In the competitive world of alcoholic beverages, Constellation Brands, Inc. (STZ) and Brown-Forman Corporation (BF-B) stand out as industry leaders with strong market presence. Both companies operate in the wineries and distilleries sector, offering diverse portfolios of spirits, wines, and beers across global markets. Their innovation strategies and brand strength make them compelling candidates for investment consideration. This article will help you decide which company aligns best with your investment goals.

Table of contents

Companies Overview

I will begin the comparison between Constellation Brands, Inc. and Brown-Forman Corporation by providing an overview of these two companies and their main differences.

Constellation Brands, Inc. Overview

Constellation Brands, Inc. operates in the beverages industry, focusing on wineries and distilleries. The company produces, imports, markets, and sells beer, wine, and spirits primarily in the US, Canada, Mexico, New Zealand, and Italy. Its portfolio includes brands like Corona, Modelo, Meiomi, and Robert Mondavi, serving wholesale distributors, retailers, and state alcohol agencies. Founded in 1945, it is headquartered in Victor, New York.

Brown-Forman Corporation Overview

Brown-Forman Corporation also operates in the beverages sector, specializing in alcoholic beverages including spirits, wines, and ready-to-drink products. It markets brands such as Jack Daniel’s, Herradura, Korbel, and Finlandia, with operations in the US, Germany, Australia, and other international markets. Founded in 1870, the company is headquartered in Louisville, Kentucky, serving retail customers, distributors, and government entities.

Key similarities and differences

Both companies operate in the beverages industry with a focus on alcoholic products and have diversified brand portfolios including spirits and wines. Constellation Brands has a larger geographic footprint in North America and more emphasis on beer brands, while Brown-Forman offers a broader range of ready-to-drink and flavored liqueurs with a stronger presence in international markets like Germany and Australia. Each serves retail and government channels but differs in scale and product mix.

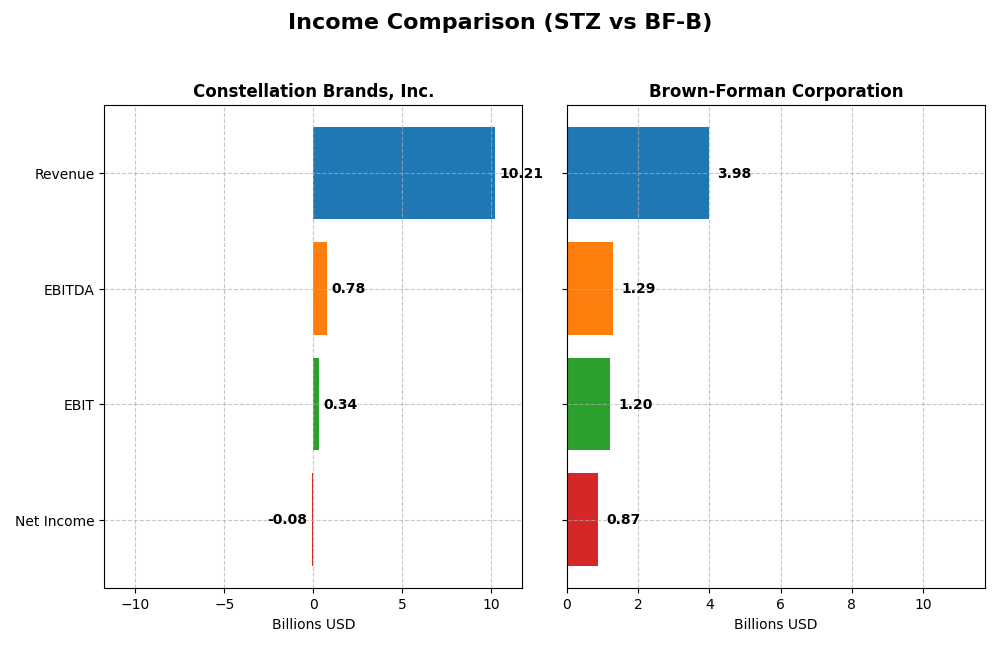

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Constellation Brands, Inc. and Brown-Forman Corporation for the fiscal year 2025.

| Metric | Constellation Brands, Inc. (STZ) | Brown-Forman Corporation (BF-B) |

|---|---|---|

| Market Cap | 26.4B USD | 12.6B USD |

| Revenue | 10.2B USD | 3.98B USD |

| EBITDA | 783M USD | 1.29B USD |

| EBIT | 336M USD | 1.20B USD |

| Net Income | -81.4M USD | 869M USD |

| EPS | -0.45 USD | 1.84 USD |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Constellation Brands, Inc.

Constellation Brands showed steady revenue growth from 8.6B in 2021 to over 10B in 2025, an 18.5% increase. However, net income deteriorated significantly, turning negative in recent years, with a -0.8% net margin in 2025. The gross margin remained favorable near 51%, but EBIT margin dropped sharply to 3.3%, indicating operational challenges in 2025.

Brown-Forman Corporation

Brown-Forman’s revenue grew from 3.46B in 2021 to 3.98B in 2025, a 14.9% increase, but net income declined slightly with a 21.9% net margin in 2025. The company maintains strong profitability with a favorable 58.9% gross margin and 30.3% EBIT margin, despite a recent decline in revenue and net income growth over the last year.

Which one has the stronger fundamentals?

Both companies face unfavorable net income trends despite revenue growth. Brown-Forman maintains superior profitability margins and a stronger EBIT margin, while Constellation Brands struggles with negative net income and sharply reduced EBIT margin. Overall, both have unfavorable growth in net income and margins, but Brown-Forman’s fundamentals appear more robust.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Constellation Brands, Inc. (STZ) and Brown-Forman Corporation (BF-B) for the most recent fiscal year available.

| Ratios | Constellation Brands, Inc. (STZ) 2025 | Brown-Forman Corporation (BF-B) 2025 |

|---|---|---|

| ROE | -1.18% | 21.76% |

| ROIC | 6.83% | 12.16% |

| P/E | -391.27 | 18.95 |

| P/B | 4.63 | 4.12 |

| Current Ratio | 0.92 | 3.88 |

| Quick Ratio | 0.56 | 1.56 |

| D/E (Debt-to-Equity) | 1.76 | 0.68 |

| Debt-to-Assets | 56.0% | 33.8% |

| Interest Coverage | 8.80 | 9.07 |

| Asset Turnover | 0.47 | 0.49 |

| Fixed Asset Turnover | 1.28 | 3.63 |

| Payout ratio | -899.02% | 48.33% |

| Dividend yield | 2.30% | 2.55% |

Interpretation of the Ratios

Constellation Brands, Inc.

Constellation Brands shows several unfavorable financial ratios in 2025, including negative net margin (-0.8%) and return on equity (-1.18%), alongside a weak current ratio (0.92) and high debt-to-assets ratio (55.95%). Its dividend yield of 2.3% is favorable, but concerns about liquidity and leverage persist. The firm maintains dividend payments despite some profitability challenges.

Brown-Forman Corporation

Brown-Forman exhibits mostly favorable ratios with a strong net margin of 21.86%, ROE at 21.76%, and robust interest coverage of 9.86. Its current ratio is relatively high but considered unfavorable at 3.88. The dividend yield is 2.55%, supported by consistent profitability and moderate leverage, indicating stable shareholder returns and effective capital management.

Which one has the best ratios?

Brown-Forman’s ratios are generally stronger, with a majority favorable evaluation, particularly in profitability and liquidity metrics. In contrast, Constellation Brands faces multiple unfavorable ratios, especially in profitability and solvency. Therefore, Brown-Forman holds the advantage in this ratio comparison based on the given data.

Strategic Positioning

This section compares the strategic positioning of Constellation Brands, Inc. and Brown-Forman Corporation, including market position, key segments, and exposure to technological disruption:

Constellation Brands, Inc.

- Leading in beverages with strong brand portfolio; faces competitive pressure in beer and spirits markets.

- Key segments are beer ($8.5B in 2025) and wines/spirits ($1.7B), driven by Corona and Modelo brands.

- Moderate exposure to disruption; traditional beverage categories with evolving consumer preferences.

Brown-Forman Corporation

- Established spirits-focused company, competing globally with recognized whiskey and tequila brands.

- Key segments include whiskey ($2.8B), ready-to-drink ($491M), tequila ($262M), and other spirits.

- Moderate exposure; innovation in ready-to-drink and premium spirits to address market shifts.

Constellation Brands, Inc. vs Brown-Forman Corporation Positioning

Constellation Brands exhibits a diversified portfolio with significant beer and wine/spirits segments, while Brown-Forman concentrates on spirits, especially whiskey. This diversification offers revenue spread versus focused brand strength and product specialization.

Which has the best competitive advantage?

Both companies show slight favorable economic moats, creating value with ROIC above WACC but declining profitability trends. Brown-Forman has a higher ROIC spread, indicating a stronger competitive advantage despite similar challenges in sustaining growth.

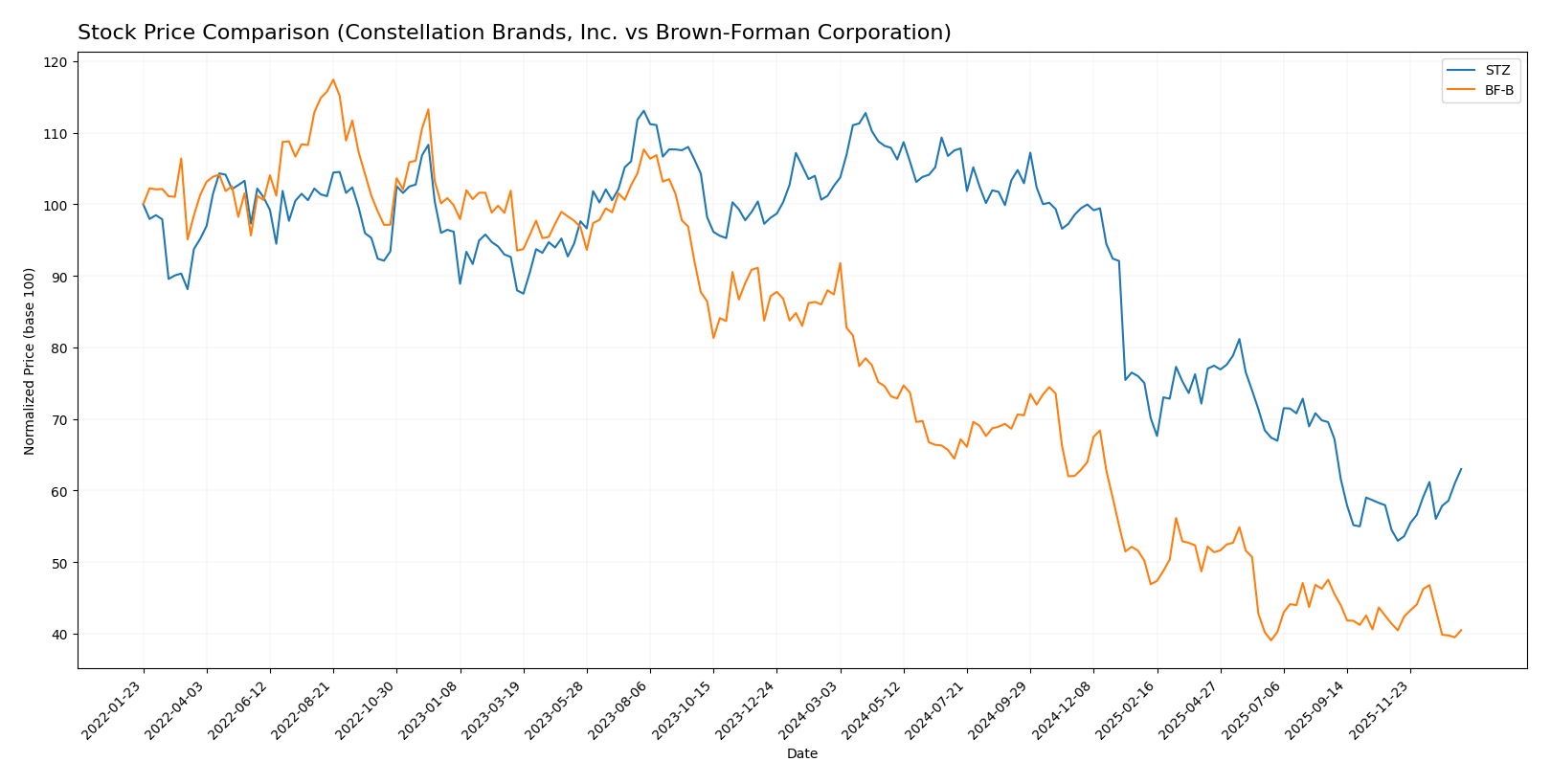

Stock Comparison

The stock price movements of Constellation Brands, Inc. (STZ) and Brown-Forman Corporation (BF-B) over the past 12 months reveal significant bearish trends with varying degrees of recent activity and volatility.

Trend Analysis

Constellation Brands, Inc. (STZ) experienced a pronounced bearish trend over the past year, with a price decline of -38.59%. This trend showed acceleration, hitting a high of 271.76 and a low of 127.65, supported by a high volatility of 46.23.

Brown-Forman Corporation (BF-B) also recorded a bearish trend with a steeper price drop of -53.7%, accompanied by accelerating momentum. The stock’s price ranged from 60.37 to 25.68, with lower volatility at 8.84 compared to STZ.

Comparatively, STZ delivered the highest market performance recently, showing a 15.56% price increase over the last two and a half months, whereas BF-B continued a slight decline of -2.24% in the same period.

Target Prices

Constellation Brands, Inc. shows a clear target price consensus from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Constellation Brands, Inc. | 209 | 135 | 172.91 |

Analysts expect Constellation Brands’ stock to appreciate, with a consensus target approximately 14% above the current price of $151.82, indicating moderate upside potential. For Brown-Forman Corporation, no verified target price data is available from recognized analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Constellation Brands, Inc. (STZ) and Brown-Forman Corporation (BF-B):

Rating Comparison

STZ Rating

- Rating: B+, considered very favorable overall.

- Discounted Cash Flow Score: 5, indicating a very favorable valuation outlook.

- ROE Score: 4, showing favorable efficiency in generating profit from equity.

- ROA Score: 4, favorable asset utilization.

- Debt To Equity Score: 1, a very unfavorable financial risk rating.

- Overall Score: 3, moderate overall financial standing.

BF-B Rating

- Rating: B, also considered very favorable overall.

- Discounted Cash Flow Score: 3, reflecting a moderate valuation outlook.

- ROE Score: 5, indicating very favorable efficiency in profit generation.

- ROA Score: 5, very favorable asset utilization.

- Debt To Equity Score: 2, a moderate financial risk rating.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

Based strictly on the provided data, STZ holds a higher rating (B+ vs B) and excels in discounted cash flow, while BF-B scores better on ROE and ROA. Both have the same overall moderate score, but BF-B has a slightly better debt-to-equity rating.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

Constellation Brands, Inc. (STZ) Scores

- Altman Z-Score: 2.79, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

Brown-Forman Corporation (BF-B) Scores

- Altman Z-Score: 4.23, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Which company has the best scores?

Brown-Forman has a higher Altman Z-Score placing it in the safe zone, suggesting lower bankruptcy risk. Constellation Brands has a stronger Piotroski Score, indicating better financial health. Both show solid but different strengths.

Grades Comparison

Here is a detailed comparison of the latest reliable grades for Constellation Brands, Inc. and Brown-Forman Corporation:

Constellation Brands, Inc. Grades

The table below summarizes recent grades assigned to Constellation Brands, Inc. by recognized grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2026-01-09 |

| UBS | Maintain | Buy | 2026-01-09 |

| Needham | Maintain | Buy | 2026-01-09 |

| Citigroup | Maintain | Neutral | 2026-01-09 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Needham | Maintain | Buy | 2026-01-08 |

| Needham | Maintain | Buy | 2026-01-06 |

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Jefferies | Downgrade | Hold | 2025-12-17 |

| Piper Sandler | Maintain | Neutral | 2025-11-21 |

Overall, Constellation Brands exhibits a strong buy and outperform trend with most firms maintaining positive grades, despite a recent downgrade from Jefferies.

Brown-Forman Corporation Grades

The table below presents recent grades for Brown-Forman Corporation from established grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Downgrade | Sell | 2025-12-17 |

| Evercore ISI Group | Maintain | In Line | 2025-12-05 |

| JP Morgan | Maintain | Underweight | 2025-12-05 |

| Barclays | Maintain | Overweight | 2025-11-28 |

| Needham | Maintain | Hold | 2025-10-16 |

| Barclays | Maintain | Overweight | 2025-10-07 |

| Barclays | Maintain | Overweight | 2025-09-02 |

| JP Morgan | Maintain | Underweight | 2025-09-02 |

| Needham | Maintain | Hold | 2025-08-29 |

| UBS | Maintain | Neutral | 2025-08-29 |

Brown-Forman’s grades show a mixed pattern with notable downgrades, including a sell rating from Citigroup, and multiple hold and underweight assessments.

Which company has the best grades?

Constellation Brands, Inc. has received generally stronger grades, with a consensus leaning towards “Buy” and several “Outperform” and “Overweight” ratings. Brown-Forman Corporation’s consensus is “Hold,” reflecting more cautious or negative views. This difference may influence investors’ perception of growth potential and risk profile between the two stocks.

Strengths and Weaknesses

Below is a comparative overview of Constellation Brands, Inc. (STZ) and Brown-Forman Corporation (BF-B) based on key business criteria.

| Criterion | Constellation Brands, Inc. (STZ) | Brown-Forman Corporation (BF-B) |

|---|---|---|

| Diversification | Focuses on Beer (8.54B in 2025) and Wines & Spirits (~1.67B); moderate product spread but heavy reliance on beer | Broad portfolio including Whiskey (2.83B), Tequila (262M), Ready-to-Drink (491M), and other spirits; more diversified within spirits |

| Profitability | Declining profitability; net margin -0.8%, ROE -1.18%, ROIC 6.83% (neutral), overall ratios unfavorable | Strong profitability; net margin 21.86%, ROE 21.76%, ROIC 12.16%, overall ratios favorable |

| Innovation | Limited recent innovation signals; declining ROIC trend (-22.5%) suggests challenges in efficiency gains | Also shows declining ROIC trend (-27.5%) but maintains higher profitability and innovation reflected in product variety |

| Global presence | Significant presence in beer markets; global distribution but moderate expansion in wines & spirits | Strong global footprint particularly in premium spirits; solid brand recognition worldwide |

| Market Share | Leading in beer segment but less dominant in wines & spirits | Leading in whiskey segment with strong presence in tequila and ready-to-drink categories |

Key takeaways: Brown-Forman demonstrates stronger profitability and diversified spirits portfolio, making it a more robust value creator despite a declining ROIC trend. Constellation Brands relies heavily on beer with weaker margins and financial ratios, signaling caution for investors.

Risk Analysis

Below is a comparison of key risks for Constellation Brands, Inc. (STZ) and Brown-Forman Corporation (BF-B) based on the most recent data from 2025.

| Metric | Constellation Brands, Inc. (STZ) | Brown-Forman Corporation (BF-B) |

|---|---|---|

| Market Risk | Beta 0.444 (low volatility) | Beta 0.414 (low volatility) |

| Debt Level | High leverage: Debt/Equity 1.76, Debt/Assets 56% (unfavorable) | Moderate leverage: Debt/Equity 0.68, Debt/Assets 34% (neutral) |

| Regulatory Risk | Exposure to multiple markets with varying alcohol regulations | Similar multi-market exposure with complex regulations |

| Operational Risk | Lower asset turnover (0.47) and interest coverage ratio (0.82) indicate operational stress | Better operational efficiency (asset turnover 0.49) and strong interest coverage (9.86) |

| Environmental Risk | Standard industry exposure, no major issues reported | Standard industry exposure, no major issues reported |

| Geopolitical Risk | Operations in US, Canada, Mexico, New Zealand, Italy | Operations in US, Germany, Australia, UK, Mexico |

Constellation Brands faces the most significant risk from its high debt levels and weak interest coverage ratio, increasing financial vulnerability despite low market volatility. Brown-Forman shows stronger financial health with moderate debt and robust operational metrics, making it less risky overall. Regulatory and geopolitical risks remain comparable for both due to global operations.

Which Stock to Choose?

Constellation Brands, Inc. (STZ) shows a mixed financial profile with a modest revenue growth of 2.47% in 2025 but a negative net margin of -0.8%. Its financial ratios are mostly unfavorable, including a high debt-to-equity ratio of 1.76 and weak liquidity ratios, though it maintains a slightly favorable moat with ROIC exceeding WACC despite a declining trend. The company’s rating is very favorable at B+ with moderate overall scores and a grey zone Altman Z-Score, indicating moderate financial risk.

Brown-Forman Corporation (BF-B) demonstrates a stronger profitability with a 21.86% net margin and robust return metrics, although it reported a revenue decline of -4.86% in 2025. Its financial ratios are predominantly favorable, with low debt, good interest coverage, and strong liquidity, supported by a slightly favorable moat rating reflecting ROIC above WACC but declining. The rating is very favorable at B, complemented by a safe zone Altman Z-Score and strong Piotroski score.

For investors seeking growth potential, STZ’s value creation and moderate market position might appear appealing despite some financial challenges. Conversely, BF-B’s solid profitability and financial stability could be more suitable for investors prioritizing quality and risk management. Thus, the choice could depend on whether the investor favors growth with caution or prefers consistent financial strength with some revenue contraction.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Constellation Brands, Inc. and Brown-Forman Corporation to enhance your investment decisions: