 12.7%, and net margin stays favorable at 7.6%. In 2024, Expeditors exhibits strong earnings momentum, with EPS up 14%, underpinned by disciplined cost control and solid operating leverage.

C.H. Robinson Worldwide, Inc. Analysis

C.H. Robinson’s revenue declines to $16.2B in 2025 from a higher base, with net income at $587M. Gross margin remains neutral at 8.4%, while net margin is weaker at 3.6%. Despite top-line pressures, the company improves EBIT by 17% and net margin by 38% in the latest year, signaling improved profitability efficiency amid a challenging revenue environment.

Margin Strength vs. Revenue Resilience

Expeditors leads with consistent revenue growth and higher net margins, reflecting superior profitability and operational discipline. C.H. Robinson faces top-line contraction but boosts margins through expense management. For investors prioritizing stable profit expansion, Expeditors presents a more attractive profile, while C.H. Robinson appeals to those focused on margin recovery despite shrinking sales.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Expeditors International of Washington, Inc. (EXPD) | C.H. Robinson Worldwide, Inc. (CHRW) |

|---|---|---|

| ROE | 36.4% | 27.0% |

| ROIC | 27.6% | 15.4% |

| P/E | 19.3 | 26.6 |

| P/B | 7.03 | 7.19 |

| Current Ratio | 1.77 | 1.28 |

| Quick Ratio | 1.77 | 1.28 |

| D/E | 0.256 | 1.01 |

| Debt-to-Assets | 11.97% | 32.86% |

| Interest Coverage | 0 (not available) | 7.44 |

| Asset Turnover | 2.23 | 3.35 |

| Fixed Asset Turnover | 10.59 | 38.37 |

| Payout Ratio | 25.2% | 63.3% |

| Dividend Yield | 1.31% | 2.38% |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, uncovering hidden risks and highlighting operational excellence that raw numbers alone cannot reveal.

Expeditors International of Washington, Inc.

Expeditors demonstrates robust profitability with a 36.4% ROE and a strong 27.6% ROIC, indicating efficient capital use. The valuation appears fair, with a P/E of 19.3 suggesting the stock is reasonably priced. Shareholders benefit from a moderate 1.31% dividend yield, reflecting balanced capital allocation between returns and growth.

C.H. Robinson Worldwide, Inc.

C.H. Robinson shows solid but lower profitability, with a 27.0% ROE and 15.4% ROIC, signaling decent efficiency. However, its P/E of 26.6 marks it as relatively expensive. The company offers a higher 2.38% dividend yield, emphasizing shareholder income over aggressive reinvestment in growth initiatives.

Valuation Discipline vs. Income Focus

Expeditors balances superior operational returns with a reasonable valuation, reducing exposure to valuation risk. C.H. Robinson trades at a premium but rewards investors with higher dividends. Expeditors fits investors prioritizing growth and efficiency, while C.H. Robinson suits those seeking income and stability.

Which one offers the Superior Shareholder Reward?

I see Expeditors International (EXPD) and C.H. Robinson (CHRW) pursue distinct distribution strategies. EXPD yields ~1.3% with a conservative 25% payout ratio, funding buybacks and generating strong free cash flow (4.8/share). CHRW offers a higher 2.4% yield but a heavy 63% payout ratio, stretching cash flow coverage and leaning on debt. EXPD’s balanced dividend and steady buybacks signal more sustainable total returns in 2026. I conclude EXPD delivers a superior shareholder reward profile, blending yield, buybacks, and financial prudence.

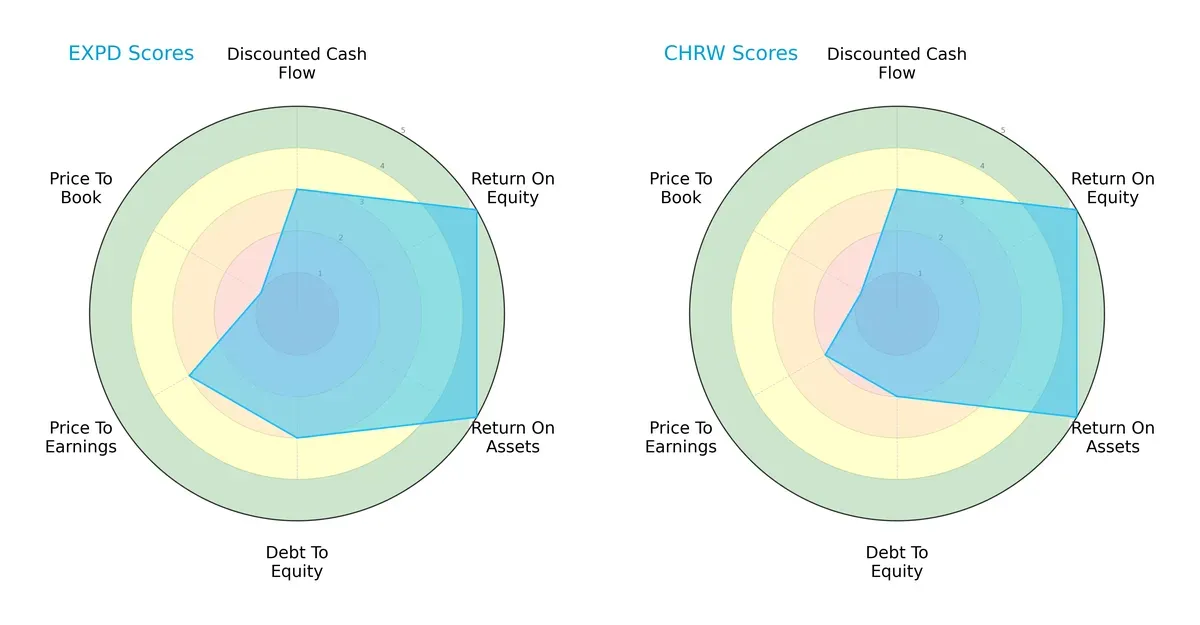

Comparative Score Analysis: The Strategic Profile

The radar chart exposes the core financial DNA and trade-offs underpinning Expeditors International and C.H. Robinson’s strategies:

Expeditors shows a more balanced profile with strong ROE and ROA scores (5 each) and moderate DCF and debt-to-equity scores (3 each). C.H. Robinson matches Expeditors on ROE and ROA but reveals a slightly weaker debt-to-equity score (2) and lower valuation metrics (P/E and P/B scores at 2 and 1, respectively). Expeditors relies less on leverage and maintains a more favorable overall score (4 vs. 3), suggesting stronger capital allocation discipline.

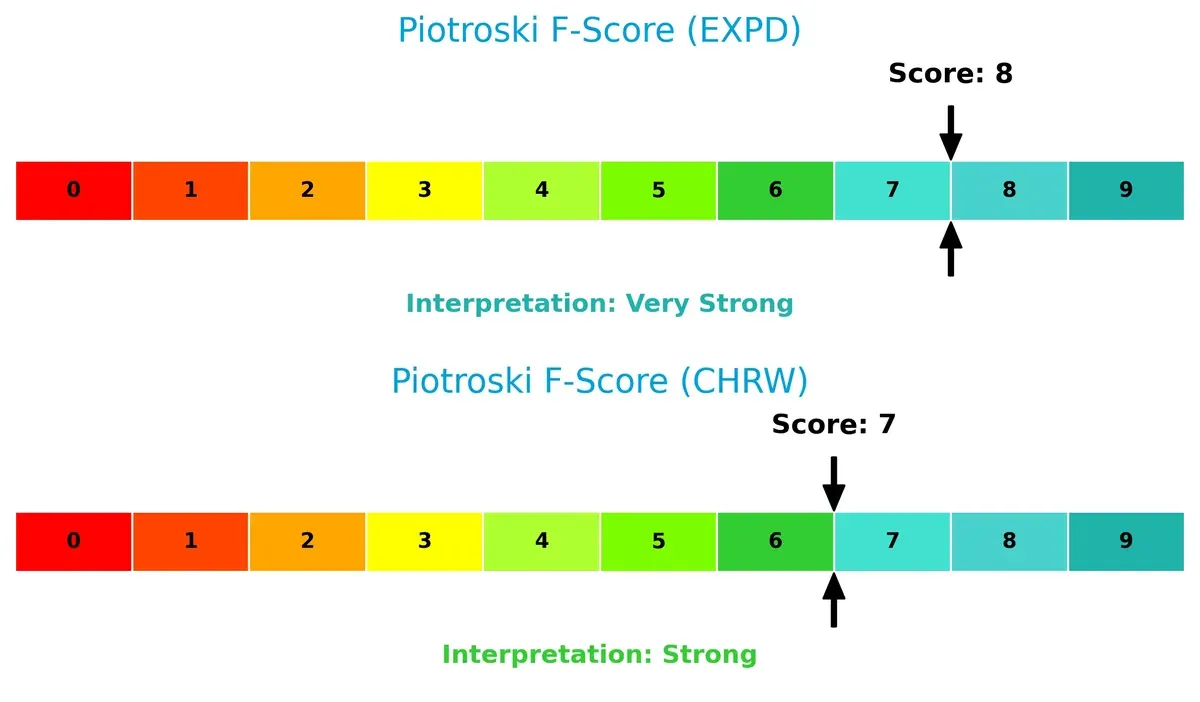

Bankruptcy Risk: Solvency Showdown

Expeditors and C.H. Robinson both score safely above 9 on the Altman Z-Score, indicating robust solvency and low bankruptcy risk in this cycle:

Financial Health: Quality of Operations

Expeditors edges out with a Piotroski F-Score of 8, signaling very strong financial health, while C.H. Robinson’s 7 still reflects strong operational quality but with slightly more internal risk factors:

How are the two companies positioned?

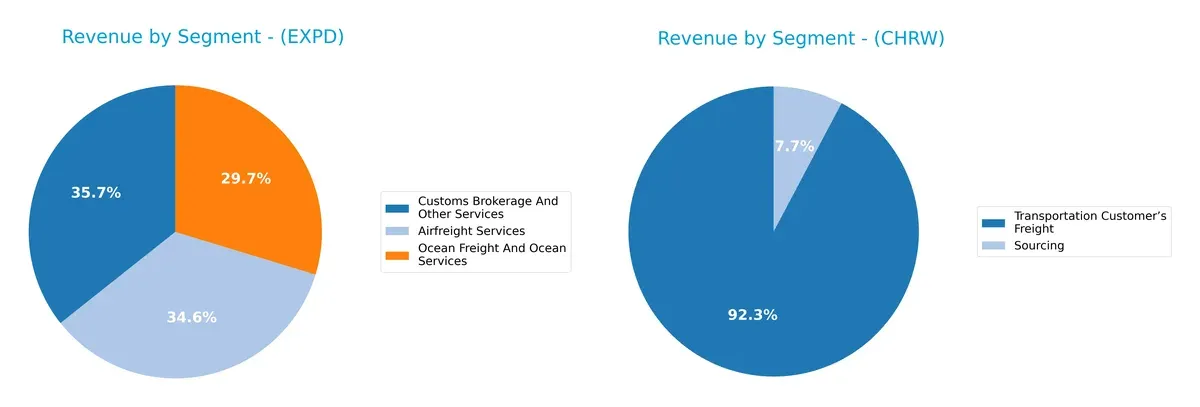

This section dissects the operational DNA of EXPD and CHRW by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to reveal which business model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Expeditors International and C.H. Robinson diversify their income streams and where their primary sector bets lie:

Expeditors International maintains a balanced revenue mix across Airfreight ($3.67B), Customs Brokerage ($3.78B), and Ocean Freight ($3.15B) in 2024. This diversification reduces reliance on any one segment, mitigating concentration risk. In contrast, C.H. Robinson leans heavily on Transportation Customer’s Freight ($16.35B), dwarfing its Sourcing segment ($1.37B). This concentration anchors C.H. Robinson’s strategic dominance in freight logistics but exposes it to sector-specific volatility.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Expeditors International of Washington, Inc. and C.H. Robinson Worldwide, Inc.:

Expeditors Strengths

- Strong profitability with ROE 36.44% and ROIC 27.62% above WACC 9%

- Favorable liquidity ratios current and quick at 1.77

- Low leverage with debt-to-assets 11.97%

- Diversified revenue from airfreight, customs, and ocean freight

- Global presence with significant sales in North Asia and Europe

- Asset turnover efficient at 2.23

C.H. Robinson Strengths

- Favorable ROE 27.04% and ROIC 15.36% exceeding WACC 7.78%

- High asset turnover at 3.35 and fixed assets turnover 38.37

- Diverse revenue streams in transportation and sourcing

- Robust global footprint with dominant US revenue and notable non-US sales

- Interest coverage strong at 12.45

- Higher dividend yield at 2.38%

Expeditors Weaknesses

- Price-to-book ratio high at 7.03, indicating potential overvaluation

- Net margin neutral at 7.64% but lower than ROE suggests capital efficiency depends on leverage

- PE ratio neutral at 19.28

- Moderate market share concentration in US and Asia

- Dividend yield modest at 1.31%

C.H. Robinson Weaknesses

- Low net margin at 2.63%, signaling profitability pressure

- Price-to-earnings and price-to-book ratios elevated at 26.58 and 7.19 respectively

- Higher leverage with debt-to-equity at 1.01 and debt-to-assets 32.86%

- Current ratio just neutral at 1.28, indicating less liquidity buffer

- Market heavily concentrated in US segment

Expeditors shows robust profitability and conservative financial structure supporting diversified global operations. C.H. Robinson leverages high asset efficiency and solid global reach but faces margin compression and higher leverage. These profiles suggest differing strategic focuses on capital structure and market positioning.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion:

Expeditors International of Washington, Inc.: Operational Efficiency Moat

Expeditors leverages a cost advantage through streamlined logistics and technology, reflected in a high ROIC exceeding WACC by 18.6%. Its growing ROIC trend signals durable profitability. Expansion in Asia and Europe could further deepen this moat in 2026.

C.H. Robinson Worldwide, Inc.: Network and Scale Moat

C.H. Robinson’s moat stems from an extensive transportation network and scale, but its ROIC, while above WACC, shows a declining trend. Compared to Expeditors, its margin compression and revenue declines challenge its moat. Yet, innovation in managed TMS services may offer growth catalysts.

Cost Leadership vs. Network Scale: The Moat Battle

Expeditors’ operational efficiency and rising returns create a deeper, more durable moat than C.H. Robinson’s eroding network advantage. I see Expeditors better positioned to defend and expand market share amid intensifying logistics competition.

Which stock offers better returns?

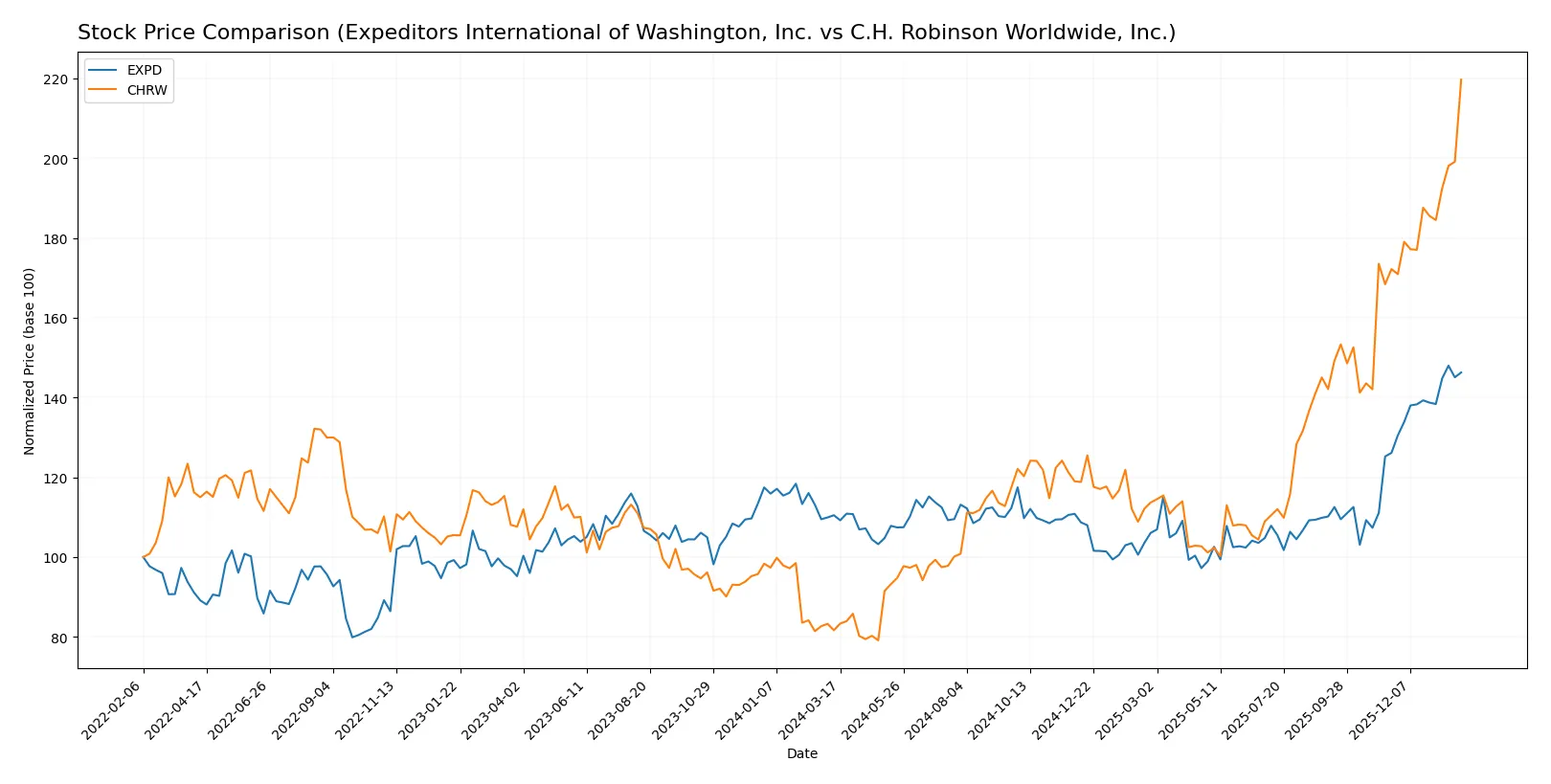

The past year shows strong bullish momentum for both stocks, with notable price acceleration and sustained buying dominance shaping their trading dynamics.

Trend Comparison

Expeditors International of Washington, Inc. (EXPD) posted a 32.39% price increase over the past year, reflecting a bullish trend with accelerating gains. The stock hit a high of 162.41 and a low of 106.7.

C.H. Robinson Worldwide, Inc. (CHRW) surged 169.08% in the same period, signaling a robust bullish trend with accelerating momentum. It reached a peak price of 194.95 and a low of 70.22.

CHRW outperformed EXPD significantly, delivering the highest market return with a strong acceleration pattern and greater volatility over the last 12 months.

Target Prices

Analysts present a wide but optimistic target consensus for both Expeditors International and C.H. Robinson.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Expeditors International of Washington, Inc. | 95 | 160 | 139.13 |

| C.H. Robinson Worldwide, Inc. | 90 | 220 | 184.19 |

Expeditors trades near its high target, signaling limited upside. C.H. Robinson’s consensus implies 5% upside, reflecting stronger growth expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The institutional grades for Expeditors International of Washington, Inc. and C.H. Robinson Worldwide, Inc. are as follows:

Expeditors International of Washington, Inc. Grades

The table summarizes recent grade actions from various reputable institutions for Expeditors International of Washington, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Hold | 2026-01-15 |

| Barclays | Maintain | Underweight | 2026-01-15 |

| JP Morgan | Maintain | Underweight | 2026-01-12 |

| Stifel | Maintain | Hold | 2025-12-16 |

| Morgan Stanley | Maintain | Underweight | 2025-12-08 |

| UBS | Upgrade | Buy | 2025-11-17 |

| Stifel | Maintain | Hold | 2025-11-06 |

| TD Cowen | Maintain | Sell | 2025-11-05 |

| JP Morgan | Maintain | Underweight | 2025-11-05 |

| Truist Securities | Maintain | Hold | 2025-11-05 |

C.H. Robinson Worldwide, Inc. Grades

Below are the recent ratings from established grading companies for C.H. Robinson Worldwide, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-30 |

| Benchmark | Maintain | Buy | 2026-01-30 |

| Stifel | Maintain | Buy | 2026-01-29 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-29 |

| Morgan Stanley | Maintain | Underweight | 2026-01-29 |

| Truist Securities | Maintain | Buy | 2026-01-29 |

| Wells Fargo | Maintain | Overweight | 2026-01-29 |

| Susquehanna | Maintain | Positive | 2026-01-29 |

| UBS | Maintain | Buy | 2026-01-23 |

| Truist Securities | Maintain | Buy | 2026-01-15 |

Which company has the best grades?

C.H. Robinson holds a stronger consensus of Buy and Outperform ratings, compared to Expeditors’ predominantly Hold and Underweight grades. Investors may view C.H. Robinson’s grades as reflecting higher confidence and potential upside.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing Expeditors International of Washington, Inc. and C.H. Robinson Worldwide, Inc. in the 2026 market environment:

1. Market & Competition

Expeditors International of Washington, Inc.

- Faces intense competition in integrated freight logistics with pressure on pricing and margins.

C.H. Robinson Worldwide, Inc.

- Competes broadly in freight and produce logistics, with niche exposure to perishables increasing complexity.

2. Capital Structure & Debt

Expeditors International of Washington, Inc.

- Maintains low debt with a debt-to-equity ratio of 0.26, indicating strong financial stability.

C.H. Robinson Worldwide, Inc.

- Exhibits higher leverage with a debt-to-equity ratio of 1.01, posing greater financial risk.

3. Stock Volatility

Expeditors International of Washington, Inc.

- Beta of 1.136 suggests slightly above-market volatility, indicating moderate sensitivity to market swings.

C.H. Robinson Worldwide, Inc.

- Beta of 0.913 shows below-market volatility, implying more defensive stock behavior.

4. Regulatory & Legal

Expeditors International of Washington, Inc.

- Global operations expose it to complex trade compliance and customs regulations.

C.H. Robinson Worldwide, Inc.

- Faces regulatory scrutiny especially in food safety and transportation compliance for perishables.

5. Supply Chain & Operations

Expeditors International of Washington, Inc.

- Relies on global air and ocean freight networks vulnerable to disruption and capacity constraints.

C.H. Robinson Worldwide, Inc.

- Operations include managing extensive carrier contracts, increasing operational complexity and risk.

6. ESG & Climate Transition

Expeditors International of Washington, Inc.

- Pressure to reduce carbon footprint in logistics; sustainability initiatives are critical for client retention.

C.H. Robinson Worldwide, Inc.

- Faces similar environmental pressures, with added risk from perishables requiring cold chain sustainability.

7. Geopolitical Exposure

Expeditors International of Washington, Inc.

- Exposure to trade tensions and tariffs in Asia, Europe, and the Middle East.

C.H. Robinson Worldwide, Inc.

- Geopolitical risks amplified by global sourcing and perishables markets sensitive to regional instability.

Which company shows a better risk-adjusted profile?

Expeditors faces its greatest risk in global supply chain disruptions, while C.H. Robinson’s highest risk lies in elevated financial leverage. Expeditors’ strong balance sheet and lower debt enhance its risk-adjusted profile. Recent financial data show Expeditors’ Altman Z-Score of 9.46 versus C.H. Robinson’s 9.35, confirming its superior financial resilience amid market uncertainties.

Final Verdict: Which stock to choose?

Expeditors International of Washington, Inc. (EXPD) stands out as a cash-generating powerhouse with a robust and growing economic moat. Its ability to generate high returns on invested capital signals disciplined capital allocation and operational excellence. The key point of vigilance remains its premium valuation metrics, which could pressure returns if growth slows. EXPD suits aggressive growth portfolios seeking durable competitive advantages.

C.H. Robinson Worldwide, Inc. (CHRW) offers a strategic moat rooted in its extensive logistics network and recurring revenue streams. While it carries higher leverage and exhibits a declining ROIC trend, CHRW’s safety profile remains solid with strong liquidity and a protected market position. It fits well in GARP portfolios that prioritize stability with reasonable growth prospects.

If you prioritize durable value creation and operational efficiency, Expeditors International outshines as the compelling choice due to its superior ROIC growth and financial strength. However, if you seek a blend of recurring revenue safety and moderate growth within a more conservative risk profile, C.H. Robinson offers better stability despite its slower profitability trend. Both scenarios demand close monitoring of valuation and industry cycle risks.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Expeditors International of Washington, Inc. and C.H. Robinson Worldwide, Inc. to enhance your investment decisions: