In the fast-evolving semiconductor industry, Broadcom Inc. (AVGO) and SkyWater Technology, Inc. (SKYT) represent two distinct yet overlapping players. Broadcom is a global technology giant with diverse product lines and a vast market presence, while SkyWater focuses on specialized semiconductor development and manufacturing services. Comparing these companies sheds light on innovation strategies and market positioning, helping you identify which stock might best enhance your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Broadcom Inc. and SkyWater Technology, Inc. by providing an overview of these two companies and their main differences.

Broadcom Inc. Overview

Broadcom Inc. is a global technology company specializing in semiconductor and infrastructure software solutions. Headquartered in San Jose, California, it operates through four segments: Wired Infrastructure, Wireless Communications, Enterprise Storage, and Industrial & Other. Broadcom’s products serve diverse markets including data centers, telecommunications, smartphones, and factory automation, supported by a workforce of 37,000 employees.

SkyWater Technology, Inc. Overview

SkyWater Technology, Inc., based in Bloomington, Minnesota, offers semiconductor development and manufacturing services. Founded in 2017, it focuses on co-creating technologies with customers and provides manufacturing for silicon-based analog, mixed-signal, and rad-hard integrated circuits. SkyWater serves industries such as aerospace, automotive, bio-health, and industrial IoT, employing around 700 people.

Key similarities and differences

Both companies operate in the semiconductor industry and serve tech-driven sectors, but Broadcom is a large diversified provider with a wide product portfolio and global reach, while SkyWater is a smaller, specialized foundry focused on development and manufacturing services. Broadcom’s scale and segment diversity contrast with SkyWater’s niche emphasis on co-development and manufacturing support for specific integrated circuits.

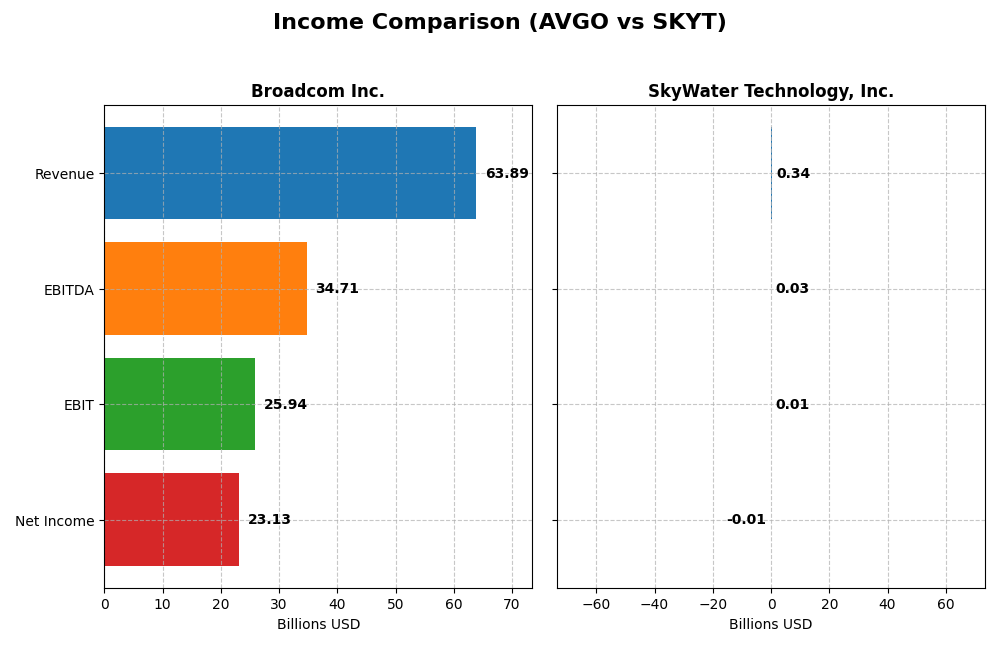

Income Statement Comparison

This table presents the most recent full fiscal year income statement metrics for Broadcom Inc. and SkyWater Technology, Inc., providing a side-by-side financial snapshot.

| Metric | Broadcom Inc. (AVGO) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Cap | 1.6T | 1.5B |

| Revenue | 63.9B | 342M |

| EBITDA | 34.7B | 25.3M |

| EBIT | 25.9B | 6.6M |

| Net Income | 23.1B | -6.8M |

| EPS | 4.91 | -0.14 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Broadcom Inc.

Broadcom Inc. showed strong revenue growth from $27.45B in 2021 to $63.89B in 2025, with net income rising from $6.44B to $23.13B. Margins improved notably, with a gross margin of 67.77% and net margin of 36.2% in 2025. The most recent year displayed accelerated growth, with a 23.87% revenue increase and 216.69% net margin expansion, reflecting robust profitability gains.

SkyWater Technology, Inc.

SkyWater Technology’s revenue grew from $140M in 2020 to $342M in 2024, while net income losses narrowed from -$20.6M to -$6.8M. The gross margin improved to 20.34%, but net margin remained negative at -1.98%. The latest fiscal year featured favorable growth in revenue (+19.39%) and net margin (+81.5%), though profitability remains under pressure despite operational improvements.

Which one has the stronger fundamentals?

Broadcom exhibits substantially stronger fundamentals, driven by significantly higher revenues, consistent profitability, and improving margins. SkyWater shows progress with revenue growth and narrowing losses, but its negative net margin and smaller scale suggest a riskier profile. Broadcom’s scale and margin strength provide a more favorable income statement outlook.

Financial Ratios Comparison

The table below compares key financial ratios for Broadcom Inc. and SkyWater Technology, Inc. based on their most recent fiscal year data.

| Ratios | Broadcom Inc. (2025) | SkyWater Technology, Inc. (2024) |

|---|---|---|

| ROE | 28.4% | -11.8% |

| ROIC | 16.4% | 3.4% |

| P/E | 73.9 | -100.3 (negative earnings) |

| P/B | 21.0 | 11.8 |

| Current Ratio | 1.71 | 0.86 |

| Quick Ratio | 1.58 | 0.76 |

| D/E (Debt to Equity) | 0.80 | 1.33 |

| Debt-to-Assets | 38.1% | 24.5% |

| Interest Coverage | 7.94 | 0.74 |

| Asset Turnover | 0.37 | 1.09 |

| Fixed Asset Turnover | 25.3 | 2.07 |

| Payout Ratio | 48.2% | 0% |

| Dividend Yield | 0.65% | 0% |

Interpretation of the Ratios

Broadcom Inc.

Broadcom’s financial ratios are generally strong, with favorable net margin at 36.2%, ROE at 28.45%, and ROIC at 16.36%. However, high valuation multiples such as a PE ratio of 73.87 and PB of 21.01 are unfavorable. The current and quick ratios are solid, indicating good liquidity. The company pays dividends with a modest yield of 0.65%, suggesting cautious shareholder returns.

SkyWater Technology, Inc.

SkyWater shows mostly weak financial ratios, with negative net margin (-1.98%) and ROE (-11.79%), indicating profitability challenges. Its WACC is high at 19.73%, and liquidity ratios are below 1, reflecting short-term financial pressure. The company does not pay dividends, likely due to ongoing losses and a focus on reinvestment and growth, as evidenced by low dividend yield and unfavorable coverage ratios.

Which one has the best ratios?

Broadcom Inc. exhibits a more favorable financial profile with stronger profitability, liquidity, and returns despite some valuation concerns. SkyWater Technology’s ratios are largely unfavorable, reflecting operational and financial difficulties. Overall, Broadcom’s ratios present a more stable and positive outlook compared to SkyWater’s challenging metrics.

Strategic Positioning

This section compares the strategic positioning of Broadcom Inc. and SkyWater Technology, Inc. including Market position, Key segments, and disruption:

Broadcom Inc.

- Leading global semiconductor and infrastructure software provider, facing competitive pressure in tech industry.

- Operates diversified segments: Wired Infrastructure, Wireless Communications, Enterprise Storage, Industrial & Other.

- Exposure to disruption managed through diverse product portfolio including firmware and complex sub-systems.

SkyWater Technology, Inc.

- Smaller player in semiconductor development and manufacturing services, operating in niche markets.

- Focuses on advanced technology services and wafer manufacturing, targeting aerospace, defense, automotive, bio-health.

- Faces disruption risk in semiconductor manufacturing but leverages engineering and process development support.

Broadcom Inc. vs SkyWater Technology, Inc. Positioning

Broadcom pursues a diversified business model with large-scale product and segment variety, supporting broad market reach. SkyWater concentrates on specialized manufacturing and development services, serving specific industries which may limit scale but enhance niche expertise.

Which has the best competitive advantage?

Broadcom demonstrates a very favorable moat with consistent value creation and growing profitability, indicating a durable competitive advantage. SkyWater shows a slightly unfavorable moat, shedding value despite improving profitability, suggesting a less established competitive position.

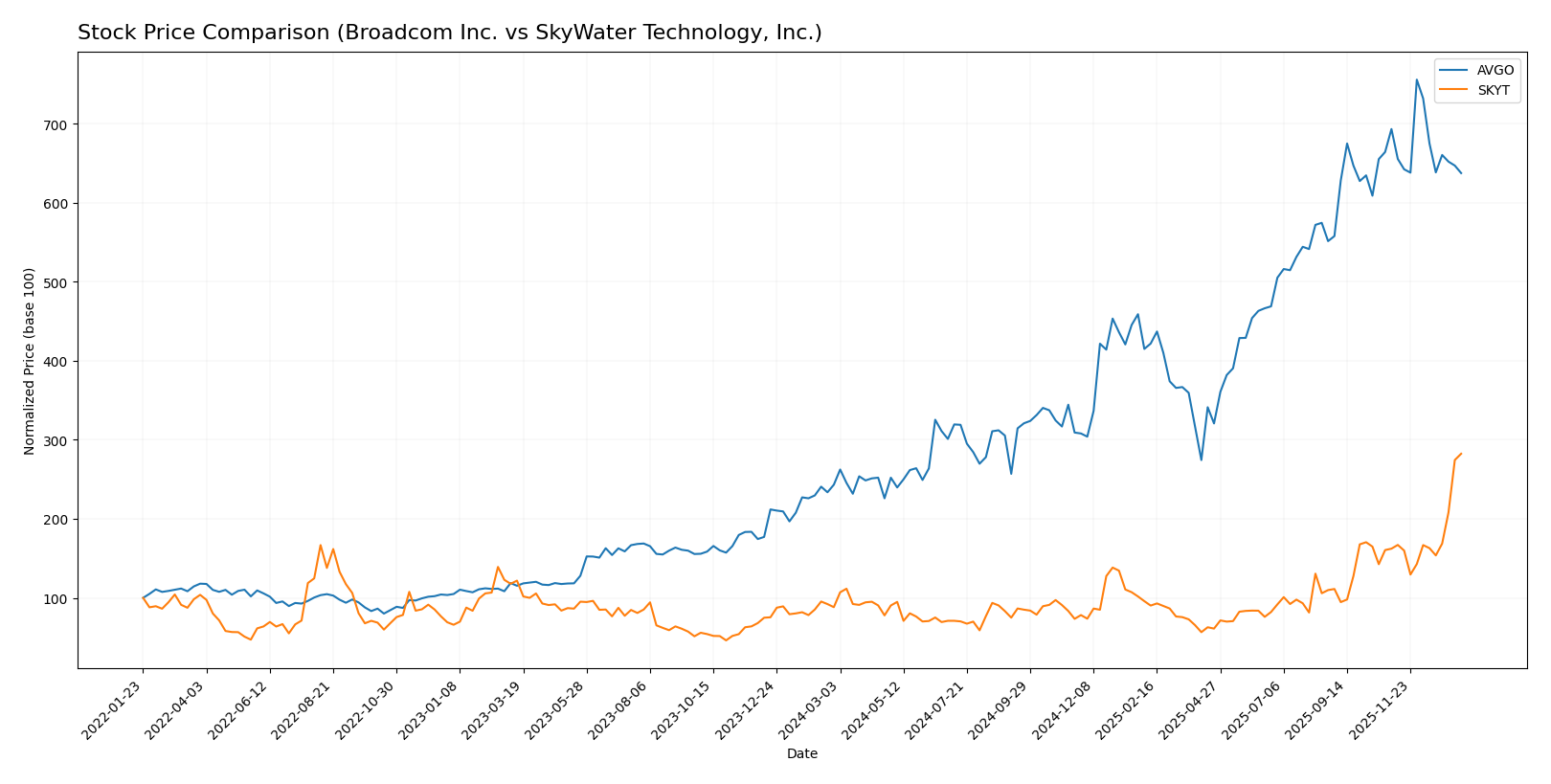

Stock Comparison

The stock price movements of Broadcom Inc. (AVGO) and SkyWater Technology, Inc. (SKYT) over the past 12 months reveal contrasting dynamics, with AVGO showing a strong overall rise but recent weakness, while SKYT exhibits sustained growth and accelerating momentum.

Trend Analysis

Broadcom Inc. (AVGO) experienced a 162.18% price increase over the past year, indicating a bullish trend with deceleration. The stock ranged from $120.47 to $402.96, showing high volatility (std deviation 78.56). Recently, AVGO declined 8.05%, reflecting a short-term bearish slope.

SkyWater Technology, Inc. (SKYT) posted a 220.08% gain over the same period, signaling a bullish trend with acceleration. The price fluctuated between $6.10 and $30.44, with low volatility (std deviation 4.34). Recently, SKYT surged 74.04%, confirming continued upward momentum.

Comparing the two, SKYT outperformed AVGO in total price appreciation and recent gains, delivering the highest market performance among the analyzed stocks.

Target Prices

The current analyst consensus suggests a promising outlook for Broadcom Inc. and SkyWater Technology, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Broadcom Inc. | 510 | 370 | 454.8 |

| SkyWater Technology, Inc. | 25 | 25 | 25 |

Analysts expect Broadcom’s stock to appreciate significantly from its current price of $339.89, while SkyWater’s target consensus is below its current price of $30.44, indicating potential downside or cautious sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial grades for Broadcom Inc. and SkyWater Technology, Inc.:

Rating Comparison

Broadcom Inc. Rating

- Rating: B, considered Very Favorable overall by analysts.

- Discounted Cash Flow Score: Moderate at 3, indicating balanced valuation.

- ROE Score: Very Favorable at 5, showing efficient profit generation.

- ROA Score: Very Favorable at 5, demonstrating effective asset use.

- Debt To Equity Score: Very Unfavorable at 1, indicating high financial risk.

- Overall Score: Moderate at 3, reflecting balanced strengths and weaknesses.

SkyWater Technology, Inc. Rating

- Rating: B+, also rated Very Favorable overall by analysts.

- Discounted Cash Flow Score: Very Unfavorable at 1, suggesting overvaluation risk.

- ROE Score: Very Favorable at 5, equally strong profit efficiency.

- ROA Score: Very Favorable at 5, matching Broadcom in asset utilization.

- Debt To Equity Score: Very Unfavorable at 1, also reflecting elevated financial risk.

- Overall Score: Moderate at 3, showing similar overall financial standing.

Which one is the best rated?

SkyWater Technology holds a slightly higher rating of B+ compared to Broadcom’s B. However, both have equal overall scores and strong profitability metrics. Broadcom shows a better discounted cash flow score, while both share similar high financial risk from debt levels.

Scores Comparison

Here is a comparison of the financial scores for Broadcom Inc. and SkyWater Technology, Inc.:

AVGO Scores

- Altman Z-Score: 12.13, indicating a safe financial zone and low bankruptcy risk.

- Piotroski Score: 8, reflecting very strong financial health and investment potential.

SKYT Scores

- Altman Z-Score: 1.63, indicating financial distress and high bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength and moderate investment potential.

Which company has the best scores?

Broadcom Inc. shows significantly stronger financial health with a high Altman Z-Score in the safe zone and a very strong Piotroski Score. SkyWater Technology, Inc. has a concerning Altman Z-Score in the distress zone and only an average Piotroski Score.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Broadcom Inc. and SkyWater Technology, Inc.:

Broadcom Inc. Grades

This table summarizes the latest grades from reputable financial institutions for Broadcom Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2026-01-09 |

| Truist Securities | Maintain | Buy | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-15 |

| Benchmark | Maintain | Buy | 2025-12-12 |

| Rosenblatt | Maintain | Buy | 2025-12-12 |

| Piper Sandler | Maintain | Overweight | 2025-12-12 |

| TD Cowen | Maintain | Buy | 2025-12-12 |

| B of A Securities | Maintain | Buy | 2025-12-12 |

| JP Morgan | Maintain | Overweight | 2025-12-12 |

| Mizuho | Maintain | Outperform | 2025-12-12 |

Overall, Broadcom Inc. shows a consistent pattern of buy and outperform ratings by major grading firms.

SkyWater Technology, Inc. Grades

Below is a summary table of recent grades from established financial firms for SkyWater Technology, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology, Inc. maintains a steady consensus of buy and overweight ratings from recognized grading companies.

Which company has the best grades?

Broadcom Inc. has received a higher volume of buy and outperform ratings from more grading companies compared to SkyWater Technology, Inc., which mainly holds buy and overweight grades. This suggests stronger analyst confidence in Broadcom, potentially signaling greater investor interest and perceived stability.

Strengths and Weaknesses

The table below compares key strengths and weaknesses of Broadcom Inc. (AVGO) and SkyWater Technology, Inc. (SKYT) based on their recent financial and operational data.

| Criterion | Broadcom Inc. (AVGO) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Diversification | Strong diversification with major revenue from Semiconductor Solutions ($36.9B) and Infrastructure Software ($27.0B) in 2025 | Less diversified, primarily focused on Advanced Technology and Wafer Services with total revenues under $250M in 2024 |

| Profitability | High profitability: net margin 36.2%, ROIC 16.36%, ROE 28.45%, with favorable margin and coverage ratios | Negative profitability: net margin -1.98%, ROIC 3.4%, ROE -11.79%, largely unfavorable financial ratios |

| Innovation | Demonstrates durable competitive advantage with growing ROIC (+34.4%) and strong value creation (ROIC > WACC by 7.08%) | Improving ROIC trend (+170.7%) but still destroying value (ROIC < WACC by -16.3%) indicating early-stage innovation struggles |

| Global presence | Large global footprint supported by scale in semiconductor and software markets | Smaller, niche player primarily in US-based advanced technology services and wafer fabrication |

| Market Share | Significant market share in semiconductor solutions and infrastructure software segments | Limited market share, focused on specialized wafer and technology services markets |

Key takeaways: Broadcom enjoys strong diversification, high profitability, and a durable competitive moat, making it a favorable investment with relatively lower risk. SkyWater, while showing improving profitability trends, remains unprofitable and less diversified, posing higher risk but potential upside if growth continues.

Risk Analysis

Below is a comparative table of key risks for Broadcom Inc. (AVGO) and SkyWater Technology, Inc. (SKYT) as of the most recent fiscal years:

| Metric | Broadcom Inc. (AVGO) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Risk | Beta 1.22, large cap tech volatility | Beta 3.49, highly volatile small cap |

| Debt level | Moderate (D/E 0.8, 38% debt/assets) | High (D/E 1.33), financial strain |

| Regulatory Risk | Moderate, global operations regulatory complexity | Moderate, US-focused semiconductor sector |

| Operational Risk | Diversified segments reduce risk | Smaller scale, reliance on few customers |

| Environmental Risk | Moderate, exposure to manufacturing emissions | Moderate, compliance costs in manufacturing |

| Geopolitical Risk | Exposure to global supply chain disruptions | Higher, dependent on US defense/aerospace contracts |

Broadcom’s moderate debt and global exposure pose manageable risks, while its stable Altman Z-Score (12.13) indicates strong financial health. SkyWater’s higher volatility, elevated debt, and distress-level Altman Z-Score (1.63) present significant financial and operational risks. Market fluctuations and geopolitical tensions affecting semiconductor supply chains are the most impactful concerns for both.

Which Stock to Choose?

Broadcom Inc. (AVGO) shows strong income growth with a 23.87% revenue increase in 2025, favorable profitability metrics including a 36.2% net margin, and a very favorable financial ratio profile. Its debt levels are moderate with a neutral debt-to-equity ratio, supported by a very favorable “B” rating and a durable competitive moat.

SkyWater Technology, Inc. (SKYT) reports favorable revenue growth of 19.39% in 2024 but suffers from negative net margin and less favorable financial ratios, including an unfavorable debt-to-equity ratio and current liquidity below 1. Despite a very favorable “B+” rating, the company is classified as value destroying, showing slightly unfavorable moat status and signs of financial distress.

For investors prioritizing strong profitability, stable financial ratios, and competitive advantage, Broadcom might appear more favorable, while those inclined toward growth potential amid higher risk could interpret SkyWater’s improving income growth and accelerating stock trend as attractive for a risk-tolerant profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Broadcom Inc. and SkyWater Technology, Inc. to enhance your investment decisions: