Masco Corporation and Builders FirstSource, Inc. are two key players in the construction industry, each with distinct approaches to building materials and home improvement solutions. Masco focuses on manufacturing and distributing innovative plumbing and decorative products, while Builders FirstSource offers a broad range of building materials and construction services tailored to professional builders. This article will explore their strategies and market positions to help you decide which company presents the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Masco Corporation and Builders FirstSource, Inc. by providing an overview of these two companies and their main differences.

Masco Corporation Overview

Masco Corporation designs, manufactures, and distributes home improvement and building products across North America, Europe, and internationally. The company operates in the construction industry, offering plumbing and decorative architectural products under numerous brands such as DELTA, BEHR, and KICHLER. Headquartered in Livonia, Michigan, Masco serves a diverse customer base including wholesalers, home centers, and hardware stores.

Builders FirstSource, Inc. Overview

Builders FirstSource, Inc. supplies building materials, manufactured components, and construction services primarily to professional homebuilders, remodelers, and consumers in the United States. The company offers lumber, engineered wood products, windows, doors, and other building supplies, along with design and installation services. Based in Dallas, Texas, Builders FirstSource focuses on providing comprehensive construction solutions within the industrial sector.

Key similarities and differences

Both companies operate in the construction sector and cater to the home improvement market, but Masco emphasizes manufactured home products and decorative finishes, while Builders FirstSource concentrates on raw materials and construction components. Masco has a broader international presence, whereas Builders FirstSource is primarily U.S.-focused. Additionally, Builders FirstSource offers integrated construction services, contrasting with Masco’s product-centric business model.

Income Statement Comparison

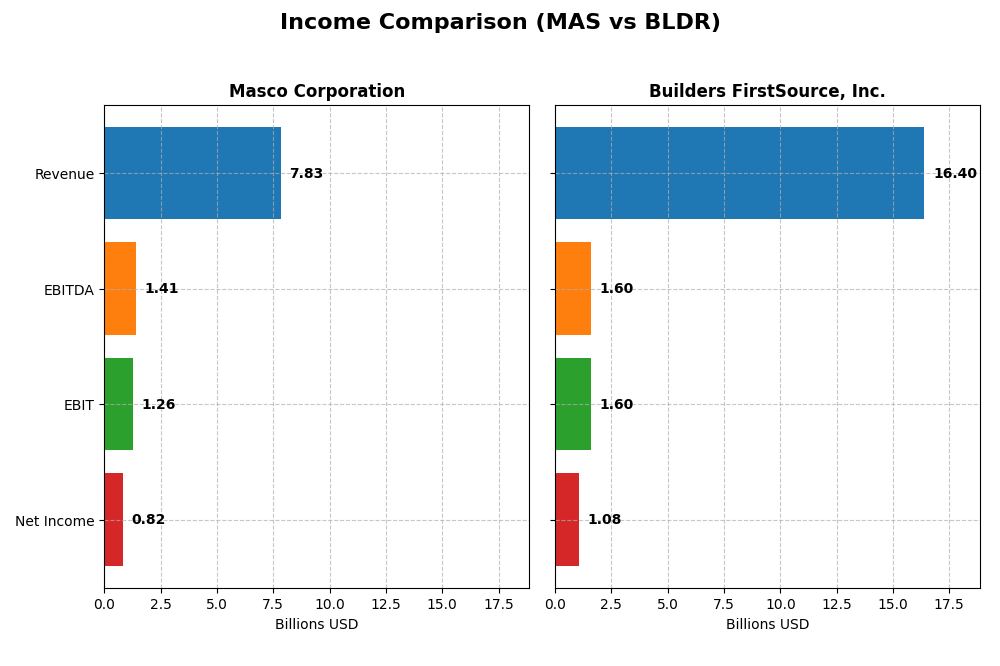

The table below presents a side-by-side comparison of key income statement metrics for Masco Corporation and Builders FirstSource, Inc. for the fiscal year 2024.

| Metric | Masco Corporation (MAS) | Builders FirstSource, Inc. (BLDR) |

|---|---|---|

| Market Cap | 13.96B | 12.31B |

| Revenue | 7.83B | 16.40B |

| EBITDA | 1.41B | 1.60B |

| EBIT | 1.26B | 1.60B |

| Net Income | 822M | 1.08B |

| EPS | 3.77 | 9.13 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Masco Corporation

Masco’s revenue showed moderate overall growth of 8.9% from 2020 to 2024, but net income declined by 32.8% during the same period. Margins remain favorable, with a solid gross margin of 36.2% and a net margin of 10.5% in 2024. However, the most recent year saw a 1.7% revenue drop and an earnings decline, indicating some deceleration in growth and margin compression.

Builders FirstSource, Inc.

Builders FirstSource reported strong revenue growth of 91.6% over five years and a remarkable net income surge of 243.8%. Despite a revenue decline of 4.1% in 2024, its margins remain reasonable with a gross margin of 32.8% and a net margin of 6.6%. The latest year experienced significant earnings contraction, with net margin and EPS decreasing by over 24%, reflecting recent margin pressures.

Which one has the stronger fundamentals?

Builders FirstSource demonstrates more robust long-term growth in revenue, net income, and EPS, supported by consistent favorable margin improvements. Masco shows stable margins but struggles with declining net income and recent revenue contraction. Overall, Builders FirstSource’s income statement performance appears stronger, though both companies face recent challenges in sustaining growth momentum.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Masco Corporation (MAS) and Builders FirstSource, Inc. (BLDR) based on their 2024 fiscal year data.

| Ratios | Masco Corporation (MAS) | Builders FirstSource, Inc. (BLDR) |

|---|---|---|

| ROE | -2.94% | 25.09% |

| ROIC | 29.30% | 13.90% |

| P/E | 19.25 | 15.65 |

| P/B | -56.50 | 3.93 |

| Current Ratio | 1.75 | 1.77 |

| Quick Ratio | 1.15 | 1.09 |

| D/E (Debt-to-Equity) | -11.48 | 1.01 |

| Debt-to-Assets | 64.07% | 40.94% |

| Interest Coverage | 13.77 | 7.68 |

| Asset Turnover | 1.56 | 1.55 |

| Fixed Asset Turnover | 5.81 | 6.42 |

| Payout Ratio | 30.90% | 0% |

| Dividend Yield | 1.61% | 0% |

Interpretation of the Ratios

Masco Corporation

Masco shows mostly strong ratios with favorable net margin at 10.5% and robust returns on invested capital at 29.3%. However, the negative return on equity (-293.57%) and high debt-to-assets ratio (64.07%) raise concerns. Its current and quick ratios indicate good liquidity. The company pays dividends with a 1.61% yield, supported by moderate payout risks.

Builders FirstSource, Inc.

Builders FirstSource has mixed ratios: a favorable return on equity of 25.09% and good asset turnover, though net margin is only neutral at 6.57%. Debt-to-equity is unfavorable at 1.01, and the company carries a neutral debt-to-assets ratio of 40.94%. It does not pay dividends, likely focusing on reinvestment and growth.

Which one has the best ratios?

Masco presents a more favorable overall ratios profile, with 64.29% favorable metrics compared to Builders FirstSource’s 50%. Despite Masco’s concerns on equity returns and leverage, its stronger profitability and liquidity ratios position it ahead. Builders FirstSource shows solid returns but weaker dividend policy and more unfavorable leverage indicators.

Strategic Positioning

This section compares the strategic positioning of Masco Corporation and Builders FirstSource, Inc., including market position, key segments, and exposure to technological disruption:

Masco Corporation

- Large market cap of 13.96B with moderate beta of 1.28, facing competitive pressure in construction industry.

- Focuses on Plumbing and Decorative Architectural Products driving revenues over 7.8B in 2024.

- Exposure to disruption limited to product innovation in plumbing and decorative products; no direct tech disruption noted.

Builders FirstSource, Inc.

- Market cap of 12.31B and higher beta of 1.57, indicating more volatility in construction sector.

- Key segments include Lumber, Manufactured Products, Specialty Building Products, totaling over 16B revenue.

- Primarily exposed to traditional building materials and services; no explicit mention of tech disruption.

Masco Corporation vs Builders FirstSource, Inc. Positioning

Masco shows a diversified product portfolio across plumbing and decorative segments, while Builders FirstSource concentrates on lumber and building materials. Masco’s broader segment mix contrasts with Builders FirstSource’s focus on construction supply, reflecting differing business drivers and market approaches.

Which has the best competitive advantage?

Both companies demonstrate very favorable moats with growing ROIC above WACC, indicating value creation. Masco’s larger ROIC spread (20.8% vs 4.6%) suggests a stronger and more durable competitive advantage in profitability and capital efficiency.

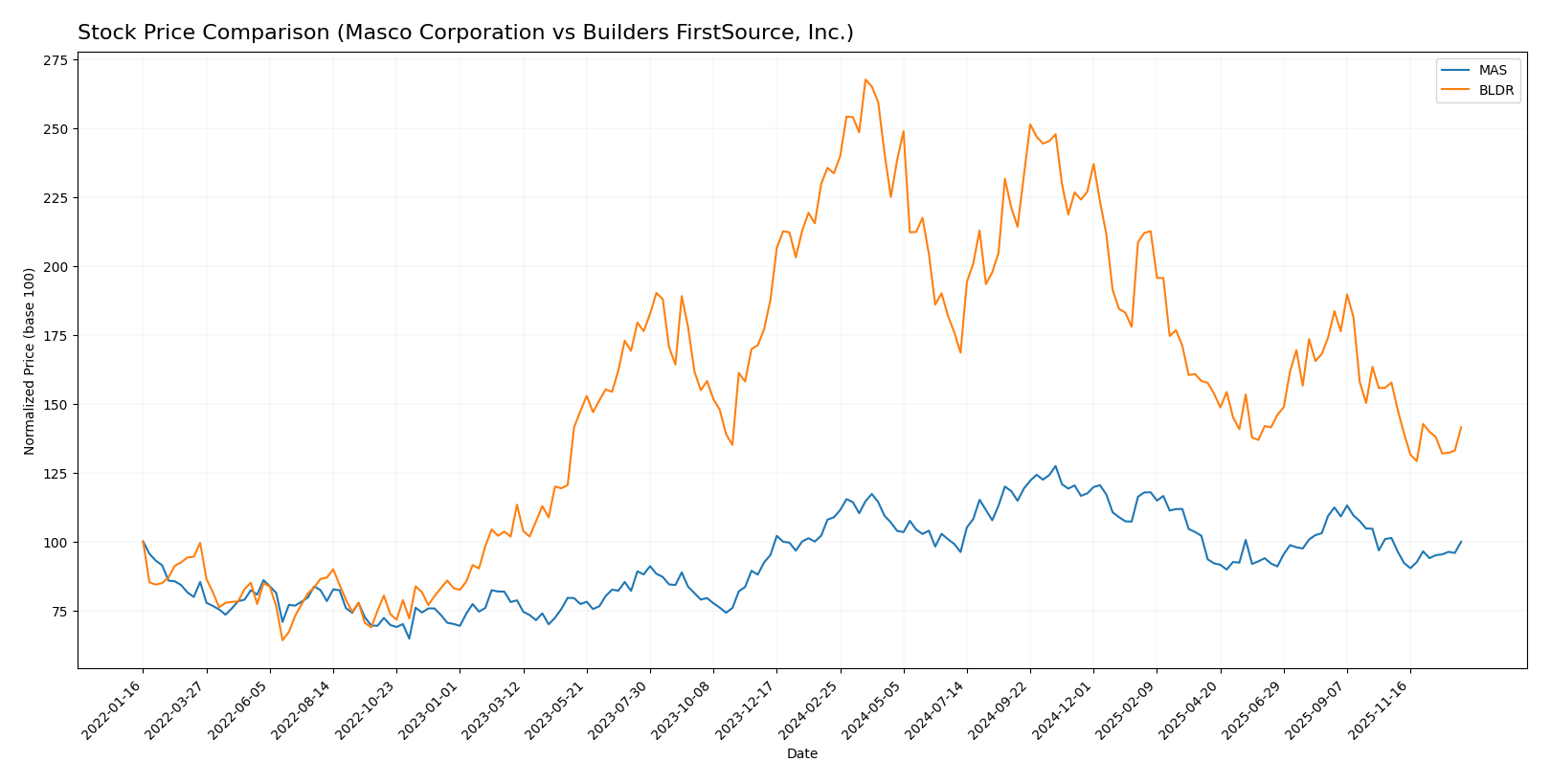

Stock Comparison

The stock price movements of Masco Corporation (MAS) and Builders FirstSource, Inc. (BLDR) over the past 12 months reveal distinct bearish trends with differing volatility and recent trading dynamics.

Trend Analysis

Masco Corporation’s stock experienced a bearish trend over the past year with an 8.12% price decline and accelerating downward momentum, fluctuating moderately with a standard deviation of 6.54%.

Builders FirstSource’s stock faced a sharper bearish trend, falling 39.45% over the year with decelerating momentum and significantly higher volatility, reflected in a 30.44% standard deviation.

Comparing these trends, Masco Corporation delivered the highest market performance, showing a smaller decline and less volatility than Builders FirstSource during the analyzed period.

Target Prices

The current target price consensus for Masco Corporation and Builders FirstSource, Inc. suggests potential upside for both stocks.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Masco Corporation | 84 | 73 | 77.83 |

| Builders FirstSource, Inc. | 155 | 109.41 | 131.16 |

Analysts expect Masco’s stock to rise from its current price of $67.22 toward a consensus near $77.83, while Builders FirstSource shows a higher target consensus of $131.16 versus its current $111.29, signaling bullish sentiment on both.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Masco Corporation and Builders FirstSource, Inc.:

Rating Comparison

MAS Rating

- Rating: B-, categorized as Very Favorable

- Discounted Cash Flow Score: 3, moderate valuation

- ROE Score: 1, very unfavorable profitability

- ROA Score: 5, very favorable asset utilization

- Debt To Equity Score: 1, very unfavorable financial risk

- Overall Score: 2, moderate overall financial standing

BLDR Rating

- Rating: B+, categorized as Very Favorable

- Discounted Cash Flow Score: 5, very favorable valuation

- ROE Score: 4, favorable profitability

- ROA Score: 3, moderate asset utilization

- Debt To Equity Score: 3, moderate financial risk

- Overall Score: 3, moderate overall financial standing

Which one is the best rated?

Based strictly on the provided data, Builders FirstSource holds a higher overall rating (B+) and stronger scores in discounted cash flow, ROE, and debt-to-equity compared to Masco. Masco scores higher only in ROA. Overall, Builders FirstSource is better rated.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Masco Corporation and Builders FirstSource, Inc.:

MAS Scores

- Altman Z-Score: 3.91, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength and investment quality.

BLDR Scores

- Altman Z-Score: 2.87, indicating a grey zone with moderate bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health and better investment potential.

Which company has the best scores?

Based strictly on the data, MAS has a better Altman Z-Score indicating less bankruptcy risk, while BLDR has a higher Piotroski Score reflecting stronger financial health. Each company leads in a different score category.

Grades Comparison

Here is a detailed comparison of recent grades assigned to Masco Corporation and Builders FirstSource, Inc.:

Masco Corporation Grades

The following table summarizes the latest grades from recognized grading firms for Masco Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Upgrade | Overweight | 2025-12-15 |

| Barclays | Downgrade | Equal Weight | 2025-12-08 |

| Argus Research | Maintain | Buy | 2025-11-05 |

| Barclays | Maintain | Overweight | 2025-10-30 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-30 |

| RBC Capital | Maintain | Sector Perform | 2025-10-30 |

| Evercore ISI Group | Maintain | In Line | 2025-10-30 |

| UBS | Maintain | Buy | 2025-10-30 |

| Wells Fargo | Maintain | Equal Weight | 2025-09-11 |

| Oppenheimer | Maintain | Outperform | 2025-08-04 |

Masco shows a mix of “Buy” and “Overweight” ratings, with recent upgrades and some downgrades, reflecting a generally positive but cautious outlook.

Builders FirstSource, Inc. Grades

The latest grades for Builders FirstSource, Inc. from credible grading companies are as follows:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-06 |

| Stifel | Maintain | Hold | 2025-12-16 |

| Jefferies | Downgrade | Hold | 2025-12-15 |

| Barclays | Maintain | Overweight | 2025-12-08 |

| DA Davidson | Maintain | Neutral | 2025-11-03 |

| UBS | Maintain | Buy | 2025-10-31 |

| Barclays | Maintain | Overweight | 2025-10-31 |

| Zelman & Assoc | Upgrade | Neutral | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| Wedbush | Downgrade | Neutral | 2025-09-15 |

Builders FirstSource presents a blend of “Buy,” “Hold,” and “Neutral” ratings, with some recent downgrades indicating a more cautious stance compared to Masco.

Which company has the best grades?

Masco Corporation generally holds stronger and more consistent buy and outperform-type grades, while Builders FirstSource shows a wider spread including more hold and neutral ratings. This suggests Masco may be perceived as having better near-term prospects, potentially impacting investor confidence and portfolio positioning.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses between Masco Corporation (MAS) and Builders FirstSource, Inc. (BLDR) based on the most recent data.

| Criterion | Masco Corporation (MAS) | Builders FirstSource, Inc. (BLDR) |

|---|---|---|

| Diversification | Focus on Plumbing and Decorative Architectural Products; less diversified but specialized | Broader product range: Lumber, Manufactured Products, Specialty Building, Windows & Doors |

| Profitability | High ROIC at 29.3%, net margin 10.5%, but negative ROE (-293.57%) due to accounting factors | Moderate ROIC at 13.9%, net margin 6.57%, positive ROE at 25.09% |

| Innovation | Demonstrates durable competitive advantage with growing profitability and innovation in product lines | Also shows durable competitive advantage with steady ROIC growth; innovation evident in expanding specialty products |

| Global presence | Strong presence in North America with key segments in plumbing and architectural products | Large North American footprint with diversified building product offerings |

| Market Share | Leading in plumbing and decorative architectural sectors | Significant share in lumber and building materials markets, growing specialty segments |

Masco Corporation excels in profitability with very high ROIC and a focused product portfolio, while Builders FirstSource benefits from broader diversification and solid profitability metrics. Both companies show durable competitive advantages, but MAS’s negative ROE suggests caution despite strong capital efficiency.

Risk Analysis

Below is a comparative table highlighting key risk factors for Masco Corporation (MAS) and Builders FirstSource, Inc. (BLDR) based on the latest 2024 data:

| Metric | Masco Corporation (MAS) | Builders FirstSource (BLDR) |

|---|---|---|

| Market Risk | Beta 1.28, moderate volatility | Beta 1.57, higher volatility |

| Debt Level | High debt-to-assets 64.1%, negative debt-to-equity ratio | Moderate debt-to-assets 40.9%, debt-to-equity 1.01 |

| Regulatory Risk | Medium, US/EU construction regulations | Medium, US construction sector regulations |

| Operational Risk | Diverse product lines, global supply chain complexity | Extensive supply chain, integration risk from acquisitions |

| Environmental Risk | Moderate, exposure to material sourcing and manufacturing impacts | Moderate, focus on sustainable materials but industry impact remains |

| Geopolitical Risk | Low to moderate, international exposure | Low, primarily US market focused |

Masco faces significant leverage risk with a high debt-to-assets ratio, increasing financial vulnerability despite strong operational efficiency. Builders FirstSource shows higher market volatility and moderate leverage but benefits from a strong Piotroski score and safer Altman Z-Score. Market and debt-related risks are the most impactful factors to monitor closely for both companies.

Which Stock to Choose?

Masco Corporation (MAS) shows a mixed income evolution with a slight recent decline but overall revenue growth since 2020. Its financial ratios are mostly favorable, highlighted by strong asset turnover and interest coverage, despite negative return on equity and high debt ratio. Profitability is solid but challenged by shrinking net margin, while the company maintains a very favorable rating and demonstrates a durable competitive advantage with a very favorable moat.

Builders FirstSource, Inc. (BLDR) exhibits strong revenue and net income growth over the period despite recent declines. Its financial ratios are slightly favorable, supported by positive return on equity and solid return on invested capital, though debt levels and dividend yield raise some concerns. Profitability is moderate with neutral to favorable margins, and the company holds a very favorable rating alongside a durable competitive advantage, albeit with a slightly lower moat score than MAS.

For investors prioritizing durable competitive advantages and financial stability, MAS’s very favorable moat and mostly favorable ratios might appear more attractive. Conversely, those focused on growth metrics and improving profitability could find BLDR’s strong earnings growth and favorable rating more appealing. The choice could therefore depend on whether the investor leans toward stability and value preservation or growth potential.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Masco Corporation and Builders FirstSource, Inc. to enhance your investment decisions: