In the dynamic world of alcoholic beverages, Diageo plc and Brown-Forman Corporation stand out as industry giants with rich histories and diverse portfolios. Both companies operate in the wineries and distilleries sector, competing globally with innovative strategies to capture market share. By comparing their market presence, product innovation, and financial health, I will help you identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Diageo plc and Brown-Forman Corporation by providing an overview of these two companies and their main differences.

Diageo plc Overview

Diageo plc is a leading global producer, marketer, and seller of alcoholic beverages, including whisky, vodka, rum, and beer. Headquartered in London and founded in 1886, it operates across multiple regions such as North America, Europe, Africa, and Asia Pacific. The company is known for iconic brands like Johnnie Walker, Smirnoff, and Guinness, positioning itself as a diversified powerhouse in the beverages industry.

Brown-Forman Corporation Overview

Brown-Forman Corporation, founded in 1870 and based in Louisville, Kentucky, manufactures and markets a wide range of alcoholic beverages, including whiskey, vodka, tequila, and champagnes. Its portfolio includes well-known brands like Jack Daniel’s, Old Forester, and Korbel Champagnes. The company serves consumers worldwide through distributors and governments, maintaining operations in the US, Europe, and other international markets.

Key similarities and differences

Both companies operate in the beverages sector, focusing on the production and marketing of alcoholic drinks with strong global footprints. While Diageo offers a broader product mix including beer and non-alcoholic options, Brown-Forman emphasizes whiskey and ready-to-drink products. Diageo is headquartered in the UK with a larger workforce of about 30K employees, whereas Brown-Forman is US-based with a leaner team of 5.7K employees, reflecting differences in scale and operational models.

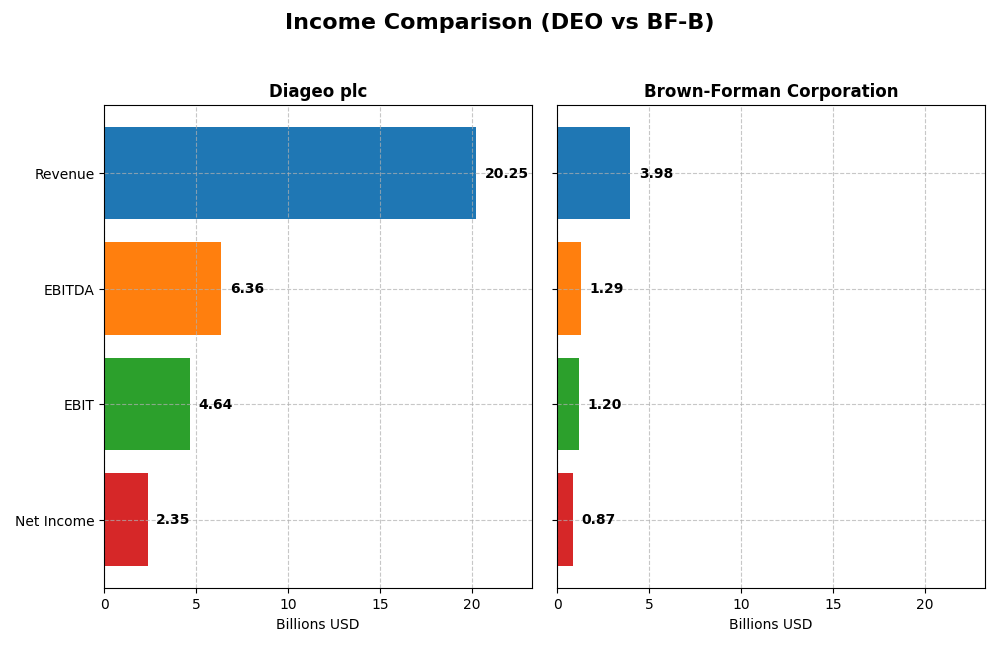

Income Statement Comparison

The table below summarizes the key income statement metrics for Diageo plc and Brown-Forman Corporation based on their latest fiscal year results.

| Metric | Diageo plc (DEO) | Brown-Forman Corporation (BF-B) |

|---|---|---|

| Market Cap | 50.5B | 12.6B |

| Revenue | 20.2B | 3.98B |

| EBITDA | 6.36B | 1.29B |

| EBIT | 4.64B | 1.20B |

| Net Income | 2.35B | 869M |

| EPS | 4.24 | 1.84 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Diageo plc

Diageo plc showed a 59% revenue increase over 2021-2025, but net income declined by 11.5% in the same period. Margins remained favorable, with a gross margin of 60.13% and net margin of 11.63%, though the latest fiscal year saw a revenue dip of 0.12% and a sharp net income fall of 39.1%, indicating margin pressures and slowing growth.

Brown-Forman Corporation

Brown-Forman experienced a 14.85% revenue growth over five years, accompanied by a slight net income decrease of 3.77%. Margins are strong, with a gross margin near 59% and a net margin of 21.86%. However, the most recent year recorded a 4.86% revenue decline and a 10.8% drop in net margin, signaling some recent operational challenges.

Which one has the stronger fundamentals?

Both companies face unfavorable overall income statement growth, particularly in net income and margins. Diageo has higher revenue growth but more significant earnings declines and margin contractions. Brown-Forman demonstrates better net and EBIT margins with milder declines, suggesting relatively stronger profitability fundamentals despite more modest revenue gains.

Financial Ratios Comparison

The table below compares key financial ratios for Diageo plc (DEO) and Brown-Forman Corporation (BF-B) based on their most recent fiscal year data.

| Ratios | Diageo plc (DEO) FY 2025 | Brown-Forman Corp (BF-B) FY 2025 |

|---|---|---|

| ROE | 21.23% | 21.76% |

| ROIC | 7.47% | 12.16% |

| P/E | 23.80 | 18.95 |

| P/B | 5.05 | 4.12 |

| Current Ratio | 1.63 | 3.88 |

| Quick Ratio | 0.64 | 1.56 |

| D/E (Debt-to-Equity) | 2.20 | 0.68 |

| Debt-to-Assets | 49.47% | 33.80% |

| Interest Coverage | 4.19 | 9.07 |

| Asset Turnover | 0.41 | 0.49 |

| Fixed Asset Turnover | 2.12 | 3.63 |

| Payout Ratio | 97.62% | 48.33% |

| Dividend Yield | 4.10% | 2.55% |

Interpretation of the Ratios

Diageo plc

Diageo shows a slightly favorable profile with strong net margin (11.63%) and ROE (21.23%), but faces concerns in leverage (debt-to-equity 2.2) and liquidity (quick ratio 0.64). Its dividend yield is robust at 4.1%, supported by consistent payouts, though elevated debt and moderate free cash flow coverage could pose risks to sustainability.

Brown-Forman Corporation

Brown-Forman presents a favorable ratio landscape, highlighted by a higher net margin (21.86%) and ROE (21.76%) than Diageo, along with strong interest coverage (9.86) and liquidity (quick ratio 1.56). The dividend yield of 2.55% is supported by solid earnings and conservative leverage, reflecting a balanced approach to shareholder returns and risk.

Which one has the best ratios?

Brown-Forman’s ratios are generally more favorable, with stronger profitability, liquidity, and coverage metrics. Diageo, while offering a higher dividend yield, shows weaker leverage and liquidity ratios. Overall, Brown-Forman demonstrates a more robust financial position with fewer unfavorable indicators compared to Diageo.

Strategic Positioning

This section compares the strategic positioning of Diageo plc and Brown-Forman Corporation, focusing on Market position, Key segments, and Exposure to technological disruption:

Diageo plc

- Leading global player with market cap of 50B USD, facing moderate competitive pressure.

- Diverse portfolio emphasizing spirits (22B GBP) and beer, with growing ready-to-drink segment.

- No explicit data on technological disruption exposure available.

Brown-Forman Corporation

- Mid-sized competitor with 13B USD market cap, subject to competitive pressure in multiple regions.

- Concentrated portfolio focused on whiskey (2.8B USD) and tequila, plus ready-to-drink and wine products.

- No explicit data on technological disruption exposure available.

Diageo plc vs Brown-Forman Corporation Positioning

Diageo has a diversified global portfolio across multiple beverage categories and regions, while Brown-Forman focuses more narrowly on whiskey and related products. Diageo’s scale offers broad market exposure, Brown-Forman emphasizes specialized segments with fewer employees.

Which has the best competitive advantage?

Both companies show a slightly favorable moat with ROIC above WACC but declining profitability. Brown-Forman has a higher ROIC premium over WACC, indicating a marginally stronger competitive advantage under current conditions.

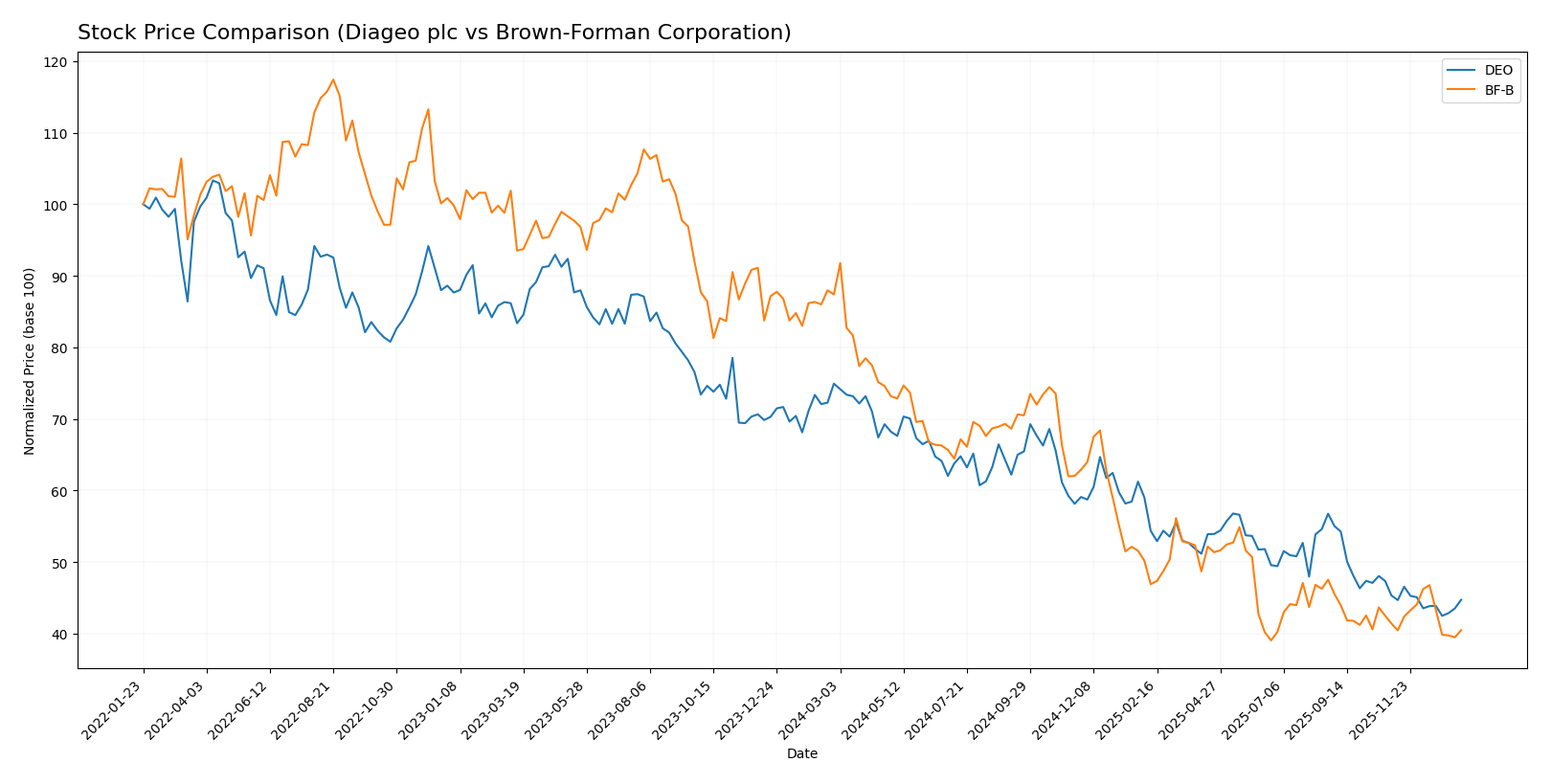

Stock Comparison

The stock prices of Diageo plc and Brown-Forman Corporation both exhibited significant declines over the past 12 months, with marked bearish trends and accelerating downward momentum.

Trend Analysis

Diageo plc’s stock fell 40.32% over the past year, showing a bearish trend with accelerating decline and high volatility (std deviation 17.64). The price ranged from 152.29 at its peak to 86.32 at its lowest.

Brown-Forman Corporation experienced a sharper 53.7% drop in the same period, also bearish with accelerating decline and lower volatility (std deviation 8.84). The stock peaked at 60.37 and bottomed at 25.68.

Comparatively, both stocks trended downward, but Diageo’s loss was less severe, delivering relatively higher market performance over the past 12 months.

Target Prices

The consensus target price for Diageo plc shows strong confidence among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Diageo plc | 124 | 124 | 124 |

Analysts expect Diageo’s stock to rise significantly from its current price of 90.89 USD, indicating potential upside and positive outlook. No verified target price data is available from recognized analysts for Brown-Forman Corporation.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Diageo plc and Brown-Forman Corporation:

Rating Comparison

Diageo plc Rating

- Rating: B- indicating a very favorable status

- Discounted Cash Flow Score: 3, moderate

- ROE Score: 5, very favorable

- ROA Score: 3, moderate

- Debt To Equity Score: 1, very unfavorable

- Overall Score: 3, moderate

Brown-Forman Corporation Rating

- Rating: B indicating a very favorable status

- Discounted Cash Flow Score: 3, moderate

- ROE Score: 5, very favorable

- ROA Score: 5, very favorable

- Debt To Equity Score: 2, moderate

- Overall Score: 3, moderate

Which one is the best rated?

Based strictly on the data, Brown-Forman holds a higher overall rating (B vs. B-) and a better ROA and debt-to-equity score, indicating a more favorable financial profile compared to Diageo.

Scores Comparison

Here is a comparison of the financial health scores for Diageo plc and Brown-Forman Corporation:

Diageo plc Scores

- Altman Z-Score: 2.80, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 7, reflecting strong financial strength.

Brown-Forman Corporation Scores

- Altman Z-Score: 4.23, indicating low bankruptcy risk in the safe zone.

- Piotroski Score: 7, reflecting strong financial strength.

Which company has the best scores?

Brown-Forman Corporation has a higher Altman Z-Score, placing it in the safe zone, while both companies share the same Piotroski Score of 7. Based on these scores, Brown-Forman shows a stronger financial stability in terms of bankruptcy risk.

Grades Comparison

The following is a summary of the latest reliable grades assigned to Diageo plc and Brown-Forman Corporation:

Diageo plc Grades

This table lists recent grades from established financial institutions for Diageo plc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Downgrade | Neutral | 2025-12-03 |

| B of A Securities | Maintain | Buy | 2025-09-26 |

| TD Cowen | Maintain | Hold | 2025-01-08 |

| Jefferies | Upgrade | Buy | 2024-12-04 |

| Citigroup | Upgrade | Buy | 2024-07-03 |

| Citigroup | Upgrade | Buy | 2024-07-02 |

| Argus Research | Downgrade | Hold | 2024-01-04 |

| Argus Research | Downgrade | Hold | 2024-01-03 |

| JP Morgan | Downgrade | Neutral | 2023-11-29 |

| JP Morgan | Downgrade | Neutral | 2023-11-28 |

Overall, grades for Diageo plc have shifted between Buy, Hold, and Neutral, with recent downgrades indicating a more cautious outlook.

Brown-Forman Corporation Grades

Below are the recent grades from recognized grading companies for Brown-Forman Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Downgrade | Sell | 2025-12-17 |

| Evercore ISI Group | Maintain | In Line | 2025-12-05 |

| JP Morgan | Maintain | Underweight | 2025-12-05 |

| Barclays | Maintain | Overweight | 2025-11-28 |

| Needham | Maintain | Hold | 2025-10-16 |

| Barclays | Maintain | Overweight | 2025-10-07 |

| Barclays | Maintain | Overweight | 2025-09-02 |

| JP Morgan | Maintain | Underweight | 2025-09-02 |

| Needham | Maintain | Hold | 2025-08-29 |

| UBS | Maintain | Neutral | 2025-08-29 |

Brown-Forman’s grades mostly range from Hold to Overweight, but a recent downgrade to Sell by Citigroup suggests some negative sentiment.

Which company has the best grades?

Diageo plc generally holds a more favorable rating trend with multiple Buy grades and fewer Sell ratings, while Brown-Forman shows mixed ratings including a recent Sell. This divergence may affect investors’ perceptions of relative risk and potential growth.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Diageo plc (DEO) and Brown-Forman Corporation (BF-B), based on the most recent financial and market data.

| Criterion | Diageo plc (DEO) | Brown-Forman Corporation (BF-B) |

|---|---|---|

| Diversification | Extensive product range with strong spirits segment (GBP 22.17B in 2025) and growing beer and ready-to-drink categories | Focused portfolio with dominant whiskey sales (USD 2.83B in 2025) and growing tequila and ready-to-drink products |

| Profitability | Net margin 11.63%, ROE 21.23%, ROIC 7.47% (neutral) with dividend yield 4.1% | Higher profitability: Net margin 21.86%, ROE 21.76%, ROIC 12.16%, dividend yield 2.55% |

| Innovation | Moderate innovation with steady product growth, but declining ROIC trend (-29%) signals caution | Strong innovation and efficiency with favorable ROIC (12.16%) despite a similar declining trend (-27%) |

| Global presence | Broad global footprint with diversified revenue streams across regions | Global presence concentrated in key markets with strong brand loyalty in whiskey and premium spirits |

| Market Share | Large market share in spirits and beer globally | Leading market share in premium whiskey and tequila segments |

Key takeaways: Both companies are value creators with favorable economic moats but face declining profitability trends. Brown-Forman shows stronger profitability and operational efficiency, while Diageo benefits from greater diversification. Investors should weigh profitability against diversification and declining ROIC trends when considering these stocks.

Risk Analysis

The following table summarizes key risks for Diageo plc (DEO) and Brown-Forman Corporation (BF-B) as of 2025, considering financial and operational factors.

| Metric | Diageo plc (DEO) | Brown-Forman Corporation (BF-B) |

|---|---|---|

| Market Risk | Low beta (0.15), stable demand | Moderate beta (0.41), US-focused exposure |

| Debt Level | High debt/equity (2.2), moderate coverage | Moderate debt/equity (0.68), strong coverage |

| Regulatory Risk | Global operations, exposure to diverse regulations | Significant US and international regulations |

| Operational Risk | Large workforce (30K), complex supply chain | Smaller workforce (5.7K), efficient operations |

| Environmental Risk | Moderate, growing sustainability focus | Moderate, increasing eco-initiatives |

| Geopolitical Risk | Exposure to emerging markets and trade tensions | Mainly US and Europe, geopolitical stability |

Diageo’s most impactful risks are its relatively high leverage and geopolitical exposure in emerging markets, increasing financial and operational uncertainty. Brown-Forman benefits from stronger financial stability and lower debt but faces moderate market risk due to its US-centric operations. Investors should weigh leverage and regional risks carefully.

Which Stock to Choose?

Diageo plc (DEO) shows a mixed financial picture with slightly favorable ratios but an unfavorable income statement marked by declining profitability and growth. Its debt levels are relatively high, and it holds a very favorable rating of B- despite some financial weaknesses.

Brown-Forman Corporation (BF-B) presents a more favorable financial ratio profile and a very favorable B rating. While its income statement also indicates declining margins and profits, it maintains lower debt and stronger liquidity compared to DEO, supported by solid profitability metrics.

Investors focused on stability and financial strength may find BF-B more appealing due to its favorable ratios and ratings, while those who accept moderate debt and mixed income signals could interpret DEO’s profile as suitable for value creation despite recent challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Diageo plc and Brown-Forman Corporation to enhance your investment decisions: