Johnson Controls International plc (JCI) and Builders FirstSource, Inc. (BLDR) are two prominent players in the construction industry, each with distinct approaches to building solutions and materials. JCI focuses on advanced building systems and energy efficiency, while BLDR specializes in manufacturing and supplying essential construction components. This comparison will help investors identify which company offers the most compelling opportunity in a dynamic market. Let’s explore their strengths and potential for growth.

Table of contents

Companies Overview

I will begin the comparison between Johnson Controls International plc and Builders FirstSource, Inc. by providing an overview of these two companies and their main differences.

Johnson Controls International plc Overview

Johnson Controls International plc focuses on engineering, manufacturing, and retrofitting building products and systems globally. The company serves commercial, industrial, retail, and institutional customers with HVAC, controls, security, fire protection, and energy efficiency solutions. Operating in four geographic segments, it offers both products and smart building software, positioning itself as a comprehensive provider in building technologies.

Builders FirstSource, Inc. Overview

Builders FirstSource, Inc. manufactures and supplies building materials and construction services primarily to US homebuilders and remodelers. Its product range includes lumber, engineered wood, windows, doors, and siding, along with installation and design assistance. The company emphasizes on-site framing and customized building components, focusing on the residential construction market with a broad portfolio of materials and services.

Key similarities and differences

Both companies operate in the construction industry and provide building-related products and services. Johnson Controls has a broader international footprint and focuses on building systems, controls, and smart technologies across various sectors. In contrast, Builders FirstSource specializes in supplying raw and manufactured materials for residential construction within the US, emphasizing installation and on-site services. Their business models differ in scope and market focus, with Johnson Controls offering integrated systems globally and Builders FirstSource concentrating on material supply and services domestically.

Income Statement Comparison

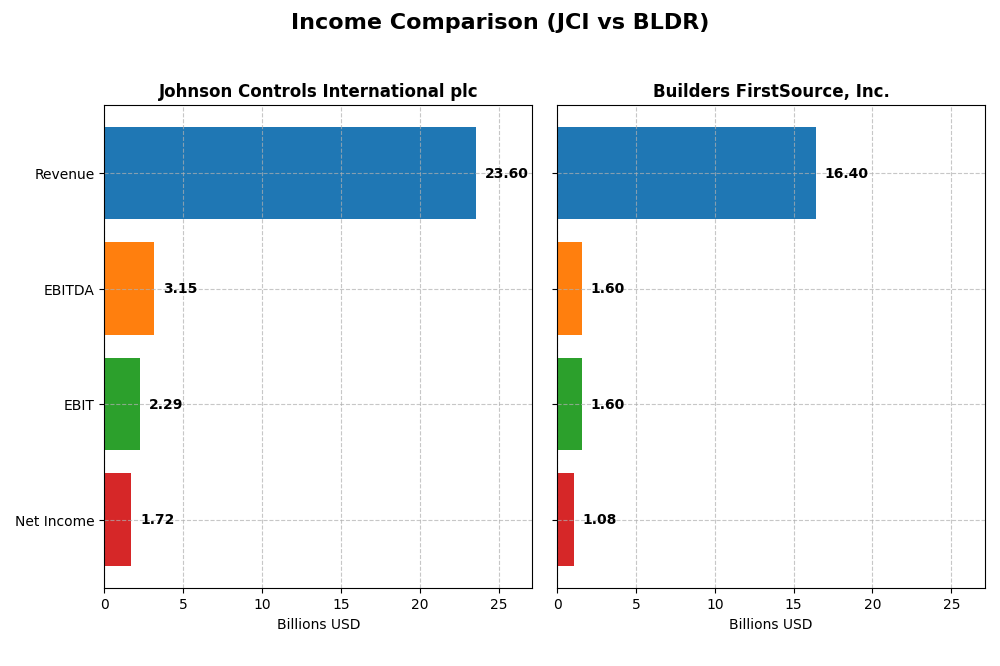

The table below compares key income statement metrics for Johnson Controls International plc and Builders FirstSource, Inc. based on their most recent fiscal year results.

| Metric | Johnson Controls International plc (JCI) | Builders FirstSource, Inc. (BLDR) |

|---|---|---|

| Market Cap | 72.8B | 12.3B |

| Revenue | 23.6B | 16.4B |

| EBITDA | 3.15B | 1.60B |

| EBIT | 2.29B | 1.60B |

| Net Income | 1.72B | 1.08B |

| EPS | 2.64 | 9.13 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Johnson Controls International plc

Johnson Controls International plc’s revenue showed a slight overall decline from 23.7B in 2021 to 23.6B in 2025, with net income rising modestly by 5.13% over the period. Gross margin remained favorable at 36.41%, while EBIT margin was neutral at 9.7%. In 2025, revenue growth slowed to 2.81%, but EBIT improved by 15.32%, reflecting operational efficiency.

Builders FirstSource, Inc.

Builders FirstSource exhibited strong revenue growth of 91.62% from 2020 to 2024, with net income surging 243.79%. Gross margin stayed favorable at 32.82%, and EBIT margin was neutral at 9.73%. However, the latest fiscal year showed a 4.08% revenue decline and a 26.7% drop in EBIT, signaling recent operational challenges despite overall positive long-term trends.

Which one has the stronger fundamentals?

Johnson Controls International maintains stable margins and consistent net income growth, with favorable profitability metrics and improving EBIT in the most recent year. Builders FirstSource has demonstrated remarkable long-term growth in revenue and net income but faced significant earnings and margin contractions recently. Both companies have favorable income statement evaluations, yet Johnson Controls shows more stable fundamentals in 2025.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Johnson Controls International plc (JCI) and Builders FirstSource, Inc. (BLDR) based on their most recent fiscal year data.

| Ratios | Johnson Controls International plc (JCI) FY 2025 | Builders FirstSource, Inc. (BLDR) FY 2024 |

|---|---|---|

| ROE | 13.3% | 25.1% |

| ROIC | 8.8% | 13.9% |

| P/E | 41.6 | 15.7 |

| P/B | 5.54 | 3.93 |

| Current Ratio | 0.93 | 1.77 |

| Quick Ratio | 0.76 | 1.09 |

| D/E (Debt-to-Equity) | 0.76 | 1.01 |

| Debt-to-Assets | 26.0% | 40.9% |

| Interest Coverage | 8.87 | 7.68 |

| Asset Turnover | 0.62 | 1.55 |

| Fixed Asset Turnover | 10.76 | 6.42 |

| Payout ratio | 56.7% | 0% |

| Dividend yield | 1.36% | 0% |

Interpretation of the Ratios

Johnson Controls International plc

Johnson Controls exhibits a mixed ratio profile with some favorable metrics like debt-to-assets at 26.04% and interest coverage at 7.17, but also several unfavorable ratios including a high P/E of 41.64 and weak liquidity ratios under 1. The company maintains a dividend yield of 1.36%, indicating moderate shareholder returns with neutral payout sustainability and no evident excessive buybacks.

Builders FirstSource, Inc.

Builders FirstSource shows stronger profitability and liquidity ratios, such as a 25.09% ROE and a current ratio of 1.77, alongside favorable asset turnover of 1.55. However, the company does not pay dividends, reflecting a reinvestment strategy likely focused on growth and operational expansion, supported by solid free cash flow yields and no dividend-related risks.

Which one has the best ratios?

Builders FirstSource has a more favorable ratio profile overall, with 50% favorable ratios compared to 21.43% for Johnson Controls. While Johnson Controls has strengths in debt management, its valuation and liquidity ratios are less attractive. Builders FirstSource’s stronger profitability, liquidity, and reinvestment approach suggest a comparatively healthier financial position.

Strategic Positioning

This section compares the strategic positioning of Johnson Controls International plc (JCI) and Builders FirstSource, Inc. (BLDR) covering Market position, Key segments, and Exposure to technological disruption:

Johnson Controls International plc (JCI)

- Large market cap of 73B with global operations across multiple regions; faces competitive pressure in construction industry.

- Diverse segments: Building Solutions in North America, EMEA/LA, Asia Pacific, and Global Products driving revenues.

- Exposure to technology via smart building solutions, controls software, and energy efficiency in non-residential buildings.

Builders FirstSource, Inc. (BLDR)

- Smaller market cap of 12B, focused on US market; competes in building materials and services.

- Key segments include Lumber, Manufactured Products, Specialty Building Products, and Windows/Doors.

- Limited explicit mention of technological disruption; focus on manufacturing and supply of traditional building products.

Johnson Controls International plc vs Builders FirstSource, Inc. Positioning

JCI adopts a diversified global approach with multiple business segments and advanced building technologies, offering broad exposure but facing diverse challenges. BLDR concentrates on US markets and traditional building materials, which may limit technological exposure but focuses on core construction supply.

Which has the best competitive advantage?

BLDR shows a very favorable moat with ROIC exceeding WACC by 4.6% and consistent profitability growth, indicating a durable competitive advantage. JCI’s moat is slightly unfavorable, with value destruction despite improving ROIC trends.

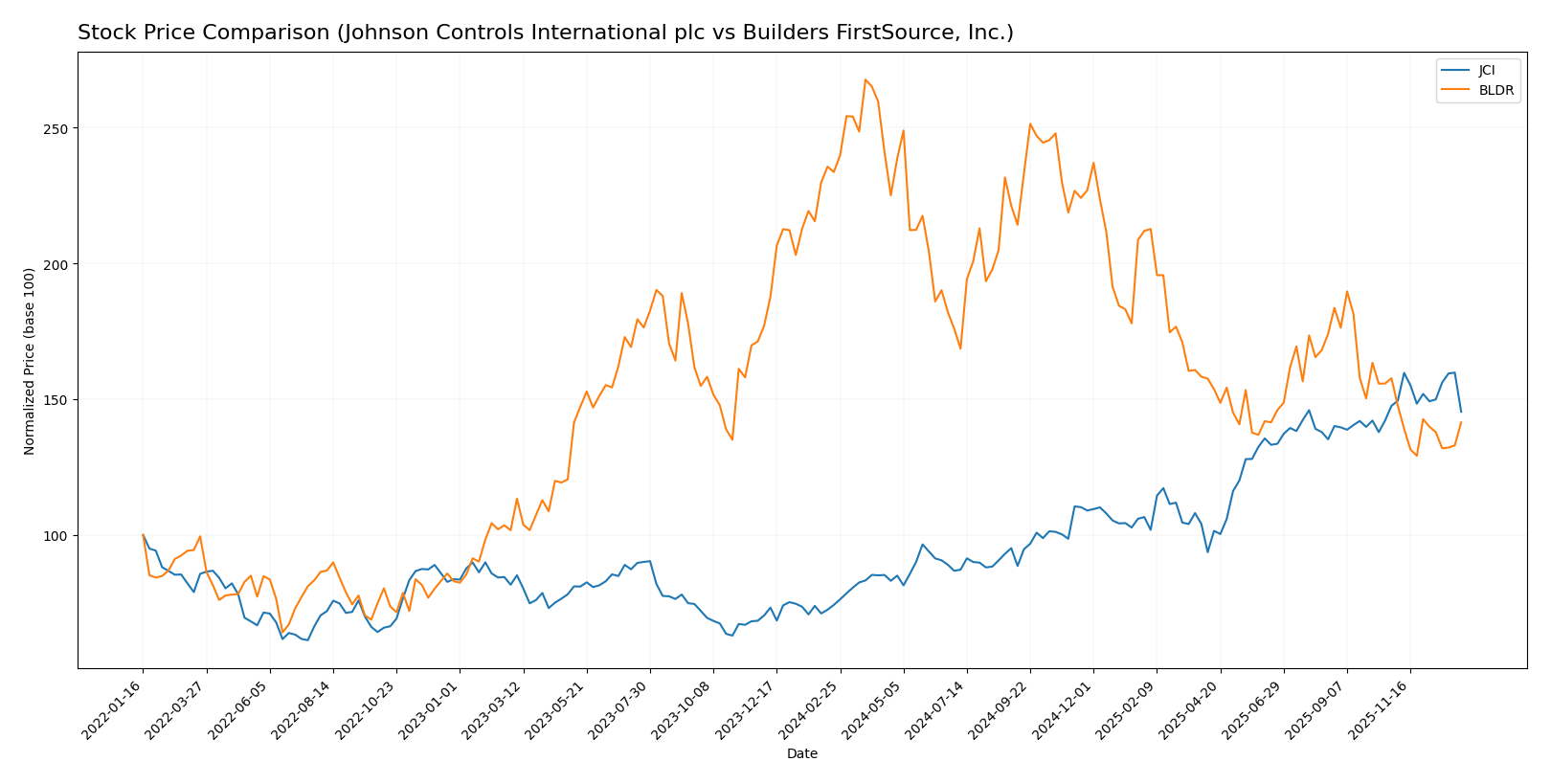

Stock Comparison

The stock prices of Johnson Controls International plc and Builders FirstSource, Inc. exhibited contrasting movements over the past 12 months, with Johnson Controls showing strong gains and Builders FirstSource experiencing notable declines.

Trend Analysis

Johnson Controls International plc’s stock price rose sharply by 95.73% over the past year, indicating a bullish trend with decelerating momentum and a high volatility level of 18.47. Recent months show a slight neutral adjustment with a -1.46% change.

Builders FirstSource, Inc. recorded a significant 39.45% decline, marking a bearish trend with decelerating momentum and higher volatility at 30.44. The recent period saw an accelerated bearish movement with a -10.29% drop.

Comparing both, Johnson Controls International plc delivered the highest market performance with a strong positive price change, while Builders FirstSource, Inc. faced substantial losses over the same period.

Target Prices

Analysts present a bullish consensus with notable upside potential for both Johnson Controls International plc and Builders FirstSource, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Johnson Controls International plc | 148 | 124 | 134.75 |

| Builders FirstSource, Inc. | 155 | 109.41 | 131.16 |

The consensus target prices suggest a significant appreciation potential compared to the current stock price of $111.29 for each company, indicating positive analyst sentiment in the construction sector.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Johnson Controls International plc and Builders FirstSource, Inc.:

Rating Comparison

JCI Rating

- Rating: B-, indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: Moderate at 3, suggesting average valuation.

- ROE Score: Favorable at 4, showing efficient profit generation from equity.

- ROA Score: Moderate at 3, indicating average asset utilization.

- Debt To Equity Score: Moderate at 2, reflecting moderate financial risk.

- Overall Score: Moderate at 2, summarizing the company’s financial standing.

BLDR Rating

- Rating: B+, also indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: Very favorable at 5, indicating strong undervaluation potential.

- ROE Score: Favorable at 4, similarly reflecting efficient profit generation from equity.

- ROA Score: Moderate at 3, indicating average asset utilization.

- Debt To Equity Score: Moderate at 3, indicating slightly higher financial leverage.

- Overall Score: Moderate at 3, indicating a somewhat stronger overall financial position.

Which one is the best rated?

Based strictly on the provided data, BLDR holds a higher rating of B+ compared to JCI’s B-. BLDR outperforms JCI notably in discounted cash flow and overall scores, suggesting a stronger financial position and valuation.

Scores Comparison

Here is the comparison of the companies’ Altman Z-Score and Piotroski Score:

JCI Scores

- Altman Z-Score: 2.71, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 6, reflecting average financial strength.

BLDR Scores

- Altman Z-Score: 2.87, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 7, reflecting strong financial strength.

Which company has the best scores?

BLDR has a slightly higher Altman Z-Score and a better Piotroski Score than JCI, indicating relatively stronger financial health in this comparison.

Grades Comparison

The following section compares the latest grades assigned to Johnson Controls International plc and Builders FirstSource, Inc.:

Johnson Controls International plc Grades

This table summarizes recent grades assigned to Johnson Controls by major financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-07 |

| Goldman Sachs | Maintain | Buy | 2025-11-07 |

| Argus Research | Maintain | Buy | 2025-11-07 |

| RBC Capital | Maintain | Sector Perform | 2025-11-06 |

| Wells Fargo | Maintain | Overweight | 2025-11-06 |

| Mizuho | Maintain | Neutral | 2025-11-06 |

| Barclays | Maintain | Equal Weight | 2025-11-06 |

| JP Morgan | Maintain | Overweight | 2025-10-15 |

| Citigroup | Maintain | Neutral | 2025-10-09 |

| Morgan Stanley | Maintain | Overweight | 2025-08-21 |

Johnson Controls’ grades mostly range from Neutral to Overweight, with several Buy ratings and no downgrades noted.

Builders FirstSource, Inc. Grades

This table presents recent grades assigned to Builders FirstSource by recognized financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-06 |

| Stifel | Maintain | Hold | 2025-12-16 |

| Jefferies | Downgrade | Hold | 2025-12-15 |

| Barclays | Maintain | Overweight | 2025-12-08 |

| DA Davidson | Maintain | Neutral | 2025-11-03 |

| UBS | Maintain | Buy | 2025-10-31 |

| Barclays | Maintain | Overweight | 2025-10-31 |

| Zelman & Assoc | Upgrade | Neutral | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| Wedbush | Downgrade | Neutral | 2025-09-15 |

Builders FirstSource exhibits a mix of Buy, Hold, and Neutral grades with some downgrades and an upgrade, indicating more variability.

Which company has the best grades?

Johnson Controls International plc has received more consistent Buy and Overweight grades with no downgrades, whereas Builders FirstSource shows a wider range including several downgrades. This consistency might imply relatively steadier analyst confidence in Johnson Controls, potentially affecting investor perceptions of stability and risk.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Johnson Controls International plc (JCI) and Builders FirstSource, Inc. (BLDR) based on the most recent data.

| Criterion | Johnson Controls International plc (JCI) | Builders FirstSource, Inc. (BLDR) |

|---|---|---|

| Diversification | High product and regional diversification with strong presence in Building Solutions across multiple continents and Global Products segment | Focused on building materials and services with less geographic diversification but strong product segment growth |

| Profitability | Moderate net margin at 7.29%, ROIC 8.75%, but ROIC below WACC indicating value destruction | Solid profitability with ROE 25.09%, ROIC 13.9%, ROIC above WACC showing clear value creation |

| Innovation | Moderate innovation reflected in steady ROIC growth but challenged by valuation multiples (PE 41.64) | Demonstrates innovation in product mix and operations with improving ROIC and favorable asset turnover |

| Global presence | Strong global footprint, notably in North America, EMEA/LA, and Asia Pacific markets | Primarily North American focus with growing market share in building materials distribution |

| Market Share | Leading position in building solutions and global products segments | Increasing market share in lumber, manufactured products, and specialty building products |

Key takeaways: Builders FirstSource (BLDR) shows a stronger competitive advantage with favorable returns above cost of capital and solid profitability metrics. Johnson Controls (JCI) offers broad diversification and global reach but currently faces challenges in value creation despite growing profitability. Investors should weigh BLDR’s focused strength and value creation against JCI’s scale and improving efficiency.

Risk Analysis

Below is a comparative analysis of key risks for Johnson Controls International plc (JCI) and Builders FirstSource, Inc. (BLDR) based on the most recent financial and market data.

| Metric | Johnson Controls International plc (JCI) | Builders FirstSource, Inc. (BLDR) |

|---|---|---|

| Market Risk | Beta 1.42, moderate volatility | Beta 1.57, higher volatility |

| Debt Level | Debt-to-assets 26.0%, moderate leverage | Debt-to-assets 40.9%, higher leverage |

| Regulatory Risk | Medium, diversified global operations | Medium, primarily US-focused |

| Operational Risk | Large scale with 94K employees, complex supply chain | Mid-size with 29K employees, focused on US market |

| Environmental Risk | Exposure to regulations on energy efficiency and emissions | Exposure to US environmental regulations on construction materials |

| Geopolitical Risk | Moderate, global footprint including Europe and Asia Pacific | Lower, mainly US market exposure |

The most impactful risks are market volatility and debt levels. BLDR shows higher beta and debt leverage, indicating greater sensitivity to market swings and financial risk. JCI’s broad geographic presence exposes it to geopolitics and regulatory shifts but may also offer some diversification benefits. Investors should monitor debt management closely for BLDR and regulatory developments impacting energy and environmental standards for JCI.

Which Stock to Choose?

Johnson Controls International plc (JCI) shows a mixed income evolution with a slight revenue decline over 2021-2025 but favorable profitability metrics including a 7.29% net margin. Its financial ratios are slightly unfavorable overall, with a 13.31% ROE and moderate debt levels. The company’s rating is very favorable at B- but with some caution due to weak price multiples. JCI’s economic moat analysis indicates value destruction despite a rising ROIC trend.

Builders FirstSource, Inc. (BLDR) exhibits strong income growth overall, though recent annual figures show declines. Profitability remains solid with a 6.57% net margin and favorable returns on equity (25.09%) and invested capital. Its financial ratios are slightly favorable, supported by a robust current ratio and asset turnover. BLDR holds a very favorable B+ rating and a very favorable moat with value creation and steady ROIC growth.

For investors prioritizing stable income growth and strong economic moats, BLDR may appear more favorable given its value creation and financial ratio strength. Conversely, those focused on established companies with moderate profitability and a mixed financial ratio profile might view JCI as a viable option, albeit with some caution regarding valuation and value destruction signals. The choice could depend on the investor’s risk tolerance and preference for growth versus stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Johnson Controls International plc and Builders FirstSource, Inc. to enhance your investment decisions: